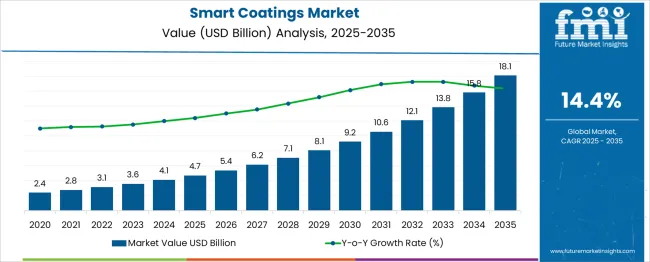

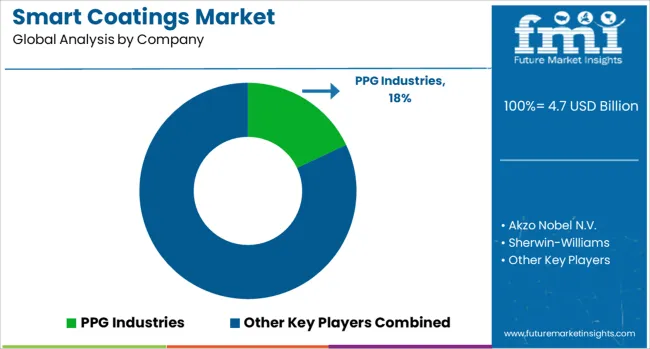

The Smart Coatings Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 18.1 billion by 2035, registering a compound annual growth rate (CAGR) of 14.4% over the forecast period. During the first half-decade (2025–2030), the market increases from USD 4.7 billion to USD 9.2 billion, resulting in a cumulative gain of USD 4.5 billion. This phase contributes nearly 34% of the total value expansion across the forecast period. Moderate volume growth is expected in automotive components, aerospace structures, and industrial enclosures, driven by requirements for corrosion resistance, abrasion protection, and responsive material coatings under regulatory and operational constraints.

In the second half-decade (2030–2035), the market rises from USD 9.2 billion to USD 18.1 billion, contributing USD 8.9 billion, equivalent to 66% of the total value gain. This heavier weighting is attributed to expanding adoption of anti-biofouling, self-cleaning, and energy-efficient coatings in construction, marine, and medical equipment. Product lifecycle enhancements and maintenance cost reduction are expected to drive acceptance across large-scale infrastructure and capital-intensive assets. The curve’s steepening slope in the second half reflects market maturity, material cost optimization, and widespread supplier capability, positioning this segment for higher value generation in the later stage of the forecast window.

| Metric | Value |

|---|---|

| Smart Coatings Market Estimated Value in (2025 E) | USD 4.7 billion |

| Smart Coatings Market Forecast Value in (2035 F) | USD 18.1 billion |

| Forecast CAGR (2025 to 2035) | 14.4% |

The smart coatings market holds about 25.6 % of the building and construction coatings segment, supported by demand for self-cleaning facades, thermal regulating exterior paints and anti-microbial surfaces in infrastructure. It represents approximately 24% of the automotive coatings industry, reflecting use in self-healing, anti-corrosion, and UV-adaptive finishes on vehicles. In the marine and shipping coatings sector, smart coatings account for nearly 19 %, particularly in hull anti-fouling and protective seawater applications. Within aerospace and defense, its share stands at about 18%, driven by anti-icing, self-healing and sensor-responsive surface requirements. In electronics and industrial coatings, smart coatings comprise around 13 %, used for environmental sensing, conductive protection and responsive encapsulations. Advances in self-healing coatings are reducing maintenance by enabling automatic repair of minor damage and corrosion. Anti-corrosion formulations now incorporate nanomaterials to provide real-time sensing and protective response. Anti-microbial and anti-icing coatings are gaining traction in healthcare and aviation. Thermal reflective and energy-regulating coatings help reduce heating and cooling loads in buildings, especially under stronger environmental regulations in the Asia-Pacific and Europe. Integration with IoT and edge devices enables coatings to report status, permit predictive asset monitoring and support smart infrastructure. Multi-functional coatings combining self-cleaning, anti-fouling, and color shifting capabilities are increasingly adopted in complex environments such as smart cities, transportation hubs and industrial automation settings.

The Smart Coatings market is experiencing strong momentum as industries adopt intelligent surface solutions that offer functionality beyond traditional protection. This growth is being accelerated by increasing demand for coatings that provide responsive behaviors such as self-healing, corrosion resistance, and environmental sensing. Advances in material science, particularly in nanotechnology and polymer chemistry, have played a pivotal role in enabling these functionalities.

Moreover, stringent environmental regulations and sustainability goals have encouraged the use of smart coatings in sectors where performance and longevity are critical. Cost savings from reduced maintenance cycles and longer service life have further incentivized end users to invest in these advanced materials.

The rise in industrial automation, the need for lightweight and efficient components, and expanding applications across automotive, aerospace, marine, and construction sectors are expected to support continued growth. As innovation and production capabilities evolve globally, smart coatings are positioned to become integral components in next-generation manufacturing and infrastructure projects..

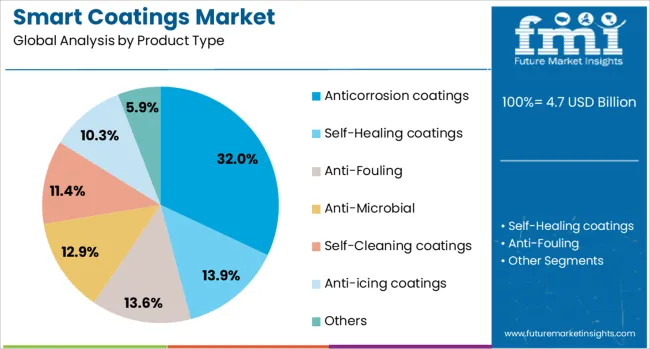

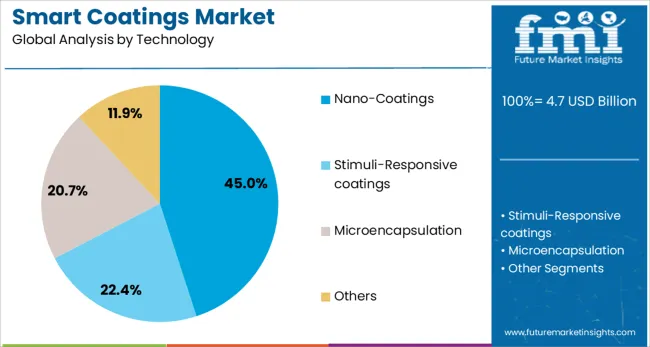

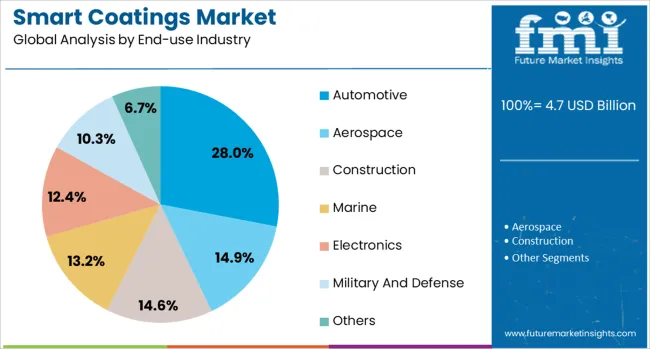

The smart coatings market is segmented by product type, technology, and end-use industry and geographic regions. By product type of the smart coatings market is divided into Anticorrosion coatings, Self-Healing coatings, Anti-Fouling, Anti-Microbial, Self-Cleaning coatings, Anti-icing coatings, and Others. In terms of technology of the smart coatings market is classified into Nano-Coatings, Stimuli-Responsive coatings, Microencapsulation, and Others. Based on end-use industry of the smart coatings market is segmented into Automotive, Aerospace, Construction, Marine, Electronics, Military And Defense, and Others. Regionally, the smart coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anticorrosion coatings segment is projected to hold 32% of the Smart Coatings market revenue share in 2025, making it the leading product type. This dominance is being driven by the escalating need for long-lasting protection in infrastructure, transportation, and industrial equipment. These coatings have been recognized for their ability to actively respond to environmental stimuli and delay the onset of degradation, thereby extending asset lifespans and reducing overall maintenance costs.

Significant uptake has been observed in sectors exposed to high moisture, salt, or chemical environments, where traditional coatings have proven insufficient. Innovations in anticorrosive smart coatings have enabled the release of protective agents on demand, maintaining structural integrity even under stress.

Their integration into asset protection strategies by energy and construction companies has further supported their widespread application. As durability and life-cycle performance become key considerations for infrastructure planning and operational efficiency, the anticorrosion segment is expected to retain its market leadership in the coming years..

The nano-coatings segment is anticipated to account for 45% of the Smart Coatings market revenue share in 2025, positioning it as the leading technology. This segment’s growth has been driven by the increasing application of nanoscale materials that deliver superior protective, functional, and aesthetic properties. These coatings have been widely utilized for their enhanced adhesion, chemical resistance, and surface smoothness, all achieved with ultra-thin layers.

Industries have adopted nano-coatings for their role in reducing material usage while maintaining high-performance outcomes. Their use in electronics, automotive parts, and healthcare equipment has been expanding due to the precision and control they offer at the molecular level.

The ability of nano-coatings to facilitate additional features such as UV resistance, anti-microbial behavior, and thermal regulation has made them particularly attractive in emerging smart material applications. As the manufacturing of nano-enabled formulations becomes more cost-effective, the technology is expected to witness continued scalability and strong adoption across various high-growth industries..

The automotive segment is expected to hold 28% of the Smart Coatings market revenue share in 2025, making it the leading end-use industry. This growth has been attributed to the increasing need for multifunctional coatings that enhance vehicle performance, safety, and aesthetic appeal. Automotive manufacturers have increasingly incorporated smart coatings to protect vehicles against corrosion, scratches, and UV damage, while also improving fuel efficiency through weight reduction.

The segment has benefited from rising consumer demand for advanced vehicle features and long-lasting finishes. In addition, the rise in electric vehicle production has created new opportunities for thermal and electronic protection solutions that can be delivered through smart coatings.

Industry standards for durability, combined with growing environmental regulations, have prompted a shift toward low-VOC and environmentally friendly coating technologies. As manufacturers continue to prioritize innovation and lightweight design, smart coatings are being integrated into various automotive components, reinforcing their role in shaping the future of mobility solutions..

Demand for smart coatings has grown as industries pursue multifunctional surface solutions that provide corrosion protection, self-healing, antimicrobial action, and thermal regulation. Applications span automotive, aerospace, construction, and healthcare sectors where durability and efficiency are prioritized. Advanced coating systems—such as sensors-integrated, photochromic, and responsive polymer formulations—are being adopted to enhance performance and reduce lifetime maintenance costs. Growing interest in smart infrastructure, climate-adaptive materials, and sustainability-focused innovations is accelerating development and integration of smart coating technologies across both industrial and commercial use cases.

Smart coatings are being embraced where enhanced functionality is essential. Self-healing polymers and corrosion-inhibiting systems have been applied to extend service life in harsh environments, especially in marine, steel infrastructure, and power plant applications. Anti-microbial and anti-fouling coatings have been utilized in medical facilities and HVAC systems to reduce maintenance intervals and promote hygiene. Thermochromic and energy-regulating formulations have supported temperature adaptation in building facades and automotive surfaces. Sensor-embedded coatings capable of detecting stress or chemical exposure have been installed in critical infrastructure and industrial equipment. These systems collectively reduce downtime and total cost of ownership. User demand for coatings that combine aesthetic appeal, performance, and multifunctionality has increased, driving innovation in hybrid smart coating platforms.

Research investments have resulted in advanced nanocomposite coatings, stimuli-responsive polymers, and hybrid inorganic–organic systems. Self-healing smart coatings now incorporate microencapsulated healing agents that activate under mechanical stress, enabling rapid surface repair. Conductive coatings with embedded nanomaterials support anti-corrosion monitoring and offer electrical conductivity for surface sensing. Photochromic and thermochromic agents enable coatings to adjust reflectivity based on ambient conditions, improving energy efficiency in architectural surfaces. Functional additives such as nanoparticles and biomimetic compounds have enhanced coating adherence and lifespan. Integration of IoT-compatible sensing elements allows remote signal transmission for predictive maintenance. These technological advancements have expanded application scope—from industrial equipment and medical devices to smart packaging and adaptive infrastructures.

Widespread implementation of smart coatings has been constrained by regulatory approvals, production complexity, and elevated unit costs. Specialty coatings require rigorous testing for environmental, health, and safety compliance, especially for applications in food, medical, and public infrastructure. Scaling production from pilot to industrial levels demands process validation and precision in nanomaterial dispersion to ensure consistent performance. High-value formulations remain expensive—often 2–3 times the cost of conventional coatings—hindering adoption in cost-sensitive segments. Compatibility with substrate materials and legacy application processes can pose integration challenges. Additionally, limited long-term durability data for emerging formulations has led specifiers in critical sectors to require extended field validation before deployment. Infrastructure and OEM adoption tend to focus on phased rollouts in controlled environments.

The smart coatings market is being shaped by its adoption across vertical sectors. In transportation, OEMs are applying self-healing and anti-corrosion coatings on metal panels and underbody components to extend service life. Building and construction firms are using thermal-regulating and antimicrobial coatings in commercial spaces and public infrastructure. The aerospace and defense sectors have integrated embedded sensing coatings to monitor structural health. Marine operators continue to invest in fouling-resistant technologies to minimize maintenance. Medical devices and packaging industries are deploying antimicrobial formulations for hygiene-critical environments. Emerging economies are gradually embracing smart coatings in infrastructure and industrial zones, where high-performance surface solutions offer long-term operational value. Growing collaboration between material innovators, OEMs, and integrators is accelerating prototype-to-market transitions.

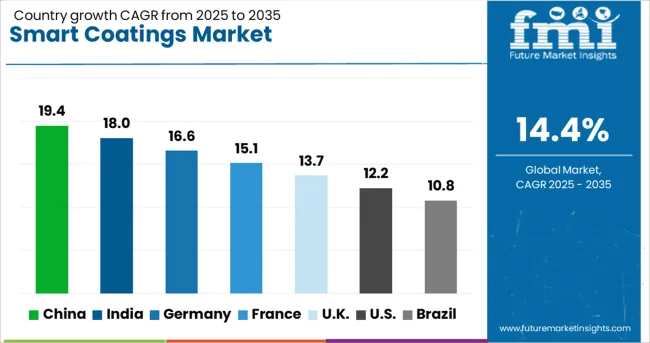

| Country | CAGR |

|---|---|

| China | 19.4% |

| India | 18.0% |

| Germany | 16.6% |

| France | 15.1% |

| UK | 13.7% |

| USA | 12.2% |

| Brazil | 10.8% |

Global demand for smart coatings is projected to increase at a CAGR of 14.4% between 2025 and 2035. China, with a CAGR of 19.4%, leads global output and usage, followed by India at 18.0% and Germany at 16.6%. These three countries are growing at premiums of +35%, +25%, and +15% respectively over the global average. The United Kingdom, at 13.7%, is tracking just below the global trend, while the United States, at 12.2%, remains the slowest among the top five. Faster adoption in Asia and Europe is supported by strong OEM integration, growing R&D ecosystems, and government-linked testing labs. Slower growth in the United States is linked to longer industrial validation cycles. Five country-level insights are summarized below, with full coverage extended to over 40 countries in the complete dataset.

China is projected to grow at a CAGR of 19.4% between 2025 and 2035 in the smart coatings market. State-funded research institutions and integrated manufacturers have driven innovation in temperature-sensitive and corrosion-resistant formulations. The automotive sector has moved beyond standard protective finishes toward coatings with embedded microencapsulation and surface-adaptive properties. Pilot implementation of anti-bacterial smart coatings is also observed in public infrastructure projects such as rail transit hubs. Rapid R&D commercialization cycles, driven by vertically integrated supply chains, have accelerated both industrial and consumer adoption. Chinese companies continue to reduce lead times for deployment in aerospace, packaging, and electronics.

India is expected to register a CAGR of 18.0% from 2025 to 2035 in the smart coatings market. The push for localized manufacturing under national schemes has expanded uptake of responsive coatings in heavy equipment and defense production. Indian railways, ports, and mining infrastructure have adopted self-healing coatings to reduce lifecycle maintenance costs. Private R&D investment in UV-responsive and thermochromic coatings has increased across Bengaluru and Hyderabad-based labs. Local startups are also working with automotive OEMs to develop anti-corrosion and smart friction coatings for domestic and export models. Cost efficiency and industrial demand continue to drive steady innovation.

Germany is projected to expand at a CAGR of 16.6% during 2025–2035 in the smart coatings market. The country’s dominant position in machinery and automotive exports has pushed OEMs to transition toward scratch-resistant, anti-fingerprint, and self-cleaning coatings. Smart anti-corrosion coatings for offshore wind turbines and shipbuilding are supported by state research grants. Siemens, Bosch, and ThyssenKrupp have integrated multi-layer smart coating technologies into product lines. Environmental regulation has also accelerated the phase-out of legacy finishes, boosting adoption of water-based intelligent coatings. Industrial testing infrastructure, combined with university-led pilot programs, continues to reinforce adoption.

The United Kingdom is expected to record a CAGR of 13.7% between 2025 and 2035 in the smart coatings market. Market expansion is supported by construction and defense applications, particularly in Scotland and Northern England. Aerospace manufacturers have adopted thermal-barrier coatings for propulsion systems and composite panels. Universities in Bristol and Sheffield are leading trials of responsive coatings in structural health monitoring. While innovation levels are high, commercial translation remains limited by procurement frameworks and longer trial periods. Industrial players continue to explore hybrid coating technologies combining visual feedback and surface hardness properties.

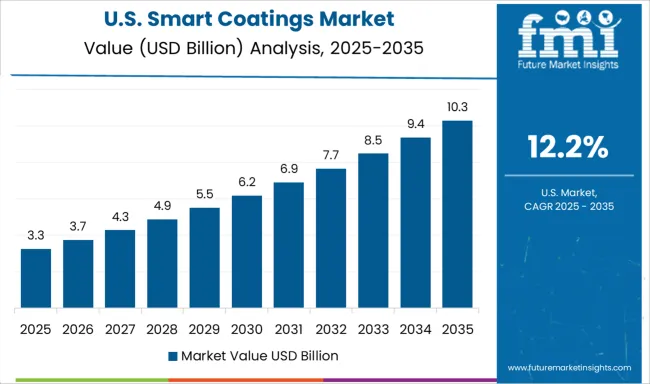

The United States is forecast to grow at a CAGR of 12.2% between 2025 and 2035 in the smart coatings market. Growth is being driven by niche deployment in aerospace, consumer electronics, and advanced defense programs. However, high certification costs, fragmented value chains, and reliance on conventional coatings have limited broader penetration. OEMs in Texas and Michigan are piloting color-changing and impact-resistant coatings, but widespread adoption remains delayed. Regulatory flexibility has supported innovation in labs, yet scalability challenges persist. The current growth rate reflects demand from large-volume, slow-cycle sectors such as aerospace and infrastructure.

PPG Industries has expanded its smart coatings portfolio with offerings that incorporate self-healing, anti-corrosion, and moisture-sensing functionalities. Focus has been placed on aerospace and industrial applications, where predictive maintenance and surface durability are critical. Akzo Nobel N.V. delivers responsive coatings for infrastructure and marine assets, supported by research into microencapsulation and responsive polymer technologies. Its approach includes collaborations with universities and end-users to tailor performance in harsh environments. Sherwin-Williams has developed multi-layered coatings with thermal and anti-fouling properties targeted at transportation and energy sectors.

Product development focuses on extending service life and reducing recoating frequency. Axalta Coating Systems provides smart coatings engineered for automotive and industrial surfaces, emphasizing improved substrate bonding and conductivity control. Its R&D investments target surface protection under dynamic environmental conditions. RPM International Inc. supports smart building applications through coatings that offer UV resistance, anti-slip features, and active surface responses. Its brands cater to both commercial and specialty construction markets, where performance-driven coatings address safety, wear resistance, and environmental adaptability.

Self-healing coatings became widespread in infrastructure maintenance, while anti-corrosion solutions were retrofitted on aging pipelines and vessels. Multifunctional multi-layer systems with nanotechnology emerged across construction, automotive, and aerospace.

Growth accelerated in Asia Pacific construction and healthcare, where antimicrobial coatings were applied extensively in hospitals. IoT-enabled coatings with embedded sensors gained traction for predictive maintenance in industrial assets. Sustainable, eco-friendly formulations and photonic coatings like thermochromic VO₂, advanced energy-efficient building and mobility applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product Type | Anticorrosion coatings, Self-Healing coatings, Anti-Fouling, Anti-Microbial, Self-Cleaning coatings, Anti-icing coatings, and Others |

| Technology | Nano-Coatings, Stimuli-Responsive coatings, Microencapsulation, and Others |

| End-use Industry | Automotive, Aerospace, Construction, Marine, Electronics, Military And Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PPG Industries, Akzo Nobel N.V., Sherwin-Williams, Axalta Coating Systems, and RPM International Inc. |

The global smart coatings market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the smart coatings market is projected to reach USD 18.1 billion by 2035.

The smart coatings market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in smart coatings market are anticorrosion coatings, self-healing coatings, anti-fouling, anti-microbial, self-cleaning coatings, anti-icing coatings and others.

In terms of technology, nano-coatings segment to command 45.0% share in the smart coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Seed Coatings Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA