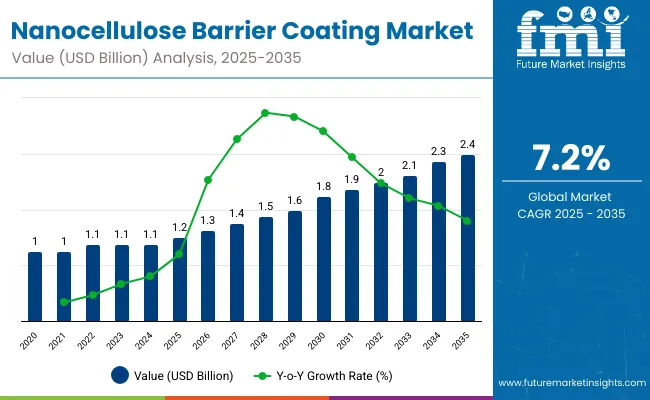

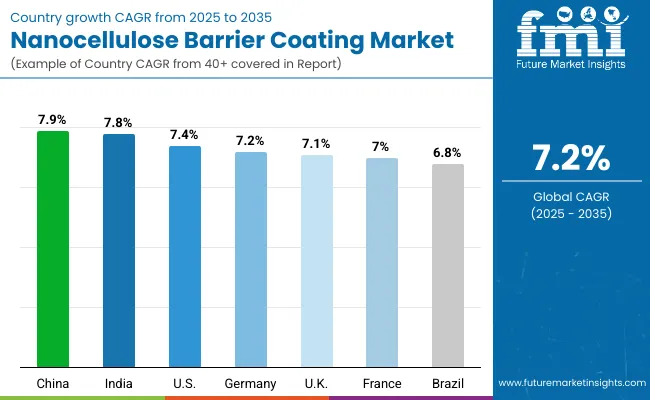

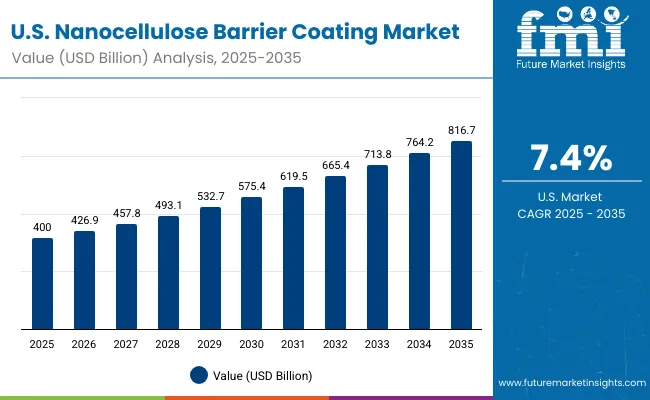

The nanocellulose barrier coating market is expected to grow from USD 1.2 billion in 2025 to USD 2.4 billion by 2035, resulting in a total increase of USD 1.2 billion over the forecast decade. This represents a 100.0% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 7.2%. Over ten years, the market grows by a 2.0 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.4 billion |

| CAGR (2025 to 2035) | 7.2% |

In the first five years (2025-2030), the market progresses from USD 1.2 billion to USD 1.6 billion, contributing USD 0.4 billion, or 33.3% of total decade growth. This phase is shaped by adoption in food and beverage packaging, driven by demand for plastic alternatives. Early support comes from regulations encouraging renewable and biodegradable coatings.

In the second half (2030-2035), the market grows from USD 1.6 billion to USD 2.4 billion, adding USD 0.8 billion, or 66.7% of the total growth. This acceleration is supported by advancements in hybrid nanocellulose composites, scalability in industrial coating lines, and rising applications in electronics and healthcare. Strengthened by sustainability goals, nanocellulose coatings emerge as a core enabler of eco-friendly packaging solutions.

From 2020 to 2024, the nanocellulose barrier coating market grew from USD 0.9 billion to USD 1.1 billion, driven by demand for renewable, lightweight, and biodegradable alternatives to plastic coatings in packaging. Nearly 70% of revenues were led by specialty chemical and paper companies advancing nanocellulose formulations. Leaders such as Stora Enso, UPM, and Nippon Paper emphasized oxygen barrier performance, compostability, and food-contact safety. Differentiation focused on coating uniformity, recyclability, and scalability, while antimicrobial integration remained secondary. Service-driven offerings such as sustainability certifications accounted for under 15% of revenue, with producers preferring direct procurement of eco-compatible coatings for food and consumer goods packaging.

By 2035, the nanocellulose barrier coating market will reach USD 2.4 billion, growing at a CAGR of 7.20%, with bio-based high-barrier coatings accounting for over 40% of total value. Competitive momentum will rise as providers deliver hybrid nanocellulose composites, water-based dispersions, and smart coatings with digital traceability. Established leaders are pivoting toward hybrid models pairing coatings with automation-ready application systems. Emerging entrants such as CelluComp, Granbio, and Melodea are gaining share through recyclable, lightweight coatings, enhanced printability, and scalable industrial solutions, aligning with sustainability mandates and increasing global demand for plastic-free packaging in food, beverage, and retail sectors.

The increasing demand for renewable, lightweight, and high-performance packaging materials is driving growth in the nanocellulose barrier coating market. These coatings provide excellent oxygen and grease resistance, making them ideal for food, beverage, and pharmaceutical applications. Rising regulations on plastic reduction and consumer preference for eco-friendly products further accelerate adoption.

Nanocellulose coatings engineered with bio-based polymers and advanced dispersion technologies are gaining traction for their ability to enhance recyclability and biodegradability. Their compatibility with paper and fiber-based substrates supports sustainable packaging innovation. Cost efficiency from lightweight structures and alignment with circular economy goals reinforce their importance in next-generation barrier solutions globally.

The market is segmented by type, coating method, substrate, end-use industry, and region. Type segmentation includes microfibrillated cellulose (MFC), cellulose nanofibers (CNF), and cellulose nanocrystals (CNC), each enhancing barrier properties in sustainable coatings. Coating method covers water-based, solvent-based, and hybrid/composite coatings, tailored for performance and environmental compliance.

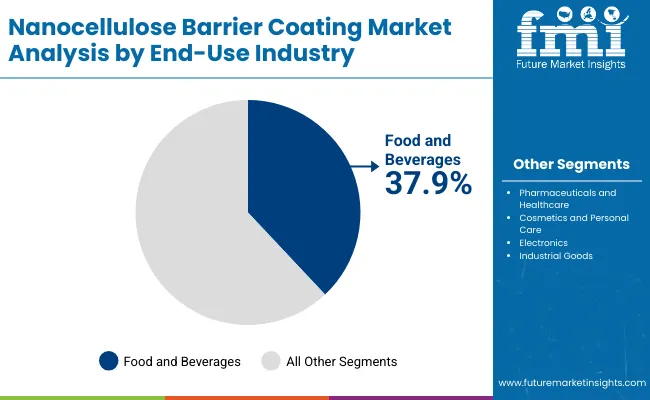

Substrate segmentation includes paper and paperboard, plastics, biopolymers, and textiles, supporting applications in both packaging and industrial use. End-use industries comprise food and beverages, pharmaceuticals and healthcare, cosmetics and personal care, electronics, and industrial goods, reflecting broad adoption across consumer and manufacturing sectors. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

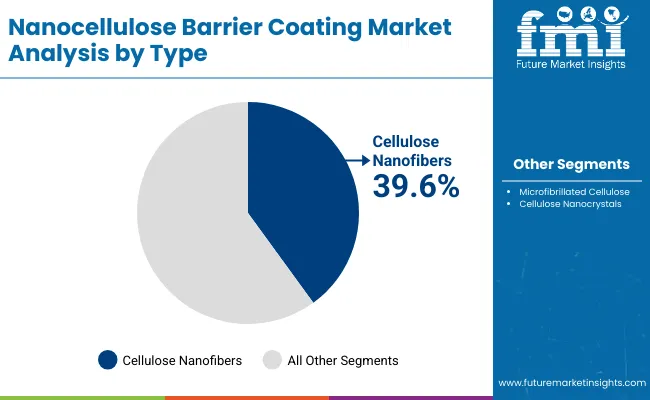

Cellulose nanofibers (CNF) are projected to account for 39.6% of the market in 2025, owing to their excellent barrier properties, mechanical strength, and renewable origin. CNF coatings provide low oxygen permeability, making them suitable for food, pharmaceutical, and electronics packaging applications. Their ability to form flexible, transparent films enhances adoption across industries.

Growing sustainability mandates reinforce CNF’s position as a viable replacement for petroleum-based coatings. Their compatibility with existing coating lines and recyclability ensures cost efficiency for packaging manufacturers. As demand for renewable, high-performance materials rises, CNF remains the leading nanocellulose type.

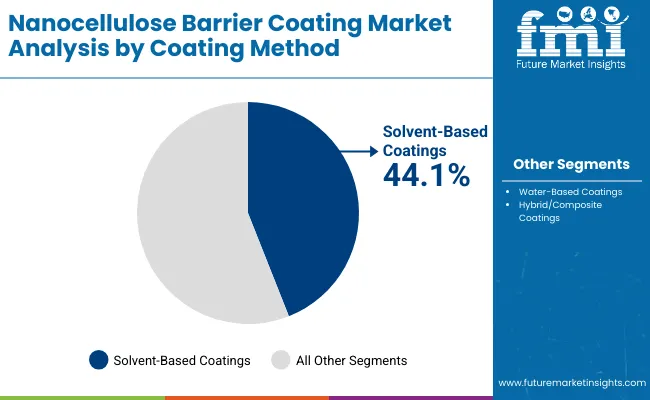

Solvent-based coatings are expected to capture 44.1% of the market in 2025, favored for their superior adhesion and resistance to moisture and grease. These coatings are widely used where barrier strength is critical, especially in pharmaceutical and high-value food packaging. Their ability to extend product shelf life ensures consistent demand.

Although environmental regulations challenge solvent-based systems, innovations in green solvents and reduced VOC formulations support ongoing use. Their role in applications requiring high barrier performance and durability secures their market dominance despite sustainability pressures.

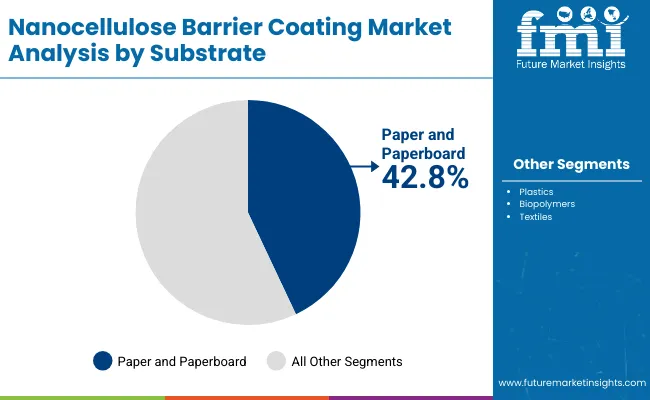

Paper and paperboard are forecast to represent 42.8% of the market in 2025, as they align with global shifts toward sustainable packaging. Nanocellulose coatings enhance the barrier properties of paper without compromising recyclability or compostability. This makes them an attractive alternative to plastic laminates.

Their adoption is accelerated by the food and beverage industry, where moisture and oxygen protection are vital. Paper substrates coated with nanocellulose meet both performance and environmental requirements. As consumer and regulatory focus on plastic reduction intensifies, paperboard with nanocellulose coatings dominates.

The food and beverages sector is expected to account for 37.9% of the market in 2025, reflecting its reliance on barrier coatings to preserve freshness and safety. Nanocellulose coatings provide natural, renewable protection while extending shelf life of perishable products.

Adoption is reinforced by the industry’s commitment to sustainability, replacing plastics with biodegradable solutions. Flexible packaging, cartons, and wraps benefit from nanocellulose’s functional performance. With rising consumption of packaged foods and beverages globally, this sector remains the core end-user for nanocellulose coatings.

The nanocellulose barrier coating market is expanding as industries seek sustainable, renewable alternatives to plastic-based coatings for packaging. Rising demand from food, pharmaceuticals, and personal care sectors is driving adoption due to nanocellulose’s excellent oxygen and grease resistance. However, high processing costs and scalability challenges restrain growth. Advances in hybrid coatings, biodegradable solutions, and automation integration are shaping the market’s development.

Sustainability, Performance, and Regulatory Compliance Driving Adoption

Nanocellulose coatings are increasingly applied to paper and board packaging to replace plastic films, aligning with global regulations restricting single-use plastics. Their superior oxygen barrier properties protect food products, extending shelf life while maintaining recyclability and compostability. Pharmaceutical and cosmetic brands are adopting these coatings for moisture resistance and clean-label appeal. As consumer awareness of eco-friendly packaging grows, nanocellulose coatings are becoming a critical enabler of sustainable packaging solutions across diverse industries.

High Costs, Production Complexity, and Scale Limitations Restraining Growth

Despite clear advantages, adoption is hindered by the high costs of nanocellulose production and coating application technologies. Energy-intensive processing and limited industrial-scale facilities add to operational expenses. Compatibility with high-speed coating lines and performance consistency under varying environmental conditions remain challenges. Additionally, the lack of standardized testing and certification frameworks for nanocellulose materials slows broader market acceptance. These barriers restrict uptake, particularly in cost-sensitive packaging segments.

Hybrid Coatings, Biodegradable Materials, and Smart Integration Trends Emerging

Key trends include the development of hybrid coatings combining nanocellulose with bio-based polymers or minerals to enhance moisture resistance and durability. Research is advancing on fully biodegradable nanocellulose formulations that strengthen circular economy practices. Integration with automated coating and printing systems is improving scalability and efficiency. Customizable performance levels tailored to specific end uses, such as frozen foods or medical packaging, are also gaining traction. These innovations position nanocellulose barrier coatings as next-generation solutions for sustainable, high-performance packaging applications.

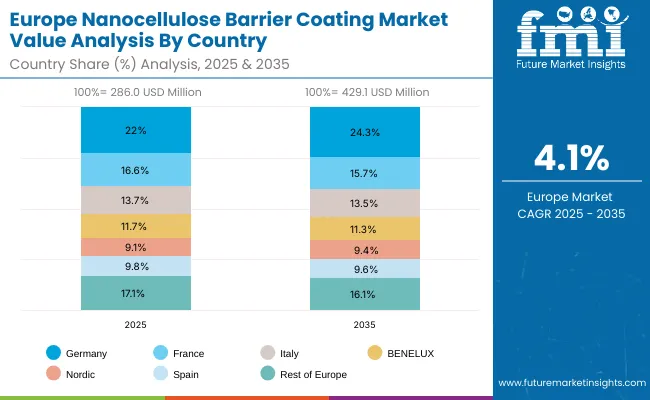

The global nanocellulose barrier coating market is witnessing rapid growth, fueled by demand for renewable, high-barrier packaging alternatives to plastics. Asia-Pacific is leading expansion, with China and India driving adoption through government-backed sustainability initiatives and growing FMCG sectors. Developed markets such as the USA, Germany, and Japan are focusing on precision-engineered coatings with recyclability and compostability features, enabling compliance with strict environmental regulations while meeting consumer demand for eco-friendly, high-performance packaging solutions across industries.

The USA market is projected to grow at a CAGR of 7.4% from 2025 to 2035, supported by demand in food, beverages, and healthcare packaging. Rising pressure to replace single-use plastics is driving adoption of nanocellulose coatings with superior oxygen and moisture barrier properties. Manufacturers are focusing on large-scale coating systems compatible with existing paper and board substrates. The push for recyclable and compostable solutions further strengthens the role of nanocellulose coatings in the USA packaging industry.

Germany’s market is expected to grow at a CAGR of 7.2%, driven by strict EU recycling mandates and strong demand in premium food and beverage packaging. German manufacturers are developing multilayer nanocellulose coatings that combine durability with sustainability. Advanced R&D initiatives are focusing on enhancing barrier efficiency while ensuring compostability. Adoption is reinforced by Germany’s leadership in green packaging innovation, making it a hub for recyclable barrier technologies in European industries.

The UK market is forecast to grow at a CAGR of 7.1%, supported by rising demand for recyclable packaging in FMCG, healthcare, and retail. Government regulations on packaging waste reduction are accelerating adoption of nanocellulose coatings as plastic alternatives. SMEs are investing in cost-efficient solutions to enhance compliance and sustainability. Local manufacturers are focusing on flexible, water-based coating systems compatible with multiple substrates, boosting adoption across diverse packaging applications.

China’s market is projected to grow at a CAGR of 7.9%, fueled by large-scale food processing, retail, and government-led green packaging mandates. Domestic producers are scaling affordable nanocellulose coating technologies for high-volume adoption. Strong demand is emerging in e-commerce, where sustainable packaging is becoming a competitive advantage. Export-focused companies are also investing in certified recyclable coatings to align with global standards, making China a leader in sustainable barrier packaging adoption.

India is forecast to grow at a CAGR of 7.8%, supported by FMCG growth, government bans on single-use plastics, and rising export packaging requirements. SMEs and startups are adopting nanocellulose coatings to meet global sustainability standards affordably. Strong demand is emerging from food and beverage exporters who require recyclable and compostable packaging. Local R&D initiatives and government support are driving innovation, making India a fast-growing hub for green packaging solutions.

Japan’s market is projected to grow at a CAGR of 7.0%, anchored by demand in electronics, healthcare, and premium food packaging. Manufacturers are developing high-performance coatings that combine barrier efficiency with sustainability. Compact, recyclable packaging solutions are gaining traction, reflecting Japan’s cultural focus on minimalism and eco-consciousness. Strong innovation pipelines in advanced nanomaterials ensure that Japan remains a key player in global sustainable packaging solutions.

South Korea’s market is expected to grow at a CAGR of 7.2%, supported by demand in cosmetics, food exports, and electronics. Export-driven industries are adopting nanocellulose coatings to meet sustainability regulations abroad. Local manufacturers are focusing on recyclable, lightweight coating systems to enhance product appeal. With K-beauty and K-food exports gaining momentum, nanocellulose coatings are becoming essential for ensuring eco-compliance and premium branding across South Korea’s growing packaging landscape.

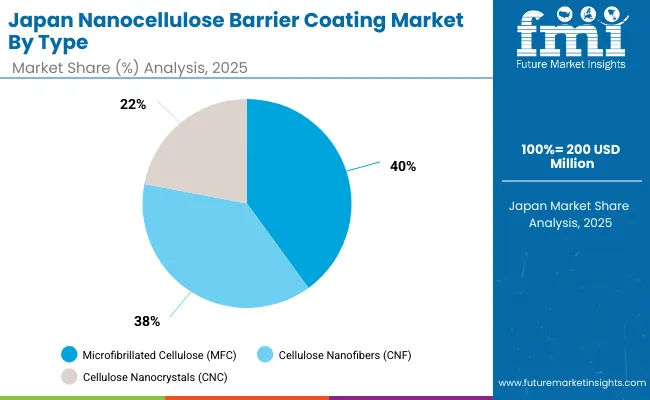

Japan’s nanocellulose barrier coating market, valued at USD 200 million in 2025, is led by microfibrillated cellulose (MFC), capturing 40.0% share due to its versatility in food and beverage packaging and excellent barrier properties. Cellulose nanofibers (CNF) follow with 38.0%, offering strong reinforcement and lightweight applications. Cellulose nanocrystals (CNC) hold 22.0%, serving specialized uses in electronics and biomedical packaging. MFC’s dominance reflects Japan’s packaging industry’s focus on durability and sustainability. CNF adoption grows with its strength-to-weight advantage, while CNC, though smaller, finds high-value niches. This material distribution reflects Japan’s balanced innovation in eco-friendly, high-performance barrier coatings.

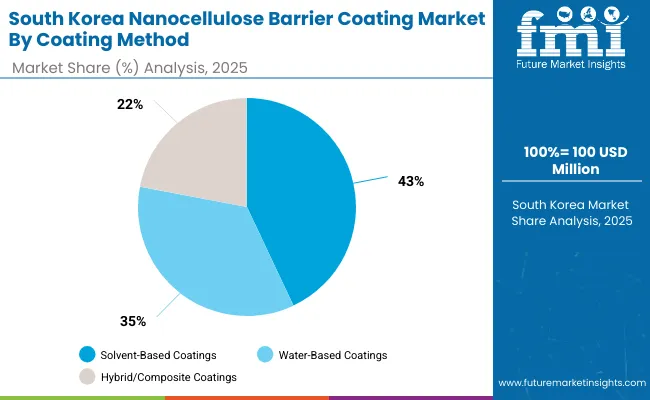

South Korea’s nanocellulose barrier coating market, valued at USD 100 million in 2025, is dominated by solvent-based coatings, which hold 42.6% share for their superior adhesion and performance in industrial applications. Water-based coatings follow at 35.5%, driven by sustainability demands and regulatory compliance in food packaging. Hybrid/composite coatings represent 21.9%, offering specialized properties for electronics and healthcare. Solvent-based coatings remain crucial for high-performance packaging, but the rapid growth of water-based alternatives highlights South Korea’s move toward eco-friendly solutions. Hybrid systems, though smaller, reflect the country’s focus on high-tech, specialized industries requiring tailored performance. This mix illustrates South Korea’s innovation-driven approach.

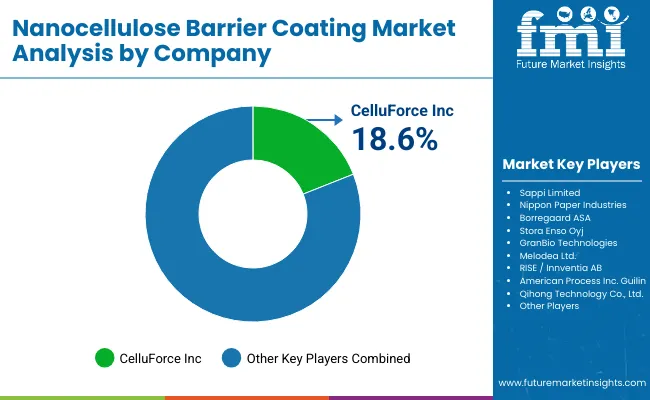

The nanocellulose barrier coating market is moderately fragmented, with pulp and paper leaders, bio-based material innovators, and regional technology developers competing across food packaging, pharmaceuticals, and specialty industrial applications. Global leaders such as CelluForce Inc., Sappi Limited, and Nippon Paper Industries hold notable market share, driven by renewable nanocellulose feedstock, superior barrier properties, and compliance with global food safety regulations. Their strategies increasingly emphasize plastic replacement, recyclability, and alignment with circular economy initiatives.

Established mid-sized players including Borregaard ASA, Stora Enso Oyj, and GranBio Technologies are supporting adoption of nanocellulose coatings featuring oxygen and grease resistance, printability, and compatibility with existing paperboard substrates. These companies are especially active in sustainable packaging and fiber-based alternatives, offering scalable pilot lines, industrial-grade coatings, and partnerships with consumer goods brands to reduce plastic dependency.

Specialized innovators such as Melodea Ltd., RISE/Innventia AB, American Process Inc., and Guilin Qihong Technology Co., Ltd. focus on customized nanocellulose coating solutions for regional and niche markets. Their strengths lie in R&D-driven breakthroughs, rapid prototyping, and integration with biodegradable substrates, enabling the development of next-generation coatings that deliver high-performance protection while ensuring environmental sustainability.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By Type | Microfibrillated Cellulose (MFC), Cellulose Nanofibers (CNF), Cellulose Nanocrystals (CNC) |

| By Coating Method | Water-Based Coatings, Solvent-Based Coatings, Hybrid/Composite Coatings |

| By Substrate | Paper and Paperboard, Plastics, Biopolymers, Textiles |

| By End-Use Industry | Food and Beverages, Pharmaceuticals and Healthcare, Cosmetics and Personal Care, Electronics, Industrial Goods |

| Key Companies Profiled | CelluForce Inc., Sappi Limited, Nippon Paper Industries, Borregaard ASA, Stora Enso Oyj, GranBio Technologies, Melodea Ltd., RISE / Innventia AB, American Process Inc., Guilin Qihong Technology Co., Ltd. |

| Additional Attributes | Increasing adoption of nanocellulose coatings as bio-based alternatives to plastics, growing demand for water-based coatings to support recyclability, strong uptake in food and pharmaceutical packaging to enhance barrier performance, rising applications in electronics and textiles for lightweight sustainable protection, and expanding R&D efforts by key players driving commercialization of hybrid and composite nanocellulose formulations. |

The global nanocellulose barrier coating market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the nanocellulose barrier coating market is projected to reach USD 2.4 billion by 2035.

The nanocellulose barrier coating market is expected to grow at a CAGR of 7.2% between 2025 and 2035.

The key coating methods in the nanocellulose barrier coating market include water-based coatings, solvent-based coatings, and hybrid/composite coatings.

The solvent-based coatings segment is projected to account for the highest share of 44.1% in the nanocellulose barrier coating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nanocellulose Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Nanocellulose Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Barrier System Market Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Barrier Shrink Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Market Share Insights for Barrier Shrink Bag Providers

Key Players & Market Share in the Barrier Coated Paper Industry

Competitive Landscape of Barrier Packaging Providers

Barrier Film Market Trends & Industry Growth Forecast 2025 to 2035

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Barrier Bags Market

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA