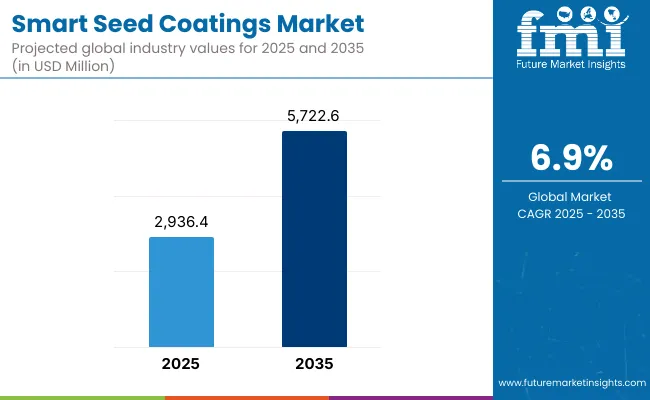

The Smart Seed Coatings Market is expected to record a valuation of USD 2,936.4 million in 2025 and reach USD 5,722.6 million in 2035, reflecting a CAGR of 6.9%. From 2025-2030, incremental growth of around USD 1.1 billion is anticipated, driven by large-scale adoption of polymer-based smart coatings in cereals and oilseeds, alongside demand for pest and disease resistance coatings.

Smart Seed Coatings Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value In (2025E) | USD 2,936.4 Million |

| Market Forecast Value In (2035f) | USD 5,722.6 Million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The second half of the decade, 2030-2035, is projected to add nearly USD 1.6 billion, fueled by rapid uptake of nanomaterial-enhanced and biopolymer-based coatings, as well as strong expansion of sensor-integrated solutions that offer real-time responsiveness in stress conditions. Functionalities like stress tolerance and nutrient/smart release will rise in importance as agriculture adapts to climate variability, while microencapsulation and controlled-release polymers enhance precision and efficiency.

Regionally, East Asia and South Asia & Pacific will drive momentum with CAGRs above 8%, supported by hybrid seed penetration, mechanization, and climate resilience programs. Mature regions like Europe and North America are expected to emphasize regulatory alignment, precision farming, and traceability, ensuring steady uptake of premium coatings. Distribution models will evolve as direct sales dominate, while online platforms, though smaller in base, expand fastest with a CAGR above 10%.

Between 2020 and 2024, smart seed coatings adoption advanced steadily, supported by demand for multi-functional inputs and sustainable farming practices. In 2025, the market is valued at USD 2,936.4 million, driven by polymer-based coatings and functionalities like germination enhancement and pest resistance. By 2035, it is forecast to reach USD 5,722.6 million, expanding at a 6.9% CAGR, with nanomaterial-enhanced, biopolymer-based, and sensor-integrated solutions redefining performance benchmarks. Growth momentum is expected to shift toward Asia-Pacific, where India and China are scaling hybrid seeds, stress-tolerance applications, and climate-resilient agriculture. Competitive advantage will increasingly depend on stack integration, traceability, and the alignment of smart coatings with digital agronomy and ESG-focused supply chains.

Growth in the Smart Seed Coatings Market is being driven by technological innovation, sustainability imperatives, and the need for climate-resilient agriculture. Farmers and seed producers are increasingly adopting coatings that go beyond protection to deliver multi-functional benefits such as enhanced germination, nutrient delivery, pest resistance, and stress tolerance. The integration of nanotechnology, bio-based polymers, and sensor-enabled coatings enables precise, responsive solutions that align with modern farming practices.

Rising adoption of hybrid and high-value seeds further supports premium coatings, as ensuring uniform emergence and higher yields becomes critical to farm economics. Regulatory encouragement for environmentally friendly inputs is also spurring demand for biodegradable and biopolymer-based coatings, reducing reliance on synthetic alternatives. Meanwhile, digital agriculture platforms are making smart coatings more accessible, enabling advisory-driven purchases and adoption by mid-size and smallholder farmers. Collectively, these dynamics reinforce smart seed coatings as a cornerstone of next-generation, sustainable crop production systems.

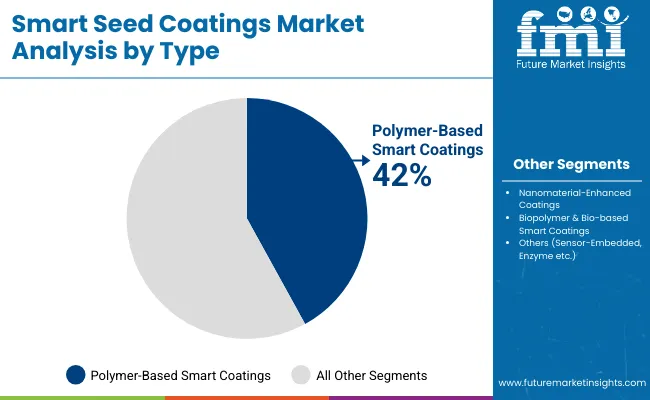

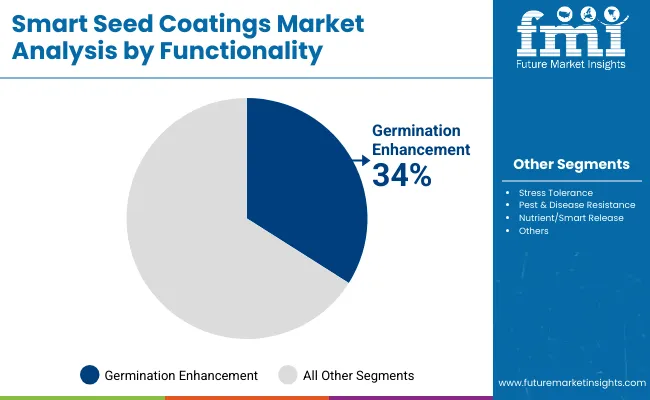

The Smart Seed Coatings Market is segmented by type, functionality, crop type, technology, end user, distribution, and region, each contributing unique adoption drivers. By type, polymer-based smart coatings dominate large-scale applications, while nanomaterial-enhanced coatings and biopolymer formats grow fastest with double-digit expansion, supported by sustainability and performance advantages. Functionality is anchored in germination enhancement and pest resistance, but stress tolerance is projected to grow quickly due to climate pressures.

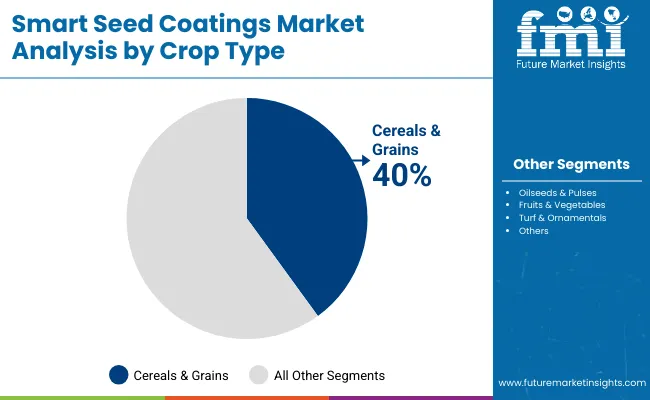

Crop segmentation highlights cereals and grains as the largest category, with fruits and vegetables advancing rapidly as high-value crops demand precision coatings. On the technology front, microencapsulation and controlled-release polymers ensure efficient dosing, while nano-coatings and sensor-integrated formats position the market for innovation-led growth. Commercial farmers and seed processors remain dominant end users, supported by direct sales contracts, while online platforms provide the fastest-growing distribution channel.

| Type | Market Value Share, 2025 |

|---|---|

| Polymer-Based Smart Coatings | 42.00% |

| Others | 58.00% |

Polymer-based smart coatings are projected to dominate the type segment in 2025, accounting for 42% of global share. Their leadership stems from strong film-forming ability, cost efficiency, and ease of integration with conventional seed treatment equipment. These coatings are widely used for cereals and oilseeds, where large-scale seed volumes demand durable and uniform coverage. Nanomaterial-enhanced coatings, though smaller at present, are expected to grow at the fastest pace (10.5% CAGR) due to their ability to improve seed-to-soil interaction, enhance water retention, and provide targeted stress resilience.

Biopolymer and bio-based coatings are also advancing as sustainable alternatives, particularly in markets where regulatory frameworks discourage synthetic additives. Sensor-embedded and enzyme-aided coatings remain in the early adoption phase but represent the most disruptive innovations, offering real-time responsiveness and traceability. Together, these categories underscore a shift from traditional protective coatings toward multi-functional, performance-driven solutions.

| Functionality | Market Value Share, 2025 |

|---|---|

| Germination Enhancement | 34.00% |

| Others | 66.00% |

The functionality segment is anchored by germination enhancement, which captured 34% of global share in 2025. Farmers and seed companies rely heavily on these coatings to ensure uniform stand establishment, seed vigor, and improved yield stability. Germination enhancement coatings are designed to deliver micronutrients, regulate water uptake, and optimize early-stage root development, making them essential for both high-volume crops and high-value horticulture.

Pest and disease resistance coatings, accounting for 28%, are also widely adopted, particularly in regions with high pathogen pressure, while stress tolerance coatings (26%) are growing rapidly at a 9.3% CAGR, reflecting rising climate risks. Nutrient and smart release coatings, though smaller in share at 12%, are emerging as high-growth innovations with advanced controlled-release mechanisms. This distribution highlights how smart coatings are being tailored not only to protect seeds but also to enhance plant performance under variable conditions.

| Crop Type | Market Value Share, 2025 |

|---|---|

| Cereals & Grains | 40.00% |

| Others | 60.00% |

Cereals and grains are the largest crop type segment, representing 40% of the market in 2025. Their dominance is attributed to vast global acreage, mechanized seed treatment infrastructure, and the importance of reliable stand establishment for staple crops such as wheat, rice, maize, and barley. Farmers prioritize smart coatings for cereals to ensure uniform germination, seedling vigor, and resilience under stress. Oilseeds and pulses, with 24% share, follow strongly, driven by soybean and canola adoption in North and South America.

Fruits and vegetables, accounting for 22%, are forecast to be the fastest-growing segment at a 9.7% CAGR, reflecting premium seed value and the demand for enhanced emergence uniformity. Turf and ornamentals represent niche markets but benefit from precision-coated seeds used in landscaping and protected environments. This segmentation illustrates cereals’ central role in anchoring volume while fruits and vegetables drive innovation-led demand.

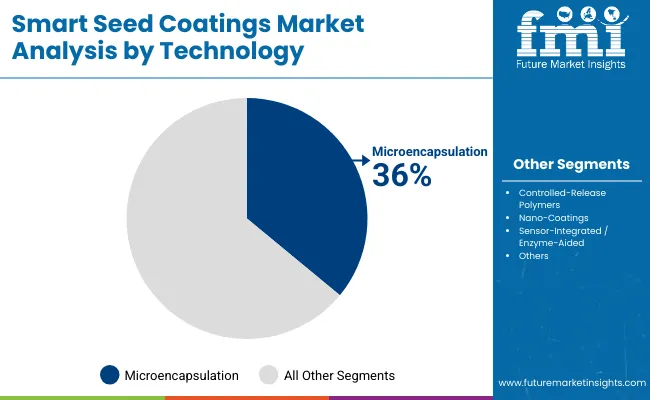

| Technology | Market Value Share, 2025 |

|---|---|

| Microencapsulation | 36.00% |

| Others | 64.00% |

The technology segment is led by microencapsulation, which accounts for 36% of share in 2025. Its success is driven by the ability to encapsulate active ingredients in controlled layers, ensuring uniform release and seed safety. Microencapsulation is widely adopted across cereals, oilseeds, and vegetables for its precision, compatibility with multiple actives, and cost-effectiveness. Controlled-release polymers, holding 28% share, are also critical as they regulate nutrient delivery and reduce input losses, supporting sustainable farming practices.

Nano-coatings are projected to record the highest CAGR (10.7%), offering enhanced stress tolerance and seed-to-soil interaction through nanoscale material engineering. Sensor-integrated and enzyme-aided coatings, with 16% share, represent the frontier of innovation, enabling smart responsiveness to soil conditions, moisture, and microbial activity. This segment reflects how smart coatings are evolving from passive barriers to intelligent delivery systems.

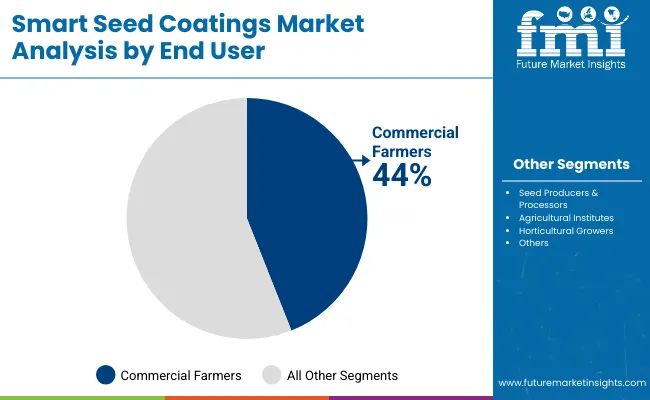

| End User | Market Value Share, 2025 |

|---|---|

| Commercial Farmers | 44.0% |

| Others | 56.0% |

Commercial farmers dominate the end user segment with 44% share in 2025. Their leadership is supported by large-scale adoption of smart coatings to maximize returns through yield stability and resilience against stress. These users value coatings that combine germination enhancement, disease resistance, and nutrient delivery, ensuring reliable performance in large fields.

Seed producers and processors, with 28% share, are key enablers of adoption as they integrate smart coatings into treated seed lots, setting new standards for uniformity and quality. Horticultural growers, though smaller at 16%, are expanding fastest with a 9.1% CAGR, driven by demand for premium formulations in high-value fruits and vegetables. Agricultural institutes contribute modestly at 12%, primarily supporting R&D and field validation. This distribution highlights commercial farmers’ role in driving volume and horticultural growers’ role in driving innovation.

Driver Multi-functionality and precision delivery accelerate adoption

The adoption of smart seed coatings is being propelled by their ability to deliver multiple functionalities beyond traditional protection. Farmers increasingly demand coatings that not only safeguard against pathogens but also enhance germination, regulate nutrient release, and improve stress tolerance under adverse conditions. Polymer-based smart coatings dominate bulk crops for their durability, while nanomaterial-enhanced formats are emerging as high-growth solutions due to superior water retention and targeted root zone delivery.

Biopolymer-based coatings further strengthen the sustainability profile, aligning with green agricultural policies. Controlled-release polymers and microencapsulation technologies ensure efficient utilization of nutrients and biologicals, reducing wastage and supporting cost efficiency. This combination of protection, performance, and sustainability is positioning smart coatings as indispensable in modern agriculture, particularly in hybrid seeds and high-value horticultural crops.

Restraint High costs and validation hurdles challenge widespread uptake

Despite strong innovation, the cost of smart seed coatings remains a significant barrier to adoption, especially for smallholder farmers in emerging markets. Nanomaterials, enzyme-aided coatings, and sensor-integrated formats carry higher production expenses due to advanced raw materials and specialized equipment requirements. While biopolymer-based coatings provide sustainability advantages, their sourcing and processing often increase price points compared to conventional coatings.

Regulatory approval and validation cycles also remain lengthy, as smart coatings must demonstrate consistent field performance, safety, and compatibility with existing seed treatment systems. These processes can delay commercialization and limit adoption to premium crop sectors. For large-volume crops like cereals and pulses, farmers are highly price-sensitive, making cost a key restraint. Unless manufacturing scale and technology optimization reduce input costs, broader penetration will remain constrained to high-value or contract-driven agriculture.

Trend Climate resilience and digital agriculture reshape the market

Smart seed coatings are evolving into a critical tool for climate-resilient farming. Rising occurrences of drought, salinity, and extreme temperatures are driving demand for coatings that enhance stress tolerance and seedling vigor under adverse conditions. Nano-coatings and biopolymer-based solutions are being engineered to regulate water uptake, improve root architecture, and boost resistance against abiotic stress.

At the same time, sensor-integrated coatings and enzyme-aided technologies are creating opportunities for responsive solutions that interact with soil and environmental conditions in real time. Digital agriculture platforms are further amplifying this trend by linking seed coating data with precision farming systems, enabling farmers to track performance and optimize input use. This integration of smart coatings with data-driven farming and sustainability imperatives is reshaping market adoption patterns, particularly in Asia-Pacific and Europe.

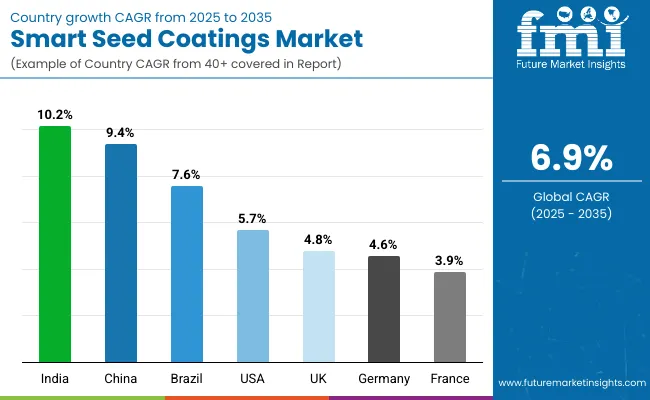

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 9.4% |

| India | 10.2% |

| Germany | 4.6% |

| France | 3.9% |

| UK | 4.8% |

| USA | 5.7% |

| Brazil | 7.6% |

Adoption of smart seed coatings is advancing at varied rates across regions, shaped by seed technology infrastructure, sustainability imperatives, and climate resilience needs. In Asia-Pacific, rapid growth is being recorded as hybrid seed penetration, mechanization, and agri-tech investments accelerate demand for coatings that enhance stress tolerance and germination. India, with a forecast CAGR of 10.2%, and China, at 9.4%, emerge as the fastest-expanding markets, supported by climate variability policies, government-backed seed modernization, and rising private investment.

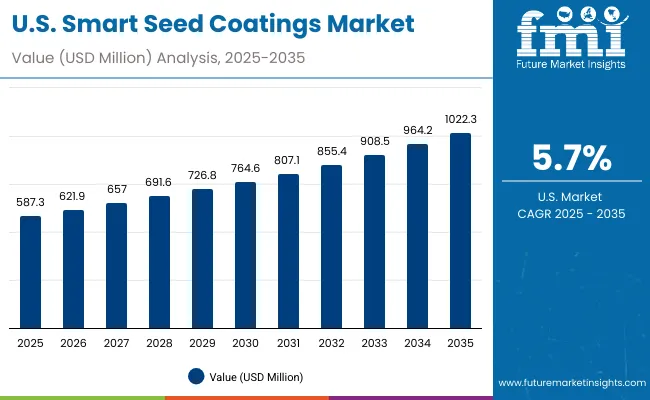

In North America, the United States retains leadership, holding a 20% share in 2025, though this is projected to ease to 18% by 2035 as Asia gains ground. Growth in the USA, at 5.7% CAGR, remains anchored in commercial seed treaters, stacked functionalities, and strong uptake of microencapsulation and controlled-release polymers.

Europe demonstrates steady but compliance-driven growth. Germany and France, with projected CAGRs of 4.6% and 3.9% respectively, emphasize sustainability compliance, traceability, and dust-control performance, while the UK, at 4.8% CAGR, is advancing through horticulture specialization and advisory-led adoption.

Latin America and the Middle East & Africa showcase emerging opportunities, led by Brazil at 7.6% CAGR, where soybean and maize acreage underpin adoption and stress-tolerance coatings are gaining momentum under variable rainfall conditions.

| Year | USA Smart Seed Coatings Market (USD Million) |

|---|---|

| 2025 | 587.3 |

| 2026 | 621.9 |

| 2027 | 657.0 |

| 2028 | 691.6 |

| 2029 | 726.8 |

| 2030 | 764.6 |

| 2031 | 807.1 |

| 2032 | 855.4 |

| 2033 | 908.5 |

| 2034 | 964.2 |

| 2035 | 1,022.3 |

The United States is projected to retain a leading role in the smart seed coatings market, though its share is expected to moderate from 20% in 2025 to 18% by 2035. Growth at a 5.7% CAGR will be supported by strong uptake of polymer-based coatings and controlled-release polymers across cereals, maize, and soybean crops. Commercial seed processors are likely to emphasize microencapsulation for uniformity, planter safety, and regulatory compliance. Pest and disease resistance will remain the most common functionality, while germination enhancement will be critical for maintaining yield stability. Stress-tolerance and nutrient-release functionalities are expected to gain traction in drought-prone areas, particularly in the Midwest. Direct B2B contracts will dominate, while digital sales platforms grow gradually for mid-sized farms.

China is anticipated to expand rapidly, increasing its market share from 15% in 2025 to 20% by 2035, at a robust 9.4% CAGR. Hybrid seed penetration, government-backed modernization, and mechanized farming are projected to underpin demand. Polymer-based coatings will dominate cereals and maize, while nano-coatings and sensor-enabled coatings are expected to accelerate in high-stress provinces. Germination enhancement will remain a priority, while stress-tolerance coatings rise due to frequent drought and salinity issues. Provincial extension services and OEM calibration programs will raise coating consistency. Online platforms are projected to enhance reach among smallholder farmers in horticulture. China is expected to position itself as a hub for nano-enabled and bio-based smart coatings, reshaping global competition.

India is expected to be the fastest-growing national market, rising from 9% in 2025 to 12% in 2035 at a 10.2% CAGR. Rapid hybrid seed adoption, mechanization, and government focus on climate resilience are projected to drive demand. Stress-tolerance coatings are forecast to lead functional expansion due to salinity and drought across several agro-climatic zones. Germination enhancement and pest resistance will sustain core demand in cereals and pulses.

Organized seed processors are expected to integrate microencapsulation and controlled-release polymers to standardize treated seed performance. Nanomaterial-enhanced coatings will gain popularity in horticulture and spices, where high returns justify investment. Direct B2B contracts will dominate distribution, while agri-ecommerce platforms expand among mid-sized growers with advisory-driven bundles.

Germany is expected to expand at a 4.6% CAGR, with its market share easing slightly from 7% in 2025 to 6% in 2035. Adoption will remain compliance-driven, with seed processors emphasizing dust minimization, planter hygiene, and sustainable sourcing. Microencapsulation and controlled-release polymers will dominate specifications for cereals, oilseeds, and sugar beet, ensuring uniformity under cool-wet sowing conditions. Pest and disease resistance coatings will remain the largest functionality, though nutrient delivery formats are expected to rise gradually. Traceability and lifecycle analysis will drive trials of bio-based smart coatings among export-oriented seed producers. Direct B2B agreements will anchor supply, while regional distributors address smaller grower groups.

The UK market is projected to expand at a 4.8% CAGR, with its share declining from 5% in 2025 to 4% by 2035. Growth will remain tied to high-value horticulture and specialty seeds, where germination enhancement and stress-tolerance functionalities are increasingly sought. Controlled-release polymers and encapsulation will dominate technology use, ensuring precision and compliance with environmental regulations. Private-label treated seeds and contract-treated lots will drive distribution, supported by distributors providing local coverage. Direct B2B and subscription-led channels will expand among small and mid-sized farms, particularly those investing in premium horticulture. Traceability requirements and sustainability mandates are expected to push adoption of biopolymer-based and nano-enabled coatings over the forecast horizon.

France is projected to grow at a 3.9% CAGR, with adoption concentrated in cereals, oilseeds, and vegetables. Pest and disease resistance will remain the most widely applied functionality, while stress-tolerance coatings are likely to gain in drought-prone southern regions. Nutrient-release coatings are expected to see selective uptake in vegetable and horticultural systems. Regulatory emphasis on sustainability and reduced synthetic input use will accelerate adoption of biopolymer-based coatings. Direct sales will dominate, complemented by distributors serving fragmented farming groups. France will remain an important but secondary player in Europe, influenced heavily by EU-wide compliance policies.

Brazil is expected to grow strongly at a 7.6% CAGR, underpinned by vast soybean and maize acreage. Polymer-based coatings and microencapsulation are projected to dominate bulk applications, ensuring planter hygiene and stand uniformity. Stress-tolerance coatings will expand in the Cerrado and semi-arid regions, where irregular rainfall creates challenges. Germination enhancement remains vital for tropical cropping systems, while pest resistance sustains core demand. Distributors dominate coverage across farming belts, though direct contracts with large farm groups are expanding. Online sales channels are emerging in specialty horticulture, offering nutrient-release coatings and advisory bundles. Brazil’s agricultural scale ensures it will remain a key high-growth market over the next decade.

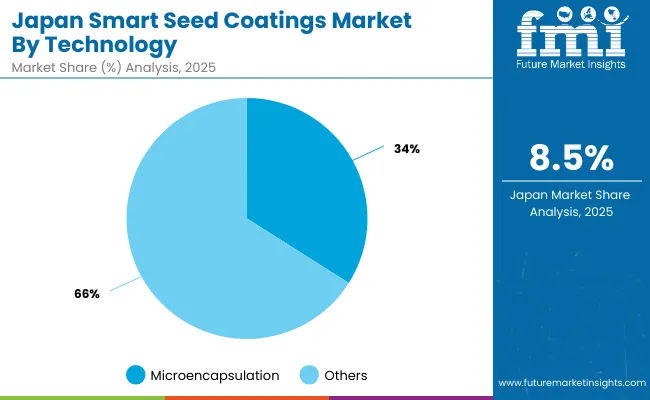

| Sub-Segment | Share (2025) |

|---|---|

| Microencapsulation | 34% |

| Others | 66% |

Japan is forecast to increase its market share modestly from 7% in 2025 to 8% in 2035, with demand concentrated in greenhouse and export-oriented horticulture. Growth will be supported by microencapsulation, which dominates with 34% share in 2025, providing uniform release and compatibility with inoculants. Controlled-release polymers, with an 8.5% CAGR, will rise in premium vegetables, while nano-coatings and sensor-integrated formats will expand faster with pilot projects. Traceability and clean-label standards will encourage adoption of bio-based inputs in export lots. Specialized distributors and processors offering advisory and calibration support will remain central to adoption.

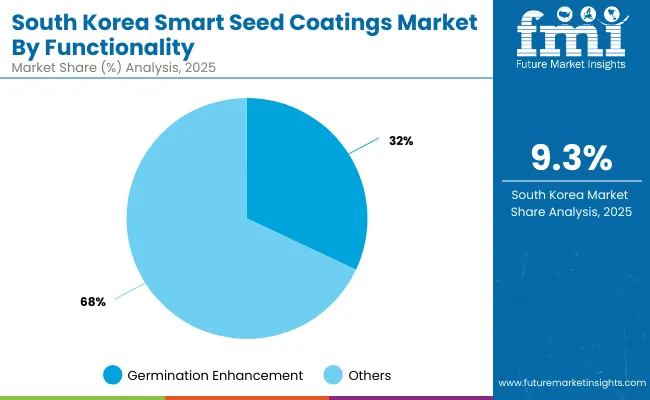

| Sub-Segment | Share (2025) |

|---|---|

| Germination Enhancement | 32% |

| Others | 68% |

South Korea is expected to maintain a stable global share, with growth supported by greenhouse farming, horticulture, and ESG-driven sourcing. Germination enhancement dominates with 32% share in 2025, while stress-tolerance coatings expand rapidly at a 9.3% CAGR. Nutrient/smart release coatings, though smaller, are projected to grow fastest at 10.5% CAGR, supporting fertigation and climate-controlled cultivation. Pest resistance will remain foundational in cereals and maize, while horticultural growers increasingly trial premium bio-based recipes. Digital advisory services and agri-ecommerce will enhance access, enabling broader adoption among mid-sized farms. South Korea is expected to emerge as an innovation-led market for fermentation-compatible and traceable coating solutions.

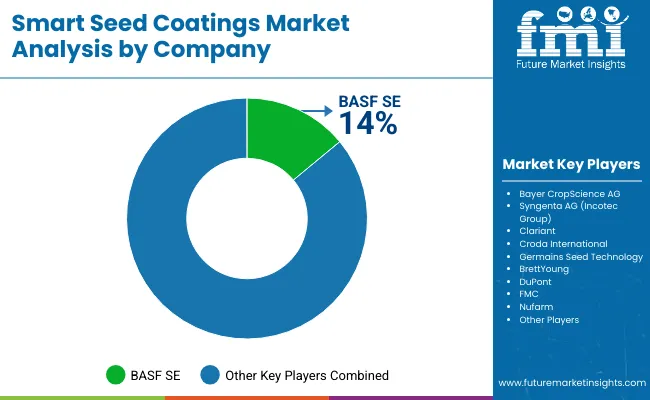

The competitive landscape of the Smart Seed Coatings Market is shaped by a mix of global agrochemical leaders, specialized seed technology providers, and regional innovators. BASF SE is assessed as the leading player with a 14% global value share in 2025, owing to its broad portfolio of polymer-based and controlled-release technologies integrated into commercial seed treatment platforms. Bayer CropScience AG and Syngenta AG (via Incotec Group) are positioned strongly in germination enhancement and pest resistance coatings, supported by proprietary encapsulation and nano-formulation platforms.

Clariant and Croda International are expanding their bio-based and specialty polymer segments, focusing on compliance-driven European markets. Niche players like Germains Seed Technology and BrettYoung concentrate on horticulture and high-value crops, delivering tailored solutions. In emerging markets, especially in Asia-Pacific, regional innovators are gaining traction with nanomaterial-enhanced and bio-based coatings suited for stress tolerance and nutrient release applications.

Competitive differentiation is expected to shift toward companies that can integrate multi-functional stacks, ensure traceability, and align with sustainability mandates. Over the forecast horizon, digital agronomy tie-ins, partnerships with seed producers, and the ability to scale controlled-release and sensor-integrated technologies are anticipated to define leadership in the smart seed coatings industry.

Key Developments in Smart Seed Coatings Market

| Item | Details |

|---|---|

| Market Size, 2025 | USD 2,936.4 Million |

| Market Size, 2035 | USD 5,722.6 Million |

| Absolute Growth (2025-2035) | USD 2,786.2 Million |

| CAGR (2025-2035) | 6.90% |

| Value Added 2025-2030 | ~USD 1.1 Billion |

| Value Added 2030-2035 | ~USD 1.6 Billion |

| Type (2025) | Polymer-Based Smart Coatings lead (42% share) |

| Functionality (2025) | Germination Enhancement leads (34% share) |

| Crop Type (2025) | Cereals & Grains lead (40% share) |

| Technology (2025) | Microencapsulation leads (36% share) |

| End User (2025) | Commercial Farmers lead (44% share) |

| Distribution Channel (2025) | Direct Sales lead (60% share) |

| Key Growth Regions (CAGR) | India (10.2%), China (9.4%), South Asia & Pacific (9.2%), East Asia (8.6%) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, UK, Germany, France, China, India, Japan, South Korea, Brazil |

| Key Companies Profiled | BASF SE, Bayer CropScience AG, Syngenta AG (Incotec Group), Clariant, Croda International, Germains Seed Technology, BrettYoung, DuPont, FMC, Nufarm |

| Additional Attributes | Multi-functional stacks; nano -enabled stress tolerance; bio-based polymers; sensor-integrated coatings; digital agronomy tie-ins; sustainability and traceability compliance |

The market is valued at USD 2,936.4 million in 2025.

The market is forecasted to reach USD 5,722.6 million by 2035.

The market is projected to grow at a CAGR of 6.9% during the forecast period.

Polymer-Based Smart Coatings are expected to dominate with a 42% share in 2025.

India (10.2% CAGR), China (9.4%), South Asia & Pacific (9.2%), and East Asia (8.6%) are anticipated to expand fastest through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Smart Built-In Kitchen Appliance Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA