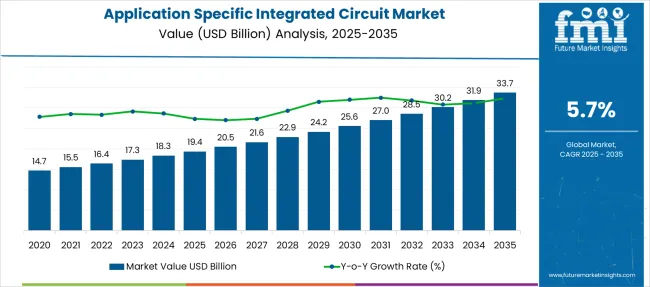

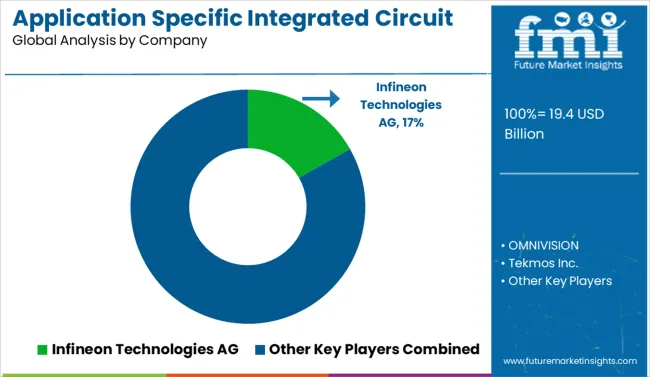

The Application Specific Integrated Circuit Market is estimated to be valued at USD 19.4 billion in 2025 and is projected to reach USD 33.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Application Specific Integrated Circuit Market Estimated Value in (2025 E) | USD 19.4 billion |

| Application Specific Integrated Circuit Market Forecast Value in (2035 F) | USD 33.7 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The application specific integrated circuit (ASIC) market is expanding steadily, driven by rising demand for high-performance, energy-efficient chips tailored for specific applications across industries. The increasing complexity of modern electronic devices and the need for optimized power consumption, miniaturization, and enhanced processing capabilities are propelling the adoption of ASICs over general-purpose integrated circuits.

Sectors such as telecommunications, automotive, consumer electronics, and industrial automation are actively integrating ASICs to achieve greater system integration, performance, and cost-efficiency. The future outlook remains positive as the shift toward 5G, edge computing, and AI-centric workloads continues to create new opportunities for custom silicon solutions.

Investments in semiconductor R&D and advancements in chip design tools are also expected to accelerate the deployment of ASICs across diverse end uses, enabling tailored functionality and enhanced competitive advantages for OEMs.

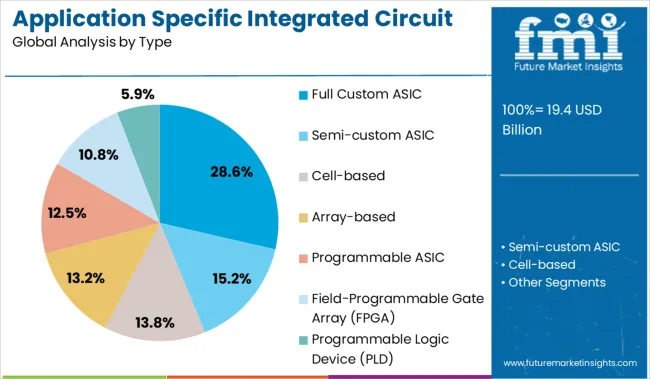

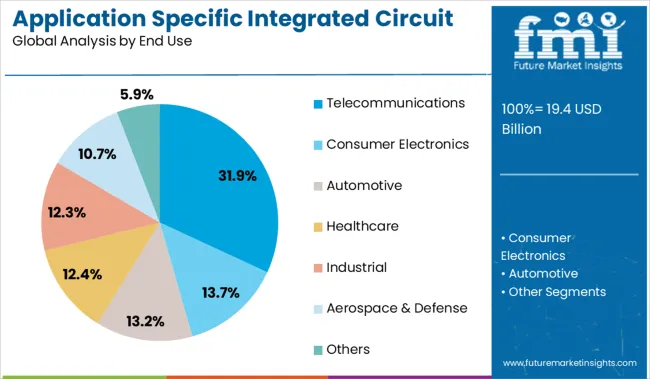

The application-specific integrated circuit market is segmented by type and end use, and geographic regions. The application-specific integrated circuit market is divided by type into Full Custom ASIC, Semi-custom ASIC, Cell-based, Array-based, Programmable ASIC, Field-Programmable Gate Array (FPGA), and Programmable Logic Device (PLD). In terms of end use, the application-specific integrated circuit market is classified into Telecommunications, Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense, and Others. Regionally, the application-specific integrated circuit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The full custom ASIC segment commands a notable 28.6% market share within the type category, highlighting its significance in delivering the highest level of design flexibility and performance optimization. These ASICs are engineered from the ground up to meet specific application needs, allowing maximum control over power, size, and functionality.

The segment is widely utilized in critical applications such as network infrastructure, AI accelerators, and defense electronics, where proprietary performance and IP protection are essential. Although development time and costs are higher compared to standard cell or gate array designs, the long-term operational advantages continue to justify investment in full custom solutions.

Growth is further supported by advancements in electronic design automation (EDA) tools and foundry services, which streamline the complex development process. As end-use industries seek differentiated chip architectures to handle specialized workloads, the demand for full custom ASICs is projected to remain strong.

The telecommunications sector leads the end use category with a 31.9% share, reflecting its foundational role in driving demand for application specific integrated circuits. The proliferation of 5G networks, high-speed broadband infrastructure, and data center interconnects is intensifying the need for ASICs that deliver high bandwidth, low latency, and reduced power consumption.

ASICs are increasingly deployed in telecom equipment such as base stations, optical transceivers, routers, and switches, where they enable efficient signal processing and protocol handling. This segment has gained momentum as network operators and equipment vendors invest in next-generation infrastructure to meet rising data traffic and connectivity requirements.

Custom ASICs offer significant advantages over off-the-shelf components by allowing performance tuning and integration of security features. Continued global investments in telecom infrastructure and the transition toward software-defined networking and network function virtualization are expected to solidify the telecommunications segment’s position in the ASIC market.

The market is expanding rapidly as demand grows for highly optimized chips in consumer electronics, data centers, automotive systems and specialized industrial uses. Emerging AI-driven use cases and tailored frameworks promise significant scale.

Organizations are increasingly investing in application-specific integrated circuits (ASICs) to maximize efficiency and performance for tasks such as machine learning inference, network acceleration, video encoding and sensor data processing. ASICs deliver superior power and size efficiency compared to general-purpose chips, allowing companies to optimize form factors and energy consumption in mobile devices and edge nodes. Hyperscale data centers deploy custom silicon to improve cost per operation while retaining performance at scale. Automotive firms integrate ASICs into advanced driver assistance systems and infotainment architectures to meet reliability standards. Consumer electronics manufacturers use ASICs in cameras and audio devices to enable specialized processing and differentiation. Demand for tailored silicon is rising as industries seek optimized hardware for critical workloads.

Growth opportunities stem from accessible design platforms that allow rapid ASIC prototyping and iteration for domain specific use cases such as networking, vision or IoT edge deployments. Alliances between EDA tool vendors and chip fabricators are enabling lower-cost design flows and faster time to silicon. Vertical partnerships between semiconductor firms and hyperscale cloud or consumer brands support co developed ASICs optimized for specific workloads and ecosystems. Specialized turn-key foundry services help startups and system integrators convert algorithmic models into custom silicon without heavy IP licensing burdens. Expansion across emerging industry verticals including smart manufacturing, robotics and specialized telecom infrastructure opens new markets. Flexible project based access, IP‑lite licensing and integration support help bring ASIC design within reach for midsize players.

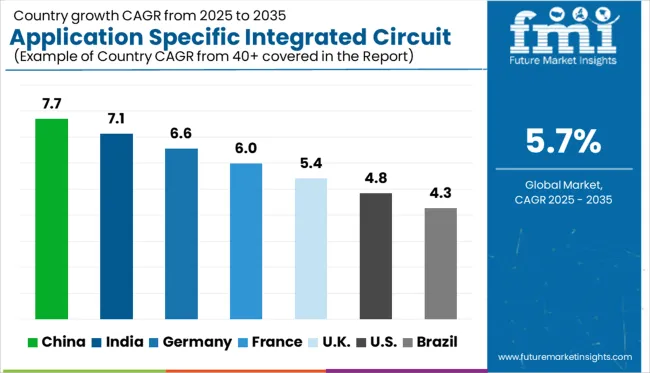

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

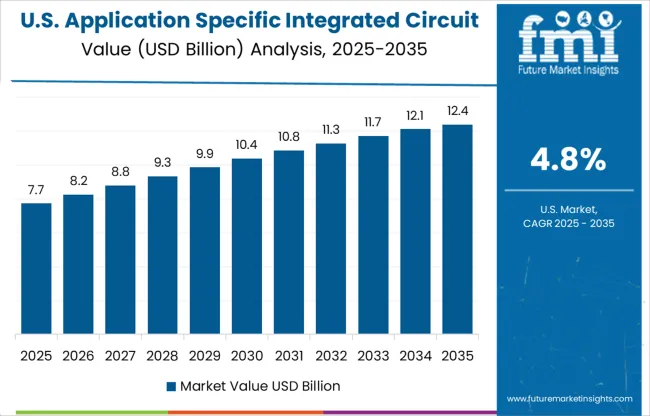

| USA | 4.8% |

| Brazil | 4.3% |

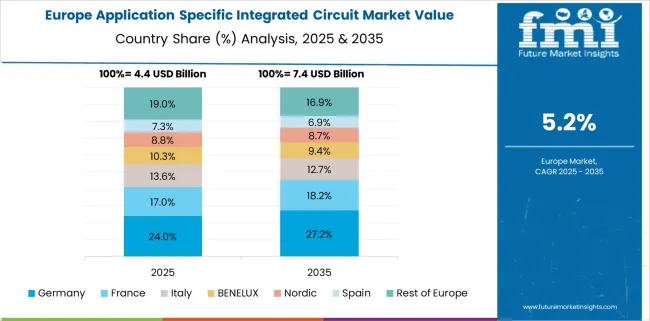

The global market is projected to expand at a CAGR of 5.7% from 2025 to 2035, driven by rising demand for customized silicon in AI, automotive, and industrial automation. China is leading growth with a 7.7% CAGR, supported by strong domestic semiconductor programs and growing AI chip manufacturing. India follows at 7.1%, underpinned by national electronics policies and R&D investments across fabless design. Germany, an OECD nation, registers 6.6% CAGR due to demand from its robust automotive and industrial automation sectors. The UK, with 5.4%, reflects innovation in telecommunications and defense applications. The US, though mature, shows a modest 4.8% CAGR, focusing on high-performance custom chips for aerospace and cloud computing. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is expanding at a 7.7% CAGR, with solid YoY growth driven by rising demand in telecommunications, automotive electronics, and consumer devices. The local chip design ecosystem is scaling rapidly, as domestic players accelerate development of proprietary ASICs to reduce reliance on imports. Most orders originate from OEMs in the 5G infrastructure and electric vehicle segments. Foundry partnerships with regional fabs are improving lead times for volume manufacturing. Performance-specific ASICs for AI accelerators and image processing are gaining traction in surveillance equipment and mobile devices. Government-backed initiatives are also funding startups focused on customizable chip platforms for industrial control systems.

India is progressing at a 7.1% CAGR, with healthy YoY expansion as demand rises from local consumer electronics, medical devices, and defense projects. ASIC development is becoming more localized with increased participation from fabless startups catering to home-grown IoT and embedded systems. Most chip designs are aimed at specific control functions in low-power and real-time use cases. Universities and technical institutes are contributing to ASIC research through joint development programs with private players. Rising demand for edge-based processors in smart metering and wearable applications is leading to new orders for mid-volume fabrication abroad.

Germany is growing at a 6.6% CAGR, with YoY improvements driven by automotive electronics, factory automation, and renewable energy systems. Demand is rising for precision ASICs used in motor control units, battery management, and industrial sensors. Design firms are focusing on temperature-stable and function-specific circuits suited to German automotive standards. Tier-1 suppliers in the EV and robotics sectors are placing long-term ASIC orders to optimize form factor and reduce latency in control systems. There is increasing preference for mixed-signal ASICs capable of integrating analog and digital functions within compact automotive modules.

The United Kingdom is advancing at a 5.4% CAGR, with modest YoY gains across sectors such as aerospace, communications, and security systems. Specialized ASICs are in demand for radar signal processing, encryption modules, and satellite communication hardware. Domestic chip designers are partnering with niche defense contractors to develop compact chips tailored to mission-critical performance conditions. The country is also seeing demand from industrial IoT deployments requiring long lifecycle support and minimal error margins. Custom silicon for radio frequency and sensor applications is contributing to a small but consistent growth trend.

The United States is expanding at a 4.8% CAGR, with steady YoY performance led by ASIC adoption in data centers, avionics, and healthcare devices. Key players are optimizing ASIC configurations for use in custom compute, neural networks, and image recognition workflows. Design optimization for thermal load and performance per watt is a primary focus in server and cloud hardware applications. Demand is also coming from aerospace equipment firms requiring radiation-hardened ASICs for mission durability. As large-scale integrators prioritize application-specific compute, interest is shifting from FPGAs to more efficient fixed-function silicon.

The application-specific integrated circuit (ASIC) market is moderately consolidated, with global semiconductor leaders shaping innovation across automotive, industrial, and consumer electronics. Infineon Technologies AG leads with strength in automotive ASICs, leveraging advanced power management and security features. Key players like STMicroelectronics, Texas Instruments, and Renesas Electronics support scalable ASIC solutions for embedded systems and IoT. Intel Corporation provides high-performance ASICs for data centers and AI workloads. Meanwhile, OMNIVISION specializes in image-sensing ASICs, and Tekmos Inc. offers legacy ASIC support and custom designs. Market momentum is driven by rising demand for custom silicon, energy-efficient designs, and integration into mission-critical systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.4 Billion |

| Type | Full Custom ASIC, Semi-custom ASIC, Cell-based, Array-based, Programmable ASIC, Field-Programmable Gate Array (FPGA), and Programmable Logic Device (PLD) |

| End Use | Telecommunications, Consumer Electronics, Automotive, Healthcare, Industrial, Aerospace & Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Infineon Technologies AG, OMNIVISION, Tekmos Inc., Intel Corporation, Honeywell International Inc., Renesas Electronics Corporation, STMicroelectronics, and Texas Instruments Inc. |

| Additional Attributes | Dollar sales by design type, end-use industry, and processing node; regional demand driven by custom chip adoption in automotive, telecom, and consumer electronics; innovation in low-power design, 3D packaging, and AI acceleration; cost dynamics shaped by design complexity, foundry access, and volume scalability; environmental impact from fabrication energy use; and emerging use cases in edge computing, cryptocurrency mining, and autonomous systems. |

The global application specific integrated circuit market is estimated to be valued at USD 19.4 billion in 2025.

The market size for the application specific integrated circuit market is projected to reach USD 33.7 billion by 2035.

The application specific integrated circuit market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in application specific integrated circuit market are full custom asic, semi-custom asic, cell-based, array-based, programmable asic, field-programmable gate array (fpga) and programmable logic device (pld).

In terms of end use, telecommunications segment to command 31.9% share in the application specific integrated circuit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Application Release Automation Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Controllers Market Size and Share Forecast Outlook 2025 to 2035

Application Virtualization Market Size and Share Forecast Outlook 2025 to 2035

Application Processor Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Network Market by Product, End-user, Environment, Deployment Type, Vertical, and Region, Forecast through 2035

Application Control Software Market Insights – Growth & Forecast 2025-2035

Application Metrics and Monitoring Tools Market Analysis By Component, Mode, Deployment, Verticals, and Region through 2035

Application Centric Infrastructure Market

Application Management Services Market Analysis – Trends & Forecast 2017-2027

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

MES Applications For Process Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

CRM Application Software Market Report – Forecast 2017-2022

Agile Application Life-Cycle Management Market Size and Share Forecast Outlook 2025 to 2035

Email Application Market Analysis by Product Type, Deployment, and Region Through 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA