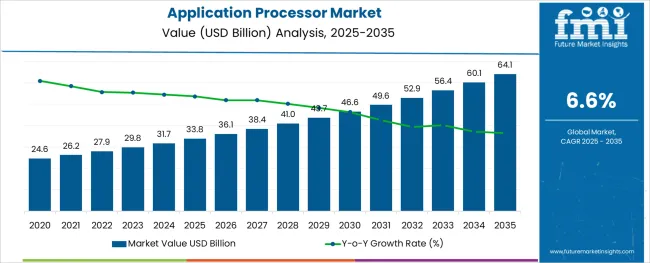

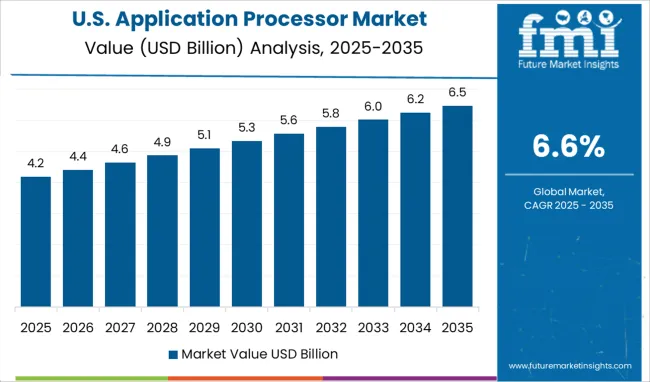

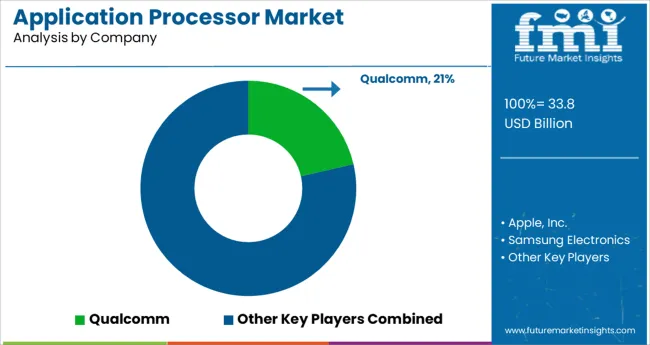

The Application Processor Market is estimated to be valued at USD 33.8 billion in 2025 and is projected to reach USD 64.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

The application processor market is growing rapidly due to increasing demand for high-performance computing in consumer electronics and mobile devices. Advances in semiconductor technology have enabled processors to become more powerful and energy-efficient, supporting complex applications like gaming, artificial intelligence, and multimedia processing.

Consumer electronics manufacturers are prioritizing processors that can deliver smooth user experiences and multitasking capabilities. The rise of mobile phones as primary computing devices has further accelerated the market’s expansion. Industry focus on integrating more cores and advanced processing architectures has enabled new features and improved device responsiveness.

As consumer expectations evolve, application processors are becoming central to device differentiation and performance optimization. Segment growth is being driven by the mobile phones application processor segment, the octa-core core type, and applications focused on consumer electronics, reflecting market trends in device sophistication and user demand.

The market is segmented by Device Type, Core Type, and Industry and region. By Device Type, the market is divided into Mobile Phones Application Processor, PC Tablets Application Processor, Smart Wearables Application Processor, and Automotive ADAS & Infotainment Systems Application Processor. In terms of Core Type, the market is classified into Octa-core Application Processor, Single-core Application Processor, Dual-core Application Processor, Quad-core Application Processor, and Hexa-core Application Processor. Based on Industry, the market is segmented into Application Processor for Consumer Electronics and Application Processor for Automotive. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

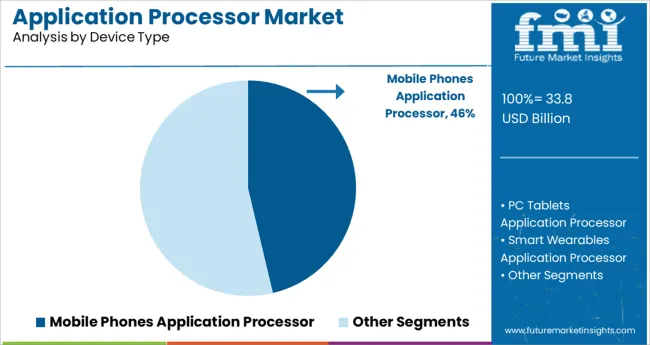

The Mobile Phones Application Processor segment is expected to hold 46.3% of the market share in 2025, driven by the ubiquitous use of smartphones globally. The need for powerful processing to handle high-resolution displays, complex apps, and 5G connectivity has made mobile phones the leading device type for application processors.

Manufacturers have focused on enhancing performance while optimizing power consumption to extend battery life. The continual upgrade cycle in smartphones encourages regular processor advancements, fueling steady market growth.

With mobile devices remaining essential tools for communication entertainment and productivity, the demand for advanced application processors in this segment is expected to continue rising.

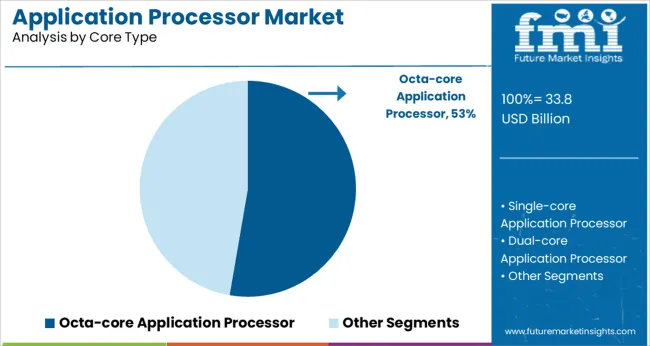

The Octa-core Application Processor segment is projected to account for 52.7% of the market share in 2025 due to its balance of power efficiency and performance. Octa-core designs enable devices to run multiple applications smoothly by distributing workloads effectively across cores.

This architecture supports high-performance tasks such as gaming video processing and multitasking while managing energy consumption. As consumer preferences shift towards richer multimedia experiences and faster response times, octa-core processors have become the preferred choice for mid to high-end devices.

Their versatility across device types has driven widespread adoption and contributed to segment growth.

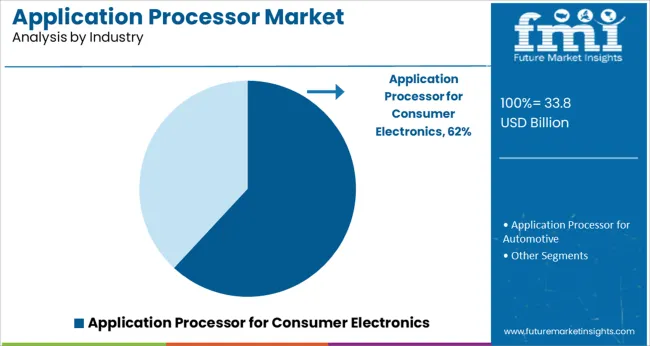

The Application Processor for Consumer Electronics segment is expected to contribute 61.9% of the market revenue in 2025, leading industry applications. Consumer electronics encompass a wide range of devices including smartphones tablets smart TVs and wearables all requiring efficient and capable processors.

The demand for seamless user interfaces, multimedia streaming, and connectivity has positioned application processors as critical components in this sector. Ongoing innovations in processor design have enabled new functionalities and improved user experiences.

Growing consumer preference for smart connected devices and rapid adoption of Internet of Things technologies are key factors supporting this segment’s growth. The segment’s dominance is likely to continue as consumer electronics evolve and expand.

Many factors are driving the market for application processors, and one of the major factors is the high adoption of application processors in the industries like consumer electronics specifically the wearable devices, and also in other industries for its use in applications like automotive ADAS and the infotainment systems.

This has been the major driver for the application processor market and has led to the strong growth of the market. Also, the increase in penetration of smartphones has increased the sales of mobile application processors which are a part of the application processor market. This has also been a driving factor for the application processor market and has led to the fast growth of the market.

Some of the restraints in the application processor market have been related to the development of application processors in the market. There have been problems regarding the development of the application processor which needs skilled personnel for its development. This has been a restraining factor for the application processor market as the processors take time to reach the end-user which slows down the process cycle of the application process market leading to slow growth.

Besides, the costs associated with mobile application processor development and operations will test the mobile apps market in the upcoming years. Mobile apps are designed to enable user activities with technological support. However, with the swelling demand for mobile apps, there has been an augmented need for administrative support, maintenance support, and infrastructure services, among others. These events incur a higher price than that involved in application development cost.

The North American region is likely to capture lion’s share in the application processor segment, backed by the bolstering demand for smart wearables and increasing penetration of tablets. Several tech giants are making hefty investments in developing fast and powerful processors to support all types of gadgets, exhibiting a positive elevation in the growth trajectory. Across the region, Apple led the tablet AP market with a 62 percent revenue share, followed by Intel with 12 percent and Qualcomm with 10 percent.

In March 2025, Apple announced M1 Ultra, the next giant leap for Apple silicon and the Mac. Which featured UltraFusion - Apple’s innovative packaging architecture that interconnects the die of two M1 Max chips to create a system on a chip (SoC) with unique levels of performance and capabilities - M1 Ultra delivers breathtaking computing power to the new Mac Studio while maintaining industry-leading performance per watt. The new SoC consists of 64.1 billion transistors, the most ever in a personal computer chip. According to Future Market Insights, the demand for application processors is likely to expand at a CAGR of 6% by 2035 end.

With the consistent advancement in smartphone technology and growing emphasis on powerful processors, the APAC region is witnessing immense growth in the current scenario which is prospective to continue in the future nearby. Prominent players like Qualcomm and Samsung are working together to enhance the user experience of using a smart gadget by offering next-generation processors.

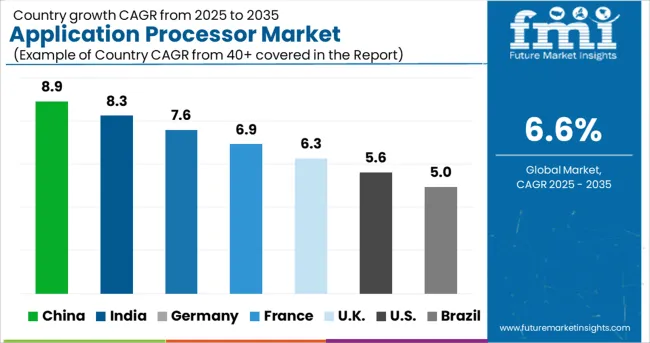

For instance, Qualcomm’s Snapdragon 8 Gen 1 flagship, the mobile platform created a market in the first quarter of 2025. The performance in Q1 2025 will be propelled by design wins in the Samsung Galaxy S22 series and launches in the Chinese New Year. With the announcement of 5G network connectivity in India, major OEMs are offering advanced processors with their products. The APAC market for application processors is projected to reflect a CAGR of 6.5% throughout the forecast period, reveals Future Market Insights report.

Some of the key players in the Application Processor market are Apple, Inc., Samsung Electronics, Qualcomm, MediaTek Inc., Intel Corporation, Advanced Micro Devices, Inc., NXP Semiconductors, NVIDIA Corporation, Renesas Mobile Corporation, Huawei Technologies Co. Ltd., Texas Instruments, Broadcom Corporation, Allwinner Technology, and HiSilicon Technologies among others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.6% from 2025 to 2035 |

| Market Value in 2025 | USD 27.93 Billion |

| Market Value in 2035 | USD 53 Billion |

| Base Year for Estimation | 2024 |

| Historical Data Available For | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Device Type, Core type, Industry, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Russia, BENELUX, China, Japan, South Korea, GCC, South Africa, Turkey |

| Key Companies Profiled | Apple, Inc.; Samsung Electronics; Qualcomm; MediaTek Inc.; Intel Corporation; Advanced Micro Devices, Inc.; NXP Semiconductors; NVIDIA Corporation; Renesas Mobile Corporation; Huawei Technologies Co. Ltd.; Texas Instruments; Broadcom Corporation; Allwinner Technology; HiSilicon Technologies |

| Customization | Available Upon Request |

The global application processor market is estimated to be valued at USD 33.8 billion in 2025.

It is projected to reach USD 64.1 billion by 2035.

The market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types are mobile phones application processor, pc tablets application processor, smart wearables application processor and automotive adas & infotainment systems application processor.

octa-core application processor segment is expected to dominate with a 52.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tablet And e-Reader Application Processor Market Size and Share Forecast Outlook 2025 to 2035

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Controllers Market Size and Share Forecast Outlook 2025 to 2035

Application Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Application Specific Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Network Market by Product, End-user, Environment, Deployment Type, Vertical, and Region, Forecast through 2035

Application Control Software Market Insights – Growth & Forecast 2025-2035

Application Metrics and Monitoring Tools Market Analysis By Component, Mode, Deployment, Verticals, and Region through 2035

Application Centric Infrastructure Market

Application Management Services Market Analysis – Trends & Forecast 2017-2027

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

MES Applications For Process Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

CRM Application Software Market Report – Forecast 2017-2022

Agile Application Life-Cycle Management Market Size and Share Forecast Outlook 2025 to 2035

Email Application Market Analysis by Product Type, Deployment, and Region Through 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA