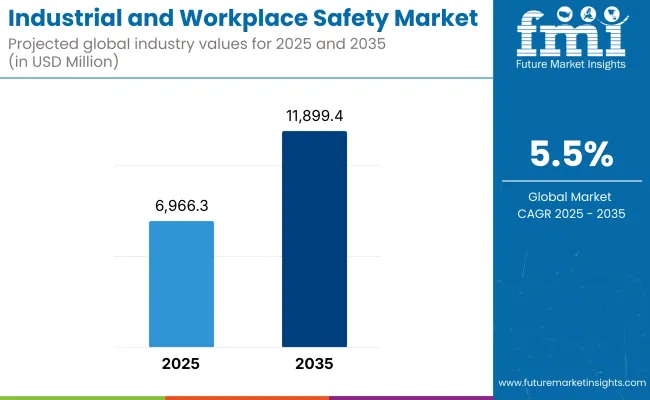

The industrial and workplace safety market is projected to reach USD 6,966.3 million in 2025 and is expected to grow to USD 11,899.4 million by 2035, with an annual growth rate of 5.5%. The increasing adoption of smart factories, the utilization of AI and IoT for safety checks, and the investment in wearable safety gear are all contributing to this growth. More will come from a focus on data predictions and real-time risk checks.

The Industrial and Workplace Safety Market looks to grow a lot from 2025 to 2035. This is because of strict rules from the government, more awareness of job risks, and improved AI safety tech. This market includes safety gear, smart safety systems, danger spotters, and rule check software. Industries such as making things, building, oil & gas, health, and mining will benefit, ensuring worker safety, stable work flow, and rule following.

North America will likely lead the industrial and workplace safety market. This is due to tough OSHA rules, more use of AI for safety, and a strong focus on workers. The USA and Canada lead the area because they invest a lot in smart protective gear, safety automation, and AI for predicting risks.

Growth in wearable safety tech, new digital twin tech for testing workplace hazards, and real-time reports on incidents are driving up market needs. Also, government rewards for safety and laws for preventing workplace hazards help to grow the market.

Europe has a large share of the industrial and workplace safety market. Countries like Germany, the UK, France, and Italy lead in smart safety, robots, and rules. The EU’s strong safety laws and growing use of AI in spotting risks help the market grow. More use of smart helmets, IoT tools for hazard checks, and safety automation in risky jobs shape trends. Also, Europe’s care for safe workspaces and worker well-being opens more doors.

The Asia-Pacific area will see the fastest growth in the industrial and workplace safety market. Rapid growth in industry, more building projects, and stricter safety laws by governments are helping this. Countries like China, India, Japan, and South Korea are using smart factories, AI for safety checks, and enforcing rules.

China is making a big push for workplace safety by investing in quick hazard detection and automated safety training. India is switching to digital safety options, wants smart safety gear, and has strong government efforts to stop industrial hazards. Japan and South Korea lead in using robots for workplace safety and AI for monitoring, which is helping the market grow in the area.

Challenges

High Implementation Costs and Resistance to Automation

One big challenge in the Work Safety Market is the high cost to start AI-driven safety tools, IoT-based watching, and predictive systems. Small and medium businesses often face budget issues, making it hard for them to adopt. Also, pushback to tech changes in old-school industries can slow the use of smart safety tech.

Opportunities

AI-Driven Predictive Safety, Smart PPE, and Robotics in Workplace Safety

The industrial and workplace safety market has big chances to grow despite challenges. AI-driven tools can now spot work risks in real-time and help prevent problems before they happen, which is making work safer for workers.

New kind of safety gear, like smart PPE with sensors to watch heart rate, control temperature, and check tiredness, is making big changes in safety. Robots and machines in tough jobs like mining, oil and gas, and building are making new money ways for safety tech sellers.

Safety rules are easier to follow now with cloud-based systems that keep an eye on risks and check rules in real-time. This boosts market growth even more.

Between 2020 and 2024, the safety market for jobs and factories got a big boost. This was because there was more care for worker health, more strict rules, and new smart safety tools. Groups like OSHA, ISO, and NIOSH made companies follow tough safety rules. This led to firm’s spending money on better gear, classes, and ways to stick to the rules.

Between 2025 and 2035, the safety market will change a lot. AI will help with safety, smart gear you wear, and blockchain for tracking safety rules. Self-working safety checks, AI tools to spot risks, and smart tools for emergencies will make workplaces safer. It will change how we stop hazards, cut down accidents, and keep workers safe.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with OSHA, ISO, and NIOSH safety standards for workplace safety. |

| Technological Advancements | Growth in IoT-enabled safety systems, AI-driven hazard detection, and PPE innovation. |

| Industry Applications | Used in manufacturing, construction, oil & gas, and healthcare. |

| Adoption of Smart Equipment | Integration of sensors, data-driven safety analytics, and automated hazard reporting tools. |

| Sustainability & Cost Efficiency | Shift toward eco-friendly PPE, optimized safety operations, and AI-assisted compliance cost reduction. |

| Data Analytics & Predictive Modeling | Use of AI-assisted predictive analytics, IoT-driven workplace hazard detection, and smart compliance tracking. |

| Production & Supply Chain Dynamics | Challenges in safety equipment production, supply chain disruptions, and regulatory compliance gaps. |

| Market Growth Drivers | Growth fueled by rising workplace safety awareness, regulatory mandates, and digital safety transformation. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-powered safety compliance tracking, AI-driven real-time safety monitoring, and global zero-incident safety regulations. |

| Technological Advancements | AI-powered autonomous safety monitoring, smart PPE with real-time alerts, and blockchain-based safety certification systems. |

| Industry Applications | Expanded into AI-driven smart industrial safety, predictive worker health monitoring, and real-time hazard response automation. |

| Adoption of Smart Equipment | AI-powered predictive safety analytics, AR-assisted risk assessment, and AI-enabled emergency response systems. |

| Sustainability & Cost Efficiency | Carbon-neutral safety gear, AI-optimized sustainability-driven safety measures, and decentralized, cost-effective safety infrastructure. |

| Data Analytics & Predictive Modeling | AI-powered autonomous safety management, real-time predictive safety analytics, and blockchain-backed safety risk profiling. |

| Production & Supply Chain Dynamics | AI-driven decentralized safety equipment production, automated safety logistics tracking, and blockchain-secured workplace safety supply chains. |

| Market Growth Drivers | Future expansion driven by AI-powered industrial safety automation, AI-integrated risk assessment tools, and sustainability-driven workplace safety innovations. |

The USA industrial and workplace safety market grows well. This is driven by strict OSHA rules, more IoT safety tools, and more cash being used to stop work accidents. The USA Department of Labor and NIOSH make sure places like factories, building sites, and oil fields follow safety rules.

The rise of AI safety tools, a higher need for PPE, and use of worker tracking systems help the market grow too. Also, new connected safety gear and smart wearables are changing the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

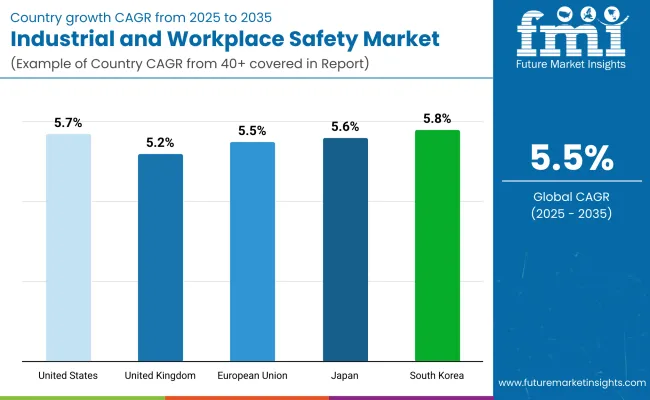

| USA | 5.7% |

The industrial and workplace safety market in the UK is growing fast. This is because of strict job safety rules, more use of tech to manage risks, and better knowledge of worker health. The UK Health and Safety Executive (HSE) and British Standards Institution (BSI) set safety rules for jobs, which helps keep workers safe in risky fields.

Using AI for safety checks, smart helmets, and connected worker tools helps this market grow. More money is going into environmental health and safety (EHS) software. New ways to train workers with virtual reality (VR) and augmented reality (AR) are also getting more popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

The market for safety in EU workplaces is growing steadily. This is because of strict safety rules and care for the environment. More companies use new Industry 4.0 tech, and there's a higher need for worker protection. EU-OSHA and the EU Commission push for safer jobs and following rules.

Germany, France, and Italy are at the front. They use AI to check for risks. They also use robots in risky places and put money into smart gear for safety. New trends show that people care more about mental health at work, reducing stress is a big focus.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.5% |

The industrial and workplace safety market in Japan is growing fast. This is because the government cares a lot about worker safety, especially in old industries. There's more money going into smart tech that finds risks. Smart safety gear is becoming more popular too. The Ministry of Health, Labour, and Welfare (MHLW) and Japan Industrial Safety and Health Association (JISHA) make rules for keeping workers safe and stopping accidents.

Many companies in Japan are spending money on tech like AI to watch over safety at work. They are also using things like exoskeleton suits for hard jobs and smart wearables to see if workers are tired. There's also more use of machines in dangerous jobs like building and making chemicals, which is bringing new ideas and ways to be safe.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The safety market in South Korea's workplaces is growing fast. This is due to strict rules on work safety, a rise in digital safety tools, and more money spent on smart PPE. The South Korean Ministry of Employment and Labor (MOEL) and the Korea Occupational Safety and Health Agency (KOSHA) make sure safety rules are followed in fields like shipbuilding, electronics, and mining.

New workplace safety trends are forming. These include AI safety tools, gas detection, and hazardous environment checks. Also, biometric safety checks, real-time worker tracking, and quick response systems are getting more common. This helps keep workplaces safer.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The industrial and workplace safety market is growing. More safety rules, rise in automated work, and awareness of worker safety drive this growth. Machines and workers are kept safe by top methods. It helps to prevent accidents, follow rules, and work better overall.

Machine safety solutions aim to keep workers safe from machine dangers, equipment breakdowns, and accidental contact with moving parts. They make sure that businesses follow safety rules such as OSHA, ANSI, and ISO 13849. These solutions use safety locks, emergency stop systems, and smart safety controllers to lower the risks linked with machines.

More businesses are using machine safety systems because production is becoming more automated, safety rules are getting tougher, and there is a need to cut down on workplace injuries. Advances in AI for predicting maintenance, safety monitoring, and fixing problems from afar are making machines safer and reducing downtime.

Although these systems give many benefits, they face challenges such as high setup costs, tough merging with old systems, and worker pushback against automation. Innovations in wireless safety tech, IoT-enabled machine checks, and flexible safety measures are likely to solve these issues and boost use and effectiveness.

Worker safety tools keep workers safe in risky places like building sites, chemical plants, and oil fields. These include safety gear, fall detectors, and emergency plans.

More people want worker safety tools because of more work accidents, more employer worries, and better safety tech. New AI tools check risks, smart helmets track in real-time, and auto-alerts help workers stay safe.

Yet, problems exist like making sure rules are followed, some fight safety rules, and high costs for new safety gear. New AI tech finds tired workers, checks worker health in real-time, and connects gear to the Internet. These might make safety tools more used and better.

The need for safety in workplaces comes from using key safety tools. Sensors that sense any danger, and safety controllers which act quickly, seem to be the most common. They work to find risks right away and enforce safety rules automatically.

Safety sensors detect people and items in risky places using infrared, ultrasonic, and radar tech. They automatically stop machines or send out alerts to avoid accidents. Such sensors are common in factories, robot work areas, and material handling tasks.

More places are using these sensors because of smart manufacturing, AI use in safety, and a goal for no accidents. Better 3D vision sensors, AI threat detection, and wireless networks make finding problems easier and faster.

Yet, there are issues like false alarms, sensor setup problems, and cybersecurity risks in linked safety systems. But improvements in AI safety, quick processing on site, and secure data communication promise to boost trust and use.

Safety controllers, modules, and relays are key. They are vital for keeping things safe, watching many safety tools, and making sure shutdowns happen in emergencies. These parts help connect machine safety to industrial systems, giving real-time updates and fail-safe plans.

There is more need for these safety tools. Why? More places use Industry 4.0, rules are stricter, and big factories need better safety setups. Also, AI helps with safety plans, logs events quickly, and modular designs allow for growth and tweaks.

But, there are issues. Old machines might not work well with new safety tools. Setting up can be pricey and making the safety plans can be complex. Still, new plug-and-play safety tools, safety systems tied to the cloud, and AI for quick risk checks are likely to help workplaces be safer and more widely used.

The industrial and workplace safety market is growing fast. There's more need for better safety, following rules (like OSHA, ISO, NFPA), and using smart tech like IoT and AI to watch things. More dangers at work, machines doing tasks, and caring more about workers drive this growth.

Firms focus on PPE (like gloves, helmets), AI for safety checks, live monitoring, and managing rules to stop dangers, check risks, and be safe at work. The market has top safety gear makers, IoT tech companies, and software creators, all helping with new connected worker tools, smart safety guesses, and clever safety gear.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Honeywell International Inc. | 18-22% |

| 3M Company | 14-18% |

| DuPont de Nemours, Inc. | 12-16% |

| Rockwell Automation, Inc. | 10-14% |

| MSA Safety Incorporated | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Honeywell International Inc. | Develops smart PPE, gas detection systems, and connected worker safety solutions. |

| 3M Company | Specializes in personal protective equipment (PPE), respiratory safety, and workplace hazard monitoring. |

| DuPont de Nemours, Inc. | Manufactures high-performance protective clothing, including Kevlar®, Nomex®, and Tyvek®. |

| Rockwell Automation, Inc. | Provides industrial safety automation, machine safeguarding, and AI-driven risk assessments. |

| MSA Safety Incorporated | Focuses on fire-resistant gear, fall protection, and gas detection technologies. |

Key Company Insights

Honeywell International Inc. (18-22%)

Honeywell leads the industrial safety market, offering AI-powered safety analytics, gas detection, and industrial-grade protective gear.

3M Company (14-18%)

3M specializes in workplace PPE, ensuring high-quality respiratory protection, noise reduction, and headgear safety.

DuPont de Nemours, Inc. (12-16%)

DuPont develops advanced industrial protective clothing, ensuring fire resistance, chemical protection, and mechanical durability.

Rockwell Automation, Inc. (10-14%)

Rockwell provides automation-based industrial safety solutions, integrating predictive maintenance and worker safety analytics.

MSA Safety Incorporated (6-10%)

MSA Safety focuses on personal protective gear, catering to hazardous industries such as construction, oil & gas, and firefighting.

Other Key Players (30-40% Combined)

Several industrial safety firms, smart PPE manufacturers, and safety software providers contribute to advancements in workplace hazard prevention, predictive analytics, and industrial IoT integration. These include:

The overall market size for the Industrial and Workplace Safety Market was USD 6,966.3 Million in 2025.

The Industrial and Workplace Safety Market is expected to reach USD 11,899.4 Million in 2035.

Stringent occupational safety regulations, increasing adoption of IoT-based safety solutions, and growing awareness of workplace hazard prevention will drive market growth.

The USA, Germany, China, Japan, and India are key contributors.

PPE (Personal Protective Equipment) is expected to dominate due to its critical role in protecting workers from physical, chemical, and biological hazards.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA