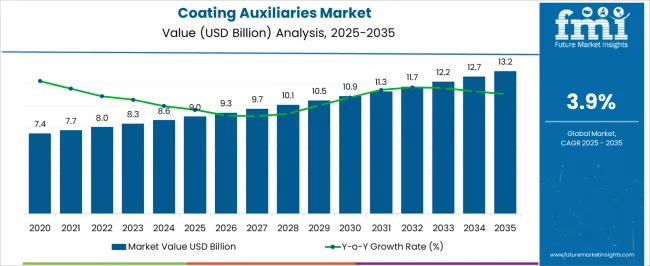

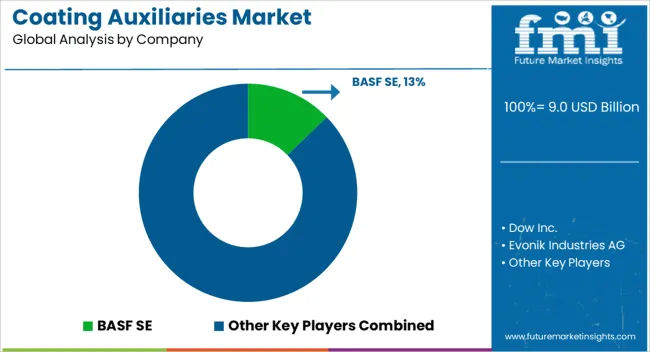

The Coating Auxiliaries Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| Coating Auxiliaries Market Estimated Value in (2025 E) | USD 9.0 billion |

| Coating Auxiliaries Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The coating auxiliaries market is experiencing significant growth driven by increasing demand for high-performance coatings across industrial and architectural applications. Growth is being supported by the rising adoption of environmentally friendly coatings and waterborne formulations, which require specialized additives to improve product stability, dispersion, and application performance. Technological advancements in coating chemistry, coupled with stricter environmental regulations, are influencing manufacturers to optimize product formulations using advanced auxiliaries.

Rising investments in construction and infrastructure development, particularly in emerging markets, are driving the need for durable, aesthetically appealing, and long-lasting coatings. Enhanced functionality of coatings, including resistance to corrosion, abrasion, and UV exposure, is being achieved through the integration of advanced dispersing, wetting, and leveling agents.

The growing focus on energy-efficient and sustainable buildings is further accelerating the adoption of high-quality architectural coatings As industrial expansion continues and regulatory frameworks encourage safer and more effective coating systems, the market is positioned for steady long-term growth with increasing opportunities for innovation in auxiliary chemistries.

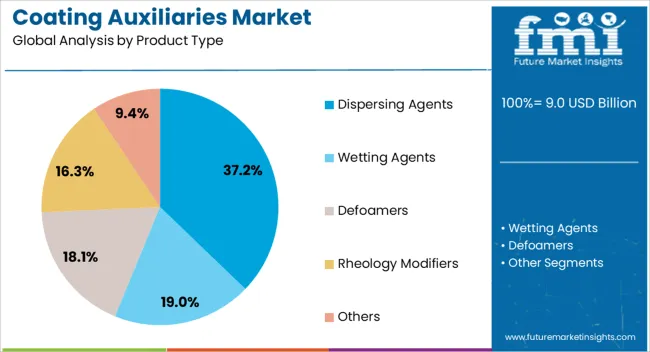

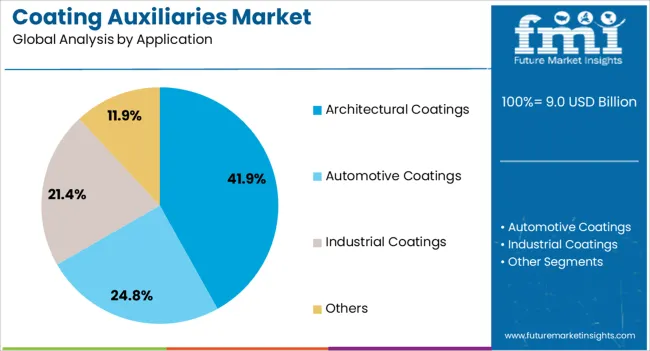

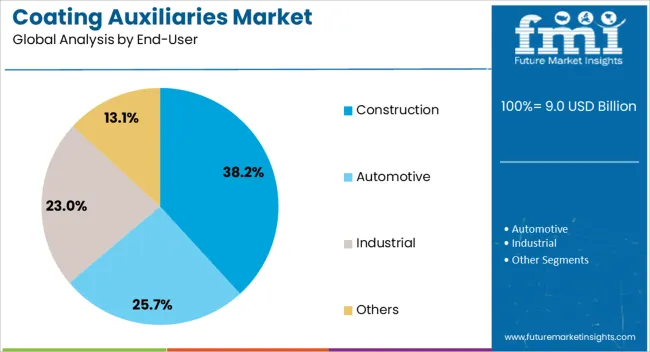

The coating auxiliaries market is segmented by product type, application, end-user, and geographic regions. By product type, coating auxiliaries market is divided into Dispersing Agents, Wetting Agents, Defoamers, Rheology Modifiers, and Others. In terms of application, coating auxiliaries market is classified into Architectural Coatings, Automotive Coatings, Industrial Coatings, and Others. Based on end-user, coating auxiliaries market is segmented into Construction, Automotive, Industrial, and Others. Regionally, the coating auxiliaries industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dispersing agents product type segment is projected to hold 37.2% of the coating auxiliaries market revenue share in 2025, establishing it as the leading product category. Its dominance is being driven by the essential role dispersing agents play in enhancing the uniformity, stability, and performance of coating formulations.

These agents reduce pigment agglomeration, ensure consistent color distribution, and improve flow and leveling properties, which are critical for high-quality finishes in both architectural and industrial coatings. The segment is benefiting from increasing demand for waterborne and low-VOC coatings, where efficient dispersion is key to maintaining product performance and compliance with environmental regulations.

Advancements in polymer chemistry and surfactant technologies have enabled the development of dispersing agents that perform effectively under diverse processing conditions, supporting higher efficiency and reduced production costs The segment’s leadership is further reinforced by its widespread use across multiple coating applications, making it a critical component in achieving desired functional and aesthetic properties while meeting industry standards and sustainability objectives.

The architectural coatings application segment is anticipated to account for 41.9% of the coating auxiliaries market revenue share in 2025, making it the largest application category. This dominance is being supported by the rising demand for high-performance coatings in residential, commercial, and public infrastructure projects. Coating auxiliaries are being leveraged to enhance attributes such as smooth finish, durability, UV resistance, and long-term color stability in architectural coatings.

The segment is benefiting from increasing construction and renovation activities, as well as a heightened focus on eco-friendly and low-VOC formulations that comply with stringent environmental regulations. Advanced auxiliary formulations are enabling better workability, improved adhesion, and extended shelf life, which enhance overall coating performance.

Additionally, the integration of innovative additives allows for improved coating efficiency and reduced material waste, supporting sustainability goals As building aesthetics, protection, and longevity become critical priorities, the architectural coatings segment is expected to maintain its leading position and continue to drive the adoption of high-performance coating auxiliaries globally.

The construction end-user segment is expected to hold 38.2% of the coating auxiliaries market revenue share in 2025, establishing it as the dominant end-use category. This leadership is being driven by the growing requirement for high-performance coatings in commercial, residential, and industrial construction projects, where durability, weather resistance, and aesthetic appeal are essential.

Coating auxiliaries, including dispersing agents, wetting agents, and rheology modifiers, are being utilized to improve application efficiency, enhance coating uniformity, and extend the lifespan of construction coatings. The segment’s growth is further supported by large-scale infrastructure development, urbanization trends, and increased adoption of green building materials, which demand advanced auxiliary chemistries to meet regulatory and sustainability requirements.

Manufacturers are increasingly focusing on developing specialized coatings for construction applications that combine performance with environmental compliance, driving the adoption of high-quality coating auxiliaries As construction activities continue to expand globally and regulatory frameworks tighten, the segment is expected to remain a key contributor to overall market growth and a primary driver for product innovation in the coating auxiliaries sector.

The coating Auxiliaries market is expected to expand rapidly due to the following:

Coating auxiliaries are consumed for the purpose of optimizing as well as supporting the application of coatings and release agents to guarantee an smooth production flow. Various products such as wiping fillers and dilutions, primers, cleaners, and mould cleaners belong to this category.

These products are ideal for cleaning mould and processing equipment, and exhibit certain industrial advantages such as high release strength of polyurethane (PU) and release agent residues. Coating auxiliaries provide an ideal preparation for many coating applications and also enhance the adhesion property of the coatings to the substrate. Manufacturers such as Bomix Chemie GmbH develop dilutions to achieve an effective processing viscosity.

The global market for coating auxiliaries has been witnessing a significant increase due to growth of its application and end user industries. Coating auxiliaries are used in various coating applications which are further implemented in industries such as construction and textile.

Growing demand from major application market such as textile and home furnishing are anticipated to remain the major growth factors for the market of coating auxiliaries. Significant per capita consumption has been witnessed from the textile industry, particularly in emerging economies such as Russia, China, Brazil and India.

his factor is expected to result in rising demand for coatings over the forecast period. However, rising environmental concerns regarding the hazards from the consumption of these coatings is expected to result in an unfavorable regulatory landscape which is expected to be a critical challenge for market players, resulting in the slowdown of the coating auxiliaries market.

In terms of the overall coatings market, polyurethane and silicone based coatings account for the most consumed products where silicone coatings are anticipated to witness the fastest growth over the forecast period primarily due to rising innovation in product development which is leading to growth in packaging and automobile industries where these coatings are significantly consumed for protection and lamination.

Emerging regions such as Asia Pacific accounted for the largest market share in terms of region in the global urethane coating auxiliaries market, followed by Europe and North America.

Growth of the major end user industries such as textiles and construction, particularly in the emerging economies of India and China are anticipated to boost the demand for coating auxiliaries over the forecast period. The market for coating auxiliaries in China is expected to rise significantly on account of the country’s growing consumer demand for high quality products as well as the continued rapid pace of the construction industry in the country.

Majority of the coating auxiliaries in China are consumed in construction applications, where commercial and residential construction account for the largest shares.

Increasing demand for coatings and adhesives on account of the rapidly growing construction industry is expected to boost the demand for coating auxiliaries over the next few years.

Moreover, increasing number of construction activities, particularly in the BRIC region (Brazil, Russia, India, and China) is anticipated to fuel the demand for coating auxiliaries as well. However, rising environmental regulations and concerns regarding the use of coating auxiliaries are expected to slow down the growth of the market. On account of these factors, focus of manufacturers towards developing bio-based coatings is expected to provide new opportunities for the growth of the market.

Baalbaki, Bomex Berlac Group, and Mayday Graphics are some of the manufactures of coatings auxiliaries present in the market.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types and applications.

Huge Market Potential Due to Its Pervasive Application in the Manufacturing of Technical Textiles:

A rise in the number of uses for technical textiles has increased the adoption of coating Auxiliaries. Incorporating textile Auxiliaries improves a wide range of properties in technical fabrics. The coating Auxiliaries market stands to gain from R&D into concentrated textile Auxiliaries for usage in the sector, which is expected to lead to new revenue opportunities.

Consumption of Textile Auxiliaries, Most Noticeably Dyeing and Printing Agents, is Growing as Apparel Fabric Demand Increases

Textile Auxiliaries, such as dyeing agents, printing agents, and finishing agents, are widely used in the textile processing industry, greatly increasing the consumption of these goods. Sales of coating Auxiliaries are being driven by the increasing need for a wide variety of fabrics used in fashion and home furnishings.

According to the research conducted on the coating Auxiliaries market, the dyeing and printing agent's category is a lucrative one and is expected to grow at a CAGR of almost 4% between 2025-2035.

Manufacturing techniques for textiles are progressively using environmentally friendly treatment methods. With their focus on greener methods, the industrial coating industry is likely to be able to expand into uncharted territory.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies

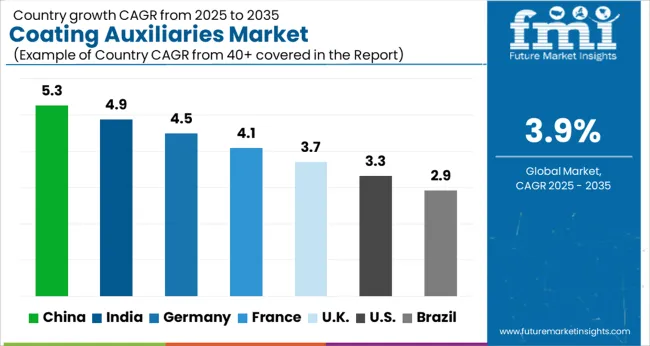

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The Coating Auxiliaries Market is expected to register a CAGR of 3.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.3%, followed by India at 4.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.9%, yet still underscores a broadly positive trajectory for the global Coating Auxiliaries Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.5%. The USA Coating Auxiliaries Market is estimated to be valued at USD 3.1 billion in 2025 and is anticipated to reach a valuation of USD 4.3 billion by 2035. Sales are projected to rise at a CAGR of 3.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 447.8 million and USD 256.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.0 Billion |

| Product Type | Dispersing Agents, Wetting Agents, Defoamers, Rheology Modifiers, and Others |

| Application | Architectural Coatings, Automotive Coatings, Industrial Coatings, and Others |

| End-User | Construction, Automotive, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Dow Inc., Evonik Industries AG, Clariant AG, Arkema Group, Ashland Global Holdings Inc., Eastman Chemical Company, Solvay S.A., Croda International Plc, Huntsman Corporation, Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Wacker Chemie AG, Momentive Performance Materials Inc., BYK-Chemie GmbH, Elementis plc, and Lubrizol Corporation |

The global coating auxiliaries market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the coating auxiliaries market is projected to reach USD 13.2 billion by 2035.

The coating auxiliaries market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in coating auxiliaries market are dispersing agents, wetting agents, defoamers, rheology modifiers and others.

In terms of application, architectural coatings segment to command 41.9% share in the coating auxiliaries market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA