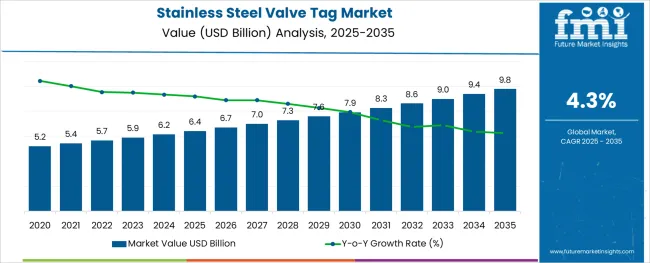

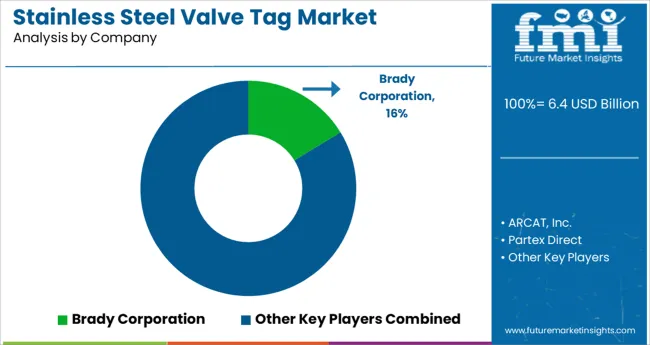

The Stainless Steel Valve Tag Market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

The market is segmented by Thickness, Product Type, and Distribution Channel and region. By Thickness, the market is divided into Less than 30 mm, 30-50 mm, and Above 50 mm. In terms of Product Type, the market is classified into Engraved and Blank. Based on Distribution Channel, the market is segmented into Online and Offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

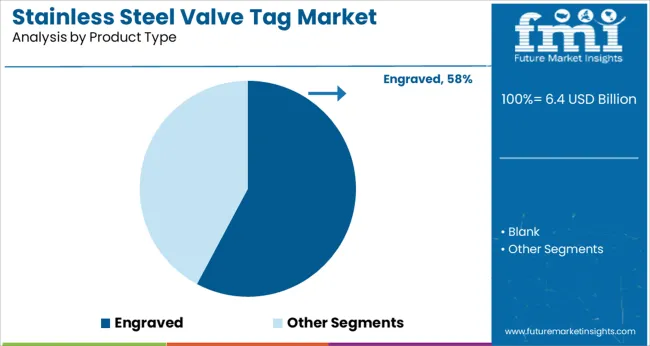

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

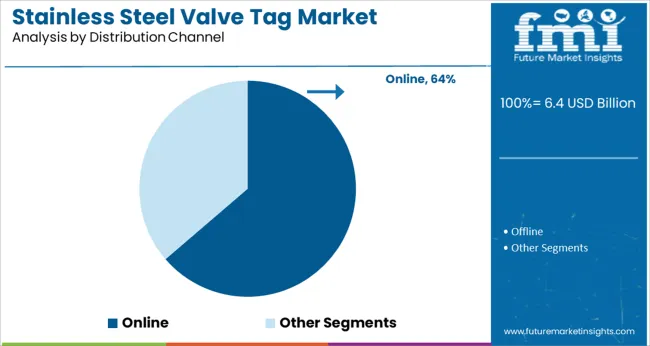

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

Identification and labeling of the valve, pipe, equipment, and instrument are considered vital and prudent. Accidents, damage, and injuries to equipment can be caused by people not knowing what distinct valve, pipe, equipment, and instrument contains.

Stainless steel valve tag is widely used in various end-use industries for valve identification needs, increasing the sales of stainless steel valve tags.

This factor is expected to drive the growth of the global stainless steel valve tag market during the forecast period.

Stainless steel valve tag is gaining popularity in various end-use industries due to its low cost, low thickness, and highly durable nature, which can withstand extreme environmental conditions. Such factors are expected to push the growth in the sales of stainless steel valve tags during the forecast period.

The continuous expansion of end-user industries such as food processing, medical, chemical, and others across the globe is expected to create significant demand for stainless steel valve tags during the forecast period. Overall, the global stainless steel valve tag is likely to expand with notable CAGR during the forecast period.

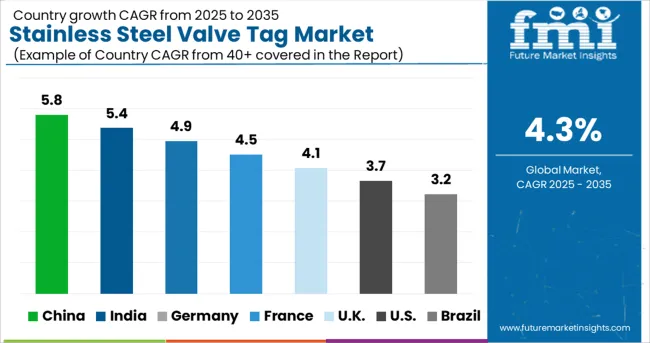

The Asia Pacific, excluding Japan (APEJ) region is expected to be at the forefront in terms of market share of the global stainless steel valve tag market during the forecast period.

The presence of high growth economies, coupled with a rapid expansion of end-use industries, is expected to drive the growth of the APEJ stainless steel valve tag market during the forecast period. India and ASEAN countries are expected to register the peak growth rate of the stainless steel valve tag market during the forecast period.

Latin America and the Middle East and Africa are expected to create significant demand for stainless steel valve tag markets during the forecast period. Expansion of various end-user industries and the presence of emerging economies are the factors driving the stainless-steel valve tag market in Latin America and the Middle East & Africa region.

Western Europe and North America are significant shareholders of the global stainless steel valve tag market and are likely to register notable CAGR during the forecast period.

Germany in Western Europe and the USA in North America are expected to be highly attractive in terms of the market share of stainless-steel valve tags during the forecast period. Japan's stainless steel valve tag market is anticipated to expand with moderate CAGR during the forecast period.

The key players of the Stainless steel valve tag market is focusing on. The competitors also focus on factors like product launches, partnerships for better access to distribution channels. Companies also work on durability, design and new market specific sizes that drive the demand for Stainless steel valve tag business. This drives the sales of Stainless steel valve tag.

Key players in Stainless steel valve tag market include Seton – A Brandy Corporation Company, Metal Marker Manufacturing, Inland Products, Big City Manufacturing, Tag-It Industries, Ketchum Manufacturing Inc and National Band & Tag company.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.3% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million, volume in kilotons, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Stainless Steel, Thickness Type, Sales Channel, End Use, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Seton – A Brandy Corporation Company; Metal Marker Manufacturing; Inland Products; Big City Manufacturing; Tag-It Industries; Ketchum Manufacturing Inc and National Band & Tag company |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global stainless steel valve tag market is estimated to be valued at USD 6.4 billion in 2025.

It is projected to reach USD 9.8 billion by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are less than 30 mm, 30-50 mm and above 50 mm.

engraved segment is expected to dominate with a 57.8% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stainless Steel One-touch Fitting Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA