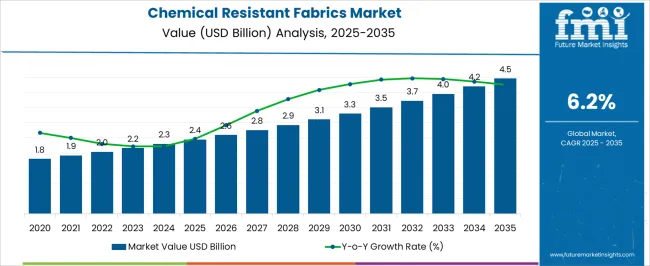

The Chemical Resistant Fabrics Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. From 2020 to 2024, the market expanded from USD 1.8 billion to USD 2.3 billion, with annual growth rates ranging between 5.5% and 6.1%. Early adoption was gradual, driven by industrial, laboratory, and protective clothing applications. Year-on-year growth during this phase reflects steady integration into manufacturing and safety operations, incremental procurement, and rising awareness of fabric performance. These initial years established the foundation for wider adoption and consistent market expansion.

Between 2025 and 2030, the market enters a scaling phase, rising from USD 2.4 billion to USD 3.3 billion, with YoY growth averaging 6.0–6.3%. Adoption expands across chemical processing, healthcare, and industrial safety sectors, supported by recurring procurement and replacement cycles. From 2030 to 2035, growth continues steadily to USD 4.5 billion, with annual increases around 6.1–6.4%. The YoY analysis highlights predictable expansion, with recurring purchases, broader adoption in industrial safety applications, and rising demand across key regions driving steady market growth and marking the transition toward a mature and stable market environment.

Cross-functional tensions emerge between product development teams pursuing optimal chemical protection and regulatory compliance departments navigating evolving chemical restrictions that affect coating formulations. Process engineers evaluate manufacturing modifications required to accommodate PFAS-free treatments while maintaining chemical resistance performance. Quality assurance departments develop testing protocols that validate chemical barrier effectiveness while ensuring compliance with changing restrictions on textile treatment chemicals. Sales teams must communicate protection capabilities while addressing customer concerns about regulatory compliance and alternative chemistry performance.

Manufacturing processes for chemical resistant fabrics require integration of textile production technology with specialized coating and lamination systems. Production facilities install precision coating equipment, controlled atmosphere curing systems, and sealing technologies that ensure consistent barrier properties across fabric widths. Environmental control systems manage solvent emissions and implement worker protection measures required by occupational health regulations. Quality control procedures evaluate chemical permeation rates, mechanical durability, and seam integrity through sophisticated testing equipment that simulates actual exposure conditions.

The competitive landscape demonstrates significant differentiation between established textile manufacturers with PPE expertise and specialized chemical barrier companies focusing on high-performance applications. Major textile producers leverage economies of scale and comprehensive testing facilities while developing alternative chemistries to replace restricted substances. Specialized barrier fabric companies focus on extreme chemical resistance applications and customer technical support, often requiring partnerships with chemical suppliers for custom formulation development. This creates market segmentation where different customer segments prioritize either cost efficiency through established suppliers or maximum protection through specialized barrier technologies.

| Metric | Value |

|---|---|

| Chemical Resistant Fabrics Market Estimated Value in (2025 E) | USD 2.4 billion |

| Chemical Resistant Fabrics Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The chemical resistant fabrics market is experiencing steady growth, driven by rising industrial safety standards and the increasing need for protective clothing in hazardous environments. Stringent regulations across manufacturing, oil and gas, pharmaceuticals, and chemical processing are encouraging the adoption of fabrics that can provide long-lasting protection against corrosive substances. Advancements in fabric engineering, coating technologies, and fiber blending are improving resistance to acids, alkalis, solvents, and other aggressive chemicals while enhancing wearer comfort and durability.

Growing awareness about occupational health risks and the importance of compliance with safety norms is prompting industries to invest in high-quality protective fabrics. Global supply chain expansion in chemical-intensive industries is further fueling demand, particularly in developing economies where industrialization is accelerating.

Additionally, manufacturers are focusing on producing lightweight, breathable, and flame-resistant chemical protective fabrics to address multiple safety requirements in a single solution As safety regulations tighten and technology continues to improve, the market is positioned for sustained growth, with innovation and regulatory compliance acting as primary drivers of adoption worldwide.

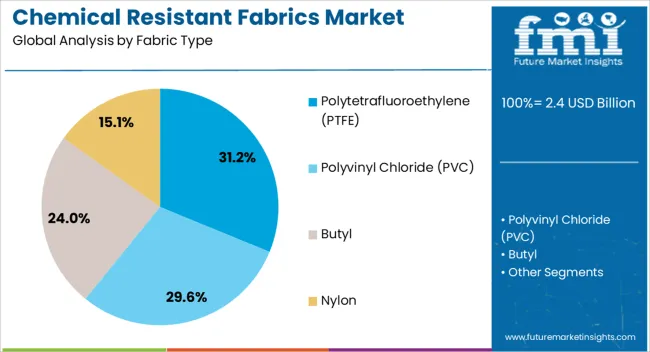

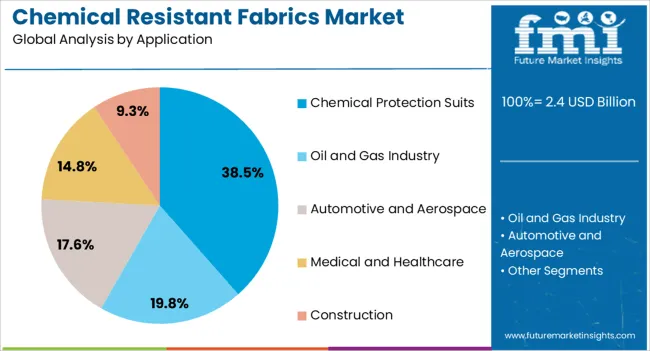

The chemical resistant fabrics market is segmented by fabric type, application, end-user industry, form, grade, and geographic regions. By fabric type, chemical resistant fabrics market is divided into Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Butyl, and Nylon. In terms of application, chemical resistant fabrics market is classified into Chemical Protection Suits, Oil and Gas Industry, Automotive and Aerospace, Medical and Healthcare, and Construction.

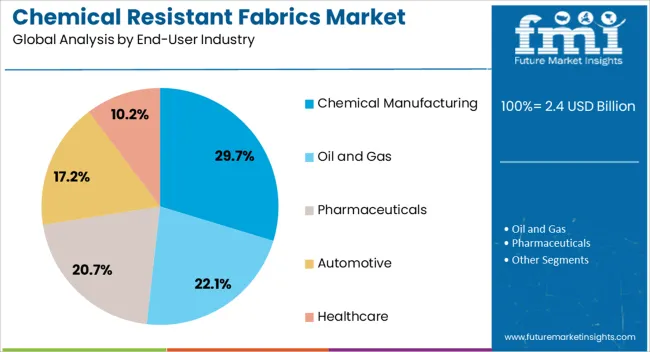

Based on end-user industry, chemical resistant fabrics market is segmented into Chemical Manufacturing, Oil and Gas, Pharmaceuticals, Automotive, and Healthcare. By form, chemical resistant fabrics market is segmented into Woven, Non-Woven, and Laminated. By grade, chemical resistant fabrics market is segmented into Standard and Military-Grade. Regionally, the chemical resistant fabrics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polytetrafluoroethylene fabric type segment is projected to hold 31.2% of the chemical resistant fabrics market revenue share in 2025, making it the leading fabric type. Its dominance is being reinforced by exceptional chemical inertness, high temperature resistance, and non-stick properties, which make it highly suitable for environments involving aggressive chemical exposure. PTFE fabrics maintain their integrity even when exposed to strong acids, alkalis, and organic solvents, ensuring consistent performance and extended product life.

The segment is benefiting from increasing demand in industries where chemical spills, splashes, and vapors present significant safety hazards. Technological improvements in weaving and lamination techniques are enabling better bonding and mechanical strength without compromising flexibility.

Additionally, PTFE fabrics are valued for their resistance to UV radiation and environmental degradation, making them suitable for both indoor and outdoor applications. The combination of superior protective performance, durability, and compliance with stringent safety regulations is solidifying PTFE’s position as the preferred material for high-grade chemical protective gear and industrial safety apparel.

The chemical protection suits application segment is expected to account for 38.5% of the chemical resistant fabrics market revenue share in 2025, making it the dominant application area. Its leadership is supported by the critical role these suits play in safeguarding workers from chemical exposure during manufacturing, handling, and emergency response activities. The increasing frequency of chemical-related incidents, coupled with stricter occupational safety laws, is driving greater adoption of advanced chemical protection suits in high-risk industries.

The integration of chemical resistant fabrics into suit designs allows for enhanced protection without significantly increasing weight or reducing mobility. Continuous advancements in fabric technology, including multi-layered composites and breathable membrane systems, are improving wearer comfort while maintaining high protection levels.

The segment is also benefiting from rising demand in hazardous material handling, oil refining, and laboratory environments. As industries prioritize worker safety and regulatory compliance, chemical protection suits made from high-performance fabrics are expected to remain the primary line of defense against chemical hazards, ensuring continued segment growth.

The chemical manufacturing end-user industry segment is projected to capture 29.7% of the chemical resistant fabrics market revenue share in 2025, positioning it as the leading end-use industry. This dominance is driven by the inherently high-risk environment of chemical production facilities, where exposure to corrosive substances and hazardous compounds is routine. The segment’s growth is supported by stringent safety protocols, international standards, and regulatory requirements that mandate the use of certified protective clothing for workers.

Chemical resistant fabrics are being widely adopted in this industry to produce protective garments, gloves, and other safety gear capable of withstanding direct contact with aggressive chemicals. Increasing investment in expanding chemical production capacities, particularly in Asia-Pacific and the Middle East, is creating a higher demand for reliable protective materials.

Manufacturers are focusing on developing fabrics that combine chemical resistance with additional properties such as flame retardancy and abrasion resistance to meet the diverse safety needs of chemical manufacturing plants. As the global chemical industry continues to grow, this end-user segment is expected to maintain its leading position, supported by continuous innovation and strict compliance requirements.

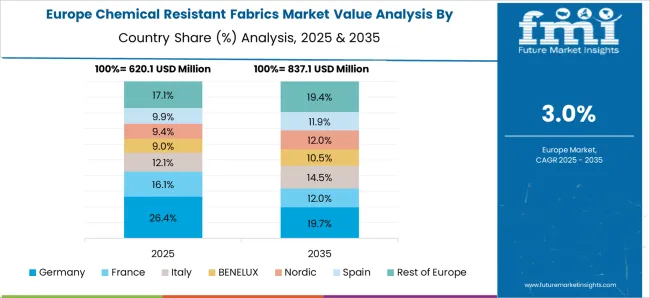

The chemical resistant fabrics market is growing due to rising demand for protective clothing in industrial, medical, and laboratory environments. These fabrics prevent exposure to acids, alkalis, solvents, and other hazardous chemicals, ensuring worker safety. Asia-Pacific leads in production and consumption due to expanding manufacturing and chemical industries, while Europe emphasizes high-performance, certified fabrics. Manufacturers focus on durability, comfort, flexibility, and multi-layer protection to enhance usability across various industrial, military, and healthcare applications.

Chemical resistant fabrics are crucial in industries such as chemical manufacturing, pharmaceuticals, oil and gas, and wastewater treatment. Workers exposed to corrosive liquids or hazardous substances require protective garments that resist permeation, abrasion, and tearing. Fabrics are engineered with multilayer laminates, coated textiles, or polymer blends to provide robust chemical protection while maintaining breathability and comfort. Suppliers offering fabrics that meet industry safety standards and certification requirements, such as ISO and ASTM, gain preference among manufacturers of industrial workwear. Until alternative materials provide equivalent chemical resistance and durability, these fabrics remain essential for worker protection and operational safety in industrial environments.

In healthcare and laboratory settings, chemical resistant fabrics protect personnel from biological fluids, disinfectants, and laboratory reagents. Surgical gowns, lab coats, and aprons made from these materials prevent cross-contamination and reduce the risk of chemical or pathogen exposure. Lightweight, flexible, and breathable fabrics are preferred to ensure comfort during extended use. Manufacturers emphasizing compliance with regulatory standards and providing garments with enhanced barrier properties gain trust from hospitals, research labs, and diagnostic centers. Until alternative materials provide the same combination of chemical resistance, comfort, and regulatory compliance, chemical resistant fabrics remain indispensable in healthcare and research applications.

Chemical resistant fabrics are used in protective gear for military personnel, hazmat teams, and emergency responders dealing with chemical spills, warfare agents, or hazardous material incidents. These fabrics must withstand corrosive agents while allowing mobility, thermal regulation, and durability under extreme conditions. Suppliers offering advanced coatings, multi-layer protection, and high tensile strength fabrics cater to these specialized applications. Until alternative protective solutions meet the combined requirements of chemical resistance, flexibility, and rapid response performance, chemical resistant fabrics will remain critical in military, defense, and emergency preparedness applications.

Manufacturers of chemical resistant fabrics must comply with safety standards and environmental regulations concerning chemical exposure, flame retardancy, and material toxicity. Regulatory certifications, including ISO, NFPA, and EN standards, are key factors influencing adoption in industrial and healthcare sectors. Additionally, growing demand for environmentally friendly fabrics drives innovation in recyclable, low-emission coatings and sustainable fiber options. Suppliers balancing regulatory compliance, performance, and sustainability gain a competitive advantage. Until alternative materials provide the same protective performance while meeting environmental and regulatory standards, chemical resistant fabrics will continue to play a pivotal role in occupational safety.

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global Chemical Resistant Fabrics Market is projected to grow at a CAGR of 6.2% through 2035, supported by increasing demand across industrial, protective clothing, and chemical handling applications. Among BRICS nations, China has been recorded with 8.4% growth, driven by large-scale production and deployment in protective and industrial fabrics, while India has been observed at 7.8%, supported by rising utilization in chemical and industrial safety applications. In the OECD region, Germany has been measured at 7.1%, where production and adoption for industrial, protective, and chemical-resistant applications have been steadily maintained. The United Kingdom has been noted at 5.9%, reflecting consistent use in industrial and safety fabrics, while the USA has been recorded at 5.3%, with production and utilization across protective, industrial, and chemical handling sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The chemical resistant fabrics market in China is expanding at a CAGR of 8.4%, driven by increasing demand from chemical processing, manufacturing, and industrial safety sectors. Rising industrialization, stricter occupational safety regulations, and the need for protective apparel in hazardous environments are fueling growth. Adoption of advanced fabrics with high chemical resistance, durability, and comfort is increasing in chemical plants, laboratories, and industrial facilities. Government initiatives to improve workplace safety and environmental compliance further support market expansion. The development of lightweight, flame-retardant, and multi-functional fabrics also boosts adoption. Manufacturers are investing in R&D to create fabrics that provide superior protection against acids, solvents, and industrial chemicals while ensuring flexibility and durability. Rising awareness among workers and industries about safety standards ensures steady demand for chemical resistant fabrics across China.

The chemical resistant fabrics market in India is growing at a CAGR of 7.8%, supported by expanding chemical, pharmaceutical, and manufacturing industries. Increasing awareness of worker safety, government mandates on protective equipment, and rising industrial hazards drive the adoption of chemical resistant fabrics. Advanced textiles offering high resistance to acids, alkalis, solvents, and industrial chemicals are increasingly used in laboratories, manufacturing units, and industrial facilities. Manufacturers focus on producing lightweight, durable, and comfortable fabrics suitable for long working hours in hazardous conditions. Growth in chemical plants, pharmaceutical production, and industrial infrastructure projects further boosts market demand. Technological innovations such as anti-static, flame-retardant, and multi-functional fabrics enhance protective performance. Rising safety consciousness among industrial workers and enforcement of workplace regulations ensure steady adoption of chemical resistant fabrics in India.

The chemical resistant fabrics market in Germany is expanding at a CAGR of 7.1%, driven by stringent industrial safety standards and the presence of large chemical and pharmaceutical industries. Protective fabrics are increasingly adopted for workers handling corrosive chemicals, solvents, and hazardous substances in industrial facilities. Germany’s focus on occupational health, environmental compliance, and workplace safety ensures high demand for reliable and advanced protective textiles. Technological advancements, including multi-layered fabrics, flame retardancy, anti-static properties, and chemical repellency, enhance safety and usability. Industrial automation and the expansion of chemical plants, laboratories, and manufacturing units contribute to consistent market growth. Manufacturers are investing in R&D to develop lightweight, flexible, and durable fabrics meeting stringent European standards. Rising safety awareness and compliance requirements further boost the market for chemical resistant fabrics across Germany.

The chemical resistant fabrics market in the United Kingdom is growing at a CAGR of 5.9%, supported by industrial, chemical, and pharmaceutical applications. Protective fabrics are essential for workers exposed to hazardous chemicals, acids, solvents, and industrial pollutants. Adoption of lightweight, durable, and comfortable chemical resistant textiles is rising across laboratories, manufacturing units, and chemical plants. Government regulations focusing on occupational safety, hazard prevention, and industrial compliance promote the use of protective fabrics. Technological innovations such as multi-functional fabrics with flame retardancy, anti-static properties, and chemical repellency enhance market appeal. Industrial expansion, increased chemical production, and workplace safety awareness further drive demand. Continuous R&D efforts by manufacturers to improve protection, comfort, and durability of fabrics ensure steady growth of the chemical resistant fabrics market in the United Kingdom.

The chemical resistant fabrics market in the United States is growing at a CAGR of 5.3%, driven by chemical, pharmaceutical, and industrial safety requirements. Protective fabrics are used extensively in laboratories, manufacturing plants, chemical processing facilities, and industrial sites to safeguard workers from exposure to hazardous chemicals and solvents. Technological innovations such as high chemical repellency, flame retardancy, anti-static properties, and multi-layer construction enhance protective performance. Government regulations, OSHA compliance standards, and workplace safety initiatives boost adoption across industries. The growth of chemical and pharmaceutical sectors, industrial automation, and awareness of worker safety further contribute to market expansion. Manufacturers are focused on developing lightweight, durable, and flexible fabrics that maintain comfort while offering superior protection. The USA market benefits from continuous R&D investments, ensuring a steady rise in chemical resistant fabrics adoption.

The Chemical Resistant Fabrics Market is growing steadily, driven by increasing demand for protective clothing and industrial safety materials across chemical processing, oil and gas, healthcare, and manufacturing sectors. These fabrics are engineered to resist degradation from acids, alkalis, solvents, and hazardous liquids, ensuring worker safety and regulatory compliance in high-risk environments. Market growth is being accelerated by rising workplace safety standards, stricter occupational health regulations, and growing investment in advanced protective textile technologies.

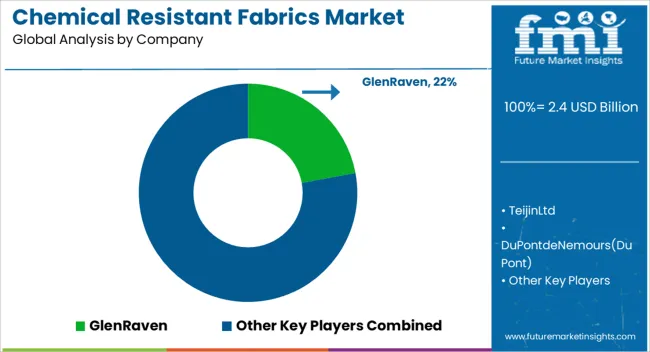

Leading manufacturers such as Glen Raven Inc., Teijin Ltd., and DuPont de Nemours Inc. dominate the market with innovative high-performance fabrics that combine durability, comfort, and multi-layer protection. DuPont’s Nomex® and Kevlar® fibers remain benchmarks in flame- and chemical-resistant apparel, while Teijin’s Aramid and Twaron fibers offer lightweight yet high-strength protection. Glen Raven Inc. specializes in woven and coated performance fabrics that resist chemical penetration while maintaining breathability and flexibility, making them ideal for industrial uniforms and protective gear.

Milliken & Company is expanding its portfolio with sustainable, multi-functional textile technologies that enhance chemical resistance while integrating moisture control and comfort. Kolon Industries Inc. contributes with advanced aramid fibers optimized for chemical and thermal resistance in protective garments used in firefighting, defense, and industrial applications. Koninklijke TenCate B.V. focuses on composite fabric systems that deliver high durability and consistent protection for hazardous environments and first-responder gear.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Fabric Type | Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Butyl, and Nylon |

| Application | Chemical Protection Suits, Oil and Gas Industry, Automotive and Aerospace, Medical and Healthcare, and Construction |

| End-User Industry | Chemical Manufacturing, Oil and Gas, Pharmaceuticals, Automotive, and Healthcare |

| Form | Woven, Non-Woven, and Laminated |

| Grade | Standard and Military-Grade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Glen Raven Inc., Teijin Ltd., DuPont de Nemours Inc., Milliken & Company, Kolon Industries Inc., Koninklijke TenCate B.V. |

| Additional Attributes | Dollar sales vary by fabric type, including coated fabrics, laminated fabrics, and blended fabrics; by application, such as protective clothing, industrial workwear, medical apparel, and filtration; by end-use industry, spanning chemical processing, pharmaceuticals, healthcare, and oil & gas; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by stringent safety regulations, rising industrialization, and demand for worker protection against chemical hazards. |

The global chemical resistant fabrics market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the chemical resistant fabrics market is projected to reach USD 4.5 billion by 2035.

The chemical resistant fabrics market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in chemical resistant fabrics market are polytetrafluoroethylene (ptfe), polyvinyl chloride (pvc), butyl and nylon.

In terms of application, chemical protection suits segment to command 38.5% share in the chemical resistant fabrics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Flame Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Finishing Chemical for Coated Fabrics Market Forecast Outlook 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA