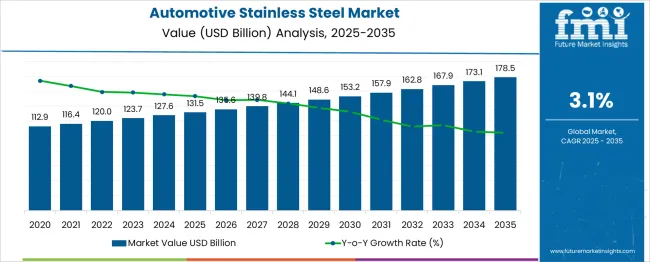

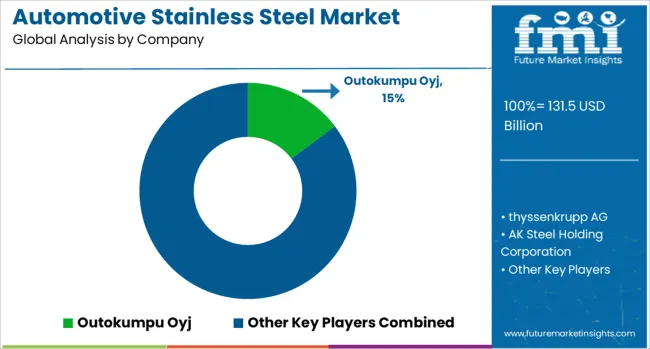

The Automotive Stainless Steel Market is estimated to be valued at USD 131.5 billion in 2025 and is projected to reach USD 178.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Stainless Steel Market Estimated Value in (2025 E) | USD 131.5 billion |

| Automotive Stainless Steel Market Forecast Value in (2035 F) | USD 178.5 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The automotive stainless steel market is experiencing notable growth driven by the increasing emphasis on vehicle durability, emission control, and safety standards. Stainless steel's corrosion resistance, strength, and heat tolerance make it indispensable for critical automotive components such as exhaust systems, structural parts, and fuel tanks.

As global automotive production gradually recovers and transitions toward hybrid and electric vehicles, demand for advanced materials that support lightweighting and long-term reliability continues to rise. Regulatory mandates focused on emission reduction and enhanced crash performance are also influencing material selection, favoring stainless steel for its recyclability and structural integrity.

Future growth is expected to be reinforced by innovations in manufacturing methods, rising demand for premium vehicles, and the steady expansion of electric vehicle infrastructure. The market outlook remains strong as stainless steel continues to deliver functional and regulatory advantages across multiple vehicle platforms.

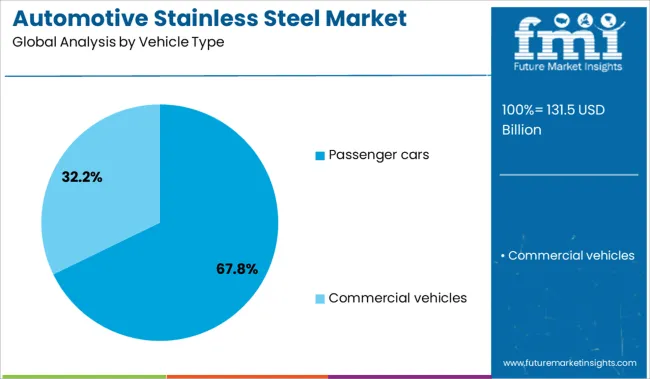

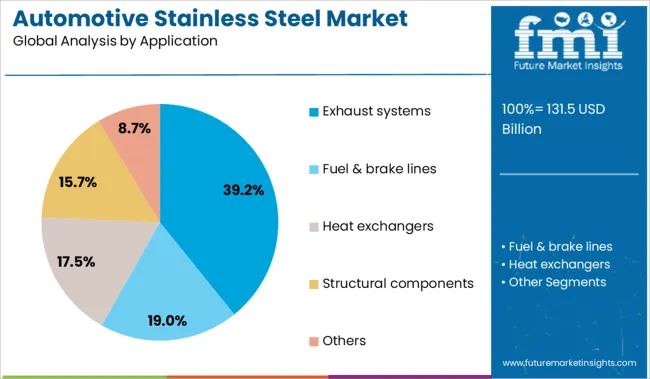

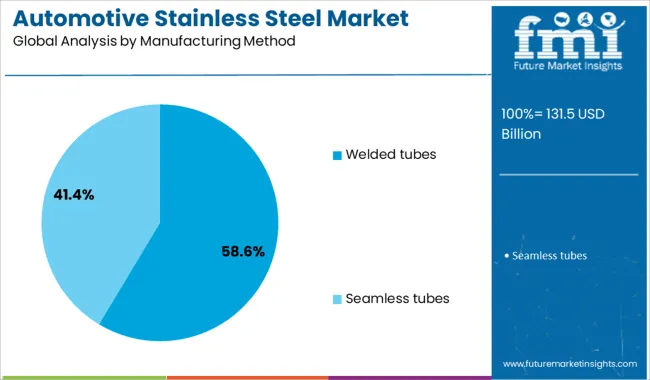

The automotive stainless steel market is segmented by vehicle type, application, manufacturing method, tube type, and outer diameter, as well as geographic regions. The automotive stainless steel market is divided by vehicle type into Passenger cars and Commercial vehicles. The automotive stainless steel market is classified into Exhaust systems, Fuel & brake lines, Heat exchangers, Structural components, and Others. Based on the manufacturing method, the automotive stainless steel market is segmented into welded tubes and Seamless tubes. The automotive stainless steel market is segmented by tube type into Straight tubes, U-bends, and Coiled tubes. By outer diameter of the automotive stainless steel market is segmented into 4mm - 12mm, Less than 4mm, and Above 12 mm. Regionally, the automotive stainless steel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment holds a commanding 67.8% share in the vehicle type category, reflecting the large-scale integration of stainless steel components in mass-produced vehicles. As the global demand for personal mobility and mid-size vehicles persists, automakers continue to utilize stainless steel for parts requiring strength, corrosion resistance, and thermal stability.

The material’s compatibility with safety structures, chassis components, and underbody protections has solidified its usage in both internal combustion and electric vehicles. Cost-effectiveness and recyclability further enhance its appeal in passenger car production.

OEMs prioritize stainless steel to meet evolving crashworthiness standards while maintaining weight-efficiency, particularly as pressure mounts to reduce emissions and increase fuel economy. This segment is expected to maintain dominance, supported by steady consumer demand and ongoing platform upgrades across mainstream automotive brands.

The exhaust systems segment leads the application category with a 39.2% share, driven by the material’s critical role in resisting high temperatures, oxidation, and corrosion. Stainless steel is the preferred choice for exhaust pipes, mufflers, and catalytic converter housings, ensuring optimal performance and longer life cycles under demanding engine conditions.

Emission regulations worldwide have spurred innovation in exhaust technologies, including particulate filters and after-treatment systems, which rely on stainless steel’s durability and high-temperature stability. While electric vehicle adoption may eventually reduce demand in this area, hybrid vehicles and internal combustion engines are still widely produced, sustaining high volumes in this segment.

Additionally, aftermarket demand for performance-grade exhaust systems contributes to its continued strength. This application is expected to remain relevant in the medium term, particularly in regions with slower EV adoption rates and large ICE vehicle fleets.

The welded tubes segment dominates the manufacturing method category with a 58.6% share, driven by its cost efficiency, flexibility, and suitability for high-volume production of automotive components. Welded stainless steel tubes are extensively used in structural parts, exhaust systems, and fluid transport lines due to their consistent quality, dimensional accuracy, and adaptability to complex geometries.

The method offers significant advantages in terms of processing speed and reduced material waste, making it ideal for meeting the scale requirements of the automotive industry. Increasing demand for lightweight yet durable tubing systems, especially in electric and hybrid vehicles, continues to reinforce the relevance of welded tube production.

This segment’s growth is further supported by technological improvements in welding and forming techniques, enabling the manufacture of precision components that meet rigorous performance standards. The welded tubes category is expected to retain its lead as manufacturers focus on cost-effective and scalable stainless steel fabrication.

Automotive stainless steel use is increasing as manufacturers prioritize corrosion resistance, formability and recyclability in vehicle designs. Components such as exhaust systems catalytic converter shells structural reinforcements and chassis components have incorporated high grade stainless alloys to ensure longevity under high thermal and corrosive loads. Applications have been expanded across electric, hybrid and ICE vehicles through improved alloy coatings and reduced weight options which support both performance and environmental mandates. Supply relationships have been strengthened via partnerships between steel mills automotive OEMs and tiered suppliers to meet evolving material demands.

Automotive stainless steel has been chosen for its ability to withstand corrosion in exhaust systems catalytic converter housings and underbody components exposed to road salt and moisture. High temperature performance has been recognized in turbocharger housings and manifold applications where thermal stability is essential. Automotive OEMs and suppliers have developed specialized alloy grades and surface finish treatments to improve resistance to oxidation and wear during extended service intervals. Manufacturing efficiencies have been achieved through roll forming and laser welding adapted for high strength stainless grades. Collaborations between mill and OEM teams have enabled material certification for crash compliance and NVH control. As lifecycle cost considerations have risen, material swaps from coated mild steel to stainless options have been justified through reduced warranty claims and longer part service cycles.

Adoption of stainless steel in automotive components has been slowed by material cost premiums compared to traditional steel alternatives. Specialized welding and forming techniques have been required for high chromium and nickel grades which have increased production complexity and capital investment. Tooling wear rates have been compounded by abrasive alloy properties leading to higher maintenance costs. Compatibility with EV mass production has demanded lighter alloy variants whose properties differ from conventional grades requiring further R&D and certification testing. Scrap recycling streams have required segregation to avoid contamination of mixed alloy flows. As OEMs have evaluated cost versus durability trade offs component suppliers have encountered challenge in scaling stainless use across mid volume vehicle lines.

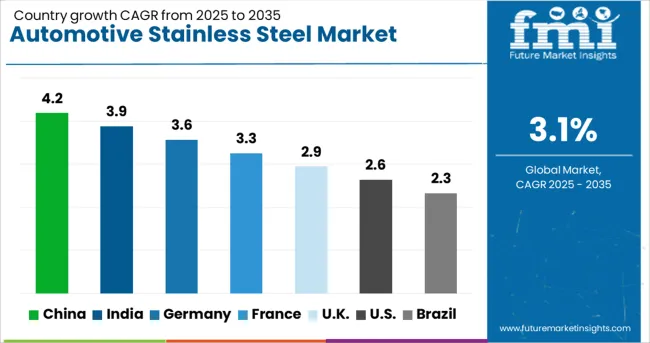

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The global automotive stainless steel market is forecast to expand at a 3.1% CAGR from 2025 to 2035, supported by increasing demand for corrosion-resistant and lightweight components in vehicles. Of the 40 countries analyzed, China leads at 4.2%, followed by India at 3.9% and Germany at 3.6%, while France records 3.3% and the United Kingdom posts 2.9%. Growth premiums shows rising EV manufacturing in Asia and integration of stainless steel in exhaust systems, fuel tanks, and structural reinforcements. OECD markets prioritize advanced grades for lightweighting and durability, while BRICS economies drive higher consumption through expanding automotive production bases. The report includes analysis of over 40 countries, with five profiled below for reference.

China is expected to grow at a 4.2% CAGR, driven by its position as the largest global automotive manufacturing hub. Rising electric vehicle production encourages stainless steel usage in battery protection and chassis components due to high corrosion resistance. Domestic producers are investing in ferritic and austenitic grades optimized for lightweight structures. Partnerships between OEMs and steel suppliers accelerate innovation for crash-resistant designs. Automotive stainless steel demand is also reinforced by emission standards promoting high-performance exhaust systems. E-commerce-driven component distribution and integrated logistics support supply chain efficiency across Tier I and II cities.

India is projected to grow at a 3.9% CAGR, supported by rising passenger vehicle output and export-oriented automotive production. Stainless steel demand is concentrated in exhaust systems, catalytic converter housings, and fuel tanks, driven by regulatory pressure for emission compliance. Domestic mills are expanding capacity for automotive-grade stainless steel to reduce reliance on imports. Collaborations between automakers and steel producers are introducing cost-optimized, lightweight stainless solutions to improve fuel efficiency in compact cars. Increasing penetration of CNG and hybrid vehicles further drives the use of high-heat-resistant stainless components in the powertrain system.

Germany is forecast to grow at a 3.6% CAGR, anchored in its premium automotive sector and strong EV adoption rate. Demand for stainless steel extends to high-strength structural reinforcements and safety-critical parts in luxury vehicles. German manufacturers prioritize stainless components for precision-engineered exhaust systems and thermal management assemblies. Investments in high-grade martensitic steels with superior fatigue strength address requirements for drivetrain and transmission applications. Integration of stainless solutions in EV battery modules is expanding due to stringent safety standards. Local R&D efforts emphasize recyclability and lightweight composite pairing for sustainability-focused production models.

France is projected to grow at a 3.3% CAGR, influenced by demand from hybrid and electric vehicle segments. Stainless steel usage in high-pressure hydrogen storage tanks is increasing as part of fuel cell vehicle initiatives. Automakers prioritize stainless reinforcements for crash safety and thermal shields for high-performance engines. Local manufacturers are investing in forming technologies to produce complex stainless components for lightweighting targets. Partnerships with European steel giants aim to deliver custom stainless grades for specific automotive applications. Compliance with EU emission and safety regulations sustains steady adoption in both passenger and commercial vehicles.

The United Kingdom is expected to grow at a 2.9% CAGR, reflecting steady demand from EV platforms and luxury vehicle production. Stainless steel adoption in battery module housings, exhaust systems, and decorative trims remains significant. OEMs prioritize premium finishes and corrosion resistance for aesthetic and performance advantages. Manufacturers are focusing on cost-efficient fabrication techniques, including laser welding for stainless automotive assemblies. Investments in closed-loop recycling systems ensure compliance with sustainability-driven mandates. Partnerships between British automakers and global steel suppliers are advancing stainless innovation for high-performance and lightweight applications in next-generation mobility solutions.

The automotive stainless steel market is dominated by global producers focusing on advanced material solutions for durability, strength, and lightweight performance. Outokumpu Oyj and thyssenkrupp AG lead with specialized grades for exhaust systems, structural components, and decorative trims. AK Steel, Nippon Steel, and JFE Steel leverage extensive R&D and integrated manufacturing to meet stringent emission and safety regulations.

POSCO and Acerinox prioritize corrosion-resistant alloys suited for electric and hybrid vehicles, while Sandvik AB and Aperam emphasize precision-engineered stainless steels for performance-critical applications. Ta Chen International supports market reach through robust distribution networks across major automotive hubs. Competitive strategies revolve around cost optimization, recycling technology, and high-grade stainless steel development to address growing OEM demand for advanced vehicle components.

On June 16, 2025, Outokumpu entered a strategic partnership with Alstom to supply its Circle Green® low-emission stainless steel for Alstom’s Metropolis metro cars. This collaboration aims to reduce CO₂ emissions by up to 93% compared to conventional stainless steel, supporting sustainable rail mobility.

| Item | Value |

|---|---|

| Quantitative Units | USD 131.5 Billion |

| Vehicle Type | Passenger cars and Commercial vehicles |

| Application | Exhaust systems, Fuel & brake lines, Heat exchangers, Structural components, and Others |

| Manufacturing Method | Welded tubes and Seamless tubes |

| Tube Type | Straight tubes, U-bends, and Coiled tubes |

| Outer Diameter | 4mm - 12mm, Less than 4mm, and Above 12 mm |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Outokumpu Oyj, thyssenkrupp AG, AK Steel Holding Corporation, Nippon Steel Corporation, JFE Steel Corporation, POSCO, Acerinox S.A., Sandvik AB, Aperam S.A, and Ta Chen International, Inc. |

| Additional Attributes | Dollar sales in the automotive stainless steel market are driven by rising demand for high-strength, corrosion-resistant materials used in exhaust systems, structural parts, and decorative trims. Growth is fueled by increasing adoption in electric and hybrid vehicles, advanced manufacturing techniques, and stringent safety and emission standards. Asia-Pacific leads production, while leading players focus on alloy innovation and cost efficiency. |

The global automotive stainless steel market is estimated to be valued at USD 131.5 billion in 2025.

The market size for the automotive stainless steel market is projected to reach USD 178.5 billion by 2035.

The automotive stainless steel market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in automotive stainless steel market are passenger cars and commercial vehicles.

In terms of application, exhaust systems segment to command 39.2% share in the automotive stainless steel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA