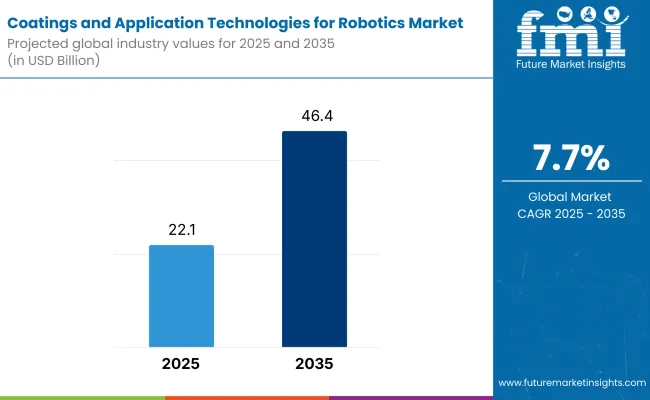

The coatings and application technologies for the robotics market are projected to grow from an estimated value of USD 22.1 billion in 2025 to approximately USD 46.4 billion by 2035 at a CAGR of 7.7% during the forecast period. This upward growth trend can be explained largely by rising spending on automation and the application of robots by the motor vehicles, production, and electrical equipment industries.

One of the key drivers for the industry is the rising demand for high-performance coatings that offer enhanced durability, corrosion resistance, and improved operating reliability in robotic systems exposed to harsh environments.

The industry trend is being reinforced by advancements in surface engineering, including nano coatings, thermal spray coatings, and UV-cured technologies, which enable robotics to be more resilient and efficient for mission-critical applications. In addition to increasing functionality, these technologies also support sustainability by reducing maintenance intervals and power consumption.

Industries are thus increasingly employing coatings to optimize the lifespan of robotic systems. Furthermore, the integration of smart coatings with self-healing, conductivity modulation, or adaptive response to stimuli is opening a new frontier in robotic technology. These next-generation materials offer enhanced sensory and protective functions, which are in proportion to the growing need for intelligent automation systems in industrial and service robots.

Geographically, the Asia-Pacific and North American regions are expected to remain the leading industries, driven by the aggressive deployment of industrial robots and strong R&D expenditures. Europe, as it is being developed, is experiencing renewed momentum in applications such as collaborative robots and clean energy generation, which further boost demand for advanced coatings.

The industry will also be boosted by the creation of regulatory standards and sustainability goals, which are prompting coating manufacturers to produce coatings with reduced volatile organic compounds (VOCs) and environmentally friendly application technologies. This trend will drive the adoption of powder coatings and waterborne systems, particularly in industries with stringent environmental regulations.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 22.1 billion |

| Industry Value (2035F) | USD 46.4 billion |

| CAGR (2025 to 2035) | 7.7% |

| Key Purchasing Metrics Across End-Use Segments | Demand Growth |

|---|---|

| Consumer Electronics | High |

| Industrial Monitoring | Very High |

| Healthcare & Disinfection | High |

| Environmental Monitoring | Very High |

| Key Purchasing Metrics Across End-Use Segments | Accuracy & Sensitivity |

|---|---|

| Consumer Electronics | High |

| Industrial Monitoring | Very High |

| Healthcare & Disinfection | Very High |

| Environmental Monitoring | High |

| Key Purchasing Metrics Across End-Use Segments | Cost Sensitivity |

|---|---|

| Consumer Electronics | Medium |

| Industrial Monitoring | High |

| Healthcare & Disinfection | Medium |

| Environmental Monitoring | High |

| Key Purchasing Metrics Across End-Use Segments | Integration with IoT |

|---|---|

| Consumer Electronics | Very High |

| Industrial Monitoring | High |

| Healthcare & Disinfection | Medium |

| Environmental Monitoring | High |

| Key Purchasing Metrics Across End-Use Segments | Regulatory Compliance |

|---|---|

| Consumer Electronics | Medium |

| Industrial Monitoring | Very High |

| Healthcare & Disinfection | Very High |

| Environmental Monitoring | High |

The continued miniaturization of consumer electronics, coupled with the need for the surfaces of robotic assembly lines to withstand the rigors of the manufacturing process, will support high demand for coatings and application technologies in consumer electronics. They focus heavily on integration with IoT and place a moderate emphasis on regulatory compliance and cost sensitivity.

Industrial monitoring, on the other hand, has extremely high demand and puts significantly higher pressure on accuracy, compliance, and cost-effectiveness. These environments especially require coatings that offer high thermal tolerance, high chemical resistance, and extended operational integrity.

For healthcare and environmental monitoring segments, hygienic coatings and contamination-resistant surfaces are pursued at a higher pace. These sectors need high sensitivity, strong regulatory adherence and medium cost management. Challenge: Antimicrobial and Biocompatible Coatings The post-pandemic rise of Disinfection Robotics compounds the demand for antimicrobial and biocompatible coatings.

Between 2020 and 2024, the industry picked up momentum because of rising automation in automotive, electronics, and industrial industries. Robotics improved the accuracy and efficiency of coating applications like anti-corrosive, heat-resistant, and low-friction coatings.

Initial breakthroughs involved spray automation and electrostatic coating technologies that minimized human exposure and waste. Yet, high upfront costs, shortage of skilled personnel, and low flexibility to different substrates were still challenges.

Between 2025 and 2035, the industry will make a revolutionary leap with the inclusion of AI-powered robotics, adaptive spray systems, and 3D vision-based precision controls. Robot arms will autonomously adapt their coating techniques in real-time based on material, environment, and performance criteria.

Smart sensors and IoT-backed feedback loops will give a minimum of overspray, environmental impact, and consistent thickness on complex shapes. Self-healing, antimicrobial, or energy-efficient green coatings will be the drivers for innovation.

Furthermore, digital twins and predictive analytics will enable manufacturers to simulate, adjust, and deploy optimized coating strategies before physical execution. This new trend of autonomous, intelligent, and sustainable coating ecosystems will redefine the aerospace, automotive, and renewable energy manufacturing sectors.

Comparative Table 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The demand for consistency, labor reduction, and safety in hazardous environments was the main driver for growth. | The demand for smart, sustainable, and autonomous coating systems across sectors will drive the industry . |

| Robotic spray equipment and simple automation platforms were standard. | Adaptive control, 3D vision, and real-time optimization robots driven by AI will be the norm. |

| Coating consistency was enhanced by robotics, but systems were not adaptive. | Predictive AI and real-time sensor feedback will offer precise coating of dynamic surfaces with zero waste. |

| Base anti-rust, heat-resistant, and cosmetic coatings were supported. | The future systems will enable advanced materials such as nanocoatings , bio-paints, and self-healing coatings. |

| Robotics ran in autonomous mode with minimal integration into extended production lines. | Coating robots will be completely integrated with MES, PLM, and digital twin platforms for end-to-end process optimization. |

| Waste reduction and emissions control were priorities but not yet implemented. | Low-VOC sustainable coatings and circular application systems will be regulatory and consumer-driven norms. |

| Limited part or material geometry-based customization was achievable. | AI systems will automatically adjust coating patterns and compositions to individual parts, textures, and climates. |

| Setup, monitoring, and regular adjustments required operators. | Human intervention will be minimal, confined to high-level supervision and exception handling. |

| Data gathered in the field was seldom utilized beyond reporting via QC. | IoT and analytics will enable constant learning, performance benchmarking, and remote diagnostics. |

| Automotive and heavy machinery industry led the adoption and followed by continued adoption in other industries. | Aerospace, medical devices, electronics, and renewable technology will take up smart robotic coating solutions at a quick pace. |

The industry has a number of risks that are likely to impact its growth trend during 2025 to 2035. The most significant challenge is the complicated and frequently shifting regulatory environment regarding the application of coatings in robotics processes in industries like healthcare and environmental monitoring.

These kinds of regulations can differ significantly by geography, leading to compliance challenges for international manufacturers. In addition, strict environmental and safety regulations may impose cost pressures on manufacturers to restrict adoption in cost-sensitive industries.

The other major threat is the price volatility of raw materials, especially specialty chemicals and high-performance composite materials for robotic coatings. Price volatility generates supply chain disruption and margins for profit, especially for small firms that lack strong bargaining capacity in procurement.

Furthermore, reliance on limited numbers of high-performance coating suppliers increases the risk of supply chain disruption, which was particularly evident during periods of global crises like the COVID-19 pandemic.

Finally, accelerated technological developments in robot manufacturing and surface engineering might make current coating technologies redundant. Firms that do not invest in continuous R&D might not be able to keep up with emerging requirements like ultra-thin film coatings, nanotechnology-enabled solutions, or multi-functional coatings that combine durability with antimicrobial or conductive properties. This innovation pressure prevents entry and only allows those firms with good technical prowess and agile business models to survive.

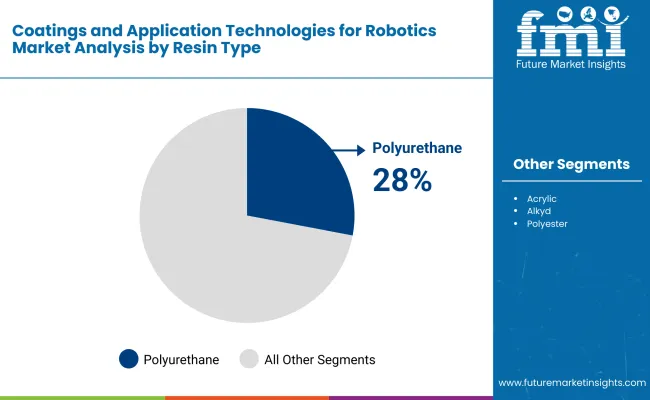

It is expected that polyurethane resins will occupy the largest industry share of 28%. Due to its excellent abrasion resistance and flexibility, accompanied by durability, polyurethane coating finds widespread application in protecting robotic components in some of the harshest environments, such as manufacturing, automotive, and logistics.

These coatings prolong the life of robotic arms, sensors, and grippers that are subjected to corrosive chemicals and mechanical stress, or varying temperatures. Companies such as AkzoNobel and Sherwin-Williams provide leading polyurethane coatings designed specifically for automated spray systems and robotic application tools that ensure consistent coverage and finish quality.

Their quick-drying nature and superior wear resistance make them any industrial environment where the performance and uptime of the robots are paramount. Approximate epoxy resins command about a 25% share in the industry, owing to their outstanding chemical resistance, adhesion, and rigidity.

In these areas, coatings are applied to the robotic components wherever there is a need for control over such parameters and protection against solvent or corrosive environments, like electronics, aerospace, and heavy machinery.

PPG Industries and Hempel are other critical players supplying epoxy formulations that are specifically tailored for precise robotic applications with uniform film thickness and coating stability assurance for the entire period of use. Furthermore, epoxy characteristics make it suitable for the coating of sensitive robotic electronics and circuit boards, as it behaves like an electrical insulator.

With advancing technology, robotic systems are gaining utmost accuracy and are penetrating highly demanding industrial sectors, thus propelling the demand for corrosion-resistant coatings such as polyurethane and epoxy. The selection of resin is becoming more application-oriented, along with easy automation and environmental compliance standards.

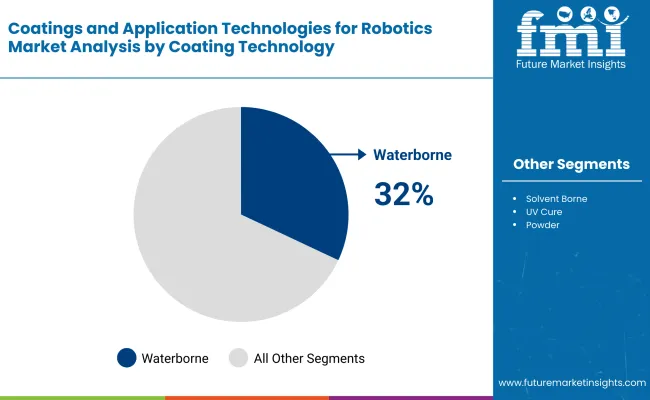

Coating technology plays a key role in influencing performance and efficiency, while promoting compliance with environmental legislation in the 2025 global robotics coatings and application technology sector. Among the various types of coating technologies, waterborne coatings and solvent-borne coatings are the most prevalent, accounting for 32% and 28% of the industry's global share, respectively.

The increasing number of waterborne coatings is due to the low VOC levels they provide and their compliance with the stricter environmental regulations existing nowadays. They only account for about 32% of the industry, and due to their nontoxic nature, they are used in health-oriented applications and consumer products such as electronics, medical, and robots.

AkzoNobel and Sherwin-Williams have developed advanced waterborne formulations specifically designed for robotic applicators, ensuring a high-quality finish while minimizing environmental impact. Their primacy in applications where uniform coverage and minimum emissions are paramount, trade practices adopted in automotive and appliance manufacturing provided an added impetus to their acceptability.

Solvent-borne paints still hold a respectable industry share of 28% as their characteristics offer durability, fast curing time, and the ability to withstand harsh environments. Such coatings are extremely critical for high-end applications, particularly in aerospace robotics, marine equipment, and industrial machinery coatings.

The solvent-borne coatings from BASF and PPG Industries are highly effective in various chemical and weather-resistant applications, including situations where robotic parts are subjected to extreme mechanical stress or are exposed to harsh environments. Additionally, some coatings offer a very smooth surface with good adhesion, even on complex surfaces, for robotic applications that require higher precision.

As automated systems are increasingly introduced across various sectors, both waterborne and solvent-borne technologies are being optimized for compatibility with robotic systems. Expect to see a surge in investment into hybrid technologies and smart coatings that combine performance with sustainability, a trend driven by industry leaders committed to innovation and compliance.

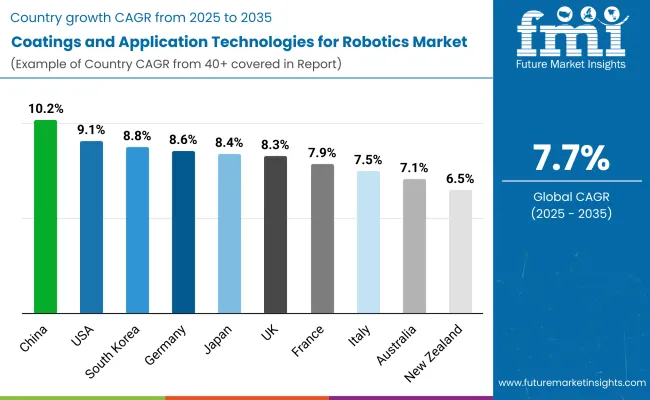

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.1% |

| UK | 8.3% |

| France | 7.9% |

| Germany | 8.6% |

| Italy | 7.5% |

| South Korea | 8.8% |

| Japan | 8.4% |

| China | 10.2% |

| Australia | 7.1% |

| New Zealand | 6.5% |

The US industry is expected to experience high growth due to a robust manufacturing base and increasing automation adoption in the automotive, aerospace, and defense sectors. Advanced coating materials with properties that resist abrasion, corrosion, and high temperatures are a priority when robotic systems are used in applications with longer operating cycles and demanding conditions.

Increased capital infusion from industry participants and government policies in R&D functions is also driving higher innovation within surface treatment technologies. Companies like PPG Industries, Axalta Coating Systems, and RPM International are undertaking portfolio diversification to serve cthe ollaborative robot and industrial robot industries.

The USA has a strategic orientation towards performance efficiency and sustainability, which has increased the demand for environmentally friendly coatings and low-VOC coatings, among others. Strategic partnerships between manufacturers of coatings and original robotics equipment manufacturers are simplifying the process by incorporating the latest application technology to match specific operating requirements.

The UK is experiencing steady growth in the industry, driven by significant advancements in manufacturing automation and digitalization. The take up of robotics in logistics, electronics, and food processing industries has spurred growth for niche coatings with enhanced chemical resistance, surface finish, and cleanliness.

This has led to the adoption of plasma and thermal spray technologies in metal and non-metallic substrates. Key industry players like HMG Paints and AkzoNobel are investing more in robotics-compatible coating solutions with intelligent curing properties.

Waterborne and powder coating technology, as per environmental regulatory compliance standards, is gaining momentum. Academic-industry collaborations in the UKindustry facilitate the adoption of robotics coatings that enhance uptime and lower maintenance costs.

In France, the industry is changing with an overwhelming focus on automation in the electronics, automotive, and pharmaceutical industries. Growth is driven by growing awareness of operation benefits from protective coatings in robotic efficiency and lifespan improvement.

Thermal barrier and anti-friction coatings demand rise with the need for high-precision performance in varying operating conditions. Massive French and worldwide coating providers are expanding local visibility to address the need for robotic-specific coatings.

Enterprises like Arkema and Mäder Group are investing in research to create responsive coating systems in line with smart robotics. Industry trends show a shift towards digitally controlled application procedures to address coating evenness, which will drive high-volume production levels.

Germany is a growing market in the European industry, with support from a very advanced industrial base and robotics integration leadership. Having automation centers globally recognized has created a demand for high-durability coatings that are anti-static, anti-microbial, and impact-resistant.

Automotive assembly lines and precision machinery production on a large scale have been the drivers of industry growth. These include companies like BASF and Beckers Group, which are launching modular coating systems for robot outer surfaces and inner parts.

Process automation of the coating process itself is underway, which improves precision and minimizes downtime. Enforceability focuses on environmental sustainability, prompting bio-based and solvent-free coating technologies that are in harmony with robot systems.

Italy's industry is growing at a steady pace due to advancements in industrial robotics in metal processing, ceramics, and packaging sectors. Applications for thermal insulation, abrasion-resistant, and low-friction coatings are significantly on the rise. These functional attributes are of prime importance in applications where robotic movement involves high speed and repetition.

Local companies are also joining forces with European coating technology providers to enhance process efficiency and product performance. Innovation focuses on hybrid coating technologies, which combine the integration of UV-curable systems and nanomaterials to give improved durability. The expansion of robot-integrated coating cells is improving productivity at high-mix, low-volume production levels across the country.

South Korea has a high level of expertise in coatings and robotics application technologies backed by electronics, semiconductors, and leadership in smart manufacturing. Ultra-thin high dielectric strength coatings with anti-contamination features are increasingly in demand, especially for application in cleanroom and precision assembly processes.

Demand for evenly coating deposition on complex robotic geometries has encouraged the use of sophisticated atomization and electrostatic spray methods. Industry leaders like KCC Corporation and Samhwa Paints are driving the development of specialty coatings for flexible and miniaturized robot systems.

AI-based application processes are improving accuracy and precision in coating processes, leading to quality uniformity and operational efficiency. Emphasis on high-performance materials is likely to continue to fuel growth during the forecast period.

Japan continues to be a leading provider inthe industry, with continued industrial automation and process improvement. The country's emphasis on robotics to address aging population issues and disaster recovery has generated a demand for coatings that address biocompatibility, anti-bacterial functionality, and durability for exposure in harsh environments.

Lightweight yet robust coatings are being engineered to enhance the duty cycle of service robots. Kansai Paint and Nippon Paint Holdings are in charge of R&D expenditures, creating self-healing and anti-fouling coatings.

Technology on coatings for robotic arms that minimize particulate generation grows in stature as a major concern for semiconductor and pharma production. Material science and robotics design junction remains the Japanese industry road.

China dominates the industry in CAGR, spurred by a boom in industrialization, smart factory programs, and large-scale robot deployment in various industries. The domestic emphasis on high-tech manufacturing has created a demand for high-performance coatings with chemical resistance, UV blocking, and thermal stability.

Demand is particularly strongly felt in industries like automotive, shipping, and heavy equipment. Chinese companies such as Carpoly and Yatu Paint are increasing their products in smart coating systems and robotics coating automation systems.

Cross-border tech partnerships and government strategic support are creating a conducive ecosystem to drive innovation. Strong and resilient coating systems for robot application are most likely to be the dominant driver of sustainable growth up to 2035.

Australia's industry is experiencing moderate growth, with rising applications of robotics in mining, farm, and building industries leading to demand for ruggedized coats. Requirements in coats are focused on abrasion and corrosion resistance along with heat control when the operations are in distant or harsh environments.

The industry is witnessing a step-by-step transition towards conventional techniques from automated application technology through robotics. Firms like DuluxGroup are spending money on formulations that are suitable for autonomous systems and mechanical arms.

Low environmental footprint and energy-efficient coating technologies are driving purchasing decisions. While relatively low volume, solution innovations for targeted applications are expected to build long-term industry attractiveness.

New Zealand's industry is still in the early stages of adoption, with prospecting opportunities growing in areas like logistics, food processing, and bio-manufacturing. The demand hub for protective and sanitary coating enhances cleanability and the ability to withstand chemical attacks.

With growing rates of automation applications, uses of standardized coatings, low-maintenance and appropriate for light-use robotics are more on the agenda. Local and domestic manufacturers are concentrating on providing coatings that meet high environmental standards and provide consistent performance on semi-automatic production lines.

Spray-on coating innovation for corrosion protection and energy-saving purposes is gaining popularity. Further growth in the use of robotics is likely to drive the industry size incrementally over the forecast period.

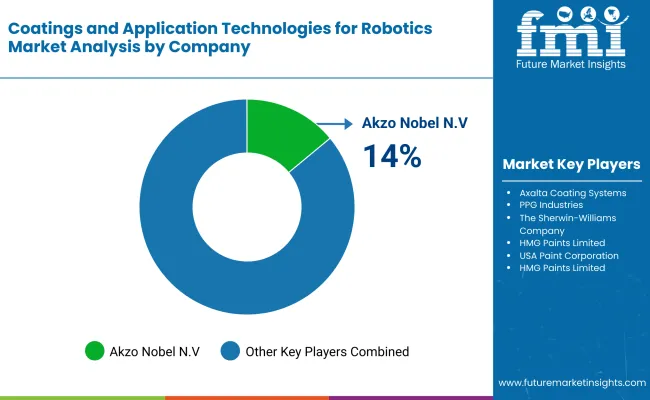

The industryhas been dominated by some key global players such as Akzo Nobel N.V., Axalta Coating Systems, PPG Industries, and Sherwin-Williams Co., which are all producers of high-performance coatings used throughout industrial, automotive, and commercial robotics.

These companies have access to the most advanced formulations-including anti-corrosion, anti-static, and wear-resistant coatings, to further the durability and operational efficiency of the robot. They hold a competitive advantage by innovating in materials, having proprietary chemical formulations as well as having strong partnerships with robotic manufacturers.

The transformation of the industry is now leaning towards functional coatings, which include self-healing coatings, conductive coatings for sensor integration, and antimicrobial coatings relevant to healthcare robotics.

The partners, such as HMG Paints Limited and Lubrizol, are expanding the development of smart coatings that improve energy effectiveness and operational longevity in automated systems. On the other hand, the industry is being reshaped by investments in AI-based spray application techniques and nano-coating technologies.

The competitive landscape is defined by strategic expansions and collaborations, with companies investing in new production facilities and R&D centers. PPG Industries as well as Sherwin-Williams have expanded their automated coating application divisions, while Nippon Paint Holdings focused its efforts on developing custom coatings for cobots (collaborative robots). The M&A landscape also plays a role in competition, with the top players acquiring specialty coating manufacturers to enhance their product list.

On the other hand, smaller and niche players such as Yashm Paint & Resin Industries and Bernardo Ecenarro SA are focusing largely on custom coatings for specific robotic applications, such as high-temperature-resistant coatings for manufacture and hydrophobic coatings for autonomous drones. Startups, as well as regional players, are gaining traction by challenging traditional solvent-based coatings with eco-friendly waterborne coatings that comply with stricter environmental regulations.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Akzo Nobel N.V. | 14-18% |

| Axalta Coating Systems | 12-16% |

| PPG Industries | 11-15% |

| The Sherwin-Williams Company | 9-13% |

| HMG Paints Limited | 6-10% |

| Others (Combined) | 39-50% |

| Company Name | Offerings and Activities |

|---|---|

| Akzo Nobel N.V. | High-performance coatings with advanced anti-corrosion and anti-static properties for robotic applications. |

| Axalta Coating Systems | Smart coatings with AI-driven application systems for industrial and automotive robotics. |

| PPG Industries | Functional coatings, including self-healing and nano -coatings for high-precision robotic arms. |

| The Sherwin-Williams Company | Eco-friendly, waterborne coatings and UV-resistant solutions for industrial automation. |

| HMG Paints Limited | Custom coatings with hydrophobic and heat-resistant properties for specialized robotic use cases. |

Key Company Insights

Akzo Nobel N.V. (14-18%)

Anindustry leader in industrial coatings, Akzo Nobel, integrates nano-coating technology and self-healing formulations to enhance robotic durability and efficiency in automated manufacturing.

Axalta Coating Systems (12-16%)

Axalta invests in AI-driven application technologies and UV-curable coatings, ensuring fast-drying, high-durability solutions for robotic automation in the automotive and electronics sectors.

PPG Industries (11-15%)

PPG pioneers are conductive and antimicrobial coatings, enabling robots to function in clean and sensitive environments and enhancing their industry appeal in medical robotics.

The Sherwin-Williams Company (9-13%)

Sherwin-Williams focuses on sustainable coatings and developing VOC-free and waterborne solutions to meet environmental regulations while ensuring high performance in robotic applications.

HMG Paints Limited (6-10%)

HMG Paints specializes in custom, heat-resistant, and hydrophobic coatings, catering to harsh industrial environments where robots require extreme protection.

By resin type, the industry is segmented into polyurethane, acrylic, alkyd, polyester, and epoxy.

By coating technology, the industry is segmented into solvent borne, water borne, UV cure, and powder.

By coating layer, the industry is segmented into primer, base coat, topcoat, and clear coat.

By end use industry, the industry is segmented into healthcare, agriculture, mining, manufacturing, and construction.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The industry is estimated to be USD 22.1 billion in 2025.

By 2035, the industry is projected to reach approximately USD 46.4 billion.

China is expected to witness a 10.2% CAGR, fueled by rapid industrialization, a booming robotics sector, and large-scale investments in smart manufacturing.

Polyurethane coatings dominate the industry due to their excellent flexibility, abrasion resistance, and protective properties ideal for robotic applications.

Key players include Akzo Nobel N.V., Axalta Coating Systems, PPG Industries, The Sherwin-Williams Company, HMG Paints Limited, The Lubrizol Corporation, Yashm Paint & Resin Industries, USA Paint Corporation, Kansai Paint Co. Ltd., Bernardo Ecenarro SA, Nippon Paint Holdings Co., Ltd., Sheboygan Paint Company, Beckers Group, Alps Coating Sdn. Bhd, NOROO Paint & Coatings Co., Ltd., WEG SA, Reichhold LLC, and Tikkurila.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Resin Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Resin Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Coating Technology, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Coating Technology, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Coating Layer, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Coating Layer, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by End Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 26: Global Market Attractiveness by Resin Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Coating Technology, 2023 to 2033

Figure 28: Global Market Attractiveness by Coating Layer, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 56: North America Market Attractiveness by Resin Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Coating Technology, 2023 to 2033

Figure 58: North America Market Attractiveness by Coating Layer, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Resin Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Coating Technology, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Coating Layer, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Resin Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Coating Technology, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Coating Layer, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Resin Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Coating Technology, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Coating Layer, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Resin Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Coating Technology, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Coating Layer, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End Use Industry, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Resin Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Coating Technology, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Coating Layer, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End Use Industry, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Resin Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Coating Technology, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Coating Layer, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Resin Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Resin Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Resin Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Resin Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Coating Technology, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Coating Technology, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Coating Technology, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Coating Technology, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Coating Layer, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Coating Layer, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Coating Layer, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Coating Layer, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by End Use Industry, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Resin Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Coating Technology, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Coating Layer, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End Use Industry, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Application Crowdtesting Service Market Size and Share Forecast Outlook 2025 to 2035

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Controllers Market Size and Share Forecast Outlook 2025 to 2035

Application Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Application Specific Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Application Processor Market Size and Share Forecast Outlook 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Application Delivery Network Market by Product, End-user, Environment, Deployment Type, Vertical, and Region, Forecast through 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Application Control Software Market Insights – Growth & Forecast 2025-2035

Application Metrics and Monitoring Tools Market Analysis By Component, Mode, Deployment, Verticals, and Region through 2035

Robotics Sweeper Market

Application Centric Infrastructure Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA