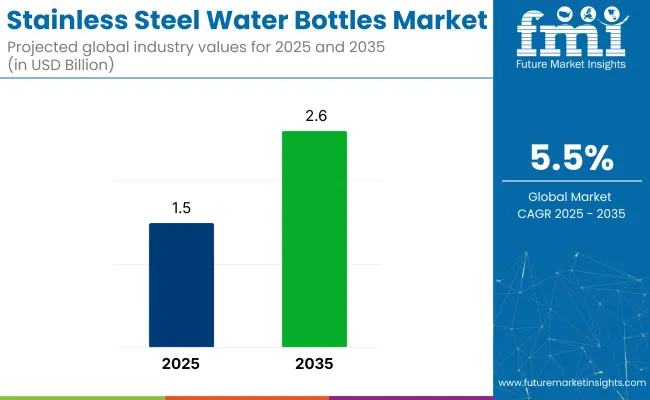

The global stainless steel water bottles market is projected to grow from USD 1.5 billion in 2025 to USD 2.6 billion by 2035, registering a CAGR of 5.5% during the forecast period. Sales in 2024 were recorded at USD 1,432.3 million.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 1.5 billion |

| Market Value (2035F) | USD 2.6 billion |

| CAGR (2025 to 2035) | 5.5% |

This growth is primarily attributed to rising environmental concerns, regulations banning single-use plastics, and increasing consumer demand for durable, safe hydration options.Stainless steel bottles offer temperature insulation, corrosion resistance, and reusability, making them attractive to health-conscious and eco-aware consumers. Aesthetic customization, lifestyle branding, and portability have made these bottles a preferred choice across urban, fitness, and student populations.

In January 2025, YETI Holdings, a leading premium drinkware and outdoor lifestyle brand, reported a 22% increase in international sales, now comprising 23% of total revenue. This strategic growth was driven by YETI’s expanded footprint in the European and Asia-Pacific markets, supported by investments in regional distribution and digital retail infrastructure.

“We’re focused on reducing our reliance on Chinese manufacturing while expanding our brand presence in key global markets,” stated Matt Reintjes, President and CEO of YETI, during the Q1 2025 earnings call. The company aims to reduce sourcing from China to below 5% for the USA market by the end of 2025. These moves underline YETI’s long-term strategy to diversify its supply chain and strengthen global market penetration across premium stainless steel hydration products.

Recent innovations include smart lids, magnetic caps, temperature indicators, and triple-wall insulation. Brands are integrating 18/10 food-grade steel for enhanced longevity and launching customized designs with matte coatings and sustainable packaging.

The market is expected to grow rapidly across Asia-Pacific, fueled by urbanization, online retail growth, and increasing government regulation on plastic usage. Manufacturers are likely to prioritize ergonomic, affordable, and region-specific product offerings to sustain competitive growth.

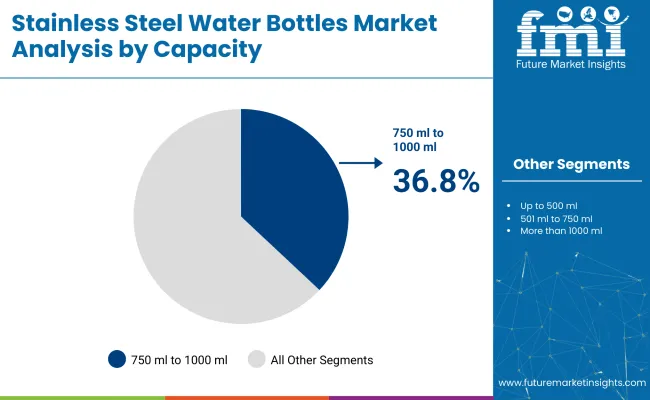

The market has been segmented based on capacity, usage, sales channel, and region. By capacity, up to 500 ml, 501 ml to 750 ml, 750 ml to 1000 ml, and more than 1000 ml variants have been developed to address hydration needs ranging from compact portability to extended outdoor use.

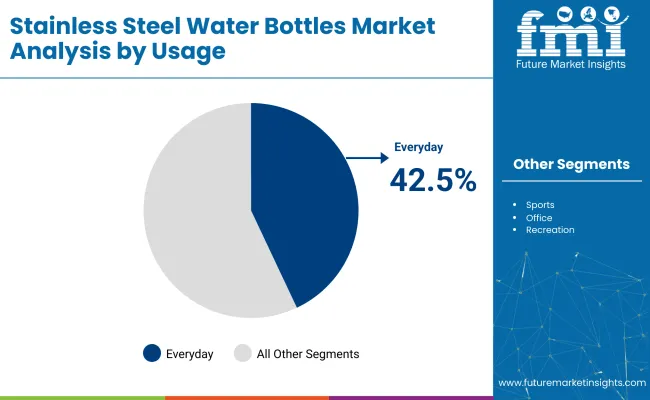

Every day, sports, office, recreation, and other usage categories (including travel) have been adopted to align with consumers’ lifestyle, work environment, and fitness preferences. Sales channels have been divided into manufacturers (direct sales), retail, hypermarkets, supermarkets, convenience stores, distributors, and online platforms to reflect evolving purchase behavior across urban and rural geographies.

Regional segmentation has been conducted for North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa to capture differences in health consciousness, retail penetration, and environmental policy trends impacting sustainable product adoption.

The 750 ml to 1000 ml segment is projected to dominate the stainless steel water bottles market with a 36.8% share in 2025, attributed to its ideal balance between volume, portability, and consumer hydration needs. This capacity range is widely adopted across lifestyle, sports, and office use cases where consumers prefer bottles that last several hours without being bulky.

These bottles offer practical hydration for daily routines, gym sessions, and short hikes, catering to growing health-conscious behaviors and sustainable living trends. Their mid-range size also meets the bottle-size limits preferred by backpack users, cyclists, and commuters, particularly in urban and travel environments. Brands such as Hydro Flask and Thermos have capitalized on this preference, offering vacuum-insulated, leak-proof options with aesthetic finishes and ergonomic grips within this volume bracket.

Advanced designs featuring temperature retention (up to 24 hours cold / 12 hours hot), wide-mouth openings, and compatibility with cup holders have further reinforced the 750 ml to 1000 ml segment's versatility. Moreover, regulatory momentum against single-use plastic bottles in schools, workplaces, and government facilities has contributed to its widespread appeal. As demand for mid-size, reusable hydration gear expands, this segment is poised to remain a core contributor to overall market value through 2035.

The everyday usage segment is forecasted to lead the application category in the stainless steel water bottles market with a 42.5% share in 2025, driven by rising awareness about hydration, environmental sustainability, and long-term health. Consumers increasingly opt for durable, reusable water bottles as part of their daily carry essentials at work, school, commuting, or during errands.

This usage trend aligns with broader shifts toward eco-friendly products in response to climate change discourse and plastic waste reduction goals. Stainless steel bottles offer a superior alternative to single-use plastics by ensuring BPA-free, rust-resistant, and odor-neutral hydration solutions. With urban consumers seeking practical and stylish accessories, manufacturers have introduced slim-profile bottles with minimalist aesthetics, integrated handles, and detachable lids for convenience during every day routines.

Retail brands have also targeted the daily use demographic through smart marketing campaigns around wellness, zero-waste lifestyles, and corporate giveaways. Online marketplaces, department stores, and lifestyle brands continue to bundle every day-use bottles in seasonal and gift packaging to drive volume sales. This segment’s resilience lies in its wide demographic appeal from students and professionals to homemakers making it a strategic focal point for brand expansion and innovation.

High Production Costs and Market Competition

To mitigate the high demand for stainless steel water bottles, the challenge lies in elevated production costs for raw materials and manufacturing processes. Alternative reusable bottle materials, including glass and BPA-free plastics, also provide competition that results in pressure on pricing and brand standing.

Innovation in Design and Smart Bottles

The market has lucrative growth opportunities driven by technological advancements in stainless steel water bottle features, such as enhancements in temperature retention and built-in filtration systems, as well as smart hydration tracking.

Businesses that focus on innovative designs and customization are likely to secure a niche in the market. The market will be further driven by collaborations with fitness and wellness brands and growing distribution networks.

The USA stainless steel water bottles market is driven by increasing awareness of sustainability, growing demand for an eco-friendly alternative over plastic bottles, rising demand from outdoor activities and pet owners, and higher adoption of healthy hydration habits across the population fuels the market expansion in this region.

Product safety, the materials used and environmental impact are governed by Regulatory bodies such as the USA Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA).

The major trends projected to drive the overall market include rising preference for insulated stainless-steel bottles, continuing penetration of BPA-free and food-grade stainless steel and flourishing investments in customized and smart water bottles, with temperature regulator and hydration tracking. In addition, market growth is being propelled by corporate sustainability initiatives and the boot of single-use plastics across multiple states.

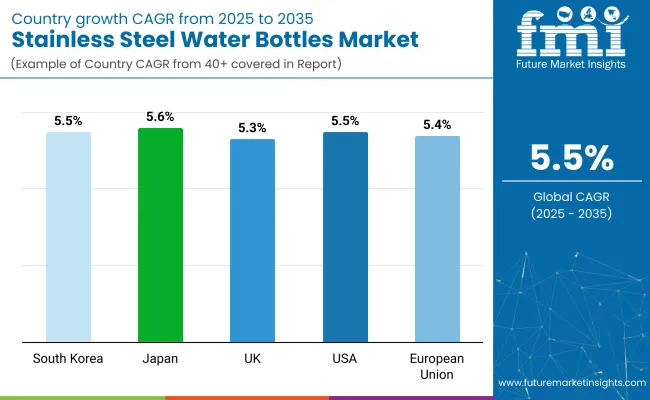

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

United Kingdom

The UK stainless steel water bottles market is growing slowly. More people care about the planet. The government limits single-use plastics. Shoppers like fancy, insulated bottles more. For example, the UK's Environment Agency and the British Standards Institution set rules for the materials used to make sure the bottles are good and safe.

The market is seeing a shift to green and light designs. There is a rise in buying branded and luxury bottles. Online shops and special stores are also selling more of these bottles. There is a growing adoption of reusable drinkware also from the corporate wellness programs which promote their use.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

European Union

As the European Union has stringent environmental regulations and consumers prefer durable and recyclable drinkware, sales of stainless steel water bottles are expected to create a substantial market opportunity in this region, accompanied by rising demand for high-end and customizable bottles. The same goes for the European Chemicals Agency (ECHA) and the European Commission (EC) who govern product safety, material quality, and environmental impact.

Germany, France, and the Netherlands also dominate the market because of a high level of consumer awareness of sustainability, a strong retail distribution network, and corporate efforts to reduce plastic waste. Moreover, increasing usage of vacuum-insulated bottles for keeping beverages temperature stable is fuelling innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

Japan

The stainless steel water bottles market in Japan is thriving due to high consumer demand for durable, leak-proof, and insulated bottles, increasing health-conscious habits, and government initiatives promoting sustainable and plastic-free alternatives. The MHLW and JSSA governs the safety of materials and quality of products.

Important trends in the market are complex product designs featuring smooth, ergonomic aesthetics,high sales of thermos-style and vacuum-insulated bottles and growing demand for lightweight stainless steel bottles such as those used for outdoors or debt use. Japan’s high-tech approach to hydration is also driving demand for smart and sensor-enabled stainless steel bottles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

South Korea

The South Korea market for stainless steel water bottles is segmented on the basis of product type, and distribution channel. Korea Ministry of Environment (MOE) regulation on product safety and Korean Agency for Technology and Standards (KATS) regulation on product sustainability standard.

Rising adoption of personalized and premium range of stainless steel bottles, growing demand for insulated and multifunctional bottles for hot and cold beverages, and increasing innovation in compact and foldable designs for convenience. K-lifestyle trends are also propelling partnerships between beverage and reusable bottle brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The market for stainless steel water bottles is growing fast. People like eco-friendly and reusable drink containers. They worry about plastic waste. New tech keeps drinks hot or cold longer. Buyers want bottles that last, that don't leak harmful chemicals, and that keep drinks at the right temp.

Firms are making new designs and using green methods. Some bottles even have smart tech for drinking. Big bottle makers, lifestyle brands, and green firms are in this market.

The overall market size for the stainless steel water bottles market was USD 1.5 billion in 2025.

The stainless steel water bottles market is expected to reach USD 2.6 billion in 2035.

Growing consumer awareness of sustainability, increasing concerns about plastic pollution, rising preference for durable and reusable hydration solutions, and advancements in insulated bottle technology will drive market growth.

The USA, China, Germany, India, and the UK are key contributors.

The online retail segment is expected to lead due to the increasing penetration of e-commerce, wide product variety, and convenience of doorstep delivery.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stainless Steel One-touch Fitting Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA