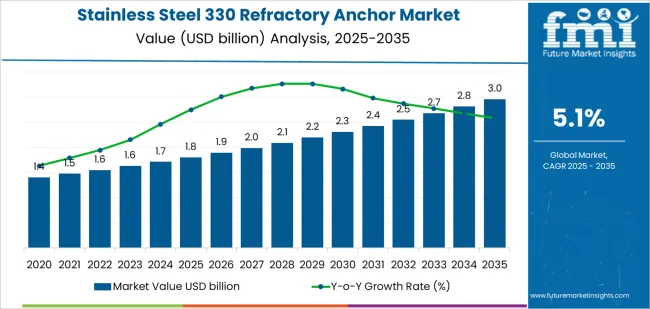

The global stainless steel 330 refractory anchor market is projected to grow from USD 1.8 billion in 2025 to approximately USD 2.9 billion by 2035, recording an absolute increase of USD 1.1 billion over the forecast period. This translates into a total growth of 64.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.1% between 2025 and 2035. The overall market size is expected to grow by 1.6X during the same period, supported by expanding industrial infrastructure development, increasing petrochemical facility construction, and growing demand for high-temperature resistant anchoring solutions in cement manufacturing processes.

The robust market expansion reflects the critical role of stainless steel 330 anchoring technology in maintaining structural integrity and operational reliability across high-temperature industrial applications. Manufacturing facilities worldwide are increasingly adopting specialized refractory anchoring systems to ensure furnace stability and equipment longevity while maintaining process efficiency, with advanced metallurgical formulations and precision engineering techniques creating enhanced performance characteristics for demanding operating environments including extreme temperature variations, corrosive atmospheres, and prolonged thermal cycling conditions.

Production capabilities are advancing through specialized metallurgical processing technologies and automated manufacturing systems that enable consistent quality control while reducing production costs. Leading manufacturers are investing in advanced steel processing equipment and alloy development programs to create anchor products that deliver superior heat resistance, extended service life, and reliable performance under varying thermal stress conditions. Industrial equipment suppliers and refractory system specialists are expanding their stainless steel 330 anchor offerings to address specific application requirements across steel production, petrochemical processing, cement manufacturing, and power generation applications.

Quality standards continue evolving as applications demand higher durability specifications and consistent performance under extreme operating conditions including temperature fluctuations, chemical exposure, and mechanical stress cycles. Industry certification programs and testing protocols ensure reliable product performance while supporting market confidence in stainless steel 330 anchoring technology adoption across critical industrial processes and regulated manufacturing environments. Compliance requirements for industrial safety and structural integrity applications are driving investments in comprehensive quality assurance systems and validation procedures throughout the manufacturing supply chain.

International manufacturing coordination is supporting market development as major industrial projects require standardized anchoring solutions across multiple facility locations. Global manufacturing companies are establishing unified specifications for refractory anchoring systems that influence worldwide procurement standards and create opportunities for specialized anchor manufacturers. Industrial engineering firms are forming partnerships with refractory system suppliers to develop application-specific anchoring solutions tailored to emerging high-temperature requirements and industrial equipment specifications.

Investment patterns are shifting toward integrated system solutions as manufacturing facilities seek comprehensive refractory anchoring systems that combine advanced material performance with installation efficiency and maintenance-friendly characteristics. Industrial companies are implementing standardized anchor specifications across their facilities, while equipment manufacturers are incorporating advanced stainless steel 330 anchor technology into their refractory system designs to ensure structural reliability and operational efficiency. This trend toward standardization and performance optimization is reshaping competitive dynamics across the industrial refractory components value chain.

Market maturation is evident in the emergence of specialized application segments that demand unique material characteristics and performance specifications. Petrochemical applications require specialized corrosion-resistant formulations and design features under strict safety requirements, while cement manufacturing systems need anchors that maintain structural integrity during high-temperature operations and provide consistent performance in automated production environments. These specialized requirements are driving innovation in metallurgical science, manufacturing technologies, and integration methodologies that extend beyond traditional refractory anchoring applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.8 billion |

| Market Forecast Value (2035) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

| INDUSTRIAL INFRASTRUCTURE EXPANSION | HIGH-TEMPERATURE PERFORMANCE REQUIREMENTS | MANUFACTURING EFFICIENCY |

|---|---|---|

| Steel Production Growth - Manufacturing capacity expansion requiring specialized anchoring solutions for blast furnaces, steel processing equipment, and high-temperature manufacturing systems, refractory installations, and industrial applications with enhanced structural integrity performance for facility compliance and operational safety requirements. | Thermal Resistance Standards - Industrial processes and high-temperature manufacturing requirements driving adoption of effective anchoring solutions for furnace installations requiring certified thermal resistance performance and regulatory compliance documentation. | Production Optimization - Manufacturing facility improvements implementing refractory anchoring technology for operational efficiency, reduced maintenance requirements, and enhanced equipment longevity while maintaining productive work environments and quality standards. |

| Petrochemical Expansion - Industrial facility advancement requiring integrated anchoring components for petrochemical processing systems, refinery operations, and chemical manufacturing applications with superior thermal resistance and reliability characteristics. | Material Performance - Industrial facility standards requiring comprehensive anchoring solutions for manufacturing operations, equipment installations, and facility expansions with documented performance and certification requirements. | Equipment Integration - Manufacturing system optimization requiring specialized anchoring components for industrial equipment, process systems, and facility infrastructure with enhanced performance and standardized specifications. |

| Infrastructure Development - Refractory system suppliers implementing comprehensive anchoring solutions for industrial projects, manufacturing system installations, and equipment upgrades with specialized design characteristics and performance specifications. | Regulatory Requirements - Industrial safety standards and structural integrity regulations requiring certified anchoring performance for manufacturing facilities, equipment operations, and worker protection with comprehensive compliance documentation and testing validation. | Cost Effectiveness - Manufacturing cost reduction initiatives requiring durable anchoring solutions for refractory systems, equipment maintenance optimization, and facility operational efficiency with proven performance and reliability characteristics. |

| Category | Segments / Values |

|---|---|

| By Shape | V Shape; Y Shape; Others |

| By Application | Steel; Petrochemical; Cement; Power Generation; Glass; Others |

| By End-User | Manufacturing Companies; Industrial Equipment Suppliers; Refractory System Installers; Construction Contractors; Others |

| By Temperature Range | Standard Temperature (800-1000°C); High Temperature (1000-1200°C); Ultra-High Temperature (1200°C+); Others |

| By Installation Type | Welded Anchors; Mechanical Anchors; Cast-In Anchors; Others |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025-2035 Outlook |

|---|---|

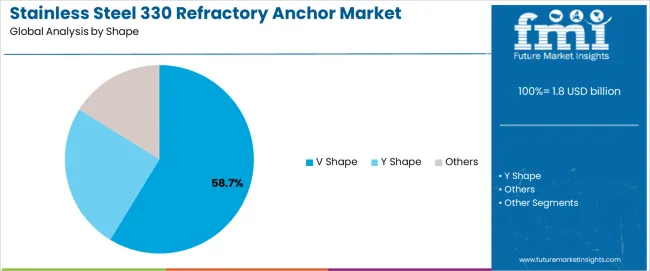

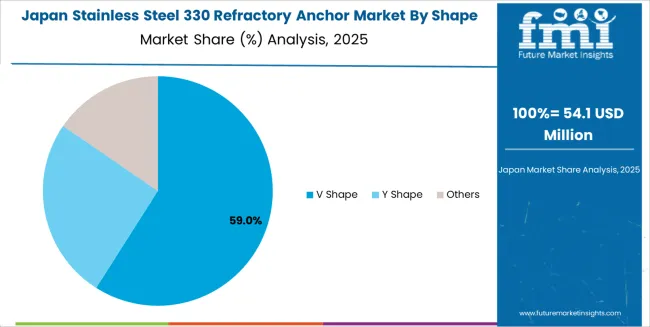

| V Shape | Leader in 2025 with 58.7% market share; standard design configuration for refractory installations and industrial applications requiring reliable structural support and consistent thermal performance. Widely adopted across steel production facilities and high-temperature manufacturing systems. Momentum: strong growth across industrial infrastructure and petrochemical system segments. Watchouts: competition from Y shape alternatives in specialized high-stress applications. |

| Y Shape | Growing segment with 32.6% share, favored for heavy-duty industrial installations and specialized manufacturing systems requiring enhanced load distribution capabilities and superior structural integrity. Momentum: exceptional growth in advanced industrial applications and high-temperature manufacturing environments. Watchouts: higher material costs compared to traditional V shape solutions in cost-sensitive applications. |

| Others | Specialized segment serving applications requiring custom anchor configurations for specific equipment requirements and unique installation constraints. Momentum: steady growth in specialized industrial applications and custom refractory system designs. Watchouts: limited application scope compared to standard V shape alternatives. |

| Segment | 2025-2035 Outlook |

|---|---|

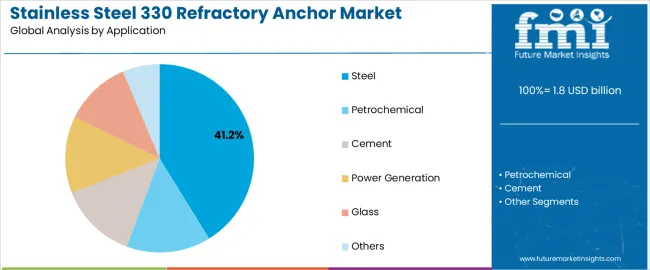

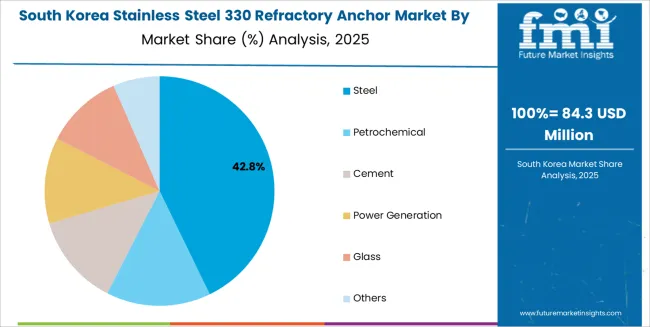

| Steel | Largest application segment in 2025 at 41.2% share, driven by steel production expansion and blast furnace installations requiring effective anchoring systems for high-temperature operations, structural integrity, and equipment reliability. Momentum: robust growth from steel industry modernization and production capacity expansion initiatives. Watchouts: pressure for cost reduction and standardization in competitive steel manufacturing markets. |

| Petrochemical | Critical segment representing 28.4% share, experiencing strong growth from refinery expansion and chemical processing facility development requiring corrosion-resistant anchoring solutions for specialized manufacturing operations. Momentum: consistent growth as petrochemical facilities expand production capacity and improve operational reliability. Watchouts: strict safety requirements and performance specification standards in regulated petrochemical sectors. |

| Cement | Growing segment at 16.9% share for cement manufacturing applications, kiln installations, and industrial equipment requiring specialized anchoring solutions for high-temperature operations. Momentum: moderate growth from cement production expansion and industrial infrastructure development. Watchouts: technical complexity and application-specific requirements limiting broad market adoption. |

| Others | Includes power generation, glass manufacturing, and emerging industrial applications. Momentum: diverse growth opportunities across multiple industrial sectors and specialized high-temperature applications. |

| End-User | Status & Outlook (2025-2035) |

|---|---|

| Manufacturing Companies | Dominant end-user in 2025 with 52.3% share for direct refractory system installations and facility anchoring requirements. Provides operational reliability, structural integrity, and equipment longevity improvements for industrial operations. Momentum: steady growth driven by manufacturing expansion and infrastructure investment. Watchouts: cost pressure and procurement standardization requirements across multiple facility locations. |

| Industrial Equipment Suppliers | Technical end-user serving original equipment manufacturer applications and integrated refractory system solutions requiring certified anchoring performance and reliability specifications. Momentum: moderate growth as equipment suppliers enhance structural integrity offerings and system integration capabilities. Watchouts: competitive pressure and performance specification requirements in diverse industrial applications. |

| Refractory System Installers | Specialized end-user for installation services and system integration projects serving industrial construction and facility upgrade applications. Momentum: consistent growth as industrial facilities upgrade and expand existing refractory installations. Watchouts: skilled labor requirements and technical expertise demands for complex installation projects. |

| Others | Includes construction contractors, maintenance service providers, and emerging industrial end-user categories. Momentum: selective growth opportunities in specialized applications and emerging industrial sectors. |

| KEY TRENDS | DRIVERS | RESTRAINTS |

|---|---|---|

| Material Innovation - Advanced stainless steel formulations and metallurgical technology delivering enhanced corrosion resistance, temperature tolerance, and structural reliability for demanding industrial applications with improved performance characteristics and extended service life. | Industrial Infrastructure Growth across manufacturing facilities and production systems creating substantial demand for refractory anchoring solutions supporting high-temperature equipment, structural installations, and manufacturing operations requiring effective thermal management and regulatory compliance. | Cost Sensitivity in industrial procurement and budget constraints limiting adoption of premium anchoring solutions across cost-conscious manufacturing facilities and competitive industrial applications with restricted capital equipment budgets. |

| System Integration - Expanding integration with refractory installation systems, industrial construction equipment, and facility management platforms enabling comprehensive structural monitoring, maintenance optimization, and performance tracking capabilities. | High-Temperature Application Expansion - Industrial processes and manufacturing requirements driving adoption of certified anchoring technology for steel production, petrochemical processing, and power generation applications requiring documented thermal resistance performance and regulatory validation. | Market Fragmentation - Diverse industrial applications, equipment specifications, and regional requirements creating complexity for suppliers developing standardized anchoring solutions across multiple manufacturing sectors and international markets. |

| Digital Manufacturing - Integration with Industry 4.0 initiatives and smart manufacturing systems enabling predictive maintenance, performance monitoring, and automated anchoring system optimization for enhanced operational efficiency and reliability. | Equipment Modernization - Industrial facility upgrades and refractory system enhancements requiring specialized anchoring components for improved operational efficiency, reduced maintenance costs, and enhanced workplace environments with superior structural integrity performance. | Technical Complexity - Application-specific requirements, installation procedures, and performance validation affecting deployment timelines and operational capabilities for industrial facilities lacking specialized refractory system expertise and maintenance capabilities. |

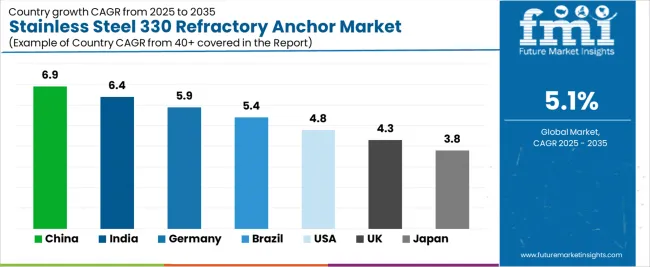

| Country | CAGR (2025-2035) |

|---|---|

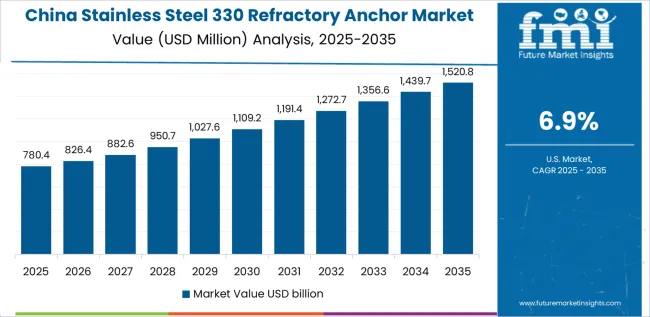

| China | 6.9% |

| India | 6.4% |

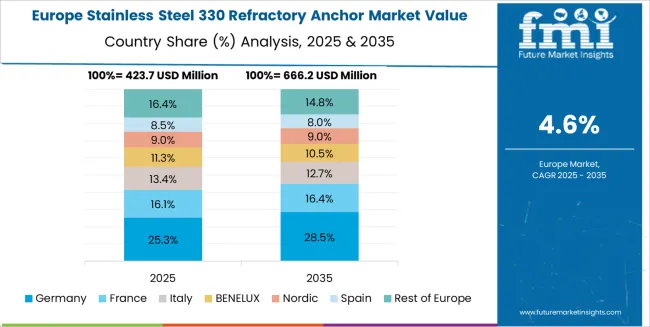

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

Revenue from stainless steel 330 refractory anchors in China is projected to exhibit robust growth with a market value of USD 1 billion by 2035, driven by extensive steel production modernization programs and comprehensive industrial infrastructure development initiatives creating substantial opportunities for anchoring technology suppliers across refractory system installations, manufacturing facility projects, and industrial equipment development sectors. The country's ambitious steel industry upgrade programs including national production capacity expansion initiatives and automated manufacturing facility development are creating consistent demand for specialized refractory anchoring systems. Major steel companies and industrial equipment suppliers including Baosteel Group, China Steel Corporation, and specialized refractory component manufacturers are establishing comprehensive anchoring solution programs to support large-scale steel production and advanced manufacturing technology applications.

Revenue from stainless steel 330 refractory anchors in India is expanding to reach USD 387.2 million by 2035, supported by extensive steel industry development programs and comprehensive industrial infrastructure modernization initiatives creating demand for refractory anchoring solutions across diverse manufacturing facility and high-temperature system application segments. The country's growing steel production capabilities and expanding industrial infrastructure are driving demand for anchoring components that provide exceptional reliability while supporting advanced manufacturing system requirements. Industrial companies and steel manufacturing facilities are investing in refractory anchoring technology to support growing production demand and industrial modernization advancement requirements.

Demand for stainless steel 330 refractory anchors in Germany is projected to reach USD 142.8 million by 2035, supported by the country's leadership in industrial engineering technology and advanced manufacturing systems requiring sophisticated refractory anchoring solutions for precision steel production and industrial facility applications. German manufacturing operators are implementing cutting-edge anchoring platforms that support advanced operational capabilities, precision performance, and comprehensive quality monitoring protocols. The market is characterized by focus on engineering excellence, technology innovation, and compliance with stringent industrial safety and performance standards.

Revenue from stainless steel 330 refractory anchors in Brazil is growing to reach USD 89.6 million by 2035, driven by industrial infrastructure development programs and increasing steel production capabilities creating opportunities for anchoring suppliers serving both industrial manufacturers and specialized equipment contractors. The country's expanding manufacturing sector and growing industrial infrastructure are creating demand for anchoring components that support diverse manufacturing requirements while maintaining performance standards. Industrial companies and steel manufacturing facilities are developing technology strategies to support operational efficiency and system reliability advancement.

Demand for stainless steel 330 refractory anchors in United States is projected to reach USD 176.3 million by 2035, expanding at a CAGR of 4.8%, driven by advanced manufacturing technology innovation and specialized industrial applications supporting precision steel production and comprehensive facility technology applications. The country's established manufacturing technology tradition including major industrial equipment manufacturers and steel production facilities are creating demand for high-performance refractory anchoring components that support operational advancement and safety standards. Manufacturers and industrial system suppliers are maintaining comprehensive development capabilities to support diverse manufacturing and steel production requirements.

Revenue from stainless steel 330 refractory anchors in United Kingdom is growing to reach USD 67.4 million by 2035, supported by manufacturing technology heritage and established industrial engineering communities driving demand for premium refractory anchoring solutions across traditional steel production systems and specialized industrial facility applications. The country's rich industrial engineering heritage including major manufacturing companies and established industrial system capabilities create demand for anchoring components that support both legacy system advancement and modern manufacturing applications.

Demand for stainless steel 330 refractory anchors in Japan is projected to reach USD 124.9 million by 2035, driven by precision manufacturing technology tradition and established industrial leadership supporting both domestic steel production system markets and export-oriented component production. Japanese companies maintain sophisticated refractory anchoring development capabilities, with established manufacturers continuing to lead in anchoring technology and industrial equipment standards.

European stainless steel 330 refractory anchor operations are increasingly concentrated between German engineering excellence and specialized manufacturing across multiple countries. German facilities dominate high-performance refractory anchoring production for precision steel production and industrial facility applications, leveraging cutting-edge manufacturing technologies and strict quality protocols that command price premiums in global markets. British manufacturing technology operators maintain leadership in industrial system innovation and refractory anchoring method development, with organizations like specialized engineering companies and university research centers driving technical specifications that suppliers must meet to access major industrial contracts.

Eastern European operations in Czech Republic and Poland are capturing specialized production contracts through precision manufacturing expertise and EU compliance standards, particularly in component fabrication and assembly technologies for industrial applications. These facilities increasingly serve as development partners for Western European manufacturing programs while building their own industrial technology expertise.

The regulatory environment presents both opportunities and constraints. European industrial safety framework requirements create quality standards that favor established European manufacturers and industrial system operators while ensuring consistent performance specifications for critical manufacturing infrastructure and safety applications. Brexit has created complexity for UK manufacturing collaboration with EU programs, driving opportunities for direct relationships between British operators and international refractory anchoring suppliers.

Technology collaboration accelerates as manufacturing companies seek technology advancement to support major industrial modernization milestones and steel production development timelines. Vertical integration increases, with major industrial system operators acquiring specialized manufacturing capabilities to secure component supplies and quality control for critical manufacturing programs. Smaller industrial contractors face pressure to specialize in niche applications or risk displacement by larger, more comprehensive operations serving mainstream manufacturing and steel production requirements.

South Korean stainless steel 330 refractory anchor operations reflect the country's advanced manufacturing technology capabilities and export-oriented industrial development model. Major industrial system operators including POSCO and technology companies drive component procurement strategies for their steel production facilities, establishing direct relationships with specialized refractory anchoring suppliers to secure consistent quality and performance for their industrial development programs and advanced manufacturing technology systems targeting both domestic infrastructure and international collaboration projects.

The Korean market demonstrates particular strength in integrating refractory anchoring technologies into automated steel production platforms and advanced industrial system configurations, with engineering teams developing solutions that bridge traditional manufacturing anchoring applications and next-generation industrial systems. This integration approach creates demand for specific performance specifications that differ from conventional applications, requiring suppliers to adapt anchoring capabilities and system coordination characteristics.

Regulatory frameworks emphasize industrial safety and manufacturing system reliability, with Korean industrial standards often exceeding international requirements for refractory anchoring systems. This creates barriers for standard component suppliers but benefits established manufacturers who can demonstrate industrial-grade performance capabilities. The regulatory environment particularly favors suppliers with Korean manufacturing system qualification and comprehensive testing documentation systems.

Supply chain excellence remains critical given Korea's steel production focus and international collaboration dynamics. Industrial system operators increasingly pursue development partnerships with suppliers in Japan, Germany, and specialized manufacturers to ensure access to cutting-edge refractory anchoring technologies while managing infrastructure risks. Investment in industrial infrastructure supports performance advancement during extended manufacturing development cycles.

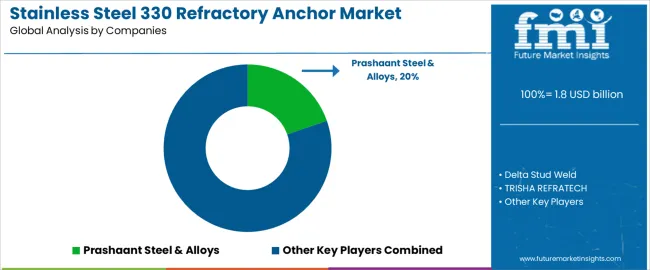

Prashaant Steel & Alloys leads the market with 19.7% share owing to its comprehensive refractory component portfolio and established industrial manufacturing relationships, which manufacturers use to implement integrated anchoring solutions across diverse high-temperature applications. Profit pools are consolidating upstream in advanced metallurgical development and downstream in application-specific solutions for steel production, petrochemical processing, and specialized industrial markets where thermal performance reliability, installation efficiency, and consistent structural integrity command substantial premiums. Value is migrating from basic anchoring component production to specification-driven, application-ready refractory systems where material expertise, precision manufacturing, and reliable integration capabilities create competitive advantages.

Several archetypes define market leadership: established Indian component companies defending share through comprehensive refractory system development and proven industrial manufacturing support; German industrial suppliers leveraging manufacturing excellence and engineering capabilities; American technology leaders with steel production expertise and precision manufacturing heritage; and emerging Asian manufacturers pursuing cost-effective production while developing advanced metallurgical capabilities.

Switching costs - system integration, equipment compatibility validation, industrial certification - provide stability for established suppliers, while technological advancement requirements and specialized application growth create opportunities for innovative component manufacturers. Consolidation continues as companies seek manufacturing scale; direct industrial partnerships grow for specialized applications while traditional refractory distribution remains relationship-driven. Focus areas: secure premium steel production and industrial facility market positions with application-specific performance specifications and technical collaboration; develop refractory anchoring technology and advanced manufacturing capabilities; explore specialized applications including petrochemical processing and power generation requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Indian Component Leaders | Comprehensive refractory expertise; proven industrial integration; established manufacturer relationships | Precision manufacturing; technical innovation; industrial certification support |

| German Industrial Suppliers | Manufacturing excellence; comprehensive steel production development programs; established customer partnerships | Engineering collaboration focus; integrated solutions; technical consultation |

| American Technology Leaders | Steel production system expertise; precision technology leadership; trusted by major manufacturing programs | Industrial partnerships; application-specific specifications; manufacturing infrastructure collaboration |

| Emerging Asian Producers | Manufacturing efficiency; competitive pricing; rapid technology development | Production scaling; technology advancement; market entry strategies |

| Industrial Distributors | Technical distribution networks; manufacturing service relationships | Industrial expertise; inventory management; technical support services |

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 billion |

| Shape Segments | V Shape; Y Shape; Others |

| Applications | Steel; Petrochemical; Cement; Power Generation; Glass; Others |

| End-Users | Manufacturing Companies; Industrial Equipment Suppliers; Refractory System Installers; Construction Contractors; Others |

| Temperature Segments | Standard Temperature (800-1000°C); High Temperature (1000-1200°C); Ultra-High Temperature (1200°C+); Others |

| Installation Types | Welded Anchors; Mechanical Anchors; Cast-In Anchors; Others |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Prashaant Steel & Alloys; Delta Stud Weld; TRISHA REFRATECH; Savoy Piping Inc; Keystone Refractories; Alkegen; Calderys; Triveni Metal Corporation; Hitesh Steel; CeraMaterials; Tesco Steel; Flouch Engineering Co Ltd; Ami Refractrahold |

| Additional Attributes | Dollar sales by shape and application; Regional demand trends (NA, EU, APAC); Competitive landscape; Manufacturing vs. aftermarket adoption patterns; Industrial facility and refractory system integration; Advanced metallurgical innovations driving thermal performance enhancement, installation reliability, and industrial safety excellence |

The global stainless steel 330 refractory anchor market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the stainless steel 330 refractory anchor market is projected to reach USD 3.0 billion by 2035.

The stainless steel 330 refractory anchor market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in stainless steel 330 refractory anchor market are V shape, y shape and others.

In terms of application, steel segment to command 41.2% share in the stainless steel 330 refractory anchor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Stainless Steel 330 Refractory Anchor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stainless Steel 330 Refractory Anchor in UK Size and Share Forecast Outlook 2025 to 2035

Stainless Steel One-touch Fitting Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Submerged Arc Welding Wire Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Direct Acting Solenoid Valve Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Miniature Screw Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA