The warehouse robotics market is expanding rapidly, fueled by the growth of e-commerce, supply chain automation, and demand for high-throughput warehouse operations. Rising labor costs and the need for faster, more accurate order fulfillment are accelerating robotic integration.

The market benefits from advances in AI, machine vision, and real-time navigation systems, which have improved robot autonomy and coordination. Scalable robotic solutions are being increasingly adopted by logistics providers, third-party warehouses, and retail fulfillment centers to optimize storage utilization and workflow efficiency.

The outlook remains positive as companies prioritize automation to achieve operational resilience and minimize human intervention. The convergence of robotics with IoT and data analytics is expected to further enhance performance efficiency and drive long-term market growth.

| Metric | Value |

|---|---|

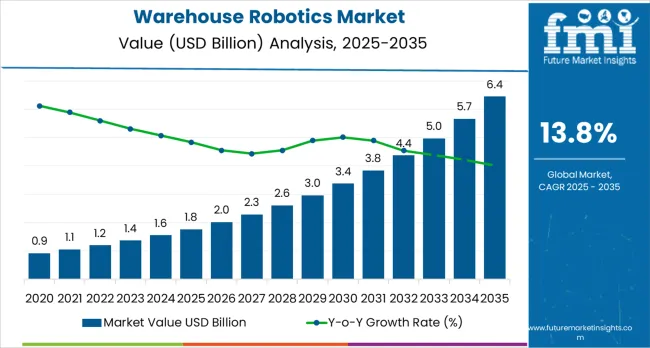

| Warehouse Robotics Market Estimated Value in (2025 E) | USD 1.8 billion |

| Warehouse Robotics Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 13.8% |

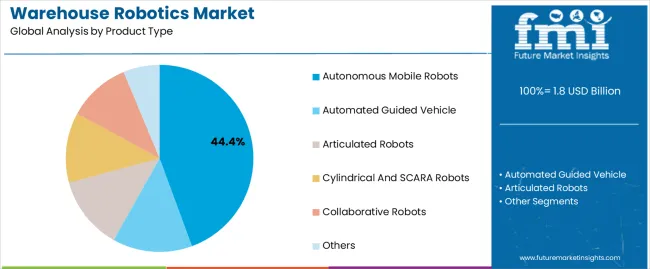

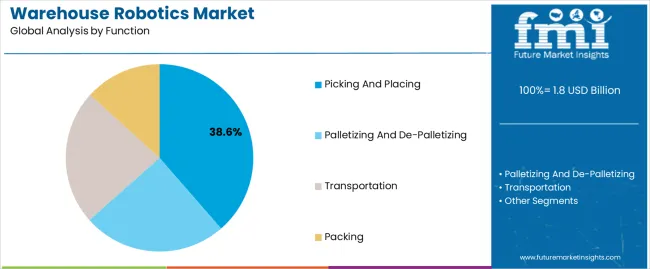

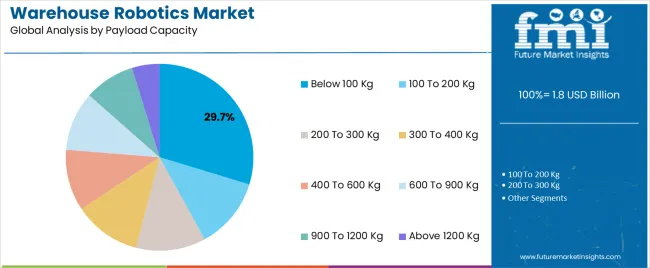

The market is segmented by Product Type, Function, Payload Capacity, and End-Use Industry and region. By Product Type, the market is divided into Autonomous Mobile Robots, Automated Guided Vehicle, Articulated Robots, Cylindrical And SCARA Robots, Collaborative Robots, and Others. In terms of Function, the market is classified into Picking And Placing, Palletizing And De-Palletizing, Transportation, and Packing. Based on Payload Capacity, the market is segmented into Below 100 Kg, 100 To 200 Kg, 200 To 300 Kg, 300 To 400 Kg, 400 To 600 Kg, 600 To 900 Kg, 900 To 1200 Kg, and Above 1200 Kg.

By End-Use Industry, the market is divided into Food And Beverage, Electronics And Electrical, Metal And Machinery, Automotive, Pharmaceuticals, Independent Warehouse, Cold Storage, Dry Storage, E-Commerce, Chemical, Rubber And Plastics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The autonomous mobile robots (AMRs) segment leads the product type category with approximately 44.4% share, reflecting growing demand for flexible, intelligent mobility solutions. AMRs are designed to operate collaboratively with humans and other automated systems, ensuring adaptability in dynamic warehouse environments.

Their ability to navigate using sensors and mapping technologies without fixed infrastructure reduces installation time and costs. The segment’s growth is supported by its use in goods transportation, inventory movement, and real-time logistics management.

As fulfillment centers focus on scalability and space optimization, AMRs provide a modular automation solution. With continuous technological improvements and declining hardware costs, the AMR segment is expected to remain dominant over the forecast horizon.

The picking and placing segment holds approximately 38.6% share of the function category, underpinned by its critical role in improving order accuracy and throughput efficiency. Robotic systems equipped with advanced vision sensors and AI-driven motion algorithms enable precise handling of diverse products.

This segment benefits from the rising complexity of product assortments and growing demand for rapid fulfillment in e-commerce and retail logistics. Integration with warehouse management systems ensures seamless coordination between robots and inventory databases.

As industries focus on minimizing manual errors and optimizing workflow, adoption of robotic picking and placing systems continues to expand. The segment’s importance will further grow as labor shortages and order customization increase operational pressure on warehouses.

The below 100 kg segment leads the payload capacity category with approximately 29.7% share, supported by demand for lightweight and energy-efficient robots in small to medium warehouse operations. This category caters primarily to e-commerce, consumer goods, and retail applications requiring frequent but light payload movements.

Compact design, ease of deployment, and low maintenance requirements make these robots cost-effective for flexible automation. The segment benefits from growing demand for last-mile logistics and fulfillment centers that handle high product turnover.

With the trend toward micro-warehousing and increased adoption by SMEs, the below 100 kg segment is expected to sustain its leading share through the forecast period.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 5,609.75 million |

| Market Value for 2025 | USD 5,609.75 million |

| Market CAGR from 2020 to 2025 | 11.7% |

The market analysis for warehouse robotics that is split and is explained in the following part emphasizes how automated guided vehicles (AGVs) are prevalent in the type category and function of transportation.

Extensive research highlights AGVs' role in changing warehouse automation, and the warehouse robotics market landscape now highlights transportation as a critical operational factor. These results highlight the crucial roles that transportation networks and AGVs play in determining how warehouse robotics innovation and acceptance develop.

| Leading Segment | Automated Guided Vehicle |

|---|---|

| Segment Share (2025) | 44.0% |

| Leading Segment | Transportation |

|---|---|

| Segment Share (2025) | 38.5% |

Extensive analysis in tables about major economies such as Australia, India, the United States, Germany, and China highlights the rapidly expanding field of warehouse robotics. A close look demonstrates Australia's enormous potential, offering much room for development and innovation.

Australia is a potential location for integrating and improving warehouse robotics solutions, with its growing economy and technical infrastructure. It is well-positioned to boost productivity and efficiency in logistics operations.

| Nation | Australia |

|---|---|

| CAGR (2025 to 2035) | 19.1% |

| Country | India |

|---|---|

| CAGR (2025 to 2035) | 16.8% |

| Country | United States |

|---|---|

| CAGR (2025 to 2035) | 13.9% |

| Nation | Germany |

|---|---|

| CAGR (2025 to 2035) | 11.9% |

| Nation | China |

|---|---|

| CAGR (2025 to 2035) | 10.9% |

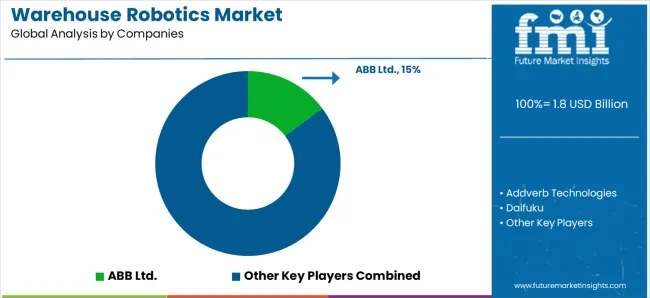

The producers of warehouse robotics foster competition and innovation by bringing special advantages to the table. ABB Ltd. and FANUC Corporation are leading the way with their modern warehouse robotics solutions, both renowned for their proficiency in industrial automation.

Geekplus Technology and Addverb Technologies demonstrate inventiveness in self-governing mobile robots, while Daifuku is a leader in material handling systems.

The warehouse robot market is diverse because warehouse robotics vendors like Hikrobot, IAM Robotics, and InVia Robotics Inc. provide state-of-the-art robotic systems for various warehouse applications. JBT contributes its knowledge in automated guided vehicles and material handling systems.

The competitive environment changes as businesses push the limits of warehouse automation, creating avenues for advancements and warehouse robotics market expansion.

Notable Developments

| Company | Details |

|---|---|

| KION Group | KION Group constructed a brand-new, highly automated warehouse in Germany in February 2025 to accommodate the shipping of spare parts. This new, fully automated distribution entry helped customers acquire spare parts faster and more effectively. |

| Honeywell International Inc. | To improve its technology and assist European logistics and warehouse industries, Honeywell International Inc. announced in February 2025 the launch of a new research and development facility. |

| KUKA Industries GmbH & Co. KG | KUKA Industries GmbH & Co. KG, Obernburg, has decided to sell its robotic automation integration company in June 2025. The new owners offer KUKA Industries and its employees a more aligned business model and a new strategic direction. It entails broader market exposure and the creation of more independent sales structures. |

| BlueBotics | BlueBotics presented ANTdriven.com in May 2025. Factories, supply chains, and warehouse managers can learn about and experiment with several automated vehicle technologies from the ANT navigation ecosystem using this new teaching resource. |

| Omron Corporation | To serve the logistics sector in Southeast Asia and Oceania, Omron Corporation established a new automation center in Singapore in December 2025. Cobots, cooperative robots, and AMRs, or autonomous mobile robots, are displayed at this automation center. |

| ABB Robotics | The FlexPicker IRB 365 robot, designed for picking and packing tasks up to 1.5 kg, was introduced by ABB Robotics in August 2025. Bottle handling, parcel sorting, and shelf-ready packaging are just a few of the many uses for this "fastest-in-class" robot. |

| FANUC | FANUC unveiled the CRX-5iA, CRX-20iA/L, and CRX-25iA collaborative robots in March 2025. Payloads between 4 and 35 kg can be handled by these robots. The use of these warehouse robotics is accelerated across industrial verticals by this characteristic. |

| Omron Corporation | Omron Automation introduced a powerful mobile robot with a 1500 kg payload capacity in July 2025. Due to its ability to handle large objects, the HD-1500 mobile robot gives producers more alternatives for autonomous material delivery. |

The global warehouse robotics market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the warehouse robotics market is projected to reach USD 6.6 billion by 2035.

The warehouse robotics market is expected to grow at a 13.8% CAGR between 2025 and 2035.

The key product types in warehouse robotics market are autonomous mobile robots, automated guided vehicle, articulated robots, cylindrical and scara robots, collaborative robots and others.

In terms of function, picking and placing segment to command 38.6% share in the warehouse robotics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Warehouse Design and Layout Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Tug Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

The Robotics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Robotics Prototyping Market Trends - Growth & Forecast 2025 to 2035

Warehouse Racking Market Growth - Trends & Forecast 2025 to 2035

Warehouse RFID Market Size, Share, Trends & Forecast 2024-2034

Warehouse Barcode Systems Market

Robotics Sweeper Market

Lab Robotics Market

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Smart Warehouse Technologies Market Size and Share Forecast Outlook 2025 to 2035

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Consumer Robotics Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA