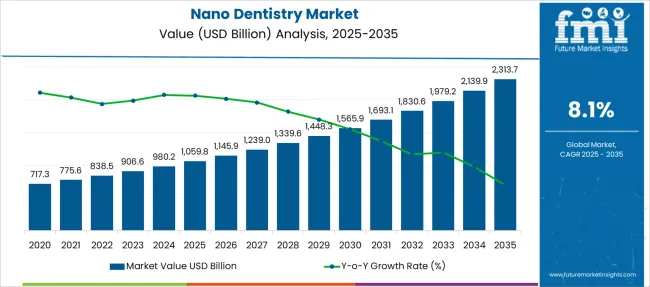

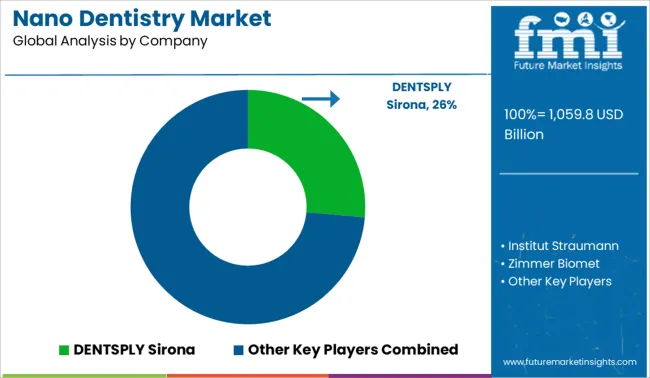

The Nano Dentistry Market is estimated to be valued at USD 1059.8 billion in 2025 and is projected to reach USD 2313.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Nano Dentistry Market Estimated Value in (2025 E) | USD 1059.8 billion |

| Nano Dentistry Market Forecast Value in (2035 F) | USD 2313.7 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The nano dentistry market is gaining traction due to advancements in nanomaterials and their integration into dental treatments aimed at enhancing precision, durability, and patient comfort. Increasing awareness around aesthetic and minimally invasive procedures has further contributed to market expansion.

Innovations in nano engineered materials are facilitating improvements in dental restorations, drug delivery, tissue regeneration, and preventive care. Clinicians are increasingly adopting nano based solutions to improve bonding strength, antimicrobial activity, and tissue compatibility.

Regulatory approvals and academic validation of nano materials for dental use are reinforcing trust and clinical adoption. As the demand for high performance, long lasting, and bioactive dental materials rises across global markets, the outlook for nano dentistry remains highly promising with opportunities emerging across both therapeutic and preventive domains.

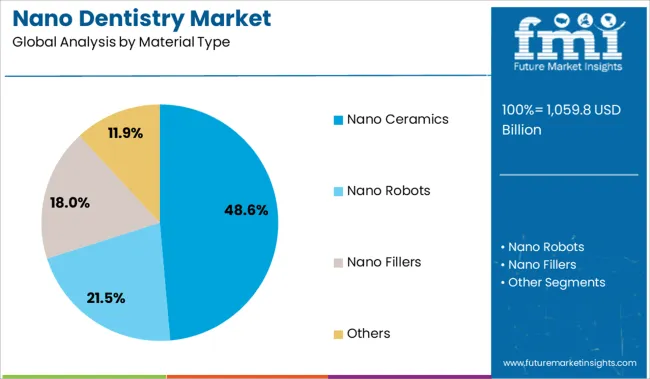

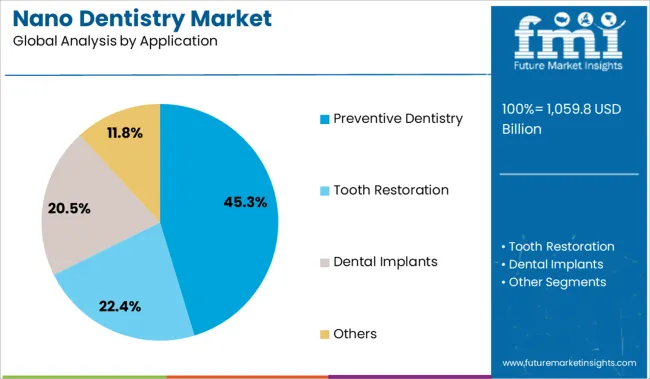

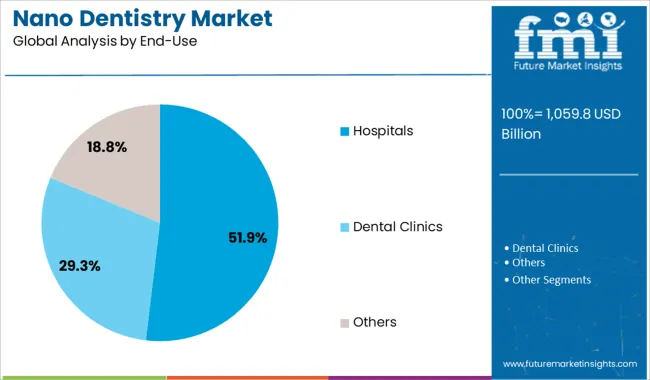

The market is segmented by Material Type, Application, and End-Use and region. By Material Type, the market is divided into Nano Ceramics, Nano Robots, Nano Fillers, and Others. In terms of Application, the market is classified into Preventive Dentistry, Tooth Restoration, Dental Implants, and Others. Based on End-Use, the market is segmented into Hospitals, Dental Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Nano ceramics are projected to represent 48.60% of the total market share by 2025 under the material type category, making them the dominant choice. Their widespread adoption is supported by superior properties such as enhanced mechanical strength, biocompatibility, and natural tooth like aesthetics.

Nano ceramic materials offer improved wear resistance and bonding capabilities, making them ideal for crowns, veneers, and implant coatings. Their ability to mimic natural enamel and integrate well with surrounding tissues has positioned them as the preferred material for advanced dental restorations.

Ongoing research and clinical trials have further expanded their applicability across a wide range of restorative and prosthetic solutions, ensuring sustained leadership in this segment.

Preventive dentistry holds 45.30% of the total market share in 2025 under the application category, highlighting its position as the most significant area of application. This prominence is driven by increased public awareness regarding oral hygiene, the rising prevalence of dental caries, and the growing focus on early intervention.

Nano based technologies in preventive care such as remineralizing agents, antibacterial coatings, and targeted delivery systems are being increasingly adopted by dental professionals. These solutions help in plaque control, enamel regeneration, and cavity prevention without invasive procedures.

The shift toward personalized and proactive oral healthcare practices continues to support the dominance of preventive dentistry within the nano dentistry market.

The hospitals segment is expected to account for 51.90% of the total market revenue by 2025 in the end use category, positioning it as the leading setting for nano dental applications. Hospitals benefit from access to advanced diagnostic and treatment technologies and serve as primary hubs for surgical and restorative dental procedures.

The integration of nano materials into hospital based dentistry has been strengthened by institutional research partnerships, skilled practitioner availability, and infrastructure capable of supporting complex procedures. Additionally, patient trust in hospital settings for precision treatment options such as implants, restorations, and regenerative therapies is driving demand.

This environment has created a stronghold for hospitals as the preferred end use channel within the nano dentistry market.

The Global nano dentistry market size was valued at USD 1059.8 Million in 2025 while exhibiting a CAGR of 9.1% during the historical period. The rising prevalence of dental diseases, growing demand for nano dentistry products, increasing oral hygiene awareness, and increasing adoption of advanced dental technology is augmenting the market growth.

Considering these factors, the global nano dentistry market is projected to garner a valuation of USD 1.98 Billion by the end of the forecast period, exhibiting a CAGR of 8.12%.

Technological Advancements will fuel the market growth of Nano Dentistry

According to nano-dentistry research, nanorobots can insert periodontal tissue directly, making it more convenient to reposition, orthodontic, and rotate teeth quickly. This advancement helps orthodontists treat molars, which can take weeks or months to complete the procedure. In summary, the market objective for nano-dentistry is to bring progress in monitoring, controlling, engineering, repairing, and enhancing the patient's overall oral health. This technology has wonderful potential to change the healthcare industry. Better technology, advanced medicines and solutions, and long-term impression will prioritize the demand for nano-dentistry. All these factors are expected to augment the nano-dentistry market growth during the forecast period.

A decline in patient awareness and education regarding nano-dentistry is one of the challenges in the expansion of the nano-dentistry market. There is growing concerned about the safety of non-materials in various products. Nanoparticles have a high surface area-to-volume ratio. The larger the specific surface area, the more likely it is to be absorbed through the skin, lungs, or gastrointestinal tract. This can have unsought effects on the lungs and other organs throughout the body due to the potential for the accumulation of non-degradable nanoparticles.

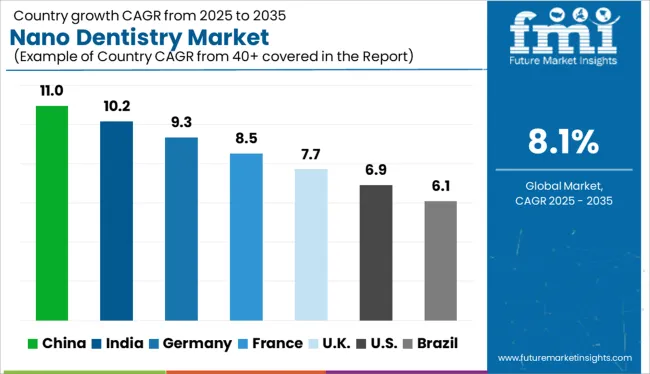

In 2025, North America dominated the market with a revenue share of over 38.4% because of factors including growing Research and Development activities in dentistry, increasing disposable income, and the presence of independent clinics. Moreover, the rising government funding for dental programs is likely to contribute to market growth.

According to CDC, in 2020, 47.20% of adults aged 30 years in the USA had some form of periodontal disease, with the condition being more commonly present in men than women, as they are more prone to smoking & health conditions such as diabetes. The rising prevalence of oral diseases is anticipated to boost the growth of the nano dentistry market. Adult education, sensitization on oral hygiene, and the need for treatment have stimulated local demand in the region.

Asia Pacific is expected to witness the fastest growth of 8.4% from 2025 to 2035 as this region is densely populated, with a growing geriatric population and prevalent oral diseases. Asia-Pacific countries are also known for their low-cost dental treatment, making them a target medical tourism market.

Asia Pacific is likely to record significant growth owing to the medical tourism industry expansion. Better services at comparatively lower costs and improvement in healthcare infrastructure will fuel regional growth. However, high costs for the local population and limited awareness regarding novel techniques may hinder the market growth.

In 2025, the nanoceramics segment dominated the market and held a revenue share of over 38.1%. Nanoceramics possess chemical, physical, and mechanical properties that contrast them from other materials such as traditional ceramic materials, metals, and plastics. Nanoceramics are tremendously strong and display great resistance against bending and compression. This material improves the overall functionality of various dental materials and dental prostheses in the oral cavity.

In 2025, the tooth restoration segment dominated the market with a revenue share of 35.25% and is likely to grow at a CAGR of 8% from 2025 to 2035 as it restores the natural function of the teeth and prevents additional damage from decay. Tooth restoration involves restorative materials generally used to replace a loss of tooth structure due to dental caries, or tooth wear due to dental trauma.

Additionally, they may be used to change the cosmetic appearance of an individual’s teeth. Restorative materials are anticipated to possess several properties such as resistance to chemical erosion & wear, low thermal conductivity & expansion, biocompatibility, and aesthetics among others.

In 2025, the dental clinic segment dominated the market and held a revenue share of 51.7%. The dental clinic’s segment is also anticipated to witness the highest growth rate of 8.3% over the forecast period. owing to many dental colleges and clinics that have started in recent years. The increasing enrolment in dental courses is also propelling the growth of the segment.

For instance, as per the NCBI in 2020 2.7 lakh are registered with the Dental Council of India (DCI). The country achieved more than the ideal dentists-to-population ratio of 1:5,000, as against the 1:7,500 suggested by the WHO in 2024. The growing number of dental clinics and a high number of freshly passed-out dental students per year are likely to propel the segment growth.

The global nano dentistry market is consolidated with few large and medium-sized players accounting for most of the market revenue. Major players are deploying various strategies, entering into mergers and acquisitions, strategic agreements and contracts, developing testing, and introducing more effective veterinary rehabilitation services solutions. Some of the major company profiles included in the global Nano dentistry market report are-

DENTSPLY Sirona, Institut Straumann, Zimmer Biomet, Ivoclar Vivadent, aap Implantate AG, Heraeus Kulzer, BioHorizons IPH, 3M, Danaher Corporation, Biotronik

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 1059.8 billion |

| Market Value in 2035 | USD 2313.7 billion |

| Growth Rate | CAGR of 8.12% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Challenges, Trends, and Pricing Analysis |

| Segments Covered | Material, Application, End User, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Indonesia, Singapore, Thailand, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | DENTSPLY Sirona; Institut Straumann; Zimmer Biomet; Ivoclar Vivadent; aap Implantate AG; Heraeus Kulzer; BioHorizons IPH; 3M; Danaher Corporation; Biotronik |

| Customization | Available Upon Request |

The global nano dentistry market is estimated to be valued at USD 1,059.8 billion in 2025.

The market size for the nano dentistry market is projected to reach USD 2,313.7 billion by 2035.

The nano dentistry market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in nano dentistry market are nano ceramics, nano robots, nano fillers and others.

In terms of application, preventive dentistry segment to command 45.3% share in the nano dentistry market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanoscale Zero-Valent Iron Market Size and Share Forecast Outlook 2025 to 2035

Nanoscale Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Nano Fibers Market Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

Nano Precipitated Calcium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nanocatalysts Market Size and Share Forecast Outlook 2025 to 2035

Nano Suspension Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Barrier Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nano Zinc Oxide Market Size and Share Forecast Outlook 2025 to 2035

Nano Composite Zirconia Market Size and Share Forecast Outlook 2025 to 2035

Nanomaterial Supercapacitors Market Size and Share Forecast Outlook 2025 to 2035

Nano Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Nanosilver Market Size and Share Forecast Outlook 2025 to 2035

Nanographic Printing Market Size and Share Forecast Outlook 2025 to 2035

Nanoparticle Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA