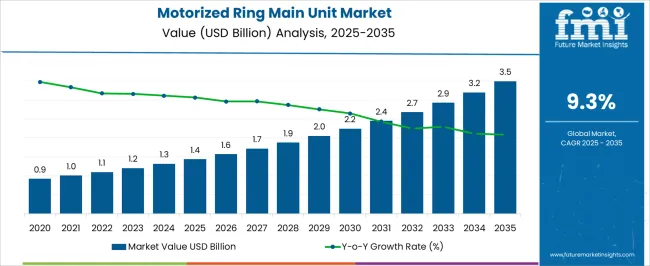

The motorized ring main unit market is projected to grow from USD 1.4 billion in 2025 to USD 3.5 billion by 2035, reflecting a compound annual growth rate of 9.3%. During the early adoption phase (2020–2024), the market saw gradual uptake as utilities and industrial operators explored automated switching solutions to enhance operational reliability. Market values increased from USD 0.9 billion to 1.3 billion, indicating cautious adoption and pilot implementations.

Early adopters focused on critical networks and high-value installations, helping validate performance standards and operational benefits. This period established supply chains, installation expertise, and confidence in motorized RMU solutions. From 2025 to 2030, the market enters a scaling phase, growing from USD 1.4 billion to around USD 2.7 billion. Wider adoption occurs as operators seek reliable, remotely controlled switching for network efficiency. Production capacities expand, and deployment accelerates across distribution networks.

Between 2030 and 2035, the market moves into consolidation, reaching USD 3.5 billion by 2035. Leading manufacturers strengthen market positions, smaller players exit or are acquired, and growth stabilizes. Adoption becomes mainstream, with incremental gains driven by process standardization and broader geographic deployment of motorized RMU solutions.

| Metric | Value |

|---|---|

| Motorized Ring Main Unit Market Estimated Value in (2025 E) | USD 1.4 billion |

| Motorized Ring Main Unit Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

The motorized ring main unit (RMU) market is a specialized segment within several broader parent markets in the power distribution and electrical equipment sectors. In 2025, the combined parent markets are estimated at over USD 250 billion, growing to approximately USD 400 billion by 2035, representing a CAGR of around 5.0%. Motorized RMUs currently account for about 0.6% of the total in 2025, increasing to roughly 0.9% by 2035, reflecting their growing adoption in medium-voltage distribution networks. Key parent markets include: medium-voltage switchgear, distribution transformers, smart meters, circuit breakers, substations, automation and control systems, power cables, protective relays, and electrical panels.

Medium-voltage switchgear represents the largest share, contributing nearly 30% of the parent market, driven by demand for reliable switching solutions. Distribution transformers and circuit breakers together account for about 25%, supporting network stability and safety.

Smart meters and automation systems represent 15% combined, aligning with operational monitoring needs. Substations, power cables, protective relays, and electrical panels make up the remaining 30%. While the overall parent markets grow steadily at a moderate pace, motorized RMUs outpace this growth with a 9.3% CAGR, reflecting focused adoption in precision-controlled distribution networks. This growth highlights opportunities for suppliers of medium-voltage equipment, automation devices, and installation services.

The motorized ring main unit market is experiencing steady expansion due to the increasing need for reliable medium voltage distribution solutions and the rising adoption of automation in power networks. The demand is being fueled by rapid urbanization, grid modernization initiatives, and the integration of renewable energy sources which require advanced distribution management systems.

Motorized ring main units provide improved operational safety, reduced downtime, and remote monitoring capabilities, making them critical for utilities and industrial sectors. Advancements in switching technology, compact designs, and smart grid compatibility are further enhancing market adoption.

Regulatory mandates for energy efficiency and the replacement of aging infrastructure are creating strong growth opportunities. The overall outlook remains positive as utilities and industries prioritize resilient, automated, and efficient power distribution networks.

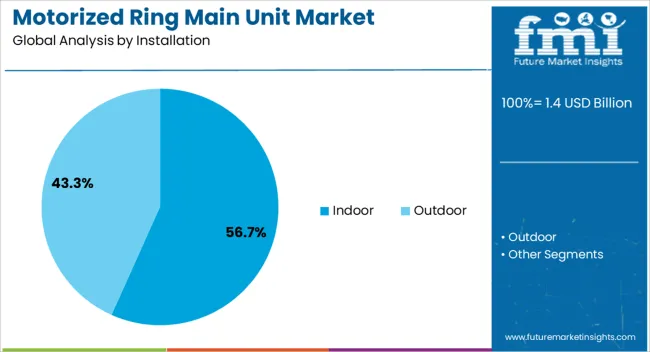

The motorized ring main unit market is segmented by installation, application, and geographic regions. By installation, motorized ring main unit market is divided into Indoor and Outdoor. In terms of application, motorized ring main unit market is classified into Distribution Utilities, Infrastructure, and Others. Regionally, the motorized ring main unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The indoor installation segment is projected to account for 56.70% of the total market revenue by 2025, making it the dominant installation type. This growth is supported by the increasing deployment of compact, insulated switchgear in urban substations and industrial facilities where space constraints and environmental protection are critical.

Indoor units offer better protection from weather conditions, reduced maintenance requirements, and enhanced operational safety. Their suitability for integration with building management and automation systems has further increased adoption.

As cities expand and infrastructure becomes more complex, the need for reliable indoor power distribution solutions is expected to maintain this segment’s leading position.

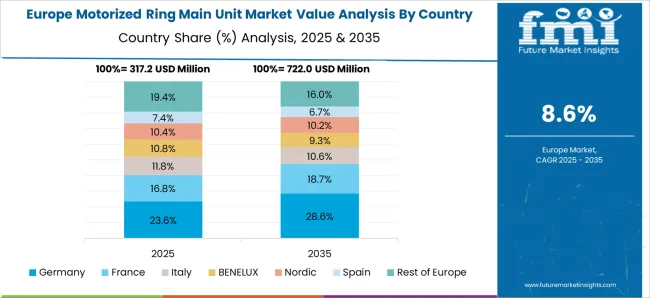

The motorized ring main unit (RMU) market is growing due to increasing urbanization, grid modernization, and rising demand for reliable medium-voltage distribution systems. North America and Europe lead with RMUs integrated into smart grids and automated substations, focusing on safety, remote control, and reliability. Asia-Pacific shows rapid growth driven by expanding power distribution networks and industrial electrification. Manufacturers differentiate through compact designs, advanced switching mechanisms, IoT-enabled monitoring, and low-maintenance systems. Regional infrastructure maturity, regulatory standards, and energy efficiency priorities shape adoption globally.

Adoption of motorized RMUs is driven by the need for automated switching and remote monitoring in medium-voltage distribution networks. North America and Europe emphasize RMUs with motorized operations, IoT-enabled controls, and predictive maintenance features to ensure uninterrupted power supply and reduce operational costs. Asia-Pacific markets focus on cost-effective motorized units for expanding urban grids, balancing performance with affordability. Differences in automation sophistication affect grid reliability, fault management, and operational efficiency. Leading suppliers provide motorized RMUs with smart sensors, communication protocols, and real-time monitoring, while regional players offer functional, budget-friendly alternatives. Automation and monitoring contrasts shape adoption, system reliability, and competitiveness in global RMU markets.

RMU adoption is influenced by compactness and suitability for urban and industrial substation layouts. North America and Europe prioritize space-saving designs for underground and rooftop substations, supporting high-density grid networks. Asia-Pacific focuses on modular RMUs for overhead and ground-mounted distribution systems, emphasizing ease of installation and maintenance. Differences in design compactness affect installation feasibility, operational flexibility, and land-use efficiency. Leading suppliers deliver compact, modular, and easy-to-upgrade RMUs, while regional manufacturers provide robust, functional units suitable for large-scale deployments. Design and space optimization contrasts shape adoption, infrastructure planning, and competitive positioning in the global motorized RMU market.

High reliability, safety, and switching performance are critical for RMU deployment. North America and Europe emphasize units with arc-resistant enclosures, fast switching mechanisms, and fault-limiting features to minimize outages and protect personnel. Asia-Pacific markets adopt reliable, cost-efficient RMUs for industrial and urban distribution systems, balancing safety and budget. Differences in reliability and operational performance affect grid stability, maintenance costs, and system longevity. Leading suppliers provide motorized RMUs with high fault withstand capability and automated safety interlocks, while regional players focus on durable, practical solutions. Reliability and performance contrasts drive adoption, operational continuity, and competitiveness in global RMU applications.

Compliance with international and regional medium-voltage standards, safety codes, and energy efficiency regulations influences RMU adoption. North America and Europe follow IEC, ANSI, and local utility standards requiring certified switching performance and environmental compliance. Asia-Pacific regulations vary, with advanced economies adhering to international norms and emerging markets implementing domestic standards to balance cost and safety. Differences in regulatory requirements affect project approvals, procurement timelines, and operational compliance. Suppliers offering certified, standard-compliant RMUs gain premium adoption, while regional manufacturers provide locally approved cost-efficient options. Regulatory and efficiency contrasts shape adoption, market credibility, and strategic positioning in global motorized RMU markets.

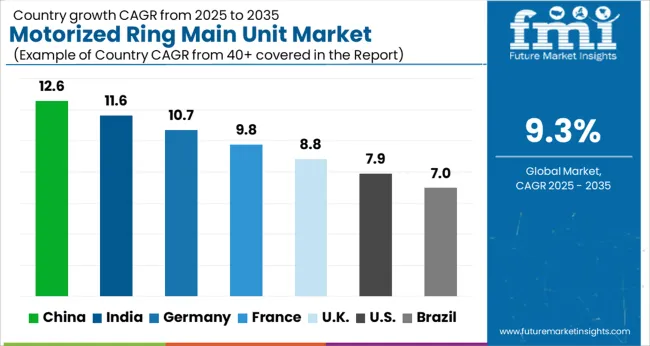

| Country | CAGR |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| France | 9.8% |

| UK | 8.8% |

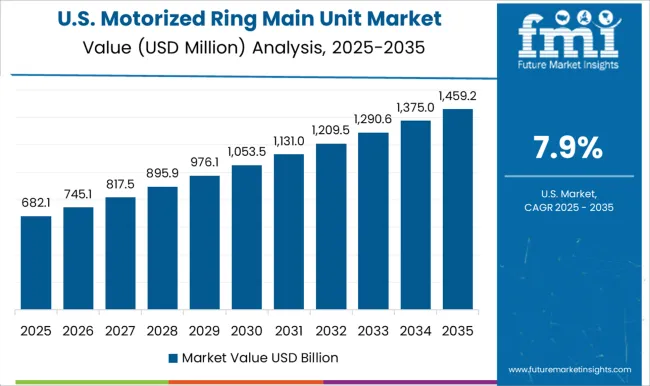

| USA | 7.9% |

| Brazil | 7.0% |

The global motorized ring main unit market is projected to grow at a 9.3% CAGR through 2035, driven by demand in power distribution, industrial, and utility networks. Among BRICS nations, China led with 12.6% growth as large-scale manufacturing and deployment facilities were commissioned and compliance with electrical standards was enforced, while India, at 11.6% growth, expanded production capacity to meet rising regional demand.

In the OECD region, Germany, at 10.7% maintained substantial output under strict industrial and regulatory frameworks, while the United Kingdom, at 8.8% operated moderate-scale manufacturing units for commercial and utility applications. The USA, growing at 7.9%, supported steady adoption across power distribution and industrial segments, adhering to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Rapid growth in electrical distribution networks has positioned the motorized ring main unit market to grow at a CAGR of 12.6% in China. The motorized ring main unit market is being supported by demand for reliable and efficient medium voltage switching equipment in urban and industrial areas. Manufacturers are being encouraged to provide durable, safe, and high performance units suitable for grid applications. Distribution through utility providers, industrial suppliers, and authorized dealers is being strengthened. Research in compact designs, automation integration, and improved switching mechanisms is being conducted. Increasing investment in power infrastructure, renewable energy integration, and urban expansion are considered key drivers of growth for the motorized ring main unit market in China.

Rising modernization of power grids is propelling the motorized ring main unit market in India to a CAGR of 11.6%. The motorized ring main unit market is being supported by adoption in medium voltage networks to ensure safe and reliable energy distribution. Manufacturers are being encouraged to supply cost effective, durable, and technologically advanced units. Distribution through industrial suppliers, utility providers, and authorized dealers is being expanded. Technical workshops and training sessions are being conducted to improve installation and operational efficiency. Increasing urban electrification, renewable energy projects, and industrial power demands are being recognized as important growth factors for the motorized ring main unit market in India.

Germany is experiencing growth in the motorized ring main unit market at a CAGR of 10.7% due to demand for automated and safe medium voltage distribution systems. The motorized ring main unit market is being strengthened by adoption in industrial and utility networks requiring reliable switching solutions. Manufacturers are being encouraged to provide high quality, compact, and performance optimized units. Distribution through utility companies, industrial suppliers, and specialized dealers is being maintained. Research in automation integration, enhanced safety features, and efficient switching mechanisms is being pursued. Growth of renewable energy projects, industrial automation, and advanced power networks is being considered a key driver for the motorized ring main unit market in Germany.

Increasing investments in power network modernization are driving the motorized ring main unit market in the United Kingdom, which is expected to grow at a CAGR of 8.8%. The motorized ring main unit market is being supported by adoption in urban, industrial, and renewable energy networks requiring safe and reliable switching. Manufacturers are being focused on providing durable, compact, and efficient units. Distribution through authorized suppliers, utility companies, and industrial partners is being strengthened. Awareness programs and technical workshops are being conducted to ensure proper installation and operational safety. Urban electrification, renewable energy integration, and utility expansion are recognized as primary drivers for the motorized ring main unit market in the United Kingdom.

Rising demand for reliable medium voltage switching solutions has positioned the motorized ring main unit market in the United States to grow at a CAGR of 7.9%. The motorized ring main unit market is being supported by adoption in industrial, utility, and renewable energy grids to ensure safe and continuous power distribution. Manufacturers are being encouraged to deliver advanced, compact, and high performance units. Distribution through utility providers, industrial suppliers, and authorized dealers is being maintained. Research in automation, switching efficiency, and compact designs is being conducted. Expansion of power infrastructure, renewable energy projects, and industrial electrification are considered important factors driving growth of the motorized ring main unit market in the United States.

The motorized ring main unit (RMU) market has been expanding steadily due to the increasing need for reliable, compact, and automated medium-voltage switchgear in power distribution networks. RMUs play a critical role in urban and industrial electrical networks by ensuring safe, uninterrupted power supply, minimizing downtime, and enabling remote monitoring and automation. The rising adoption of smart grids, renewable energy integration, and the modernization of aging infrastructure are key factors driving the demand for motorized RMUs.

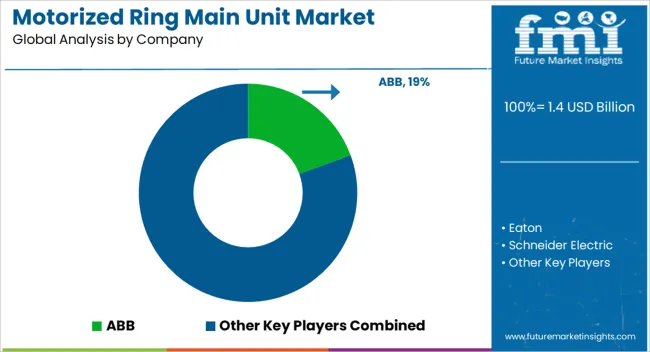

These units provide enhanced operational efficiency, safety, and flexibility, making them indispensable in modern power distribution systems. Prominent players operating in the global motorized RMU market include ABB, Eaton, Schneider Electric, CG Power & Industrial Solutions Ltd., Siemens, Lucy Group Ltd., LS ELECTRIC Co. Ltd., TIEPCO, HD HYUNDAI ELECTRIC CO., LTD., Toshiba Energy Systems & Solutions Corporation, alfanar Group, CHINT Group, Electric & Electronic Co. Ltd., Bonomi Eugenio SpA, and Orecco. These companies are leveraging technological innovations, strategic partnerships, and product portfolio expansions to maintain their competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Installation | Indoor and Outdoor |

| Application | Distribution Utilities, Infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Eaton, Schneider Electric, CG Power & Industrial Solutions Ltd., Siemens, Lucy Group Ltd., LS ELECTRIC Co. Ltd., TIEPCO, HD HYUNDAI ELECTRIC CO., LTD., Toshiba Energy Systems & Solutions Corporation, alfanar Group, CHINT Group, Electric & Electronic Co. Ltd., Bonomi Eugenio SpA, and Orecco |

| Additional Attributes | Dollar sales vary by unit type, including gas-insulated and vacuum-insulated RMUs; by voltage class, spanning medium voltage (12–36 kV); by application, such as power distribution, industrial facilities, and renewable energy integration; by end-use, covering utilities, commercial complexes, and industrial plants; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for reliable, compact, and automated power distribution solutions. |

The global motorized ring main unit market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the motorized ring main unit market is projected to reach USD 3.5 billion by 2035.

The motorized ring main unit market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in motorized ring main unit market are indoor and outdoor.

In terms of application, distribution utilities segment to command 48.9% share in the motorized ring main unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Ring Pull Cap Market Size and Share Forecast Outlook 2025 to 2035

Ring Lights Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Ringworm Treatment Market - Growth & Drug Innovations 2025 to 2035

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Ring Lights Market

Market Share Distribution Among Ring Panel Filters Providers

Ring Laser Gyroscope Market

Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Moringa Tea Market Size and Share Forecast Outlook 2025 to 2035

Curing Oven Market Analysis Size and Share Forecast Outlook 2025 to 2035

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Spring Applied Clutches Market Size and Share Forecast Outlook 2025 to 2035

String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA