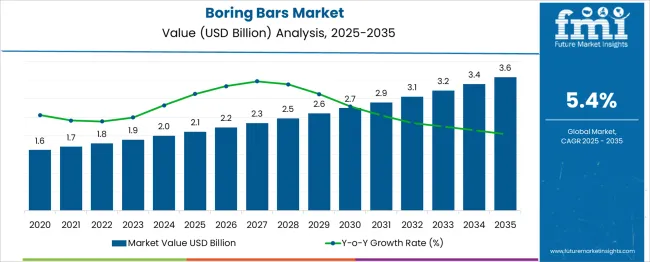

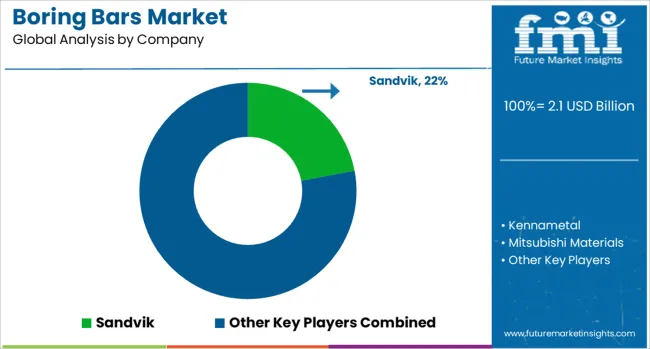

The Boring Bars Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. The boring bars market is projected to experience steady growth from USD 1.6 billion in 2020 to approximately USD 3.6 billion by 2035, reflecting a consistent upward trajectory over the 16-year period. During the initial phase from 2020 to 2025, the market value rises from USD 1.6 billion to USD 2.1 billion, driven by increasing demand in oil and gas, mining, and construction sectors that rely heavily on precision boring technologies. This period is characterized by growing investments in infrastructure development and enhanced exploration activities, which support the adoption of advanced boring bars that offer improved durability and machining accuracy.

Between 2026 and 2030, the market expands from USD 2.2 billion to USD 2.9 billion, supported by technological advancements such as carbide-tipped and coated boring bars that increase operational efficiency and tool life. The integration of smart manufacturing and automation in machining processes further propels market demand during this period. From 2031 to 2035, growth accelerates, with the market advancing from USD 3.1 billion to USD 3.6 billion. This phase benefits from sustained industrial activity, modernization of manufacturing facilities, and increasing focus on precision engineering in aerospace and automotive industries. The Boring Bars Market is positioned for sustained growth through 2035, driven by technological innovation, expanding end-use sectors, and ongoing investments in infrastructure and manufacturing modernization.

| Metric | Value |

|---|---|

| Boring Bars Market Estimated Value in (2025 E) | USD 2.1 billion |

| Boring Bars Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The boring bars market accounts for a specialized yet vital position within the global machining tools and precision engineering industry, accounting for approximately 22–25% share of the boring tools category, underscoring its importance in achieving high-accuracy internal machining operations. Within the broader cutting tools market, boring bars contribute around 10–12%, as they are essential in automotive, aerospace, and heavy equipment manufacturing for precision hole finishing and maintaining strict dimensional tolerances. In the global metalworking and machine tool sector, they command an estimated 8–9% share, driven by rising demand for high-performance tooling solutions that reduce cycle times and improve surface finish quality.

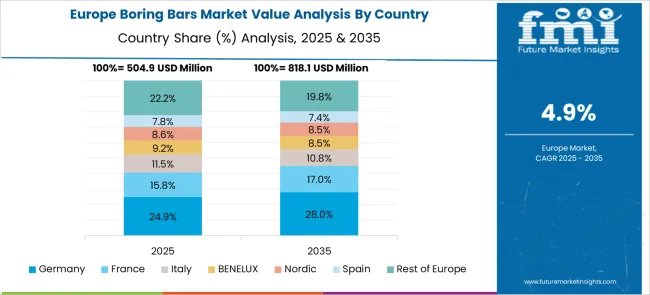

Growth is supported by increasing adoption in CNC machining centers and automated manufacturing setups, where boring bars are indispensable for maintaining repeatability in complex production runs. The market is witnessing significant advancements in modular boring systems, vibration-damping technologies, and coated carbide inserts, which enhance cutting performance and extend tool life, reducing downtime in high-speed operations. Hybrid and digital boring tools equipped with IoT-based monitoring systems are emerging to meet the growing demand for predictive maintenance and process optimization in smart factories. Regional growth is particularly strong in Asia-Pacific, supported by large-scale automotive and industrial production, while Europe and North America are driven by aerospace component manufacturing and advanced machining applications. Despite challenges such as high initial costs and the need for skilled operators, the boring bars market remains integral to achieving precision and efficiency in modern machining environments, making it a cornerstone of the global cutting tools landscape.

The Boring Bars market is demonstrating consistent expansion, driven by increasing demand for precision machining in industries such as automotive, aerospace, heavy equipment, and general manufacturing. As global manufacturing scales up to meet the requirements of tighter tolerances and smoother surface finishes, boring bars are being preferred for their ability to maintain dimensional accuracy in internal machining operations.

The growing penetration of CNC machining and automated lathes has amplified the requirement for high-performance boring tools that offer longer tool life and superior rigidity. In particular, the rising complexity of component designs has elevated the need for customized and durable boring solutions.

Advancements in tool materials, coatings, and insert technologies are also playing a vital role in enhancing performance and productivity. With industrial production accelerating in both developed and emerging economies, and the adoption of Industry 4.0 technologies gaining traction, the boring bars market is expected to witness sustained growth through investments in higher-grade tools and precision engineering solutions..

The boring bars market is segmented by type, material, diameter size, application, and distribution channel and geographic regions. The boring bars market is divided by type into Standard boring bars and Modular/customizable systems. The boring bars market is classified by material into Carbide, Heavy metal, Cement, and Others. Based on the diameter size of the boring bars, the market is segmented into Small diameter, Medium diameter, and Large diameter. By application, the boring bars market is segmented into Automotive, Aerospace, Machinery manufacturing, Oil & gas, and Others. The distribution channel of the boring bars market is segmented into Offline and Online. Regionally, the boring bars industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

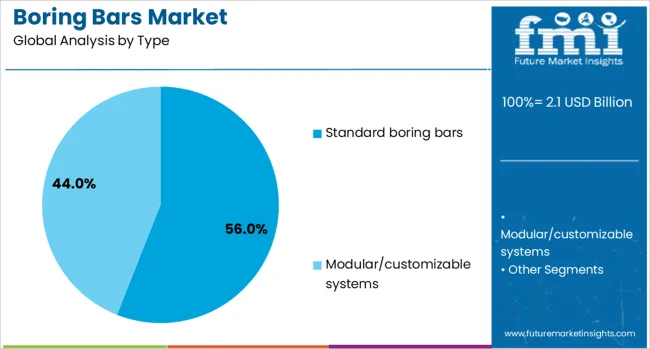

The standard boring bars segment is projected to account for 56% of the total Boring Bars market revenue in 2025, establishing it as the leading segment by type. Growth in this segment has been reinforced by its widespread use in conventional and CNC machining environments where reliability, cost-efficiency, and general-purpose adaptability are key priorities.

Standard boring bars have been favored due to their versatility across a broad range of internal turning and hole-finishing operations. These tools are readily available in various geometries and shank configurations, making them suitable for numerous machining applications without the need for customization.

Additionally, consistent product availability and compatibility with most machine tool systems have increased their preference among manufacturers seeking efficient and scalable solutions. Their cost-effective nature, combined with well-established manufacturing and supply chains, continues to drive the dominance of standard boring bars in the overall market landscape..

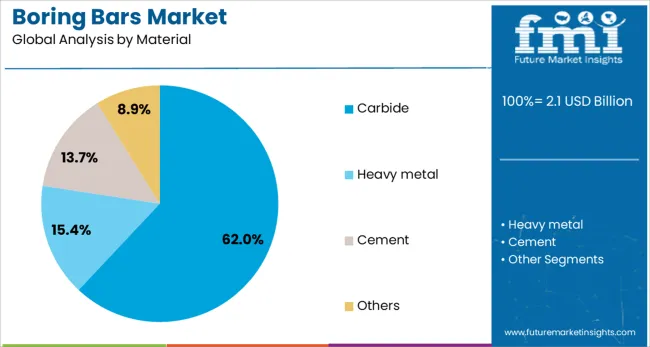

The carbide material segment is anticipated to capture 62% of the Boring Bars market revenue share in 2025, making it the leading material type. Growth in this segment has been supported by the superior hardness, wear resistance, and thermal stability that carbide materials offer under high-speed and high-temperature machining conditions.

Carbide boring bars have been widely adopted across manufacturing sectors due to their ability to maintain dimensional precision and reduce tool replacement frequency, which results in improved productivity and lower operational downtime. This material has also enabled longer tool life when machining hardened steels and alloys, which are increasingly common in aerospace and automotive components.

Moreover, ongoing advancements in powder metallurgy and coating technologies have enhanced the toughness and versatility of carbide tools. As manufacturers increasingly prioritize cost per component, carbide boring bars have become the material of choice for precision-driven and high-volume machining operations..

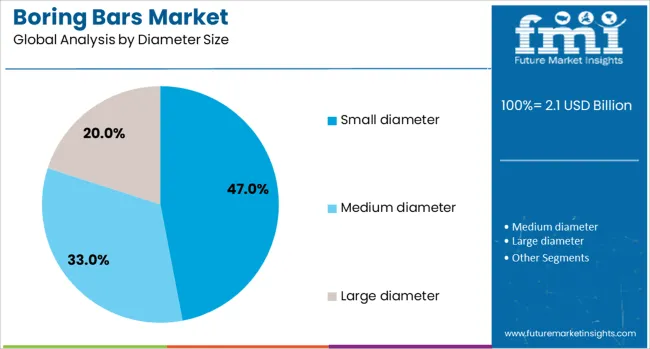

The small diameter segment is forecasted to hold 47% of the Boring Bars market revenue in 2025, making it the leading segment by diameter size. The growth of this segment has been driven by increasing demand for intricate internal machining in industries such as electronics, medical devices, and precision automotive components. Small diameter boring bars have been preferred in operations requiring access to confined spaces and the ability to machine fine bores with minimal vibration.

Their compact design allows for high-speed operation and precise control, which are essential for micro-machining and detailed part features. Additionally, manufacturers have been investing in specialized tool designs that enhance rigidity and chip evacuation in small-diameter applications, further strengthening their utility.

As component miniaturization trends continue to shape next-generation products, the adoption of small diameter boring bars has been consistently rising. The combination of demand for high-precision parts and advancements in toolholder systems has maintained this segment’s leadership in the market..

The boring bars market is expanding through increased demand in automotive, aerospace, and CNC-integrated systems. Modular designs, vibration-damping solutions, and regional manufacturing growth shape the competitive dynamics globally.

The boring bars market is experiencing significant growth driven by increasing demand from automotive and aerospace manufacturing industries. Precision boring tools are essential for producing engine blocks, transmission housings, and structural components requiring tight tolerances. The rising production of electric vehicles and fuel-efficient engines further amplifies demand for high-performance boring bars capable of handling advanced alloys and composite materials. Aerospace applications emphasize extreme precision and consistency in machining turbine housings and critical airframe components, creating opportunities for premium boring solutions. As manufacturers focus on reducing production errors and improving productivity, boring bars remain central to achieving dimensional accuracy in these critical sectors.

Modular boring systems are gaining traction due to their flexibility in accommodating diverse hole sizes and configurations, making them cost-effective for high-mix production environments. Vibration-damping boring bars are also witnessing strong adoption in industries where surface finish and accuracy are paramount. These systems incorporate tuned mass dampers or anti-vibration materials that reduce chatter and improve machining stability. The shift toward advanced boring solutions is driven by the need to maintain cutting speeds without compromising precision, particularly in deep-hole boring operations. This trend is enabling manufacturers to achieve faster cycle times while enhancing tool life and overall process reliability.

The integration of boring bars into CNC machining centers and automated production lines is a major growth driver. With increasing adoption of multi-axis machines and flexible manufacturing systems, boring bars designed for compatibility with automated setups are in high demand. These tools allow precise adjustments and quick tool changes, reducing downtime and boosting efficiency in batch production environments. Manufacturers are also focusing on solutions that enable digital presetting and easy calibration to improve operational consistency. As production facilities move toward higher throughput and lean operations, boring bars play a pivotal role in ensuring process accuracy and repeatability.

Asia-Pacific leads the global boring bars market, supported by strong automotive and industrial manufacturing bases in China, India, and Japan. Europe remains a critical market, driven by advanced engineering sectors and demand for high-precision tooling in aerospace and defense applications. North America continues to invest in automated machining systems, creating opportunities for specialized boring tools with enhanced performance features. The competitive landscape is marked by established tooling companies expanding their portfolios with modular and digital-enabled solutions. Strategic priorities include partnerships with CNC machine manufacturers, product customization, and regional distribution expansion to capture growing demand across industrial hubs.

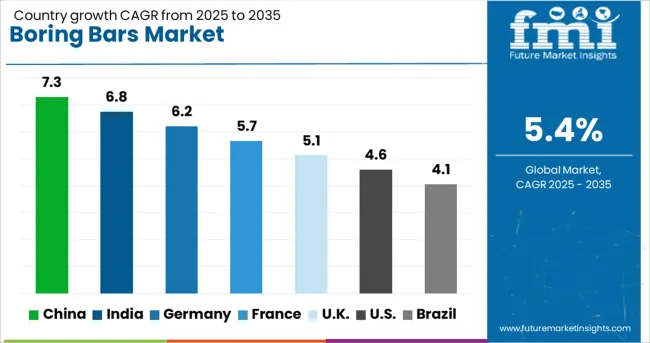

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The boring bars market is projected to grow globally at a CAGR of 5.4% between 2025 and 2035, driven by rising demand in automotive, aerospace, and precision engineering sectors. China leads with a CAGR of 7.3%, supported by rapid industrial automation, expansion of automotive manufacturing, and strong investments in advanced metal-cutting technologies. India follows at 6.8%, fueled by robust growth in automotive production, infrastructure projects, and the adoption of CNC machining centers in small and mid-sized enterprises. France records 5.7%, driven by demand for high-performance boring tools in defense and energy sectors, coupled with ongoing modernization of machine tools. The United Kingdom grows at 5.1%, influenced by increasing adoption of modular and anti-vibration boring bars in advanced manufacturing setups, while the United States shows a CAGR of 4.6%, reflecting steady investments in automated production systems and retrofitting initiatives across aerospace and automotive facilities. The analysis spans over 40 countries worldwide, with these five representing key benchmarks for growth strategies, product development priorities, and regional expansion opportunities in the global boring bars market.

China is projected to register a CAGR of 7.3% for 2025–2035, up from nearly 6.5% during 2020–2024, significantly higher than the global average of 5.4%. The growth acceleration is driven by rapid industrial automation, large-scale automotive production, and expanding aerospace manufacturing capabilities. During the earlier phase, demand was primarily fueled by conventional machining in automotive components and infrastructure equipment. However, the upcoming decade is expected to witness higher adoption of advanced boring solutions featuring anti-vibration designs and modular systems tailored for CNC machining centers. Government-backed programs supporting smart manufacturing and increased investment in precision tooling solutions continue to reinforce China’s leadership position.

India is expected to grow at a CAGR of 6.8% during 2025–2035, rising from approximately 6.0% in 2020–2024, indicating a healthy upward trend. Earlier growth was driven by steady automotive production and infrastructure investments, with conventional machine tools dominating the landscape. Post-2024, the push toward electric vehicle manufacturing and integration of CNC technology in small and medium-scale enterprises has amplified demand for high-performance boring bars. Government initiatives such as “Make in India” and increased FDI in manufacturing are also creating favorable conditions for premium tooling adoption. This shift from standard tools to precision boring systems is expected to boost overall market revenue in the long term.

France is forecasted to post a CAGR of 5.7% for 2025–2035, compared to nearly 5.0% during 2020–2024, reflecting a moderate but steady rise. In the earlier phase, the market was influenced by strong aerospace manufacturing and defense sector investments requiring precision tooling solutions. The upcoming period brings more focus on automated machining and hybrid boring systems tailored for high-value applications in turbines, aerospace components, and energy infrastructure. Strategic R&D initiatives in vibration-damping boring bars and partnerships with European machine tool manufacturers are reinforcing competitiveness in this segment. Continuous emphasis on process optimization and digital-ready solutions positions France as a vital market within Europe.

The UK is projected to post a CAGR of 5.1% for 2025–2035, increasing from about 4.3% during 2020–2024, highlighting a gradual improvement. The earlier growth pace was restricted by limited capital investment in new machining technologies across smaller workshops. In the coming years, higher adoption of CNC and automated production systems in aerospace, automotive, and renewable energy equipment manufacturing will boost boring bar utilization. Strong emphasis on localizing advanced tooling supply and technological partnerships is also driving market readiness. Expansion of high-precision component manufacturing, particularly for export markets, will further sustain demand.

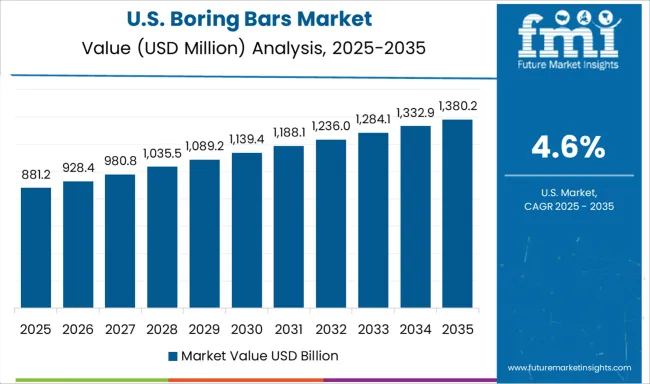

The United States is expected to grow at a CAGR of 4.6% during 2025–2035, up from around 3.9% in 2020–2024, representing consistent but slower growth relative to emerging markets. In the earlier phase, the market benefited from steady retrofitting of machining systems in automotive and heavy equipment sectors. Looking forward, the focus is on high-precision boring bars for aerospace, defense, and medical device manufacturing, where tolerances are extremely tight. Investments in smart factories and integration of digital presetting technologies are influencing the adoption of advanced boring systems. Continued reshoring initiatives in manufacturing will further create new demand pockets for precision tooling solutions.

The boring bars market is led by globally recognized cutting tool manufacturers such as Sandvik, Kennametal, Mitsubishi Materials, ISCAR (IMC Group), and Ceratizit, all competing on precision engineering, product innovation, and cost efficiency. Sandvik dominates with a strong portfolio of advanced boring solutions, emphasizing modular systems and vibration-damping technologies for high-precision machining in automotive and aerospace industries. Kennametal leverages its expertise in wear-resistant tooling to deliver high-performance boring bars optimized for CNC integration, offering extended tool life and improved cutting stability for complex components. Mitsubishi Materials focuses on delivering versatile boring solutions with enhanced chip evacuation and coated carbide inserts, catering to demanding sectors such as heavy machinery and energy. ISCAR (IMC Group) differentiates through its strong emphasis on smart tooling and advanced anti-vibration designs that enable superior performance in deep-hole boring operations.

Ceratizit plays a key role in the European market, providing customized boring solutions tailored for small- and medium-scale enterprises, with an emphasis on cost-effective production without compromising quality. Competitive dynamics are shaped by the adoption of modular and digital-ready boring bars, driven by increasing automation and CNC machining adoption across industries. Strategic priorities include the development of IoT-enabled boring tools for predictive maintenance, partnerships with machine tool OEMs for integrated solutions, and the expansion of regional manufacturing hubs to reduce lead times. With rising demand from automotive, aerospace, and industrial manufacturing, these players are positioned to capture significant market share by delivering high-performance, customizable, and application-specific solutions.

On June 24, 2025, Sandvik announced the first phase of restructuring in its Machining division (2025–2030), focusing on operational efficiency and margin resilience as part of its “Advancing to 2030” strategy.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Type | Standard boring bars and Modular/customizable systems |

| Material | Carbide, Heavy metal, Cement, and Others |

| Diameter Size | Small diameter, Medium diameter, and Large diameter |

| Application | Automotive, Aerospace, Machinery manufacturing, Oil & gas, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sandvik, Kennametal, Mitsubishi Materials, ISCAR (IMC Group), and Ceratizit |

The global boring bars market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the boring bars market is projected to reach USD 3.6 billion by 2035.

The boring bars market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in boring bars market are standard boring bars, _single-point boring bars, _multi-point boring bars, _micro boring bars, _heavy-duty boring bars, modular/customizable systems, _quick-change boring bars, _adjustable boring heads, _digital boring systems and _custom solution boring bars.

In terms of material, carbide segment to command 62.0% share in the boring bars market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cylinder Boring Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Boring Machines Market Size and Share Forecast Outlook 2025 to 2035

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Snack Bars Market – Growth, Demand & Functional Nutrition Trends

Cereal Bars Market Growth - Health & Convenience Food Trends 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Bars Market Analysis by Type, Distribution Channel, and Region Through 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Nootropic Energy Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Automotive Light Bars Market Growth - Trends & Forecast 2025 to 2035

Two Wheeler Handlebars Market Size and Share Forecast Outlook 2025 to 2035

Automotive Door Impact Bars Market

Demand for Vegan Protein Bars in EU Size and Share Forecast Outlook 2025 to 2035

Cold Finished Iron and Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Rolled Or Extruded Aluminum Rods Bars And Wires Market Size and Share Forecast Outlook 2025 to 2035

Hot Rolled Or Cold Finished Alloy Steel Bars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA