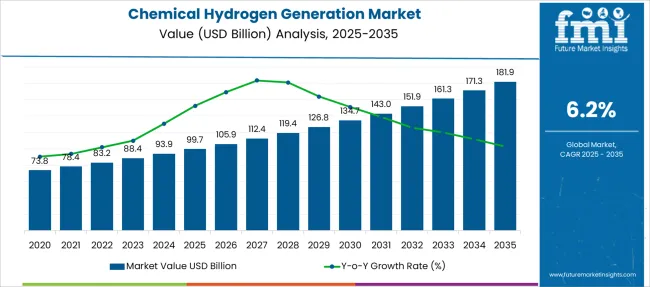

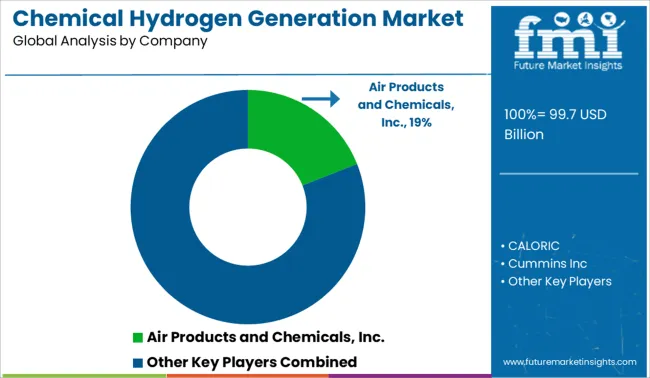

The Chemical Hydrogen Generation Market is estimated to be valued at USD 99.7 billion in 2025 and is projected to reach USD 181.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Chemical Hydrogen Generation Market Estimated Value in (2025 E) | USD 99.7 billion |

| Chemical Hydrogen Generation Market Forecast Value in (2035 F) | USD 181.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The chemical hydrogen generation market is undergoing structural expansion, supported by the growing shift toward low-emission industrial processes, rising investments in hydrogen ecosystems, and increasing demand from refining, chemical, and mobility sectors. Government-led clean energy initiatives and industrial decarbonization mandates are accelerating the transition from conventional fuel-based systems to hydrogen-integrated operations.

Advancements in chemical reforming technologies and improved energy efficiency parameters are further influencing adoption. Industry players are emphasizing localized production for supply chain resilience, particularly through captive hydrogen generation.

Strategic collaborations between public entities and energy technology providers are fostering infrastructure development across key economies. As clean hydrogen emerges as a strategic pillar in energy transition roadmaps, the market is expected to gain momentum through policy incentives, integrated electrochemical platforms, and targeted cost-reduction programs in hydrogen production pathways

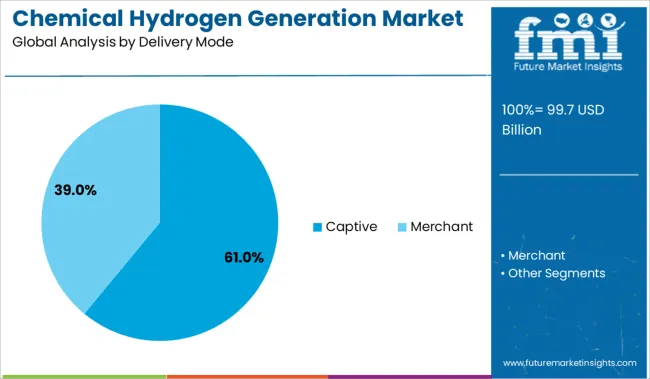

The market is segmented by Delivery Mode, Process Type, and region. By Delivery Mode, the market is divided into Captive and Merchant. In terms of Process Type, the market is classified into Steam Reformer, Electrolysis, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The captive delivery mode is projected to dominate the chemical hydrogen generation market in 2025, holding approximately 61.0% of total revenue share. This leadership is being driven by the growing need for on-site hydrogen production to ensure supply continuity, minimize transportation losses, and optimize cost-efficiency.

Captive systems offer operational control and safety compliance benefits, especially in industries with continuous hydrogen demand such as petrochemicals, metal processing, and fertilizers. The ability to tailor capacity based on plant load requirements enhances scalability and resource planning.

In regions with limited hydrogen infrastructure, captive generation models are increasingly being adopted as interim and long-term solutions. Moreover, technological advancements in compact reformers and pressure swing adsorption units are enabling cleaner and more flexible integration into existing industrial setups

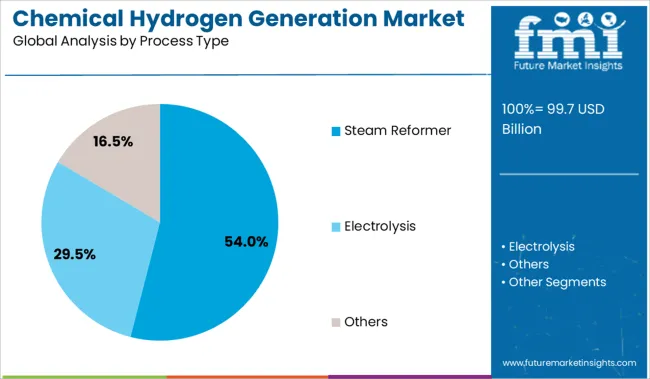

Steam reforming is expected to account for 54.0% of the revenue in 2025, establishing it as the leading process type in the chemical hydrogen generation market. This segment’s strength is attributed to the well-established maturity of steam methane reforming (SMR) technology, which continues to be favored for its high hydrogen yield and economic viability at scale.

The widespread availability of natural gas and its compatibility with existing refinery infrastructure have reinforced SMR's use across industrial sectors. Innovations in catalyst efficiency, thermal integration, and carbon capture retrofitting are helping mitigate environmental impact while extending asset life.

Additionally, integration of blue hydrogen systems with SMR units is enabling a transitional pathway toward cleaner hydrogen production, aligning with decarbonization targets without overhauling current capital investments

The chemical hydrogen generation market is experiencing growth driven by the increasing demand for cleaner energy sources and advancements in hydrogen production technologies. However, challenges such as high production costs, infrastructure limitations, and regulatory complexities continue to impact the market's expansion.

The chemical hydrogen generation market is expanding due to the growing demand for clean energy solutions across various industries. Hydrogen is increasingly recognized as a versatile and clean energy carrier, suitable for applications in transportation, industrial processes, and power generation. Governments worldwide are implementing policies and providing incentives to promote the adoption of hydrogen technologies, further driving market growth. Additionally, advancements in production methods, such as electrolysis and steam methane reforming, are enhancing the efficiency and cost-effectiveness of hydrogen generation.

Despite the positive outlook, the chemical hydrogen generation market faces significant challenges related to production costs and infrastructure development. The current methods of hydrogen production, particularly green hydrogen through electrolysis, remain expensive due to high energy requirements and the cost of renewable electricity. Furthermore, the lack of widespread infrastructure for hydrogen storage, transportation, and refueling stations hinders the large-scale adoption of hydrogen technologies. These factors contribute to the slow pace of market expansion and necessitate continued investment and innovation to overcome these barriers.

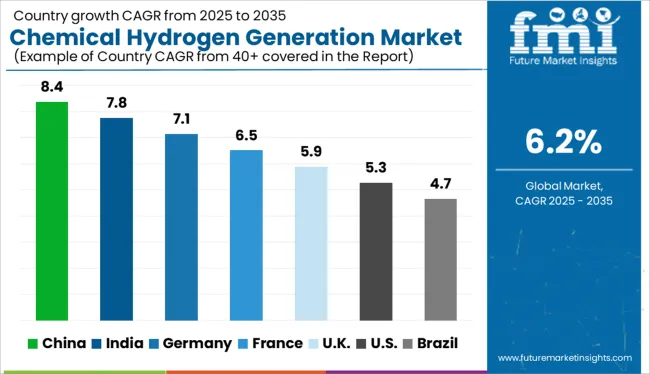

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

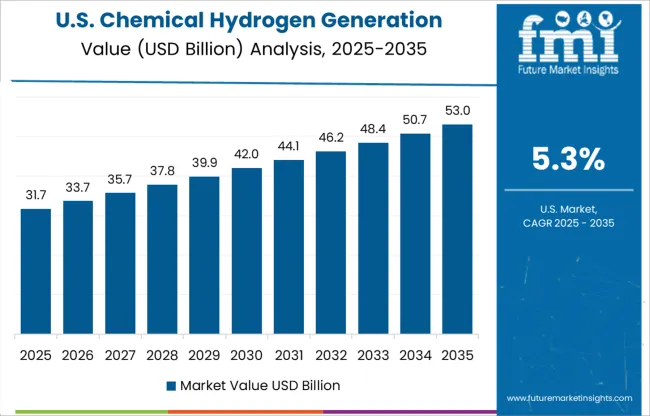

| USA | 5.3% |

| Brazil | 4.7% |

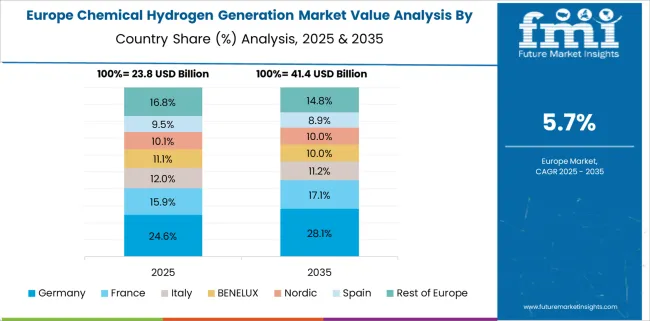

Global chemical hydrogen generation market demand is projected to rise at a 6.2% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 8.4%, followed by India at 7.8%, and Germany at 7.1%, while the United Kingdom records 5.9% and the United States posts 5.3%. These rates translate to a growth premium of +35% for China, +26% for India, and +14% for Germany versus the baseline, while the United Kingdom and the United States show slower growth. Divergence reflects local catalysts: increasing adoption of chemical hydrogen generation for industrial applications in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to market maturity and the ongoing development of hydrogen infrastructure.

China is projected to lead the chemical hydrogen generation market with a CAGR of 8.4% from 2025 to 2035. Industrial-scale hydrogen programs and extensive R&D investments have been prioritized to develop low-cost chemical hydrogen production using sodium borohydride, ammonia borane, and metal hydrides. Pilot projects across provinces like Jiangsu and Sichuan are integrating hydrogen generation with battery-electric systems. State-backed partnerships with academia and energy firms are enhancing local manufacturing of compact hydrogen reactors.

India is expected to grow at a CAGR of 7.8% in the chemical hydrogen generation sector. National Hydrogen Mission policies are supporting local chemical-based hydrogen routes, especially for off-grid and industrial applications. Companies like Reliance and Adani are investing in pilot plants using sodium borohydride and urea cracking processes. Portable hydrogen generation units are being deployed for telecom towers, emergency medical services, and railways.

Germany is forecasted to grow at 7.1% CAGR through 2035. Engineering firms are leading chemical hydrogen projects focused on energy storage and decarbonization. Collaborations with Scandinavian firms have strengthened supply chain efficiency for boron-based chemical hydrides. Energy clusters in Bavaria and North Rhine-Westphalia are hosting pilot trials integrating hydrogen generation with district heating and microgrid systems.

The UK is projected to expand at 5.9% CAGR between 2025 and 2035 in the chemical hydrogen generation space. Focus has shifted toward portable chemical hydrogen systems for maritime, defense, and heavy-duty transport. Innovate UK and BEIS-funded consortia are developing borohydride-based cartridges and reforming solutions. Partnerships with university spinouts are driving breakthroughs in safe storage and catalytic dehydrogenation.

The USA chemical hydrogen generation market is set to grow at 5.3% CAGR. The Department of Defense and energy startups are collaborating on robust, long-duration hydrogen power systems. Federal funding has supported chemical hydrogen R&D targeting sodium borohydride and liquid organic hydrogen carriers. These technologies are favored for remote bases, mobile labs, and critical infrastructure backup.

In the chemical hydrogen generation market, competition hinges on production capacity, purity levels, and vertical integration. Air Products leads globally by operating large steam methane reforming plants and supplying both merchant hydrogen and onsite generation systems across North America, Europe, and Asia. Linde plc and Messer follow with integrated syngas platforms and turnkey solutions for industrial gas users. Cummins (via electrolytic hybrids), FuelCell Energy, and Nel Hydrogen have positioned themselves in functional niches like on-demand high-purity delivery. Regional players-HyGear in Europe and Green Hydrogen Systems in the Nordics-offer modular units via e-commerce and private-label installations. In India, Reliance Industries and CALORIC have secured refinery and fertilizer clients. Regulatory factors such as emission permits, CO₂-steam balancing, and API-grade certification are influencing investment decisions across jurisdictions.

| Item | Value |

|---|---|

| Quantitative Units | USD 99.7 Billion |

| Delivery Mode | Captive and Merchant |

| Process Type | Steam Reformer, Electrolysis, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products and Chemicals, Inc., CALORIC, Cummins Inc, FuelCell Energy, Green Hydrogen Systems, HyGear, Linde plc, Messer Group GmbH, Nel Hydrogen, Parker Hannifin Corporation, Plug Power Inc., Reliance Industries Ltd, and Resonac Corporation |

| Additional Attributes | Dollar sales concentrated in industrial hydrogen use across refining, ammonia/urea production, and chemical processing, share led by steam methane reforming (SMR) and captive on-site delivery, demand surging for carbon-capture-retrofitted SMR and electrolysis systems to meet green molecule mandates, retrofitting prevalent in petrochemical fed-backs and renewables-adjacent electrolysis hubs, ergonomic and safety compliance emphasized in skid-mounted membrane reactor modules, and momentum shifting toward modular electrolysers and membrane-reformer units over traditional SMR to enable decentralized, low-carbon hydrogen production. |

The global chemical hydrogen generation market is estimated to be valued at USD 99.7 billion in 2025.

The market size for the chemical hydrogen generation market is projected to reach USD 181.9 billion by 2035.

The chemical hydrogen generation market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in chemical hydrogen generation market are captive and merchant.

In terms of process type, steam reformer segment to command 54.0% share in the chemical hydrogen generation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA