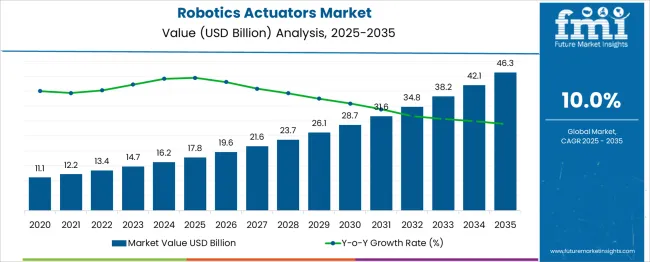

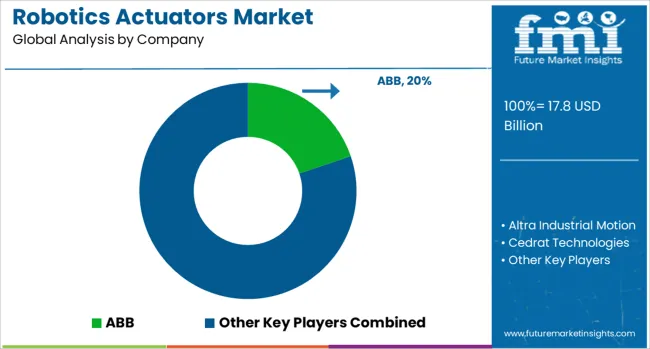

The Robotics Actuators Market is estimated to be valued at USD 17.8 billion in 2025 and is projected to reach USD 46.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Robotics Actuators Market Estimated Value in (2025 E) | USD 17.8 billion |

| Robotics Actuators Market Forecast Value in (2035 F) | USD 46.3 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The need for precise and reliable movement control has driven demand for sophisticated actuators that can deliver enhanced performance. Technological progress in actuator design has improved power efficiency and responsiveness, enabling their use in complex systems such as flight control.

The rise in aerospace applications has particularly contributed to growth, with flight control systems requiring actuators that provide high torque and precise positioning. Additionally, ongoing research into miniaturization and material innovation is making actuators more compact and durable.

As robotics becomes integral to manufacturing, defense, and aerospace sectors, the market outlook remains positive. Segment growth is expected to be led by electric actuation technology, torque-focused characteristics, and applications in flight control systems.

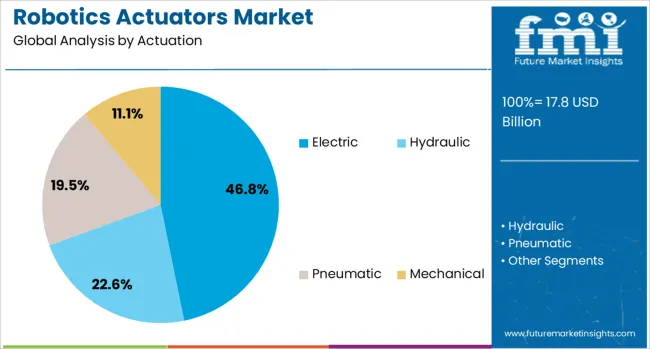

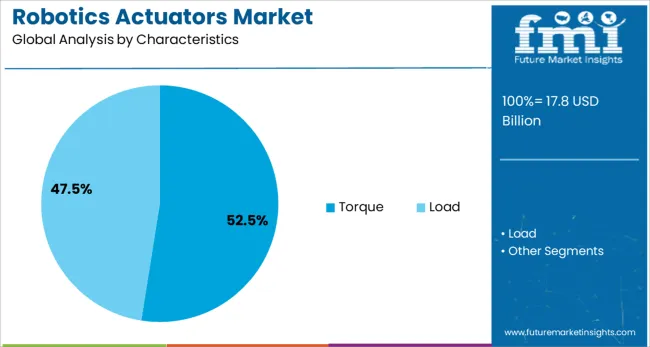

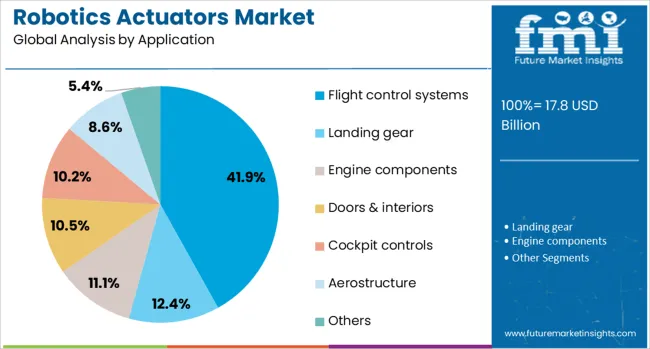

The robotics actuators market is segmented by actuation, characteristics, application, type, and end use and geographic regions. By actuation of the robotics actuators, the market is divided into Electric, Hydraulic, Pneumatic, and Mechanical. The robotics actuators market is classified into Torque and Load. Based on the application of robotics actuators, the market is segmented into Flight control systems, Landing gear, Engine components, Doors & interiors, Cockpit controls, Aerostructure, and Others. The robotics actuators market is segmented by type into Rotary and Linear. The robotics actuators market is segmented by end use into Automotive, Oil & gas, Chemicals & CPI, Water & wastewater, Paper & pulp, Mining, Food & beverages, and Others. Regionally, the robotics actuators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric actuation segment is projected to hold 46.8% of the robotics actuators market revenue in 2025, retaining its leadership among actuation types. This dominance is attributed to the efficiency and precision offered by electric actuators in controlling robotic motion. They are favored for their ease of integration with electronic control systems and adaptability across various robotic platforms.

The growing complexity of robotic applications demands actuation that can deliver consistent and repeatable torque output, making electric actuators the preferred choice. Furthermore, advancements in motor technologies have enhanced their performance while reducing energy consumption.

The ability to operate quietly and require minimal maintenance further supports their widespread adoption. The electric segment is poised to maintain its lead as robotics applications continue to evolve.

The torque characteristic segment is expected to contribute 52.5% of the market revenue in 2025, reflecting its importance in robotics actuator performance. Torque is essential for enabling actuators to generate the rotational force necessary for precise movement and control in robotic systems. Applications that require lifting, positioning, or manipulating heavy loads rely heavily on actuators with high torque capabilities.

The demand for reliable and powerful torque output has increased with the expansion of robotics in sectors such as aerospace, manufacturing, and defense. Innovations that optimize torque while maintaining compact actuator size have gained attention.

The torque segment’s significance is reinforced by its critical role in ensuring smooth and accurate robotic operations across varied applications.

The flight control systems segment is projected to account for 41.9% of the robotics actuators market revenue in 2025, solidifying its position as the leading application area. Growth in this segment is driven by the aerospace industry's need for actuators that provide precise and reliable control of aircraft surfaces. Flight control systems require actuators capable of delivering high torque and responsiveness under demanding environmental conditions.

The increasing focus on unmanned aerial vehicles and advanced aircraft has further propelled demand. Safety and performance standards in aerospace necessitate actuators that can operate consistently and withstand rigorous testing.

As aerospace technology advances, flight control systems will continue to represent a critical market for robotics actuators, driving innovation and adoption.

Robotics actuator demand has increased as performance expectations have risen across industrial automation, service robots, and logistics applications. Linearity, torque precision, and compact size are being prioritized in actuator specifications. Electric, pneumatic, and hydraulic actuation systems are being implemented to meet payload, speed, and positional accuracy requirements. Integration with motion control platforms, safety systems, and modular robotic arms has improved flexibility for both large assembly plants and agile delivery robots. Manufacturers have focused on enhancing efficiency through feedback systems, energy recovery, and collaboration-ready designs.

Robotics actuators are being selected due to their ability to combine precise torque control, low backlash gearing, and positional repeatability. High-resolution encoders and torque sensors have enabled closed-loop feedback for real-time adjustment during pick-and-place operations. Multi-axis actuator modules with compact designs have been deployed in collaborative robots to handle tasks such as assembly, palletizing, and medical device handling. Actuators capable of fast acceleration and low inertia responses have improved cycle time and throughput. Integration with safety-rated drives and compliance-sensing modules has supported safe operation alongside human workers. End users in automotive manufacturing, warehouse automation, and laboratory instrumentation have adopted actuators offering plug-and-play compatibility and simplified cabling, improving machine uptime and system adaptability.

Despite performance benefits, actuator adoption has been limited by incompatibility between vendor-specific interfaces and motion control platforms. Firmware updates, encoder calibration and drive tuning have required specialist technical support and extended commissioning timelines. Servo and torque actuator components can be expensive relative to simple pneumatic alternatives, discouraging usage in cost-sensitive projects. Integration of sensors, safety feedback and real-time control loops has prolonged system validation and testing phases. Lack of unified protocols for robot-grade actuator modules has restricted modularity across brands. Limited availability of engineering support in emerging markets has impeded local system deployment and tuning.

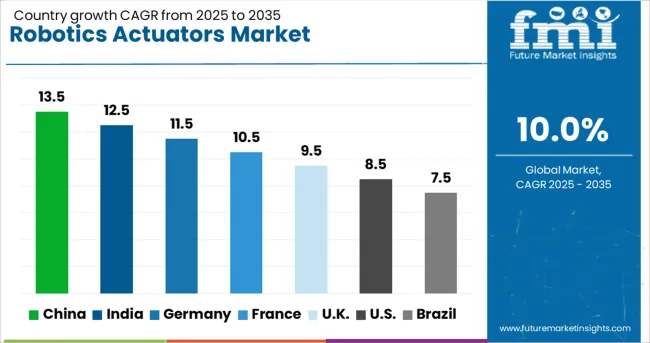

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global robotics actuators market is projected to expand at a 10.0% CAGR from 2025 to 2035. Among 40 countries analyzed, China leads at 13.5%, followed by India at 12.5% and Germany at 11.5%, while France posts 10.5% and the United Kingdom records 9.5%. These growth premiums indicate +35% for China, +25% for India, and +15% for Germany above the global average, whereas France and the UK remain close to baseline performance. Market divergence is shaped by robotics integration in manufacturing and logistics in China, EV and automation adoption in India, Industry 4.0 innovation in Germany, aerospace and food automation in France, and warehouse robotics modernization in the UK. The report includes analysis of over 40 countries, with five profiled below for reference.

China is expected to grow at a 13.5% CAGR, driven by strong demand for robotic automation in automotive, electronics, and intralogistics sectors. High-volume deployments of collaborative robots and AGVs are accelerating actuator consumption in industrial clusters. Domestic OEMs are focusing on developing compact, energy-efficient actuators for articulated and SCARA robots. National programs such as “Made in China 2025” are incentivizing smart factories, increasing the adoption of servo-electric and integrated actuator systems. Demand for AI-enabled actuators supporting predictive maintenance continues to grow in Tier I manufacturing zones.

India is projected to grow at a 12.5% CAGR, supported by increased automation in automotive assembly, electronics, and healthcare robotics. Expanding EV production is driving demand for actuators in welding, painting, and material handling robots. Compact electric actuators are preferred in collaborative robots for mid-sized manufacturing facilities. Local partnerships with global actuator suppliers are strengthening supply chain availability. Robotics integration under the PLI and Digital India initiatives is promoting adoption in MSME clusters, while robotics-assisted surgery and warehouse automation add new growth avenues.

Germany is forecast to grow at an 11.5% CAGR, supported by advanced robotics adoption in automotive, aerospace, and precision engineering sectors. Servo-hydraulic and electric actuators are preferred for their high accuracy and energy efficiency in industrial robots. Industry 4.0 innovation has driven integration of actuators with digital twin platforms for predictive maintenance and real-time performance optimization. Flexible manufacturing systems require actuators with quick-change capabilities to accommodate dynamic production schedules. Germany’s export leadership in high-precision robotics adds momentum to actuator demand from global markets.

France is expected to grow at a 10.5% CAGR, driven by investments in defense robotics, aerospace, and food processing automation. Actuator demand is strong for high-torque systems in robotic arms used for aircraft assembly. Compact actuators for cobots and mobile robots are gaining traction in packaging and pharmaceutical industries. Government-led R&D programs support actuator innovation for advanced robotics platforms. Automation in logistics warehouses is further fueling demand for actuators integrated with smart sensors for improved positioning accuracy and energy savings.

The United Kingdom is projected to grow at a 9.5% CAGR, with major adoption in logistics automation, e-commerce warehouses, and healthcare robotics. Electric actuators are widely deployed in robotic arms and mobile platforms for flexible manufacturing systems. Growth in AGV and AMR installations accelerates actuator consumption for intralogistics and material handling. UK-based OEMs are developing lightweight actuators for mobile service robots to support aging workforce solutions. Robotics integration in pharmaceutical production is boosting demand for high-precision actuator systems with cleanroom compatibility.

The robotics actuators market is characterized by intense competition among global automation and motion control leaders, including ABB, Rockwell Automation, Moog, SMC, Curtiss-Wright, Tolomatic, SKF, Festo, Altra Industrial Motion, Cedrat Technologies, DVG Automation, Nook Industries, and Harmonic Drive LLC. ABB maintains leadership through advanced actuator integration in industrial automation platforms, improving motion precision and operational reliability. Harmonic Drive LLC specializes in compact, high-precision gear actuators, extensively deployed in collaborative robots and surgical robotics. Rockwell Automation and Moog focus on electromechanical actuator solutions designed for heavy-duty and high-torque applications. SMC dominates pneumatic actuator technology, catering to cost-sensitive and fast-response systems. Cedrat Technologies and Tolomatic target niche applications requiring high-performance linear actuators. Competitive dynamics emphasize accuracy, durability, connectivity, and energy efficiency. Demand for miniaturized actuators and connected motion solutions continues to accelerate product innovation and strategic alliances.

In June 2025, ABB introduced the Flexley Mover P603 at Automatica in Munich. This AI-powered Autonomous Mobile Robot (AMR) features Visual-SLAM navigation, ±5 mm positioning accuracy. It supports payloads up to 1,500 kg without fixed paths, enabling flexible and efficient material handling in industrial environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.8 Billion |

| Actuation | Electric, Hydraulic, Pneumatic, and Mechanical |

| Characteristics | Torque and Load |

| Application | Flight control systems, Landing gear, Engine components, Doors & interiors, Cockpit controls, Aerostructure, and Others |

| Type | Rotary and Linear |

| End Use | Automotive, Oil & gas, Chemicals & CPI, Water & wastewater, Paper & pulp, Mining, Food & beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Altra Industrial Motion, Cedrat Technologies, Curtis Wright, DVG Automation, Emerson Electric CO., Harmonic Drive LLC, Macron Dynamics, MISUMI Group Inc., Moog, Nook Industries Inc., Rockwell Automation, SKF, SMC, and Tolomatic |

| Additional Attributes | Dollar sales by actuation type (electric, hydraulic, pneumatic, mechanical), with electric actuators leading for high precision and efficiency. Rotary actuators are increasingly adopted for versatile motion control in robotics. Regional trends are dominated by Asia-Pacific, driven by large-scale industrial automation and rapid integration of robotic systems in manufacturing. Key players focus on miniaturization, torque optimization, and smart sensor integration. |

The global robotics actuators market is estimated to be valued at USD 17.8 billion in 2025.

The market size for the robotics actuators market is projected to reach USD 46.3 billion by 2035.

The robotics actuators market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in robotics actuators market are electric, hydraulic, pneumatic and mechanical.

In terms of characteristics, torque segment to command 52.5% share in the robotics actuators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Robotics Sweeper Market

Lab Robotics Market

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Robotics Market Insights - Growth & Forecast 2025 to 2035

Warehouse Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robotics Retrofit Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Robotics Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robotics Market Growth – Trends & Forecast 2025-2035

Internet of Robotics Things - Market Trends & Forecast 2025 to 2035

Cyber Security in Robotics Market Size and Share Forecast Outlook 2025 to 2035

Medical Rehabilitation Robotics Market Trends - Growth & Forecast 2025 to 2035

Motion Control Software in Robotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA