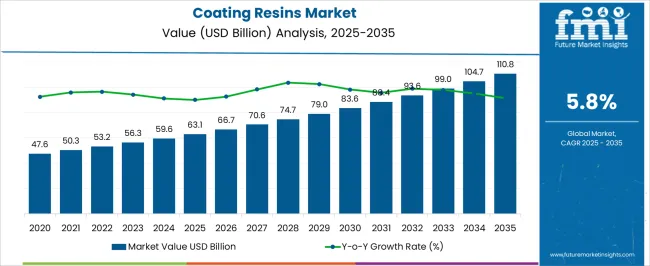

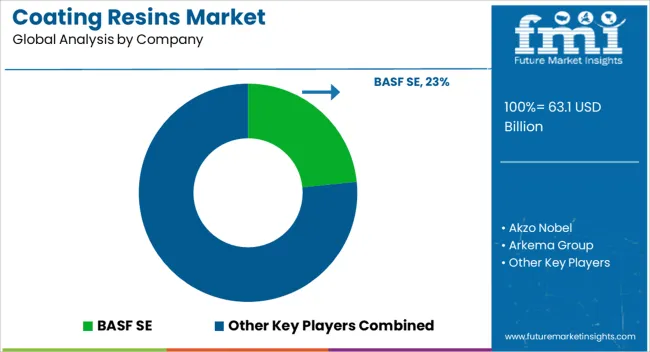

The global coating resins market is projected to reach USD 110.8 billion by 2035 from an estimated USD 63.1 billion in 2025, representing a CAGR of 5.8% over the forecast period. Market expansion is driven by increasing demand for high-performance coatings across construction, automotive, and industrial applications, where durability, chemical resistance, and aesthetic finishes are prioritized. Growth momentum is anticipated to be supported by rising adoption of waterborne and bio-based resins, which are favored for low-VOC and eco-friendly formulations.

Regional industrialization, infrastructure development, and expansion of automotive production hubs are expected to sustain consistent market growth. Product innovation remains a key driver, with suppliers focusing on advanced acrylics, epoxies, polyurethanes, and hybrid resin formulations that deliver superior adhesion, flexibility, and corrosion resistance. Evolving consumer preferences in decorative and protective coatings are also influencing the market trajectory, leading to increased investments in specialty resins for wood, metal, and plastic surfaces. The competitive environment encourages strategic partnerships, licensing agreements, and capacity expansions to meet rising demand.

Technological enhancements in resin synthesis and formulation efficiency are expected to improve cost-effectiveness and performance, further accelerating adoption. With steady growth anticipated across Asia-Pacific, North America, and Europe, the market is likely to witness diversified application uptake and incremental revenue gains, ensuring sustained momentum from 2025 through 2035.

| Metric | Value |

|---|---|

| Coating Resins Market Estimated Value in (2025 E) | USD 63.1 billion |

| Coating Resins Market Forecast Value in (2035 F) | USD 110.8 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The coating resins market is strongly influenced by five interconnected parent markets, each contributing differently to overall demand and growth. The architectural and decorative coatings market holds the largest share at 40%, driven by demand for durable, aesthetic, and weather-resistant finishes in residential, commercial, and industrial buildings. The automotive coatings segment contributes 25%, with increasing vehicle production and consumer preference for high-performance, corrosion-resistant, and visually appealing finishes fueling resin consumption.

Industrial coatings account for 15%, where protective and functional coatings are applied on machinery, equipment, and infrastructure to enhance longevity and operational efficiency. The packaging coatings market holds a 12% share, driven by the need for barrier properties, printability, and chemical resistance in metal, plastic, and paper-based packaging solutions. Finally, the specialty coatings and adhesives segment represents 8%, encompassing applications in electronics, wood, and other niche sectors requiring tailored resin formulations. Collectively, architectural, automotive, and industrial coatings account for 80% of overall resin demand, indicating that protection, performance, and aesthetics are the primary growth drivers, while packaging and specialty applications offer incremental opportunities.

The market share distribution emphasizes that resin innovation, such as development of waterborne, bio-based, and hybrid resins, and regional industrial growth significantly influence consumption patterns, supporting steady expansion of the coating resins market globally.

The coating resins market is experiencing robust growth driven by the rising demand for durable, high performance coatings across construction, automotive, and industrial applications. Increasing emphasis on environmental compliance and the adoption of low VOC formulations are reshaping manufacturing practices.

Technological advancements in resin chemistry have enabled enhanced adhesion, chemical resistance, and weatherability, broadening the application spectrum. Growth in infrastructure development, particularly in emerging economies, is creating sustained demand for architectural and protective coatings.

Additionally, the integration of bio based raw materials and the shift toward waterborne technologies are aligning with global sustainability goals. The market outlook remains positive as industries continue to prioritize performance, sustainability, and cost efficiency in their coating solutions.

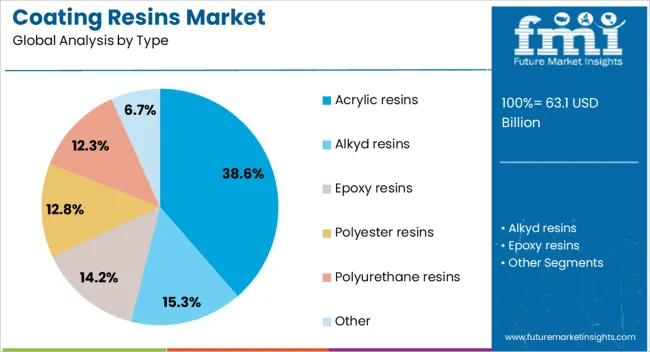

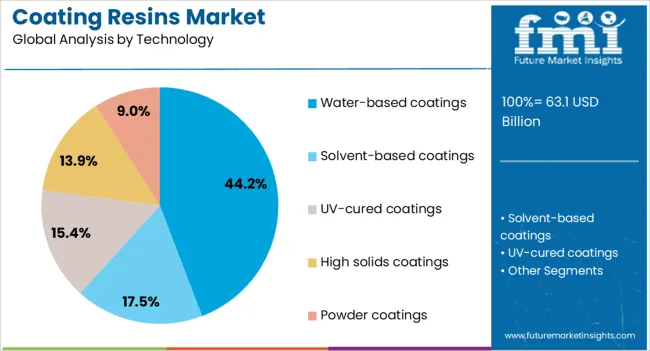

The coating resins market is segmented by type, technology, application, and geographic regions. By type, coating resins market is divided into Acrylic resins, Alkyd resins, Epoxy resins, Polyester resins, Polyurethane resins, and Other. In terms of technology, coating resins market is classified into Water-based coatings, Solvent-based coatings, UV-cured coatings, High solids coatings, and Powder coatings.

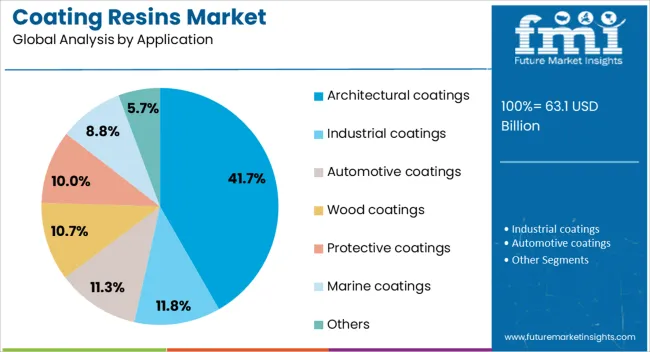

Based on application, coating resins market is segmented into Architectural coatings, Industrial coatings, Automotive coatings, Wood coatings, Protective coatings, Marine coatings, and Others. Regionally, the coating resins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic resins segment is projected to account for 38.60% of the total market revenue by 2025 within the type category, making it the leading segment. This growth is supported by the superior weather resistance, color retention, and versatility of acrylic resins, which make them suitable for a wide range of substrates and environmental conditions.

Their compatibility with various formulation technologies and ability to deliver both aesthetic and protective functions have strengthened their adoption in multiple industries.

Furthermore, their relatively low maintenance requirements and environmental compliance credentials have reinforced their market position.

The water based coatings segment is expected to hold 44.20% of the total market share by 2025 in the technology category, positioning it as the dominant segment. This is due to increasing regulatory pressure to reduce volatile organic compound emissions and growing consumer preference for environmentally friendly products.

Water based formulations offer low odor, easy cleanup, and improved worker safety, making them a preferred choice in residential, commercial, and industrial settings.

Advancements in formulation chemistry have addressed traditional performance gaps, allowing water based coatings to compete effectively with solvent based alternatives.

The architectural coatings segment is forecasted to represent 41.70% of total revenue by 2025 under the application category, making it the leading segment. Growth is being fueled by rising construction activities, renovation trends, and urbanization across both developed and developing regions.

Architectural coatings based on advanced resin systems offer long lasting protection, aesthetic enhancement, and resistance to harsh weather conditions.

Increasing focus on energy efficient and sustainable building materials has further encouraged the use of high performance coating solutions, solidifying the dominance of architectural coatings in the market.

Coating resins growth is led by architectural, automotive, and industrial applications. Product differentiation and regional adoption patterns are central to market expansion.

The architectural and decorative coatings segment drives substantial growth in the coating resins market, as residential and commercial construction projects require durable, aesthetic, and weather-resistant finishes. Waterborne resins are increasingly adopted to meet regulatory limits on emissions and provide improved application properties. Consumer preferences for long-lasting colors, scratch resistance, and chemical durability further encourage resin use. Regional expansion in Asia-Pacific and North America supports steady adoption of advanced resin formulations in paints, primers, and protective coatings. Demand is also shaped by renovation activities, government building codes, and eco-friendly finishing requirements. Growth in decorative coatings is expected to maintain steady momentum, representing the largest share of overall resin consumption globally.

The automotive coatings sector significantly contributes to resin consumption due to rising vehicle production, replacement, and aftermarket activities. Resin formulations in polyurethanes, acrylics, and epoxies are heavily applied for corrosion resistance, scratch protection, and high-gloss finishes. Consumer focus on aesthetics, durability, and low maintenance further stimulates market demand. Increasing production of electric and hybrid vehicles creates opportunities for lightweight and chemically resistant coatings. Regional production hubs in Europe, North America, and Asia-Pacific shape competitive adoption of high-performance resins. Additionally, automotive OEMs and body shops favor coatings that enhance efficiency, reduce application time, and maintain cost-effectiveness, ensuring automotive coatings remain a primary growth driver.

Industrial coatings continue to support resin demand in sectors like machinery, equipment, infrastructure, and pipelines where protective and functional finishes are required. The packaging coatings market is also expanding, driven by applications in metal, plastic, and paper packaging that require barrier properties, chemical resistance, and printability. Specialty resins for flexible, rigid, and multi-layer packaging improve product performance while maintaining cost efficiency. Growth is influenced by rising industrial output, packaging modernization, and demand for functional coatings in consumer goods, electronics, and metal fabrication. Together, industrial and packaging segments represent a considerable share of overall resin consumption, ensuring consistent revenue growth and market penetration across applications.

Resin manufacturers focus on developing tailored products for specific end uses, such as high-gloss decorative paints, anti-corrosive automotive coatings, and chemical-resistant industrial finishes. Product differentiation through hybrid formulations, waterborne options, and specialty resins enhances application efficiency, reduces environmental impact, and improves performance. Investment in R&D to optimize adhesion, flexibility, and durability supports adoption across decorative, automotive, industrial, and packaging coatings. Market expansion is also influenced by competitive strategies, including licensing agreements, mergers, and regional capacity expansions, allowing manufacturers to address diverse demand patterns globally. These factors collectively drive sustained market momentum from 2025 to 2035.

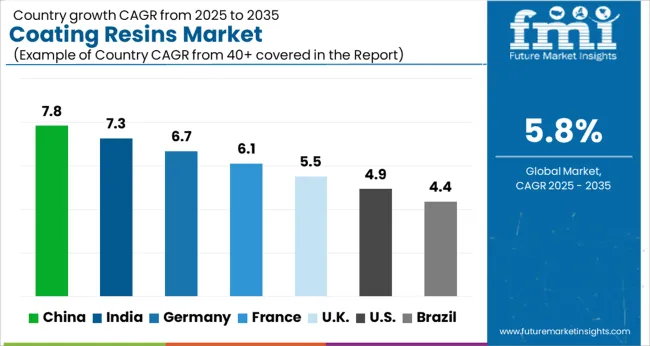

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

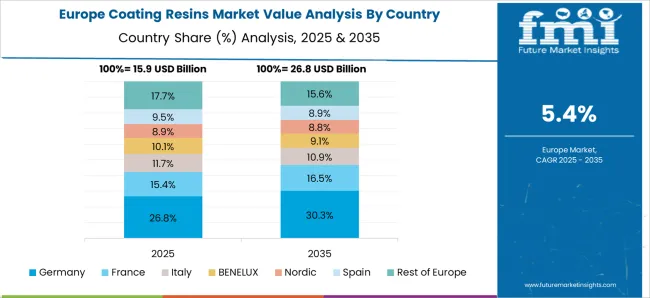

The global coating resins market is projected to grow at a CAGR of 5.8% from 2025 to 2035, led by China at 7.8% and India at 7.3%, both key emerging economies driving demand through industrial expansion, infrastructure development, and construction activities. France, the UK, and the USA, major OECD members, are expanding due to automotive production, industrial coatings, and packaging applications. Growth is fueled by waterborne, acrylic, epoxy, polyurethane, and hybrid resins tailored for decorative, protective, and specialty coatings. Strategic partnerships, capacity expansions, and regional manufacturing hubs enhance market penetration, while rising consumer and industrial demand continues to support adoption globally. The analysis includes over 40 countries, with the leading markets shown below.

The coating resins market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035, supported by rapid industrialization, expanding automotive manufacturing, and large-scale infrastructure projects. Rising demand for decorative, protective, and specialty coatings drives consumption of waterborne, acrylic, epoxy, and polyurethane resins. Domestic resin manufacturers are investing in capacity expansion and advanced formulations to meet industrial and consumer needs. Urban construction and renovation activities further stimulate the architectural coatings segment, while automotive OEMs increasingly adopt high-performance coatings for corrosion resistance and aesthetic finishes. Regulatory initiatives promoting low-VOC and environmentally friendly resins are also shaping market adoption.

The coating resins market in India is expected to grow at a CAGR of 7.3% between 2025 and 2035, fueled by infrastructure development, industrial modernization, and rising automotive production. Decorative coatings for residential and commercial construction increasingly drive resin consumption, while industrial coatings support machinery and equipment protection. Demand for waterborne, acrylic, epoxy, and polyurethane resins is growing due to performance, durability, and chemical resistance. Manufacturers are investing in production scale-up, R&D for hybrid resins, and collaborations with global suppliers. Expansion of retail and distribution networks ensures widespread availability of resins for industrial and decorative applications.

The coating resins market in France is projected to grow at a CAGR of 6.1% from 2025 to 2035, led by demand in automotive refinishing, industrial applications, and decorative coatings. Rising adoption of waterborne and low-VOC resins supports compliance with environmental regulations and provides performance advantages. The automotive industry’s focus on corrosion-resistant, aesthetic coatings fuels growth, while industrial coatings for machinery, equipment, and packaging contribute to overall market expansion. Domestic and international resin suppliers invest in specialty and hybrid formulations to meet diverse application needs. Increased construction activities and renovation projects further support decorative coatings uptake across the country.

The coating resins market in the UK is anticipated to grow at a CAGR of 5.5% from 2025 to 2035, driven by automotive production, industrial coatings, and building renovation activities. Decorative coatings for residential and commercial properties require high-performance resins such as acrylics, epoxies, and polyurethanes. Industrial sectors, including machinery, metal fabrication, and packaging, are expanding resin adoption for protective and functional finishes. Suppliers focus on waterborne and hybrid resin technologies to enhance performance, reduce emissions, and meet regulatory requirements. Strategic partnerships, capacity expansions, and adoption of specialty resins help manufacturers maintain a competitive edge.

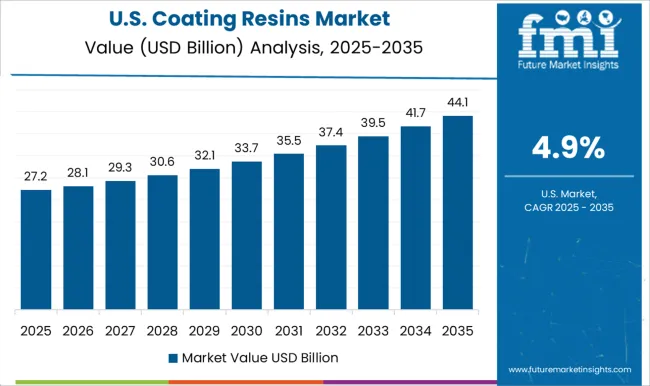

The coating resins market in the USA is projected to grow at a CAGR of 4.9% from 2025 to 2035, supported by automotive, industrial, and packaging applications. Decorative coatings for residential and commercial construction drive demand for acrylic and polyurethane resins, while industrial coatings for machinery, infrastructure, and packaging sustain steady growth. Suppliers are investing in hybrid and waterborne resin technologies to meet performance, environmental, and durability requirements. Regional manufacturing hubs, strategic alliances, and capacity expansions enhance supply and adoption. Increased refurbishment and renovation projects, coupled with industrial expansion, contribute to long-term market stability.

Competition in the coating resins market is defined by product performance, formulation versatility, and regulatory compliance. BASF SE leads with a wide portfolio of acrylics, polyurethanes, epoxies, and specialty resins, emphasizing high-quality formulations, global supply, and adherence to environmental and performance standards. Akzo Nobel focuses on advanced waterborne, solventborne, and powder resins for decorative, industrial, and protective coatings, leveraging strong R&D capabilities and application expertise. Arkema Group competes through high-performance specialty resins and hybrid formulations tailored for automotive, industrial, and construction coatings, emphasizing chemical resistance and long-term durability. Axalta Coating Systems differentiates with resin solutions optimized for automotive OEMs and refinishing markets, combining corrosion protection, aesthetic appeal, and regulatory compliance. PPG Industries maintains a competitive edge with diversified resin technologies for architectural, industrial, and protective coatings, emphasizing high-performance, waterborne solutions, and global distribution. RPM International provides specialty coatings and resins with a focus on construction, industrial maintenance, and packaging applications, leveraging niche formulations and service programs. The Sherwin-Williams Company competes through integrated resin and coating systems, emphasizing decorative, protective, and industrial applications with extensive technical support, customization, and co-development with applicators and manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 63.1 Billion |

| Type | Acrylic resins, Alkyd resins, Epoxy resins, Polyester resins, Polyurethane resins, and Other |

| Technology | Water-based coatings, Solvent-based coatings, UV-cured coatings, High solids coatings, and Powder coatings |

| Application | Architectural coatings, Industrial coatings, Automotive coatings, Wood coatings, Protective coatings, Marine coatings, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Akzo Nobel, Arkema Group, Axalta Coating Systems, PPG Industries, RPM International, and The Sherwin-Williams Company |

| Additional Attributes | Dollar sales by resin type (acrylic, epoxy, polyurethane, hybrid), share by end-use segment (architectural, automotive, industrial, packaging), regional demand patterns, growth in waterborne and low-VOC resins, competitive pricing, product innovation, regulatory compliance trends. |

The global coating resins market is estimated to be valued at USD 63.1 billion in 2025.

The market size for the coating resins market is projected to reach USD 110.8 billion by 2035.

The coating resins market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in coating resins market are acrylic resins, alkyd resins, epoxy resins, polyester resins, polyurethane resins and other.

In terms of technology, water-based coatings segment to command 44.2% share in the coating resins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Resins Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA