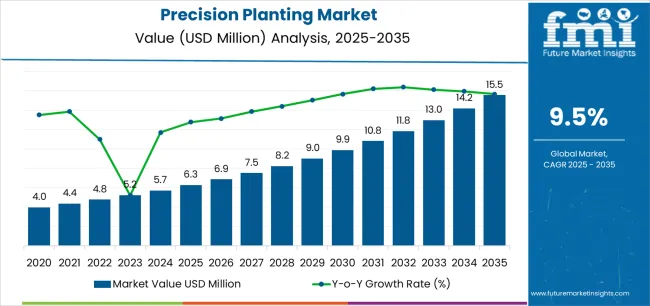

The Precision Planting Market is estimated to be valued at USD 6.3 million in 2025 and is projected to reach USD 15.5 million by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

The precision planting market is experiencing robust growth driven by rising demand for sustainable agriculture, efficient resource utilization, and enhanced crop productivity. Market expansion is being supported by the integration of digital technologies, automation, and data analytics into farming operations. Current dynamics reflect increased adoption of advanced planting systems that improve seed placement accuracy and optimize input usage.

Manufacturers are focusing on developing user-friendly, scalable solutions compatible with a wide range of agricultural machinery. The future outlook is shaped by the continued emphasis on precision agriculture, government support for smart farming initiatives, and growing awareness of climate-resilient cultivation practices. Increasing labor shortages and the need for yield optimization are also propelling investment in automated planting systems.

Growth rationale is anchored on continuous innovation in planting equipment, advancements in sensor technology, and improved connectivity that enable real-time monitoring and control These developments are expected to sustain market expansion and enhance profitability for stakeholders across the agricultural value chain.

| Metric | Value |

|---|---|

| Precision Planting Market Estimated Value in (2025 E) | USD 6.3 million |

| Precision Planting Market Forecast Value in (2035 F) | USD 15.5 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

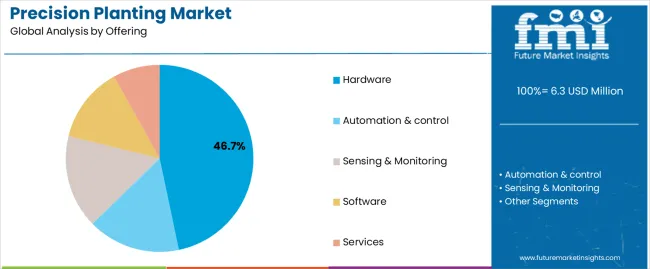

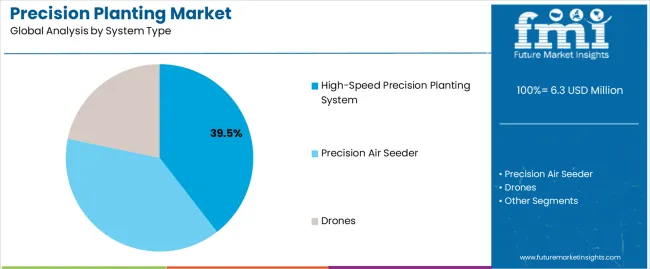

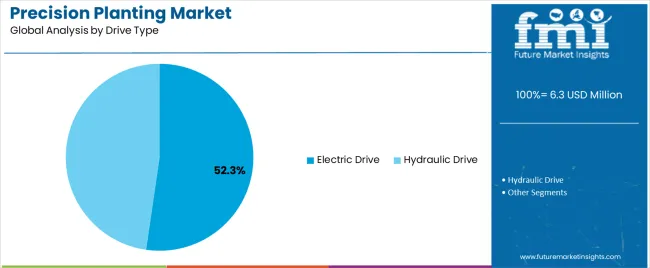

The market is segmented by Offering, System Type, Drive Type, and Crop Type and region. By Offering, the market is divided into Hardware, Automation & control, Sensing & Monitoring, Software, and Services. In terms of System Type, the market is classified into High-Speed Precision Planting System, Precision Air Seeder, and Drones. Based on Drive Type, the market is segmented into Electric Drive and Hydraulic Drive. By Crop Type, the market is divided into Row Crops, Grains, Oilseeds & Pulses, Forestry, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, accounting for 46.70% of the offering category, has maintained its dominance owing to high adoption of advanced mechanical and electronic components that enhance planting precision. Demand has been driven by the replacement of conventional seeding tools with intelligent hardware systems that ensure consistent depth, spacing, and population control.

Manufacturers are focusing on integrating durable materials and modular designs to improve field performance and reduce maintenance costs. The segment’s growth is supported by the scalability of hardware solutions across diverse crop types and farm sizes.

Continuous innovation in control units, sensors, and actuators has strengthened operational efficiency, while compatibility with variable-rate technology has expanded the application base Increasing investment in farm mechanization, particularly in developing agricultural economies, is expected to further reinforce the segment’s market share over the coming years.

The high-speed precision planting system segment, holding 39.50% of the system type category, is leading due to its ability to maximize planting accuracy at higher operational speeds. Its adoption has been supported by growing awareness of time-efficient planting practices that improve productivity during critical sowing periods. These systems are equipped with advanced seed meters, hydraulic downforce, and control technologies that minimize skips and doubles.

Enhanced field efficiency and reduced fuel consumption have contributed to wider acceptance among commercial farms. Manufacturers are prioritizing R&D to further improve seed singulation and placement accuracy.

The scalability of high-speed systems across large-acreage farming operations has made them a preferred choice in regions with advanced mechanization Continued technological innovation and compatibility with digital farm management platforms are expected to strengthen the segment’s leadership position in the global market.

The electric drive segment, representing 52.30% of the drive type category, has emerged as the dominant technology owing to its superior control, energy efficiency, and reduced maintenance requirements compared to mechanical systems. The segment’s growth has been driven by increasing adoption of variable-rate seeding and section control capabilities, which allow precise seed population management and minimize input wastage.

Electric drives provide independent row control, enabling optimized seed placement and improved field uniformity. Integration with advanced monitoring systems and GPS-guided automation has enhanced reliability and operational precision.

Manufacturers are focusing on expanding the compatibility of electric drive systems with diverse planter models and retrofitting options for existing machinery The continued transition toward electrification in agricultural equipment, combined with growing focus on cost efficiency and sustainability, is expected to maintain the segment’s leading position in the precision planting market.

From 2020 to 2025, the precision planting market experienced a CAGR of 12.4%. The adoption of precision planting technology gained momentum with the development of more advanced systems incorporating precision seed meters, automated row shut-off, and variable rate seeding capabilities. As precision planting systems became more affordable and accessible, adoption rates increased, particularly among larger farms in developed regions.

Ongoing advancements in sensor technology, automation, and data analytics will continue to drive innovation in precision planting systems, enabling farmers to achieve higher levels of accuracy, efficiency, and productivity in their planting operations.

Emerging agricultural markets, particularly in developing regions, will present significant growth opportunities for the precision planting market. As farmers in these regions seek to improve productivity and profitability, they will increasingly adopt precision planting solutions tailored to their specific needs and conditions.

As precision planting becomes increasingly integrated into mainstream agriculture, it will play a crucial role in shaping the future of farming and food production worldwide. Projections indicate that the global precision planting market is expected to experience a CAGR of 10% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 12.4% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 10% |

The provided table highlights the top five countries in terms of revenue, with Japan and South Korea leading the list. A strong emphasis on adopting innovative agricultural technologies to enhance productivity and efficiency in farming practices in Japan drives market growth.

The governments of South Korea have been actively promoting the adoption of precision agriculture technologies to address challenges related to food security, environmental sustainability, and rural development.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 10.1% |

| The United Kingdom | 10.5% |

| China | 10.2% |

| Japan | 11.5% |

| South Korea | 11.1% |

The precision planting market in the United States is expected to expand with a CAGR of 10.1% from 2025 to 2035. The United States has been at the forefront of technological innovation in agriculture, and precision planting is no exception.

Continuous advancements in GPS, sensors, automation, and data analytics have enabled farmers to adopt precision planting systems that offer higher accuracy, efficiency, and yield optimization.

The trend towards larger farm sizes and increased mechanization has driven demand for precision planting technology among large-scale farming operations in the United States Consolidation allows for greater economies of scale, making investments in precision planting equipment and technology more feasible and attractive.

Farmers in the United Kingdom are increasingly embracing precision agriculture technologies to improve efficiency, optimize resource use, and enhance productivity.

Precision planting is seen as a key component of this digital transformation, offering benefits such as improved seed placement, reduced input costs, and higher yields. The precision planting market in the United Kingdom is expected to expand with a CAGR of 10.5% from 2025 to 2035

The United Kingdom government has been supporting initiatives aimed at promoting sustainable agriculture practices and innovation in the farming sector. Funding programs, grants, and incentives are available to farmers investing in precision planting equipment and technologies, encouraging adoption and driving market growth.

China has one of the largest agricultural sectors globally, with a diverse range of crops grown across vast areas. Precision planting technologies offer significant benefits in terms of efficiency, productivity, and resource optimization, making them increasingly attractive to Chinese farmers. The precision planting market in China is expected to expand with a CAGR of 10.2% from 2025 to 2035

With a growing population and changing dietary patterns, there is a heightened focus on enhancing food security and self-sufficiency in China. Precision planting helps maximize agricultural productivity while minimizing resource inputs, contributing to food security goals.

The Chinese government has been actively promoting agricultural modernization and technological advancement as part of its broader rural development and food security initiatives. Policies, subsidies, and incentives are provided to encourage farmers to adopt precision planting technologies.

The precision planting market in Japan is expected to expand with a CAGR of 11.5% from 2025 to 2035. Japan's farming population is aging, leading to a labor shortage and increased demand for labor saving technologies.

Precision planting systems, with their automation and efficiency-enhancing features, help address this challenge by reducing the need for manual labor and increasing productivity per worker.

The Japanese government has been actively promoting agricultural modernization and productivity improvement through policies, subsidies, and incentives. Initiatives such as the 'Agricultural ICT Promotion Plan' and the 'Next-Generation Agriculture Support Program' provide support for adopting precision planting technologies and other advanced agricultural practices. Precision planting technologies offer solutions to maximize productivity and optimize resource use in Japan's constrained agricultural landscape.

South Korea is known for its advanced technology sector and its agricultural industry benefits from innovations in precision planting technology. Local companies develop and offer cutting-edge solutions incorporating GPS guidance, automated control, and data analytics to improve planting accuracy and efficiency.

Environmental concerns, including soil erosion, water scarcity, and pollution, are driving the adoption of precision planting technologies in South Korea.

By optimizing seed placement and reducing chemical inputs, precision planting helps minimize environmental impact and promote sustainable farming practices. The precision planting market in South Korea is expected to expand with a CAGR of 11.1% from 2025 to 2035

The below section shows the leading segment. The hardware segment is to rise at a CAGR of 9.8% from 2025 to 2035. Based on system type, the high-speed precision planting system segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 9.6% from 2025 to 2035.

| Category | CAGR |

|---|---|

| Hardware | 9.8% |

| High-speed precision planting system | 9.6% |

Based on the offering, the hardware segment is anticipated to thrive at a CAGR of 9.8% from 2025 to 2035. Hardware such as precision planters, seed meters, sensors, GPS receivers, and control systems are essential components of precision planting technology.

These hardware components are necessary for accurately planting seeds at the desired depth, spacing, and timing, which are critical factors for optimizing crop yields.

Precision planting hardware enables farmers to achieve high levels of precision and accuracy in their planting operations. Advanced technologies such as GPS guidance, variable rate seeding, and automated control systems ensure consistent seed placement, uniform plant spacing, and optimal plant populations, leading to improved crop performance and yield outcomes.

Precision planting hardware helps farmers increase efficiency and productivity by automating planting operations, reducing manual labor requirements, and enabling faster and more precise planting across large agricultural areas. This allows farmers to cover more ground in less time while maintaining planting accuracy and consistency.

Based on the system type, the high-speed precision planting system segment is anticipated to thrive at a CAGR of 9.6% from 2025 to 2035.

High-speed precision planting systems allow farmers to cover more ground in less time compared to traditional planting methods. By planting at higher speeds without sacrificing accuracy, farmers can complete planting operations more quickly, enabling them to take advantage of optimal planting windows and weather conditions.

Time is a critical factor in agriculture, especially during busy planting seasons. High-speed precision planting systems help farmers save time by reducing the time required to plant each acre of land. This allows farmers to manage larger acreages with fewer resources and labor hours, leading to increased operational efficiency.

With high-speed precision planting systems, farmers can plant more acres in a given period, resulting in improved productivity and higher overall yields. By maximizing planting efficiency, farmers can achieve higher crop yields while minimizing labor and equipment costs.

Market players invest heavily in research and development to innovate and develop advanced precision planting technologies. This includes improving hardware components such as planters, seed meters, and sensors, as well as software solutions for data analytics, automation, and decision support systems.

Continuous technological innovation allows companies to offer cutting-edge solutions that meet the evolving needs of farmers and enhance their operational efficiency.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 5.7 billion |

| Projected Market Valuation in 2035 | USD 14.7 billion |

| Value-based CAGR 2025 to 2035 | 10% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | north america; latin america; western europe; eastern europe; south asia and pacific; east asia; middle east and africa |

| Key Market Segments Covered | offering, system type, drive type, crop type, region |

| Key Countries Profiled | the united states, canada, brazil, mexico, germany, the united kingdom, france, spain, italy, russia, poland, czech republic, romania, india, bangladesh, australia, new zealand, china, japan, south korea, GCC countries, south africa, israel |

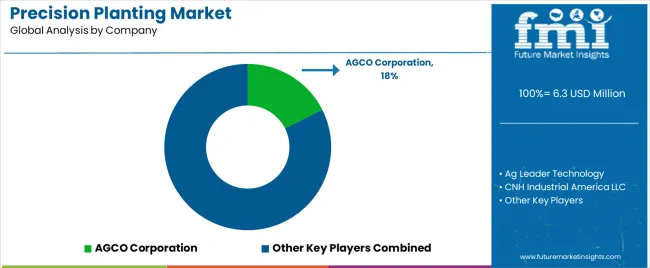

| Key Companies Profiled | ag leader technology; agco corporation; cnh industrial america llc; kubota corporation; morris industries ltd.; precision ag solutions; precision seeding solutions; titan machinery; trimble inc.; vaderstad |

The global precision planting market is estimated to be valued at USD 6.3 million in 2025.

The market size for the precision planting market is projected to reach USD 15.5 million by 2035.

The precision planting market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in precision planting market are hardware, automation & control, sensing & monitoring, software and services.

In terms of system type, high-speed precision planting system segment to command 39.5% share in the precision planting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Livestock Farming Market - Trends & Forecast 2034

Precision Agriculture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA