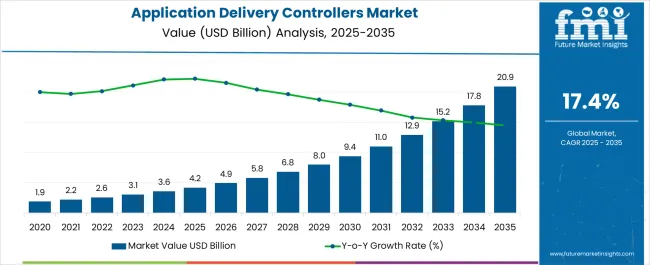

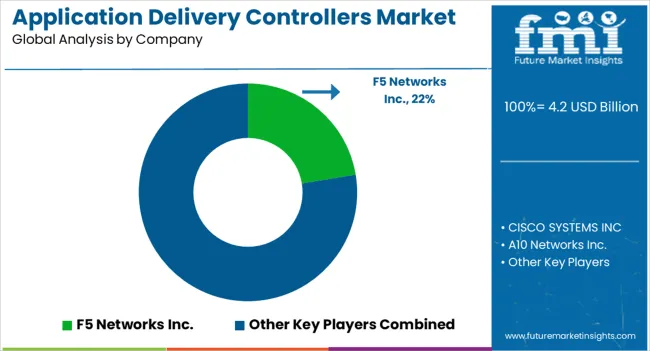

The Application Delivery Controllers Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 20.9 billion by 2035, registering a compound annual growth rate (CAGR) of 17.4% over the forecast period.

| Metric | Value |

|---|---|

| Application Delivery Controllers Market Estimated Value in (2025 E) | USD 4.2 billion |

| Application Delivery Controllers Market Forecast Value in (2035 F) | USD 20.9 billion |

| Forecast CAGR (2025 to 2035) | 17.4% |

The application delivery controllers market is experiencing robust momentum driven by the increasing adoption of cloud-based services, rising internet traffic, and the critical need for secure and optimized application performance. Organizations are focusing on scalable solutions that support digital transformation and hybrid IT environments.

The demand for intelligent traffic management, load balancing, and advanced security functionalities such as web application firewalls is fueling growth. Additionally, the shift toward microservices, containerized applications, and API-driven architectures is reinforcing the role of application delivery controllers in ensuring agility and resilience.

Regulatory compliance requirements across industries such as banking, financial services, and healthcare are also prompting enterprises to invest in application delivery solutions that provide data protection and performance optimization. The market outlook remains strong as enterprises prioritize efficiency, security, and cost-effective digital infrastructure enhancements.

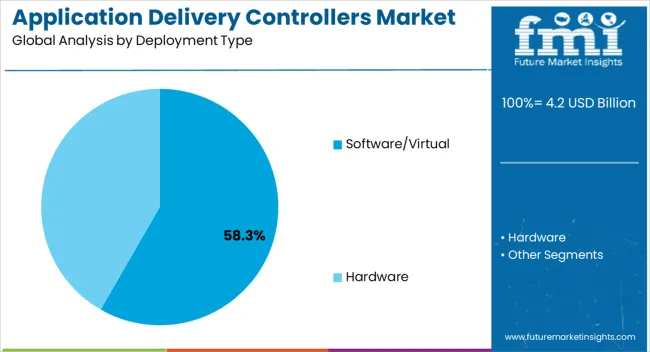

The software or virtual deployment type is expected to capture 58.30% of the total market revenue by 2025, positioning it as the leading segment. This dominance is attributed to the increasing shift toward virtualized infrastructure and cloud environments, where flexibility and scalability are paramount.

Software-based application delivery controllers reduce hardware dependency, enable seamless integration with existing IT frameworks, and support rapid deployment. Enterprises are adopting virtual solutions due to their cost-effectiveness, ease of upgrades, and adaptability to evolving workloads.

The surge in remote work and distributed applications has further accelerated adoption, making software or virtual deployment the preferred model in modern IT ecosystems.

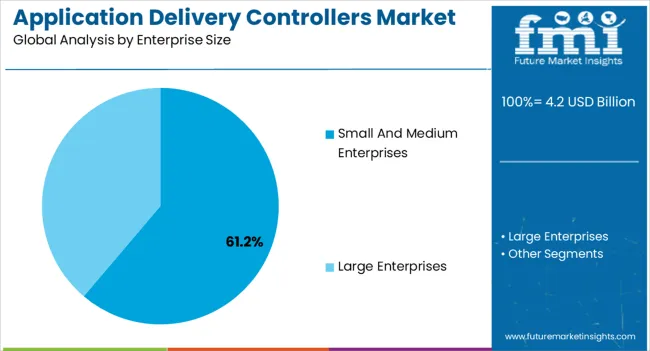

Small and medium enterprises are projected to account for 61.20% of market revenue in 2025 within the enterprise size category, emerging as the most significant contributors. This trend is driven by the need for SMEs to optimize limited IT resources while ensuring secure and reliable application delivery.

Cost-efficient virtual deployment models have made advanced solutions accessible to smaller organizations, enabling them to compete with larger enterprises. SMEs are increasingly leveraging cloud-native technologies and SaaS applications, which require robust delivery controllers to maintain performance and security.

Growing digitization across developing economies has also strengthened adoption, as SMEs seek scalable and affordable solutions to support business continuity and growth.

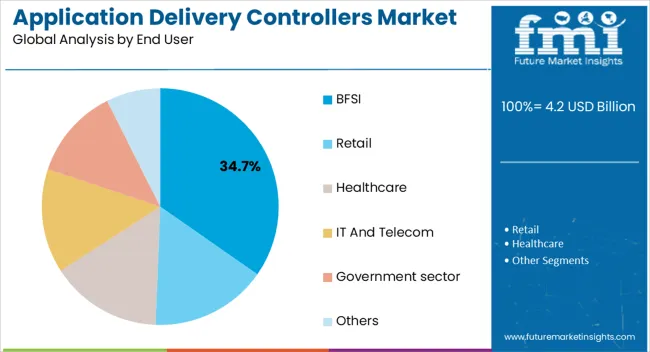

The BFSI sector is anticipated to hold 34.70% of the overall market revenue by 2025, making it the leading end-user category. The dominance of this segment is influenced by the sector’s stringent security requirements, demand for high availability, and need for seamless digital service delivery.

Application delivery controllers are widely deployed to ensure secure online transactions, fraud prevention, and uninterrupted digital banking experiences. Increasing mobile banking adoption and customer reliance on digital platforms have further necessitated advanced traffic management and application optimization.

Regulatory frameworks requiring compliance with data privacy and security standards are also reinforcing investment in these solutions. As the BFSI sector continues to expand digital offerings, reliance on robust application delivery systems remains critical, sustaining its leadership in the market.

The global demand for application delivery controllers is projected to increase at a CAGR of 18.3% during the forecast period between 2025 to 2035, reaching a total of USD 20.9 billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 16.2%.

During the historic outlook, the demand for data storage platforms witnessed tremendous growth due to swiftly increasing global data traffic. This, in turn, has resulted in unprecedented growth in cloud-based services and technologies driven by data centers.

Several organizations are expanding their customer base, which burgeons the demand for alternative storage, which has nurtured the cloud infrastructures in developed and emerging economies like the United States, China & India.

The service providers develop and deploy large-scale data centers and associated cloud services to compute large amounts of data. These factors are anticipated to boost the application delivery controller demand globally.

Exponential Growth in the IT Industry & Increasing Internet Penetration to Act as Prominent Growth Drivers

Evolving digital infrastructure worldwide and the changing business and working structure make modernization a key to success. During the COVID-19 pandemic, application visibility and management have gained demand for an increase in working from their home.

This is predicted to bolster the market growth in upcoming years. The rise in data traffic with the increasing use of cloud applications has secured the requirement for content and application delivery systems, supporting the Growth of ADCs.

The growth in distributed denial-of-service (DDoS) attacks, disrupting enterprise servers and overloading the companies rely on the ADCs to set limits on requests and traffic hitting an internal server. The above factors are responsible for the market growth and are anticipated to drive the market during the forecast period.

Death of Tech Experts May Hamper the Market Expansion

Crucial challenges exist to fulfill business requirements and uphold the efficiency of the data center. They are sustaining the application availability, keeping networks protected, consolidating resources and staff requirements, and scaling current infrastructure demands for an efficient solution. These factors are estimated to hinder the market expansion of application delivery controllers.

| Attributes | Details |

|---|---|

| North America Market Share - 2025 | 28.5% |

| United States Market Share - 2025 | 19.7% |

| Australia Market Share - 2025 | 3.7% |

Rising Internet Users & Availability of Well-developed Infrastructure Have Fuelled the Market Growth

North America captures the dominating share, accounting for 35.7% of the Application Delivery Controller (ADC) in 2025. The growth in the region is primarily owing to the well-established IT & telecom sector. Trends such as the rise in the adoption of cloud and SDN devices, virtualization, and network security are predicted to influence the market growth during the forecast period positively.

North America is the most rapidly changing and competitive market across the globe. Besides, the region is also expected to adopt new technologies at a faster pace as compared to other countries around the world.

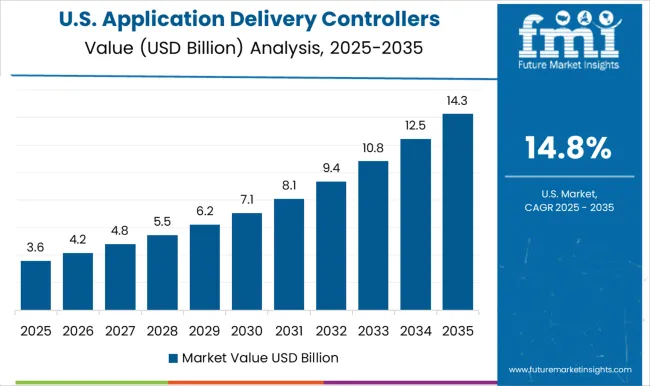

As per the recent analysis by Future Market Insights, the increasing internet traffic in countries like the United & Canada is one of the prominent market drivers of the application delivery controllers. In August 2024, the United States had 313 million active internet users, and 90% of Americans have internet access.

| Attributes | Details |

|---|---|

| Japan Market Share - 2025 | 5.4% |

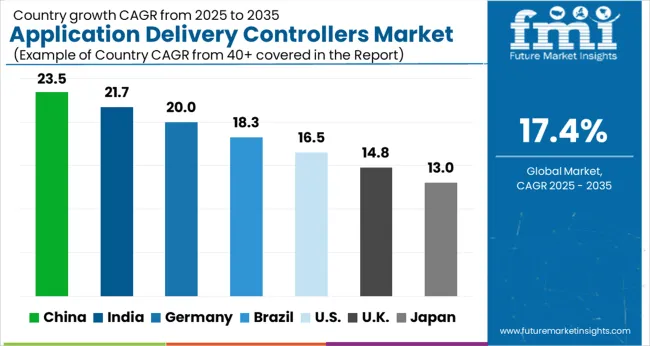

| China Market CAGR (From 2025 to 2035) | 20.3% |

| India Market CAGR (From 2025 to 2035) | 22.5% |

Swelling Adoption of Advanced Technologies to Propel the Regional Market

Asia Pacific is the robust-growing region registering a significant CAGR for the Application Delivery Controller (ADC) during the forecast period, followed by North America. The key factor responsible for the growth in this region is a rise in internet penetration coupled with technological advancement.

Several government initiatives, including Make in India, by the Government of India and OpenNet by the Chinese government, to progress the performance of web applications and services are the supporting factors driving the market growth in this region.

| Attributes | Details |

|---|---|

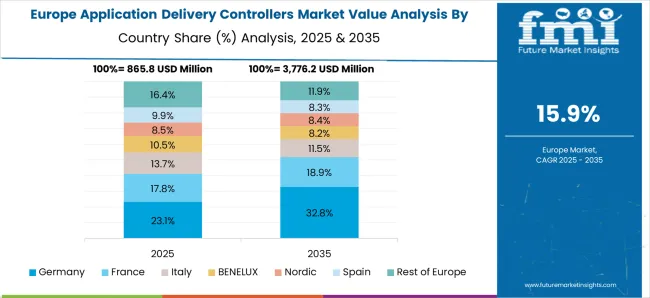

| Europe Market Share - 2025 | 24.3% |

| Germany Market Share - 2025 | 8.1% |

| United Kingdom Market CAGR (From 2025 to 2035) | 19.3% |

Soaring Investments & Encouraging Governments Policies to Foster the Demand for Application Delivery Controllers

Based on the geographies, European is the second-leading region, acquiring a 24.2% share in the Application Delivery Controllers market as of 2025. During the forecast period, the area is estimated to witness moderate growth, backed by soaring investments in the IT & Telecom industry for better connectivity during work from home. The United Kingdom contributes a huge revenue share of the regional market.

Europe is likely to showcase substantial growth during the forecast period. Government Initiatives such as the Local Digital Declaration, Technology Code of Practice, Cloud First Policy, and Digital Market Place across the United Kingdom are driving cloud adoption.

The increasing incidence of cyber-attacks and cloud adoption by small & medium enterprises may cultivate the demand for application-based controller solutions across the region.

| Category | Deployment Type |

|---|---|

| Leading Segment | Application Delivery Controllers Software/Virtual |

| Market Share | 67.60% |

| Category | End User |

|---|---|

| Leading Segment | Application Delivery Controllers for Large Enterprises |

| Market Share | 56.70% |

Small & Medium Enterprises (SMEs) are Expected to Register Significant Growth.

Based on enterprise size, the Application Delivery Controller (ADC) market is segmented into SMEs and large enterprises. Of these, SMEs are the swift-growing segment and are anticipated to continue with the same growth pace during the forecast timeframe.

ADCs, help the applications adapt to the networks and protocols in place today, which are broadly deployed as a key fixture in the enterprise. Also, they ensure that apps execute optimally, are available, and there are no security risks either to the user or the business.

Most SMEs rely upon web-based apps and web-enabled services for running the business. These apps are prone to intrusions, viruses, and DoS attacks. ADCs help reduce IT security risks and ensure compliance with privacy regulations and data security.

With a CAGR of 8.5% between 2025 and 2035, the virtual application delivery controller sector is the market's most significant segment by type. The demand for this area has grown excessively due to less expensive options that provide more control than conventional application delivery controllers.

Application delivery controllers can now be implemented more flexibly thanks to software-defined networking and virtualization, enabling them to offer more capability on a tighter budget. How businesses run their data centers is evolving due to the development of multi-cloud platforms and microservice environments, including containers. The advantages of a virtual application delivery controller include multi-tiered architecture, sophisticated design, and thorough packet inspection.

Virtual application delivery controllers have greatly increased the ADC market's growth compared to hardware application delivery controllers. Virtual application delivery controller market participants have acquired this applicability by enhancing application visibility and enabling a more user-friendly experience for clients.

The product's features include threat intelligence, service analytics, management, etc. The clients include Handle, Uber, Leaseweb, SK Telecom, and Klein ISD. The firm has collected total funding of USD 118 million.

The solution comprises a modern web-based UI to access the controller. The controller controls using integrated analytics, and the service engines collect the application-related metrics. Since its foundation, the firm has acquired total funding of 93 million.

The application delivery controller market is highly competitive. Healthcare, retail, and other end-user verticals dominate the demand in this sector. Players in the market are constantly coming up with new ideas and implementing different product innovations, acquisitions, and strategic mergers to get an advantage over rivals.

The application delivery controller market has a vibrant, competitive environment, but there needs to be more room for new entrants. Competitors concentrate on implementing cutting-edge technologies like artificial intelligence (AI) and machine learning that may broadly support the application delivery controller market solutions.

Vital Players:

Recent Innovations and Advancements

| Company | Radware |

|---|---|

| Strategy | Radware Secures a Deal with Leading Carrier to Safeguard Expanding Cloud Network |

| Details | Radware announced a multimillion-dollar partnership with a Tier-one carrier in January 2025. The leading carrier in the market is bolstering its Radware security defenses to safeguard and manage it is expanding worldwide cloud infrastructure. |

| Company | NGINX |

|---|---|

| Strategy | NGINX Controller Application Delivery Module Upgraded with Advanced Features |

| Details | NGINX, a control plane solution for NGINX Plus load balancers, updated its NGINX Controller Application Delivery Module in January 2025. Improved workload health checks, caching configuration upgrades, and instance groups are new features. |

| Company | F5 Networks, Inc. |

|---|---|

| Strategy | F5 Networks Enhances Management and API Solutions with NGINX Acquisition |

| Details | In March 2024, F5 Networks, Inc. announced an acquisition with NGINX with a total enterprise value of approximately US$ 670 million, subject to certain adjustments. This acquisition helps F5’s application services portfolio to enhance performance, management, and availability, together with NGINX’s leading software application delivery and API management solutions. |

| Company | A10 Networks |

|---|---|

| Strategy | A10 Networks Introduces Innovative Solutions for Hybrid-Cloud Environments |

| Details | In June 2024, A10 Networks announced a set of solutions that deliver application security and availability for its customers facing the safety and operational complexities of hybrid-cloud infrastructures. |

The global application delivery controllers market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the application delivery controllers market is projected to reach USD 20.9 billion by 2035.

The application delivery controllers market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in application delivery controllers market are software/virtual and hardware.

In terms of enterprise size, small and medium enterprises segment to command 61.2% share in the application delivery controllers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Application Delivery Network Market by Product, End-user, Environment, Deployment Type, Vertical, and Region, Forecast through 2035

Application Crowdtesting Service Market Size and Share Forecast Outlook 2025 to 2035

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Application Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Application Specific Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Application Processor Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

Application Control Software Market Insights – Growth & Forecast 2025-2035

Application Metrics and Monitoring Tools Market Analysis By Component, Mode, Deployment, Verticals, and Region through 2035

Application Centric Infrastructure Market

Application Management Services Market Analysis – Trends & Forecast 2017-2027

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

MES Applications For Process Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA