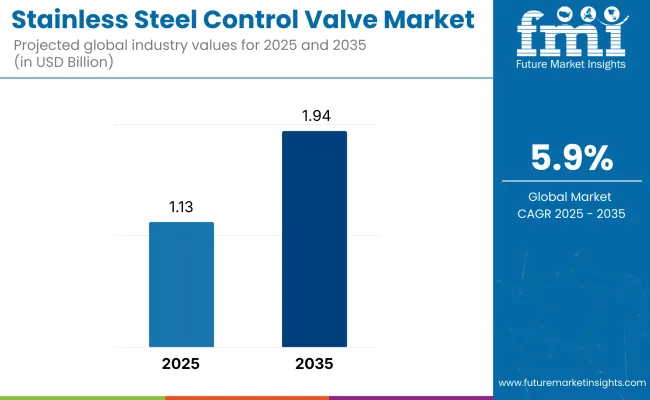

The global stainless steel control valve market is projected to expand from USD 1.13 billion in 2025 to USD 1.94 billion by 2035, reflecting a steady CAGR of 5.9% over the forecast period. Growth is primarily driven by the rising demand for durable, corrosion-resistant valves in sectors such as oil and gas, water treatment, power generation, and chemicals. North America remains a dominant market due to early adoption of automation, while Asia Pacific-led by China and South Korea-is rapidly gaining ground due to industrial expansion and infrastructure investments.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 1.13 billion |

| Projected Value (2035F) | USD 1.94 billion |

| CAGR (2025 to 2035) | 5.9% |

In 2024, a surge in exploration activities and midstream upgrades pushed demand for stainless steel valves in the oil and gas industry. Similarly, the chemical and petrochemical industries embraced these valves for their reliability under high pressure and corrosive conditions. Across all regions, manufacturers are innovating with enhanced stainless-steel alloys and introducing IoT-enabled smart valves capable of real-time diagnostics, remote monitoring, and predictive maintenance-features increasingly demanded in critical operations.

The market is also witnessing a transition in actuation preferences. While pneumatic actuators have long been dominant, electric actuators are gaining strong traction due to their precision, energy efficiency, and compatibility with Industry 4.0 systems. This shift aligns with global sustainability goals and the need for reduced operational downtime. Adoption is particularly strong in the U.S. and Germany, with Japan and South Korea balancing performance with cost by favoring hybrid solutions.

Looking ahead, sectors such as pharmaceuticals, food processing, and semiconductors are poised to outpace traditional segments in growth. These industries require hygienic, high-precision, and highly automated fluid control systems-areas where stainless steel valves excel. As regulatory compliance becomes tighter across all verticals, demand for validated, high-specification valves is set to surge.

To stay competitive, manufacturers are pursuing targeted strategies including geographic expansion, product innovation in electric and cryogenic valves, and strategic collaborations-such as the Emerson-Schneider automation partnership-to address region-specific priorities.

Among actuation types, electric control valves are poised for the fastest growth through 2035. While pneumatic valves currently dominate due to their reliability in oil & gas and water treatment, the shift toward automation, IoT integration, and lower maintenance is driving adoption of electric variants.

These valves offer better precision, energy efficiency, and real-time diagnostics, making them ideal for smart factories and digital infrastructure. In contrast, manual and hydraulic actuators are losing ground due to higher labor costs and complexity, respectively. Growing investments in Industry 4.0 across North America, Europe, and China further reinforce the shift toward electric actuation.

| Actuation Technology Segment | CAGR (2025 to 2035) |

|---|---|

| Electric Control Valves | 7.2% |

The ball valve segment is projected to register the fastest growth, surpassing others due to its compact design, excellent shut-off capability, and minimal maintenance. These valves are increasingly used in energy, chemicals, and water industries where space, cost, and reliability matter.

While globe valves remain dominant for precision flow control, especially in power plants and chemical reactors, the rise of automation-friendly ball valves is reshaping the market. Butterfly valves are favored for large-scale water management, whereas cryogenic valves cater to niche LNG and gas applications.

| Valve Type Segment | CAGR (2025 to 2035) |

|---|---|

| Ball Control Valves | 6.8% |

While oil & gas and chemical processing remain the largest consumers of stainless steel control valves due to their harsh operational environments, the semiconductor and electronics manufacturing segment is emerging as the fastest-growing application.

Precision, contamination control, and real-time monitoring are essential in these industries, boosting the need for smart, compact valve systems. Additionally, wastewater management and power generation will continue to invest in corrosion-resistant valves for sustainability and regulatory compliance.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Semiconductor & Electronics Manufacturing | 7.4% |

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, industrial operators, and regulators in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

75% of USA stakeholders viewed smart control valves as a worthwhile investment due to enhanced operational efficiency, while only 40% in Japan favoured traditional, mechanical valves.

Consensus

Stainless Steel Alloys: Selected by 80% globally for their corrosion resistance, strength, and ability to withstand extreme temperatures and pressures.

Variance

Shared Challenges

83% cited increasing raw material prices and supply chain disruptions as a primary concern.

Regional Differences

Manufacturers

Distributors

End-Users (Industrial Operators)

Alignment

70% of global manufacturers plan to invest in automated, IoT-enabled stainless steel control valves to enhance operational efficiency and predictive maintenance.

Divergence

High Consensus

Durability, compliance, and cost efficiency remain top priorities across the globe.

Key Variances

Strategic Insight

A regional approach is crucial for success. Emphasizing automation and smart technologies in the USA, sustainability in Europe, and cost-effective, compact designs in Japan and South Korea will allow manufacturers to tailor their offerings and capture diverse industry segments effectively.

| Countries | Government Regulations and Policies Impacting the Market |

|---|---|

| USA |

|

| UK |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| Australia-NZ |

|

| India |

|

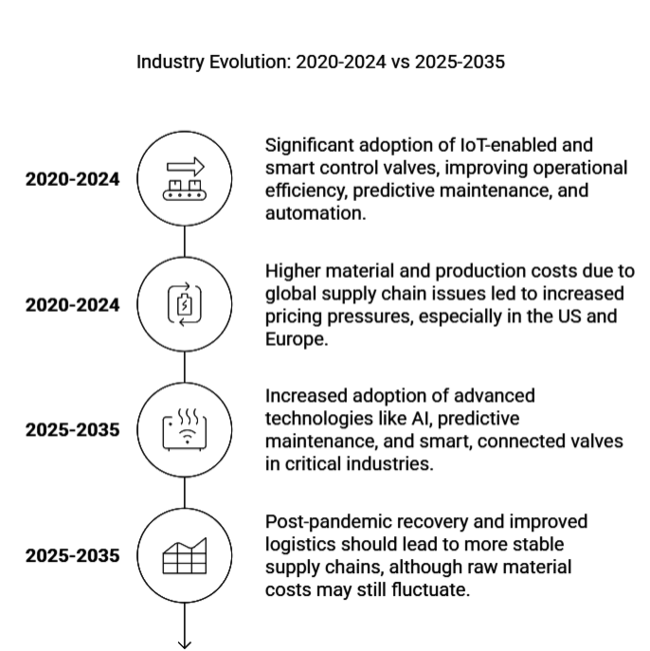

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry experienced steady growth, driven by demand from the oil & gas, chemical, water treatment, and power generation industries. | The industry is expected to expand at a CAGR of 5.9%, driven by industrial automation, increasing demand for energy-efficient solutions, and regulatory pressure. |

| Significant adoption of IoT-enabled and smart control valves, improving operational efficiency, predictive maintenance, and automation. | Increased adoption of advanced technologies like AI, predictive maintenance, and smart, connected valves in critical industries. |

| The COVID-19 pandemic caused production delays and disruptions in global supply chains, impacting valve manufacturing and distribution. | Post-pandemic recovery and improved logistics should lead to more stable supply chains, although raw material costs may still fluctuate. |

| Compliance with environmental and safety standards (e.g., EPA, CE marking, ATEX) was a key driver for demand, particularly in Europe and North America. | Increasingly stringent safety, environmental, and performance standards across regions (e.g., stricter EU emissions and safety policies). |

| Higher material and production costs due to global supply chain issues led to increased pricing pressures, especially in the USA and Europe. | While price sensitivity will remain, the trend toward automation and smart solutions will drive value-based pricing, especially in developed industries. |

| High adoption rates in developed regions (USA, Europe) for advanced, energy-efficient valves, while cost sensitivity in Asia led to slower uptake of newer technologies. | Greater penetration in Asia and developing industries as industries increasingly prioritize reliability, safety, and regulatory compliance, driving adoption. |

| Stainless steel remained the material of choice due to its durability, corrosion resistance, and ability to handle extreme conditions. | Demand for high-performance stainless-steel alloys (e.g., duplex) will grow, especially for highly corrosive and extreme temperature applications. |

| Demand was concentrated in industries like oil & gas, water treatment, and chemicals, with growing interest in automation and digital controls. | Expansion of demand into new sectors like pharmaceuticals, food processing, and semiconductor industries, with increased focus on automation. |

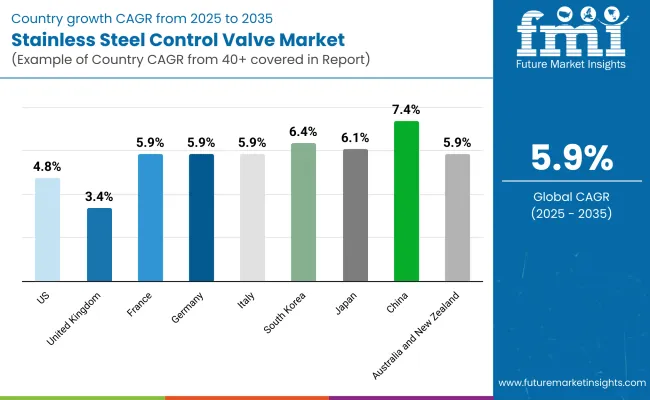

The stainless-steel valve industry in the United States is expected to grow at a CAGR of 4.8% from 2025 to 2035. Key growth drivers in the country include the continued expansion of the oil and gas sector, particularly in shale oil extraction, which requires durable and high-performance valves.

Additionally, increased investments in water treatment infrastructure and power generation plants are fuelling demand for reliable control valves. Regulatory pressures, such as stricter emissions standards and safety regulations, further push industries toward adopting advanced, energy-efficient valve solutions.

The integration of smart technologies, IoT, and automation in manufacturing processes is expected to drive growth, enabling predictive maintenance and improved system efficiencies. Despite steady growth, the USA industry faces challenges from cost pressures, supply chain disruptions, and a maturing industrial landscape.

Sales in the United Kingdom are anticipated to grow at a CAGR of 3.4% from 2025 to 2035.A key driver of growth in the UK is the stringent environmental and safety regulations they work within - particularly in critical sectors such as water treatment, chemical processing and power generation.

The need for energy efficiencies and sustainable solutions in all industries encouraged the government to push the demand for low-power valve technologies. Upgrading water systems and renewable energy are examples of types of infrastructure projects that will drive demand for stainless steel control valves to remain steady, but growth is slow due to stringent regulations as well as a trend towards cost-effective solutions in some more minor industries.

The Chinese industry is projected to grow at a strong CAGR of 7.4% by 2025 to 2035. This growth will be primarily driven by the country’s rapid industrialization and infrastructure construction focus. High-performance control valves are in increasing demand in the key industries of chemicals, oil and gas, and water treatment, among others.

The Chinese government's investment in smart manufacturing, automation, cleaner energy, and stricter environmental regulations is driving up demand for stainless steel valves. Moreover, a rise in China’s middle class and urbanization are pressuring the need for upgraded infrastructure, especially in wastewater treatment and power generation, driving a steady increase in valve demand.

Japan industry is projected to grow at 6.1% CAGR through 2025 to 2035. Demand will continue to be driven mainly by Japan's industrial sectors, especially electronics and automotive and chemical manufacturing. Furthermore, since the country focuses on precision and quality control systems, coupled with sustainable and energy-efficient solutions, the adoption of advanced valve technologies is facilitated.

The aging infrastructure in Japan and a commitment to environmental regulations also contribute to the demand for durable, high-performance valves in water treatment and power generation. The continued drive towards industrial automation and the growth of the smart factory helps support greater industry growth via greater monitoring of systems for preventative maintenance of reported faults.

The industry in South Korea is projected to grow at a compound annual growth rate (CAGR) of 6.4% during the period 2025 to 2035. This growth is largely tied to the country's booming heavy industries such as semiconductor manufacturing, petrochemical, and automotive. These Industries are Investing In Automation, which Increase Demand of High-Performance Control Valves to Maintain Precision & Reliability of Critical System Behind It.

The government of South Korea is also placing a strong emphasis on improving energy efficiency and sustainability within sectors, thus fostering an ideal platform for the proliferation of advanced valve solutions. Ongoing growth in infrastructure projects across urbanization and water treatment will also underpin demand for durable, corrosion-resistant stainless-steel valves.

The industry in France is projected to achieve a stable CAGR of 5.9%. The high-quality control valves demand will be driven by France’s healthy industrial sectors as well including energy, chemical processing, and manufacturing. Government regulations on sustainability and minimizing emissions will continue to drive industries toward adopting more energy-efficient valve technologies.

Decarbonization policies and plans in France (with a focus on wind and solar energy) will further drive demand for advanced valve solutions in the power generation sector as well. The country’s commitment to renewing infrastructure, including modernizing water treatment facilities, will drive growth in the industry as well.

Germany’s stainless steel valve industry is forecast to grow at a CAGR of 5.9% from 2025 to 2035. As one of the largest industrial hubs in Europe, Germany’s strong manufacturing and chemical sectors drive demand for stainless steel valves. The country’s focus on sustainability and green energy, backed by stringent environmental regulations, is encouraging industries to invest in more energy-efficient and environmentally friendly valve solutions.

Additionally, the German industry is benefiting from increased automation in manufacturing and industrial processes, driving the need for smart and precise control valves. The ongoing need for infrastructure upgrades, particularly in water treatment and power generation, will further support the industry's expansion.

The stainless-steel valve industry in Italy is projected to grow at a CAGR of 5.9% from 2025 to 2035. Italy’s manufacturing sector, which includes automotive, chemical processing, and energy, remains a key driver for valve demand. The country’s push for sustainability and energy efficiency, in line with European Union regulations, supports the growth of advanced control valve technologies.

Moreover, Italy’s need to upgrade its aging infrastructure, especially in water management and power generation, will drive further demand. As automation and IoT technologies continue to evolve, Italian industries will increasingly adopt smart, connected valve solutions to optimize system performance and maintenance.

The stainless-steel valve industry in Australia and New Zealand is expected to grow at a CAGR of 5.9% from 2025 to 2035. The demand for stainless steel valves in these countries is driven by key industries such as mining, oil and gas, and water treatment. With a growing focus on sustainability and energy efficiency, Australian and New Zealand industries are adopting more advanced valve solutions, including those with IoT and automation capabilities.

Additionally, the countries’ emphasis on upgrading their infrastructure, particularly in water and wastewater treatment facilities, will drive the need for durable and corrosion-resistant stainless-steel valves. The industry growth will also be supported by the expansion of renewable energy projects, requiring efficient control valves for power generation systems. The increasing need for advanced, high-performance valves in agricultural applications and smart technologies will continue to drive demand in these regions.

The stainless-steel valve industry is competitive, with major players like Emerson Electric Co., Flowserve Corporation, Kitz Corporation, IMI Plc, and Schneider Electric dominating the sector. Emerson continues to hold a strong position, driven by innovations in automation and smart valve technologies. Flowserve, with its wide product range, focuses on industrial and oil and gas sectors, while IMI Plc maintains a robust presence in Europe, offering advanced valve solutions for various industries.

In 2024, Flowserve Corporation expanded its industry presence through the acquisition of Nova Rotary Engineering, a move to bolster its position in the oil and gas industry, particularly in the Middle East and Asia-Pacific. This acquisition complements Flowserve's existing valve portfolio, enabling it to offer more comprehensive solutions. (Source: Flowserve Press Release, January 2024).

Emerson Electric Co. partnered with Schneider Electric in 2024 to integrate control valve solutions with Schneider’s EcoStruxure automation platform. This collaboration focuses on improving efficiency and performance for industries such as chemical processing, with a clear emphasis on digital transformation and IoT-enabled solutions. (Source: Emerson Press Release, February 2024).

Kitz Corporation unveiled a new series of high-performance stainless steel ball valves in 2024. Designed for the chemical and petrochemical industries, these valves feature advanced corrosion-resistant coatings, enhancing durability. The new products cater to emerging industries in Southeast Asia, where demand for such advanced valves is rising. (Source: Kitz Corporation Press Release, March 2024).

IMI Plc introduced a new range of automated control valves in 2024. These valves are integrated with digital controllers that use predictive analytics for real-time monitoring. This innovation targets industries requiring high precision, such as aerospace and energy, reinforcing IMI’s leadership in smart valve technologies. (Source: IMI Plc Annual Report, April 2024).

Schneider Electric focused on expanding its presence in the Asia-Pacific region, especially in China and India, by offering localized stainless steel valve solutions. This expansion strategy is part of Schneider’s broader effort to capture a larger share of the rapidly growing industrial industries in these countries.

These developments reflect a trend of innovation and geographic expansion, as leading valve manufacturers invest in automation, digital solutions, and strategic acquisitions to meet the evolving needs of industries worldwide.

The Stainless Steel Control Valve industry falls under the broader industrial valves category, which encompasses the design, manufacturing, and application of valves used to regulate the flow of fluids and gases across various industries, including oil and gas, chemical processing, power generation, water treatment, and manufacturing.

From a macroeconomic perspective, the industry is influenced by global industrialization, urbanization, and infrastructure development. As industries increasingly focus on automation and digital transformation, the demand for high-performance, durable control valves rises, especially for sectors requiring precise fluid regulation. Growth in renewable energy, environmental regulations promoting sustainability, and investments in aging infrastructure further boost industry demand.

Additionally, rising industrial safety standards and the adoption of IoT and smart technologies are key drivers. Economic fluctuations, such as raw material price variations and supply chain disruptions, may pose challenges, but overall, the industry is expected to expand steadily due to its essential role in critical industrial processes.

This industry is experiencing growth driven by advancements in automation and the increasing demand for precise fluid regulation across various industries. Industries such as oil and gas, chemical processing, and power generation are investing heavily in automation and digitalization, driving the need for high-performance control valves.

The shift toward smart manufacturing and IoT-enabled systems is enhancing operational efficiency, making advanced control valves integral to modern industrial processes. Furthermore, the rising focus on sustainability and energy efficiency is pushing the adoption of corrosion-resistant, durable valves, especially in industries like water treatment and renewable energy.

To seize these opportunities, companies should focus on developing IoT-integrated valve solutions that offer real-time monitoring and predictive maintenance capabilities. Innovation in energy-efficient and corrosion-resistant materials will be crucial to meeting evolving environmental regulations.

Expanding into emerging industries, particularly in Asia-Pacific and Africa, where industrialization is rapidly growing, presents significant potential. Additionally, building strategic partnerships with automation technology firms and enhancing regional manufacturing capabilities will strengthen industry position and ensure faster delivery times. By addressing these trends, stakeholders can capitalize on the expanding demand for stainless steel control valves.

The industry is divided into manual control valves, pneumatic control Valves, hydraulic control valves, electric control valves

The landscape is segmented into ball control valves, butterfly control valves, cryogenic control valves, globe control valves, others

It is divided into power generation, oil and gas, chemical industry, semiconductor and electronics manufacturing, wastewater management, others

The industry is studied across into North America, Latin America, Europe, Asia Pacific, The Middle East & Africa (MEA)

Automation, IoT integration, precision flow control, energy efficiency, and sustainability are key drivers.

Oil and gas, chemical processing, power generation, water treatment, and renewable energy industries benefit most.

Durability, corrosion resistance, precise flow regulation, and reliability in harsh environments.

Advancements in automation, IoT, and predictive maintenance improve efficiency and enable real-time monitoring.

Corrosion resistance, high temperature tolerance, durability, and reduced maintenance costs.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel 330 Refractory Anchor Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel One-touch Fitting Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Manual Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA