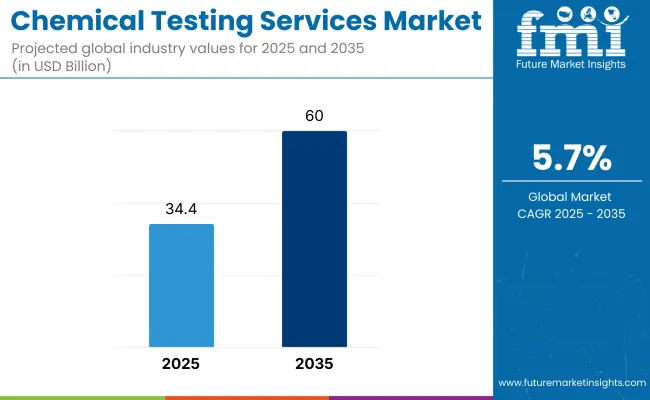

The chemical testing services market will achieve a CAGR of 5.7% over the period from 2025 to 2035. The industry, which stands at approximately USD 34.4 billion in 2025, will rise to USD 60 billion in 2035. One of the most important reasons for growth is the increasing stringency of regulatory systems in environmental, consumer goods safety, and industrial settings, which continues to be the key driving force for demand for chemical verification and compliance testing.

As businesses increasingly rely on cross-border supply chains, there is an emerging need for chemical testing services that facilitate cross-border quality assurance and compliance. It is particularly held in industries like pharmaceuticals, food safety, textiles, and electronics, where trace-level identification of chemicals becomes imperative.

Apart from regular testing, there is also an increasing demand for expert analytical capabilities that can be used both for R&D and documentation for regulatory filing, as well as for supporting the growth of the industry.

Advancements in test technologies, such as the advent of high-throughput screening, spectroscopy, chromatography, and mass spectrometry, are revolutionizing the efficiency of services and precision of detection. The technologies have quicker turnaround times without sacrificing high sensitivity and specificity to cater to increased real-time decision-making demands in production and supply operations.

Sustainability programs and a worldwide movement toward green chemistry are compelling industry forces as well. Chemical testing services are being used more to identify eco-toxicity, biodegradability, and carbon footprints of products and processes. Brands move along environmental compliance objectives as testing providers with sophisticated capabilities in these spaces are positioned to gain a competitive advantage.

Finally, increased manufacturing outsourcing activity in pursuit of affordable but advanced testing services will also propel industry activity. Growth economies are hotspots for business growth through their burgeoning industrial base and changing regulation enforcement. These trends, combined, paint a rosy future for the industry until 2035.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 34.4 billion |

| Industry Value (2035F) | USD 60 billion |

| CAGR (2025 to 2035) | 5.7% |

| Key Purchasing Metrics Across End-Use Segments | Demand Growth |

|---|---|

| Consumer Electronics | High |

| Industrial Monitoring | Very High |

| Healthcare & Disinfection | High |

| Environmental Monitoring | Very High |

| Key Purchasing Metrics Across End-Use Segments | Accuracy & Sensitivity |

|---|---|

| Consumer Electronics | High |

| Industrial Monitoring | Very High |

| Healthcare & Disinfection | Very High |

| Environmental Monitoring | High |

| Key Purchasing Metrics Across End-Use Segments | Cost Sensitivity |

|---|---|

| Consumer Electronics | Medium |

| Industrial Monitoring | High |

| Healthcare & Disinfection | Medium |

| Environmental Monitoring | High |

| Key Purchasing Metrics Across End-Use Segments | Integration with IoT |

|---|---|

| Consumer Electronics | Very High |

| Industrial Monitoring | High |

| Healthcare & Disinfection | Medium |

| Environmental Monitoring | High |

| Key Purchasing Metrics Across End-Use Segments | Regulatory Compliance |

|---|---|

| Consumer Electronics | Medium |

| Industrial Monitoring | Very High |

| Healthcare & Disinfection | Very High |

| Environmental Monitoring | High |

The industry end-use application scenario demonstrates diverse purchasing behavior, which is triggered by application complexity and regulatory requirements. Chemical testing within the consumer electronics space is focused on ensuring finished goods' sustainability and material safety. At the same time, a stringent set of sensitivity requirements and IoT infrastructure connectivity are required to enable a smart manufacturing ecosystem.

The end-use landscape of the industry induces disparate buying behavior owing to the complexity of applications and regulations adhered to. By the nature of their use, they have to be putting the chemical testing related to consumer electronic components in order to increase the safety of materials used in the product itself, so promoting the robustness of the product usually requires high sensitivity for the detection of trace amount of chemicals that are involved in the integration of IoT structures in the move towards smart manufacturing environments.

In industrial monitoring, demand is high because real-time testing is necessary for large-scale operations, particularly in processes involving chemicals. Speed and accuracy are top priority, and buyers want services that provide high-level analytics and compliance with strict occupational safety regulations. In healthcare and disinfection industries, however, chemical testing provides hygiene compliance and therapeutic safety, calling for highly accurate methods and compliance with medical-grade regulatory standards.

The segment of environmental monitoring is the toughest, with very high demand, and is mostly government- and foreign-ecological protection mandate-driven. The test providers are required to enable pollutant screening, toxicity assays, and biodegradability assays. The emphasis here is sensitivity, low cost, and high conformity to changing environmental directives, so this segment is highly dynamic and high stakes.

From 2020 to 2024, the industry expanded steadily, propelled by increasing regulatory compliance needs, global trade requirements, and a growing awareness of product safety across industries. Pharmaceutical, food and beverage, cosmetics, agricultural, and industrial production sectors relied on third-party testing facilities and in-house analysis to achieve standards such as REACH, RoHS, and FDA.

Conventional methods such as chromatography, spectroscopy, and titration were common. Although manual analysis, longer turnaround, and inconsistency in the quality of tests created operational challenges.

A glimpse of 2025 to 2035 the industry will transform at a lightning speed with the incorporation of AI, automation, and IoT-based testing solutions. Real-time chemical analysis through automation will improve speed, accuracy, and traceability along the supply chain. Remote monitoring through cloud-based technology will be possible, and predictive analytics through AI will foresee contamination risk and quality flaws.

Blockchain will provide transparency along with tamper-proof certification. Sustainability will be a driving force, encouraging testing labs to use greener reagents and eco-efficient practices. Digital twins and simulation-driven chemical behavior modeling will also make their appearance in R&D test environments. As regulations become more stringent worldwide and product complexity increases, the need for fast, affordable, and smart chemical testing will increase across developed and emerging industries.

Comparative Market Shift Table 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Demand was propelled by regulatory compliance, product safety, and quality assurance. | Real-time compliance, automation, sustainability, and predictive quality control will propel future demand. |

| Traditional approaches such as chromatography, spectroscopy, and wet chemistry dominated. | Real-time diagnosis and digital twin simulations on AI-based test platforms will be the norm. |

| Lab automation and IoT-connected equipment will make near real-time or instant testing the new normal. | Test services were always running behind schedule due to manual processes and dense sample loads. |

| Restricted use of digital platforms; handling of data was manual or semi-automated. | AI, blockchain, and cloud platforms will be at the core of managing, authenticating, and sharing test results. |

| Compliance with international standards such as REACH, RoHS, and FDA was the focus. | Compliance systems will be proactive, leveraging AI to forecast and prevent breaches before they happen. |

| Environmental footprint of chemical testing was a secondary issue. | Green testing methods, green reagents, and energy-efficient laboratory setups will be given preference. |

| Third-party laboratories or in-house facilities were used by industries for batch-wise testing. | Testing will be part of supply chain and smart labs will have continuous autonomous quality testing. |

| Reports were once static and had to be read or verified manually. | Blockchain-encrypted live reports tamper-evident will build regulator and partner confidence. |

| The industry was increasing steadily in mature economies with increasing adoption in developing economies. | Increased digitization and cross-border regulation of quality will encourage adoption in Asia, Latin America, and Africa. |

Even with a robust growth path, the industry is hampered by numerous serious threats that can undermine its stability and growth. Most critical among all is the inconsistency of regulations from location to location, where the testing providers would have to develop geography-specific skills and credentials continuously. It raises the cost of operations and can deter scalability, especially in the case of the industry's smaller players.

Technological obsolescence is another possible risk, with the rate of technological development in testing technology likely to make existing methodologies outdated or in violation of newly evolving standards.

Providers need to continually invest in capability upgrades, which require capital and trained staff-expenses that are not always available in all industries. In addition, cybersecurity threats to computerized laboratory infrastructure and handling of data could slow down operations and threaten client confidentiality.

Lastly, economic downturns and manufacturing output volatility can directly affect testing volumes, particularly in manufacturing-driven industries. In downturns, businesses will postpone testing or cut back on outsourcing budgets, exposing service providers to cutting prices and service levels. To avert such threats, industry players need to exercise strategic agility, invest in forward-looking capabilities, and develop strong regulatory alliances.

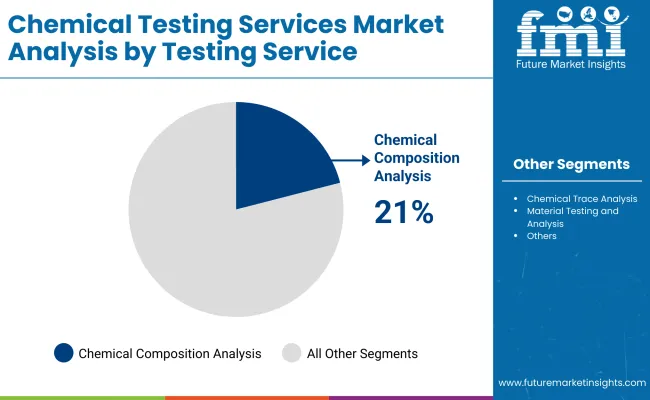

he industry is likely to experience high demand for various key testing types, particularly chemical composition analysis and chemical trace analysis. Chemical composition analysis is expected to seize 21% of the industry share. This service plays a very important role in identifying which elements and compounds are present in a substance, as well as in ensuring product quality, compliance, and consistency in different countries.

This service is essential for industries such as pharmaceutical, food & beverage, and specialty chemical industries. For example, Eurofins Scientific performs composition analysis of food ingredients to settle any discrepancies on the label and also to check for compliance with international food safety standards. Similarly, SGS does elemental analysis of metals and alloys to be used in the automotive and aerospace sectors to ensure performance reliability.

Chemical trace analysis is expected to account for 16% of the industry. This service is vital for detecting and quantifying contaminants or ultra-low concentration elements in a sample, in most cases at ppb or even lower levels. Trace analysis constitutes an important aspect of environmental monitoring while also being applied to semiconductor manufacturing and pharmaceutical product safety.

For instance, Intertek offers trace impurity detection in pharmaceuticals to meet stringent USA FDA and European Medicines Agency (EMA) requirements. Ultra-trace testing has been done by ALS Global on semiconductor materials to ensure continuous manufacturing of high-performance chips, where even the tiniest contamination can cause a failure in function.

With the enforcement of much stricter environmental regulations, increasing numbers of product recalls, and the complexities of today's supply chains, the demand for reliable chemical testing services continues to escalate. Also, the recent surge in global trade has paved the way for larger third-party testing obligations to comply with regional regulatory standards such as REACH (EU), EPA (USA), and RoHS.

Key players, including Bureau Veritas, TÜV SÜD, and NSF International, are focusing on expanding their service capabilities through advanced instrumentation and laboratory automation, thereby securing their positions as frontrunners in this ever-evolving industry.

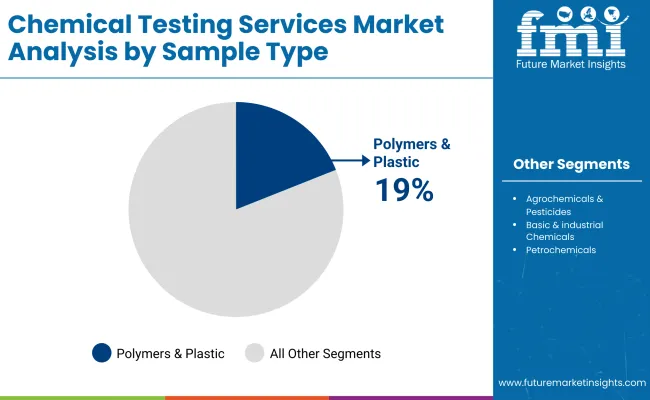

In the context of 2025, the industry is classified based on sample types into two major categories: polymers & plastics and agrochemicals & pesticides. Polymers & plastics are forecasted to account for 19% of the industry share, indicating further demand for quality and compliance testing in sectors such as automotive, construction, packaging, and consumer goods.

Materials are thus tested for parameters such as tensile strength, composition, thermal stability, and leaching potential to ensure compliance with performance and regulatory standards. For example, the SGS company conducts mechanical and chemical testing for plastic products to establish compliance with RoHS and REACH regulations for use in electronic products.

Similarities between both organizations include specialized testing support for biodegradable plastics for manufacturers to substantiate their eco-friendly product claims regarding increasing environmental scrutiny.

Agrochemicals & pesticides make up just about fifteen percent of the industry for chemical testing services in 2025. It consists of various severe international regulations dealing with pesticide residues, formulation stability, and environmental impacts. The thorough testing of agrochemicals guarantees their effectiveness, safety, and compliance with the legal residue limits before their release on the industry.

Eurofins Agroscience Services renders an all-encompassing testing activity, active ingredient analysis, and residue studies to be used in regulatory submissions within the Americas and the EU. ALS Global, on the other hand, supports manufacturers of pesticides in trace detection through advanced LC-MS/MS and GC-MS/MS analysis to meet international food safety standards.

In terms of human health versus environmental sustainability awareness and changing regulations, demand continues to increase for accurate testing among all sample types. Large service providers continue to invest in automation for these critical applications, high-throughput analytical instruments, and global lab networks to meet the growing complexity of testing needs and the volume of work.

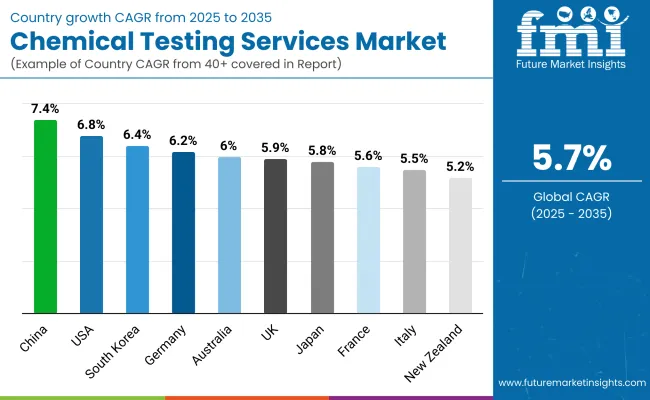

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.9% |

| France | 5.6% |

| Germany | 6.2% |

| Italy | 5.5% |

| South Korea | 6.4% |

| Japan | 5.8% |

| China | 7.4% |

| Australia | 6% |

| New Zealand | 5.2% |

The USA industry is anticipated to register a CAGR of 6.8% during the forecast period. Stringent regulatory frameworks enforced by agencies such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) are key growth impelling factors.

Greater investments in advanced testing technologies and growing demand for third-party laboratory services in the pharmaceutical and consumer goods sectors are fortifying the industry landscape. Existence of reputable industry players such as SGS North America, Intertek USA, and Eurofins Scientific fosters ongoing innovation and continuous improvement of service quality.

Expansion in industrial applications of specialty chemicals and additional emphasis on safety of products drive the demand for analytical services quicker. Further rising requirements for environmentally friendly and bio-based products also have forced the companies to drive more chemical validation processes. This trend will propel long-term service engagement with chemical test suppliers, supporting industry resilience in the forecast period.

The UKindustry will grow at a CAGR of 5.9% between 2025 to 2035. The regulatory restructuring after Brexit has engendered a mounting need for domestic chemical compliance and validation services. Testing services are being outsourced in sectors such as agriculture, healthcare, and consumer products to ensure quick turnaround times and cost-effectiveness.

Major players such as ALS Limited and Element Materials Technology are investing in digital analytics platforms and high-throughput laboratories to meet growing demand. The sector benefits from ongoing innovation in nanomaterials, biotechnology, and green packaging, all of which require stringent chemical testing.

Greater traceability requirements along the supply chain and expanding green chemistry initiative focus are anticipated to further boost service penetration. Demand across the private and public sectors is driving expansion in specialized testing protocols aligned with evolving global standards.

France is poised to register a CAGR of 5.6% in the industry between 2025 to 2035. Policies encouraging consumer protection and protection of the environment are fueling the demand for end-to-end chemical validation of food, cosmetics, and pharmaceuticals. Testing labs such as Bureau Veritas and Eurofins France lead in providing integrated services that allow for domestic compliance and international trade.

The increased use of specialty chemicals in industrial manufacturing and greater concern over endocrine disruptors and toxicants are motivating businesses to implement cyclic testing patterns. Additionally, expansion in personalized medicine products and environmentally friendly consumer goods has also created new windows for advanced chemical characterization services. All these trends together propel the expansion of the industry by synchronizing test services with regulatory needs along with industry-driven innovations.

The industry in Germany is expected to grow at a CAGR of 6.2% between 2025 and 2035. As the regional hub of the European chemical and pharma industries, Germany maintains strict test standards for raw materials as well as end products.

By bringing together advanced equipment and very high automation in the testing laboratories has enhanced service capacities in such segments as automotive, biotechnology, and manufacturing equipment. Industry leaders such as TÜV SÜD and WESSLING Group have continued to develop analytical capabilities as demand for REACH-compliant and ISO-accredited testing increases.

With industries placing greater importance on safety, performance, and sustainability, testing of chemicals has emerged as a vital process for developing products and managing product lifecycles. This continued quality assurance emphasis helps to establish Germany as one of the region's major drivers of industry growth.

Italy is anticipated to account for a CAGR of 5.5% within the industry during the forecast period. The export and manufacturing sectors in Italy have created a high demand for regulated chemical verification, particularly among textile industries, food processing, and industrial machinery.

Conformity with the European directives has triggered investments in testing labs as well as certification services. Material compatibility skills, contaminant testing, and chemical profiling of composition are being utilized by service providers such as Tecnolab del Lago Maggiore and ChemService S.r.l. to meet growing client needs.

Increased adoption of green materials and increased regulatory audits are propelling continued demand for third-party analysis services. Continued emphasis on product quality and traceability is expected to sustain industry growth in Italy over the forecast period.

South Korea is expected to grow at a CAGR of 6.4% in the industry during 2025 to 2035. South Korea's established semiconductor, electronics, and automotive industries rely extensively on precise chemical analysis to attain production efficiency and comply with international safety standards.

Consumer electronics and pharmaceutical exports are generating greater demand for validated chemical testing. Firms such as Korea Testing & Research Institute (KTR) and Korea Conformity Laboratories are leading the way in developing highly precise chemical test methods, focused on innovation and sustainability.

With ongoing advancements being made in the area of nanotechnology and sustainable materials, additional demand for value-added testing standards is generated. This rapidly evolving environment provides a great platform for service providers to improve their technical competence and geographical coverage.

Japan is anticipated to record a CAGR of 5.8% in the industry during 2025 to 2035. Japan's advanced pharmaceutical and automotive industries need high-level chemical confirmation to ensure product purity and compliance with local as well as global standards.

Expenditure on automation and artificial intelligence-based testing platforms has improved laboratory performance and accuracy. Large firms like Japan Chemical Analysis Center and Japan Inspection Association of Food and Food Industry Environment have enhanced testing processes for a wide variety of materials ranging from synthetic polymers to food additives.

Heightened focus on product innovation and protection of public health is propelling the growth of sophisticated testing services. At the same time, government initiatives to reduce environmental pollution are boosting demand for emissions and toxic substance analysis.

The Chinese industry will witness the highest CAGR among the mentioned countries, with 7.4% growth during the forecast period. Fast-paced industrialization and increasing chemical production across multiple verticals including agriculture, construction, and consumer goods are primary growth drivers.

Increased scrutiny from international trade partners has compelled domestic manufacturers to acquire advanced chemical testing for export compliance. Major players such as CNAS-accredited laboratories and the Centre Testing International Group are driving service innovation using automation and in-real-time analysis.

Increasing environmental awareness and government regulations on product safety are driving demand for high-quality testing. With an expanding middle class and a shift towards high-quality products, the industry is poised for robust long-term growth.

Australia is also anticipated to see a CAGR of 6% in the industry during the period 2025 to 2035. The robust mining, agricultural, and food processing sectors in Australia are one of the key drivers for the demand for analytical chemical testing. National regulation by bodies such as NICNAS and FSANZ ensures compliance of materials and products with high safety and environmental standards.

Service providers such as National Measurement Institute (NMI) and ChemCentre are strengthening service capacity through the adoption of enhanced test techniques such as mass spectrometry and chromatography.

Increased application of testing in renewable energy technologies and sustainable agriculture creates new opportunities for growth. Improved emphasis on reducing chemical contamination and ensuring product quality will drive steady demand in industries.

New Zealand is also likely to register a CAGR of 5.2% through the industry up to 2035. Great focus on agriculture, environment conservation, and food regulation laws within the nation instills persistent need for trusted chemical analysis. Regulation compliance to specifications set by the Ministry for Primary Industries and Environmental Protection Authority provides manufacturers with confidence in seeking out certified testing services.

Players in the domestic arena such as AsureQuality and Hill Laboratories play a fundamental part in the offering of testing services that comply with international trading standards. Growth in organic farming, green packaging, and renewable material is increasingly growing the base industry. With New Zealand planning to deepen its international export portfolio, reliable chemical testing is a vital enabler of industry expansion and consumer confidence.

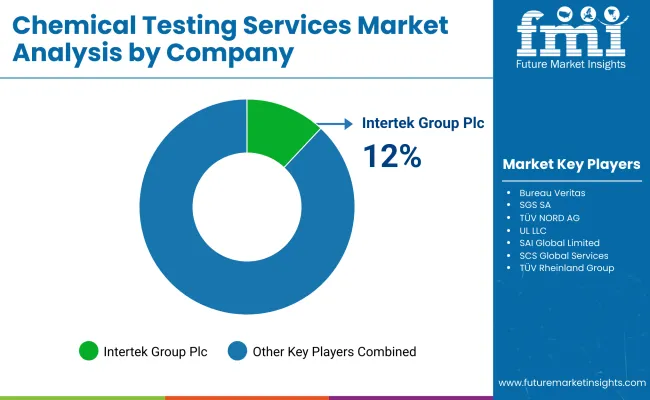

Theindustry exhibits a heavy fragmentation, with players of worldwide stature, viz. Intertek Group Plc., Bureau Veritas and SGS SA hold a strong fort due to a huge laboratory network/service of a compliance nature.

These companies engage in analytical testing, regulatory compliance verifications, and materials composition assessments across industries ranging from pharma to environmental science. Their competitive advantage arises from global accreditation, a plethora of cutting-edge instruments, and automation of testing.

The evolution of the industry is defined through increased digitalization and AI-enabled chemical analysis. The leading players, such as TÜV NORD AG and UL LLC, work on different approaches to develop AI-enabled spectroscopy applications, robotic sample handling measurements, and image analysis for blockchain traceability solutions to increase efficiency and data integrity. The increasing complexity of requirements has also increased the need for real-time reporting, thus propagating innovations in automated compliance platforms.

Strategic partnerships and acquisitions define the competition, as companies purchase specialized laboratories to enhance their service capabilities. Bureau Veritas and SGS SA, for example, are active in bioanalytical and microplastic testing and targeted acquisitions to build these areas of bespoke skills. Further, the cooperation of TÜV Rheinland Group and Eurofins Scientific strengthens the global outreach with new testing hubs in Asia and North America.

Smaller and niche players, such as Aspirata Auditing Testing And Certification, SCS Global Services, and AsureQuality Limited, focus on specific niches encompassing food safety, environmental toxicity, and sustainable materials testing. Companies providing high-volume testing, regulatory consulting, and AI-based analytics are gaining traction very fast as industries are moving towards data-based quality assurance systems.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Intertek Group Plc | 12-16% |

| Bureau Veritas | 10-14% |

| SGS SA | 9-13% |

| TÜV NORD AG | 7-11% |

| UL LLC | 6-10% |

| Others (Combined) | 45-56% |

| Company Name | Offerings and Activities |

|---|---|

| Intertek Group Plc | Global analytical testing services with a focus on regulatory compliance and AI-driven chemical analysis. |

| Bureau Veritas | Advanced safety, environmental, and material composition testing for regulatory assurance. |

| SGS SA | Comprehensive laboratory testing and certification services for industrial and consumer industrie s. |

| TÜV NORD AG | Chemical safety assessments with an emphasis on digitalized and automated testing platforms. |

| UL LLC | AI-powered chemical hazard analysis and compliance verification for industrial applications. |

Key Company Insights

Intertek Group Plc (12-16%)

A leader in chemical testing, Intertek integrates AI-driven analytics and global regulatory compliance solutions to streamline product safety evaluations across multiple industries.

Bureau Veritas (10-14%)

Bureau Veritas enhances its industry position through bioanalytical expansions, specializing in material composition testing, sustainability assessments, and digital traceability solutions.

SGS SA (9-13%)

SGS SA invests in microplastic detection, eco-toxicology, and AI-powered chemical analytics to strengthen its testing capabilities across environmental and industrial sectors.

TÜV NORD AG (7-11%)

TÜV NORD focuses on digitized testing services, leveraging automation and AI to optimize safety compliance for pharmaceuticals, food, and chemical industries.

UL LLC (6-10%)

UL LLC pioneers AI-enhanced chemical hazard assessments and cloud-based compliance verification, providing predictive risk modeling for industrial clients.

By testing service, the industry is segmented into chemical composition analysis, chemical trace analysis, chemicals regulatory compliance testing, contamination detection and analysis, material testing and analysis, elemental analysis certification, and others.

By sample type, the industry is segmented into agrochemicals & pesticides, basic & industrial chemicals, dyes & detergents, lubricants & greases, nanomaterial, petrochemicals, polymers & plastics, and specialty chemicals.

By end use, the industry is segmented into consumer goods (packaging & paper, toys, cosmetics, detergents & cleaning products, hygiene products, food material, electrical and electronic products, automotive), environmental, and manufacturing.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The industry is estimated to be USD 34.4 billion in 2025.

By 2035, the industry is projected to grow to approximately USD 60 billion.

China is expected to grow at a 7.4% CAGR, supported by expanding industrial production, stricter environmental and safety regulations, and rising exports.

Chemical composition analysis leads the industry, as it plays a critical role in quality control, regulatory compliance, and material verification across various industries.

Key players include Intertek Group Plc, Bureau Veritas, SGS SA, TÜV NORD AG, UL LLC, SAI Global Limited, Aspirata Auditing Testing and Certification (Pty) Ltd, SCS Global Services, TÜV Rheinland Group, MISTRAS Group, AsureQuality Limited, Nippon Kaiji Kentei Kyokai, Dekra SE, Lloyd’s Register Group Services Limited, Indocert, ALS Limited, ASTM International, Exova Group plc, BSI Group, and Eurofins Scientific.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Testing Service, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Testing Service, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Testing Service, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Testing Service, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Testing Service, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Sample Type, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Attractiveness by Testing Service, 2023 to 2033

Figure 18: Global Market Attractiveness by Sample Type, 2023 to 2033

Figure 19: Global Market Attractiveness by End Use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 37: North America Market Attractiveness by Testing Service, 2023 to 2033

Figure 38: North America Market Attractiveness by Sample Type, 2023 to 2033

Figure 39: North America Market Attractiveness by End Use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Testing Service, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Sample Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Testing Service, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Sample Type, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Testing Service, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Sample Type, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Testing Service, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Sample Type, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Testing Service, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Sample Type, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Testing Service, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Sample Type, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Testing Service, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Testing Service, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Testing Service, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Sample Type, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Sample Type, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sample Type, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Testing Service, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Sample Type, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA