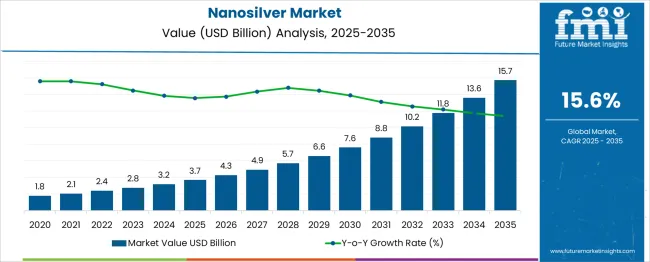

The Nanosilver Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 15.7 billion by 2035, registering a compound annual growth rate (CAGR) of 15.6% over the forecast period. The growth curve formed by the provided dataset indicates a pronounced upward acceleration, characteristic of a market in the rapid expansion phase. Early-stage increments between 2025 and 2028 range from USD 0.6 billion to USD 0.9 billion annually, showing steady initial momentum driven by increased demand for nanosilver in medical devices, antimicrobial coatings, and electronic components.

From 2029 to 2032, annual gains strengthen, moving from USD 1.2 billion to USD 1.8 billion. This sharper incline demonstrates rising acceptance of nanosilver-based solutions across diverse manufacturing sectors, aided by advances in production efficiency and cost management. The adoption pattern in this stage is supported by broader end-use integration in textiles, packaging, and water purification technologies. In the final period from 2033 to 2035, annual value additions surpass USD 2 billion, creating the steepest section of the curve. This indicates the transition toward large-scale industrial penetration with significant volume-based growth. The curve shape therefore suggests that the nanosilver industry remains in a high-growth, pre-maturity stage with further expansion potential beyond 2035, supported by technological innovation and diversified applications across high-value sectors.

| Metric | Value |

|---|---|

| Nanosilver Market Estimated Value in (2025 E) | USD 3.7 billion |

| Nanosilver Market Forecast Value in (2035 F) | USD 15.7 billion |

| Forecast CAGR (2025 to 2035) | 15.6% |

The nanosilver market is viewed as a high potential yet steadily growing category across its parent industries. It is estimated to account for about 2.3% of the global nanomaterials and advanced materials market indicating rising demand for antimicrobial additives. Within the specialty chemicals sector a share of approximately 3.5% is assessed driven by use in coatings, textiles and healthcare products. In the medical device additives and disinfectants segment around 2.8% is observed reflecting adoption in wound dressings and sterilization technologies. Within the water treatment and filtration systems market about 1.9% is calculated supported by use in biocidal filter media. In the electronics and conductive inks industry a contribution of roughly 2.6% is evaluated as nanosilver is used in printed electronics and conductive adhesives. Trends in this market have been influenced by growing interest in durable antimicrobial solutions that inhibit microbial growth across multiple applications. Innovations have been focused on surface functionalization techniques, controlled release formulations, and embedding nanosilver into polymer matrices for long term efficacy. The medical device segment has shown increased use of nanosilver coatings in wound care and implantable products. In water treatment, nanosilver infused membranes and filters have been gaining attention for bacterial reduction. The Asia Pacific region has been observed to demonstrate expedited adoption while North America has maintained strong market share based on regulatory acceptance and advanced material standards. Strategic initiatives have included collaborations between nanotech firms and healthcare or water treatment providers to deliver certified antimicrobial packaging products and modular disinfection modules for facility integration.

The nanosilver market is expanding steadily due to heightened antimicrobial demand across healthcare, consumer goods, and coatings applications. With nanosilver recognized for its potent antibacterial properties, industries are increasingly integrating it into textiles, packaging films, wound dressings, and electronics.

Market momentum is further fueled by its ability to inhibit over 650 types of pathogens at low concentrations. However, regulatory scrutiny around nanoparticle safety and environmental persistence continues to shape usage protocols.

Innovation in synthesis techniques and surface stabilization methods is enabling broader adoption while maintaining biocompatibility standards. The demand for infection-resistant materials post-pandemic and rising awareness about antimicrobial resistance (AMR) are reinforcing nanosilver’s relevance in both high-tech and public health settings.

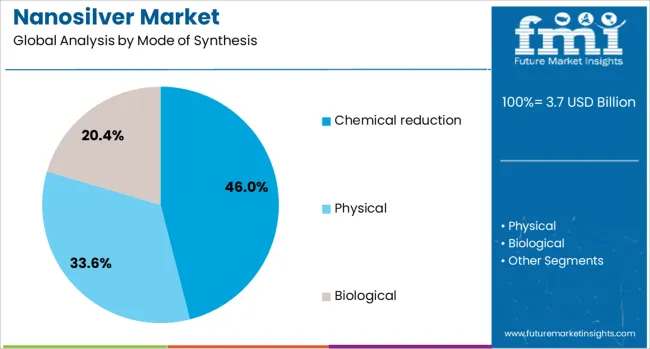

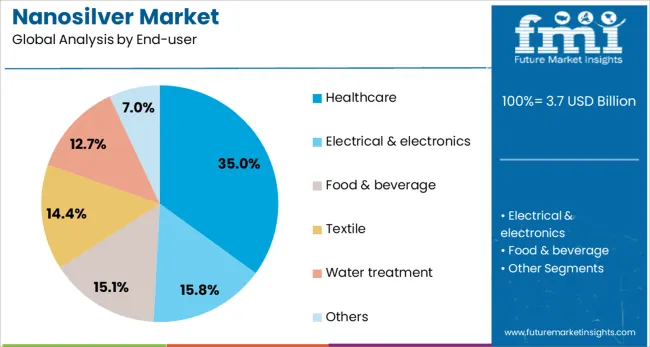

The nanosilver market is segmented by mode of synthesis, end-user, and geographic regions. By mode of synthesis of the nanosilver market is divided into Chemical reduction, Physical, and Biological. In terms of end-user of the nanosilver market is classified into Healthcare, Electrical & electronics, Food & beverage, Textile, Water treatment, and Others. Regionally, the nanosilver industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Chemical reduction is projected to lead the nanosilver synthesis market with a 46.00% share by 2025. This method remains dominant due to its simplicity, cost-effectiveness, and scalability.

It allows precise control over nanoparticle size and distribution, which is critical for consistent antimicrobial activity. The wide availability of reducing agents and stabilizers, combined with lower energy requirements, supports its use across commercial manufacturing environments.

As industries shift toward greener synthesis, modified chemical reduction methods using plant-based or less hazardous chemicals are gaining momentum, helping maintain this segment’s leadership while improving environmental compliance.

The healthcare sector is expected to account for 35.00% of nanosilver consumption in 2025, positioning it as the leading end-user industry. This dominance is driven by the material’s effectiveness in wound care, surgical instruments, catheters, and hospital textiles where sterility is critical.

Post-pandemic awareness of surface-level pathogen transmission has accelerated its integration into antimicrobial coatings and PPE. The segment also benefits from rising chronic wound cases and increased demand for advanced wound dressings.

Regulatory approvals for nanosilver-infused medical devices and expanding R&D for nanotechnology in drug delivery and diagnostics further support healthcare’s lead in nanosilver adoption.

Nanosilver has been increasingly used across healthcare, consumer goods, electronics, textiles, and water treatment due to its antimicrobial, conductive, and catalytic properties. The material's extremely small particle size has enabled high surface area interaction, enhancing performance in multiple applications. Demand has been supported by growing use in antimicrobial coatings, wound dressings, and hygiene products. Manufacturers have been developing controlled particle synthesis techniques to achieve consistent dispersion and stability. Expansion in electronics and sensor technologies has also contributed to nanosilver adoption in industrial and commercial applications.

Healthcare has been one of the largest consumers of nanosilver, utilizing its antimicrobial properties in wound care products, surgical instruments, and hospital surface coatings. Nanosilver-embedded dressings have been used to prevent bacterial infections and promote healing, particularly in burn care and chronic wound management. Medical device manufacturers have incorporated nanosilver coatings into catheters, implants, and surgical tools to reduce infection risks. Hospitals in North America, Europe, and Asia have increasingly specified nanosilver-based surface disinfectants to enhance hygiene standards. Research into controlled-release nanosilver formulations has further expanded usage potential, enabling sustained antimicrobial activity over longer periods. These healthcare-focused applications have been viewed as a stable and high-value segment due to ongoing infection control priorities in medical environments.

Nanosilver has been valued in electronics manufacturing for its exceptional electrical conductivity and compatibility with flexible substrates. Conductive inks and pastes containing nanosilver have been used in printed circuit boards, RFID antennas, touchscreens, and solar cells. The ability to print fine conductive lines without high-temperature sintering has made nanosilver an attractive choice for flexible and wearable electronics. Manufacturers in Japan, South Korea, and the United States have been developing nanosilver-based materials for next-generation electronics, including sensors and transparent conductors. Demand from renewable energy sectors, particularly in solar cell manufacturing, has added another growth avenue. The combination of high conductivity, thermal stability, and fine-pattern printing capability has positioned nanosilver as a key enabler in emerging electronic applications.

The incorporation of nanosilver into textiles and consumer products has been increasing due to its ability to provide long-lasting odor control and antimicrobial performance. Sportswear, socks, bedding, and filters have been treated with nanosilver to inhibit bacterial growth during use. In consumer goods, nanosilver has been added to household appliances such as washing machines, refrigerators, and air purifiers for continuous antimicrobial action. Textile mills in China, India, and Southeast Asia have adopted nanosilver finishing treatments for export-quality fabrics, particularly in performance apparel and home textiles. The durability of nanosilver’s effect through multiple washes has been a decisive factor in its adoption. As hygiene-conscious consumer preferences grow, the integration of nanosilver into everyday products has been recognized as a market segment with significant potential.

Despite its functional benefits, nanosilver has faced regulatory scrutiny due to concerns over environmental impact and potential toxicity at certain exposure levels. Regulations in regions such as the European Union have required detailed safety evaluations before market approval in specific applications. High production costs associated with controlled particle synthesis have also restricted nanosilver’s competitiveness in cost-sensitive markets. Public perception issues surrounding nanomaterials have slowed adoption in some consumer product categories. Additionally, large-scale recycling and waste management for nanosilver-containing products remain underdeveloped. Without advancements in cost reduction, clearer safety validation, and improved regulatory pathways, expansion into broader market segments may progress more slowly than in high-value, specialized applications.

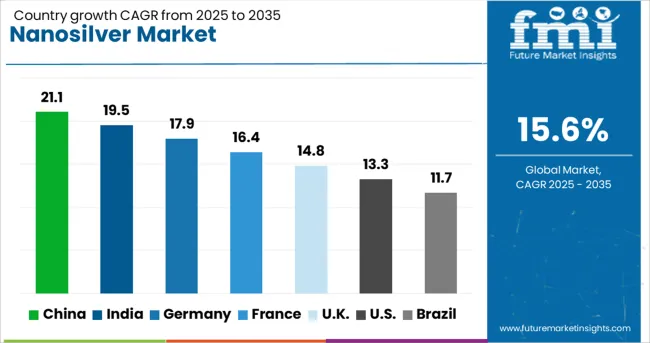

| Country | CAGR |

|---|---|

| China | 21.1% |

| India | 19.5% |

| Germany | 17.9% |

| France | 16.4% |

| UK | 14.8% |

| USA | 13.3% |

| Brazil | 11.7% |

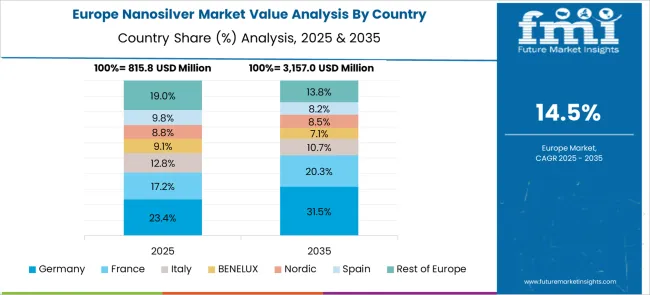

The nanosilver market is expected to grow at a global CAGR of 15.6% between 2025 and 2035, driven by its expanding use in antimicrobial coatings, electronics, textiles, and healthcare applications. China leads with a 21.1% CAGR, supported by large-scale nanomaterial production and integration in consumer products. India follows at 19.5%, fueled by demand in medical devices, water purification, and textiles. Germany, at 17.9%, benefits from advanced nanotechnology research and high-value industrial applications. The UK, projected at 14.8%, sees growth from adoption in healthcare and packaging sectors. The USA, at 13.3%, reflects strong but steady demand in electronics, defense, and wound care products. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 21.1% from 2025 to 2035 in the nanosilver market, supported by rapid advancements in nanomaterials manufacturing and extensive application development. Domestic producers such as Hongwu International Group, Beijing Dk Nano Technology, and NanoAmor China are scaling up production for use in electronics, textiles, and healthcare. The country’s consumer electronics industry is a major end-user, utilizing nanosilver for antimicrobial coatings in smartphones, tablets, and wearables. Growth in functional textiles, such as odor-resistant sportswear, is expanding the market further. Government-backed initiatives in nanotechnology R&D are also accelerating innovation and commercialization of next-generation nanosilver-based products.

India is forecasted to achieve a CAGR of 19.5% from 2025 to 2035, driven by demand from healthcare, water purification, and consumer product segments. Domestic companies like Nano Research Lab, Reinste Nano Ventures, and ABC Nanotech are expanding capabilities to supply high-purity nanosilver for antimicrobial coatings in medical devices and hospital surfaces. The packaged drinking water industry is increasingly adopting nanosilver-based filters for enhanced bacterial control. Consumer awareness of antimicrobial and self-sterilizing products is boosting retail sales in home appliances and hygiene-focused goods. Government-supported nanomaterials research is also fostering startup-led innovations in nanosilver applications.

Germany is projected to post a CAGR of 17.9% from 2025 to 2035, supported by high-value applications in electronics, renewable energy, and advanced medical products. Companies such as Heraeus Holding GmbH, Cima Nanotech Europe, and BASF are focusing on nanosilver for conductive inks used in printed electronics, photovoltaic cells, and RFID tags. The medical sector is adopting nanosilver in wound dressings, catheters, and implant coatings for enhanced antimicrobial protection. Strict EU quality regulations are driving the development of environmentally sustainable nanosilver synthesis methods. Germany’s strong R&D ecosystem is enabling continuous improvements in particle uniformity and dispersion stability.

The United Kingdom is expected to record a CAGR of 14.8% from 2025 to 2035, driven by expanding use in healthcare, defense, and smart textiles. Manufacturers and research organizations such as Nanogap UK, Promethean Particles, and BioNano Engineering are exploring nanosilver-based antimicrobial coatings for public transport, shared spaces, and military uniforms. The personal protective equipment (PPE) industry is incorporating nanosilver into reusable masks and gloves for improved hygiene. In the electronics sector, nanosilver conductive materials are being evaluated for flexible displays and printed circuits. Collaborations between universities and private firms are enhancing the commercialization of lab-scale nanosilver innovations.

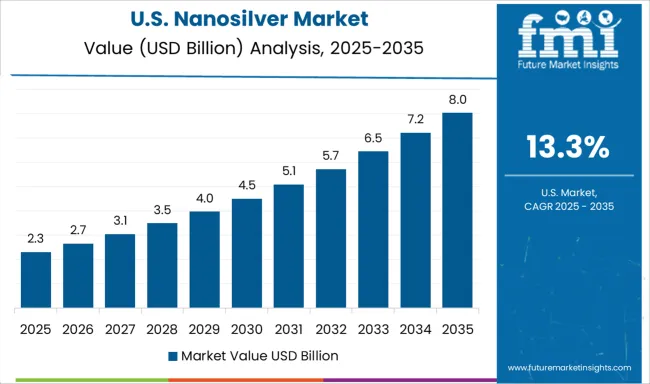

The United States is forecasted to grow at a CAGR of 13.3% from 2025 to 2035, supported by applications in healthcare, consumer electronics, and food packaging. Companies like Advanced Nano Products, Nanocomposix, and NovaCentrix are focusing on nanosilver for antimicrobial surfaces, conductive pastes, and intelligent packaging solutions. The food industry is exploring nanosilver-coated films for extended shelf life of perishable products. In healthcare, nanosilver is increasingly used in hospital surfaces, surgical instruments, and chronic wound management. Government grants for nanotechnology R&D are supporting the scale-up of innovative nanosilver manufacturing processes.

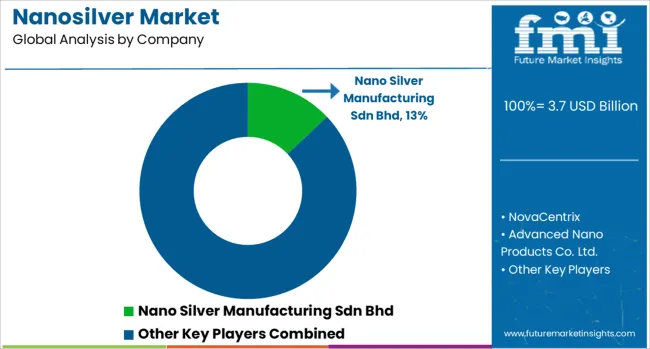

The nanosilver market is led by specialized nanomaterial producers and advanced chemical companies supplying a range of industries including healthcare, textiles, electronics, food packaging, and water treatment. Nano Silver Manufacturing Sdn Bhd and Advanced Nano Products Co. Ltd. are recognized for high-purity nanosilver powders, colloids, and dispersions used in antimicrobial coatings and functional textiles.

NovaCentrix leverages its expertise in conductive inks and printed electronics, incorporating nanosilver for improved conductivity in flexible circuits and RFID applications. Creative Technology Solutions Co. Ltd. and SILVIX Co., Ltd. focus on customized nanosilver formulations for medical device coatings, wound care products, and hygiene applications, ensuring compliance with stringent biocompatibility and safety standards. Applied Nanotech Holdings, Inc. develops nanosilver-based solutions for sensors, catalysts, and electronic components, often collaborating with research institutions for technology advancement.

Bayer Material Science AG applies nanosilver technology within high-performance materials, enhancing antimicrobial properties in specialty polymers and surface treatments. Key strategies include partnerships with healthcare and electronics manufacturers, investment in scaling production capacity, and R&D efforts to develop environmentally friendly synthesis methods. Competitive advantage in this market is driven by product consistency, particle size control, and regulatory approvals in target applications. Entry is restricted by advanced nanomaterial production requirements, intellectual property barriers, and the need for application-specific performance validation in regulated industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Mode of Synthesis | Chemical reduction, Physical, and Biological |

| End-user | Healthcare, Electrical & electronics, Food & beverage, Textile, Water treatment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nano Silver Manufacturing Sdn Bhd, NovaCentrix, Advanced Nano Products Co. Ltd., Creative Technology Solutions Co. Ltd., Applied Nanotech Holdings, Inc., Bayer Material Science AG, and SILVIX Co., Ltd. |

The global nanosilver market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the nanosilver market is projected to reach USD 15.7 billion by 2035.

The nanosilver market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in nanosilver market are chemical reduction, physical and biological.

In terms of end-user, healthcare segment to command 35.0% share in the nanosilver market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA