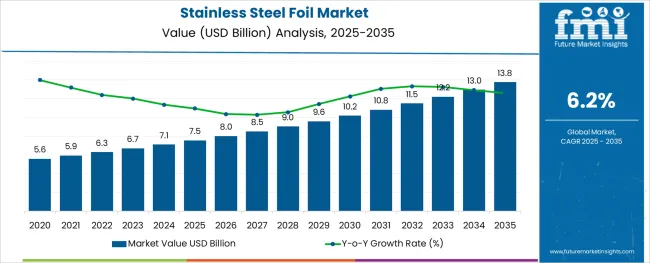

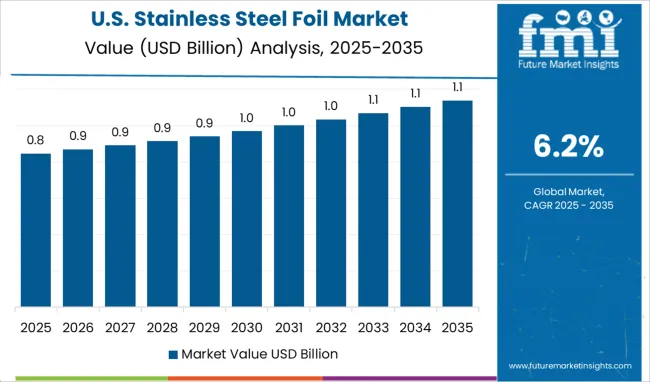

The Stainless Steel Foil Market is estimated to be valued at USD 7.5 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The stainless steel foil market is experiencing steady expansion as demand rises across sectors such as electronics, automotive, medical, and industrial filtration. Enhanced mechanical strength, superior corrosion resistance, and high heat tolerance have made stainless steel foil a preferred material for applications requiring precise dimensions and durability.

Manufacturers are focusing on ultra-thin foil processing technologies, roll-to-roll manufacturing efficiency, and precision slitting capabilities to meet evolving end-use specifications. Regulatory pushes for energy-efficient and recyclable materials have also contributed to greater adoption of stainless steel over polymer-based alternatives.

The market is seeing increased capital investment in annealing, cold rolling, and surface treatment lines, particularly in Asia Pacific and North America. As component miniaturization becomes a priority and sustainability standards evolve, stainless steel foil is expected to maintain relevance through enhanced alloy compositions and compatibility with high-performance assemblies.

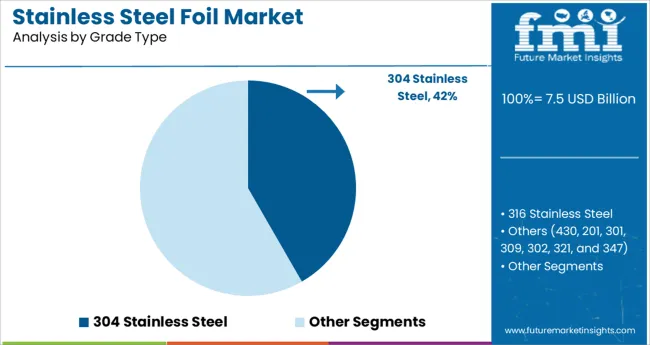

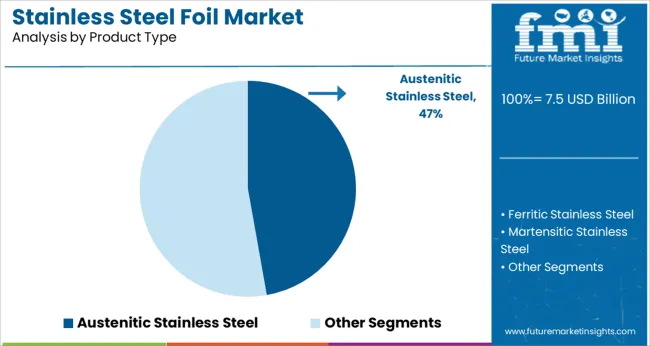

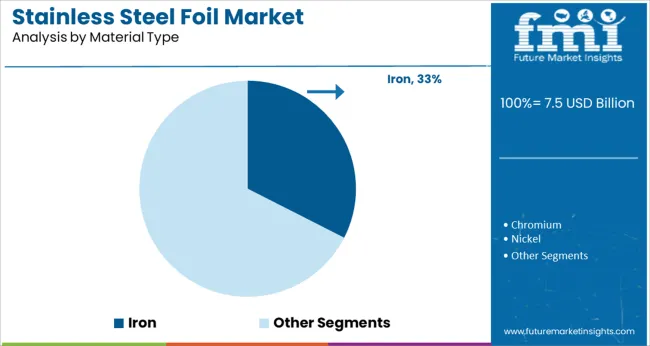

The market is segmented by Grade Type, Product Type, Material Type, Application, and End Use and region. By Grade Type, the market is divided into 304 Stainless Steel, 316 Stainless Steel, and Others (430, 201, 301, 309, 302, 321, and 347). In terms of Product Type, the market is classified into Austenitic Stainless Steel, Ferritic Stainless Steel, Martensitic Stainless Steel, and Duplex Stainless Steel. Based on Material Type, the market is segmented into Iron, Chromium, Nickel, Molybdenum, and Others (Manganese).

By Application, the market is divided into Void Filling, Cornering, Insulation, and Blocking & Bracing. By End Use, the market is segmented into Automotive, Electrical & Electronics, Pharmaceutical, Chemical, Defense, Aerospace, Building & Construction, Industrial, Food, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Within the grade type category, 304 stainless steel is projected to account for 41.7% of total market revenue in 2025, establishing it as the leading grade. This dominance is supported by its excellent balance of corrosion resistance, formability, and cost-effectiveness, making it suitable for a wide range of applications across automotive, food processing, and medical packaging sectors.

The high chromium and nickel content of 304 grade provides superior resistance to oxidation and chemical exposure, which has been instrumental in long-term durability. Its wide availability and compatibility with existing production infrastructure have further encouraged its selection in both standard and custom foil formats.

Additionally, the ongoing shift toward environmentally compliant materials in consumer electronics and industrial equipment continues to favor 304 stainless steel, reinforcing its leadership in the market.

Austenitic stainless steel is projected to capture 47.2% of revenue within the product type segment in 2025, making it the most widely used form of stainless steel foil. The superior ductility, non-magnetic properties, and excellent weldability of austenitic alloys make them ideal for forming ultra-thin foils used in demanding applications such as precision instruments, battery casings, and chemical-resistant liners.

Their consistent mechanical behavior at both low and high temperatures has supported expanded use in aerospace and heat exchanger systems. The ease of processing through cold working and the alloy's ability to maintain structural integrity during complex shaping processes have further promoted its dominance.

Investment in austenitic-grade R&D, particularly for microstructure refinement and surface stability, continues to strengthen its market position.

The iron-based segment is anticipated to hold 32.5% of the market revenue in 2025 under the material type classification, marking it as a major contributor. This is due to iron’s essential role as the base metal in all stainless steel compositions, providing foundational strength and adaptability to various alloying elements.

The availability of high-purity iron and its compatibility with different alloy systems allow manufacturers to tailor foil properties for specific functional needs, including thermal conductivity and magnetic performance. Moreover, iron’s cost efficiency relative to other alloying elements has supported its inclusion in mass production of stainless steel foils, especially where performance requirements can be met without excessive material cost.

Its dominance is further bolstered by established sourcing networks and smelting infrastructure, ensuring consistent quality and scalable output for industrial applications.

The increasing demand for tough yet lightweight metal packaging solutions worldwide is likely to propel the stainless steel foil market growth in future years. These foils are nowadays converted into alloys for their extensive usage in the pharmaceutical, food, and dairy industries.

Companies can easily trim, press, or perforate these foils as per their requirements to deliver a better fit for numerous applications. These can also be mixed with additives, such as nickel and chromium to increase their durability, as well as strength.

The ability of these foils to withstand high temperature, as compared to aluminum foils is another significant factor that is estimated to fuel the growth. These also have Ultra-High Vacuum (UHV) compatibility and are thus gaining traction in the global market.

The high prices of raw materials are anticipated to surge the cost of production in the evaluation period. Trade wars and declining production in manufacturing industries owing to the COVID-19 pandemic that occurred in December 2020 may also hinder the demand for stainless steel foils in the upcoming years.

However, the market is set to gradually get back to normalcy with increasing investments by government bodies in research and development activities.

North America is anticipated to remain at the forefront in the forthcoming years by procuring the largest stainless steel foil market share. The ever-increasing usage of these foils in the aerospace and automotive industries in the USA and Canada is set to drive the regional market.

As per the USA Department of Transportation, in 2020, around 10,893 vehicles were produced in the country, while nearly 13,677 vehicles were sold the same year. These numbers are projected to grow at a steady pace in future years, thereby propelling the North America market.

The ongoing technological development and the emergence of state-of-the-art technologies, such as flame cutting, water jets, and laser are projected to augment the Asia Pacific stainless steel foil market growth in the assessment period. The entry of cutting-edge machinery for sheet metal manufacturing in India and China is another vital factor that is estimated to augur well for the regional market.

The rapid industrialization and modernization of existing machinery in various end-use industries is also set to spur the growth in Asia Pacific. In addition to that, the rising focus of key players on the expansion of their production capacities to enhance the quality of their products is projected to accelerate the growth.

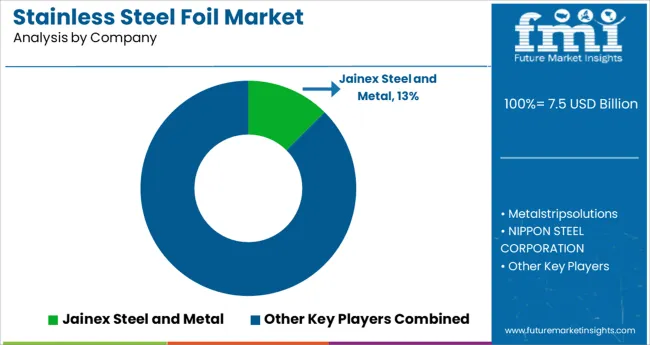

Some of the leading companies present in the global stainless steel foil market include AK Steel Corporation, ArcelorMittal, Nisshin Steel Co., Ltd., Tata Steel Limited, Ulbrich Stainless Steels & Special Metals, Inc., Reliance Foundry Co. Ltd., Jindal Stainless Ltd., A.J. Oster, LLC, Hollinbrow Precision Products (UK) Ltd., and All Foils, Inc. among others.

The global market is highly competitive with the presence of various large-scale companies. Majority of these companies are aiming to strengthen their positions in this market by engaging in mergers, acquisitions, joint ventures, and collaborations. Meanwhile, multiple local and unorganized players are anticipated to enter the market in the near future. They are set to launch new products to cater to the surging consumer demand across the globe.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Grade Type, Product Type, Material Type, Application, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | AK Steel Corporation; ArcelorMittal, Nisshin Steel Co., Ltd.; Tata Steel Limited; Ulbrich Stainless Steels & Special Metals, Inc.; Reliance Foundry Co. Ltd.; Jindal Stainless Ltd.; A.J. Oster, LLC; Hollinbrow Precision Products (UK) Ltd.; All Foils, Inc. |

| Customization | Available Upon Request |

The global stainless steel foil market is estimated to be valued at USD 7.5 billion in 2025.

It is projected to reach USD 13.8 billion by 2035.

The market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types are 304 stainless steel, 316 stainless steel and others (430, 201, 301, 309, 302, 321, and 347).

austenitic stainless steel segment is expected to dominate with a 47.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stainless Steel 330 Refractory Anchor Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel One-touch Fitting Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA