The global stainless steel welded pipe market is expected to rise from USD 20.9 billion in 2025 to USD 34 billion by 2035, reflecting a CAGR of 5% and an absolute increase of USD 13.1 billion. The growth in demand for stainless steel welded pipe is closely linked to the production environment, where capacity levels, integration strategies, and technological adoption define competitive positioning. Large-scale manufacturers often maintain vertical integration, controlling stainless steel coil procurement, welding operations, and finishing lines. This ensures greater efficiency in cost structures, better quality assurance, and more reliable delivery schedules. In contrast, smaller regional producers that rely heavily on third-party suppliers are more exposed to raw material volatility and fluctuating operational margins. The divide between integrated and non-integrated players contributes to a varied supply landscape globally.

Supply chain resilience has emerged as a decisive factor shaping output stability. Nickel and chromium, which are essential in stainless steel grades, remain highly sensitive to mining activity and geopolitical disruptions in producing countries. Global logistics bottlenecks, container shortages, and surging shipping costs add further uncertainty to delivery timelines. Manufacturers that diversify sourcing bases and establish regional warehousing solutions are better equipped to safeguard production continuity. Those without such strategies face higher exposure to feedstock price fluctuations and transportation delays, which can undermine customer commitments in industries such as oil and gas, construction, and energy.

The distribution ecosystem also plays a pivotal role. Distributors and system integrators act as a bridge between manufacturers and downstream industries, enhancing market accessibility. Their function extends beyond delivery logistics, as they often provide value-added services such as custom sizing, coatings, and packaging solutions, while ensuring compliance with international project specifications. This integration of distribution with project-specific needs strengthens demand visibility and supports large infrastructure contracts.

R&D investments are beginning to influence production efficiency, with mills adopting advanced welding automation, non-destructive inspection, and predictive maintenance solutions. AI-enabled defect detection, mechatronics-driven welding lines, and laser-based seam tracking are becoming increasingly relevant to reduce waste and improve throughput. Predictive maintenance systems are particularly valuable in large-scale continuous operations, as they minimize downtime and optimize operational efficiency. Such innovations are gradually differentiating leading suppliers from smaller, less technology-driven producers. The market structure exhibits both consolidation and fragmentation. Multinational steel groups command significant market share through scale, certifications, and established global contracts, while regional players focus on domestic markets with competitive pricing and faster responsiveness.

Between 2025 and 2030, the stainless steel welded pipe market is projected to expand from USD 20.9 billion to USD 27 billion, resulting in a value increase of USD 6.1 billion, which represents 46.6% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for oil & gas midstream infrastructure and petrochemical facility construction, product innovation in high-frequency welded and orbital welded technologies, as well as expanding integration with desalination projects and industrial water distribution initiatives. Companies are establishing competitive positions through investment in low-carbon stainless steel production capabilities, advanced welding technologies, and strategic market expansion across oil & gas, water infrastructure, and industrial process applications.

From 2030 to 2035, the market is forecast to grow from USD 27 billion to USD 34 billion, adding another USD 7 billion, which constitutes 53.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized high-performance alloy grades, including advanced nickel alloy and duplex stainless systems tailored for demanding sour-service and high-pressure applications, strategic collaborations between pipe manufacturers and energy infrastructure developers, and an enhanced focus on sustainable production and circular economy principles. The growing emphasis on LNG infrastructure and renewable energy integration will drive demand for advanced, high-performance stainless steel welded pipe solutions across diverse industrial and infrastructure applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 20.9 billion |

| Market Forecast Value (2035) | USD 34 billion |

| Forecast CAGR (2025-2035) | 5% |

The stainless steel welded pipe market grows by enabling energy operators, infrastructure developers, and industrial facility managers to achieve superior corrosion resistance and lifecycle performance while meeting evolving safety and sustainability demands. Pipeline operators face mounting pressure to minimize maintenance costs and ensure system integrity, with stainless steel welded pipe providing 3-5 times longer service life compared to carbon steel in corrosive environments, making corrosion-resistant piping essential for oil & gas transportation, water distribution, and chemical processing applications. The energy transition movement's need for reliable fluid transport infrastructure creates demand for advanced stainless steel solutions that can handle aggressive media, withstand high pressures, and ensure consistent performance across diverse operating conditions.

Government initiatives promoting water infrastructure modernization and energy security drive adoption in desalination facilities, municipal water networks, and oil & gas midstream applications, where material reliability has a direct impact on operational safety and system availability. The global shift toward sustainable materials and extended asset life accelerates stainless steel pipe demand as operators seek solutions that minimize replacement cycles and reduce lifecycle environmental impact. However, higher initial material costs compared to carbon steel and technical welding requirements may limit adoption rates among budget-constrained projects and regions with limited access to specialized welding expertise and quality control capabilities.

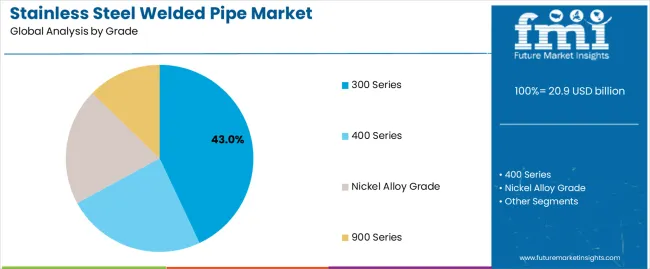

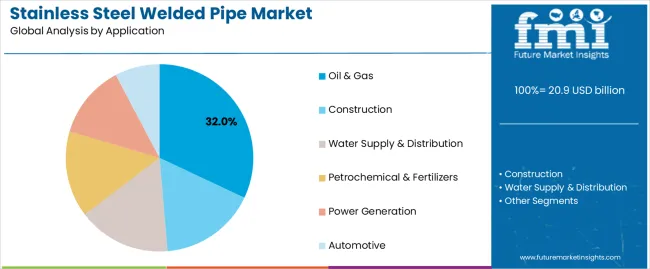

The market is segmented by grade, application, manufacturing process, diameter, end use, and region. By grade, the market is divided into 300 series, 400 series, nickel alloy grade, and 900 series. Based on application, the market is categorized into oil & gas, construction, water supply & distribution, petrochemical & fertilizers, power generation, and automotive. By manufacturing process, the market includes ERW/high-frequency welded, TIG/orbital welded, EFW/LSAW, and laser welded. Based on diameter, the market is segmented into ≤6 inch, >6-16 inch, >16-24 inch, and >24 inch. By end use, the market covers industrial, utilities & desalination, buildings & infrastructure, energy & power, automotive & transportation, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The 300 series segment represents the dominant force in the stainless steel welded pipe market, capturing approximately 43% of total market share in 2025. This advanced category encompasses austenitic stainless steel grades including 304, 304L, 316, and 316L, featuring superior corrosion resistance, excellent formability, and proven weldability, delivering comprehensive performance capabilities with optimal material properties for demanding fluid transport applications. The 300 series segment's market leadership stems from its exceptional versatility across diverse corrosive environments, superior mechanical properties at elevated and cryogenic temperatures, and compatibility with standard welding processes that require minimal specialized procedures.

The 400 series segment maintains a substantial 27% market share, serving applications where magnetic properties, higher strength, and cost-effectiveness are priorities, particularly in automotive exhaust systems and general industrial piping. Nickel alloy grades account for 18% market share, offering premium corrosion resistance for highly aggressive chemical environments and high-temperature service conditions. The 900 series represents 12% of the market, featuring specialized precipitation-hardening grades for applications requiring exceptional strength combined with moderate corrosion resistance.

Key advantages driving the 300 series segment include:

The oil & gas segment represents the leading application category in the stainless steel welded pipe market, capturing approximately 32% of total market share in 2025. This critical segment encompasses upstream production facilities, midstream gathering and processing systems, downstream refining operations, and LNG terminals where stainless steel welded pipe delivers essential corrosion resistance supporting safe hydrocarbon transport and processing. The oil & gas segment's dominance reflects the fundamental requirement for corrosion-resistant materials in sour gas service, offshore environments, and aggressive production fluids.

The construction segment maintains a substantial 21% market share, serving architectural applications, building services, and structural systems requiring aesthetic appeal and durability. Water supply & distribution accounts for 16% market share, featuring municipal water networks, desalination plants, and industrial water systems. Petrochemical & fertilizers represent 14% of the market, supporting chemical processing and ammonia production facilities. Power generation holds 10% market share for boiler tubing and steam systems, while automotive applications account for 7% covering exhaust systems and fuel delivery components.

Key factors driving oil & gas segment leadership include:

The ERW/high-frequency welded segment represents the leading manufacturing process category in the stainless steel welded pipe market, capturing approximately 46% of total market share in 2025. This critical process encompasses electric resistance welding and high-frequency induction welding technologies, where continuous seam welding enables high-volume production, consistent quality, and cost-effective manufacturing supporting broad market adoption. The ERW/high-frequency welded segment's dominance reflects the fundamental advantages of automated production enabling economical pipe manufacturing for standard diameter ranges and wall thicknesses.

The TIG/orbital welded segment maintains a substantial 30% market share, serving applications where superior weld quality, sanitary requirements, and precision joining are critical priorities, particularly in pharmaceutical, food & beverage, and semiconductor industries. EFW/LSAW processes account for 18% market share, featuring large-diameter pipe production for major infrastructure projects. Laser welded systems represent 6% of the market, offering narrow heat-affected zones and high-speed production for specialized applications.

Key factors driving ERW/high-frequency welded segment leadership include:

The market is driven by three concrete demand factors tied to infrastructure development and corrosion management outcomes. First, oil & gas midstream infrastructure expansion and LNG facility development create increasing requirements for corrosion-resistant piping, with global LNG export capacity additions requiring 50,000-100,000 tons of stainless steel pipe per major terminal supporting safe gas processing and liquefaction operations in corrosive marine environments. Second, desalination capacity expansion and municipal water network modernization drive stainless steel adoption, with seawater desalination plants requiring corrosion-resistant piping achieving 30-50 year service life versus 10-15 years for coated carbon steel while eliminating coating maintenance and replacement costs.

Market restraints include raw material cost volatility affecting project economics, with nickel and chromium price fluctuations creating 20-40% material cost variations impacting stainless steel pipe pricing and creating budgeting challenges for large infrastructure projects with multi-year procurement timelines. Competition from alternative corrosion-resistant materials poses market share pressure, with fiber-reinforced plastic pipe, titanium alloys, and advanced coating systems offering lower material costs or superior performance in specific applications challenging stainless steel specifications particularly in large-diameter water and chemical service. Specialized welding requirements and quality control complexity create additional barriers, as stainless steel welding requires trained personnel understanding proper filler metal selection, shielding gas protocols, and heat input control, with workforce skill constraints limiting adoption in regions with underdeveloped welding certification infrastructure.

Key trends indicate accelerated adoption of low-carbon stainless steel grades in sustainable construction, particularly in European and North American markets where embodied carbon reduction mandates drive specification of stainless steel produced via electric arc furnace recycling processes achieving 50-70% lower carbon footprint compared to integrated steelmaking. Digitalization and inline quality monitoring integration trends toward manufacturing facilities equipped with automated ultrasonic testing, real-time weld quality monitoring, and traceability systems are enabling comprehensive quality assurance and predictive maintenance capabilities supporting critical application requirements. However, the market thesis could face disruption if carbon fiber composite pipe achieves cost-competitive performance with comparable corrosion resistance and mechanical properties, or if advanced surface engineering enables carbon steel to match stainless steel corrosion performance at significantly lower material costs, potentially reshaping material selection criteria across infrastructure and industrial applications.

| Country | CAGR (2025-2035) |

|---|---|

| Saudi Arabia | 6% |

| India | 5.8% |

| China | 5.4% |

| Brazil | 4.8% |

| USA | 4.3% |

| Germany | 3.6% |

| Japan | 3.1% |

The stainless steel welded pipe market is gaining momentum worldwide, with Saudi Arabia taking the lead thanks to midstream oil & gas projects and desalination build-out driving stainless demand in sour-service lines. Close behind, India benefits from urban water programs and refinery/petrochemical expansion combined with stainless adoption in infrastructure, positioning itself as a strategic growth hub in the Asia-Pacific region. China shows strong advancement, where chemicals capacity additions, LNG terminals, and municipal water upgrades strengthen its role in industrial infrastructure. Brazil demonstrates robust growth through offshore pre-salt tie-backs and fertilizer/chemical investments, signaling continued energy sector development. Meanwhile, the USA stands out for LNG/gas processing facilities and water reuse projects, while Germany and Japan continue to record consistent progress driven by hygienic process piping and plant modernization. Together, Saudi Arabia and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Saudi Arabia demonstrates the strongest growth potential in the Stainless Steel Welded Pipe Market with a CAGR of 6% through 2035. The country's leadership position stems from comprehensive oil & gas infrastructure development programs, intensive desalination capacity expansion, and strategic petrochemical diversification initiatives driving adoption of corrosion-resistant stainless steel piping systems. Growth is concentrated in major industrial regions, including Eastern Province oil & gas corridor, Jubail Industrial City, Yanbu, and Red Sea coastal desalination facilities, where midstream gathering systems, sour gas processing plants, and seawater desalination complexes are implementing stainless steel welded pipe for critical fluid transport applications. Distribution channels through EPC contractors, specialized pipe distributors, and direct project procurement relationships expand deployment across energy infrastructure and water treatment facilities. The country's Vision 2030 industrial diversification and water security programs provide policy support for infrastructure modernization, including local content requirements and technology transfer initiatives.

Key market factors:

In major industrial corridors, urban centers, and refinery complexes, the adoption of stainless steel welded pipe systems is accelerating across municipal water networks, petrochemical facilities, and industrial infrastructure projects, driven by urbanization programs and industrial capacity expansion. The market demonstrates strong growth momentum with a CAGR of 5.8% through 2035, linked to comprehensive Smart Cities initiatives and increasing focus on water infrastructure enhancement solutions. Indian project developers are implementing stainless steel piping systems to achieve extended service life while meeting water quality standards in key industrial regions including Gujarat petrochemical corridor, Mumbai-Pune urban belt, Chennai industrial zone, and Delhi NCR infrastructure network. The country's water supply modernization programs and refinery expansion initiatives create sustained demand for corrosion-resistant piping solutions, while increasing emphasis on zero-liquid-discharge drives adoption of stainless steel systems that enhance chemical resistance and system reliability.

China's expanding industrial sector demonstrates sophisticated implementation of stainless steel welded pipe systems, with documented case studies showing 30-40 year service life expectations in chemical processing and municipal water applications through material optimization. The country's infrastructure development in major industrial regions, including Yangtze River Delta chemical corridor, Bohai Rim LNG terminals, Pearl River Delta manufacturing belt, and inland municipal water systems, showcases integration of stainless steel piping technologies with existing industrial practices, leveraging domestic production capabilities and engineering expertise. Chinese facility operators emphasize lifecycle cost optimization and reliability, creating demand for domestically-produced stainless steel pipe that supports industrial self-sufficiency and quality standards. The market maintains strong growth through focus on chemical capacity expansion and energy infrastructure development, with a CAGR of 5.4% through 2035.

Key development areas:

The Brazilian market demonstrates significant advancement in stainless steel pipe implementation based on offshore oil development and chemical industry expansion for enhanced production capacity. The country shows solid potential with a CAGR of 4.8% through 2035, driven by pre-salt field development and fertilizer production investment across major energy regions, including Santos Basin offshore platforms, Rio de Janeiro subsea infrastructure, and São Paulo industrial corridor. Brazilian operators are implementing stainless steel piping for subsea production systems and topside facilities, particularly in corrosive offshore environments requiring reliable material performance. Technology deployment channels through international EPC contractors, domestic pipe distributors, and integrated energy companies expand coverage across offshore and onshore applications.

Leading market segments:

The USA market demonstrates mature implementation focused on LNG export facilities and specialty industrial applications, with documented integration achieving superior performance in natural gas processing and food-grade sanitary systems. The country shows solid potential with a CAGR of 4.3% through 2035, driven by natural gas infrastructure expansion and industrial modernization across major production regions, including Gulf Coast LNG terminals, Permian Basin gathering systems, and food & pharmaceutical manufacturing centers. American facility operators are implementing stainless steel piping for amine treating systems and cryogenic applications, particularly in LNG plants requiring low-temperature service and corrosion resistance. Technology deployment channels through specialized distributors, EPC contractors, and direct mill relationships expand coverage across energy and industrial markets.

Leading market segments:

Germany's stainless steel welded pipe market demonstrates sophisticated implementation focused on pharmaceutical manufacturing and food processing applications, with documented integration achieving stringent hygienic standards in sanitary process systems. The country maintains steady growth momentum with a CAGR of 3.6% through 2035, driven by pharmaceutical industry requirements and operators' emphasis on quality assurance principles aligned with GMP standards. Major industrial regions, including Bavaria pharmaceutical cluster, North Rhine-Westphalia chemical belt, Baden-Württemberg food processing zone, and Hamburg specialty chemicals corridor, showcase advanced deployment of orbital welded stainless systems that integrate seamlessly with existing process infrastructure and validation protocols.

Key market characteristics:

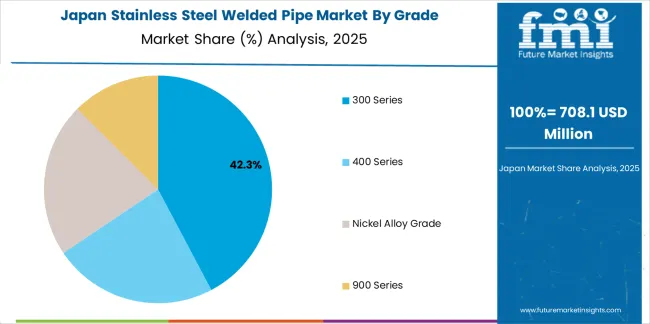

Japan's stainless steel welded pipe market demonstrates mature implementation focused on industrial plant modernization and high-specification small-diameter applications, with documented integration achieving exceptional quality in precision manufacturing environments. The country maintains steady growth through equipment replacement cycles and specialty applications, with a CAGR of 3.1% through 2035, driven by manufacturing excellence requirements and emphasis on reliability in semiconductor, pharmaceutical, and chemical industries. Major industrial regions, including Tokyo-Yokohama manufacturing corridor, Osaka-Kobe industrial belt, Nagoya automotive zone, and Kyushu semiconductor cluster, showcase advanced stainless steel piping deployment where precision manufacturing facilities integrate high-purity systems with existing production infrastructure.

Market development factors:

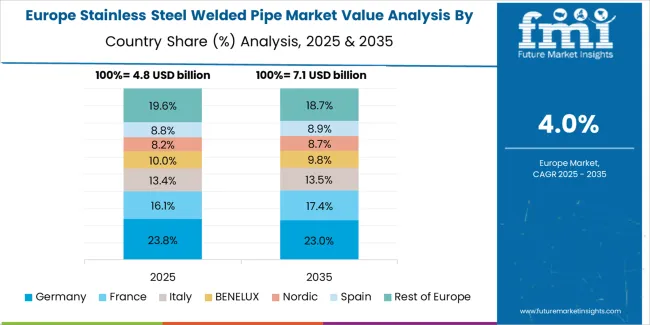

The stainless steel welded pipe market in Europe is projected to expand from USD 6 billion in 2025 to USD 9.1 billion by 2035, registering a CAGR of 4.3% over the forecast period. Germany leads with a 24.5% market share in 2025, easing slightly to 24% by 2035, supported by its advanced pharmaceutical manufacturing infrastructure and food & beverage processing requiring hygienic tubing across Bavaria, North Rhine-Westphalia, and Baden-Württemberg regions. Italy follows with an 18% share in 2025, stabilizing at 18.2% by 2035, driven by strong domestic tube production capabilities and building services demand. France holds a 16.5% share in 2025, rising to 16.9% by 2035 with nuclear power plant maintenance, district heating expansion, and water infrastructure projects. The United Kingdom accounts for 14% in 2025, edging to 13.8% by 2035 amid water network renewals and process industry upgrades. Spain holds 10.5% in 2025, trending to 10.8% by 2035 as desalination capacity expansion and food processing capital expenditure increases. Rest of Europe collectively adjusts from 16.5% to 16.3%, supported by Nordic district heating systems and Central & Eastern European investments in municipal water treatment and chemical processing facilities.

The Japanese stainless steel welded pipe market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of orbital welding systems and precision small-diameter tubing with existing industrial manufacturing infrastructure across semiconductor fabrication facilities, pharmaceutical production plants, and specialty chemical operations. Japan's emphasis on manufacturing excellence and quality assurance drives demand for premium-grade stainless steel pipe that supports stringent cleanliness requirements and performance expectations in domestic industrial standards. The market benefits from strong partnerships between international pipe manufacturers and domestic industrial equipment suppliers including engineering associations, creating comprehensive service ecosystems that prioritize material traceability and technical support programs. Industrial centers in Tokyo, Osaka, Nagoya, and Kyushu showcase advanced stainless steel piping implementations where process systems achieve exceptional purity through electropolished surfaces and validated welding procedures.

The South Korean stainless steel welded pipe market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and material certification capabilities for semiconductor manufacturing and advanced chemical applications. The market demonstrates increasing emphasis on ultra-high purity tubing and contamination-free welding technologies, as Korean manufacturers increasingly demand specialized stainless steel pipe that integrates with domestic quality management systems and sophisticated production control platforms deployed across electronics and petrochemical facilities. Regional pipe distributors are gaining market share through strategic partnerships with international mills, offering specialized services including material testing support and application-specific welding procedure development programs for demanding industrial environments. The competitive landscape shows increasing collaboration between multinational pipe manufacturers and Korean industrial engineering specialists, creating hybrid service models that combine international manufacturing expertise with local application knowledge and precision process system requirements.

The stainless steel welded pipe market features approximately 12-18 meaningful players with moderate concentration, where the top three companies control roughly 20-25% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on material quality consistency, delivery reliability, and technical support capabilities rather than price competition alone. Marcegaglia Stainless Tubes leads with approximately 8.5% market share through its comprehensive welded tubular product portfolio spanning industrial, sanitary, and structural applications.

Market leaders include Marcegaglia Stainless Tubes, Alleima (Sandvik Materials Technology), and Outokumpu, which maintain competitive advantages through global manufacturing infrastructure, extensive technical support networks, and deep expertise in stainless steel metallurgy across multiple industrial segments, creating trust and reliability advantages with project developers, EPC contractors, and industrial operators. These companies leverage research and development capabilities in advanced welding technologies and ongoing customer support relationships to defend market positions while expanding into low-carbon production methods and specialized alloy grades.

Challengers encompass Nippon Steel and ArcelorMittal, which compete through integrated steel production and broad geographic presence in key industrial markets. Product specialists, including Thyssenkrupp, Jindal SAW, and Tubacex, focus on specific application segments or regional markets, offering differentiated capabilities in large-diameter pipe production, specialized grades, and customized material solutions. Global players including Tenaris and Aperam create competitive pressure through comprehensive tubular solutions, project execution expertise, and vertical integration capabilities, particularly in energy infrastructure projects where integrated material supply and fabrication services provide advantages in delivery reliability and quality assurance.

Stainless steel welded pipe represents essential infrastructure material that enables facility operators to achieve 3-5 times longer service life compared to carbon steel in corrosive environments, delivering superior reliability and lifecycle cost performance with proven durability in demanding oil & gas, water, and industrial applications. With the market projected to grow from USD 20.9 billion in 2025 to USD 34 billion by 2035 at a 5% CAGR, these critical piping systems offer compelling advantages - corrosion resistance, mechanical strength, and extended service life - making them essential for oil & gas infrastructure (32% market share), construction applications (21% share), and projects requiring corrosion-resistant fluid transport that carbon steel cannot provide cost-effectively.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 20.9 billion |

| Grade | 300 Series, 400 Series, Nickel Alloy Grade, 900 Series |

| Application | Oil & Gas, Construction, Water Supply & Distribution, Petrochemical & Fertilizers, Power Generation, Automotive |

| Manufacturing Process | ERW/High-Frequency Welded, TIG/Orbital Welded, EFW/LSAW, Laser Welded |

| Diameter (OD) | ≤6 inch, >6-16 inch, >16-24 inch, >24 inch |

| End Use | Industrial, Utilities & Desalination, Buildings & Infrastructure, Energy & Power, Automotive & Transportation, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | Saudi Arabia, India, China, Brazil, USA, Germany, Japan, and 40+ countries |

| Key Companies Profiled | Marcegaglia Stainless Tubes, Alleima (Sandvik Materials Technology), Outokumpu, Nippon Steel, ArcelorMittal, Thyssenkrupp, Jindal SAW, Tubacex, Tenaris, Aperam |

| Additional Attributes | Dollar sales by grade, application, manufacturing process, diameter, and end use categories, regional adoption trends across Middle East & Africa, Asia Pacific, and Latin America, competitive landscape with pipe manufacturers and steel mills, technical specifications and performance requirements, integration with project execution and quality management systems, innovations in welding technology and sustainable production, and development of specialized stainless steel pipe systems with enhanced corrosion resistance and lifecycle performance capabilities. |

The global stainless steel welded pipe market is estimated to be valued at USD 20.9 billion in 2025.

The market size for the stainless steel welded pipe market is projected to reach USD 34.0 billion by 2035.

The stainless steel welded pipe market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in stainless steel welded pipe market are 300 series, 400 series, nickel alloy grade and 900 series.

In terms of application, oil & gas segment to command 32.0% share in the stainless steel welded pipe market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Stainless Steel 330 Refractory Anchor Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel One-touch Fitting Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Americas Steel Pipes Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA