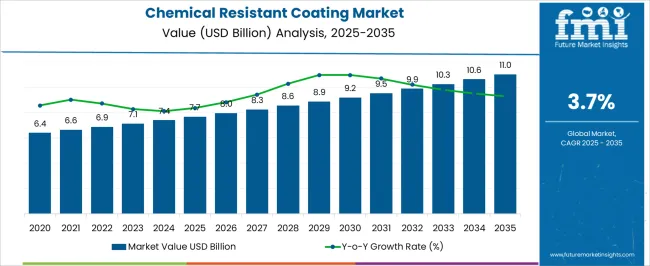

The Chemical Resistant Coating Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period. From 2020 to 2024, the market expanded from USD 6.4 billion to USD 7.4 billion, with annual growth rates ranging between 3.2% and 3.8%. Early adoption reflects gradual integration across industrial, automotive, and construction segments, where demand for protective coatings rises incrementally. Year-on-year growth during this period is supported by steady procurement and expansion in maintenance and refurbishment projects, with manufacturers increasing production capacity to meet growing demand across multiple regions and applications.

Between 2025 and 2030, the market enters a scaling phase, rising from USD 7.7 billion to USD 9.2 billion, with YoY growth averaging 3.5–3.8%. Adoption spreads across chemical processing, machinery, and infrastructure projects, supported by broader distribution and procurement channels. From 2030 to 2035, growth continues steadily to USD 11.0 billion, with annual increases of around 3.6–3.8%. The YoY analysis highlights predictable expansion, with recurring demand, coating replacements, and broader adoption across industrial applications driving consistent market growth, reflecting a transition toward a mature market with stabilized revenue streams and steady procurement patterns.

Production facilities confront operational tensions between maintaining coating performance and complying with PFAS restrictions. Plant operators must balance production efficiency against requirements for alternative chemical formulations that may not provide equivalent chemical resistance, heat stability, or durability. Engineering teams face challenges redesigning coating systems to eliminate restricted PFAS while maintaining critical properties such as low friction coefficients, chemical inertness, and temperature stability across wide operating ranges.

Cross-functional conflicts emerge between manufacturing seeking proven chemical-resistant formulations and regulatory departments demanding PFAS elimination strategies. Quality control teams encounter difficulties validating alternative coating systems that must meet the same performance specifications as PFAS-based formulations without using restricted substances. Facility managers must adapt production lines to accommodate alternative raw materials and processing methods while maintaining coating quality and application consistency.

Industrial applications face particular scrutiny due to environmental persistence concerns. PFAS-based chemical resistant coatings accumulate in the environment and bioaccumulate in organisms, leading to regulatory pressure for closed-loop production and recycling systems. Industries using fluoropolymer coatings in high-temperature applications, chemical processing equipment, and aerospace components must develop alternative protection strategies while maintaining operational safety and performance standards.

Medical and food contact applications encounter additional regulatory requirements due to PFAS migration concerns. Chemical resistant coatings used in food processing equipment, medical devices, and pharmaceutical manufacturing must comply with increasingly strict migration limits and PFAS content restrictions. Quality assurance teams face challenges maintaining sterile processing capabilities and chemical compatibility when transitioning away from PFAS-based coating systems.

| Metric | Value |

|---|---|

| Chemical Resistant Coating Market Estimated Value in (2025 E) | USD 7.7 billion |

| Chemical Resistant Coating Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

Rising industrialization, coupled with the expansion of sectors such as petrochemicals, pharmaceuticals, and water treatment, is driving demand for coatings that provide long-term corrosion and chemical resistance. Advances in formulation technologies are enabling improved performance, with coatings now offering enhanced adhesion, abrasion resistance, and durability even in extreme temperature or pH conditions.

Stringent safety and environmental regulations are encouraging industries to adopt high-performance coatings to prevent structural degradation and reduce maintenance costs. Growing investments in infrastructure and manufacturing facilities in both developed and emerging economies are further supporting market expansion.

The ability of chemical-resistant coatings to minimize downtime, extend asset life, and ensure operational safety makes them a critical component in industrial maintenance strategies. With continuous innovation in resin chemistry and application technologies, the market is positioned for sustained growth over the next decade.

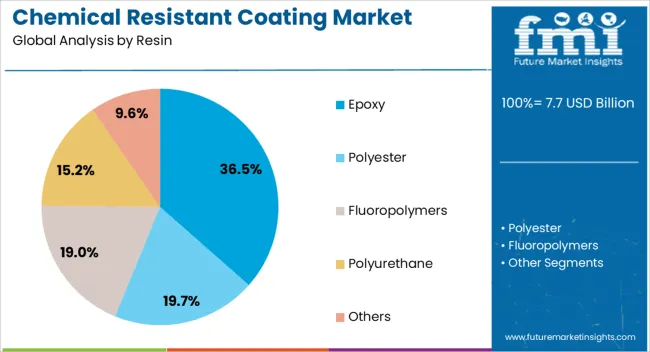

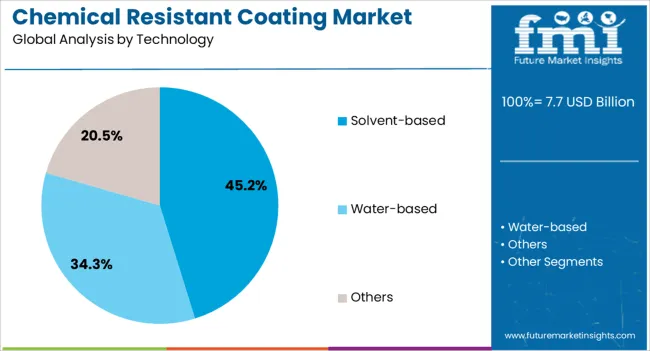

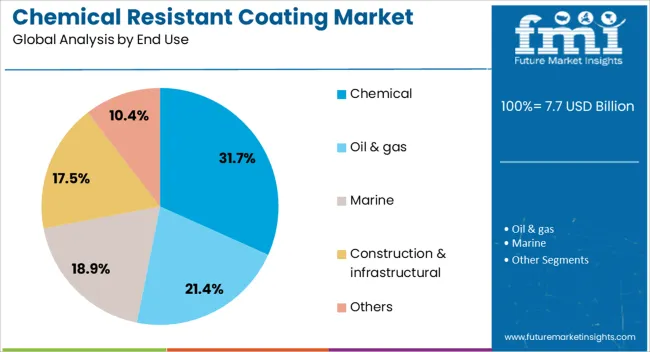

The chemical resistant coating market is segmented by resin, technology, end use, and geographic regions. By resin, chemical resistant coating market is divided into Epoxy, Polyester, Fluoropolymers, Polyurethane, and Others. In terms of technology, chemical resistant coating market is classified into Solvent-based, Water-based, and Others. Based on end use, chemical resistant coating market is segmented into Chemical, Oil & gas, Marine, Construction & infrastructural, and Others.

Regionally, the chemical resistant coating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The epoxy resin segment is projected to account for 36.5% of the chemical resistant coating market revenue share in 2025, positioning it as the leading resin type. This leadership is being driven by epoxy’s superior chemical resistance, excellent adhesion, and high mechanical strength, which make it suitable for a wide range of industrial applications. Its versatility allows it to perform effectively in environments exposed to acids, alkalis, solvents, and other corrosive agents.

The segment is benefiting from the increasing adoption of epoxy coatings in industries such as oil and gas, chemicals, marine, and water treatment, where durability and long-term performance are essential. Advances in epoxy formulation are enhancing resistance to thermal cycling and abrasion, making them suitable for both protective and decorative applications.

The relatively lower maintenance requirements of epoxy-based coatings are also appealing to cost-conscious industries. As demand for high-performance coatings rises in both infrastructure and industrial projects, epoxy resins are expected to maintain their market dominance due to their proven reliability and adaptability.

The solvent-based technology segment is anticipated to hold 45.2% of the chemical resistant coating market revenue share in 2025, making it the leading technology category. Its dominance is supported by the ability to deliver consistent performance in varied environmental conditions, including high humidity and low temperatures. Solvent-based coatings form a dense, durable film that provides superior resistance to chemicals, moisture, and abrasion, making them suitable for heavy-duty industrial applications.

This segment is also favored for its faster curing time and ability to achieve strong adhesion on a wide range of substrates, including metals and concrete. Despite increasing regulatory pressure to reduce volatile organic compounds, solvent-based formulations continue to be widely used in applications where high-performance protection is critical.

Ongoing advancements in low-VOC and compliant solvent-based systems are helping the segment adapt to evolving environmental standards while retaining performance benefits. The combination of reliability, versatility, and process efficiency is expected to keep solvent-based technology at the forefront of the market.

The chemical end use segment is expected to represent 31.7% of the chemical resistant coating market revenue share in 2025, making it the largest end-use category. This leadership is driven by the intensive exposure of chemical processing equipment and infrastructure to corrosive substances, requiring continuous protection to maintain operational integrity. Facilities such as storage tanks, reactors, pipelines, and flooring in chemical plants rely heavily on coatings that can withstand aggressive acids, solvents, and other hazardous materials.

The segment’s growth is further supported by the expansion of the global chemical manufacturing base, particularly in Asia-Pacific and the Middle East, where large-scale investments are being made in new facilities. Adoption of chemical resistant coatings in this sector is also influenced by stringent regulatory requirements for safety and environmental compliance.

Continuous innovation in coating formulations is enabling enhanced resistance to both chemical attack and mechanical wear, ensuring longer service life and reduced maintenance costs These factors collectively reinforce the segment’s position as the dominant end-use category in the market.

The chemical resistant coating market is growing due to increasing demand for protective coatings in industrial, automotive, construction, and marine applications. These coatings prevent corrosion, chemical attack, and surface degradation in harsh environments. Rising industrialization and stringent safety regulations drive adoption. Asia-Pacific leads production and consumption due to expanding chemical and manufacturing industries, while Europe and North America focus on high-performance, environmentally compliant coatings. Manufacturers emphasize durability, adhesion, and resistance to acids, alkalis, and solvents to enhance product performance across industries.

Chemical resistant coatings are critical for protecting industrial machinery, pipelines, tanks, and storage vessels exposed to corrosive chemicals. These coatings prevent deterioration, extend equipment lifespan, and reduce maintenance costs. Industries such as chemicals, oil & gas, and pharmaceuticals require coatings capable of withstanding acids, alkalis, and solvents at high temperatures. Coatings with excellent adhesion and resistance to mechanical abrasion are preferred. Manufacturers supplying customized solutions for specific chemical exposure conditions gain a competitive advantage. Until alternative materials or equipment designs achieve similar resistance, chemical resistant coatings remain indispensable for safeguarding industrial assets and ensuring operational continuity.

Marine structures, ships, and offshore platforms are constantly exposed to saltwater, chemical spills, and extreme weather conditions, creating demand for chemical resistant coatings. These coatings protect steel and concrete surfaces from corrosion, fouling, and degradation, ensuring structural integrity and safety. Coatings with UV resistance, anti-fouling properties, and high adhesion perform best in marine environments. Companies providing environmentally compliant, long-lasting coatings gain a competitive edge, especially as international regulations regarding marine protection tighten. Until alternative protective solutions match chemical and environmental resistance, chemical resistant coatings remain essential for extending the lifespan and safety of marine infrastructure.

In the automotive and transportation sector, chemical resistant coatings protect vehicle components from exposure to fuels, oils, cleaning agents, and de-icing chemicals. High-performance coatings improve corrosion resistance, maintain surface aesthetics, and enhance component durability. Engine compartments, undercarriages, and fuel systems are common application areas. Manufacturers offering coatings that combine chemical resistance with temperature stability, adhesion, and environmental compliance gain preference. Until alternative materials or surface treatments provide comparable protection, chemical resistant coatings will continue to play a vital role in prolonging vehicle lifespan, reducing maintenance, and ensuring safety in automotive and transportation applications.

Chemical resistant coatings must meet stringent safety, environmental, and emission regulations across regions. Volatile organic compound (VOC) limits, hazardous substance restrictions, and worker safety standards influence formulation and adoption. Manufacturers are developing low-VOC, solvent-free, and water-based coatings to comply with regulations while maintaining performance. Industrial buyers prioritize suppliers that provide compliance certifications, safety documentation, and consistent quality to avoid legal or operational issues. Until alternative coating technologies achieve the same regulatory compliance and performance balance, adherence to environmental and safety standards will remain a critical factor shaping adoption and competitiveness in the chemical resistant coatings market.

| Countries | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

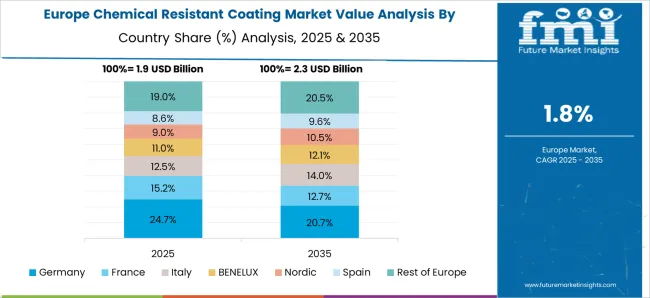

The global Chemical Resistant Coating Market is projected to grow at a CAGR of 3.7% through 2035, supported by increasing demand across industrial, chemical, and protective applications. Among BRICS nations, China has been recorded with 5% growth, driven by large-scale production and deployment in industrial and chemical facilities, while India has been observed at 4.6%, supported by rising utilization in protective and industrial coating applications. In the OECD region, Germany has been measured at 4.3%, where production and adoption for chemical and industrial protection have been steadily maintained. The United Kingdom has been noted at 3.5%, reflecting consistent use in industrial and chemical coating applications, while the USA has been recorded at 3.1%, with production and utilization across industrial, protective, and chemical sectors being steadily increased. This report includes insights on 40+ countries; the top markets are shown here for reference.

The chemical resistant coating market in China is expanding at a CAGR of 5%, fueled by growing industrialization and increasing demand for protective coatings in manufacturing, chemical processing, and construction sectors. Industries such as petrochemicals, pharmaceuticals, and metal processing require coatings that can withstand aggressive chemical exposure and extend asset lifespan. Chinese manufacturers are investing in R&D to develop advanced formulations with superior adhesion, corrosion resistance, and durability. Government initiatives supporting industrial growth, environmental protection, and chemical safety further boost the market. Additionally, export demand for industrial coatings contributes to steady market expansion. The integration of sustainable and eco-friendly coating solutions is becoming increasingly important, as companies aim to comply with regulations while maintaining performance. With technological innovations, rising industrial activities, and a strong manufacturing base, the chemical resistant coating market in China is poised for steady growth.

The chemical resistant coating market in India is growing at a CAGR of 4.6%, supported by industrial expansion and infrastructure development. Industries including pharmaceuticals, petrochemicals, and metal processing require protective coatings that ensure long-term durability and resistance to chemical attack. Manufacturers are adopting innovative coating technologies with improved adhesion, chemical resistance, and environmental compliance. Government policies promoting industrial safety, chemical processing standards, and infrastructure modernization further enhance market growth. Rising industrial exports also drive demand for high-performance coatings that meet international standards. With an increasing focus on sustainable, eco-friendly coating solutions, companies are investing in R&D to balance performance with environmental responsibility. Overall, the chemical resistant coating market in India is witnessing steady adoption across multiple industrial sectors, ensuring consistent growth in the coming years.

The chemical resistant coating market in Germany is advancing at a CAGR of 4.3%, driven by stringent industrial safety and environmental regulations. Protective coatings are increasingly adopted in chemical plants, automotive, metalworking, and pharmaceutical industries to enhance asset longevity and prevent chemical damage. German manufacturers focus on high-performance solutions, including epoxy, polyurethane, and fluoropolymer coatings, to meet rigorous standards for durability and chemical resistance. Research and development efforts aim to improve adhesion, corrosion protection, and eco-friendliness. The country’s strong export-oriented industrial base ensures steady demand for chemical resistant coatings. Adoption in infrastructure, manufacturing facilities, and chemical plants further sustains market growth. Germany’s emphasis on innovation, quality, and sustainability ensures that the chemical resistant coating market continues to expand steadily.

The chemical resistant coating market in the United Kingdom is growing at a CAGR of 3.5%, with demand from industrial, chemical processing, and construction sectors. Protective coatings are increasingly used in manufacturing, infrastructure, and maintenance to prevent corrosion, chemical damage, and asset degradation. Technological innovations focus on developing eco-friendly, high-performance coatings with improved chemical resistance and longevity. Government regulations on safety, environmental protection, and industrial standards influence adoption. The UK market also benefits from industrial refurbishment projects, chemical plant upgrades, and infrastructure modernization, creating additional demand. Rising awareness about sustainable and long-lasting coatings among manufacturers and end-users further supports growth. With technological innovation, industrial activity, and regulatory support, the chemical resistant coating market in the UK is poised for stable expansion.

The chemical resistant coating market in the United States is advancing at a CAGR of 3.1%, driven by industrial, chemical, and construction sector demand. Protective coatings are essential for pipelines, chemical processing plants, automotive facilities, and industrial equipment, ensuring durability and resistance to aggressive chemicals. Manufacturers are increasingly focusing on innovative coatings that offer superior adhesion, corrosion protection, and environmental compliance. Government regulations on chemical safety, industrial standards, and environmental protection significantly influence market adoption. The growing need for refurbishment of aging industrial assets, as well as expansion of chemical and manufacturing facilities, sustains market growth. Additionally, sustainable coating solutions that meet strict environmental norms are gaining traction. With technological advancements, regulatory support, and industrial demand, the chemical resistant coating market in the USA is expected to grow steadily.

The Chemical Resistant Coating Market is expanding robustly, driven by the growing need for durable surface protection in industries such as oil and gas, marine, construction, automotive, and chemical processing. These coatings provide superior resistance to acids, alkalis, solvents, and corrosive gases, extending equipment life and minimizing maintenance costs in harsh operating environments. Increasing infrastructure investment and stricter safety regulations are fueling the adoption of high-performance, environment-friendly coating technologies across both industrial and commercial sectors.

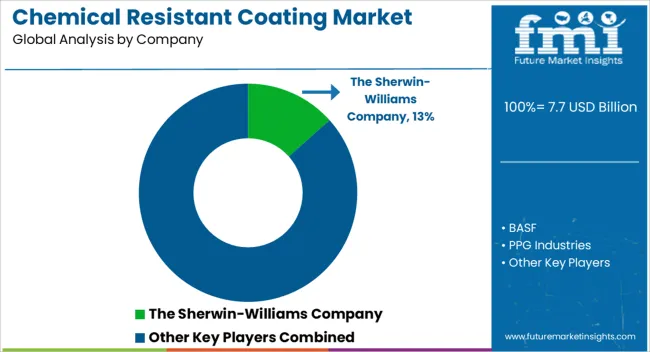

Leading global manufacturers such as The Sherwin-Williams Company, PPG Industries, and Akzo Nobel N.V. are at the forefront of innovation, developing advanced epoxy, polyurethane, and fluoropolymer-based coatings that offer long-term protection and compliance with VOC and environmental standards. BASF SE and Sika AG are investing in hybrid resin chemistries and nanotechnology-enhanced formulations to improve adhesion, abrasion resistance, and chemical stability for concrete, steel, and composite surfaces.

Jotun, Kansai Paint Co. Ltd., and Hempel A/S are focusing on expanding their marine and industrial protective coating portfolios, delivering high-performance solutions that withstand extreme chemical and thermal stress. Daikin Industries Ltd. leverages its expertise in fluorochemicals to produce coatings with exceptional non-stick, anti-corrosion, and solvent resistance properties, ideal for heavy-duty applications. RPM International Inc. is emphasizing tailored coating systems for refineries, wastewater treatment facilities, and manufacturing plants through its specialized subsidiaries.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Resin | Epoxy, Polyester, Fluoropolymers, Polyurethane, and Others |

| Technology | Solvent-based, Water-based, and Others |

| End Use | Chemical, Oil & gas, Marine, Construction & infrastructural, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Sherwin-Williams Company, BASF, PPG Industries, Akzo Nobel, Jotun, Sika AG, Daikin Industries, Kansai Paint, Hempel, RPM International |

| Additional Attributes | Dollar sales vary by coating type, including epoxy, polyurethane, fluoropolymer, and acrylic coatings; by application, such as industrial equipment, storage tanks, pipelines, and flooring; by end-use industry, spanning chemical processing, oil & gas, pharmaceuticals, and food & beverage; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by increasing industrialization, stringent safety regulations, and demand for corrosion- and chemical-resistant surfaces. |

The global chemical resistant coating market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the chemical resistant coating market is projected to reach USD 11.0 billion by 2035.

The chemical resistant coating market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in chemical resistant coating market are epoxy, polyester, fluoropolymers, polyurethane and others.

In terms of technology, solvent-based segment to command 45.2% share in the chemical resistant coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Wood Preservative Chemical & Coating Active Ingredient Market Analysis by Active Ingredient Type, Use Class, and Region through 2025 to 2035

Chemical Hydraulic Valves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Vapor Deposition Market Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA