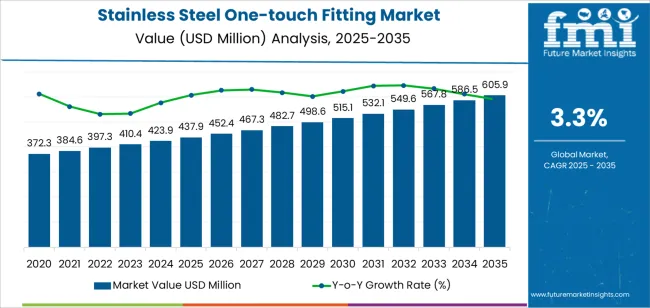

The global stainless steel one-touch fitting market is valued at USD 437.9 million in 2025. It is slated to reach USD 605.8 million by 2035, recording an absolute increase of USD 167.9 million over the forecast period. This translates into a total growth of 38.3%, with the market forecast to expand at a CAGR of 3.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.38X during the same period, supported by increasing automation in food and beverage processing facilities, growing adoption of stainless steel fittings in pharmaceutical manufacturing for contamination-free fluid transfer, and rising emphasis on corrosion-resistant and hygienic connection solutions across diverse industrial, chemical processing, and cleanroom applications.

Between 2025 and 2030, the stainless steel one-touch fitting market is projected to expand from USD 437.9 million to USD 515.0 million, resulting in a value increase of USD 77.1 million, which represents 45.9% of the total forecast growth for the decade. This phase of development will be shaped by increasing pharmaceutical production capacity and stringent hygiene requirements, rising adoption of automated assembly systems in food processing plants, and growing demand for corrosion-resistant fittings in chemical handling applications. Equipment manufacturers and system integrators are expanding their stainless steel one-touch fitting capabilities to address the growing demand for reliable and sanitary connection solutions that ensure operational efficiency and regulatory compliance.

From 2030 to 2035, the market is forecast to grow from USD 515.0 million to USD 605.8 million, adding another USD 90.8 million, which constitutes 54.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of biopharmaceutical manufacturing facilities and sterile processing requirements, the development of advanced surface treatment technologies and passivation methods, and the growth of specialized applications for semiconductor manufacturing and high-purity gas delivery systems. The growing adoption of Industry 4.0 principles and smart manufacturing strategies will drive demand for stainless steel one-touch fittings with enhanced reliability and maintenance-free operational features.

Between 2020 and 2025, the stainless steel one-touch fitting market experienced steady growth, driven by increasing food safety regulations and growing recognition of stainless steel one-touch fittings as essential components for ensuring contamination-free fluid transfer and maintaining hygiene standards in diverse pharmaceutical, food processing, and chemical handling applications. The market developed as process engineers and facility managers recognized the potential for stainless steel one-touch fitting technology to simplify installation procedures, reduce assembly time, and support sanitation objectives while meeting stringent performance requirements. Technological advancement in seal design and release mechanism engineering began emphasizing the critical importance of maintaining leak-tight connections and chemical resistance in demanding processing environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 437.9 million |

| Forecast Value in (2035F) | USD 605.8 million |

| Forecast CAGR (2025 to 2035) | 3.3% |

Market expansion is being supported by the increasing global demand for hygienic and corrosion-resistant connection solutions driven by pharmaceutical manufacturing expansion and stringent food safety regulations, alongside the corresponding need for advanced fluid transfer components that can prevent contamination, enable rapid system reconfiguration, and maintain operational reliability across various pharmaceutical production, food and beverage processing, chemical handling, and cleanroom applications. Modern facility managers and process engineers are increasingly focused on implementing stainless steel one-touch fitting solutions that can resist chemical degradation, withstand frequent cleaning cycles, and provide consistent leak-free performance in demanding operating conditions.

The growing emphasis on operational efficiency and maintenance reduction is driving demand for stainless steel one-touch fittings that can support quick changeover procedures, enable tool-free installation, and ensure comprehensive system reliability. Industrial operators' preference for connection components that combine corrosion resistance with ease of assembly and long service life is creating opportunities for innovative stainless steel one-touch fitting implementations. The rising influence of pharmaceutical industry growth and advanced food processing automation is also contributing to increased adoption of stainless steel one-touch fittings that can provide superior hygiene characteristics without compromising functionality or system integration.

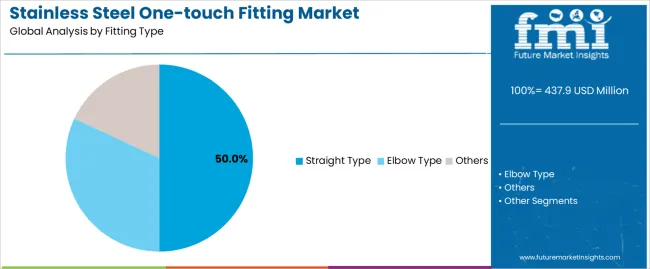

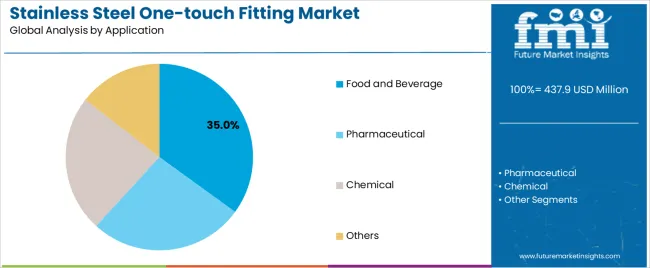

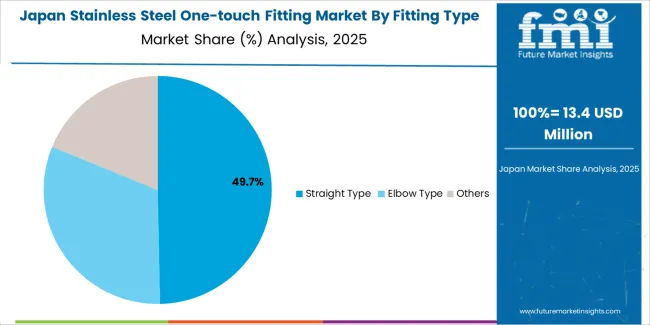

The market is segmented by fitting type, application, and region. By fitting type, the market is divided into straight type, elbow type, and others. Based on application, the market is categorized into food and beverage, pharmaceutical, chemical, and others. Regionally, the market is divided into China, India, Germany, Brazil, United States, United Kingdom, and Japan.

The straight type segment is projected to maintain its leading position in the stainless steel one-touch fitting market in 2025 with a 50% market share, reaffirming its role as the preferred fitting configuration for direct line connections and pneumatic system installations. System integrators and maintenance personnel increasingly utilize straight type fittings for their straightforward installation characteristics, excellent flow capacity, and proven effectiveness in reducing pressure drop while maintaining system efficiency. Straight type fitting technology's proven effectiveness and application versatility directly address the industry requirements for streamlined fluid distribution and simplified piping layouts across diverse processing platforms and equipment categories.

This fitting segment forms the foundation of modern pneumatic and fluid transfer systems, as it represents the configuration with the greatest contribution to installation simplicity and established reliability record across multiple industry applications and operating environments. Industrial automation investments in efficient connection technologies continue to strengthen adoption among equipment manufacturers and system builders. With operational pressures requiring reduced assembly time and improved maintenance accessibility, straight type fittings align with both productivity objectives and reliability requirements, making it the central component of comprehensive fluid handling strategies.

The food and beverage application segment is projected to represent the largest share of stainless steel one-touch fitting demand in 2025 with a 35% market share, underscoring its critical role as the primary driver for stainless steel one-touch fitting adoption across dairy processing plants, beverage production facilities, and food packaging operations. Food processing equipment manufacturers prefer stainless steel one-touch fittings for fluid transfer systems due to their exceptional hygiene characteristics, regulatory compliance benefits, and ability to withstand frequent cleaning and sterilization procedures while supporting product quality objectives and contamination prevention. Positioned as essential components for modern food processing equipment, stainless steel one-touch fittings offer both sanitary advantages and operational reliability.

The segment is supported by continuous innovation in food processing technology and the growing availability of advanced fitting designs that enable superior cleanability with enhanced durability and reduced maintenance requirements. Food processing companies are investing in comprehensive sanitation programs to support increasingly stringent food safety regulations and consumer expectations for contamination-free products. As food safety standards accelerate and hygiene requirements increase, the food and beverage application will continue to dominate the market while supporting advanced fitting utilization and processing equipment optimization strategies.

The stainless steel one-touch fitting market is advancing steadily due to increasing demand for hygienic connection solutions driven by pharmaceutical manufacturing expansion and growing adoption of automation systems that require specialized fitting technologies providing enhanced corrosion resistance and sanitation benefits across diverse food processing, pharmaceutical production, chemical handling, and cleanroom applications. The market faces challenges, including higher material costs compared to brass or plastic alternatives, competition from traditional threaded fittings and welded connections, and supply chain constraints related to stainless steel availability and machining capacity limitations. Innovation in surface treatment technologies and seal material development continues to influence product development and market expansion patterns.

The growing expansion of pharmaceutical production facilities is driving demand for specialized stainless steel one-touch fittings that address unique sanitation requirements including clean-in-place compatibility, sterile transfer capabilities, and validated cleaning procedures for active pharmaceutical ingredient handling. Pharmaceutical processing equipment requires advanced stainless steel fitting designs that deliver superior contamination prevention across multiple production stages while maintaining documentation and traceability. Equipment manufacturers are increasingly recognizing the competitive advantages of stainless steel one-touch fitting integration for pharmaceutical processing equipment and quality assurance, creating opportunities for innovative fitting designs specifically developed for regulated manufacturing environments.

Modern stainless steel one-touch fitting manufacturers are incorporating advanced surface treatment processes and electropolishing techniques to enhance corrosion resistance, improve cleanability, and support comprehensive hygiene objectives through optimized surface finish and contamination prevention capabilities. Leading companies are developing electropolished fittings with submicron surface roughness, implementing chemical passivation protocols for enhanced oxide layer formation, and advancing finishing technologies that minimize bacterial adhesion and particulate retention. These technologies improve sanitary performance while enabling new market opportunities, including ultra-high-purity applications, sterile processing equipment, and semiconductor fluid delivery systems. Advanced surface treatment integration also allows manufacturers to support comprehensive validation requirements and quality documentation beyond traditional mechanical specifications.

The expansion of semiconductor fabrication facilities, electronics manufacturing operations, and photovoltaic production is driving demand for ultra-high-purity stainless steel one-touch fittings with precisely controlled surface characteristics and exceptional cleanliness levels. These advanced applications require specialized fitting grades with stringent purity specifications that exceed traditional industrial requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in cleanroom assembly capabilities and quality validation systems to serve emerging high-technology applications while supporting innovation in specialty gas delivery, chemical distribution, and ultrapure water systems.

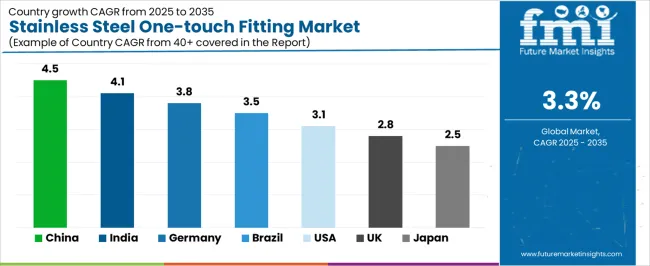

| Country | CAGR (2025-2035) |

|---|---|

| India | 4.1% |

| China | 4.5% |

| Brazil | 3.5% |

| United States | 3.1% |

| Germany | 3.8% |

| United Kingdom | 2.8% |

| Japan | 2.5% |

The stainless steel one-touch fitting market is experiencing solid growth globally, with China leading at a 4.5% CAGR through 2035, driven by expanding pharmaceutical manufacturing capacity, growing food processing industry, and increasing adoption of automated production equipment utilizing corrosion-resistant fittings. India follows at 4.1%, supported by pharmaceutical industry growth, dairy processing expansion, and growing demand for hygienic connection solutions in beverage manufacturing. Germany shows growth at 3.8%, emphasizing pharmaceutical equipment excellence, food processing automation, and precision engineering in fitting design. Brazil demonstrates 3.5% growth, supported by agricultural processing modernization, pharmaceutical production growth, and expanding chemical industry requirements. The United States records 3.1%, focusing on biopharmaceutical manufacturing, food safety compliance, and semiconductor fabrication applications. The United Kingdom exhibits 2.8% growth, emphasizing pharmaceutical production and food processing modernization. Japan shows 2.5% growth, supported by precision manufacturing standards and pharmaceutical industry requirements.

The report covers an in-depth analysis of 40 countries, with top-performing countries highlighted below.

Revenue from stainless steel one-touch fittings in China is projected to exhibit exceptional growth with a CAGR of 4.5% through 2035, driven by expanding pharmaceutical manufacturing infrastructure and rapidly growing food and beverage processing sectors supported by government food safety initiatives and industrial modernization programs. The country's massive pharmaceutical sector expansion and increasing investment in automated processing technologies are creating substantial demand for stainless steel one-touch fitting solutions. Major equipment manufacturers and pharmaceutical companies are establishing comprehensive fitting procurement capabilities to serve both domestic markets and export opportunities.

Government support for pharmaceutical industry development and food safety enhancement is driving demand for stainless steel one-touch fittings throughout major industrial regions and manufacturing clusters across pharmaceutical facilities, dairy processing plants, and beverage production centers. Strong pharmaceutical sector growth and an expanding network of food processing facilities are supporting the rapid adoption of stainless steel fitting technologies among equipment manufacturers seeking enhanced hygiene performance and regulatory compliance capabilities.

Demand for stainless steel one-touch fittings in India is expanding at a CAGR of 4.1%, supported by the country's position as a leading pharmaceutical producer, expanding dairy processing infrastructure, and increasing demand for hygienic fittings in active pharmaceutical ingredient manufacturing and aseptic beverage processing applications. The country's comprehensive pharmaceutical manufacturing capabilities and growing food processing sector are driving sophisticated stainless steel fitting adoption throughout regulated industries. Leading pharmaceutical manufacturers and dairy processors are establishing extensive equipment upgrade programs to address growing quality standards and export requirements.

Rising pharmaceutical exports and expanding dairy cooperatives are creating opportunities for stainless steel one-touch fitting adoption across drug manufacturing facilities, milk processing plants, and beverage bottling operations in major pharmaceutical and agricultural processing regions. Growing government focus on pharmaceutical quality standards and dairy safety regulations is driving adoption of corrosion-resistant fitting technologies among manufacturers seeking enhanced compliance capabilities and international certifications.

Revenue from stainless steel one-touch fittings in Germany is growing at a CAGR of 3.8%, supported by the country's leadership in pharmaceutical equipment manufacturing, expanding biotechnology sector, and strong food processing industry utilizing stainless steel fittings in precision processing systems. The nation's advanced engineering infrastructure and emphasis on quality excellence are driving sophisticated stainless steel fitting capabilities throughout regulated industries. Leading pharmaceutical equipment suppliers and food processing companies are investing extensively in advanced fitting technologies and hygienic design principles.

Advanced pharmaceutical manufacturing requirements and food processing standards are creating demand for precision-engineered stainless steel one-touch fittings among equipment manufacturers seeking superior reliability and validation documentation. Strong engineering tradition and growing focus on process automation are supporting the adoption of quick-connect technologies in pharmaceutical processing equipment and food production systems across major manufacturing centers.

Demand for stainless steel one-touch fittings in Brazil is expected to expand at a CAGR of 3.5%, supported by the country's expanding agricultural processing sector, growing pharmaceutical manufacturing, and increasing emphasis on food safety standards in meat processing and juice production applications. The nation's comprehensive agricultural industry and pharmaceutical development are driving demand for corrosion-resistant fitting solutions. Food processors and pharmaceutical manufacturers are investing in equipment modernization and hygiene improvement programs to serve both domestic and export markets.

Advanced food processing requirements and pharmaceutical production growth are creating demand for reliable stainless steel one-touch fittings among processors seeking superior sanitation capabilities and operational efficiency. Strong agricultural sector and growing pharmaceutical industry are driving deployment of stainless steel fittings in meat processing facilities, fruit juice production lines, and pharmaceutical manufacturing plants across major processing regions.

Revenue from stainless steel one-touch fittings in the United States is projected to grow at a CAGR of 3.1%, supported by the country's focus on biopharmaceutical production expansion, established food processing industry, and growing emphasis on semiconductor manufacturing requiring ultra-pure fluid handling systems. The nation's comprehensive pharmaceutical sector and food safety regulations are driving demand for sophisticated stainless steel fitting solutions. Pharmaceutical companies and food processors are investing in facility upgrades and equipment replacement to serve both regulatory compliance and operational efficiency requirements.

Advanced biopharmaceutical development and food safety regulations are creating demand for validated stainless steel one-touch fittings among pharmaceutical manufacturers seeking superior contamination control and documentation capabilities. Strong pharmaceutical industry expertise and growing cleanroom applications are driving adoption of high-purity stainless steel fittings in drug manufacturing facilities and semiconductor fabrication plants across pharmaceutical and technology clusters.

Demand for stainless steel one-touch fittings in the United Kingdom is expected to increase at CAGR of 2.8%, driven by the country's established pharmaceutical sector, food processing modernization, and strong emphasis on good manufacturing practice compliance supporting advanced stainless steel fitting adoption for sterile processing and aseptic manufacturing applications. The United Kingdom's pharmaceutical industry sophistication and regulatory standards are driving stainless steel fitting capabilities throughout regulated sectors. Pharmaceutical manufacturers and food processors are establishing comprehensive equipment validation programs for hygiene assurance and regulatory compliance.

Advanced regulatory frameworks and pharmaceutical manufacturing excellence are creating demand for documented stainless steel fitting solutions among drug manufacturers seeking enhanced quality certifications and audit readiness. Strong compliance culture and growing validation requirements are supporting the adoption of traceable stainless steel fittings throughout pharmaceutical production facilities and food processing operations.

Revenue from stainless steel one-touch fittings in Japan is expanding at a CAGR of 2.5%, supported by the country's leadership in pharmaceutical manufacturing, precision food processing applications, and strong emphasis on quality control in production systems requiring validated connection components. Japan's technological precision and manufacturing excellence are driving demand for high-specification stainless steel fitting products. Leading pharmaceutical manufacturers and food processing companies are investing in specialized capabilities for advanced hygienic applications.

Advanced pharmaceutical production standards and food processing requirements are creating opportunities for precision-engineered stainless steel one-touch fittings throughout pharmaceutical facilities and food manufacturing operations. Strong quality culture and operational discipline are driving adoption of validated fitting technologies in drug production equipment and aseptic food processing systems meeting rigorous hygiene and performance standards.

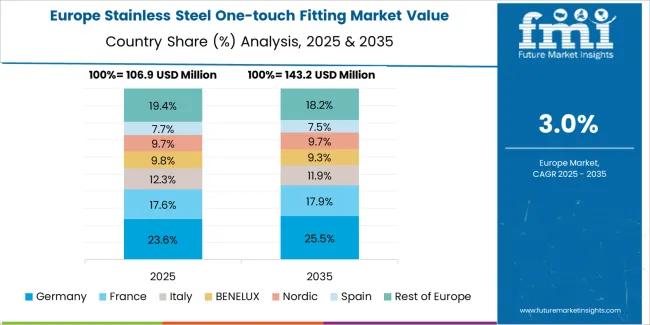

The stainless steel one-touch fitting market in Europe is projected to grow from USD 166.1 million in 2025 to USD 213.2 million by 2035, registering a CAGR of 2.5% over the forecast period. Germany is expected to maintain leadership with a 28.4% market share in 2025, moderating to 27.9% by 2035, supported by pharmaceutical equipment manufacturing, food processing technology leadership, and strong engineering-focused fitting development.

The United Kingdom follows with 19.7% in 2025, projected at 19.3% by 2035, driven by pharmaceutical production, food processing compliance, and biotechnology sector growth. France holds 16.5% in 2025, reaching 16.8% by 2035 on the back of pharmaceutical industry presence and dairy processing requirements. Italy commands 13.2% in 2025, rising slightly to 13.4% by 2035, while Spain accounts for 9.1% in 2025, reaching 9.3% by 2035 aided by food processing expansion and pharmaceutical manufacturing. The Netherlands maintains 6.3% in 2025, up to 6.4% by 2035 due to food processing concentration and pharmaceutical distribution. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 6.8% in 2025 and 6.9% by 2035, reflecting steady growth in pharmaceutical production, food processing modernization, and chemical handling applications.

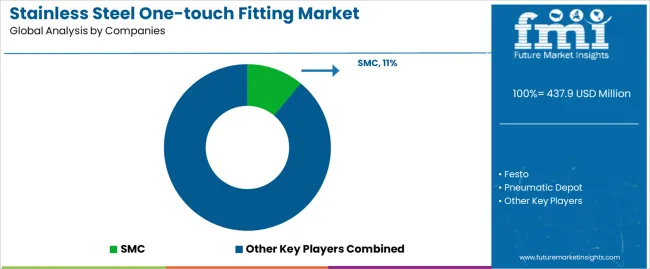

The stainless steel one-touch fitting market is characterized by competition among established pneumatic component manufacturers, specialized fluid handling companies, and regional fitting producers. Companies are investing in seal material innovation, surface treatment technology development, product portfolio expansion, and application-specific design to deliver high-performance, reliable, and cost-effective stainless steel one-touch fitting solutions. Innovation in electropolishing techniques, advanced seal compounds, and cleanroom-compatible designs is central to strengthening market position and competitive advantage.

SMC leads the market with an 11.0% share, offering comprehensive stainless steel one-touch fitting solutions with a focus on pharmaceutical applications, food processing equipment, and hygienic design principles across diverse industrial and cleanroom applications. The company provides extensive fitting configurations with validated materials and documentation supporting regulatory compliance requirements. Festo provides innovative pneumatic components with emphasis on corrosion resistance and automation integration.

Pneumatic Depot offers specialized fitting distribution with focus on application support and technical assistance. CKD Corporation delivers precision pneumatic components with emphasis on quality manufacturing and reliability. Parker Hannifin provides comprehensive fluid handling solutions with advanced sealing technologies and corrosion-resistant materials. Airtac International Group specializes in cost-effective pneumatic components for industrial applications. Pisco focuses on one-touch fitting innovation with emphasis on ease of installation. Janatics offers pneumatic automation solutions including stainless steel fittings for food processing. MISUMI provides configurable industrial components with rapid delivery capabilities. Shako specializes in pneumatic fittings for diverse applications. Mindman Industrial delivers pneumatic components for automation systems. Camozzi Automation offers comprehensive pneumatic solutions with stainless steel fitting options for regulated industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 437.9 million |

| Fitting Type | Straight Type, Elbow Type, Others |

| Application | Food and Beverage, Pharmaceutical, Chemical, Others |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | SMC, Festo, Pneumatic Depot, CKD Corporation, Parker Hannifin, Airtac International Group, Pisco, Janatics, MISUMI, Shako, Mindman Industrial, Camozzi Automation |

| Additional Attributes | Dollar sales by fitting type and application category, regional demand trends, competitive landscape, technological advancements in fitting design, surface treatment innovation, seal material development, and hygienic performance optimization |

The global stainless steel one-touch fitting market is estimated to be valued at USD 437.9 million in 2025.

The market size for the stainless steel one-touch fitting market is projected to reach USD 605.9 million by 2035.

The stainless steel one-touch fitting market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in stainless steel one-touch fitting market are straight type , elbow type and others.

In terms of application, food and beverage segment to command 35.0% share in the stainless steel one-touch fitting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA