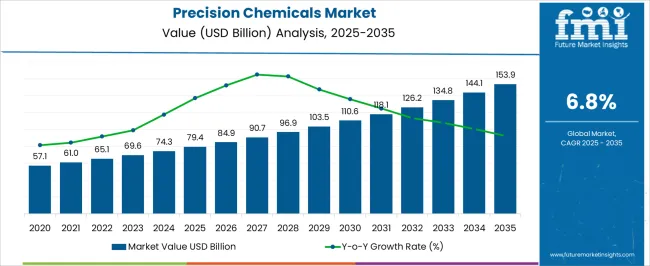

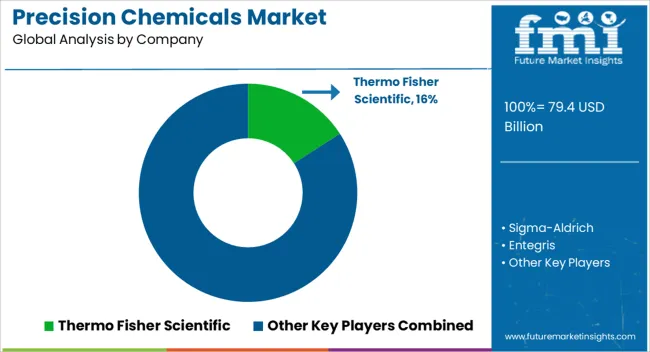

The Precision Chemicals Market is estimated to be valued at USD 79.4 billion in 2025 and is projected to reach USD 153.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Precision Chemicals Market Estimated Value in (2025 E) | USD 79.4 billion |

| Precision Chemicals Market Forecast Value in (2035 F) | USD 153.9 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The Precision Chemicals market is experiencing strong growth, driven by increasing demand for high-quality chemical products in the pharmaceutical, biotechnology, and specialty chemical sectors. Rising requirements for purity, consistency, and regulatory compliance are shaping the adoption of precision chemicals across critical applications. Advances in chemical synthesis, purification processes, and quality assurance technologies are enabling manufacturers to meet stringent standards while reducing variability and impurities.

The growth of the pharmaceutical industry, particularly in the production of high-value therapeutics, is fueling demand for precision chemicals that ensure reproducible and effective outcomes. Additionally, regulatory emphasis on safety, traceability, and adherence to Good Manufacturing Practices has accelerated adoption across end-use industries.

Continuous innovation in chemical formulation, process optimization, and custom manufacturing capabilities is further strengthening market dynamics As organizations increasingly prioritize product quality, operational efficiency, and compliance, the Precision Chemicals market is expected to sustain long-term growth, with opportunities emerging from the rising complexity of pharmaceutical, biotechnology, and specialty chemical applications worldwide.

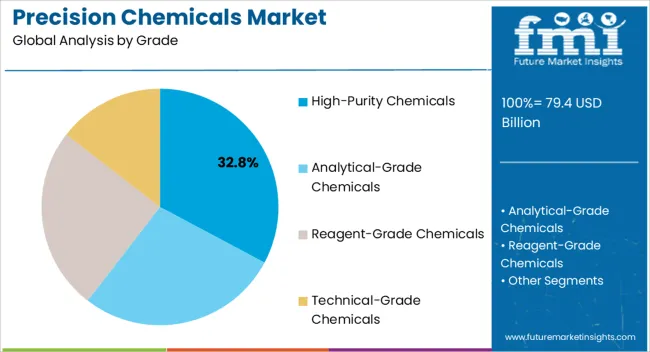

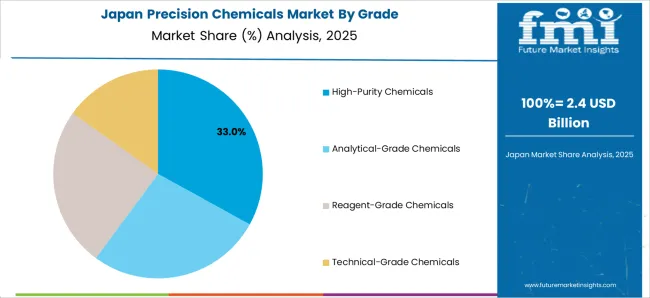

The high-purity chemicals grade segment is projected to hold 32.8% of the market revenue in 2025, establishing it as the leading grade type. Its dominance is being driven by the stringent purity requirements of pharmaceutical, biotechnology, and specialty chemical applications, where even trace-level impurities can impact product efficacy and safety.

High-purity chemicals offer consistent composition, minimal contamination, and enhanced reliability, which are critical for advanced research, process optimization, and high-value production. Manufacturers are increasingly investing in high-purity chemical production capabilities, including advanced filtration, distillation, and analytical verification processes, to meet stringent industry standards.

The ability to deliver chemicals with reproducible properties ensures that downstream applications, such as formulation of therapeutics or specialty compounds, achieve predictable performance As demand for high-quality, regulatory-compliant chemicals rises globally, the high-purity chemicals grade segment is expected to maintain its leading position, driven by increasing adoption in pharmaceutical, biotechnological, and industrial applications requiring precise chemical specifications.

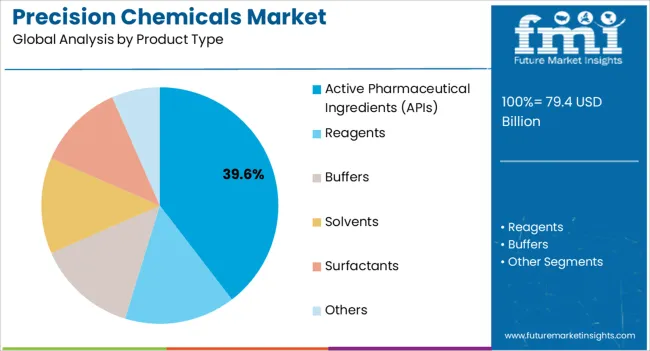

The active pharmaceutical ingredients (APIs) application segment is anticipated to account for 39.6% of the market revenue in 2025, making it the leading application area. Growth is driven by the global expansion of pharmaceutical manufacturing and the rising demand for high-quality, safe, and effective therapeutic compounds. Precision chemicals play a critical role in ensuring API consistency, stability, and purity, which directly affects drug efficacy and regulatory compliance.

Manufacturers are leveraging advanced chemical synthesis, process control, and quality verification techniques to produce APIs with reproducible performance. The integration of precision chemicals into API production improves operational efficiency, reduces variability, and supports stringent regulatory adherence.

Rising investments in generics, specialty drugs, and novel therapeutics further fuel the adoption of precision chemicals in API manufacturing As pharmaceutical companies increasingly focus on high-quality output, patient safety, and compliance with international standards, the API application segment is expected to remain a primary driver of market growth, supported by advancements in chemical processing and analytics.

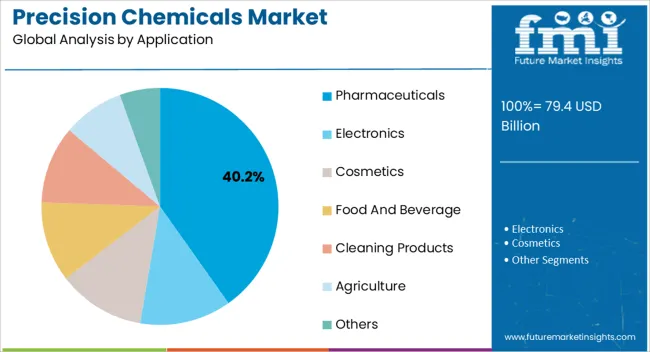

The pharmaceuticals end-use industry segment is projected to hold 40.2% of the market revenue in 2025, establishing it as the leading end-use sector. Its growth is driven by the rising demand for safe, effective, and high-quality drugs across global markets. Precision chemicals are essential for the formulation of active compounds, excipients, and intermediates, ensuring consistency, purity, and compliance with regulatory standards.

The increasing prevalence of chronic diseases, the expansion of healthcare infrastructure, and the growth of personalized medicine have amplified the need for reliable chemical inputs in pharmaceutical manufacturing. Advanced manufacturing processes, quality control, and process automation enable pharmaceutical companies to produce medicines that meet international safety and efficacy requirements.

Additionally, regulatory scrutiny, including adherence to Good Manufacturing Practices and pharmacopoeial standards, has reinforced the adoption of precision chemicals As pharmaceutical production continues to scale globally, reliance on high-performance chemicals for manufacturing, research, and development is expected to sustain market expansion, positioning the pharmaceuticals end-use industry as the primary contributor to revenue growth.

From 2020 to 2025, the global market experienced a CAGR of 6.8%, reaching a market size of USD 69,109.9 million in 2025.

From 2020 to 2025, the global market witnessed steady growth due to the rising demand for the medical and pharmaceutical industry as sulfuric acid, nitric acid, and hydrofluoric acids can be used in implantable devices. The increasing demand for these compounds is driving the growth of the market.

Looking ahead, the global market is expected to rise at a CAGR of 7.2% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 138,512.2 million.

From 2025 to 2035, these chemicals are projected to sustain their upward growth trend, primarily by the growing need for cleaning and polishing of silicon carbide, an extremely hard surface material utilized in power electrical systems and sophisticated communications, and wide band gap semiconductors (WBGS) devices The escalating demand for these chemicals in electronic and semiconductor industry is a key driver for the expansion of the market.

China, the USA, Japan, and South Korea are the key contributors to the significant market share. Among them, China stands out as the prominent player, benefiting from its extensive semiconductor manufacturing capacity owing to this there is a need for these precision compounds. The end-use industries are expected to develop throughout the projection period, and regional governments will continue to invest in and support the market in North America and Asia-Pacific.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 26,036.3 million |

| CAGR % 2025 to End of Forecast (2035) | 5.7% |

The market in the United States is expected to reach a market share of USD 26,036.3 million by 2035, expanding at a CAGR of 5.7%. The production of high-quality chemicals for use in research and development, quality control, and regulatory compliance is the primary focus of precision chemicals manufacturers in the United States. Technological advancements, a rise in the usage of chemicals such as Tri Acid Blend, silicone oil removers, etc. in research and development, and rising analytical chemical demand are some of the market-driving factors in the USA.

| Country | India |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 7,978.3 million |

| CAGR % 2025 to End of Forecast (2035) | 6.9 % |

The market in India is expected to reach a market share of US 7,978.3 million, expanding at a CAGR of 6.9% during the forecast period. Precision chemicals have emerged as a preferred choice in precision farming, and their demand continues to surge. A paradigm change in crop production and animal husbandry is referred to as precision farming, often known as smart agriculture which requires these agrochemicals compound. The rising adoption of 21st-century solutions by both commercial and intensive farms serves as the foundation for it. The "Internet of Things" (IoT), also known as Industry 4.0, which is driven by improved device connectivity and data integration, encompasses this in significant part.

The use of cutting-edge sensing technologies is essential to the IoT revolution in smart farming. These solutions give users a comprehensive understanding of all significant production factors, even down to the micro level. the demand for these chemicals in India is set to experience significant growth, propelling the overall market forward.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 48,724.6 million |

| CAGR % 2025 to End of Forecast (2035) | 7.3% |

The market in China is anticipated to reach a market share of USD 48,724.6 million, moving at a CAGR of 7.3 % during the forecast period. Highly toxic precision chemicals are often used in the electronics and semiconductor manufacturing process. To ensure the reliability of the final product and high post-process quality, precision cleaning chemicals are crucial in the manufacturing of parts.

The requirement for higher standards of cleaning is increasing while also becoming more challenging in recent years as the structural design of parts has grown more sophisticated in accordance with the development of nanoscale processing technologies. China's market for precision chemicals is predicted to expand significantly over the next few years as a result of rising demand from the semiconductor and electronics industries.

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 9,474.2 million |

| CAGR % 2025 to End of Forecast (2035) | 6.4% |

The market in Japan is estimated to reach a market share of USD 9,474.2million by 2035, thriving at a CAGR of 6.4%. Pharmaceuticals are one of the fastest-growing industries in Japan owing to technological advancement, R and D innovations, and rising consumer demand for pharmaceutical products and nutritional supplements. The production and selling of medicines have to be done with extreme caution, accuracy, and quality, according to pharmaceutical manufacturers.

Starting with stringent regulations for raw materials and moving on to the storage conditions for finished medications and supplements that are eventually offered to patients. The market in Japan is predicted to grow owing to the increasing adoption of precision compounds in the pharmaceutical industry.

From 2025 to 2035, cleaning products are predicted to dominate the market with a CAGR of 5.8%. With the increasing demand for precise cleaning products from the semiconductor and electronics industry, the need for these compounds is anticipated to increase and will account for a large market share by 2025.

Water-based and semi-water-based cleaning chemicals are used instead of solvent-based (chlorides, hydrocarbon, fluorides, bromides, etc.). The simultaneous removal of organic and inorganic contaminants is made possible by the use of surfactants to penetrate, emulsify, disperse, and prevent reattachment.

This increases the demand for water-based and semi-water-based cleansers, which both have a lower environmental effect and have higher cleaning performance. The market is witnessing growth due to the rising awareness of water-based precision chemicals in cleaning applications.

The Agrochemical industry is expected to dominate the market with a CAGR of 5.3% from 2025 to 2035. The productivity and operational efficiencies of the world agriculture sector can be greatly increased by precision agrochemicals and insecticides.

To bring the existing, antiquated systems up to date, careful monitoring and substantial changes are required. The agrochemical sector has seen several changes and trials, involving everything from equipment to safety protocols and regulations. Due to the rising demand, the precision chemical process has emerged as one of the most sought-after services. The growing need for precise and accurate concentrations of chemicals in fungicides, pesticides, and precise micro chemicals is expected to fuel the demand for precision compounds

The market is highly consolidated, with key players having a significant market share. Key players in the industry are focusing on the development of advanced technology for the manufacturing of these precision chemicals, for various applications such as pharmaceuticals, cosmetics, semiconductors, and electronics. They are also expanding their product portfolio to include new and emerging applications, such as high-precision cleaning agents, medical cleaning agents, and semiconductor-grade precision cleaners this helps them to reach a wider range of customers and grow their business.

Key Strategies Adopted by the Players

Investment in R and D

Market participants are actively developing a range of precision chemicals that demonstrate both excellent environmental and precise performance. An example of this is Fujifilm (China) Investment Co., Ltd. developing new areas for precision chemical manufacturers. Utilizing the expertise and technology it has gained in the field of photographic film, the company is expanding its operations into three new sectors: healthcare, materials, and imaging.

Acquisitions and Partnerships

Key players are engaged in acquisitions and partnerships to broaden their range of chemicals and extend their market reach. An example of this strategic approach is BASF SE and Entegris company have signed an agreement on the sale of the Precision Micro chemicals business to Entegris for USD 90 million.

Key Players in the Market

Key Developments in the Market:

The global precision chemicals market is estimated to be valued at USD 79.4 billion in 2025.

The market size for the precision chemicals market is projected to reach USD 153.9 billion by 2035.

The precision chemicals market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in precision chemicals market are high-purity chemicals, analytical-grade chemicals, reagent-grade chemicals and technical-grade chemicals.

In terms of product type, active pharmaceutical ingredients (apis) segment to command 39.6% share in the precision chemicals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Precision Wire Drawing Service Market Size and Share Forecast Outlook 2025 to 2035

Precision Planting Market Size and Share Forecast Outlook 2025 to 2035

Precision Bearing Market Size and Share Forecast Outlook 2025 to 2035

Precision Laser Engraving Machines Market Size and Share Forecast Outlook 2025 to 2035

Precision Analog Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Precision Blanking Dies Market Size and Share Forecast Outlook 2025 to 2035

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermentation Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Precision-Fermented Casein for QSR Pizza Cheese Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Precision Ruminant Minerals Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Precision Forestry Market Size and Share Forecast Outlook 2025 to 2035

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Precision Machine For Polymers Market Size and Share Forecast Outlook 2025 to 2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Precision Fermented Functional Lipids Market Analysis Size and Share Forecast Outlook 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Precision Cancer Imaging Market Growth - Industry Trends & Forecast 2025 to 2035

Precision Poultry Nutrition Market – Growth, Demand & Livestock Trends

Precision Livestock Farming Market - Trends & Forecast 2034

Precision Agriculture Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA