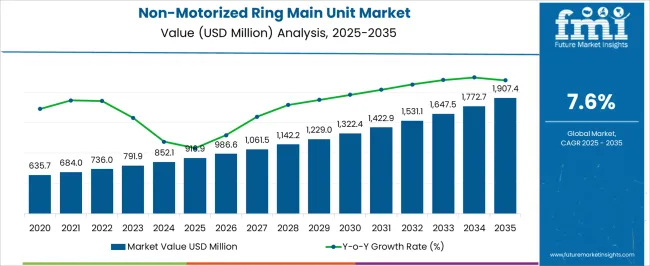

The Non-Motorized Ring Main Unit (RMU) Market, valued at USD 916.9 million in 2025 and projected to reach USD 1,907.4 million by 2035 at a CAGR of 7.6%, exhibits a technology-driven contribution pattern shaped by insulation type, switching mechanism, and modular design features. Primarily, gas-insulated and vacuum-insulated technologies drive market growth, with gas-insulated solutions leading in deployment due to their compact design, reliability under high-voltage conditions, and suitability for urban and industrial distribution networks.

Vacuum-insulated options contribute significantly to applications requiring minimal maintenance and enhanced operational safety, providing a complementary share to the overall market value. The annual incremental growth reflects gradual adoption of these technologies, with the market expanding from USD 916.9 million in 2025 to USD 1,142.2 million by 2028, and further accelerating to USD 1,907.4 million by 2035. This trajectory highlights increasing preference for advanced switchgear technologies that optimize operational efficiency, reduce system losses, and align with grid modernization initiatives.

Non-motorized mechanisms, including manual and spring-assisted switching systems, maintain consistent adoption across legacy networks where automation is limited, contributing a stable, though smaller, portion of the total market value. Value contribution analysis indicates that gas-insulated RMUs account for the majority share, followed by vacuum-insulated units, with emerging modular designs gradually enhancing flexibility and deployment efficiency. The overall technology mix suggests a market structure where innovation, safety, and reliability drive adoption patterns, positioning advanced insulation and switching solutions as central contributors to the projected market growth of USD 1,907.4 million by 2035.

| Metric | Value |

|---|---|

| Non-Motorized Ring Main Unit Market Estimated Value in (2025 E) | USD 916.9 million |

| Non-Motorized Ring Main Unit Market Forecast Value in (2035 F) | USD 1907.4 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

The non-motorized ring main unit market represents a specialized segment within the global electrical distribution and switchgear industry, emphasizing reliability, compact design, and operational safety. Within the broader medium-voltage switchgear sector, it accounts for about 4.3%, driven by demand from utilities, industrial complexes, and commercial buildings. In the ring main and distribution automation segment, its share is approximately 5.1%, reflecting adoption of compact, cost-effective, and low-maintenance units. Across the electrical infrastructure and grid modernization market, it contributes around 3.8%, supporting improved network reliability, fault isolation, and load management. Within the renewable energy and microgrid integration category, it represents 3.5%, highlighting applications in distributed generation and solar or wind-connected systems. In the overall power distribution and energy management ecosystem, the market contributes about 4.0%, emphasizing safe, efficient, and modular solutions for medium-voltage networks.

Recent developments in the non-motorized ring main unit market have focused on compact design, operational efficiency, and enhanced safety. Groundbreaking trends include integration with smart monitoring systems, remote fault detection, and modular configurations for easy installation and scalability. Key players are collaborating with utilities, industrial operators, and technology providers to deliver reliable and maintenance-free units. The adoption of vacuum interrupters, gas-insulated designs, and eco-friendly insulating mediums is gaining traction to improve operational lifespan and enhance safety. Additionally, standardized modular solutions for rapid deployment and integration with automated distribution systems are being introduced.

The non-motorized ring main unit market is witnessing steady adoption across utility and industrial networks, driven by the need for reliable medium-voltage distribution solutions with minimal operational complexity. Current market dynamics are shaped by increasing investments in grid modernization, particularly in emerging economies, where cost-effective and low-maintenance switchgear options are in demand.

Non-motorized RMUs offer operational safety, compact design, and ease of integration, making them suitable for both retrofit and new installations. Market growth is further supported by the expansion of power distribution infrastructure to meet rising electricity consumption in residential, commercial, and light industrial segments.

As environmental regulations encourage the use of gas-insulated and vacuum-insulated systems with low leakage rates, non-motorized RMUs continue to maintain a strong position due to their durability and reduced operational costs. The future outlook remains positive, with demand expected to remain resilient as utilities and industrial users prioritize long-term reliability, safety, and lifecycle value in distribution systems.

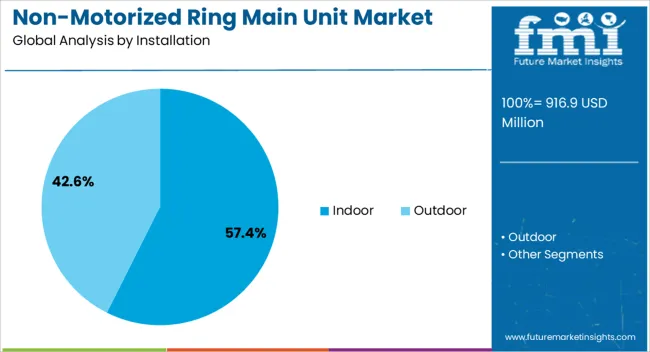

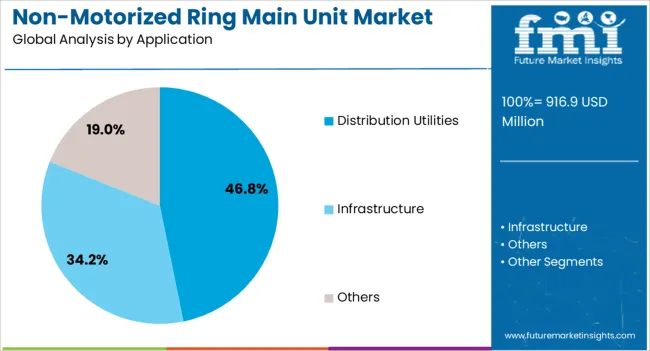

The non-motorized ring main unit market is segmented by installation, application, and geographic regions. By installation, non-motorized ring main unit market is divided into Indoor and Outdoor. In terms of application, non-motorized ring main unit market is classified into Distribution Utilities, Infrastructure, and Others. Regionally, the non-motorized ring main unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The indoor segment dominates the installation category, accounting for approximately 57.4% of the non-motorized ring main unit market. This leadership is attributed to the segment’s suitability for controlled environments such as substations, commercial complexes, and industrial facilities, where space optimization and safety are prioritized. Indoor RMUs are favored for their enhanced protection from environmental factors such as dust, humidity, and temperature fluctuations, which improves operational lifespan and reliability.

Their adoption is reinforced by the growing trend of integrating distribution equipment within enclosed facilities to comply with safety and environmental standards. Additionally, the compact and modular design of indoor RMUs facilitates easier installation in urban areas with space constraints.

With rising investments in smart and sustainable building infrastructure, the indoor segment continues to gain traction, supported by its adaptability to both new grid setups and modernization projects. This dominance is expected to persist as utilities and industries seek secure, efficient, and low-maintenance switchgear solutions.

The distribution utilities segment leads the application category, contributing approximately 46.8% of the non-motorized ring main unit market. Its strong position is driven by the critical role RMUs play in medium-voltage power distribution networks, ensuring uninterrupted electricity supply and operational safety. Utilities prioritize non-motorized RMUs for their cost-effectiveness, ease of maintenance, and proven reliability in diverse grid configurations.

The segment’s growth is supported by increasing electricity demand in urban and rural areas, which necessitates network expansion and refurbishment. Furthermore, the push toward reducing outage times and enhancing grid resilience has encouraged the deployment of RMUs in strategic locations across distribution networks.

The compatibility of non-motorized RMUs with various protection and control devices also enhances their appeal for utility-scale deployment. As energy access initiatives and urbanization trends intensify globally, the distribution utilities segment is expected to maintain its leading share, reinforced by long-term investments in power infrastructure.

The market has been witnessing steady growth due to increasing demand for reliable and compact electrical distribution solutions. These units are widely used in medium-voltage networks for power distribution, fault isolation, and system maintenance in industrial, commercial, and urban infrastructure projects. Compact design, enhanced safety features, and ease of installation have made non-motorized ring main units suitable for space-constrained substations and urban distribution grids. Adoption has been driven by modernization of electrical networks, increased urban electrification, and the need for operational reliability and minimal downtime. Manufacturers are focusing on improved insulation, smart monitoring compatibility, and long-term durability.

The operational reliability of non-motorized ring main units has been a key factor in their adoption across medium-voltage power distribution networks. These units provide efficient fault isolation and continuity of service, reducing power interruptions and maintenance downtime. The compact and modular design allows for quick integration into existing infrastructure, facilitating urban and industrial applications. Non-motorized units are favored in locations where minimal supervision and lower maintenance requirements are preferred. Standardized components and proven mechanical operations enhance predictability and reduce the risk of electrical failures. Integration with smart meters, sensors, and SCADA systems has improved monitoring capabilities, allowing operators to detect faults quickly and respond effectively. These factors have reinforced non-motorized ring main units as a reliable solution for diverse power distribution networks worldwide.

Cost-efficiency and low maintenance requirements have significantly contributed to the market expansion of non-motorized ring main units. These units require fewer mechanical and electronic components than motorized alternatives, reducing installation and operational costs. Absence of motorized drive systems lowers failure risks and eliminates frequent maintenance cycles, enhancing reliability over extended periods. Operational simplicity allows utility personnel to perform manual switching, inspection, and fault isolation with minimal training. Compact design and reduced footprint also minimize civil works and site preparation costs. These economic advantages have made non-motorized units attractive for emerging markets and rural electrification projects, where cost constraints and reliability considerations are critical. The adoption of these units has been sustained across small- and medium-scale industrial, commercial, and utility-scale distribution applications globally.

Non-motorized ring main units are increasingly being deployed in modernized grids, including renewable-integrated and smart grid systems. These units are compatible with monitoring devices, remote sensing equipment, and smart protection relays, facilitating improved network visibility and fault management. Integration with renewable energy sources such as solar and wind microgrids requires reliable switching and isolation capabilities, which non-motorized units provide. Standardized interfaces and modularity allow seamless upgrades and hybrid configurations with automated systems. The ability to maintain service continuity while accommodating distributed energy generation has positioned non-motorized units as a cost-effective solution for utilities seeking resilient and flexible distribution infrastructure. This compatibility enhances operational efficiency and supports the adoption of clean energy solutions in urban and semi-urban networks.

Safety and regulatory compliance have emerged as significant determinants in the adoption of non-motorized ring main units. Units are designed with robust insulation, arc-proof enclosures, and fail-safe mechanisms to protect operators and reduce the risk of accidents during switching operations. Compliance with international electrical standards and regional safety codes ensures acceptance in global markets. Operator safety and system reliability have become central to procurement decisions for utilities, industrial facilities, and commercial complexes.

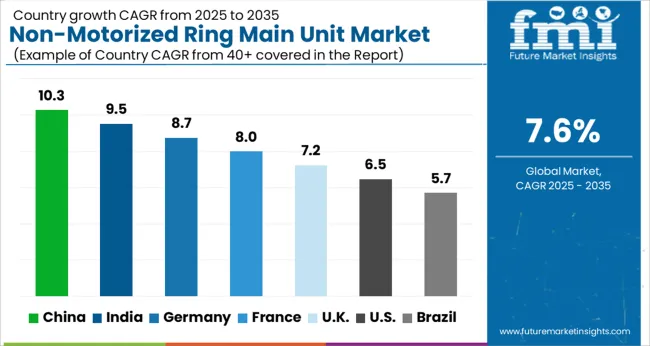

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

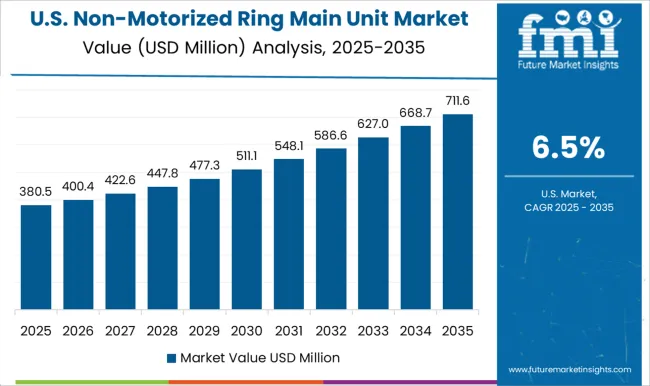

| USA | 6.5% |

| Brazil | 5.7% |

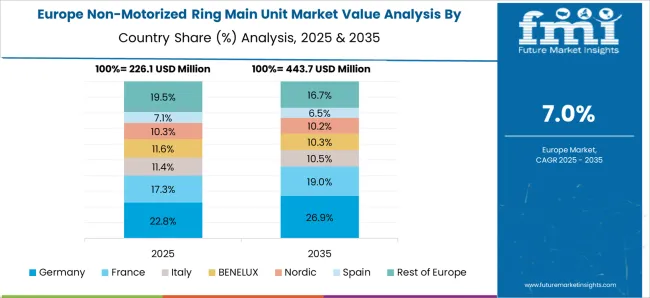

The market is projected to expand at a CAGR of 7.6% from 2025 to 2035, driven by increasing demand for reliable medium voltage distribution solutions. China leads with 10.3%, reflecting extensive grid modernization and industrial infrastructure projects. India follows at 9.5%, supported by rapid urban and rural electrification initiatives. Germany records 8.7%, influenced by grid upgrade programs and energy efficiency mandates. The UK holds 7.2%, where smart distribution solutions are gaining traction. The USA registers 6.5%, driven by utility modernization and renewable energy integration. Market growth is shaped by evolving energy distribution needs, regulatory frameworks, and technological adoption across power networks. This report includes insights on 40+ countries; the top markets are shown here for reference.

China advanced at a 10.3% CAGR, driven by expansion of urban and industrial electrical distribution networks, and increasing demand for reliable power supply systems. Utilities and private developers prioritized installation of compact, non-motorized ring main units to enhance network flexibility, reduce downtime, and improve safety. Local manufacturers invested in modular designs, automated monitoring, and high voltage resistant components to meet stringent grid requirements. Collaboration with global technology providers enabled deployment of innovative solutions across residential, commercial, and industrial zones. Market strategies emphasized cost efficiency, regional service centers, and after sales support to strengthen market penetration. Integration with smart grid initiatives further accelerated adoption of advanced non-motorized ring main units.

India recorded a 9.5% CAGR, supported by rural and urban electrification programs, industrial expansions, and modernization of distribution infrastructure. Demand for compact, non-motorized ring main units increased to ensure reliable medium voltage supply, reduce maintenance, and minimize outages. Domestic suppliers collaborated with multinational engineering firms to introduce modular designs and automated monitoring systems. Competitive strategies focused on cost effectiveness, energy efficiency, and long term service contracts. Adoption was highest in industrial corridors, urban centers, and emerging smart city projects. Regional manufacturing hubs and localized after sales support enabled timely deployment and maintenance, while government incentives for modernized electrical infrastructure encouraged market growth.

Germany progressed at an 8.7% CAGR, influenced by modernization of power distribution networks, industrial applications, and adoption of energy efficient solutions. Utilities prioritized installation of compact, non-motorized ring main units to reduce network losses, enhance safety, and support automated fault detection. Manufacturers focused on high quality, modular components with long operational life and integration with smart grid technologies. Competitive advantage was achieved through certification, compliance with stringent European electrical standards, and reliability in industrial and urban installations. Export opportunities to neighboring European markets also shaped production strategies, while partnerships with local utility providers supported timely implementation and maintenance services.

The United Kingdom expanded at a 7.2% CAGR, driven by urban distribution network upgrades, renewable integration, and increasing reliability requirements. Utilities and industrial facilities adopted non-motorized ring main units to enhance medium voltage network flexibility and minimize downtime. Manufacturers focused on energy efficient designs, automated monitoring, and modular solutions compatible with compact substations. Competitive differentiation relied on after sales service, rapid deployment, and compliance with UK electrical standards. Collaborative projects with utility companies supported deployment across urban, suburban, and industrial zones. The market also saw growth from smart grid pilot programs and renewable integration initiatives, reinforcing the strategic value of advanced non-motorized ring main units.

The United States grew at a 6.5% CAGR, influenced by industrial and commercial demand for reliable medium voltage distribution systems. Utilities invested in compact, non-motorized ring main units to enhance network resilience, reduce outage duration, and improve maintenance efficiency. Manufacturers focused on modular designs, compliance with ANSI and IEEE standards, and integration with monitoring and automation systems. Competitive strategies included long term service contracts, regional service networks, and capacity expansion near major industrial hubs. Adoption was prominent in urban centers, industrial parks, and renewable energy connected grids. Strategic partnerships with utilities and local engineering firms facilitated timely deployment and operational reliability across diverse terrains.

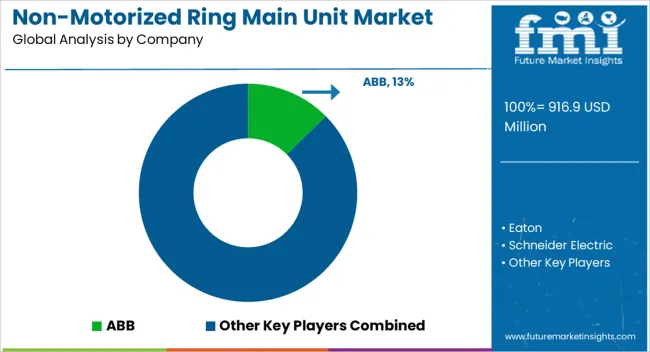

The market has been shaped by global electrical equipment leaders and regional specialists. ABB, Eaton, Schneider Electric, and Siemens have focused on delivering high reliability and grid safety, emphasizing compact design, low maintenance, and fault isolation capabilities. Their strategies highlight modular construction, ease of installation, and compliance with international standards. CG Power & Industrial Solutions, LS ELECTRIC, and Lucy Group have targeted emerging markets with scalable solutions, combining affordability with technical performance. Regional and niche players such as TIEPCO, HD HYUNDAI ELECTRIC, Toshiba Energy Systems, alfanar Group, and CHINT Group have differentiated through local manufacturing and customized designs. Product brochures consistently showcase features like vacuum interrupter technology, high insulation levels, and user-friendly operation interfaces. Focus is placed on minimizing downtime, improving operational safety, and ensuring compatibility with urban and industrial distribution networks. ABB and Schneider highlight smart grid integration, while Eaton and Siemens emphasize long service life and environmental compliance. Competition in the sector revolves around reliability, compactness, and serviceability. Bonomi Eugenio, Electric & Electronic Co., and Orecco emphasize ease of maintenance and flexible deployment. LS ELECTRIC and Toshiba promote digital monitoring and remote operation capabilities. Brochures communicate performance metrics, operational efficiency, and adherence to standards, positioning each brand as a trusted partner for utilities and industrial operators. The market is increasingly driven by product functionality, safety assurance, and technological differentiation rather than price alone.

| Item | Value |

|---|---|

| Quantitative Units | USD 916.9 Million |

| Installation | Indoor and Outdoor |

| Application | Distribution Utilities, Infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Eaton, Schneider Electric, CG Power & Industrial Solutions Ltd., Siemens, Lucy Group Ltd., LS ELECTRIC Co. Ltd., TIEPCO, HD HYUNDAI ELECTRIC CO., LTD., Toshiba Energy Systems & Solutions Corporation, alfanar Group, CHINT Group, Electric & Electronic Co. Ltd., Bonomi Eugenio SpA, and Orecco |

| Additional Attributes | Dollar sales by unit type and application, demand dynamics across urban distribution, industrial, and commercial power networks, regional trends in compact substation adoption, innovation in manual operation, safety, and insulation, environmental impact of material use and energy efficiency, and emerging use cases in rural electrification, microgrids, and decentralized power distribution. |

The global non-motorized ring main unit market is estimated to be valued at USD 916.9 million in 2025.

The market size for the non-motorized ring main unit market is projected to reach USD 1,907.4 million by 2035.

The non-motorized ring main unit market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in non-motorized ring main unit market are indoor and outdoor.

In terms of application, distribution utilities segment to command 46.8% share in the non-motorized ring main unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ring Pull Cap Market Size and Share Forecast Outlook 2025 to 2035

Ring Lights Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Ringworm Treatment Market - Growth & Drug Innovations 2025 to 2035

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Ring Lights Market

Market Share Distribution Among Ring Panel Filters Providers

Ring Laser Gyroscope Market

Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

String Power Conversion System(PCS) Market Size and Share Forecast Outlook 2025 to 2035

Moringa Tea Market Size and Share Forecast Outlook 2025 to 2035

Curing Oven Market Analysis Size and Share Forecast Outlook 2025 to 2035

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Spring Applied Clutches Market Size and Share Forecast Outlook 2025 to 2035

String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringe Scale Magnifiers Market Size and Share Forecast Outlook 2025 to 2035

Boring Bars Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA