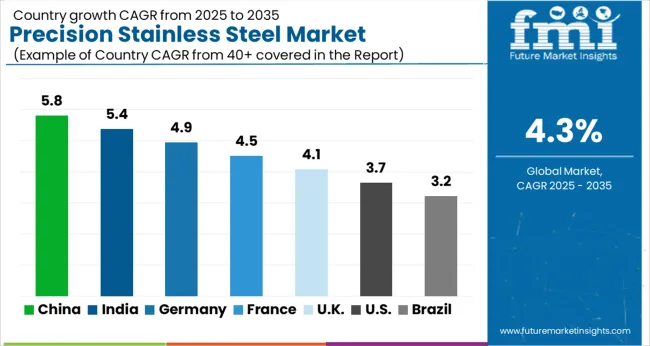

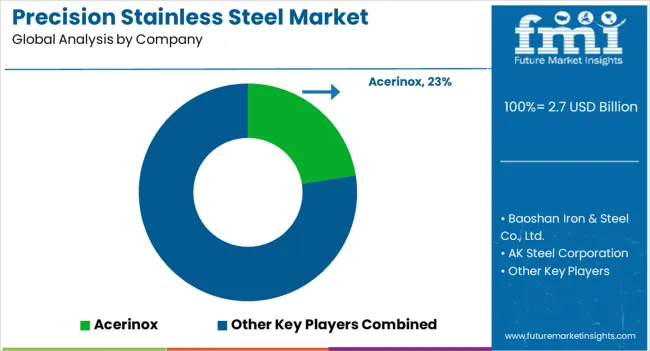

The Precision Stainless Steel Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Precision Stainless Steel Market Estimated Value in (2025 E) | USD 2.7 billion |

| Precision Stainless Steel Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The precision stainless steel market is experiencing consistent expansion driven by rising demand for high performance materials across food processing, medical devices, and precision engineering applications. The material’s superior corrosion resistance, durability, and adaptability for complex fabrication processes have supported its wide adoption.

Increasing regulatory emphasis on hygiene and safety in food and beverage manufacturing is further reinforcing the use of precision stainless steel. Technological advancements in rolling, finishing, and micro thickness manufacturing have allowed producers to meet stringent industry requirements while improving cost efficiency.

With expanding applications in both industrial and consumer sectors, the market outlook remains favorable as industries pursue reliability, compliance, and efficiency through high quality stainless steel solutions.

The below 0.1 mm material type segment is projected to hold 57.20% of the total market revenue by 2025, making it the leading material type. Its dominance is attributed to the precision, flexibility, and superior formability that this thickness offers, making it highly suitable for specialized applications.

This material is widely adopted where lightweight design, high surface quality, and micro tolerance levels are essential. Industries value it for its ability to maintain structural integrity while allowing fine machining, stamping, and complex forming processes.

Continuous improvements in rolling and thin gauge production techniques have further supported its growth. These benefits have positioned below 0.1 mm precision stainless steel as the preferred choice in high performance and high accuracy applications.

The food industry segment is expected to contribute 41.80% of total market revenue by 2025 within the end user category, establishing it as the dominant segment. Growth is being driven by strict food safety regulations, rising demand for hygienic processing environments, and the need for equipment that resists corrosion and bacterial contamination.

Precision stainless steel enables manufacturers to design durable, easy to clean components that enhance production efficiency and comply with global health standards. Its resistance to high temperature sterilization and chemical cleaning further strengthens its role in this sector.

As food manufacturers increasingly prioritize safety, longevity, and compliance, precision stainless steel continues to serve as the material of choice, solidifying its leadership in the food industry segment.

The precision stainless steel market is expected to expand at a high rate of 4.2% as compared to the historical growth rate of 1.7%.

Short term (2025 to 2025): Manufacturers are increasingly offering customized solutions to their customers, based on their specific requirements. This trend is driven by the need to provide customers with products that meet their specific needs and help them achieve a competitive edge in the market.

Medium term (2025 to 2035): The precision stainless steel market is also witnessing the adoption of advanced technologies such as additive manufacturing (3D printing), which has the potential to revolutionize the manufacturing process. Additive manufacturing is being used to produce complex and intricate precision metal components with high precision and accuracy, which would be difficult to achieve through conventional manufacturing processes.

Long term (2035 to 2035): The precision stainless steel market is expected to see the adoption of Industry 4.0 technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and Big Data Analytics, which are being used to optimize manufacturing processes and improve product quality. These technologies are also being used to monitor the production process in real-time and make necessary adjustments to ensure consistent product quality.

Cost of Raw Material and Energy and Overcapacity to hinder the Market Growth

The precision stainless steel industry is facing a significant challenge as the prices of raw materials such as coking coal and coke continue to rise due to their scarcity. This has created pricing challenges for manufacturers, particularly small-scale and local manufacturers, who are finding it difficult to compete in the market.

The high cost of raw materials such as iron ore and power has further exacerbated the pricing challenges, creating obstacles for precision stainless steel manufacturers. This, in turn, is restricting the market growth to a certain extent.

Moreover, the overcapacity in the industrial sector, particularly in China, is threatening the profitability levels of steel and steel products, including precision stainless steel. The influx of cheap steel in the global market is adversely affecting companies, workers, and the global trading regime, resulting in unfeasible profit levels for the global steel sector.

As China continues to expand its steel production beyond the required global demand, the overcapacity and production of steel and steel products are affecting the financial profitability of manufacturers. This, in turn, poses a threat to the growth of the precision stainless steel market. The industry must address these challenges to maintain sustainable growth and profitability.

Industrial manufacturing and service sector is rapidly growing in prominent economies to fulfill the domestic demand. Leading economies such as China, India, Brazil, and others are projected to drive the demand for precision stainless steel in terms of production and consumption.

The Indian market is expected to be valued at USD 65,247 million by the end of 2025. It is also expected to grow at rate of 4.1% throughout the forecast period.

Leading precision metal manufacturers operating in India are highly focusing on precision steel production to fulfil end-use industry requirements. Furthermore, installation of new manufacturing plants is industrial sectors is one of the vital factors triggering the demand for precision stainless steel in the region.

There are several prominent players in the precision stainless steel market in India.

The demand for precision stainless steel in the United States is expected to rise at rate of 1.6%, slowing down the growth from a historical rate of 2.3%. Canada’s market is experiencing a similar situation, with the forecasted growth rate at 2.3% from a high historical rate of 3.1%.

The economic downturn caused by the COVID-19 pandemic has had a significant impact on the precision stainless steel market in the USA and Canada. The pandemic has resulted in reduced demand for stainless steel products, particularly in the construction and automotive industries, which are major consumers of precision stainless steel products.

The growing popularity of alternative materials such as aluminum and plastic has created intense competition for the precision stainless steel industry in the USA and Canada. This has led to a decline in demand for precision stainless steel products, as more and more companies are switching to alternative materials that are more cost-effective and offer better performance in certain applications.

Lastly, the aging infrastructure in the USA and Canada has resulted in reduced demand for stainless steel products in the construction and engineering industries. The lack of investment in infrastructure projects has limited the demand for precision stainless steel products, which are widely used in these industries.

The precision stainless steel market in the 0.1 mm to 0.4 mm thickness segment is poised for impressive growth in the coming years. The 0.1 mm segment is on its way to capture an expected 80.7% market share by 2035. This is fueled by an upsurge in demand for superior quality stainless steel products across multiple industries, including automotive, aerospace, electronics, and medical devices. The surge in demand is driven by the need for lightweight and durable components in the automotive and aerospace sectors, a growing demand for electronic devices, and the need for top-notch medical devices such as surgical instruments, implants, and diagnostic tools. As a result, the market is set to experience a steady and robust growth trajectory, presenting a promising opportunity for players in the precision stainless steel market.

The global precision stainless steel industry is characterized by fragmentation, with the top players accounting for only 40-45% of the total production. To stay ahead in this competitive landscape, key players are adopting various strategies to expand their reach globally, diversify their product portfolio, and upgrade their supplier and distributor networks.

One of the primary strategies employed by leading players is rapid product development to gain a competitive edge in the market. With a focus on innovation, companies are leveraging advanced technologies to create new and improved products that meet the evolving demands of customers across various industries.

Top players are also investing heavily in research and development to enhance the quality of their products, improve production efficiency, and reduce costs. This approach helps companies to meet the stringent quality requirements of customers and maintain a competitive edge in the market.

Companies are exploring new market opportunities and expanding their presence in emerging markets to tap into the growing demand for precision stainless steel products. They are also diversifying their product portfolio to cater to the diverse needs of customers across various industries.

The global precision stainless steel market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the precision stainless steel market is projected to reach USD 4.1 billion by 2035.

The precision stainless steel market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in precision stainless steel market are below 0.1 mm and 0.1 mm to 0.4 mm.

In terms of end user, food industry segment to command 41.8% share in the precision stainless steel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Livestock Farming Market - Trends & Forecast 2034

Precision Agriculture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA