The Ring Main Unit Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Ring Main Unit Market Estimated Value in (2025 E) | USD 3.4 billion |

| Ring Main Unit Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The Ring Main Unit market is experiencing steady growth, driven by increasing demand for reliable and efficient power distribution systems across both urban and rural grids. The current market scenario reflects an emphasis on modernizing electrical infrastructure, upgrading aging networks, and integrating renewable energy sources. The market is being shaped by rising urbanization, industrial expansion, and the need for reduced downtime in electricity supply.

Investments in smart grid technologies, advanced monitoring systems, and regulatory frameworks promoting safe and sustainable distribution infrastructure are further supporting growth. Enhanced operational flexibility and reduced maintenance requirements offered by modern ring main units are driving adoption among utilities and private operators.

In addition, the focus on minimizing transmission losses and improving network reliability has increased preference for compact, high-performance units The market outlook remains positive, with opportunities for growth in automated monitoring, modular configurations, and integration with digital substations, ensuring that ring main units continue to play a central role in modern power distribution.

The ring main unit market is segmented by installation, insulation type, application, position, component type, and geographic regions. By installation, ring main unit market is divided into Outdoor and Indoor. In terms of insulation type, ring main unit market is classified into Gas Insulated, Oil Insulated, Solid Dielectric Insulated, Air Insulated, and Others. Based on application, ring main unit market is segmented into Distribution Utilities, Industries, Transportation, Infrastructure, and Others. By position, ring main unit market is segmented into 3 Position, 6 Position, 10 Position, and Others. By component type, ring main unit market is segmented into Switchgear, Self-powered Electronic Relays, and Fuses. Regionally, the ring main unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

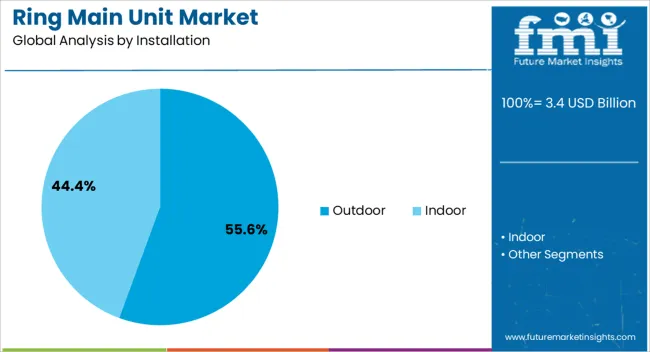

The outdoor installation segment is projected to account for 55.60% of the Ring Main Unit market revenue in 2025, making it the leading installation type. This dominance is being attributed to the wide deployment of electrical distribution networks in regions where indoor installation is not feasible due to space constraints, environmental factors, or cost considerations. Outdoor units are preferred for their durability, robustness, and adaptability to various weather conditions, ensuring uninterrupted operation in diverse climates.

The growth of this segment has been reinforced by the rising demand for rural electrification, expanding urban infrastructure, and the need for rapid deployment in areas with limited indoor space. Outdoor units also allow easier access for maintenance and monitoring, supporting operational efficiency for utilities.

Additionally, their compatibility with modular designs and software-enabled monitoring solutions has facilitated integration into modern grid networks As grid modernization continues and the demand for reliable electricity distribution rises, outdoor installation is expected to remain the dominant segment in the market.

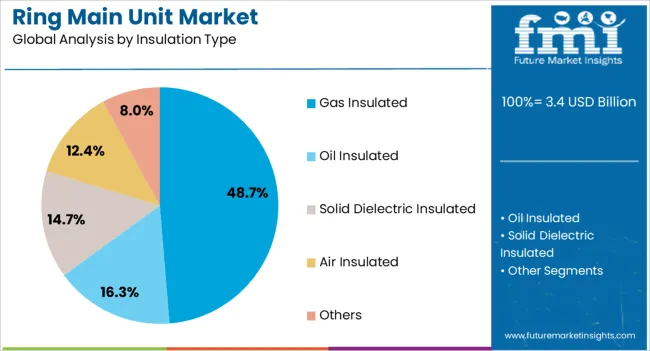

The gas insulated segment is expected to hold 48.70% of the Ring Main Unit market revenue in 2025, emerging as the leading insulation type. The prominence of this segment is being driven by its compact design, high reliability, and low maintenance requirements compared to conventional air-insulated units. Gas insulated units offer superior insulation performance, reducing the risk of faults and enabling deployment in densely populated or constrained environments where space is limited.

The segment’s growth has been accelerated by increasing adoption in urban substations, industrial facilities, and critical infrastructure, where uninterrupted power distribution is essential. Environmental and safety considerations have also influenced the shift towards gas insulated solutions, as they minimize exposure risks while maintaining high operational efficiency.

The flexibility to integrate with digital monitoring systems and automation technologies has further strengthened adoption With continued emphasis on compact and resilient distribution infrastructure, the gas insulated segment is poised to maintain leadership in the Ring Main Unit market.

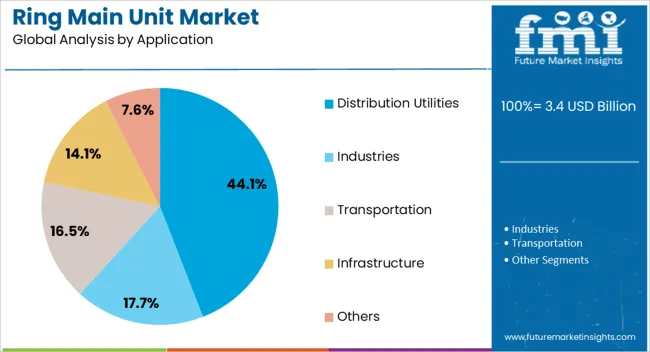

The distribution utilities application segment is anticipated to account for 44.10% of the Ring Main Unit market revenue in 2025, positioning it as the largest end-use segment. This leadership is being fueled by the need for reliable and safe electricity delivery across transmission and distribution networks operated by public and private utilities. Utilities benefit from the modularity and scalability of ring main units, which allow rapid expansion of networks and integration with smart grid technologies.

The growth of this segment is being reinforced by increasing electricity demand, urbanization, and regulatory emphasis on reducing power outages and improving network reliability. Ring main units in distribution utilities provide enhanced protection, reduced maintenance costs, and easy fault detection, enabling uninterrupted service and operational efficiency.

As utilities continue to upgrade aging infrastructure and incorporate renewable energy sources, the adoption of software-enabled, compact, and high-performance units is expected to remain strong The segment’s dominance is supported by the ongoing focus on efficiency, safety, and modernization within power distribution systems.

Ring main unit is a set of switchgear commonly used ring-type electrical power distribution networks, and it plays an important role in secondary distribution substations. A wide range of industrial applications of ring main units include transportation, infrastructure, and construction, and recent industrial developments across the globe are expected to provide a fillip to growth of the ring main unit market.

The growing trend of electrifying virtually everything is acting as the biggest trigger to increased demand for electricity across the world. According to the International Energy Agency (IEA) the global electricity demand increased by more than 3% in 2025 over 2025. Furthermore, growing needs for the upgradation of old electric distribution systems is bolstering the adoption of ring main units.

In developing countries, rising fund flow towards promoting the use of nonconventional and renewable energy sources is redefining growth prospects of the ring main unit market. Owing to the burgeoning demand for electricity worldwide, the ring main unit market is poised to envisage incremental growth in the upcoming years.

Increasing adoption of advanced electric power distribution systems is giving rise to the use of electronic component with more advanced features than conventional ones. Leading manufacturers in the ring main unit market are aiming to incorporate advanced technologies to further enhance safety and operational features of ring main units. Increasing adoption of next-generation technologies for expanding the range of innovative and smarter devices is emerging as a popular trend in the ring main unit market.

C&S Electric, a leading manufacturer of electrical and electronic components, recently introduced a smart, FRTU integrated ring main unit. The intelligent FRTU and modem integrated to the ring main unit make it a smart device that can identify and isolate any network issues and enhances reliability of uninterrupted power supply. The company announced that it is aiming to target Smart City projects and private and public power supply companies in emerging economies with launch of the ring main unit.

Another leading manufacturer in the ring main market – Eaton Corporation recently launched a wide range of power distribution products manufactured using cutting-edge technologies, in India. The company introduced RVAC SF6 Ring Main Unit (RMU), which is smart grid ready and has ergonomically designed logical mechanical and electrical interlocks. The advanced features of the RVAC ring main unit by Eaton can improve personal safety, ease of operation, and its state-of-the-art fault detection mechanism is likely to help the company to gain momentum in the ring main unit market.

The other players in the ring main unit market including General Electric, ABB, Schneider Electric, Siemens, L&T Electrical and Automation, Crompton Greaves, TIEPCO, Lucy Electric UK Ltd., LSIS Co., Ltd, Ormazabal, and Entec Electric & Electronic Co., Ltd, have been profiled in this report.

With the rising economic output, electricity demand in developing countries in the Asia Pacific region has surged significantly in the past few years. According to the International Energy Agency (IEA), developing Asian countries, such as China and India, hold a whopping 70% share in this rise in demand for electricity, which is triggering the use of secondary distribution networks in the across the world. In 2025, warm summers and strong economic growth triggered electricity demand in China by over 6%. Electricity demand in India surged by 12% in 2025 outpacing the economic growth in the country, which was 7% in the fiscal years.

Emerging economies are making significant strides in the improved access and distribution of electricity, which likely to generate lucrative opportunities for ring main unit market players in the Asia Pacific region. With the bolstering electricity capacity expansion and adoption of smart grids in rural areas in developing nations, the market for ring main units in Asia-Pacific is likely to showcase significant growth in the upcoming years.

Ring main unit market research report offers detailed analysis of the market as well as consists of thoughtful facts and insights along with historical data, which holds market data that is industry-evaluated and statistically backed up. The report comprises of projections that are generated with the help of suitable methodologies and a set of hypotheses. In addition, the research report delivers information and study based on market classifications such as industry, end-use and region.

Ring main unit market research report has been incorporated with first-hand information along with comprehensive analysis based on quality and quantity with the help of industry analysts. Inputs from participants and experts in the industry has also been integrated in the global report. Governing, micro and macro-economic aspects relating to parent market has been identified in the global report. Market attractiveness based on regions and segments along with qualitative impacts has also been included in the ring main unit market research report.

| Countries | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

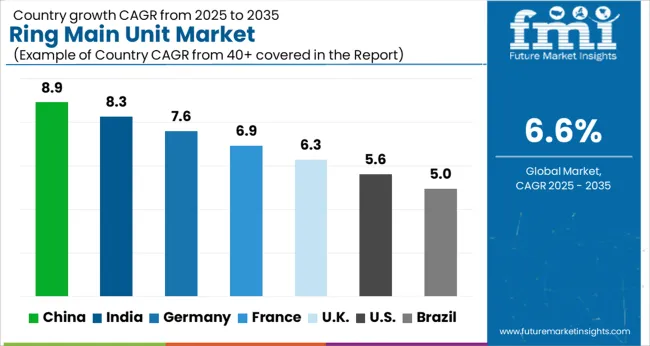

The Ring Main Unit Market is expected to register a CAGR of 6.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.9%, followed by India at 8.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.0%, yet still underscores a broadly positive trajectory for the global Ring Main Unit Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.6%. The USA Ring Main Unit Market is estimated to be valued at USD 1.3 billion in 2025 and is anticipated to reach a valuation of USD 2.2 billion by 2035. Sales are projected to rise at a CAGR of 5.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 160.2 million and USD 106.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Installation | Outdoor and Indoor |

| Insulation Type | Gas Insulated, Oil Insulated, Solid Dielectric Insulated, Air Insulated, and Others |

| Application | Distribution Utilities, Industries, Transportation, Infrastructure, and Others |

| Position | 3 Position, 6 Position, 10 Position, and Others |

| Component Type | Switchgear, Self-powered Electronic Relays, and Fuses |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

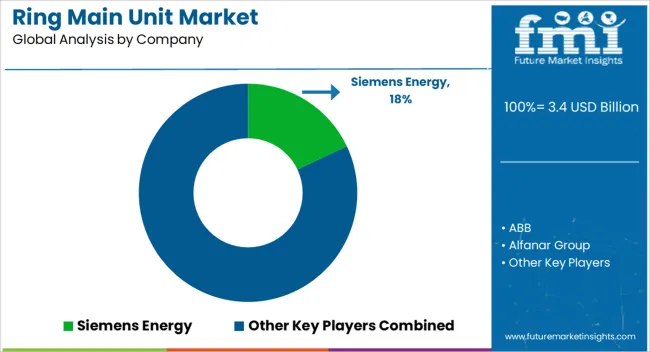

| Key Companies Profiled | Siemens Energy, ABB, Alfanar Group, CG Power, CHINT Group, Eaton, Electric & Electronic, Hyundai Electric & Energy Systems, LS ELECTRIC, Lucy Group, Ormazabal, Orecco, and Schneider Electric |

The global ring main unit market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the ring main unit market is projected to reach USD 6.5 billion by 2035.

The ring main unit market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in ring main unit market are outdoor and indoor.

In terms of insulation type, gas insulated segment to command 48.7% share in the ring main unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Non-Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Ring Pull Cap Market Size and Share Forecast Outlook 2025 to 2035

Ring Lights Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Ringworm Treatment Market - Growth & Drug Innovations 2025 to 2035

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Ring Lights Market

Market Share Distribution Among Ring Panel Filters Providers

Ring Laser Gyroscope Market

String Power Conversion System(PCS) Market Size and Share Forecast Outlook 2025 to 2035

Moringa Tea Market Size and Share Forecast Outlook 2025 to 2035

Curing Oven Market Analysis Size and Share Forecast Outlook 2025 to 2035

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Spring Applied Clutches Market Size and Share Forecast Outlook 2025 to 2035

String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA