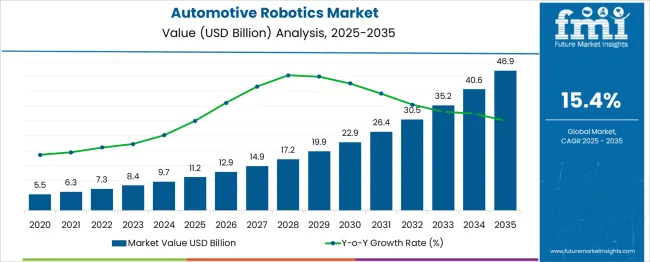

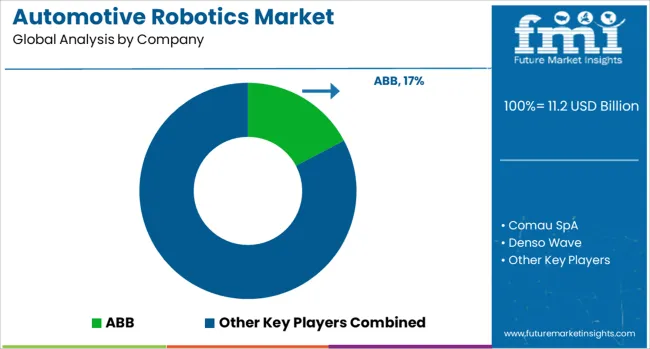

The Automotive Robotics Market is estimated to be valued at USD 11.2 billion in 2025 and is projected to reach USD 46.9 billion by 2035, registering a compound annual growth rate (CAGR) of 15.4% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Robotics Market Estimated Value in (2025 E) | USD 11.2 billion |

| Automotive Robotics Market Forecast Value in (2035 F) | USD 46.9 billion |

| Forecast CAGR (2025 to 2035) | 15.4% |

The automotive robotics market is experiencing steady growth as vehicle manufacturers increasingly automate production processes to improve efficiency and quality. The growing demand for advanced manufacturing techniques and precision assembly has accelerated the adoption of robotics technology in the automotive sector.

Innovations in robotics hardware have enhanced system reliability and performance, enabling manufacturers to meet high-volume production demands. Additionally, rising labor costs and the need to maintain consistent product quality have driven investment in automated solutions.

The integration of robotics with digital manufacturing and Industry 4.0 initiatives has further expanded market potential. Increasing emphasis on safety and ergonomic solutions on production floors is supporting robotics adoption across various applications. Market expansion is expected to be supported by continued development of robotic components, diversified robot types, and broadening applications within the automotive industry. Segment growth is anticipated to be led by hardware components, articulated robots, and material handling applications.

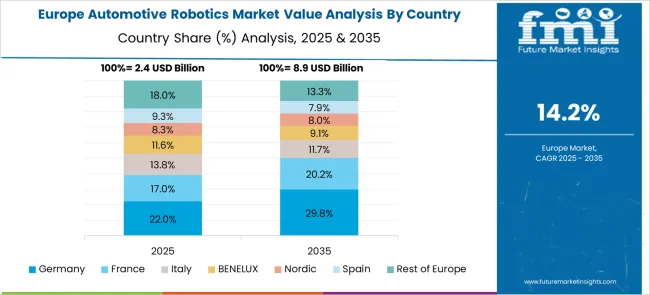

The automotive robotics market is segmented by component, robot type, application, payload capacity, deployment type, and technology, as well as geographic regions. The automotive robotics market is divided into Hardware, Software, and Service. The automotive robotics market is classified into Articulated robots, SCARA robots, Cartesian robots, Cylindrical robots, and Others. The automotive robotics market is segmented based on application into Material handling, Welding, Assembly/disassembly, Inspection, Cutting and processing, Logistics and warehouse automation, and Others. The payload capacity of the automotive robotics market is segmented into 16-60 kg, up to 16 kg, 60-225 kg, and More than 225 kg. The automotive robotics market is segmented by deployment type into Fixed robots and Mobile robots. The automotive robotics market is segmented by technology into Machine learning and artificial intelligence, 3D vision systems, IoT integration, and Cloud robotics. Regionally, the automotive robotics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

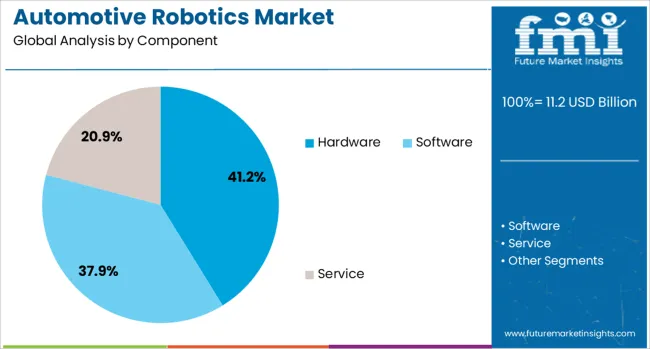

The hardware segment is projected to hold 41.2% of the automotive robotics market revenue in 2025, dominating the component category. This growth is driven by the increasing demand for durable and precise robotic parts such as sensors, controllers, and actuators that are critical for the performance of automotive robots.

Enhanced hardware capabilities enable robots to operate with higher accuracy and reliability in complex manufacturing environments. The adoption of modular and scalable hardware designs has facilitated easier integration and maintenance.

Moreover, technological advancements have improved energy efficiency and operational lifespan of hardware components. As automotive manufacturing becomes more sophisticated, the reliance on robust hardware components is expected to continue expanding.

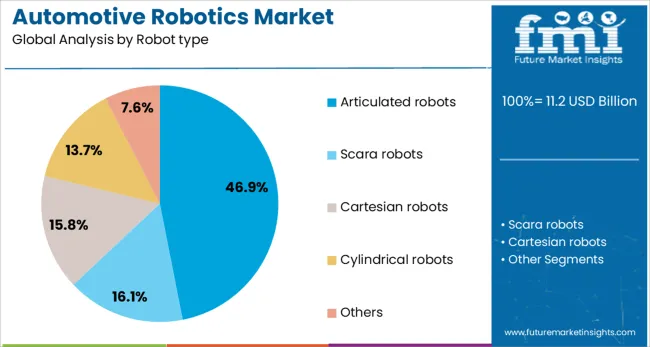

The articulated robots segment is expected to contribute 46.9% of the market revenue in 2025, leading the robot type category. These robots are favored due to their high degree of freedom and flexibility, making them suitable for a wide range of automotive manufacturing tasks including welding, assembly, and painting.

Their ability to mimic human arm movements allows for precise and complex operations. The widespread use of articulated robots is supported by their adaptability to different production lines and ease of programming.

Their role in improving productivity and product quality has cemented their position as the preferred robot type in automotive manufacturing.

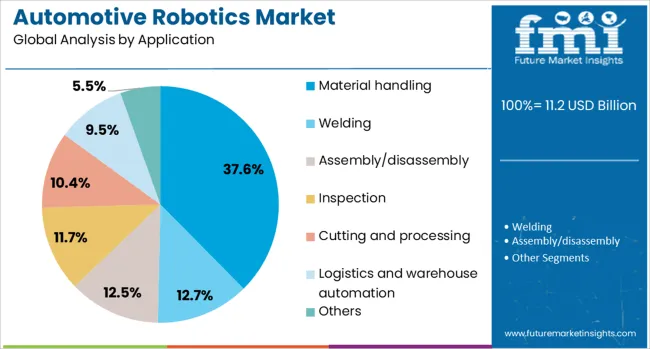

Material handling is projected to account for 37.6% of the automotive robotics market revenue in 2025, securing its place as the largest application segment. This growth is driven by the critical need to automate the movement, sorting, and storage of parts and finished products in automotive plants.

Automation of material handling reduces manual labor costs, increases throughput, and enhances workplace safety. The complexity of automotive supply chains has made efficient material handling essential to maintaining production flow and reducing downtime.

Robotic systems for material handling are valued for their precision, speed, and ability to operate continuously in demanding environments. As production volumes grow, the demand for automated material handling solutions is expected to rise steadily.

Automotive robotics adoption has intensified to boost efficiency, precision, and adaptability in production processes. Demand has been driven by the need for quality assurance, operational safety, and automation of complex and hazardous tasks.

The automotive sector has witnessed extensive adoption of robotics in assembly and production operations. Automated systems have been implemented to reduce cycle time, enhance precision, and maintain consistent output quality. High demand for robotic arms in welding, painting, and material handling has been encouraged by the need for efficiency and defect-free manufacturing. Robotic solutions are considered essential for handling repetitive tasks in large-scale production units. Manufacturers have been focusing on incorporating collaborative robots that can work in proximity to human workers without compromising safety standards. The shift toward flexible automation systems has been evident in facilities seeking adaptability to varied model designs and frequent production changes.

The growing complexity of vehicle design has increased the necessity for advanced robotics in automotive plants. Robotics has been deployed to address challenges related to accuracy in part assembly and uniformity in component placement. Enhanced reliability in handling intricate processes such as engine installation and precision painting has been prioritized by manufacturers. Robotic systems have been identified as instrumental in reducing workplace accidents by automating hazardous tasks. Their usage has expanded across production lines to support ergonomic efficiency and lower operational risks. Implementation in quality inspection processes has also been accelerated to ensure compliance with international standards and minimize recall probabilities.

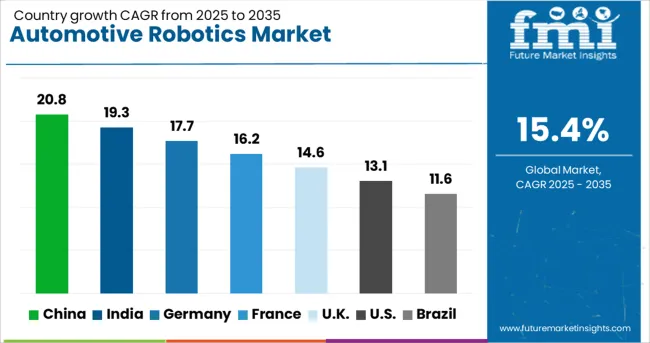

| Country | CAGR |

|---|---|

| China | 20.8% |

| India | 19.3% |

| Germany | 17.7% |

| France | 16.2% |

| UK | 14.6% |

| USA | 13.1% |

| Brazil | 11.6% |

The automotive robotics industry, anticipated to grow at a global CAGR of 15.4% from 2025 to 2035, has displayed significant variation across major economies. A strong 20.8% CAGR is being observed in China, a BRICS member, due to large-scale manufacturing and extensive automation investments. India, also part of BRICS, is demonstrating a 19.3% CAGR, supported by expanding automotive production and the preference for collaborative robotic solutions. Germany, an OECD member, is posting a 17.7% CAGR driven by automation in premium vehicle manufacturing and demand for precision engineering. The United Kingdom is reporting a 14.6% CAGR with gradual adoption in advanced assembly lines, while the United States stands at 13.1% CAGR, influenced by the modernization of existing facilities and the integration of robotics in EV production. The report provides a comprehensive outlook covering 40+ countries, with these five identified as the leading growth contributors in the forecast period.

China escalated from nearly 14.9% CAGR during 2020-2024 to an impressive 20.8% in 2025-2035, supported by rapid industrial automation and extensive EV manufacturing. High-volume assembly operations created significant demand for robotic welding, painting, and material handling systems across OEM plants. Investments from global robotics suppliers and domestic automation firms were concentrated in key automotive hubs like Shanghai and Guangzhou, where modular robotic cells were deployed for multipurpose assembly. Government-led initiatives encouraging smart manufacturing accelerated adoption in Tier-1 facilities. Robotic integration also extended into EV battery module production and powertrain lines to ensure accuracy and minimize defects, establishing China as the largest growth contributor worldwide.

The CAGR value surged from around 13.4% in 2020-2024 to 19.3% for the period of 2025-2035, driven by accelerated vehicle production and robotic automation initiatives across domestic OEM plants. Increased adoption of collaborative robots in assembly operations was witnessed to enhance flexibility and reduce error rates in multi-variant production. Automotive component suppliers integrated robotics for tasks such as precision welding, adhesive application, and quality checks to meet global compliance standards. State-backed manufacturing programs under initiatives similar to industrial competitiveness schemes supported deployment in Tier-2 and Tier-3 manufacturing units. Integration of robotics in EV platforms and localization of automation technologies reshaped the supply chain landscape for OEMs.

Germany increased from 12.6% CAGR during 2020-2024 to 17.7% across 2025-2035, fueled by strong demand for robotics in premium automotive and EV manufacturing. German OEMs focused on deploying high-precision robotic solutions in paint shops, powertrain assembly, and advanced welding lines. Automation investment was amplified to maintain product quality while reducing operational downtime in high-volume production cycles. Strategic partnerships with leading robotics brands enhanced factory flexibility for multi-model manufacturing. Robotics was also integrated into digitalized production systems under Industry 4.0 frameworks to ensure predictive maintenance and efficient cycle times, allowing Germany to remain a leader in automation-driven vehicle production.

The CAGR for the UK climbed from around 10.3% during 2020-2024 to 14.6% during the forecast period 2025-2035, supported by a transition toward EV-focused manufacturing and modernization of production plants. Robotics adoption accelerated in welding and painting operations, targeting consistency and minimizing manual error in complex designs. Local automotive plants upgraded to robotic systems for quality testing and safety validation in compliance with EU standards. Integration of collaborative robots into semi-automated lines enabled cost efficiency and improved worker ergonomics in niche production facilities. Strategic alliances between UK-based OEMs and robotics providers contributed to steady demand growth despite a mature manufacturing environment.

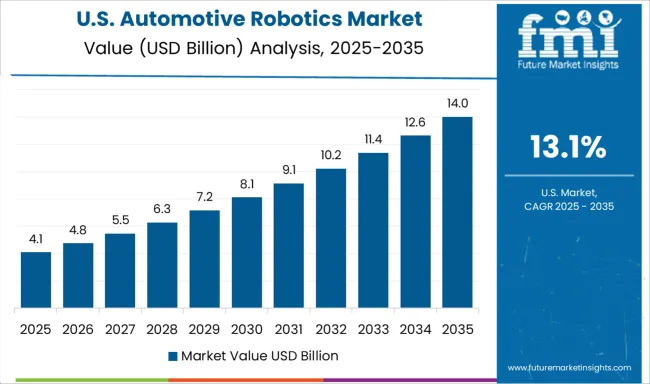

The United States market moved from a CAGR of 9.8% in 2020-2024 to 13.1% during 2025-2035, supported by rising automation in EV and hybrid vehicle production facilities. Robotic adoption expanded in powertrain assembly, chassis welding, and advanced painting lines to address labor shortages and ensure throughput consistency. Increased investment by automotive giants in automated quality inspection reduced operational risks and recall rates. North American OEMs leveraged robotics in flexible assembly lines for SUVs and EVs, while collaborative robotics gained traction in semi-automated environments. Partnerships between robotics manufacturers and technology providers accelerated AI-driven control in robotic arms, improving real-time adaptability in dynamic production processes.

In the automotive robotics industry, global leaders are focused on precision automation, flexible assembly, and AI-based process optimization to meet the growing demand for robotic integration in vehicle production. Companies such as ABB, Fanuc Corporation, and KUKA Robotics have strengthened their positions by expanding collaborative robot portfolios and enhancing welding and painting solutions for automotive OEMs. Yaskawa Electric Corporation and Kawasaki Heavy Industries have prioritized EV assembly automation and intelligent robotic control systems to optimize production cycles. Emerging innovation is being shaped by players like Universal Robots, advancing cobot deployments for smaller automotive suppliers. Automation and motion control specialists such as Omron Corporation, Rockwell Automation, and Seiko Epson Corporation are focusing on integrating predictive maintenance and real-time quality inspection. Niche providers, including Harmonic Drive System, Stäubli, and Reis GmbH & Co., are contributing to advanced gear technology and safety-compliant robotic solutions. Panasonic Welding Systems, Comau SpA, and Denso Wave remain active in welding automation and assembly robotics across global automotive hubs.

ABB completed the acquisition of Sevensense in 2024 to boost its AI-driven robotics and logistics automation footprint.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.2 Billion |

| Component | Hardware, Software, and Service |

| Robot type | Articulated robots, Scara robots, Cartesian robots, Cylindrical robots, and Others |

| Application | Material handling, Welding, Assembly/disassembly, Inspection, Cutting and processing, Logistics and warehouse automation, and Others |

| Payload Capacity | 16–60 kg, Up to 16 kg, 60–225 kg, and More than 225 kg |

| Deployment Type | Fixed robots and Mobile robots |

| Technology | Machine learning and artificial intelligence, 3D vision systems, IoT integration, and Cloud robotics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Comau SpA, Denso Wave, Dürr AG, Fanuc Corporation, Harmonic Drive System, Kawasaki Heavy Industries, KUKA Robotics, Nachi-Fujikoshi Corp, Omron Corporation, Panasonic Welding Systems Co. Ltd., Reis Gmbh & Co., Rockwell Automation, Seiko Epson Corporation, Stäubli, Universal Robots, Yamaha Robotics, and Yaskawa Electric Corporation |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive landscape, technology adoption rates, end-user preferences, growth drivers, pricing analysis, regulatory impact, and future opportunities for EV and autonomous vehicle integration. |

The global automotive robotics market is estimated to be valued at USD 11.2 billion in 2025.

The market size for the automotive robotics market is projected to reach USD 46.9 billion by 2035.

The automotive robotics market is expected to grow at a 15.4% CAGR between 2025 and 2035.

The key product types in automotive robotics market are hardware, _controller, _robot arm, _end-effector, _sensors, _others, software and service.

In terms of robot type, articulated robots segment to command 46.9% share in the automotive robotics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA