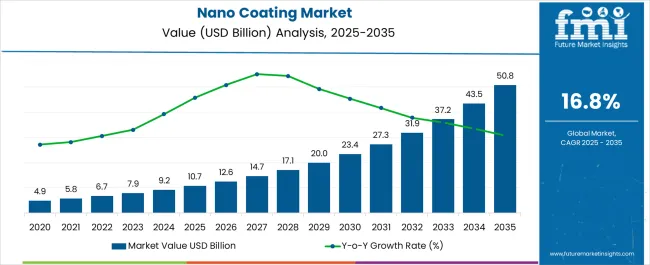

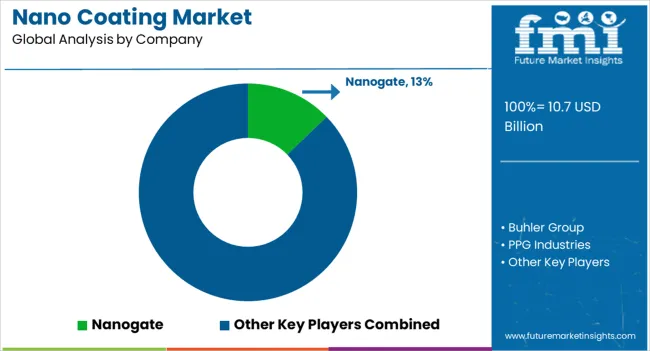

The nano coating market is expected to grow from USD 10.7 billion in 2025 to USD 50.8 billion by 2035, reflecting a 16.8% CAGR and generating an absolute dollar opportunity of USD 40.1 billion. Growth is driven by the rising demand for protective coatings across various applications, including automotive, construction, electronics, and industry. Nano coatings offer enhanced resistance to corrosion, abrasion, UV radiation, and water, extending product lifespans and improving performance. Technological advancements, such as self-cleaning, anti-fingerprint, and multifunctional coatings, further contribute to market expansion globally. Seasonality or cyclicality detection reveals fluctuations in market demand influenced by end-use industries and regional factors. In the automotive and construction sectors, demand peaks during periods of high production, typically coinciding with project cycles, vehicle launches, or seasonal construction activity. Industrial applications, such as machinery and electronics, show moderate cyclicality, with incremental adoption occurring steadily throughout the year but accelerating during capital investment periods.

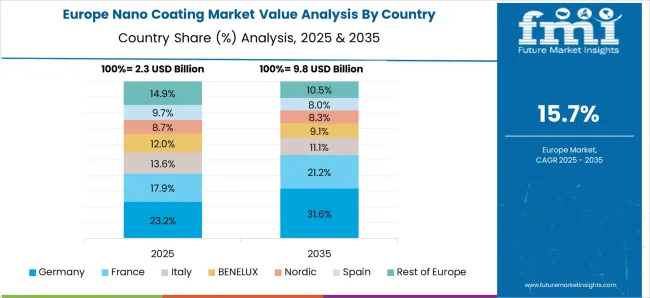

Regional variations also contribute to cyclical patterns; for example, North America and Europe experience seasonal peaks in construction-driven demand, while Asia Pacific shows stronger demand during phases of industrial expansion and infrastructure development. Overall, while the market exhibits predictable seasonal peaks linked to project and production cycles, underlying long-term growth remains robust, supported by technology adoption, regulatory compliance, and increasing focus on durability and efficiency across sectors, resulting in the USD 40.1 billion opportunity between 2025 and 2035.

| Metric | Value |

|---|---|

| Nano Coating Market Estimated Value in (2025 E) | USD 10.7 billion |

| Nano Coating Market Forecast Value in (2035 F) | USD 50.8 billion |

| Forecast CAGR (2025 to 2035) | 16.8% |

The hydraulic recloser market is driven by five primary parent markets with specific shares. Power distribution leads with 40%, as hydraulic reclosers enhance grid reliability by automatically restoring power after temporary faults. Transmission networks contribute 25%, using reclosers to protect high-voltage lines and minimize outage impact. Industrial facilities account for 15%, ensuring uninterrupted power for manufacturing, processing, and critical operations. Renewable energy installations represent 10%, integrating reclosers to manage variable generation and grid stability. Utilities and smart grid projects hold 10%, adopting advanced protection devices to improve energy management. These segments collectively define global demand for hydraulic reclosers. Recent developments in the hydraulic recloser market focus on automation, digital monitoring, and energy efficiency.

Manufacturers are introducing intelligent reclosers with remote control, fault detection, and predictive maintenance capabilities. Integration with IoT, SCADA systems, and smart grids enhances real-time monitoring, rapid fault isolation, and operational reliability. Innovations in compact and modular designs are reducing installation space and maintenance requirements. Growing investments in grid modernization, renewable energy integration, and power reliability are driving adoption. These trends are promoting innovation, improving system resilience, and expanding the deployment of hydraulic reclosers across transmission, distribution, and industrial networks worldwide.

The nano coating market is experiencing notable expansion, driven by advancements in nanotechnology and the increasing demand for surface protection solutions across multiple industries. Nano coatings provide enhanced resistance to abrasion, corrosion, and environmental degradation, while improving aesthetic and functional properties.

The market is benefiting from rapid adoption in automotive, electronics, construction, and healthcare sectors, where high-performance surface protection is critical. Current trends emphasize multifunctional coatings that offer hydrophobicity, antimicrobial properties, and self-cleaning capabilities.

Growing environmental regulations are prompting the development of eco-friendly nano coating formulations, further supporting market growth. With ongoing R&D investments and the expanding application scope in emerging industries, the nano coating market is set for sustained growth in the coming years.

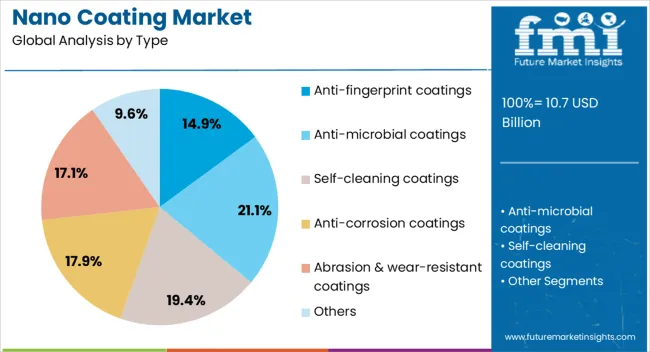

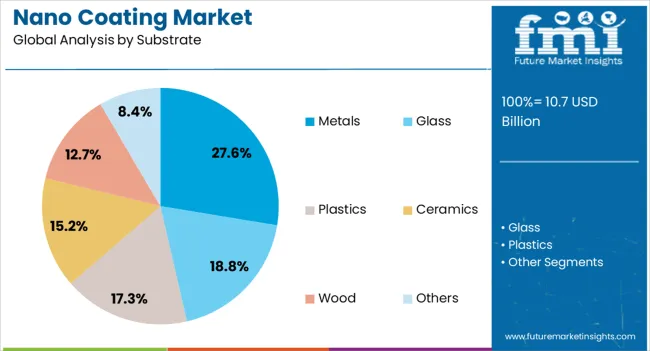

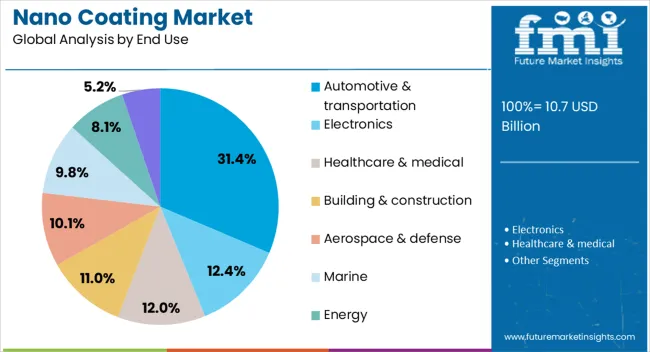

The nano coating market is segmented by type, substrate, end use, and geographic regions. By type, nano coating market is divided into Anti-fingerprint coatings, Anti-microbial coatings, Self-cleaning coatings, Anti-corrosion coatings, Abrasion & wear-resistant coatings, and Others. In terms of substrate, nano coating market is classified into Metals, Glass, Plastics, Ceramics, Wood, and Others. Based on end use, nano coating market is segmented into Automotive & transportation, Electronics, Healthcare & medical, Building & construction, Aerospace & defense, Marine, Energy, and Others. Regionally, the nano coating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anti-fingerprint coatings segment accounts for approximately 14.9% share in the type category of the nano coating market. These coatings are in demand due to their ability to reduce visible smudges and maintain surface clarity, particularly in consumer electronics, automotive interiors, and architectural applications.

Growth in this segment is supported by rising consumer expectations for premium aesthetics and low-maintenance surfaces. Advances in coating formulations have improved durability, optical transparency, and resistance to wear, making them suitable for high-contact surfaces.

As touchscreen devices, glass panels, and polished metal finishes become more prevalent, demand for anti-fingerprint coatings is expected to grow steadily.

The metals segment leads the substrate category with approximately 27.6% share, supported by widespread application of nano coatings for corrosion prevention, wear resistance, and enhanced appearance. Industrial, automotive, and aerospace sectors heavily utilize nano-coated metals to extend component lifespan and reduce maintenance costs.

The segment benefits from technological advancements enabling uniform coating application on complex geometries, ensuring consistent performance.

With rising infrastructure development and manufacturing output, metals are expected to remain the primary substrate for nano coating applications.

The automotive & transportation segment dominates the end-use category with approximately 31.4% share, driven by the need for advanced surface protection in exterior and interior vehicle components. Nano coatings enhance resistance to scratches, UV exposure, and environmental contaminants, supporting both aesthetic longevity and functional durability.

This segment benefits from the growing trend of vehicle customization and the premiumization of automotive surfaces.

As electric and autonomous vehicles enter the market, nano coatings will play a crucial role in protecting sensor housings, display panels, and exterior finishes, ensuring sustained growth in the automotive & transportation segment.

The hydraulic recloser market is expanding due to rising electricity demand, grid modernization, and the need for reliable distribution networks. North America accounts for approximately 30% of adoption, driven by upgrades in rural and urban distribution grids. Europe emphasizes smart grid integration and automation, while Asia Pacific leads in high-voltage rural electrification projects in China, India, and Southeast Asia. Hydraulic reclosers enhance power reliability, reduce outage times, and improve system safety. Adoption is rising in utility, industrial, and renewable energy sectors, driven by operational efficiency and regulatory compliance.

The primary driver of the hydraulic recloser market is the need for enhanced power distribution reliability. Utilities in North America and Europe are modernizing aging grids, replacing conventional fuses with hydraulic reclosers to minimize outage duration and improve fault management. Asia Pacific’s rapid rural electrification programs require reclosers to maintain uninterrupted supply in industrial, agricultural, and residential areas. Hydraulic reclosers can automatically restore power after transient faults, reducing downtime by 30–50% compared with traditional systems. Rising investment in renewable energy integration and distribution network automation further accelerates adoption, making hydraulic reclosers a critical component in modern power distribution systems.

Opportunities are arising from renewable energy adoption, microgrid development, and smart grid deployment. Integration of distributed generation sources, such as solar and wind farms, necessitates protective devices capable of handling variable loads and fault currents. Hydraulic reclosers are increasingly installed in distribution networks with high penetration of renewable energy to maintain stability and safety. Asia Pacific’s industrial and rural electrification projects present strong growth potential. Europe is investing in automated recloser networks connected to SCADA and advanced monitoring systems. Manufacturers offering intelligent, modular, and remotely controllable hydraulic reclosers can capture opportunities across utility, industrial, and renewable energy segments globally.

Key trends include smart grid integration, remote operation, and digital monitoring. Modern hydraulic reclosers come with IoT-enabled sensors, providing real-time data on current, voltage, and device status for predictive maintenance. Europe and North America lead in integrating hydraulic reclosers with SCADA systems for automated fault isolation and grid optimization. Asia Pacific is adopting compact and modular designs for rural and industrial applications. Electrification of distribution lines combined with advanced control software allows utilities to monitor and control reclosers remotely, improving operational efficiency by 15–20%. These trends reflect the global shift toward digitalized, intelligent power distribution networks.

Despite benefits, hydraulic reclosers face constraints due to high capital investment and technical complexity. High-voltage units require skilled installation, calibration, and regular maintenance to ensure safe and reliable operation. Costs are higher than conventional fuses or air-break switches, limiting adoption in small utilities and developing regions. Environmental conditions, such as extreme temperatures and humidity, can impact performance, requiring additional protective measures. In emerging economies, limited trained personnel and lack of standardized maintenance protocols slow adoption. Manufacturers are focusing on modular, energy-efficient, and easy-to-install designs to mitigate these challenges and expand global adoption across utility and industrial distribution networks.

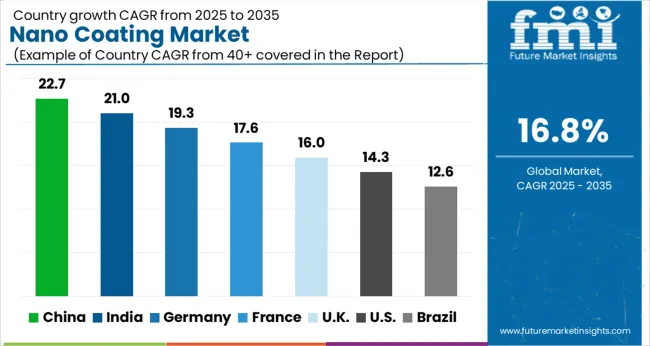

| Country | CAGR |

|---|---|

| China | 22.7% |

| India | 21.0% |

| Germany | 19.3% |

| France | 17.6% |

| UK | 16.0% |

| USA | 14.3% |

| Brazil | 12.6% |

The nano coating market is projected to grow at a global CAGR of 16.8%, driven by increasing industrial applications, protective coatings demand, and technological advancements. China leads at 22.7%, a 1.35× multiple of the global benchmark, supported by BRICS-led industrial expansion, automotive and electronics manufacturing, and research in advanced materials. India follows at 21.0%, a 1.25× multiple, reflecting rising domestic demand for protective and functional coatings across industries. Germany records 19.3%, a 1.15× multiple, influenced by OECD-focused innovation, high-performance applications, and efficiency improvements. The United Kingdom posts 16.0%, slightly below the global rate, driven by niche industrial and commercial uses. The United States stands at 14.3%, 0.85× the benchmark, with adoption focused on specialized industrial applications and protective solutions. BRICS economies drive volume growth, OECD countries prioritize technological sophistication and performance, and ASEAN regions contribute via expanding industrial and electronics sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The nano coating market in China is projected to grow at a CAGR of 22.7%, supported by rapid industrialization, advanced manufacturing, and increasing adoption in electronics, automotive, and construction sectors. Domestic manufacturers such as Shanghai Chemical Industry Park companies and foreign suppliers like BASF and Dow are supplying high-performance nano coatings offering water, corrosion, and wear resistance. Adoption is concentrated in electronics protection, automotive surface enhancement, and industrial machinery. Technological innovations include self-cleaning surfaces, anti-fingerprint coatings, and energy-efficient protective layers. Government support for advanced material development and rising demand in high-value industrial and consumer applications reinforce growth. China’s strong R&D capabilities and growing manufacturing sector further accelerate nano coating adoption.

The nano coating market in India is expected to grow at a CAGR of 21.0%, driven by increasing automotive production, electronics manufacturing, and industrial surface protection needs. Key suppliers including Pidilite, BASF, and local specialty chemical companies provide advanced coatings with anti-corrosion, hydrophobic, and wear-resistant properties. Adoption is concentrated in automotive, electronics, and construction sectors. Technological trends include thermal resistance coatings, scratch-proof surfaces, and energy-efficient protective layers. Government initiatives promoting advanced materials and industrial modernization further accelerate demand. Rising investment in electronics and automotive manufacturing, combined with infrastructure development, strengthens market growth. Industrial and consumer applications continue to drive nano coating adoption across India.

The nano coating market in Germany is projected to grow at a CAGR of 19.3%, driven by automotive, electronics, and industrial machinery applications. Leading suppliers such as BASF, Evonik, and Henkel are providing high-performance nano coatings with corrosion resistance, anti-fingerprint properties, and energy efficiency. Adoption is concentrated in automotive surface protection, industrial equipment, and electronics. Technological trends include hydrophobic, self-cleaning, and multifunctional coatings. Germany’s strong industrial base, emphasis on quality manufacturing, and environmental regulations supporting energy-efficient and durable coatings reinforce adoption. Industrial automation and advanced manufacturing processes further support nano coating growth.

The nano coating market in the United Kingdom is expected to grow at a CAGR of 16.0%, supported by electronics, automotive, and construction applications. Suppliers including BASF, AkzoNobel, and local specialty chemical companies provide coatings offering scratch resistance, corrosion protection, and self-cleaning capabilities. Adoption is concentrated in automotive surface protection, electronics, and industrial machinery. Technological trends include energy-efficient coatings, hydrophobic surfaces, and wear-resistant layers. Government initiatives promoting industrial modernization, green materials, and advanced manufacturing enhance adoption. The growth of automotive and electronics sectors further supports demand for nano coatings in the UK.

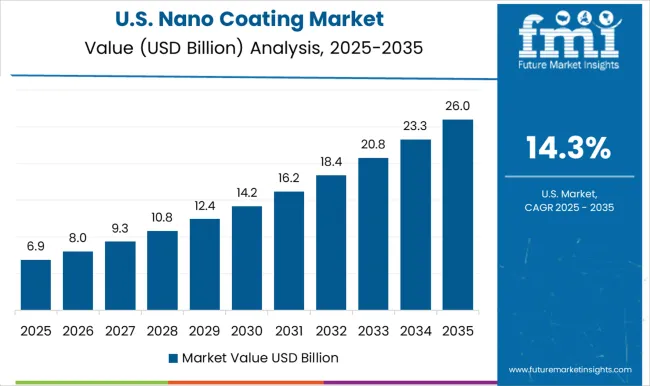

The nano coating market in the United States is projected to grow at a CAGR of 14.3%, driven by electronics, automotive, and industrial equipment applications. Key players such as PPG Industries, Dow, and Sherwin-Williams provide high-performance nano coatings with self-cleaning, anti-corrosion, and hydrophobic properties. Adoption is concentrated in industrial machinery, automotive surface protection, and electronics. Technological trends include multifunctional coatings, energy-efficient protective layers, and scratch-resistant surfaces. Government initiatives encouraging advanced materials research, renewable energy adoption, and industrial modernization support market growth. Increasing demand for high-performance coatings across electronics, automotive, and industrial sectors drives consistent market expansion.

Competition in the nano coating market is driven by global materials companies and specialized nanotechnology providers, focusing on durability, surface protection, and functional performance. PPG Industries, Buhler Group, and Nanogate lead with industrial-scale solutions, emphasizing scratch resistance, corrosion protection, and enhanced surface properties in their brochures. Tesla Nanocoatings and Nanophase Technologies Corporation target the automotive and electronics sectors, highlighting advanced hydrophobic, anti-reflective, and self-cleaning capabilities. Nanomech, AdMat Innovations, and Nanovere Technologies specialize in precision coatings for high-performance applications, emphasizing thermal stability and chemical resistance. Nanoglotec, Bio-gate, and Surfix emphasize biocompatible and environmentally friendly formulations, appealing to medical, packaging, and specialty industrial segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.7 Billion |

| Type | Anti-fingerprint coatings, Anti-microbial coatings, Self-cleaning coatings, Anti-corrosion coatings, Abrasion & wear-resistant coatings, and Others |

| Substrate | Metals, Glass, Plastics, Ceramics, Wood, and Others |

| End Use | Automotive & transportation, Electronics, Healthcare & medical, Building & construction, Aerospace & defense, Marine, Energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nanogate, Buhler Group, PPG Industries, Nanophase Technologies Corporation, Nanomech, AdMat Innovations, Nanovere Technologies, Nanoglotec, Tesla Nanocoatings, Bio-gate, and Surfix |

| Additional Attributes | Dollar sales by recloser type and end use, demand dynamics across utilities, industrial, and commercial power distribution, regional trends in grid modernization and outage management, innovation in automation, fault detection, and reliability, environmental impact of oil use and disposal, and emerging use cases in smart grids, renewable integration, and remote monitoring. |

The global nano coating market is estimated to be valued at USD 10.7 billion in 2025.

The market size for the nano coating market is projected to reach USD 50.8 billion by 2035.

The nano coating market is expected to grow at a 16.8% CAGR between 2025 and 2035.

The key product types in nano coating market are anti-fingerprint coatings, anti-microbial coatings, self-cleaning coatings, anti-corrosion coatings, abrasion & wear-resistant coatings and others.

In terms of substrate, metals segment to command 27.6% share in the nano coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanocellulose Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Barrier Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocrystal Packaging Coating Market Analysis - Size, Share, and Forecast 2025 to 2035

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Nanoscale Zero-Valent Iron Market Size and Share Forecast Outlook 2025 to 2035

Nanoscale Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Nano Fibers Market Size and Share Forecast Outlook 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

Nano Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nanocatalysts Market Size and Share Forecast Outlook 2025 to 2035

Nano Suspension Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Nano Composite Zirconia Market Size and Share Forecast Outlook 2025 to 2035

Nano Dentistry Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterial Supercapacitors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA