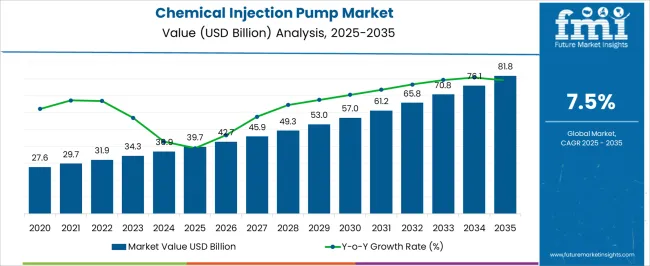

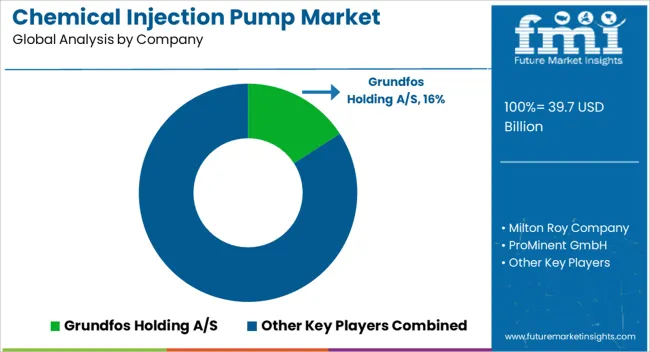

The Chemical Injection Pump Market is estimated to be valued at USD 39.7 billion in 2025 and is projected to reach USD 81.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Chemical Injection Pump Market Estimated Value in (2025 E) | USD 39.7 billion |

| Chemical Injection Pump Market Forecast Value in (2035 F) | USD 81.8 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The chemical injection pump market is experiencing steady expansion, supported by its crucial role in industries where precise dosing and reliable delivery of chemicals are required for operations. Growth is being driven by rising demand across water treatment, oil and gas, petrochemical, and power generation sectors, where efficiency, safety, and compliance with environmental regulations are prioritized. Increasing investments in industrial automation and process optimization are enhancing the adoption of pumps that offer high accuracy, durability, and low maintenance.

Stricter global environmental standards are further promoting the use of pumps designed to minimize leakages, wastage, and emissions, while ensuring stable flow under varying conditions. Advances in pump design, including smart monitoring, remote operation, and integration with digital control systems, are enabling operators to achieve higher reliability and operational efficiency.

The shift toward energy-efficient equipment and the growing emphasis on sustainability are creating opportunities for innovative pump technologies As infrastructure upgrades and industrial projects expand globally, the market is positioned for sustained growth, with end users increasingly seeking solutions that balance cost-effectiveness, durability, and compliance with international performance standards.

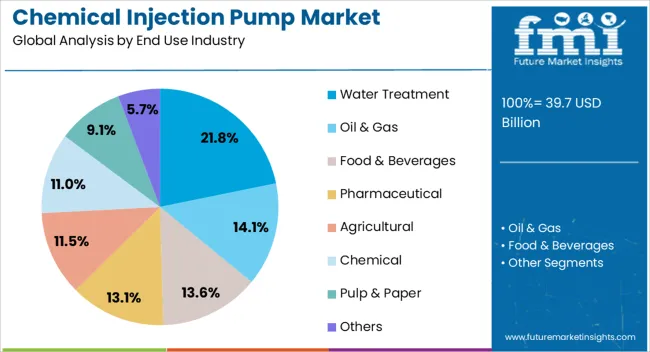

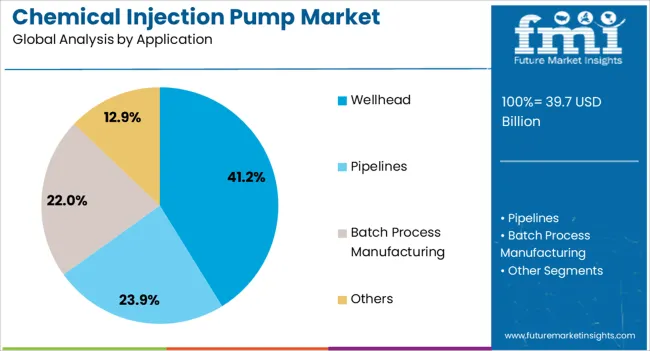

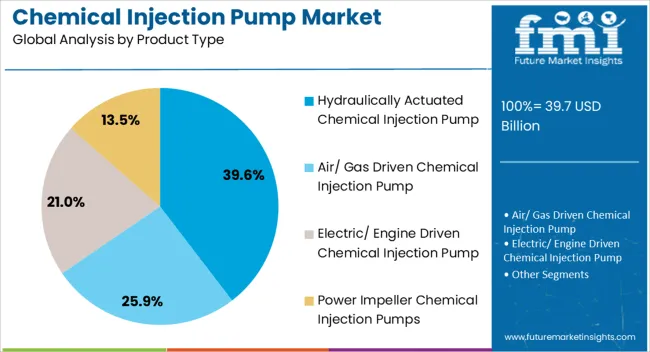

The chemical injection pump market is segmented by end use industry, application, product type, number of injection points, and geographic regions. By end use industry, chemical injection pump market is divided into Water Treatment, Oil & Gas, Food & Beverages, Pharmaceutical, Agricultural, Chemical, Pulp & Paper, and Others. In terms of application, chemical injection pump market is classified into Wellhead, Pipelines, Batch Process Manufacturing, and Others. Based on product type, chemical injection pump market is segmented into Hydraulically Actuated Chemical Injection Pump, Air/ Gas Driven Chemical Injection Pump, Electric/ Engine Driven Chemical Injection Pump, and Power Impeller Chemical Injection Pumps. By number of injection points, chemical injection pump market is segmented into Single Chemical Injection Pump and Multi Chemical Injection Pump. Regionally, the chemical injection pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water treatment segment is projected to hold 21.8% of the chemical injection pump market revenue share in 2025, establishing itself as a significant growth contributor. This dominance is being supported by the rising need for precise chemical dosing in processes such as pH adjustment, disinfection, and scaling control. The increasing demand for safe and clean water across municipal and industrial applications has heightened reliance on reliable injection pumps capable of delivering chemicals consistently and efficiently.

Rapid urbanization and population growth are driving the expansion of municipal water treatment plants, while industries such as food processing, pharmaceuticals, and power generation are implementing stricter water quality controls. Regulatory frameworks that mandate effective wastewater treatment are further accelerating adoption.

Additionally, the integration of advanced control systems into injection pumps allows for accurate chemical dosing with reduced wastage, lowering operational costs while improving compliance The strong need to ensure water safety, coupled with global emphasis on sustainability, is reinforcing the water treatment sector’s position as one of the key end-use industries in this market.

The wellhead application segment is anticipated to account for 41.2% of the chemical injection pump market revenue share in 2025, making it the leading application area. This leadership is being driven by the critical role of chemical injection pumps in oil and gas operations, where they are essential for maintaining flow assurance, preventing corrosion, and optimizing production. Pumps installed at wellheads deliver precise amounts of chemicals such as corrosion inhibitors, demulsifiers, and scale inhibitors, ensuring operational reliability in harsh environments.

Rising exploration and production activities, particularly in offshore and unconventional fields, are supporting demand for highly durable and efficient pumps capable of functioning under extreme pressures and temperatures. Compliance with stringent safety and environmental regulations is also boosting adoption, as operators prioritize equipment that minimizes leaks and emissions.

Continuous advancements in pump materials, control systems, and monitoring technologies are further enhancing their reliability and lifespan As global energy demand continues to rise, the wellhead segment is expected to retain its dominant share, driven by the critical need for uninterrupted and efficient oil and gas production.

The hydraulically actuated chemical injection pump segment is expected to represent 39.6% of the chemical injection pump market revenue share in 2025, positioning it as the leading product type. Its leadership is being reinforced by its ability to deliver precise and consistent chemical dosing even under high-pressure and demanding operating conditions. The segment is benefiting from its suitability in oil and gas, petrochemical, and power generation applications where reliability and safety are critical.

Hydraulically actuated pumps are designed to operate effectively in remote and hazardous environments, where stable performance and long service life are essential. Their robust design enables them to handle corrosive and viscous chemicals, ensuring dependable operation in diverse applications. The adoption of these pumps is being further supported by advancements in automation and digital monitoring, which enhance operational accuracy and reduce downtime.

Growing emphasis on safety, regulatory compliance, and energy efficiency across industries is also contributing to their continued use With global industrial expansion and rising infrastructure investments, hydraulically actuated pumps are expected to remain the preferred choice in applications requiring consistent, high-performance dosing.

The demand for chemical injection pump is rapidly growing for wastewater treatment during the forecast period. Chemical injection pump manufacturers are growing the end-use industry such as agriculture, chemical, energy & power and others.

However, the chemical injection pump injects chemicals on a high of repetitive basis in the oil & gas sector. The key manufacturers develop these pumps on several characteristics such as unit size, supply gas pressure and frequency of operation during the forecast period.

In European countries, the adoption of chemical injection pump is rising due to the growing consumption of chemical injection pump during the forecast period. On the other hand, stringent government rules to promote end-use industries are accelerating the global chemical injection pump market. Countries such as Germany and the UK lead the global market by capturing a significant share during the forecast period.

Asia Pacific followed by European countries due to the growing production of chemical injection pump on a large scale and the growing pharmaceutical sector during the forecast period. The presence of manufacturers and rising power industries are growing the Asia Pacific market to another height during the forecast period.

The rising demand for chemical injection pump in the automotive industry due to increasing all-over efficiency is flourishing the market growth during the forecast period. The growing advanced technologies and development of innovative products are likely to propel the market for chemical injection pump.

In addition, solar electric chemical injection pump with the adoption of temperature sensing technology due to environmental sustainability is increasing the chemical injection pump market trends.

The energy & chemical sector is one of the lead categories in the end-use segment that mushroom the market for chemical injection pump during the forecast period. In the chemical industry, the demand for chemical injection pump is rapidly increasing as it used to handle several harmful chemicals at various pressure and temperature during the forecast period.

The key market players play a crucial role in the global market by increasing the market share during the forecast period. These players focus on providing better quality products to the end-users that satisfy their requirements.

The key vendors are adopting several marketing tactics to capture a maximum output during the forecast period. The marketing methodologies are mergers, acquisitions, partnerships, agreements, collaborations and product launches.

Chemical injection is of prime concern since the chemicals being injected are in small amount and are often associated with problems such as processing and equipment safety. These chemical injection pumps work with a high level of precision on repetitive basis and are used to inject some of the typical chemicals in the oil & gas industries which includes biocides, demulsifiers, clarifiers, corrosion inhibitors, scavengers and others.

Chemical injection pump are positive displacement reciprocating units primarily used to transfer the chemical from tank to the injection point, where the flow rates can be adjusted remotely or locally to ensure that the precise amount of chemical is being injected.

Since the chemical being injected are reactive to the injection pump material, end-user must specify the manufacturer, the type of material to be injected. Selection of chemical injection pumps is based on various characteristics such as frequency of operation, unit size, supply gas pressure and inlet methane composition.

Chemical injection pump market is moderately developing due to its uniform application which makes it a backbone of various processes across many industries.

Increasing demand for waste water treatment in developing nations is primarily driving the growth of global chemical injection pump market. Moreover, another driving factor for the growth of global chemical injection pump market is the increasing need for automation in order to increase the efficiency and reduce the overall turnaround time across various end use industries.

Also stringent government regulations in order to promote efficiency across various end use industries is driving the growth of global chemical injection pump market.

Solar electric chemical injection pumps combined with temperature sensing technology are gaining traction in the market due increasing environmental sustainability.

Chemical injection pump market can be segmented by end use industry, application, product type and number of injection point. On the basis of end use industry, global chemical injection pump market can be further segmented into water treatment, oil & gas, food and beverages, pharmaceutical, agricultural, chemical, pulp & paper and others. By industry, water treatment accounts for largest market share in terms of value as well as number of units sold.

In addition to this, food & beverage industry is expected to grow at significant CAGR in the global chemical injection pump market due to the requirement of accurate and hygienic operation. Based on application global chemical injection pump market can be segmented into wellhead, pipelines, batch process manufacturing and others.

By product type, global chemical injection pump market can be segmented into hydraulically actuated chemical injection pump, Air/ Gas driven chemical injection pump, Electric/ Engine driven chemical injection pump and power impeller chemical injection pumps.

Based on number of injection point, chemical injection pump market can be segmented into single chemical injection pump and multi chemical injection pump.

Geographically, the global chemical injection pump market can be segmented into North America, Latin America, Western Europe, Eastern Europe, APEJ (Asia Pacific excluding Japan), Japan, Middle East and Africa.

In terms of revenue, Asia Pacific is expected to hold the largest market share in the global chemical injection pump market, followed by North America. Moreover, China alone is expected to account for a significant share in terms of value and is expected to dominate the APEJ chemical injection pump market due to its expanding economy, low cost raw material and increasing investment in infrastructural development. Furthermore, Western Europe is expected to record a steady CAGR over the forecast period.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies

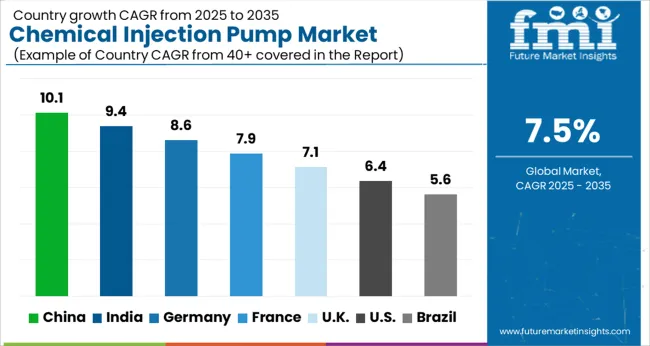

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The Chemical Injection Pump Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Chemical Injection Pump Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Chemical Injection Pump Market is estimated to be valued at USD 13.6 billion in 2025 and is anticipated to reach a valuation of USD 25.2 billion by 2035. Sales are projected to rise at a CAGR of 6.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.1 billion and USD 1.2 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.7 Billion |

| End Use Industry | Water Treatment, Oil & Gas, Food & Beverages, Pharmaceutical, Agricultural, Chemical, Pulp & Paper, and Others |

| Application | Wellhead, Pipelines, Batch Process Manufacturing, and Others |

| Product Type | Hydraulically Actuated Chemical Injection Pump, Air/ Gas Driven Chemical Injection Pump, Electric/ Engine Driven Chemical Injection Pump, and Power Impeller Chemical Injection Pumps |

| Number of Injection Points | Single Chemical Injection Pump and Multi Chemical Injection Pump |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grundfos Holding A/S, Milton Roy Company, ProMinent GmbH, SEKO S.p.A., SPX FLOW, Inc., Lewa GmbH, IDEX Corporation, Dover Corporation, Injection Pumps, Inc., and Petronash |

The global chemical injection pump market is estimated to be valued at USD 39.7 billion in 2025.

The market size for the chemical injection pump market is projected to reach USD 81.8 billion by 2035.

The chemical injection pump market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in chemical injection pump market are water treatment, oil & gas, food & beverages, pharmaceutical, agricultural, chemical, pulp & paper and others.

In terms of application, wellhead segment to command 41.2% share in the chemical injection pump market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA