The global application crowdtesting service market is valued at USD 1.2 billion in 2025 and is projected to reach USD 1.7 billion by 2035, reflecting a CAGR of 3.5%. Early-stage growth is driven by the increasing complexity of applications, the rise in mobile app development, and the growing need for diverse, real-world testing across various environments and devices. Crowdtesting services allow businesses to leverage a global pool of testers to identify bugs, usability issues, and performance bottlenecks, offering a cost-effective solution compared to traditional testing methods. As software development cycles become more rapid and the demand for high-quality applications rises, the need for crowdtesting grows in parallel.

As the market progresses toward 2035, growth remains stable but begins to moderate as the adoption of crowdtesting becomes standard practice among large enterprises and app developers. The continued emphasis on agile development and fast time-to-market strategies ensures steady demand for crowdtesting services, with increasing applications in e-commerce, mobile apps, enterprise software, and more. Innovations in AI-driven testing, real-time feedback loops, and integration with continuous integration/continuous delivery (CI/CD) pipelines contribute to the market’s sustained expansion, ensuring the industry remains relevant and competitive in the evolving landscape of application testing.

Between 2025 and 2030, the Application Crowdtesting Service Market grows from USD 1.2 billion to USD 1.5 billion, adding USD 0.3 billion in value. The market experiences steady growth, with annual increases remaining moderate at around USD 0.1 billion each year. Market share gain is primarily driven by the increasing adoption of crowdtesting services as companies look to leverage the power of a global workforce for real-time feedback on application performance, usability, and security. This trend is supported by the growing demand for faster, more scalable testing solutions in the rapidly evolving software development landscape, especially in mobile and web applications.

From 2030 to 2035, the market expands from USD 1.5 billion to USD 1.7 billion, adding another USD 0.2 billion. During this phase, the market continues to see consistent market share gain as crowdtesting becomes more integrated into DevOps pipelines and agile development cycles. Businesses in sectors like e-commerce, banking, and technology will increasingly rely on these services to improve application quality, enhance user experience, and ensure compatibility across diverse devices and operating systems. The continued emphasis on digital transformation will help drive the sustained growth of the crowdtesting service market over the next five years.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.2 billion |

| Market Forecast Value (2035) | USD 1.7 billion |

| Forecast CAGR (2025–2035) | 3.5% |

The application crowdtesting service market is expanding as development teams seek scalable, real world testing of mobile, web, and IoT apps across diverse devices, networks, and geographies. Crowdtesting services engage distributed testers to replicate actual user environments varying hardware models, operating system versions, languages, and connectivity conditions allowing organizations to identify usability issues, localization bugs, and performance bottlenecks before public release. Providers support rapid releases by delivering functional, compatibility, and exploratory testing on demand, reducing reliance on in house device labs. As mobile app update cycles accelerate and user expectations grow for flawless experiences, crowdtesting becomes a critical component in quality assurance strategies across sectors including gaming, retail, finance, and utilities.

Market expansion is also driven by increasing adoption of agile and DevOps methodologies, which prioritize continuous delivery and feedback loops. Crowdtesting integrates with CI/CD pipelines, enabling organizations to deploy new features globally while managing risk through parallel testing across multiple locales. Providers improve platform dashboards, tester verification workflows, and defect reporting tools to support transparency and stakeholder visibility. Rising demand for testing of emerging environments-such as augmented reality, wearable devices, and smart home applications-adds complexity that traditional labs struggle to replicate. Although managing diverse tester pools and maintaining data security standards pose operational challenges, the flexibility, speed, and breadth of crowdtesting services support sustained growth in the application testing market.

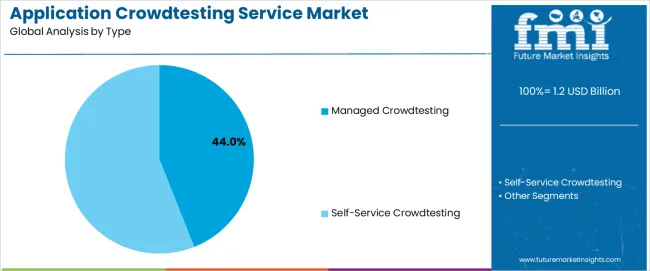

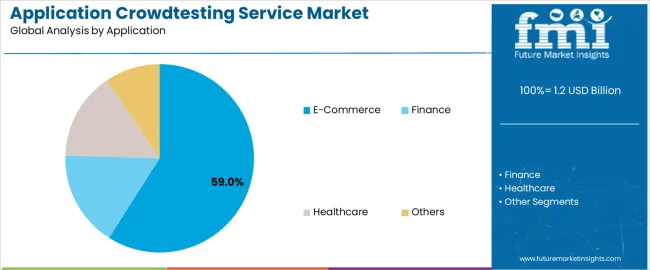

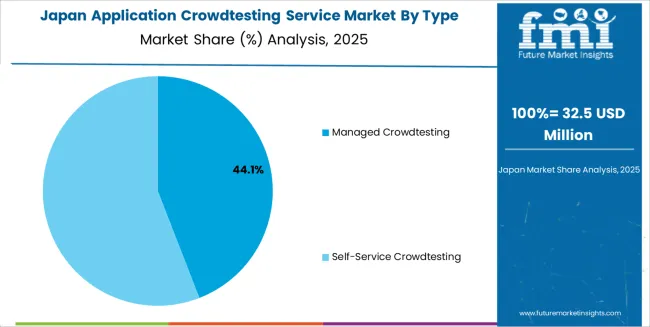

The application crowdtesting service market is segmented by type, application, and region. By type, the market is divided into managed crowdtesting and self-service crowdtesting. Based on application, it is categorized into e-commerce, finance, healthcare, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect varying quality assurance needs, regulatory requirements, and regional adoption of crowdtesting services across industries.

The managed crowdtesting segment accounts for approximately 44.0% of the global application crowdtesting service market in 2025, making it the leading type category. This position is driven by the comprehensive nature of managed services, where crowdtesting providers take full responsibility for the entire testing process. These services include task management, tester recruitment, test execution, and reporting, offering businesses end-to-end support for application testing. Managed crowdtesting is especially appealing to organizations seeking to outsource their quality assurance processes to external experts who can oversee complex testing campaigns efficiently.

Managed services are widely adopted in industries that require extensive, high-quality testing across diverse devices, geographies, and user profiles, such as e-commerce and finance. Adoption is strongest in North America, Europe, and East Asia, where businesses are scaling their digital operations and require reliable testing for new software releases. The segment maintains its lead because managed crowdtesting services provide a high level of coordination, expertise, and scalability, ensuring comprehensive coverage and quick feedback from real-world users across different platforms, devices, and environments.

The e-commerce segment represents about 59.0% of the total application crowdtesting service market in 2025, making it the dominant application category. This position reflects the critical need for e-commerce companies to ensure their websites, mobile apps, and online platforms are fully functional, secure, and user-friendly across various devices, browsers, and operating systems. E-commerce platforms require crowdtesting to simulate real user behavior, identify bugs, and evaluate usability under various conditions to maintain a seamless user experience and support high conversion rates.

E-commerce businesses often handle large volumes of traffic and complex transactions, necessitating frequent software updates, new feature rollouts, and ongoing quality assurance. Testing with a diverse, global crowd helps these companies identify and resolve issues quickly before they affect end-users. Adoption is especially high in North America, Europe, and East Asia, where e-commerce markets are large, competitive, and fast-moving. The segment maintains its lead because e-commerce is increasingly reliant on crowdtesting to optimize user experience, ensure application stability, and meet customer expectations in an increasingly digital marketplace.

The application crowd testing service market is growing as software developers and enterprises seek to validate performance, usability and compatibility across a wide range of real world devices and conditions. These services leverage a distributed “crowd” of testers to detect bugs, user experience issues and device specific faults that traditional lab testing may miss. Growth is driven by the proliferation of mobile apps, IoT devices and rapid release cycles requiring scalable testing resources. Adoption is limited by concerns around tester consistency, data security, and managing diverse global tester pools. Providers are enhancing platform automation, tester vetting, and analytics driven insights to support faster and more reliable crowd testing engagements.

Demand increases because applications must run reliably across thousands of device models, operating system versions and network conditions. In house QA teams often cannot cover this diversity cost effectively. Crowd testing services mobilise large pools of external testers in varied environments to evaluate apps under real world use cases. Agile and continuous delivery models require frequent testing windows, which crowd testing handles flexibly and at scale. Enterprises in sectors such as ecommerce, gaming, finance and telecom rely on these services to support rapid launches and updates while maintaining quality across global audiences.

Adoption is restrained by challenges in managing large distributed tester pools including quality control, standardisation of test scenarios and varying tester skill levels. Data security and confidentiality concerns arise when applications under test contain sensitive content or user data flows, complicating crowd engagements. Some companies prefer traditional in house or contracted QA teams for critical systems due to predictability and control. Pricing models and unclear ROI for smaller applications also slow adoption in mid tier firms. These issues limit full-scale use of crowd testing in regulated industries or highly secure environments.

Key trends include integration of AI and machine learning to analyse tester feedback, automate bug classification and improve tester assignment accuracy. Platforms are moving toward continuous testing models that inject crowd tests into CI/CD pipelines for faster feedback. Localization and compatibility testing for global markets are becoming standard, and demand for specialized testing such as security, performance under network stress and accessibility is growing. Regionally, growth is especially strong in Asia Pacific due to rising app usage and device volumes. Providers are also offering hybrid models combining internal QA teams with crowd testing resources for best of both worlds coverage.

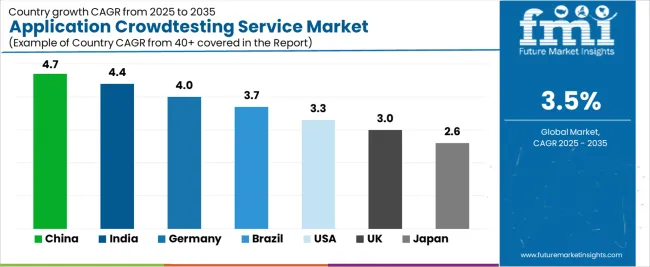

| Country | CAGR (%) |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| USA | 3.3% |

| UK | 3.0% |

| Japan | 2.6% |

The Application Crowdtesting Service Market is growing steadily worldwide, with China leading at a 4.7% CAGR through 2035, driven by rapid expansion in mobile app development, strong demand for scalable testing services, and increasing adoption of agile development practices. India follows at 4.4%, supported by a thriving IT industry, rising demand for cost-effective testing solutions, and expanding app development ecosystems. Germany records 4.0%, benefiting from a strong industrial base and high demand for high-quality, secure, and reliable testing services in enterprise applications. Brazil grows at 3.7%, driven by increased software development and testing requirements in emerging sectors. The USA, at 3.3%, remains a key market emphasizing innovative crowdtesting solutions for advanced app functionalities, while the UK (3.0%) and Japan (2.6%) focus on enhancing software quality through diverse and diverse crowdtesting methodologies for mobile and web applications.

China is projected to grow at a CAGR of 4.7% through 2035 in the application crowdtesting service market. The rapid digital transformation and expanding mobile app development ecosystem drive demand for crowdtesting services to improve the quality, security, and usability of applications. As businesses increase their reliance on digital platforms, the need for comprehensive testing from diverse user groups grows. Chinese companies focus on leveraging crowdtesting services to address a wide range of applications across industries, including e-commerce, fintech, and gaming. The market is supported by government initiatives to boost technology and innovation in the digital economy.

India is projected to grow at a CAGR of 4.4% through 2035 in the application crowdtesting service market. The increasing number of tech startups and the growing mobile application market fuel the demand for crowdtesting services in India. These services help startups ensure app quality, security, and performance by testing with real users across various regions. The growing focus on digital transformation and innovation within the Indian IT sector accelerates the adoption of crowdtesting to improve user experiences and reduce bugs in applications. Additionally, the rise in mobile gaming and e-commerce boosts the need for comprehensive testing solutions.

Germany is projected to grow at a CAGR of 4% through 2035 in the application crowdtesting service market. Stringent regulations around data security, software performance, and user experience in industries such as finance, healthcare, and automotive push German companies to adopt crowdtesting services to ensure compliance. Businesses use crowdtesting to validate their applications with real-world scenarios, helping to meet regulatory requirements and improve user satisfaction. German companies are increasingly integrating crowdtesting services to identify issues related to performance, functionality, and security across multiple platforms, ensuring applications are market-ready and compliant with local regulations.

Brazil is projected to grow at a CAGR of 3.7% through 2035 in the application crowdtesting service market. As Brazilian businesses increasingly digitalise their operations, the demand for crowdtesting services rises to ensure the functionality, usability, and security of their applications. Startups and enterprises across various sectors, including finance, retail, and health, leverage crowdtesting to gain feedback from diverse user groups. These insights help improve app performance, reduce bugs, and enhance customer satisfaction. Additionally, the rapid growth of mobile and web-based applications in Brazil fosters the widespread adoption of crowdtesting services to meet competitive pressures.

USA is projected to grow at a CAGR of 3.3% through 2035 in the application crowdtesting service market. The growing need for operational efficiency in software development drives the adoption of crowdtesting services, as businesses seek to speed up the testing phase and improve time-to-market. Crowdtesting offers scalable solutions to test applications with a diverse group of users across multiple devices and locations. The USA’s well-established tech sector, including startups and large enterprises, increasingly relies on crowdtesting to ensure application quality, performance, and security, meeting user expectations while reducing testing costs and time.

UK is projected to grow at a CAGR of 3% through 2035 in the application crowdtesting service market. As businesses increasingly focus on customer experience, the demand for crowdtesting services rises to improve app usability and performance. UK-based companies leverage crowdtesting to gather feedback from real users and ensure their applications meet user expectations. The rise in mobile app usage, digital services, and online transactions further boosts the need for crowdtesting to validate app security, functionality, and ease of use. Market growth is also driven by the increasing adoption of agile development methodologies.

Japan is projected to grow at a CAGR of 3.2% through 2035 in the application crowdtesting service market. The growing adoption of mobile applications in sectors such as retail, finance, and gaming drives the demand for crowdtesting services in Japan. Businesses use crowdtesting to validate app performance, functionality, and security with real users across multiple platforms and devices. The increasing focus on user-centred design and mobile-first strategies fuels the need for testing services that provide insights into user experience. Japan’s strong tech sector and consumer demand for high-quality mobile apps support this growth.

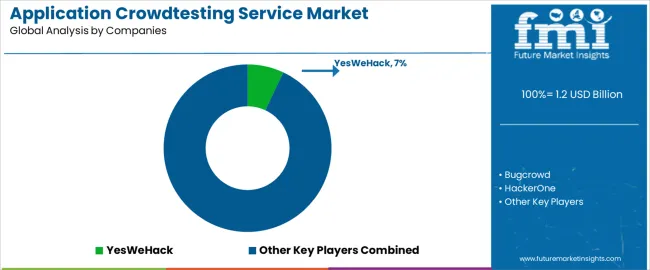

The global application crowdtesting service market is highly competitive, driven by companies offering innovative, crowd-sourced security testing, performance evaluations, and functional testing for web and mobile applications. YesWeHack, Bugcrowd, and HackerOne hold dominant positions in the market by providing robust platforms that connect businesses with a global network of ethical hackers, security experts, and quality assurance testers. Synack and Cobalt strengthen their market presence by offering hybrid models that combine crowdtesting with expert reviews, focusing on high-security testing for sensitive applications. Yogosha, Intigriti, and Hackrate further contribute to the market by specializing in vulnerability assessments, penetration testing, and bug bounty programs, helping companies enhance security and improve application performance.

Lionbridge, PeoplePerHour, and Digivante offer additional value through their wide-ranging testing services that incorporate usability studies and customer experience testing alongside security assessments. Optimal Workshop, BugBase, and Applause diversify the market by offering tools designed for user-centered testing, offering a seamless integration of crowdtesting with product development cycles. Competition across this segment is shaped by the reliability of the testing process, the expertise of the crowd, and the scalability of testing services to meet the needs of different industries. Strategic differentiation depends on the size of the tester pool, testing turnaround time, and the ability to provide actionable insights for developers. As cybersecurity concerns grow and businesses prioritize continuous testing, companies offering specialized, comprehensive, and flexible crowdtesting solutions are positioned to lead in the market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Managed Crowdtesting, Self-Service Crowdtesting |

| Application | E-Commerce, Finance, Healthcare, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | YesWeHack, Bugcrowd, HackerOne, Synack, Cobalt, Yogosha, Intigriti, Hackrate, Lionbridge, PeoplePerHour, Digivante, Optimal Workshop, BugBase, Applause |

| Additional Attributes | Dollar sales by type and application, integration with CI/CD pipelines, AI-driven bug classification, real-time feedback capabilities, compatibility testing across multiple devices, usability and customer experience testing, emerging tech testing (IoT, AR, etc.), security testing, global tester pool management. |

The global application crowdtesting service market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the application crowdtesting service market is projected to reach USD 1.7 billion by 2035.

The application crowdtesting service market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in application crowdtesting service market are managed crowdtesting and self-service crowdtesting.

In terms of application, e-commerce segment to command 59.0% share in the application crowdtesting service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Controllers Market Size and Share Forecast Outlook 2025 to 2035

Application Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Application Specific Integrated Circuit Market Size and Share Forecast Outlook 2025 to 2035

Application Processor Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Network Market by Product, End-user, Environment, Deployment Type, Vertical, and Region, Forecast through 2035

Application Control Software Market Insights – Growth & Forecast 2025-2035

Application Metrics and Monitoring Tools Market Analysis By Component, Mode, Deployment, Verticals, and Region through 2035

Application Centric Infrastructure Market

Application Management Services Market Analysis – Trends & Forecast 2017-2027

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

MES Applications For Process Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

CRM Application Software Market Report – Forecast 2017-2022

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

Agile Application Life-Cycle Management Market Size and Share Forecast Outlook 2025 to 2035

Email Application Market Analysis by Product Type, Deployment, and Region Through 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA