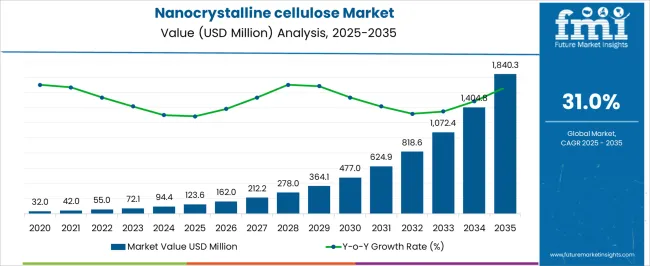

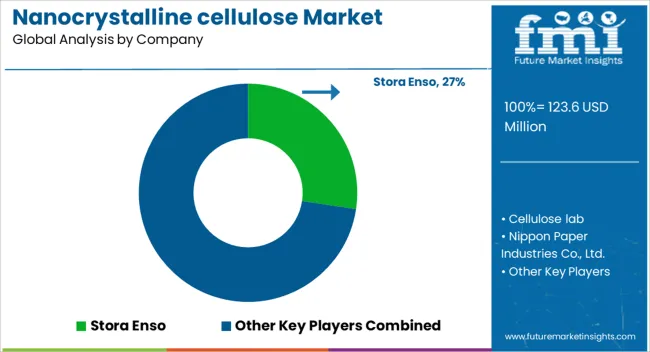

The Nanocrystalline cellulose Market is estimated to be valued at USD 123.6 million in 2025 and is projected to reach USD 1840.3 million by 2035, registering a compound annual growth rate (CAGR) of 31.0% over the forecast period.

| Metric | Value |

|---|---|

| Nanocrystalline cellulose Market Estimated Value in (2025 E) | USD 123.6 million |

| Nanocrystalline cellulose Market Forecast Value in (2035 F) | USD 1840.3 million |

| Forecast CAGR (2025 to 2035) | 31.0% |

The Nanocrystalline Cellulose market is experiencing steady growth as industries increasingly adopt sustainable and high-performance materials for applications across composites, coatings, packaging, and pharmaceuticals. The current market scenario reflects strong demand for bio-based nanomaterials that offer superior mechanical strength, lightweight properties, and biodegradability.

Growth is being supported by the ongoing shift toward environmentally friendly products, coupled with increasing investment in advanced material research and industrial adoption of nanocellulose for reinforcement and functionalization purposes. In 2025, market revenue is significantly influenced by industrial-grade applications that enable scalable production while maintaining material quality.

Technological advancements in cellulose extraction and surface modification are paving the way for new applications in high-value sectors The future outlook remains positive as manufacturers continue to focus on enhancing yield, purity, and functional properties, which will expand the usability of nanocrystalline cellulose across multiple industries and create opportunities for innovative applications in sustainable and lightweight material solutions.

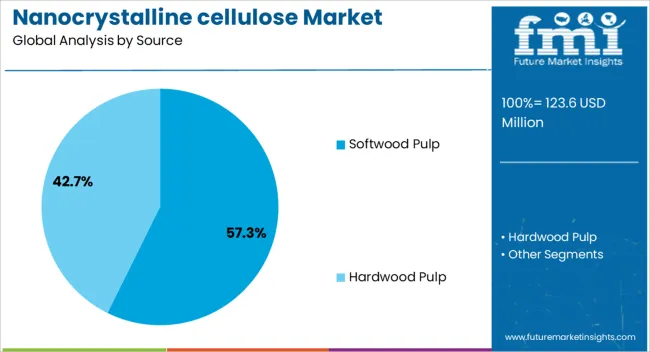

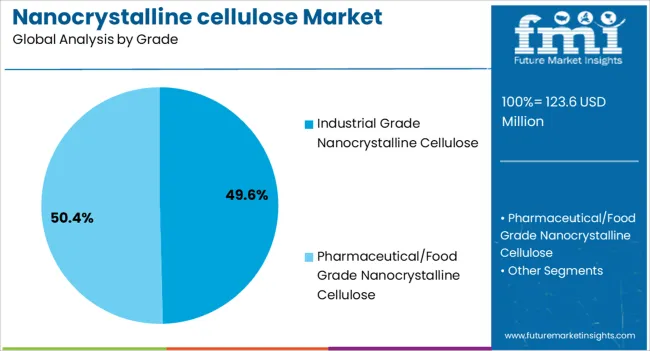

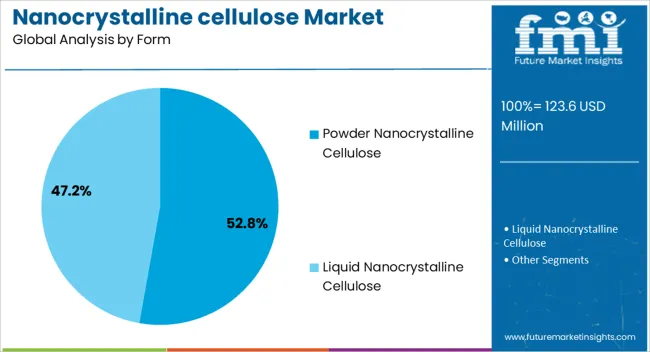

The nanocrystalline cellulose market is segmented by source, grade, form, application, and geographic regions. By source, nanocrystalline cellulose market is divided into Softwood Pulp and Hardwood Pulp. In terms of grade, nanocrystalline cellulose market is classified into Industrial Grade Nanocrystalline Cellulose and Pharmaceutical/Food Grade Nanocrystalline Cellulose. Based on form, nanocrystalline cellulose market is segmented into Powder Nanocrystalline Cellulose and Liquid Nanocrystalline Cellulose. By application, nanocrystalline cellulose market is segmented into Composites, Packaging, Paper Processing, Rheology Modifier, Biomedicine, Drilling Fluid, and Personal Care. Regionally, the nanocrystalline cellulose industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The softwood pulp source is projected to hold 57.30% of the Nanocrystalline Cellulose market revenue in 2025, making it the leading source type. This dominance is being driven by its availability, high cellulose content, and suitability for industrial-scale extraction processes. Adoption has been favored in applications requiring consistent particle morphology, superior crystallinity, and mechanical strength.

Softwood pulp allows efficient production of high-quality nanocrystalline cellulose with lower energy consumption during processing, which reduces operational costs and enhances profitability. The material properties derived from softwood pulp, such as excellent rigidity and high aspect ratio, are particularly suited for reinforcing composites and coatings.

Its wide availability and process reliability have reinforced its market leadership Future growth is expected to be sustained by the ongoing development of scalable extraction techniques and the increasing demand from industrial applications that prioritize both performance and sustainability.

Industrial grade nanocrystalline cellulose is expected to account for 49.60% of the market revenue in 2025, emerging as the leading grade segment. This prominence has been driven by the need for materials that can be produced consistently at scale while maintaining critical quality parameters.

Industrial grade products are preferred in composite manufacturing, packaging, and coatings due to their reliable performance, uniformity, and ease of integration into production lines. The growth of this segment has been further supported by rising adoption in large-scale industrial applications where batch-to-batch consistency is crucial.

As industries seek to replace conventional fillers and additives with sustainable alternatives, industrial grade nanocrystalline cellulose provides the scalability and material characteristics necessary for such transitions Continuous improvements in extraction and purification methods are expected to reinforce the dominance of this segment, enabling broader adoption across commercial and industrial end-use applications.

Powder nanocrystalline cellulose is projected to hold 52.80% of the market revenue in 2025, positioning it as the leading form segment. This leadership is being attributed to its ease of handling, uniform dispersion, and compatibility with a wide range of industrial processes. Powder form facilitates incorporation into composites, coatings, pharmaceuticals, and food formulations, allowing controlled rheology and predictable material performance.

Adoption has been driven by its ability to maintain functional properties during transportation, storage, and processing. Powdered nanocrystalline cellulose offers advantages in terms of precise dosing, mixing efficiency, and surface modification potential, which are critical for high-performance applications.

The increasing emphasis on sustainable, bio-based materials with consistent functionality has further reinforced the segment’s growth Future expansion is anticipated to be supported by rising industrial adoption, improvements in drying and milling techniques, and increasing demand for high-quality nanocellulose powders that enable innovation across diverse applications.

Nanocrystalline cellulose is classified as a key evolving renewable nanomaterial that is likely to create huge influence on numerous end-user industries. Nanocrystalline cellulose is extracted from natural wood biomass and further treated into different forms such as liquid & solids. Out of these forms of nanocrystalline cellulose the former one is getting consumed in very large scale. The major raw material used in the synthesis of nanocrystalline cellulose includes both softwood pulp and hardwood pulp of wood biomass. Acid hydrolysis process is primarily used for the fabrication of nanocrystalline cellulose & this production process is turning over as the most adopted one in the commercial marketplace.

Acid hydrolysis is generally used for the removal of amorphous parts the nanocrsytalline cellulose structure and convert it to short rod like fibrils which offers high crystallinity. The class of acid used in the acid hydrolysis process will determine the properties of the final nanocrystalline cellulose product. Sulphuric acid is generally used in the acid hydrolysis process. However, esterification & acetylation are some of the other alternative process used in the synthesis of nanocrystalline cellulose.

Nanocrystalline cellulose products are able to attain the crystallanity of almost 90 % and more. Nanocrystalline cellulose exhibits numerous exceptional properties such as high aspect ratio, high level of water uptake & uphold, complex fiber networks and biodegradability among others. Moreover, nanocrystalline cellulose possess high level of reinforcement potential and also exhibits better mechanical strength Kevlar & Aramid.

Properties such as better mechanical strength, better film formation, controlled release and strong fiber networks among others turning over nanocrystalline cellulose as a choice of material in numerous application such as paint & coatings, packaging, paper processing, drilling fluids to name a few. Growing landscape of these application is opening up new horizons for nanocrystalline cellulose in the global market place. Rising demand for packaged food across the globe is expected to generate demand potential for nanocrystalline cellulose based products. Nanocrystalline cellulose use in synthesis of composites are used in the production of automobile accessories such as headliners, headlamps and cushions.

With better fiber bond forces & high degree of reinforcement, nanocrystalline fiber is gaining adoption and marking its footsteps in paper processing industry. Nanocrystalline cellulose can also be used as a thickener and stabilizers in personal care and pharmaceutical industry. However, in the commercial market place the availability of substitutes such as cellulose ether & monocrystalline cellulose may dent the adoption of nanocrystalline cellulose up to some extent.

North America & Western Europe are turning over as the dominating region creating substantial demand space for nanocrystalline based products. Increasing demand for lightweight composites in the automotive industry is expected to increase the consumption of nanocrystalline cellulose in North America & Western Europe. China & South East Asia are the fastest growing regions for the consumption nanocrystalline cellulose based products.

Growing personal care, pharmaceutical, food & beverage and paper processing industries in the region is the key factor creating potential opportunities for nanocrystalline cellulose consumption. In Middle East & Africa, Eastern Europe and Latin America, nanocrystalline cellulose is used in the formulation of drilling mud and has been excessively adopted in oil & gas upstream operations. Nanocrystalline cellulose is used as a rheology modifier & viscosifier in drilling muds. Increase in automotive production in Japan is expected to create new growth possibilities for nanocrystalline cellulose manufacturers.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with Nanocrystalline cellulose market attractiveness as per segments. The report also maps the qualitative impact of various market factors on Nanocrystalline cellulose market segments and geographies.

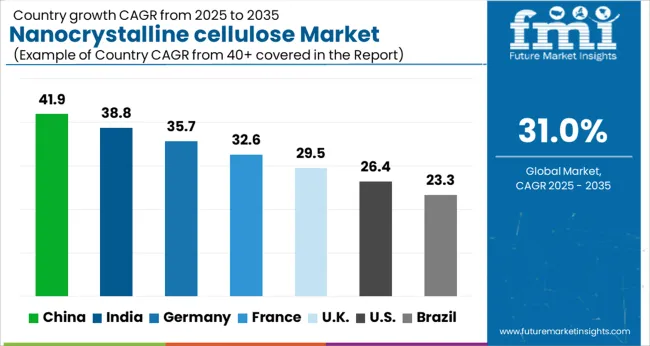

| Country | CAGR |

|---|---|

| China | 41.9% |

| India | 38.8% |

| Germany | 35.7% |

| France | 32.6% |

| UK | 29.5% |

| USA | 26.4% |

| Brazil | 23.3% |

The Nanocrystalline cellulose Market is expected to register a CAGR of 31.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 41.9%, followed by India at 38.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 23.3%, yet still underscores a broadly positive trajectory for the global Nanocrystalline cellulose Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 35.7%. The USA Nanocrystalline cellulose Market is estimated to be valued at USD 43.1 million in 2025 and is anticipated to reach a valuation of USD 447.1 million by 2035. Sales are projected to rise at a CAGR of 26.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 6.2 million and USD 3.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 123.6 Million |

| Source | Softwood Pulp and Hardwood Pulp |

| Grade | Industrial Grade Nanocrystalline Cellulose and Pharmaceutical/Food Grade Nanocrystalline Cellulose |

| Form | Powder Nanocrystalline Cellulose and Liquid Nanocrystalline Cellulose |

| Application | Composites, Packaging, Paper Processing, Rheology Modifier, Biomedicine, Drilling Fluid, and Personal Care |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stora Enso, Cellulose lab, Nippon Paper Industries Co., Ltd., Borregaard, Celluforce, Sappi Ltd., Kruger Inc., American process Inc, and Innventia AB |

The global nanocrystalline cellulose market is estimated to be valued at USD 123.6 million in 2025.

The market size for the nanocrystalline cellulose market is projected to reach USD 1,840.3 million by 2035.

The nanocrystalline cellulose market is expected to grow at a 31.0% CAGR between 2025 and 2035.

The key product types in nanocrystalline cellulose market are softwood pulp and hardwood pulp.

In terms of grade, industrial grade nanocrystalline cellulose segment to command 49.6% share in the nanocrystalline cellulose market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Esters Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Gel Market Growth, Forecast, and Analysis 2025 to 2035

Market Share Insights for Cellulose Fiber Providers

Key Players & Market Share in Cellulose Film Packaging Market

Nanocellulose Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Barrier Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Ethyl Cellulose Market

Methyl Cellulose Market

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Cellulose Derivative in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cellulose Derivative in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Cellulose Diacetate Film in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Demand for Cellulose Diacetate Film in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA