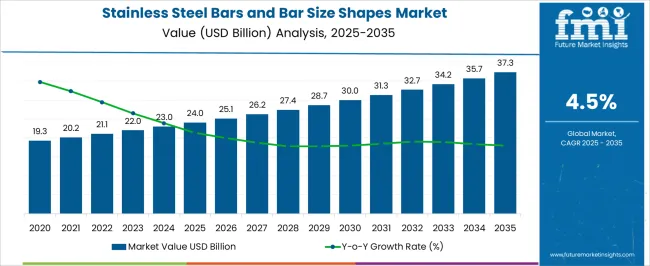

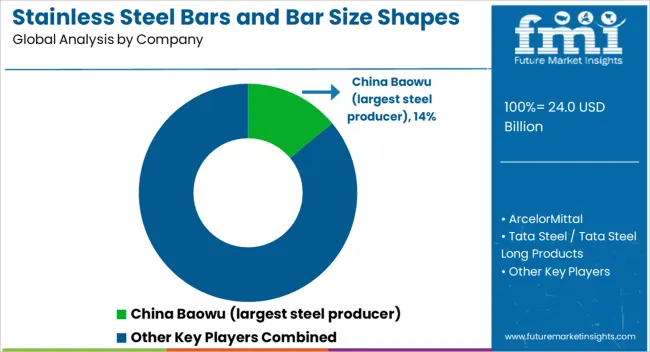

The stainless steel bars and bar size shapes market is estimated to be valued at USD 24.0 billion in 2025 and is projected to reach USD 37.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

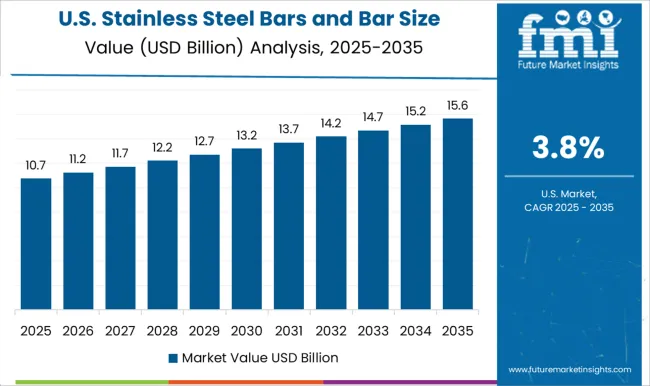

The growth trajectory of this market reveals a steady acceleration and mild deceleration pattern, indicating that while the industry consistently expands, the momentum is relatively balanced rather than volatile. Beginning from USD 19.3 billion in the early phase, the market shows a gradual lift with incremental gains year after year, reflecting strong but not aggressive demand across construction, infrastructure, automotive, and industrial applications. The climb from USD 24.0 billion in 2025 to around USD 28.7 billion by 2029 suggests the market maintains steady acceleration during the mid-term, driven by rising urban infrastructure projects and replacement demand in developed economies.

However, as the market approaches maturity toward 2030 and beyond, growth moves into a more measured pace, with increases slightly smaller on a year-over-year basis though still stable, highlighting a mild deceleration effect typical of markets that balance new demand with saturation in traditional sectors. By 2035, with the industry projected to reach USD 37.3 billion, the market demonstrates resilience with incremental stability, indicating opportunities tied to technological upgrades, sustainability goals in steel recycling, and advanced alloy applications. This pattern suggests a long-term reliability for stakeholders while also underlining that innovative solutions and diversification into specialized grades will be essential to sustain momentum in a moderately growing market.

| Metric | Value |

|---|---|

| Stainless Steel Bars and Bar Size Shapes Market Estimated Value in (2025 E) | USD 24.0 billion |

| Stainless Steel Bars and Bar Size Shapes Market Forecast Value in (2035 F) | USD 37.3 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The stainless steel bars and bar size shapes market holds a notable share within the global metal products and fabrication industry, accounting for approximately 18–20% of the total long product segment. Its role in construction, infrastructure, and industrial machinery drives this share, as stainless steel bars offer corrosion resistance, mechanical strength, and dimensional stability essential for structural and mechanical applications. Within the automotive components and heavy equipment sector, these bars capture around 12–14% share, reflecting their adoption in engine parts, shafts, and fasteners where durability and resistance to wear are critical. In the oil and gas, chemical processing, and power generation industries, stainless steel bars account for roughly 15–17% share, supporting pipelines, valves, and structural frameworks that require high performance under extreme temperature and pressure conditions.

The household appliances, kitchenware, and consumer hardware category absorbs nearly 10–12% share, driven by demand for hygienic and aesthetically durable products. Expansion in industrial applications, adoption of precision forging, and advances in metallurgical control further support market growth. Manufacturers are investing in process optimization, quality assurance, and alloy customization to meet stringent sector-specific requirements, ensuring stainless steel bars and bar size shapes remain integral to diverse global industries.

The market is experiencing strong growth as industries increasingly require materials with high corrosion resistance, mechanical strength, and durability. Expansion in sectors such as construction, automotive, energy, and heavy machinery is driving demand for stainless steel bars in varied shapes and sizes. Rising investments in infrastructure projects, coupled with the adoption of high-performance materials for demanding environments, are further contributing to market momentum.

Global trends toward sustainability and longer lifecycle products are encouraging the use of stainless steel due to its recyclability and low maintenance needs. Technological advancements in production processes and precision finishing are also supporting market growth by enabling tighter tolerances and improved surface qualities.

With manufacturers focusing on efficiency and versatility, the market is set to benefit from a growing shift toward customized specifications and specialized alloys These factors are expected to sustain steady demand and create new opportunities in both developed and emerging economies.

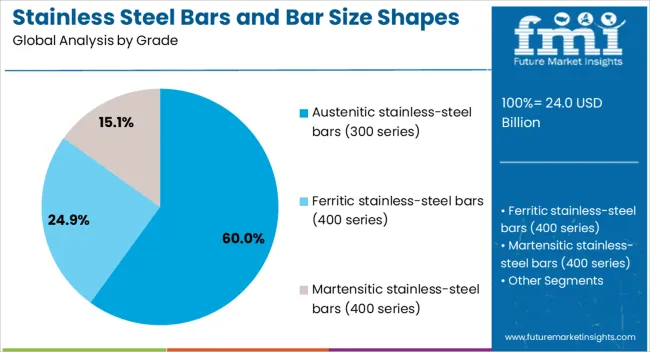

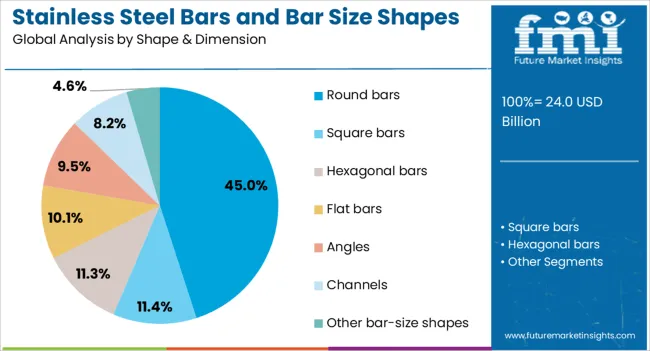

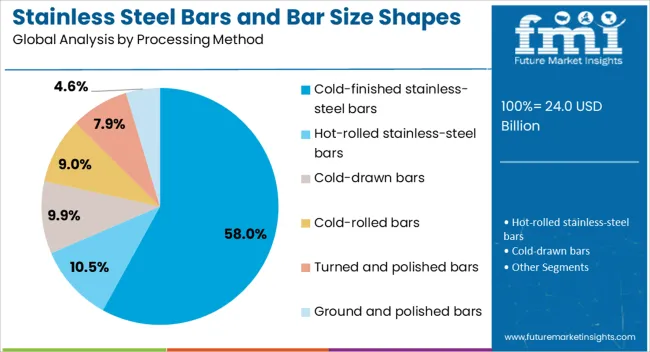

The stainless steel bars and bar size shapes market is segmented by grade, shape & dimension, processing method, application, and geographic regions. By grade, stainless steel bars and bar size shapes market is divided into austenitic stainless-steel bars (300 series), ferritic stainless-steel bars (400 series), martensitic stainless-steel bars (400 series), duplex stainless-steel bars, and precipitation hardening stainless steel bars. In terms of shape & dimension, stainless steel bars and bar size shapes market is classified into round bars, square bars, hexagonal bars, flat bars, angles, channels, and other bar-size shapes. Based on processing method, stainless steel bars and bar size shapes market is segmented into cold-finished stainless-steel bars, hot-rolled stainless-steel bars, cold-drawn bars, cold-rolled bars, turned and polished bars, and ground and polished bars. By application, stainless steel bars and bar size shapes market is segmented into automotive and transportation, aerospace and defense, construction and infrastructure, oil and gas industry, chemical and petrochemical industry, food and beverage industry, medical and pharmaceutical, power generation, marine and shipbuilding, machinery and equipment manufacturing, and other applications. Regionally, the stainless steel bars and bar size shapes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The austenitic stainless steel bars grade segment is projected to hold 60% of the stainless steel bars and bar size shapes market revenue share in 2025, making it the dominant grade type. Its leadership position is attributed to the superior corrosion resistance, high ductility, and excellent formability offered by the 300 series alloys, which are widely preferred across multiple industrial applications. These properties make the material suitable for environments exposed to moisture, chemicals, and extreme temperatures, thereby extending service life and reducing maintenance costs. The non-magnetic nature of austenitic stainless steel, along with its ability to maintain mechanical integrity at both high and low temperatures, has further driven adoption. Additionally, the segment benefits from its compatibility with advanced processing techniques, allowing manufacturers to meet stringent industry specifications Strong demand from sectors such as food processing, chemical manufacturing, and architecture continues to reinforce the segment’s leading position in the market.

The round bars shape and dimension segment is anticipated to account for 45% of the market revenue share in 2025, making it the leading shape category. This dominance is supported by the extensive applicability of round bars in machining, construction, and manufacturing operations where uniformity and precision are critical. The segment has gained prominence due to its versatility in being easily cut, drilled, and shaped to meet specific requirements across different industries. Round bars offer balanced strength and workability, enabling their use in shafts, fasteners, and structural frameworks. The shape also facilitates consistent load distribution, making it suitable for high-stress applications. Furthermore, round bars in stainless steel deliver enhanced resistance to wear and corrosion, ensuring longer operational life The combination of mechanical performance, adaptability, and widespread availability has firmly established round bars as the preferred choice in various industrial and commercial settings.

The cold-finished stainless steel bars processing method segment is expected to hold 58% of the market revenue share in 2025, emerging as the leading processing category. Its growth has been propelled by the superior surface finish, tighter dimensional tolerances, and enhanced mechanical properties achieved through cold finishing techniques. The method provides improved straightness and uniformity, which are critical for precision applications in industries such as aerospace, automotive, and engineering. Cold finishing also enhances yield strength and hardness without compromising corrosion resistance, making the products more durable under challenging conditions. Manufacturers prefer this method for its ability to produce bars that meet high-performance requirements with minimal post-processing. The consistent quality and appearance of cold-finished bars contribute to their demand in applications where aesthetics and performance are equally important These advantages have solidified the segment’s leadership in the processing method category of the market.

Stainless steel bars and bar size shapes are witnessing strong demand driven by industrial, automotive, energy, and construction applications. Growth is supported by their mechanical strength, corrosion resistance, and versatility across multiple sectors.

Demand for stainless steel bars and bar size shapes is being propelled by growth in industrial and manufacturing sectors, particularly in heavy machinery, automotive, and infrastructure projects. Increasing investments in industrial plants, expansion of production facilities, and modernization of existing machinery require high-strength, corrosion-resistant bars. The versatility of stainless steel in enduring mechanical stress, temperature fluctuations, and chemical exposure makes it a preferred choice in engineering applications. The integration of stainless steel bars into construction frameworks, oil and gas pipelines, and chemical plants enhances structural reliability. Manufacturers are focusing on optimizing alloy composition to meet specific industrial needs, ensuring longevity and performance across challenging operational environments.

Stainless steel bars and bar size shapes see growing adoption in automotive and transportation sectors due to their strength, wear resistance, and lightweight alternatives for critical components. Engine shafts, transmission systems, fasteners, and structural frameworks increasingly rely on these bars to meet regulatory and performance standards. Rising vehicle production, especially in electric and hybrid vehicles, intensifies demand for high-quality stainless steel components. Railways, shipbuilding, and aerospace sectors also contribute, using bars for structural frames and mechanical assemblies. The push for improved fuel efficiency, safety compliance, and longevity supports the selection of stainless steel bars over conventional metals, while OEMs and component manufacturers seek reliable suppliers to maintain production continuity and quality assurance.

Energy, oil, and gas infrastructure projects contribute substantially to the consumption of stainless steel bars and bar size shapes, particularly in pipelines, pressure vessels, valves, and offshore platforms. Bars are valued for their corrosion resistance in harsh chemical environments, high-temperature tolerance, and ability to withstand high pressure. Expanding renewable and non-renewable energy projects also boost demand, as power generation plants, refineries, and chemical processing units require structural components that can endure rigorous operational conditions. Suppliers are leveraging metallurgical improvements, precision forging, and strict quality control to meet industrial specifications. Rising energy infrastructure projects worldwide, coupled with stringent safety and performance standards, ensure consistent stainless steel bar demand.

Stainless steel bars and bar size shapes are increasingly used in consumer goods, kitchenware, and construction applications due to their durability, corrosion resistance, and aesthetic appeal. The construction sector integrates bars into structural supports, facades, and railings, while household appliances and furniture benefit from their hygienic and long-lasting properties. Builders and designers prefer stainless steel for its low maintenance and longevity compared to traditional metals. Demand is further strengthened by large-scale residential and commercial projects, refurbishment initiatives, and modernization of urban infrastructure. Material suppliers are focusing on precise sizing, alloy optimization, and surface finishing to meet both functional and visual expectations across industrial and consumer applications.

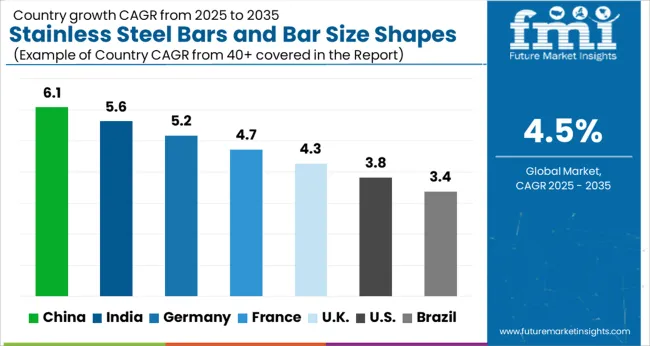

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

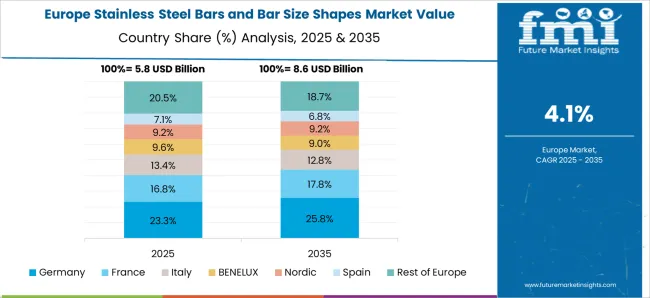

The stainless steel bars and bar size shapes market is projected to grow at a global CAGR of 4.5% between 2025 and 2035, fueled by expanding industrial, automotive, and construction applications. China leads with a CAGR of 6.1%, driven by large-scale infrastructure projects, rising industrial production, and growing use of stainless steel in machinery and pipelines. India follows at 5.6%, supported by rapid industrialization, automotive component manufacturing, and increasing adoption of corrosion-resistant bars in energy and construction sectors. France records a CAGR of 4.7%, backed by its advanced industrial machinery sector, infrastructure modernization, and high-quality steel production. The United Kingdom grows at 4.3%, reflecting demand in construction, transportation, and industrial engineering, while the United States posts 3.8%, shaped by steady use in aerospace, automotive, and energy infrastructure projects. The analysis spans over 40 global markets, with these five countries serving as benchmarks for evaluating growth trends, industrial adoption, and investment strategies in stainless steel bars and bar size shapes worldwide.

China recorded a CAGR of 5.2% during 2020–2024, which is projected to rise to 6.1% during 2025–2035, well above the global average of 4.5%. The earlier period growth was fueled by increasing industrialization, rising demand in construction, and expanding manufacturing sectors requiring corrosion-resistant steel bars. Moving into 2025–2035, higher growth is expected due to major infrastructure projects, accelerated urban construction, and increasing domestic consumption in automotive and machinery applications. Steel producers are scaling production capacities and enhancing quality control to meet rising industrial demand. The combination of government-backed industrial expansion and continued adoption of stainless steel in energy, transport, and construction is supporting strong market momentum.

India posted a CAGR of 4.8% during 2020–2024, which is anticipated to increase to 5.6% during 2025–2035, surpassing the global average of 4.5%. Initial growth was supported by rising industrial activity, expansion of construction projects, and increased use of stainless steel in automotive components. From 2025 onward, the market benefits from infrastructure development programs, accelerated industrial machinery production, and higher adoption in the energy sector. Rising demand from residential and commercial construction, combined with expanding steel alloy production, drives stronger uptake. Indian manufacturers are also investing in modern production facilities to meet domestic and export requirements, further enhancing market growth.

The UK posted a CAGR of 3.9% during 2020–2024, increasing to 4.3% during 2025–2035, slightly below the global average of 4.5%. Early growth was influenced by stable construction activity, moderate industrial production, and adoption in machinery manufacturing. In 2025–2035, the CAGR improves due to higher investments in industrial upgrades, replacement of aging infrastructure, and increased use of stainless steel in transportation and manufacturing sectors. Market expansion is also aided by import substitution, supply chain optimization, and government initiatives to modernize steel processing. Focused investment in high-quality stainless steel production is expected to reinforce market competitiveness.

The US recorded a CAGR of 3.5% during 2020–2024, which is projected to rise to 3.8% during 2025–2035, below the global CAGR of 4.5%. Growth in the initial period was driven by steady construction, aerospace, and automotive industries requiring stainless steel bars. For 2025–2035, market growth is expected to gain momentum due to infrastructure replacement programs, industrial machinery expansion, and ongoing adoption in transportation and energy projects. Domestic manufacturers are focusing on improving production efficiency and meeting quality standards to maintain competitiveness. The market is also supported by incremental growth in commercial and industrial sectors seeking durable, corrosion-resistant materials.

France posted a CAGR of 4.3% during 2020–2024, which is projected to increase to 4.7% during 2025–2035, slightly above the global average of 4.5%. Initial growth was supported by industrial machinery, construction, and automotive manufacturing needs. Moving forward, expansion is driven by infrastructure modernization, adoption of stainless steel bars in high-performance machinery, and energy sector investments. French steel producers are focusing on production optimization and alloy quality improvements to meet growing industrial requirements. The combination of industrial modernization and stable domestic demand ensures moderate but steady growth across the stainless steel bar and bar size shapes segment.

The stainless steel bars and bar size shapes market is shaped by global steel leaders, integrated producers, and regional manufacturers that ensure steady supply for construction, automotive, industrial, and machinery applications. China Baowu, as the largest steel producer, holds a dominant position by securing large-scale production capacity and maintaining extensive partnerships with domestic and international fabricators. ArcelorMittal leverages its global network to supply high-quality stainless steel bars across multiple geographies. Tata Steel and Tata Steel Long Products, along with Jindal and Jindal Stainless, cater to domestic and regional demand, offering tailored solutions for industrial and infrastructure projects. Nippon Steel, JFE, and other Japanese producers are recognized for high-grade alloys used in automotive, engineering, and specialty applications.

Acerinox, Aperam, Outokumpu, and Sandvik focus on specialty and high-performance stainless steel products for industrial and machining applications. Regional manufacturers and service centers provide flexible, cost-efficient solutions for smaller volumes and customized orders. Key strategies across this competitive landscape include vertical integration to secure raw material access, customization of stainless steel grades for specific end-use industries, and partnerships with construction, automotive, and industrial companies to expand application scope. Producers are increasingly focused on optimizing production efficiency, maintaining stringent quality standards, and developing resilient supply chains to manage market fluctuations. Competitive dynamics are expected to be influenced by global trade policies, capacity expansions in emerging markets, and innovations in alloy compositions, ensuring stainless steel bars and bar size shapes remain essential in industrial and infrastructure applications worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.0 billion |

| Grade | Austenitic stainless-steel bars (300 series), Ferritic stainless-steel bars (400 series), Martensitic stainless-steel bars (400 series), Duplex stainless-steel bars, and Precipitation hardening stainless steel bars |

| Shape & Dimension | Round bars, Square bars, Hexagonal bars, Flat bars, Angles, Channels, and Other bar-size shapes |

| Processing Method | Cold-finished stainless-steel bars, Hot-rolled stainless-steel bars, Cold-drawn bars, Cold-rolled bars, Turned and polished bars, and Ground and polished bars |

| Application | Automotive and transportation, Aerospace and defense, Construction and infrastructure, Oil and gas industry, Chemical and petrochemical industry, Food and beverage industry, Medical and pharmaceutical, Power generation, Marine and shipbuilding, Machinery and equipment manufacturing, and Other applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | China Baowu, ArcelorMittal, Tata Steel , Jindal Stainless Limited, Nippon Steel |

| Additional Attributes | Dollar sales, market share, CAGR by region, demand by end-use (construction, automotive, machinery), supply-demand gaps, price trends, raw material costs, regulatory impact, and competitive positioning. |

The global stainless steel bars and bar size shapes market is estimated to be valued at USD 24.0 billion in 2025.

The market size for the stainless steel bars and bar size shapes market is projected to reach USD 37.3 billion by 2035.

The stainless steel bars and bar size shapes market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in stainless steel bars and bar size shapes market are austenitic stainless-steel bars (300 series), 304/304l stainless steel, and others.

In terms of shape & dimension, round bars segment to command 45.0% share in the stainless steel bars and bar size shapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA