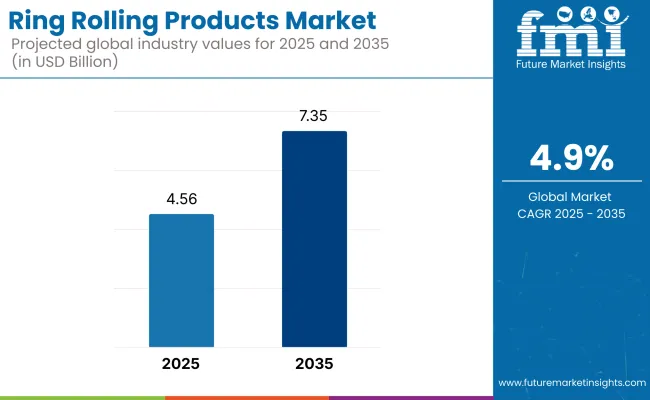

The global ring rolling products market is valued at USD 4.56 billion in 2025 and projected to reach USD 7.35 billion by 2035, growing at a 4.9% CAGR. This growth is powered by demand from aerospace, wind energy, and electric vehicle (EV) industries.

Countries like China, India, and the United States remain key manufacturing hubs, supported by reshoring trends and major infrastructure policies. Companies are prioritizing materials like high-strength steel and titanium, while segments such as slew bearings and turbine discs drive demand.

Rising demand for lightweight, corrosion-resistant parts in aerospace and EVs is accelerating the adoption of nickel-based alloys and composite-metal hybrids. Regulatory mandates in the U.S. (OSHA, EPA), EU (REACH, Energieeffizienzgesetz), and Asia (ISHA, METI, CPCB) are pushing manufacturers to adopt low-emission forging, automation, and quality-compliant processes. Radial axial rolling is the most used technology, especially for precision components in wind turbines and aerospace applications.

Looking ahead, investment in AI-enabled quality control, smart forging systems, and localized supply chains will define industry evolution. The fastest-growing sub-segment by size will be 1000 to 2000 mm rings, aligned with wind turbine deployment. Forgital Group, SMS Group, and Scot Forge are among the dominant players, accounting for over 60% of market share. Regional priorities will differ-USA focuses on automation, Western Europe on sustainability, and Japan/South Korea on compact, cost-effective forging solutions.

The slew bearings and turbine discs segments form the backbone of high-load applications in wind power, aerospace, and construction equipment. Slew bearings are vital for rotational movement in large assemblies, such as wind turbine nacelles and cranes, while turbine discs find use in both energy generation and propulsion systems.

Global investments in renewable energy infrastructure-particularly offshore wind projects-have spurred an uptick in demand for large, high-precision ring-rolled components. Additionally, the aerospace sector’s ongoing fleet upgrades and the electrification of construction machinery are expanding applications for seamless rings and gear blanks.

The smooth ring subsegment is gaining popularity in oil & gas pipelines and chemical processing due to its structural uniformity and reliability under pressure. Similarly, pressure vessels, requiring high strength and crack resistance, are critical to energy storage and hydrogen production.

| Product Segment | CAGR (2025 to 2035) |

|---|---|

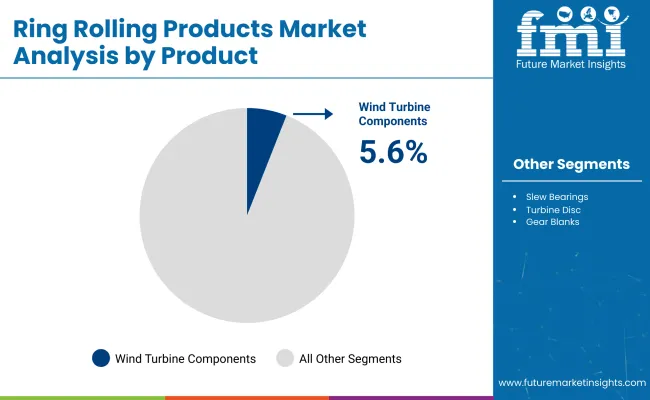

| Wind Turbine Components | 5.6% |

| Material | CAGR (2025 to 2035) |

|---|---|

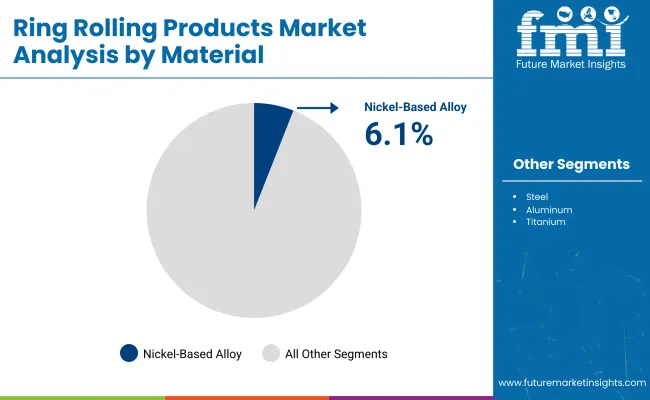

| Nickel-Based Alloy | 6.1% |

Steel remains the primary material used in ring rolling due to its mechanical strength, affordability, and ease of machining. It dominates general-purpose applications across automotive, railways, and construction. However, a major shift is underway as nickel-based alloys gain momentum-particularly in aerospace engines, nuclear reactors, and deep-sea oil rigs-thanks to their resistance to extreme temperatures, fatigue, and corrosion.

The increased demand for jet engine parts and high-efficiency turbines is driving this material's uptake. In parallel, titanium and aluminum alloys are becoming go-to materials for lightweight EV platforms and aircraft frames, helping manufacturers reduce fuel consumption and emissions. Meanwhile, composite-metal hybrids (e.g., aluminum-steel blends) are attracting attention for niche use in marine and defense sectors where both weight savings and structural integrity are paramount.

| Technology | CAGR (2025 to 2035) |

|---|---|

| Vertical Ring Rolling | 5.3% |

The radial axial rolling process has traditionally dominated due to its ability to deliver excellent concentricity and structural integrity-critical in aerospace and wind applications. However, vertical ring rolling is now gaining rapid adoption, particularly in the manufacturing of large-diameter rings required for wind turbines, offshore platforms, and heavy machinery. Its ability to accommodate larger and thicker ring profiles, combined with improved material utilization and energy efficiency, is making it the preferred choice in greenfield projects.

Technological advancements-such as AI-integrated rolling systems and smart defect detection-are enhancing the appeal of vertical systems. Meanwhile, horizontal ring rolling continues to find relevance in automotive and rail sectors due to its efficiency and suitability for high-volume, medium-sized rings. Manufacturers are increasingly investing in hybrid rolling facilities that integrate multiple technologies for flexibility in batch size and ring geometry.

The wind power industry is the fastest-growing end-use sector for ring rolling products. As nations accelerate their shift to renewable energy, the deployment of offshore wind farms-which require large, durable bearing rings for turbines-has surged. These components must endure high mechanical stress, corrosion, and harsh marine conditions.

Governments across Europe, China, and the USA are backing this expansion with clean energy policies and subsidies, making wind the most lucrative application. In aerospace, ring-rolled parts are critical for jet engines, landing gear, and structural assemblies-and their importance is increasing as manufacturers adopt lighter, stronger alloys for next-gen aircraft.

Automotive demand is supported by EV production, where ring-rolled components support lighter, more efficient drivetrain and suspension systems. The rail and marine sectors continue to demand forged rings for axle, coupling, and propulsion systems, though growth is more stable than explosive.

| End Use | CAGR (2025 to 2035) |

|---|---|

| Wind Power | 6.2% |

Global Trends

Regional Variance

The company is adopting new advanced manufacturing technologies

Major Trends

Perception of ROI (Return on Investment)

Consensus

High-Strength Steel Alloys: Due to their superior tensile strength and fatigue resistance, 67% of global stakeholders selected these.

Regional Material Choices

Shared Challenges

85% of surveyed participants indicated rising raw material and energy prices as a major concern.

Regional Price Sensitivities

Manufacturers

Distributors

Industrial Operators (End-Users)

Global Alignments

70% of world manufacturers intend to invest in automation, AI, and IoT-ready production lines.

Regional Differences

Key Takeaways

Strong Consensus: There persists a general importance of safety compliance, durability, and cost containment.

Key Variances

Strategic Insight

A single uniform solution is not feasible, as market demands vary by region. Firms must regionally customize their offerings:

That knowledge will shape 2025 and beyond into product development, pricing, and geographical expansion efforts for the industries.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| United Kingdom |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| India |

|

| 2020 to 2024 | 2025 to 2035 |

|---|---|

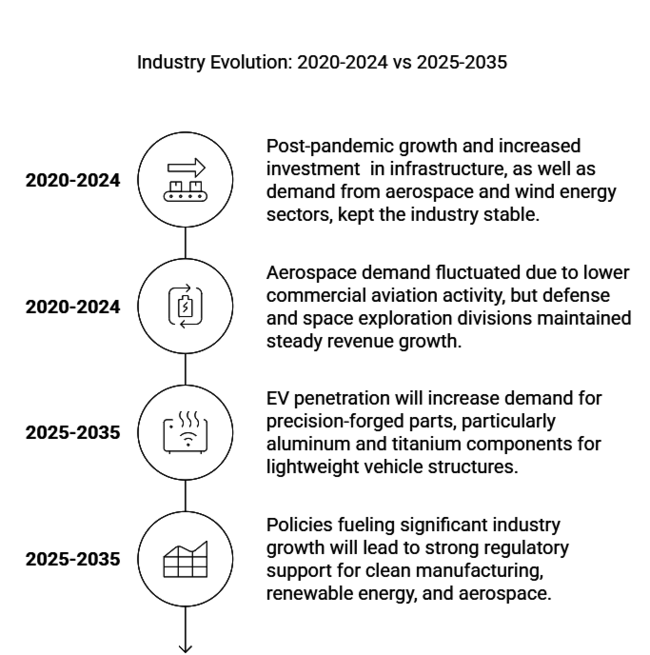

| Post-pandemic growth and increased investment in infrastructure, as well as demand from aerospace and wind energy sectors, kept the industry stable. | As far as the scope of automation, advanced materials, and heavy funding in clean energy and electric mobility go, the industry is bound to evolve at a rapid pace. |

| Disruptions from COVID-19 have caused temporary shortages of components in the supply chain and labor shortages, varying prices of raw materials, and disrupted production cycles. | Supply chains will become stable: manufacturers will localize production and adopt digital supply chain management to build resilience. |

| All over the world, stimulus packages implemented by governments alongside strengthening manufacturing, automotive, and energy sectors led to increased demand for ring rolling products. | Policies fuelling significant industry growth will lead to strong regulatory support for clean manufacturing, renewable energy, and aerospace. |

| Aerospace demand fluctuated due to lower commercial aviation activity, but defense and space exploration divisions maintained steady revenue growth. | Strong recovery and innovation of aerospace sector, notably lightweight and high-performance alloys for next-gen aircraft. |

| Automotive demand was erratic amid chip shortages and supply chain issues, but EV growth propped up the industry. | EV penetration will increase demand for precision-forged parts, particularly aluminium and titanium components for lightweight vehicle structures. |

| Investment in wind energy continued, especially in Europe and China, leading to increased demand for large seamless rings. | Wind power is another driving force, with offshore wind farms and the next generation of turbine designs exploiting a new class of high-performance rolling components. |

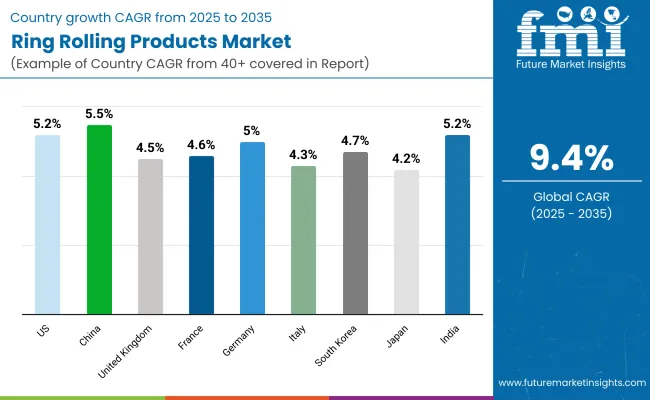

The ring rolling products industry is witnessing growth in the United States due to the presence of strong automotive, aerospace, and defence industries. The estimated incremental opportunity for the industry in the USA shall remain 5.2%. Demand for such components is driven by the Biden administration's infrastructure bill and greater investment in renewable energy projects.

Higher demand for strong metal rings is also being created by NASA and private space programs (e.g. SpaceX, Blue Origin). Strict quality and waste reduction regulations from OSHA, EPA, and ASTM are driving manufacturers toward high-end automation and AI-based defect detection. This growth in domestic production and reshoring efforts strengthens the USA industry as a key hub for ring rolling products.

The UK ring rolling sector is expanding, with rising demand in the aerospace, defense, and offshore wind power sectors. Post-Brexit trade policies have also promoted local production, reducing dependence on EU imports. The UKCA marking has taken the place of the CE marking, requiring businesses to re-evaluate their compliance strategies.

This has led to a focus on sustainability, with the UK government’s net-zero ambition (looking toward 2050) driving demand for a low-carbon manufacturing offering. The aerospace sector, still a major user of high-precision forged parts, is dominated by players such as Rolls-Royce and BAE Systems. Still, instability in the economy and fluctuating steel prices can cause issues. FMI opines that the United Kingdom rolling ring products industry will grow at nearly 4.5% CAGR through 2025 to 2035.

France has a strong industry for ring rolling products, primarily supported by the aerospace, automotive, and defence industries. As home of Airbus, France has very strict aviation standards (EN 9100) demanding very high quality on forged parts. In addition, heavy industries are subject to strong emissions control obligations under ICPE in France, which drives manufacturers to greener production technologies.

There is also enforcement of recycling in metal forging through the Extended Producer Responsibility (EPR) Law. France’s strong industrial base ensures stable demand, but high energy costs and competition from low-cost manufacturers in Asia and Eastern Europe may slow growth. FMI opines that the France rolling ring products industry will grow at nearly 4.6% CAGR through 2025 to 2035.

Its strong automotive, aerospace, and industrial sectors make Germany an important industry in terms of high-performance ring rolling products. German carmakers like Volkswagen, BMW, and Mercedes-Benz are propelling higher demand for precision-forged parts, especially for electric vehicles. The TÜV certification ensures that the produced forged parts meet high safety and strength requirements.

Germany has been actively addressing these issues by promoting greener manufacturing through the Energieeffizienzgesetz (Energy Efficiency Law), which encourages manufacturers to invest in low-carbon and energy-efficient technologies. However, growing labor costs and raw material scarcity are hindering the industry growth. FMI opines that the Germany’s rolling ring products industry will grow at nearly 5.0% CAGR through 2025 to 2035.

The Italian automotive, machinery, and shipbuilding industry provides considerable support for the ring rolling products industry. The country complies with EU CE Marking and UNI Standards, ensuring its metal forging products maintain high standards. It provides RINA certification for the supply of forged rings to Italy's heavy marine and defence sectors.

Investment in green forging technologies and automated manufacturing may enable the Italian industry to remain competitive over the next 10 years. FMI opines that the Italy’s rolling ring products industry will grow at nearly 4.3% CAGR through 2025 to 2035.

The South Korean ring rolling industry is mainly driven by the shipbuilding, automotive, and aerospace sectors in the country. Demand for high-strength, corrosion-resistant metal rings is driven by companies including Hyundai Heavy Industries and Samsung Heavy Industries. KS (Korean Industrial Standards) controls manufacturing quality, enabling high precision for industrial applications. Additionally, South Korea launched a Green New Deal, aiding manufacturers to transition to eco-friendly forging methods.

Robotic automation, Internet of Things (IoT)-based forging technologies, investments in HMLV (high, medium, and low volume) forging tools, and research partnerships for new materials will all make forging better in terms of quality, productivity, and yield. However, growth could be slowed down by a reliance on imported raw materials and trade risks. FMI opines that the South Korea’s rolling ring products industry will grow at nearly 4.7% CAGR through 2025 to 2035.

Precision engineering, quality control, and high safety standards dominate Japan's industry for ring rolling products (JIS and JIS Q 9100 for aerospace). However, the high cost of manufacturing and low rate of adoption of automation slow down the progress to an extent. Japan’s industrial sector, despite an aging infrastructure, has been upgrading its forging capabilities, focusing on compact and high-strength metal solutions.

Moreover, manufacturers are likely to take on low-emission forging processes soon under Japan's 2050 Carbon Neutrality Targets, providing an opportunity for sustainable innovation. FMI opines that the Japan’s rolling ring products industry will grow at nearly 4.2% CAGR through 2025 to 2035.

The rapidly increasing investments in various industrial sectors, including automotive and construction, as well as renewable energy, are some of the factors likely to increase the scope of ring rolling products. China holds the largest industry for ring rolling products, closely followed by North America and Europe.

China’s vast steel-making capacity offers competitive pricing, but increasing environmental regulations and trade tensions with Western economies may impact exports. Investment in next-generation automation, AI-based quality control, and high-performance materials will remain key in keeping China ahead of global production. FMI opines that the China rolling ring products industry will grow at nearly 5.5% CAGR through 2025 to 2035.

FMI opines that the India rolling ring products industry will grow at nearly 5.2% CAGR through 2025 to 2035. The ring rolling sector in India has been gaining steam as government infrastructure initiatives, automotive industry growth, and defence production take off. The Make in India campaign is encouraging local manufacture while reducing import dependence.

Supply chain congestion and inconsistent enforcement of rules can present hurdles, too. Increasing foreign direct investment (FDI) in the manufacturing sector is likely to lead to healthy demand for precision-forged components over the next 10 years.

In the ring rolling products industry, players concentrate on pricing strategy, innovation, service, geographic presence, and strategic partnerships. Price-wise, it may be low, but firms still have to cope with high-class material without breaking the bank. Large players are heavily investing in technologies like new forging methods, AI-based quality inspection, and lightweight alloys for aerospace and EV firms.

Companies in this sector align with OEMs and energy players to solidify supply chains, while developments in emerging industries propel revenues. It not only contributes to global carbon reduction efforts but also learns about sustainability practices, from low-emission production to recycled content.

The industry is segmented into slew bearings, turbine disc, gear blanks, aerospace components, wind turbine components, seamless ring and pressure vessels

It is fragmented into steel, aluminum, titanium, nickel based alloy and others

It is segmented into horizontal, vertical and radial axial

It is segmented among automotive, aerospace, railway industry, marine, oil & gas, wind power, construction and others

It is segmented as Up to 500 mm, 500 to 1000 mm, 1000 to 2000 mm, 2000 to 3000 mm, 3000 to 4000 mm and 4000 to 5000 mm

The sector is fragmented among North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Central Asia, Russia and Belarus, Balkan and Baltics Countries, Middle East and Africa

The aerospace, wind turbine, automotive, oil & gas, and rail industries constitute the largest share, as they need high-strength, precision-forged components.

In manufacturing, we’re already seeing AI-driven automation, predictive maintenance, and smart forging.

The strict environmental protection policies are forcing companies to choose low-emission forging and recyclable products and energy-efficient production.

Europe and China lead in offshore wind expansion, while India and Southeast Asia are emerging as cost-competitive manufacturing hubs.

3D simulation, digital twins, and intelligent alloys have made parts lighter, stronger, and more durable.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ring Pull Cap Market Size and Share Forecast Outlook 2025 to 2035

Ring Lights Market Size and Share Forecast Outlook 2025 to 2035

Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Ringworm Treatment Market - Growth & Drug Innovations 2025 to 2035

A Detailed Global Analysis of Brand Share for the Ring Lights Market

Market Share Distribution Among Ring Panel Filters Providers

Ring Laser Gyroscope Market

String Power Conversion System(PCS) Market Size and Share Forecast Outlook 2025 to 2035

Moringa Tea Market Size and Share Forecast Outlook 2025 to 2035

Curing Oven Market Analysis Size and Share Forecast Outlook 2025 to 2035

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Spring Applied Clutches Market Size and Share Forecast Outlook 2025 to 2035

String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringe Scale Magnifiers Market Size and Share Forecast Outlook 2025 to 2035

Boring Bars Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Stringer Pallets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA