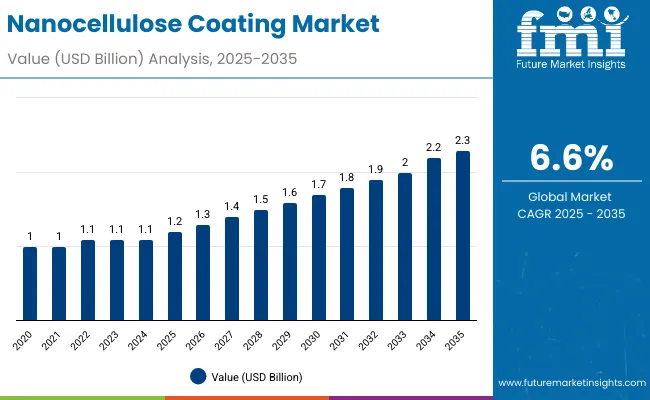

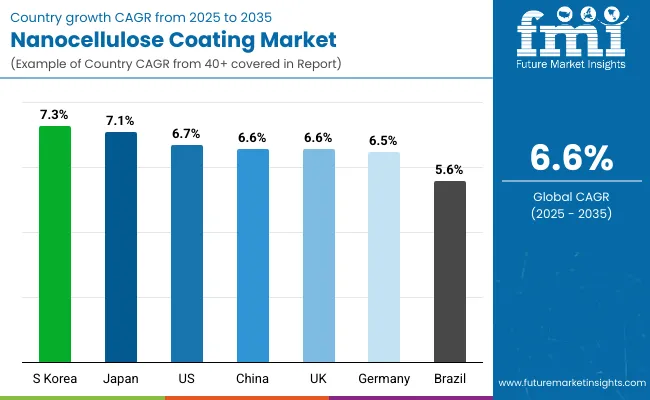

The nanocellulose coating market will expand from USD 1.2 billion in 2025 to USD 2.3 billion by 2035, advancing at a CAGR of 6.6%. Growth is supported by rising demand for renewable packaging alternatives, lightweight barrier materials, and bio-based coatings. Adoption in food and beverage, healthcare, and electronics reinforces market penetration.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.3 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, the market will add USD 0.4 billion, largely driven by packaging and regulatory support for plastic alternatives. From 2030 to 2035, another USD 0.7 billion will be added through adoption in healthcare, cosmetics, and industrial coatings. Paper and board substrates and water-based dispersions will anchor demand, with Asia-Pacific leading global growth.

From 2020 to 2024, nanocellulose coatings expanded steadily as industries sought renewable, lightweight, and biodegradable alternatives to plastic coatings. Specialty chemical and paper firms led innovations in oxygen barrier coatings and food-contact-safe solutions. Differentiation centered on recyclability, coating uniformity, and compostability. Service-driven offerings like eco-certifications accounted for smaller revenue shares but supported adoption.

By 2035, the market will reach USD 2.3 billion at 6.6% CAGR. Cellulose nanofibers will remain dominant, supported by scalable production. Water-based dispersions will account for most coatings, enhancing recyclability. Paperboard substrates will drive growth in FMCG packaging, while healthcare and cosmetics expand advanced use cases. Asia-Pacific will lead, with South Korea and Japan anchoring innovation.

The nanocellulose coating market is expanding due to rising regulatory restrictions on single-use plastics and increasing emphasis on sustainable packaging. Its oxygen and grease barrier properties make it highly suitable for food, pharmaceuticals, and personal care packaging. Brands adopt these coatings to align with circular economy goals and consumer demand for eco-friendly products.

Performance advantages such as moisture resistance, compostability, and recyclability further strengthen adoption. As e-commerce and FMCG consumption rise, demand for durable yet sustainable packaging grows. Integration into biopolymers, textiles, and specialty films broadens applications. With regulatory alignment and technical innovations, nanocellulose coatings are becoming central to global sustainability transitions.

The nanocellulose coating market is segmented by type, coating method, substrate, end-use industry, and region. By type, it includes microfibrillated cellulose, cellulose nanofibers, and cellulose nanocrystals. Coating methods comprise water-based, solvent-based, and hybrid/composite coatings. Substrates include paper, plastics, biopolymers, textiles, and glass. End-use industries span food and beverages, pharmaceuticals, cosmetics, electronics, and industrial goods across major global regions.

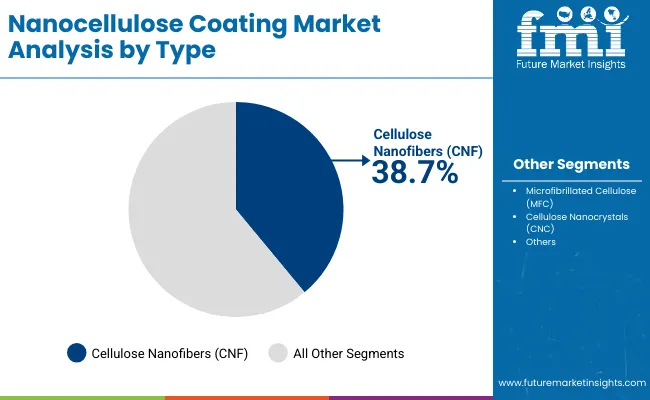

Cellulose nanofibers (CNF) will hold 38.7% share in 2025 due to superior barrier properties and scalability. Their lightweight nature and compatibility with paperboard packaging make them a preferred choice for FMCG and food applications. They also offer excellent grease and oxygen resistance.

Future demand will be supported by expanding applications in electronics and cosmetics. CNF coatings are increasingly aligned with regulatory mandates. Advances in hybrid CNF formulations will expand their durability and market penetration.

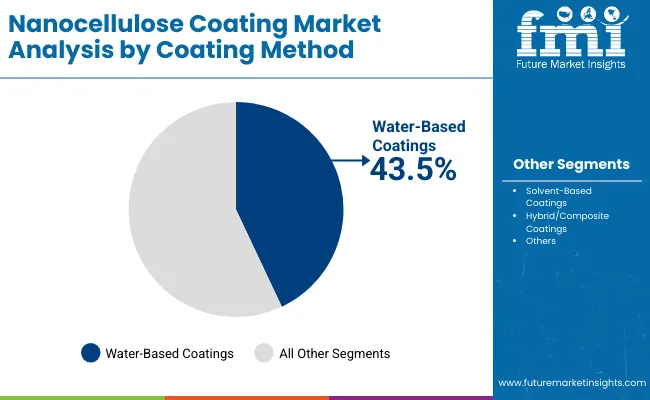

Water-based coatings will account for 43.5% share in 2025, reflecting growing demand for recyclable and eco-friendly solutions. Their compatibility with high-speed coating lines makes them ideal for packaging industries. They also reduce VOC emissions, aligning with global sustainability policies.

Future adoption will be reinforced by ongoing bans on solvent-based coatings. Advances in water dispersion technology will improve performance consistency. These coatings will remain dominant as industries align with recyclability and low-impact manufacturing.

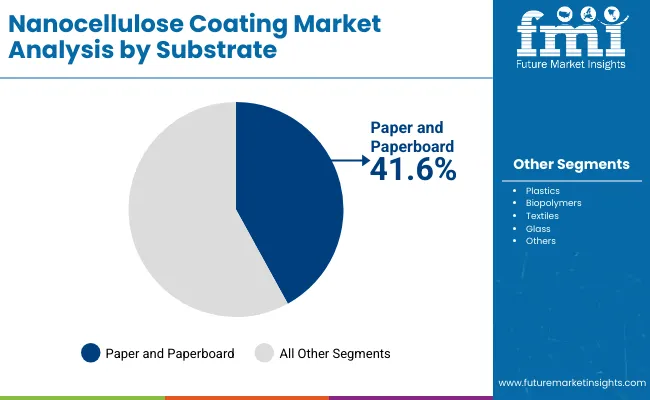

Paper and paperboard substrates will hold 41.6% share in 2025, supported by their role in food and consumer goods packaging. Nanocellulose enhances durability and oxygen barrier performance, making them a preferred choice globally. Retailers emphasize recyclability, which further strengthens adoption.

Future growth will stem from FMCG expansion and alignment with circular economy mandates. Paper-based substrates with nanocellulose coatings will dominate packaging sustainability initiatives worldwide.

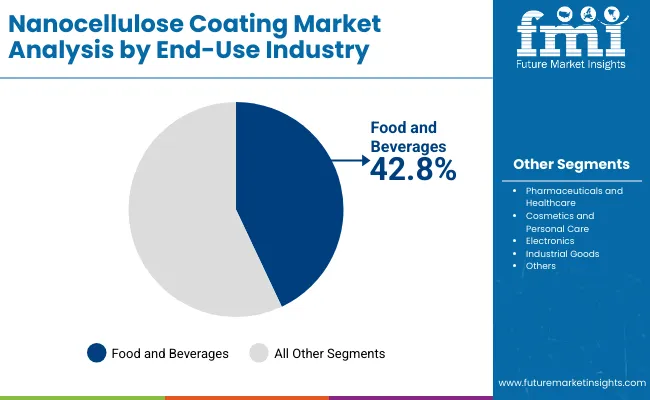

Food and beverages will represent 42.8% share in 2025, reflecting demand for sustainable barrier coatings in packaging. FMCG companies adopt nanocellulose to replace plastics while maintaining shelf life and safety. Adoption is reinforced by regulatory compliance and consumer awareness.

Growth will accelerate with rising packaged food demand in Asia-Pacific. Expanding processed food consumption will push demand for advanced coatings. Food and beverages will remain the leading end-use through 2035.

The market is driven by sustainability mandates, plastic bans, and rising FMCG demand. Nanocellulose offers superior oxygen and grease resistance while remaining compostable and recyclable. Regulatory compliance and consumer awareness fuel adoption across food, pharma, and personal care.

High processing costs and limited industrial-scale facilities restrict scalability. Performance variability under environmental stress hinders uptake. Certification frameworks for nanocellulose are still evolving, slowing acceptance.

Significant opportunities exist in hybrid coatings, biopolymer integration, and automated application systems. Healthcare, electronics, and cosmetics sectors offer growth potential. Emerging markets with plastic bans will drive rapid adoption.

Trends include hybrid coatings combining nanocellulose with bio-based polymers, biodegradable formulations, and automation integration. Smart coatings with traceability features are gaining traction. Circular economy initiatives accelerate innovation.

The market is expanding as sustainability, performance, and regulation converge. Asia-Pacific leads growth with Japan and South Korea. North America and Europe prioritize regulatory compliance, while emerging regions adopt nanocellulose through FMCG and retail packaging.

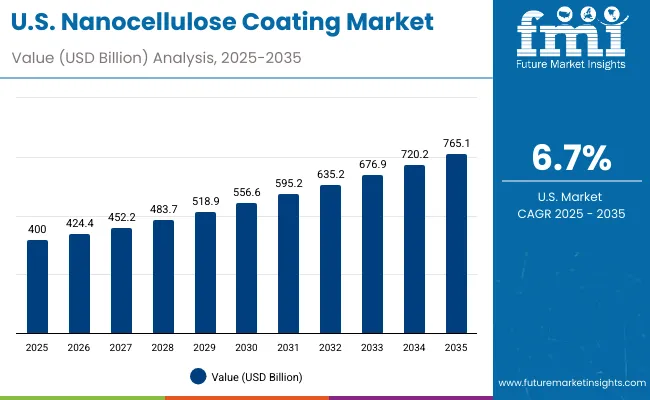

The USA coatings market is forecast to expand at 6.7% CAGR, supported by strong FMCG and healthcare packaging adoption. Leading brands are prioritizing recyclability, pushing demand for eco-compliant solutions. Regulations play a central role in reinforcing uptake, ensuring widespread compliance across industries. As packaging and healthcare logistics continue to advance, demand for coatings that combine protective qualities with sustainability and regulatory alignment will strengthen, shaping the country’s long-term growth trajectory in insulated and recyclable packaging.

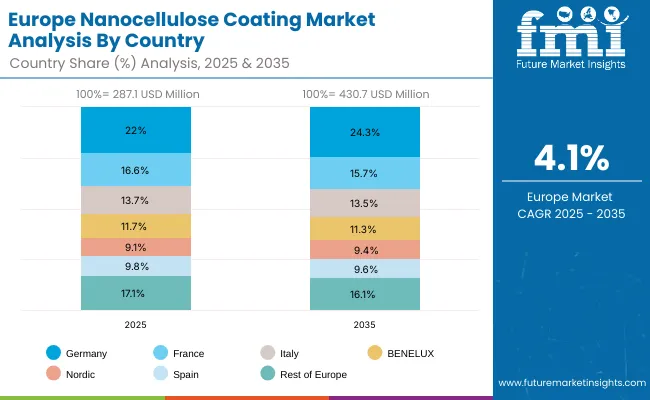

Germany is expected to grow at 6.5% CAGR, strongly influenced by strict EU sustainability mandates. Packaging remains the dominant application segment, reinforcing usage in food, FMCG, and retail supply chains. Automotive coatings also contribute significantly to expansion, creating hybrid coatings that balance functionality with eco-compliance. As Germany’s industry prioritizes sustainable practices, hybrid coating technologies that combine recyclability with durability are being adopted more widely, aligning with the country’s leading position in regulatory-driven innovation and advanced packaging practices.

The UK coatings market is projected to expand at 6.6% CAGR, supported by strict plastic tax regulations. FMCG retailers continue to emphasize recyclable formats, embedding sustainability into packaging innovation. Food and beverage brands are accelerating adoption, incorporating coatings into both mainstream and premium packaging designs. These drivers collectively position the UK as an important market where regulation and brand sustainability initiatives combine to create rising demand for coatings aligned with eco-compliance and packaging durability standards.

China is forecast to expand at a 6.6% CAGR, supported by strong growth in retail and packaging applications. E-commerce platforms continue to accelerate adoption, requiring high-performance coatings for delivery packaging. FMCG and cosmetics brands are reinforcing demand, prioritizing coatings that enhance durability, appearance, and sustainability. With domestic consumption rising sharply, China’s coating market is being shaped by demand for packaging that aligns with both functional protection and the premiumization of consumer goods across industries.

India is projected to record 6.5% CAGR, supported by nationwide plastic bans that encourage coating adoption. FMCG and food sectors dominate demand, relying on sustainable coatings for compliance and extended product protection. Affordable and low-cost coating solutions are widely expanding usage, ensuring scalability across diverse consumer markets. Together, these factors highlight India’s rapid transition toward sustainable packaging solutions, with coatings playing a pivotal role in balancing compliance, affordability, and market-driven adoption across industries.

Japan’s coatings market is expected to grow at a 7.1% CAGR, supported by advanced FMCG packaging and cosmetics applications. Premium packaging formats are leading adoption, reflecting consumer preferences for quality, aesthetics, and sustainability. Cosmetics brands continue to boost coatings demand, investing in recyclable and durable finishes. Meanwhile, regulatory frameworks ensure industry-wide compliance with eco-standards, positioning Japan as a leader in premium coatings that balance innovation, consumer appeal, and stringent environmental requirements across industries.

South Korea will lead global growth with a projected CAGR of 7.3%, driven by strong demand from food packaging and electronics sectors. Food packaging applications dominate, while electronics enhance coatings usage through protective and functional applications. Healthcare adoption further reinforces expansion, with strict requirements for pharmaceutical packaging. With retailers also emphasizing recyclable coatings, South Korea demonstrates a clear alignment between innovation, sustainability, and industrial demand, ensuring its leadership in advanced coatings adoption globally.

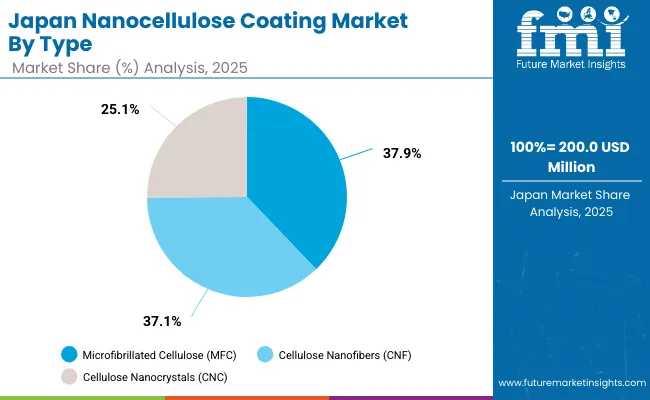

Japan’s nanocellulose coating market, worth USD 200 million in 2025, is dominated by Microfibrillated Cellulose (MFC) with 37.9% share, reflecting its versatility in barrier coatings for food packaging and industrial films. Cellulose Nanofibers (CNF) closely follow at 37.1%, driven by their strong reinforcement ability and eco-friendly performance. Cellulose Nanocrystals (CNC) account for 25.1%, valued for high crystallinity and use in specialty coatings. The market distribution highlights Japan’s growing reliance on nanocellulose to reduce plastic usage, improve barrier efficiency, and meet sustainability targets. Technological innovation in food, cosmetics, and pharmaceutical packaging is reinforcing demand for these renewable material-based coating types.

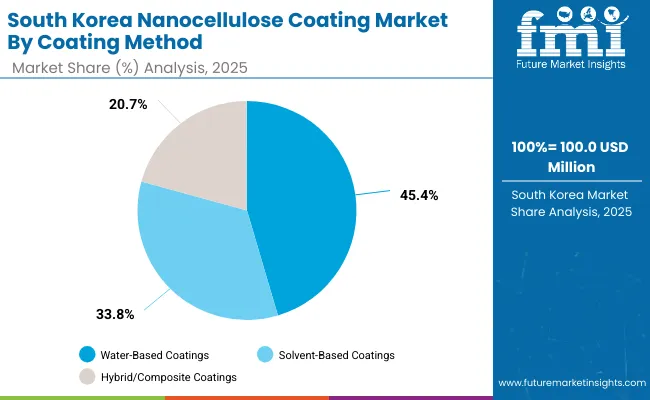

South Korea’s nanocellulose coating market, valued at USD 100 million in 2025, is led by water-based coatings with a 45.4% share, reflecting eco-friendly adoption across packaging and printing sectors. Solvent-based coatings account for 33.8%, preferred in applications requiring enhanced durability and moisture resistance. Hybrid/composite coatings hold 20.7%, gaining traction in high-barrier packaging and industrial protective layers. This structure emphasizes South Korea’s progressive shift toward sustainable solutions aligned with environmental standards, while ensuring performance for demanding applications. The balance of eco-driven water-based solutions with performance-centric solvent and hybrid options reflects the country’s dual priorities of sustainability and industrial competitiveness in coatings.

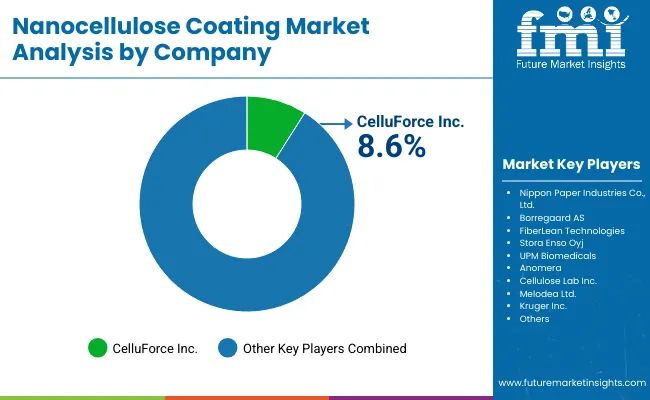

The market is moderately fragmented, with global leaders such as CelluForce Inc., Nippon Paper Industries Co., Ltd., Borregaard AS, FiberLean Technologies, Stora Enso Oyj, UPM Biomedicals, Anomera, Cellulose Lab Inc., Melodea Ltd., and Kruger Inc. These firms invest in scaling nanocellulose production, hybrid formulations, and automation-ready dispersions.

Stora Enso and Nippon Paper lead paperboard applications, while CelluForce and Borregaard emphasize CNF and CNC coatings. FiberLean and Melodea specialize in recyclability and printability innovations. Competition centers on sustainability, scalability, and certifications, with Asia-Pacific players accelerating growth through regulatory-driven adoption.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By Type | MFC, CNF, CNC |

| By Coating Method | Water-Based, Solvent-Based, Hybrid/Composite |

| By Substrate | Paper & Paperboard, Plastics, Biopolymers, Textiles, Glass |

| By End-Use Industry | Food & Beverages, Pharmaceuticals, Cosmetics, Electronics, Industrial Goods |

| Key Companies Profiled | CelluForce Inc., Nippon Paper Industries Co., Ltd., Borregaard AS, FiberLean Technologies, Stora Enso Oyj, UPM Biomedicals, Anomera, Cellulose Lab Inc., Melodea Ltd., Kruger Inc. |

| Additional Attributes | Growth supported by plastic bans, sustainability mandates, and renewable coatings adoption. |

The market will be valued at USD 1.2 billion in 2025.

The market will reach USD 2.3 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025–2035.

Cellulose nanofibers will lead with a 38.7% share in 2025.

Paper and paperboard will anchor demand with a 41.6% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanocellulose Barrier Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA