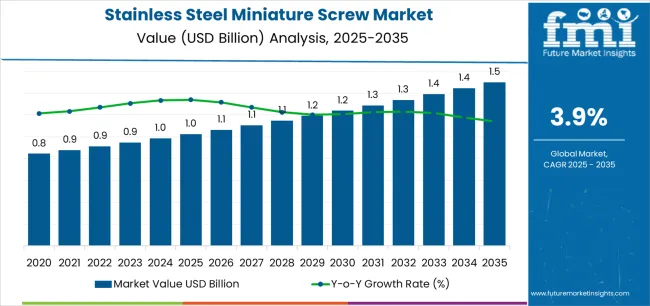

The global stainless steel miniature screw market is projected to grow from USD 1,023.5 million in 2025 to approximately USD 1,500.5 million by 2035, recording an absolute increase of USD 477 million over the forecast period. This translates into a total growth of 46.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.9% between 2025 and 2035. The overall market size is expected to grow by nearly 1.5X during the same period, supported by increasing miniaturization trends across electronic devices, expanding medical device manufacturing, and growing adoption of precision fastening solutions in automotive electronics applications.

The steady market expansion reflects the critical role of miniature screws in advanced manufacturing applications requiring precise assembly solutions and reliable mechanical fastening. Electronic device manufacturers are increasingly incorporating miniature screws to secure components in smartphones, tablets, wearable devices, and consumer electronics where space optimization and mechanical reliability are paramount. The automotive electronics sector is experiencing significant growth as vehicles integrate more sophisticated electronic systems, sensors, and control modules that require specialized miniature fastening solutions capable of withstanding harsh operating environments while maintaining electrical connectivity.

Manufacturing capabilities are evolving as producers invest in advanced precision machining equipment and quality control systems to meet stringent dimensional tolerances and material specifications. The technology landscape continues advancing with innovations in thread forming, surface treatments, and alloy compositions that enhance corrosion resistance while maintaining mechanical strength characteristics. Medical device manufacturers are establishing comprehensive supplier qualification programs to ensure consistent product quality and regulatory compliance for critical applications requiring biocompatible fastening solutions.

Quality standards are becoming increasingly demanding as applications require enhanced corrosion resistance, mechanical reliability, and dimensional precision under diverse operating conditions. Industry certification programs and testing protocols ensure consistent product performance while supporting market confidence in miniature screw technology adoption across precision assembly and manufacturing applications requiring high-performance fastening solutions.

Global supply chain integration is accelerating market development as manufacturers seek to optimize production efficiency and material sourcing strategies. Leading fastener companies are establishing regional manufacturing facilities to serve local markets while maintaining centralized engineering and design capabilities. Electronics manufacturers are forming strategic partnerships with specialized fastener suppliers to develop application-specific solutions that address unique assembly requirements and performance specifications for next-generation electronic products.

Investment patterns are shifting toward automation and precision manufacturing technologies as companies seek to improve production efficiency and maintain competitive positioning in price-sensitive markets. Consumer electronics manufacturers are implementing comprehensive supplier development programs to ensure consistent access to high-quality miniature fastening solutions while optimizing total cost of ownership. This trend toward strategic partnerships and manufacturing excellence is reshaping competitive dynamics across the precision fastener value chain.

Market maturation is evident in the emergence of specialized application segments that demand unique material properties and performance specifications. Medical device applications require exceptional biocompatibility and corrosion resistance under physiological conditions, while aerospace electronics need fastening solutions that maintain performance reliability under extreme temperature variations and vibration exposure. These specialized requirements are driving innovation in material science, surface engineering, and manufacturing processes that extend beyond traditional consumer electronics and automotive applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,023.5 million |

| Market Forecast Value (2035) | USD 1,500.5 million |

| Forecast CAGR (2025-2035) | 3.9% |

| ELECTRONICS MINIATURIZATION | MEDICAL DEVICE EXPANSION | AUTOMOTIVE ELECTRONICS GROWTH |

|---|---|---|

| Consumer Electronics Evolution -- Smartphones, tablets, wearables, and IoT devices requiring increasingly compact and reliable fastening solutions for component assembly while maintaining structural integrity and electrical connectivity in miniaturized form factors. | Medical Instrument Advancement -- Surgical instruments, diagnostic equipment, and implantable devices requiring biocompatible fastening solutions that provide exceptional corrosion resistance and mechanical reliability in physiological environments. | Vehicle Electrification -- Electric vehicles and advanced driver assistance systems incorporating sophisticated electronic control modules, sensors, and battery management systems requiring specialized fastening solutions for harsh automotive environments. |

| Portable Device Manufacturing -- Growing production of portable electronic devices including gaming systems, smart home appliances, and personal care electronics requiring precision miniature screws for secure component assembly and user accessibility. | Diagnostic Equipment Growth -- Advanced imaging systems, laboratory analyzers, and point-of-care diagnostic devices requiring precision fastening solutions that maintain calibration accuracy and operational reliability throughout extended service life. | Infotainment System Integration -- Modern vehicles incorporating complex entertainment, navigation, and communication systems requiring reliable miniature fastening solutions for display assemblies, control interfaces, and electronic module installations. |

| Wearable Technology Expansion -- Fitness trackers, smartwatches, and health monitoring devices requiring ultra-miniature fastening solutions that provide secure assembly while accommodating design aesthetics and user comfort requirements in compact form factors. | Surgical Robot Development -- Robotic surgical systems and precision medical instruments requiring specialized fastening solutions that deliver exceptional reliability and biocompatibility for critical healthcare applications demanding highest performance standards. | Sensor Technology Growth -- Advanced vehicle sensors including cameras, radar systems, and LiDAR equipment requiring specialized fastening solutions that maintain precise alignment and operational performance under extreme vibration and temperature conditions. |

| Category | Segments / Values |

|---|---|

| By Type | 304 Stainless Steel; 316 Stainless Steel; 410 Stainless Steel; Others |

| By Application | Consumer Electronics; Medical Instruments; Automotive Electronic; Others |

| By End-User | Electronics Manufacturers; Medical Device Companies; Automotive Suppliers; Industrial Applications; Others |

| By Thread Type | Machine Thread; Self-Tapping; Thread-Forming; Thread-Cutting |

| By Head Style | Phillips; Hex Socket; Torx; Slotted; Others |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025-2035 Outlook |

|---|---|

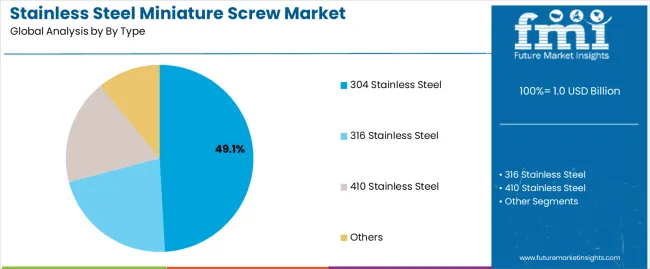

| 304 Stainless Steel | Leader in 2025 with 49.1% market share; optimal balance between corrosion resistance and cost-effectiveness. Widely adopted for consumer electronics and general industrial applications. Momentum: steady growth across electronics and automotive segments. Watchouts: material cost volatility and supply chain constraints. |

| 316 Stainless Steel | Premium segment with 28.7% share, favored for medical applications requiring superior corrosion resistance and biocompatibility. Momentum: strong growth in healthcare and marine applications. Watchouts: higher material costs and specialized processing requirements. |

| 410 Stainless Steel | Specialized segment offering enhanced strength characteristics for demanding mechanical applications. Momentum: growing adoption in automotive and industrial equipment. Watchouts: limited corrosion resistance compared to austenitic grades. |

| Others | Includes specialty alloys and custom compositions for unique application requirements. Momentum: niche growth in aerospace and specialized industrial applications. |

| Segment | 2025-2035 Outlook |

|---|---|

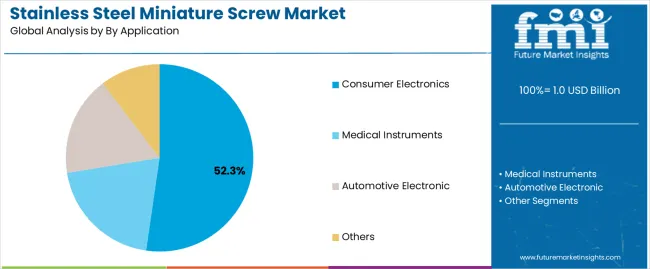

| Consumer Electronics | Largest application segment in 2025 at 52.3% share, driven by global smartphone production and portable device manufacturing growth. Includes smartphones, tablets, laptops, gaming devices, and smart home appliances. Momentum: robust growth from IoT device expansion and wearable technology adoption. Watchouts: pricing pressure from electronics manufacturers and component miniaturization challenges. |

| Medical Instruments | Critical segment representing 23.8% share, experiencing strong growth from medical device innovation and healthcare infrastructure expansion. Momentum: exceptional growth as medical technology advances and aging population drives healthcare demand. Watchouts: stringent regulatory requirements and extended qualification processes. |

| Automotive Electronic | Specialized segment at 15.4% share for vehicle electronic systems, infotainment, and electrification components requiring reliable fastening solutions. Momentum: strong growth from vehicle electrification and autonomous driving technology. Watchouts: automotive industry cyclicality and supply chain complexity. |

| Others | Includes aerospace, industrial equipment, telecommunications, and emerging applications. Momentum: diverse growth opportunities across multiple technology sectors. |

| Thread Type | Status & Outlook (2025-2035) |

|---|---|

| Machine Thread | Dominant segment with 41.2% share for precision assembly applications requiring threaded inserts or pre-tapped holes. Provides superior holding strength and reusability for electronics and medical devices. Momentum: strong growth driven by precision assembly requirements. Watchouts: increased manufacturing complexity and tapping operation costs. |

| Self-Tapping | Versatile segment serving applications requiring direct installation into plastic housings and thin metal assemblies. Momentum: moderate growth as electronics manufacturers seek simplified assembly processes. Watchouts: potential thread stripping and material compatibility issues. |

| Thread-Forming | Specialized segment for applications requiring high pull-out strength without material removal during installation. Momentum: growing adoption in automotive and medical applications requiring permanent assembly. |

| Thread-Cutting | Technical segment for precise thread formation in harder materials requiring clean, accurate thread geometry. Momentum: selective growth in precision manufacturing applications. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Electronics Miniaturization across consumer devices including smartphones, tablets, and wearables is creating sustained demand for increasingly smaller and more precise fastening solutions that maintain mechanical reliability in compact assemblies. | Material Cost Volatility and stainless steel price fluctuations affect manufacturing costs and profit margins, particularly impacting price-sensitive consumer electronics applications and high-volume production programs. | Manufacturing Automation -- Advanced production equipment and automated assembly systems are enabling higher precision manufacturing with improved dimensional consistency and reduced labor costs for high-volume applications. |

| Medical Device Innovation -- Next-generation surgical instruments, diagnostic equipment, and implantable devices require biocompatible fastening solutions with exceptional corrosion resistance and mechanical reliability for critical healthcare applications. | Quality Control Complexity -- Stringent dimensional tolerances, material specifications, and performance requirements increase manufacturing complexity and testing costs while extending product development timelines. | Surface Treatment Innovation -- Advanced coating technologies and surface finishing processes are delivering enhanced corrosion resistance, wear characteristics, and aesthetic properties for specialized applications. |

| Automotive Electronics Growth -- Vehicle electrification and advanced driver assistance systems require specialized fastening solutions capable of withstanding harsh automotive environments while maintaining electrical performance and mechanical integrity. | Supply Chain Constraints -- Raw material availability, specialized manufacturing capacity, and transportation logistics affect delivery reliability and inventory management for global electronics and automotive manufacturers. | Application Diversification -- Expanding use cases in IoT devices, renewable energy systems, and precision instrumentation are creating new market opportunities beyond traditional electronics and medical applications. |

| Global Manufacturing Expansion -- Increasing electronics production capacity in emerging markets and medical device manufacturing growth supporting technology advancement and market expansion across diverse geographic regions. | Competitive Pricing Pressure -- High-volume electronics manufacturing demands cost-effective solutions while maintaining quality standards, creating pressure for manufacturing efficiency and material optimization strategies. | Strategic Partnerships -- Collaboration between fastener manufacturers, electronics companies, and medical device producers accelerating product development and market adoption through integrated design approaches. |

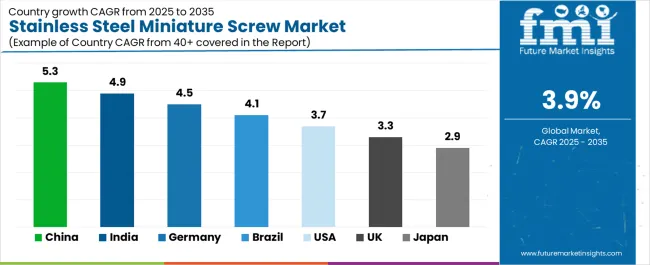

| Country | CAGR (2025-2035) |

|---|---|

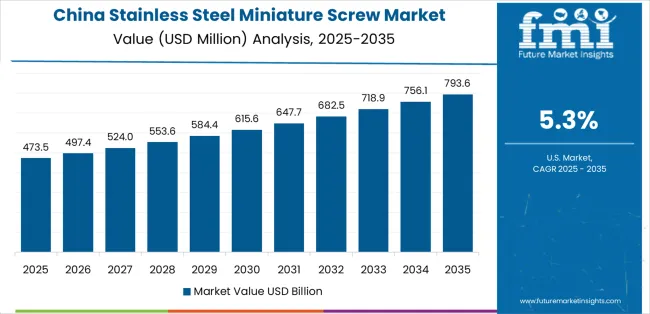

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| United States | 3.7% |

| United Kingdom | 3.3% |

| Japan | 2.9% |

Revenue from Stainless Steel Miniature Screws in China is projected to exhibit exceptional growth with a market value of USD 366.7 million by 2035, driven by massive electronics manufacturing capacity and comprehensive industrial modernization initiatives creating substantial opportunities for precision fastener suppliers across consumer electronics, medical devices, and automotive electronics sectors.

The country's dominant position in global electronics manufacturing including smartphone production, consumer appliances, and emerging technology devices creates unprecedented demand for high-quality miniature fastening systems. Major electronics manufacturers including Foxconn, BYD Electronics, and numerous specialized component producers are establishing comprehensive supplier qualification programs to support large-scale production requirements and quality standards.

Revenue from Stainless Steel Miniature Screws in India is expanding to reach USD 208.2 million by 2035, supported by extensive electronics manufacturing development and comprehensive medical device sector growth creating demand for precision fastening solutions across diverse technology applications and manufacturing segments. The country's growing electronics assembly capabilities and expanding healthcare infrastructure are driving demand for component solutions that provide exceptional performance while supporting advanced technology requirements. Electronics manufacturers and medical device companies are investing in supplier development programs to support growing production operations and quality enhancement demand.

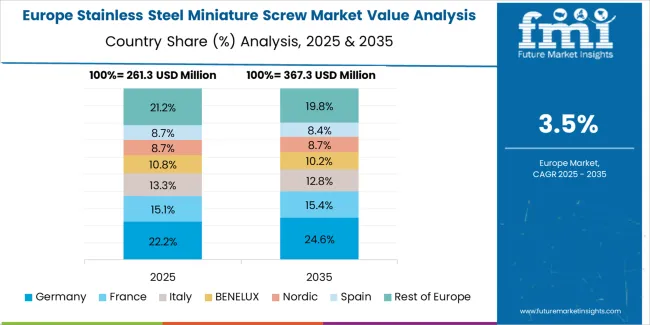

Demand for Stainless Steel Miniature Screws in Germany is projected to reach USD 226.1 million by 2035, supported by the country's leadership in precision manufacturing and advanced engineering technologies requiring sophisticated fastening systems for automotive, medical, and industrial applications. German manufacturers are implementing cutting-edge production programs that support advanced quality capabilities, operational precision, and comprehensive performance protocols. The market is characterized by focus on engineering excellence, manufacturing innovation, and compliance with stringent quality and performance standards.

Revenue from Stainless Steel Miniature Screws in Brazil is growing to reach USD 155.4 million by 2035, driven by industrial development programs and increasing electronics manufacturing capabilities creating opportunities for fastener suppliers serving both consumer electronics operations and specialized medical device contractors. The country's expanding manufacturing sector and growing technology infrastructure are creating demand for miniature screws that support diverse assembly requirements while maintaining performance standards. Electronics manufacturers and medical device companies are developing procurement strategies to support operational efficiency and quality advancement.

Demand for Stainless Steel Miniature Screws in United States is projected to reach USD 127.3 million by 2035, expanding at a CAGR of 3.7%, driven by advanced medical device excellence and specialized electronics applications supporting innovation development and comprehensive high-performance assembly applications. The country's established medical technology tradition and leading healthcare equipment manufacturers are creating demand for ultra-high performance fastening components that support operational advancement and regulatory standards. Electronics manufacturers and medical equipment suppliers are maintaining comprehensive development capabilities to support diverse innovation and healthcare requirements.

Revenue from Stainless Steel Miniature Screws in United Kingdom is growing to reach USD 101.4 million by 2035, supported by precision manufacturing heritage and established engineering communities driving demand for premium fastening solutions across traditional manufacturing systems and specialized technology applications. The country's rich engineering heritage and established manufacturing capabilities create demand for miniature screws that support both legacy system advancement and modern technology applications.

Demand for Stainless Steel Miniature Screws in Japan is projected to reach USD 78.2 million by 2035, driven by precision manufacturing tradition and established technology leadership supporting both domestic electronics markets and export-oriented component production. Japanese companies maintain sophisticated fastening development capabilities, with established manufacturers continuing to lead in miniature screw technology and precision manufacturing standards.

European Stainless Steel Miniature Screw operations are increasingly concentrated between German precision manufacturing excellence and specialized fastener production across multiple countries. German facilities dominate high-precision screw manufacturing for automotive electronics and medical device applications, leveraging advanced manufacturing technologies and strict quality protocols that command price premiums in global markets. British manufacturers maintain leadership in specialized fastening solutions and precision engineering, with companies like advanced fastener specialists driving technical specifications that suppliers must meet to access major electronics and medical contracts.

Eastern European operations in Czech Republic and Poland are capturing specialized production contracts through advanced manufacturing expertise and EU compliance, particularly in automotive component assembly and medical device manufacturing. These facilities increasingly serve as development partners for Western European technology programs while building their own precision manufacturing expertise.

The regulatory environment presents both opportunities and constraints. European quality framework requirements create standards that favor established European manufacturers and engineering companies while ensuring consistent performance specifications for critical electronics and medical applications. Brexit has created complexity for UK manufacturing collaboration with EU technology programs, driving opportunities for direct relationships between British companies and international fastener suppliers.

Manufacturing collaboration accelerates as companies seek technological advancement to support major electronics milestones and medical device development timelines. Vertical integration increases, with major technology organizations acquiring specialized manufacturing capabilities to secure component supplies and quality control for critical production programs. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more comprehensive operations serving mainstream electronics manufacturing requirements.

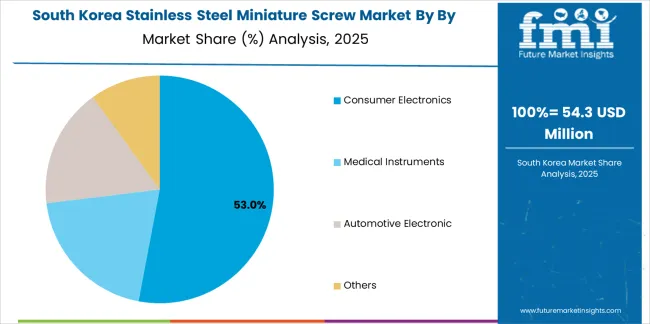

South Korean Stainless Steel Miniature Screw operations reflect the country's advanced electronics manufacturing capabilities and export-oriented technology development model. Major manufacturers including Samsung Electronics and LG establish comprehensive component procurement strategies for their global electronics production, establishing direct relationships with specialized fastener suppliers to secure consistent quality and performance for their consumer electronics programs and advanced technology systems targeting both domestic markets and international export projects.

The Korean market demonstrates particular strength in integrating miniature screw technologies into smartphone manufacturing and advanced electronics assembly, with production teams developing solutions that bridge traditional fastening applications and next-generation consumer electronics systems. This integration approach creates demand for specific performance specifications that differ from conventional applications, requiring suppliers to adapt dimensional precision and material characteristics.

Regulatory frameworks emphasize manufacturing quality and export reliability, with Korean electronics safety standards often exceeding international requirements for consumer electronics assembly systems. This creates barriers for standard component suppliers but benefits established manufacturers who can demonstrate electronics-grade performance capabilities. The regulatory environment particularly favors suppliers with Samsung and LG qualification and comprehensive testing documentation systems.

Supply chain excellence remains critical given Korea's electronics manufacturing leadership focus and global export dynamics. Technology companies increasingly pursue development partnerships with suppliers in Japan, Germany, and specialized manufacturers to ensure access to cutting-edge miniature screw technologies while managing production risks. Investment in manufacturing infrastructure supports performance advancement during extended electronics development cycles.

Profit pools are consolidating upstream in precision manufacturing and advanced material processing, and downstream in application-specific solutions for electronics assembly, medical devices, and automotive electronics markets where certification, dimensional precision, and exceptional mechanical performance command substantial premiums. Value is migrating from basic screw production to specification-driven, application-ready fastening components where materials engineering expertise, manufacturing precision, and reliable mechanical performance create competitive advantages.

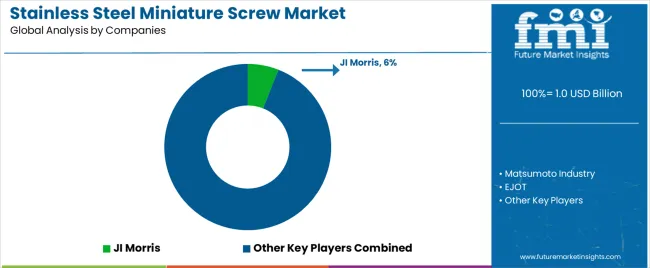

Several archetypes define market leadership: established Japanese manufacturers defending share through precision manufacturing technology and quality excellence; American fastener companies leveraging comprehensive engineering partnerships and medical device connections; European precision manufacturers with automotive industry intellectual property and engineering expertise; and emerging manufacturers pursuing cost-effective production while developing advanced manufacturing capabilities.

Switching costs - qualification requirements, performance validation, supply chain integration - provide stability for established suppliers, while technological advancement requirements and application diversification create opportunities for innovative manufacturers. Consolidation continues as companies seek manufacturing scale; direct customer partnerships grow for specialized applications while traditional distribution remains relationship-driven. Focus areas: secure electronics and medical device market positions with application-specific performance specifications and technical collaboration; develop precision manufacturing technology and advanced quality control capabilities; explore specialized applications including IoT devices and electric vehicle requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Japanese Precision Leaders | Advanced manufacturing expertise; proven quality systems; established customer relationships | Precision manufacturing; technical innovation; quality reliability |

| American Fastener Companies | Strong engineering connections; comprehensive development programs; established customer partnerships | Engineering collaboration focus; integrated solutions; technical consultation |

| European Manufacturing Specialists | Automotive expertise; precision technology leadership; trusted by major manufacturers | Industrial partnerships; application-specific specifications; engineering collaboration |

| Emerging Technology Producers | Manufacturing efficiency; competitive pricing; rapid technology development | Production scaling; technology advancement; market entry strategies |

| Specialized Distributors | Technical distribution networks; customer relationships | Engineering expertise; inventory management; technical support services |

| Item | Value |

|---|---|

| Quantitative Units | USD 1,023.5 million |

| Type Segments | 304 Stainless Steel; 316 Stainless Steel; 410 Stainless Steel; Others |

| Applications | Consumer Electronics; Medical Instruments; Automotive Electronic; Others |

| End-Users | Electronics Manufacturers; Medical Device Companies; Automotive Suppliers; Industrial Applications; Others |

| Thread Types | Machine Thread; Self-Tapping; Thread-Forming; Thread-Cutting |

| Head Styles | Phillips; Hex Socket; Torx; Slotted; Others |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | JI Morris; Matsumoto Industry; EJOT; MIZUKI; Shi Shi Tong Metal Products; Tokai Buhin Kogyo; Nitto Seiko; STANLEY Engineered Fastening; NBK; PennEngineering; SAIDA Manufacturing; PSM International; Unisteel; Chu Wu Industrial; Sanei |

| Additional Attributes | Dollar sales by type and application; Regional demand trends (NA, EU, APAC); Competitive landscape; Direct vs. distributor adoption patterns; Manufacturing and assembly integration; Advanced precision innovations driving dimensional accuracy, mechanical reliability, and electronics assembly excellence |

The global stainless steel miniature screw market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the stainless steel miniature screw market is projected to reach USD 1.5 billion by 2035.

The stainless steel miniature screw market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in stainless steel miniature screw market are 304 stainless steel, 316 stainless steel, 410 stainless steel and others.

In terms of by application, consumer electronics segment to command 52.3% share in the stainless steel miniature screw market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stainless Steel Industry Analysis in India Forecast and Outlook 2025 to 2035

Stainless Steel Welded Pipe Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Turning Inserts Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Electrical Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Casks Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Valve Tag Market Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Foil Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stainless Steel Water Bottles Market Size, Share & Forecast 2025 to 2035

Stainless Steel Control Valve Market Size, Share, and Forecast 2025 to 2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Stainless Steel Welded Pipe Sector

Precision Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Size and Share Forecast Outlook 2025 to 2035

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA