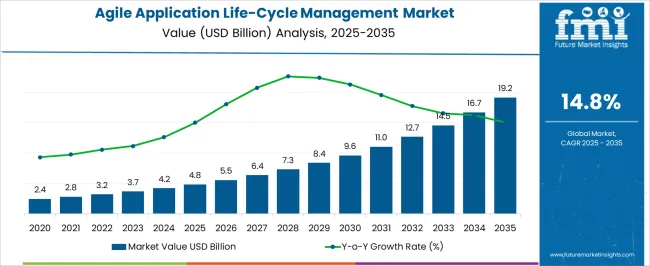

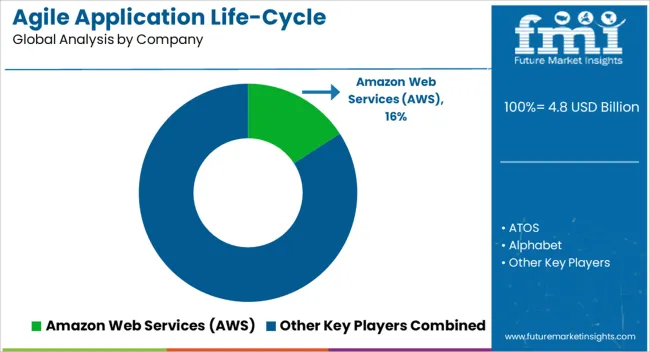

The Agile Application Life-Cycle Management Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 19.2 billion by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

| Metric | Value |

|---|---|

| Agile Application Life-Cycle Management Market Estimated Value in (2025 E) | USD 4.8 billion |

| Agile Application Life-Cycle Management Market Forecast Value in (2035 F) | USD 19.2 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

The Agile Application Life-Cycle Management (ALM) market is witnessing rapid expansion, supported by the increasing shift from traditional software development methods to agile and DevOps-based practices. Organizations across industries are seeking agile ALM platforms to manage complex software development cycles, improve collaboration among teams, and deliver products faster to market. Key growth drivers include the rising demand for real-time visibility, iterative development, and integrated toolchains that connect planning, development, testing, and deployment.

Software providers are increasingly incorporating advanced features such as cloud deployment, AI-driven insights, and automation to support dynamic development needs. Regulatory compliance and quality assurance requirements are also influencing adoption, as enterprises aim to maintain transparency and accountability throughout the software life cycle.

Additionally, the growing importance of customer-centric digital transformation initiatives is pushing businesses to adopt agile methodologies for faster responsiveness and continuous innovation With heightened competition and the need for scalability in software development, the Agile ALM market is positioned for sustained growth, with strong demand from sectors such as IT, BFSI, healthcare, and retail driving its adoption globally.

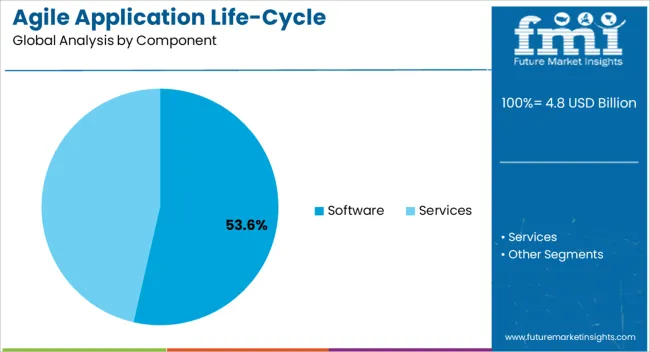

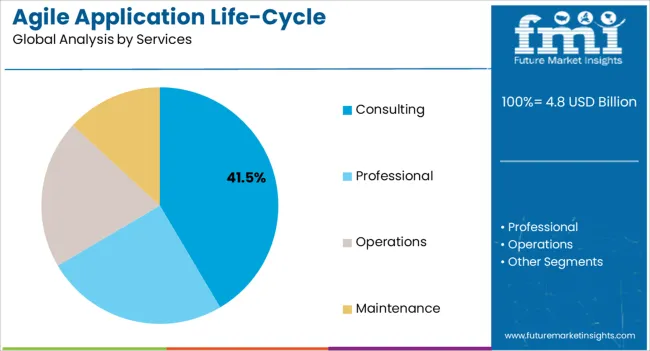

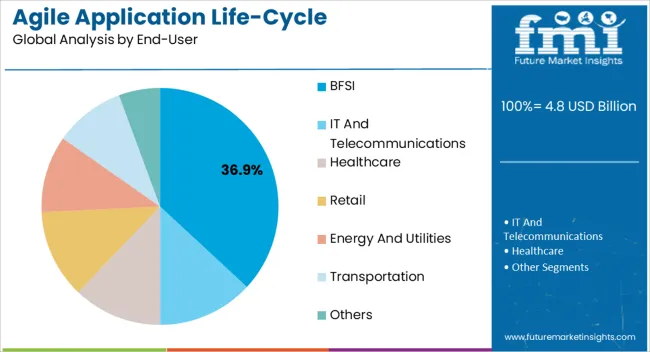

The agile application life-cycle management market is segmented by component, services, end-user, and geographic regions. By component, agile application life-cycle management market is divided into Software and Services. In terms of services, agile application life-cycle management market is classified into Consulting, Professional, Operations, and Maintenance. Based on end-user, agile application life-cycle management market is segmented into BFSI, IT And Telecommunications, Healthcare, Retail, Energy And Utilities, Transportation, and Others. Regionally, the agile application life-cycle management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is projected to account for 53.6% of the Agile ALM market revenue in 2025, making it the leading component. This leadership is being driven by the rising demand for integrated platforms that can streamline application development, testing, deployment, and maintenance. Software solutions provide end-to-end visibility, enabling developers, testers, and project managers to collaborate seamlessly within a unified ecosystem.

Advanced features such as real-time dashboards, backlog management, continuous integration, and automated reporting enhance productivity while reducing errors and development costs. Increasing reliance on cloud-based agile ALM solutions is further boosting adoption, as enterprises prioritize flexibility, scalability, and remote team collaboration. The ability of software platforms to integrate with popular DevOps tools and version control systems also strengthens their position in modern development environments.

Furthermore, businesses are adopting software-driven ALM solutions to improve transparency, regulatory compliance, and quality assurance, which are critical in highly regulated industries As organizations accelerate digital transformation initiatives, the software component segment is expected to maintain its dominance, supported by continuous innovation and strong scalability advantages.

The consulting services segment is expected to hold 41.5% of the Agile ALM market revenue in 2025, underscoring its critical role in enabling successful implementation and optimization of agile methodologies. Growth is being driven by the increasing need for expert guidance in adopting agile practices, integrating ALM tools, and customizing workflows to meet unique business requirements. Consulting services help organizations design effective transformation strategies, manage change, and align development processes with business objectives.

Enterprises often require specialized expertise to ensure smooth adoption of agile ALM platforms, especially when transitioning from legacy systems or scaling development across distributed teams. Additionally, consulting providers are assisting businesses with regulatory compliance, process automation, and risk management to maximize the value of ALM investments.

Demand is also being supported by the growing complexity of IT ecosystems, where consulting firms play a pivotal role in enabling interoperability and integration across multiple platforms As organizations continue to prioritize agility and digital transformation, consulting services are expected to remain a key driver, providing the expertise and support required for long-term success in ALM adoption.

The BFSI end-user segment is anticipated to account for 36.9% of the Agile ALM market revenue in 2025, positioning it as the leading industry vertical. This dominance is being driven by the sector’s increasing reliance on digital platforms, mobile applications, and cloud-based services, which require agile and efficient development practices. Banks, insurers, and financial institutions are adopting agile ALM solutions to improve customer experience, accelerate product launches, and maintain compliance with stringent regulatory requirements.

Agile ALM enables BFSI organizations to manage large-scale projects, enhance team collaboration, and deliver secure applications that meet evolving market demands. Features such as continuous integration, automated testing, and real-time monitoring are particularly valuable in ensuring reliability and reducing risks in mission-critical financial applications. The BFSI sector also faces growing competition from fintech companies, further driving the need for rapid innovation and operational agility.

By leveraging agile ALM platforms, BFSI enterprises can optimize workflows, reduce development costs, and respond quickly to changing customer expectations This strong alignment with industry needs is expected to sustain the BFSI segment’s leadership within the market.

Agile application life-cycle management is gradually becoming a key to innovation, and becoming a norm to drive dynamic, modern software delivery solution. This transition is happening as large vendors are offering options for smarter products and internet of things.

Agile application life-cycle management is essentially beneficial for organizations that need to provide speedy delivery of solutions and need to provide continuous release of builds during the entire life-cycle of any product or software solution.

One added benefit of agile application life-cycle management is that it is built on an open framework/architecture, hence it has the flexibility of adding more functions during the entire development lifecycle. In addition to this, agile application life-cycle management is receptive to change and can create correlations between organizations, people and development strategies.

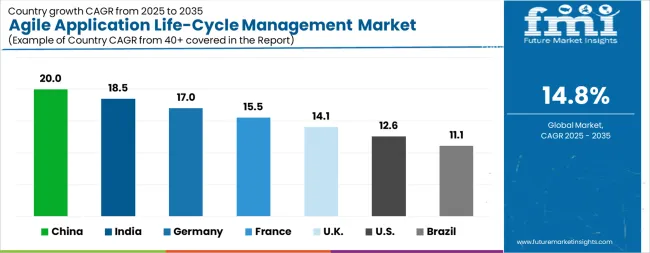

| Country | CAGR |

|---|---|

| China | 20.0% |

| India | 18.5% |

| Germany | 17.0% |

| France | 15.5% |

| UK | 14.1% |

| USA | 12.6% |

| Brazil | 11.1% |

The Agile Application Life-Cycle Management Market is expected to register a CAGR of 14.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.0%, followed by India at 18.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 11.1%, yet still underscores a broadly positive trajectory for the global Agile Application Life-Cycle Management Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.0%. The USA Agile Application Life-Cycle Management Market is estimated to be valued at USD 1.7 billion in 2025 and is anticipated to reach a valuation of USD 5.6 billion by 2035. Sales are projected to rise at a CAGR of 12.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 245.7 million and USD 164.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Component | Software and Services |

| Services | Consulting, Professional, Operations, and Maintenance |

| End-User | BFSI, IT And Telecommunications, Healthcare, Retail, Energy And Utilities, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon Web Services (AWS), ATOS, Alphabet, IBM, Microsoft, Nvidia, Oracle, SalesForce, SAP SE, and Tencent |

The global agile application life-cycle management market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the agile application life-cycle management market is projected to reach USD 19.2 billion by 2035.

The agile application life-cycle management market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in agile application life-cycle management market are software, _on-premises, _cloud based, services, _consulting, _professional, _operations and _maintenance.

In terms of services, consulting segment to command 41.5% share in the agile application life-cycle management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Application Management Services Market Analysis – Trends & Forecast 2017-2027

Contract Lifecycle Management Market Growth – Trends & Forecast 2025 to 2035

Decision Management Applications Market Size and Share Forecast Outlook 2025 to 2035

Quality Process Management Application Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Supplier Quality Management Applications Market Share

Supplier Quality Management Applications Market Outlook 2025 to 2035

AI-Driven Treasury & Risk Management – Future-Proofing Finance

UK Supplier Quality Management Applications Market Analysis – Demand, Trends & Forecast 2025-2035

USA Supplier Quality Management Applications Market Insights – Trends, Demand & Growth 2025-2035

Japan Supplier Quality Management Applications Market Trends – Size, Share & Outlook 2025-2035

Germany Supplier Quality Management Applications Market Trends – Growth, Share & Outlook 2025-2035

GCC Countries Supplier Quality Management Applications Market Growth – Demand, Trends & Forecast 2025-2035

Application Crowdtesting Service Market Size and Share Forecast Outlook 2025 to 2035

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Controllers Market Size and Share Forecast Outlook 2025 to 2035

Application Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA