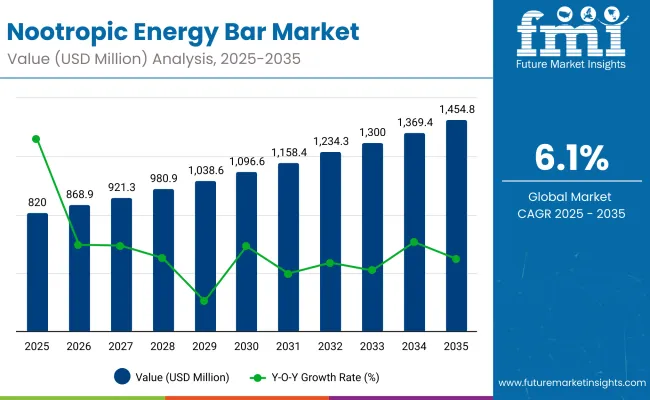

A valuation of USD 820.0 million is projected for the Nootropic Energy Bars Market in 2025, with expansion anticipated to reach USD 1,475.8 million by 2035. The absolute gain of USD 655.8 million across the decade represents a compound annual growth rate (CAGR) of 6.1%, underscoring steady expansion as functional snacking with cognitive benefits moves into mainstream adoption.

Nootropic Energy Bars Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 820 Million |

| Market Forecast Value in (2035F) | USD 1,475.8 Million |

| Forecast CAGR (2025 to 2035) | 6.1% |

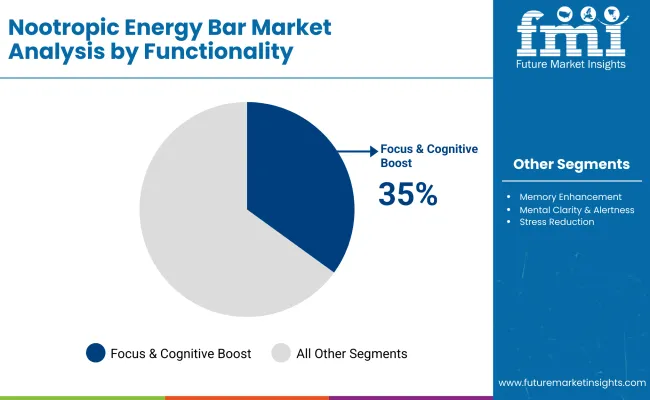

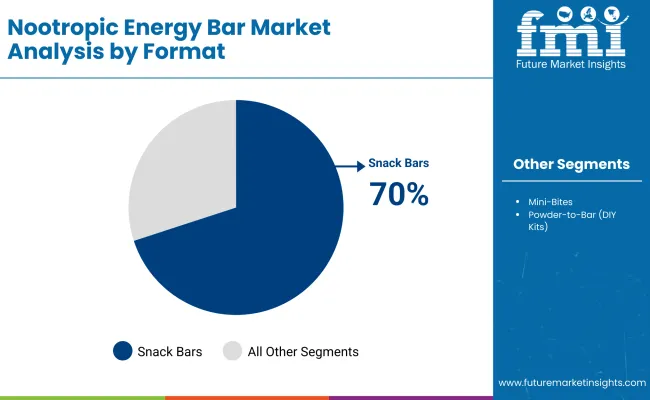

Between 2025 and 2030, the market is forecast to grow from USD 820.0 million to USD 1,100.8 million, adding nearly USD 280.8 million, which accounts for around 43% of the total expected growth for the decade. This phase will be characterized by strong uptake among students, professionals, and gamers as demand for portable mental performance solutions accelerates. Snack bars, holding a dominant 70% share, are anticipated to anchor this early-stage growth, while the focus and cognitive boost functionality is expected to lead with a 35% share in 2025, reflecting clear consumer preference for productivity-enhancing formats.

The second phase, from 2030 to 2035, is projected to contribute an additional USD 375.0 million, equal to nearly 57% of decade growth, as the market advances from USD 1,100.8 million to USD 1,475.8 million. Rising interest in adaptogens and nootropic compounds, each forecast with growth rates above 10%, is expected to reinforce premiumization trends. Mini-bites and powder-to-bar kits, despite smaller bases, are anticipated to grow faster than traditional bars, reflecting diversification of consumption occasions. By the end of the decade, regional expansion in South Asia and Europe is expected to further solidify the global footprint of nootropic energy bars.

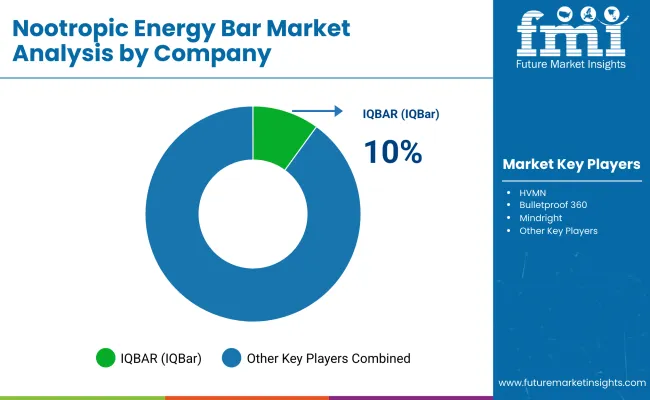

From 2020 to 2024, the Nootropic Energy Bars Market advanced from an emerging niche category to a structured functional snacking segment, supported by growing consumer demand for cognitive performance and stress management. During this period, revenue growth was driven primarily by snack bar formats, which accounted for nearly 70% of sales in 2025, while early innovation was concentrated among specialized brands such as IQBAR, HVMN, and Bulletproof 360. Competitive differentiation relied on ingredient transparency, formulation efficacy, and distribution through direct-to-consumer and online marketplaces, while broader retail penetration was still in early stages. Services and ancillary wellness ecosystems contributed minimally, accounting for less than 10% of the value proposition.

Demand for nootropic energy bars is projected to reach USD 820.0 million in 2025, marking the transition toward mainstream adoption. The revenue mix is expected to shift as adaptogen- and nootropic compound-based formulations gain double-digit growth momentum, gradually expanding their share beyond caffeine-dominated formats. Traditional category leaders are anticipated to face rising competition from agile, digital-first brands leveraging direct consumer engagement, subscription delivery models, and performance-driven claims. Larger players are expected to pivot toward hybrid strategies, combining functional innovation with convenience-led formats such as mini-bites and powder-to-bar kits. Emerging entrants focusing on stress reduction, mental clarity, and personalized nutrition are projected to gain share. The competitive advantage is expected to evolve from single-ingredient positioning to ecosystem strength, regulatory credibility, and consumer trust reinforced through scientific substantiation and transparent labeling.

Growth in the Nootropic Energy Bars Market is being fueled by rising consumer awareness of functional nutrition and the increasing demand for convenient products that deliver cognitive support. Expansion is being supported by the adoption of clean-label formulations featuring natural stimulants, adaptogens, amino acids, and nootropic compounds that align with health-focused lifestyles.

Students, professionals, and gamers are driving demand for focus, mental clarity, and sustained alertness, while athletes and fitness enthusiasts are embracing bars for performance and recovery benefits. Stress reduction and memory enhancement claims are also gaining visibility, reinforced by growing interest in adaptogens and botanicals. The trend toward plant-based, protein-fortified, and keto-friendly bases is strengthening adoption across diverse diet groups, while online retail platforms are enabling rapid product reach and consumer education. Continued innovation in formats such as mini-bites and DIY powder-to-bar kits is expected to diversify consumption occasions, supporting broad-based category expansion over the coming decade.

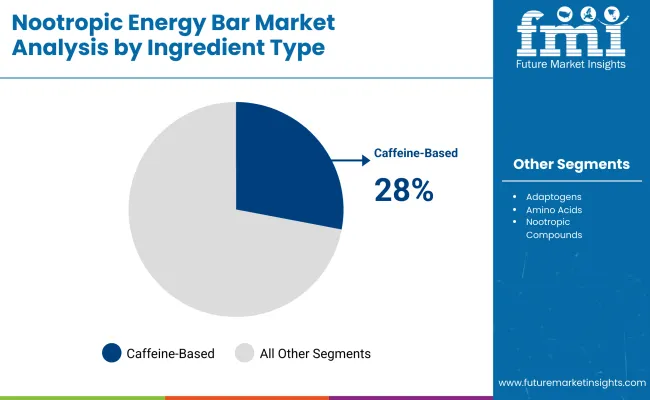

The market is segmented by ingredient type, functionality, format, base composition, consumer group, sales channel, and region. Within ingredients, categories include caffeine-based extracts, adaptogens, amino acids, nootropic compounds, and vitamins & minerals. Among these, caffeine-based bars are projected to dominate with a 28% share in 2025, supported by their well-established role in boosting alertness and mental performance.

Consumer familiarity with caffeine sources such as coffee, guarana, and green tea extract has reinforced adoption, particularly in Western markets where functional snacking is rapidly mainstreaming. Growth is also being driven by effective stacking with L-theanine and other amino acids, ensuring smoother energy release without the crash effect. While caffeine-based formulations lead, adaptogens and nootropic compounds are forecasted to expand at higher growth rates above 10% CAGR, suggesting a gradual diversification of the ingredient mix.

| Functionality | 2025 Share |

|---|---|

| Focus & Cognitive Boost | 35% |

| Memory Enhancement | 20% |

| Mental Clarity & Alertness | 25% |

| Stress Reduction | 20% |

Functional positioning of nootropic energy bars spans focus and cognitive boost, memory enhancement, mental clarity and alertness, and stress reduction. The focus and cognitive boost category is projected to lead in 2025 with a 35% share, driven by demand from students, professionals, and gamers seeking performance-driven outcomes. This segment has been strengthened by consumer preference for products that deliver immediate, perceptible benefits, often tied to ingredients such as caffeine, amino acids, and citicoline.

Stress reduction is expected to record the fastest growth at 10.1% CAGR, reflecting rising adoption of adaptogen-based bars containing ashwagandha and rhodiola to combat modern lifestyle pressures. Over the decade, demand is anticipated to broaden from focus-centric claims toward holistic benefits, with brands expected to integrate multiple functionalities within single products to capture wider consumer bases.

| Format | 2025 Share |

|---|---|

| Snack Bars | 70% |

| Mini-Bites | 20% |

| Powder-to-Bar (DIY Kits) | 10% |

The format segmentation includes snack bars, mini-bites, and powder-to-bar DIY kits. Snack bars are expected to dominate with a commanding 70% share in 2025, reflecting their convenience, portability, and compatibility with established consumer snacking habits. This dominance is being reinforced by widespread retail availability and strong brand positioning around energy and productivity.

Mini-bites, although representing a smaller 20% share, are forecasted to achieve a robust 10% CAGR, as portion control and flexible dosing gain popularity among health-conscious consumers. The fastest expansion is anticipated in powder-to-bar DIY kits with 11% CAGR, offering customization and aligning with the growing do-it-yourself wellness trend. Over the decade, diversification in formats is expected to complement the core dominance of snack bars, broadening the appeal of nootropic energy bars across demographic segments and use occasions.

| Ingredient Type | 2025 Share |

|---|---|

| Caffeine-Based | 28% |

| Adaptogens | 18% |

| Amino Acids | 15% |

| Nootropic Compounds | 25% |

| Vitamins & Minerals | 14% |

The market is segmented by ingredient type, functionality, format, base composition, consumer group, sales channel, and region. Within ingredients, categories include caffeine-based extracts, adaptogens, amino acids, nootropic compounds, and vitamins & minerals. Among these, caffeine-based bars are projected to dominate with a 28% share in 2025, supported by their well-established role in boosting alertness and mental performance.

Consumer familiarity with caffeine sources such as coffee, guarana, and green tea extract has reinforced adoption, particularly in Western markets where functional snacking is rapidly mainstreaming. Growth is also being driven by effective stacking with L-theanine and other amino acids, ensuring smoother energy release without the crash effect. While caffeine-based formulations lead, adaptogens and nootropic compounds are forecasted to expand at higher growth rates above 10% CAGR, suggesting a gradual diversification of the ingredient mix.

The Nootropic Energy Bars Market is being shaped by complex consumer dynamics, where evolving health priorities and scientific validation are intersecting with challenges around regulatory scrutiny and premium pricing in functional food categories.

Convergence of Cognitive Nutrition and Preventive Health

Growth in the market is being accelerated by the convergence of cognitive nutrition with preventive health strategies. Consumers are increasingly perceiving mental performance as a component of overall wellness, and this shift is creating demand for functional snacking that addresses both focus and resilience. Unlike traditional energy products, nootropic bars are positioned as daily-use solutions that integrate seamlessly into dietary routines. This convergence is supported by scientific exploration of amino acids, adaptogens, and nootropic compounds, which is reinforcing consumer trust when substantiated transparently. Over the forecast period, integration with broader preventive health narratives, such as stress management and long-term brain health, is expected to redefine category relevance across multiple demographic groups.

Regulatory Ambiguity in Cognitive Claims

Market expansion is being moderated by the absence of harmonized regulatory frameworks governing nootropic claims. While caffeine-related benefits have established recognition in markets like the EU, gray zones exist around adaptogens and cognitive enhancers such as bacopa or alpha-GPC. Regulatory ambiguity introduces risks of product recalls, delisting, and reputational challenges when claims overreach scientific consensus. This dynamic is anticipated to constrain aggressive marketing strategies and compel brands to rely heavily on evidence-backed communication. As the category matures, compliance costs and claim substantiation requirements are projected to remain critical hurdles, particularly for new entrants seeking rapid scale in competitive markets.

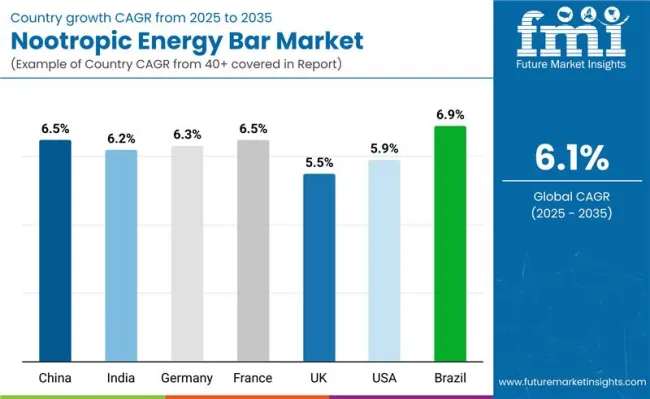

| Countries | CAGR |

|---|---|

| China | 6.50% |

| India | 6.21% |

| Germany | 6.33% |

| France | 6.51% |

| UK | 5.58% |

| USA | 5.17% |

| Brazil | 6.91% |

The Nootropic Energy Bars Market demonstrates clear disparities in country-level growth, shaped by consumer health priorities, innovation ecosystems, and regulatory climates. Brazil is forecasted to lead with a 6.91% CAGR, reflecting rapid urban adoption of functional snacks alongside increasing retail penetration in Latin America. China follows with 6.50% CAGR, where functional food categories are being accelerated by government-backed wellness initiatives and widespread consumer acceptance of adaptogens and herbal nootropics. France also shows resilience with 6.51% CAGR, supported by strong dietary supplement traditions and demand for stress reduction formulations.

Germany, at 6.33% CAGR, is projected to expand as functional snacking integrates into sports nutrition and active lifestyle categories. India, recording 6.21% CAGR, is expected to advance with a younger population base adopting cognitive nutrition for productivity and exam preparation. In contrast, the UK (5.58% CAGR) and USA (5.17% CAGR) reflect mature but slower markets, where established energy and protein bars dominate shelf space, limiting incremental share for nootropic formats. Growth in these regions is anticipated to be driven by premiumization, cleaner labels, and integration with e-commerce subscriptions. Overall, momentum is projected to be strongest in emerging economies, while Europe continues to balance tradition with innovation in functional foods.

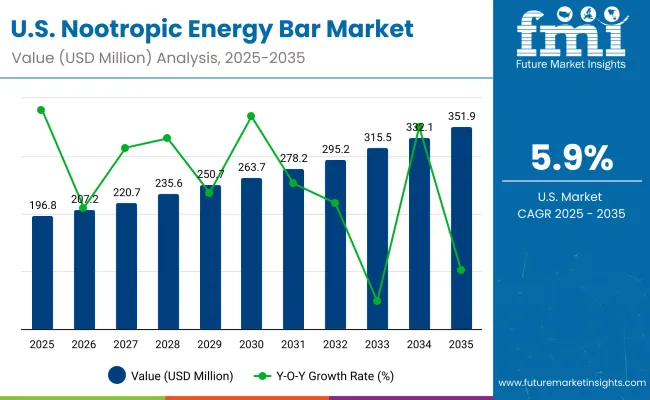

| Year | USA Nootropic Energy Bars Market (USD Million) |

|---|---|

| 2025 | 196.80 |

| 2026 | 207.2 |

| 2027 | 220.7 |

| 2028 | 235.6 |

| 2029 | 250.7 |

| 2030 | 263.7 |

| 2031 | 278.2 |

| 2032 | 295.2 |

| 2033 | 315.5 |

| 2034 | 332.1 |

| 2035 | 351.9 |

The Nootropic Energy Bars Market in the United States is projected to expand from USD 196.8 million in 2025 to USD 351.9 million in 2035, reflecting a CAGR of 6.0%. Growth will be underpinned by the rising alignment of cognitive nutrition with mainstream wellness trends and by consumer preference for functional snacking formats over traditional supplements.

By the end of the decade, the USA is expected to remain a mature but steadily expanding market, with product differentiation shifting from ingredient lists toward experience-driven outcomes, transparent labeling, and recurring subscription models.

The Nootropic Energy Bars Market in the UK is projected to grow at a CAGR of 5.58% between 2025 and 2035, reflecting steady adoption in a mature functional food landscape. Growth is expected to be shaped by rising interest in clean-label snacking, where cognitive and stress-relief benefits are aligned with broader wellness consumption.

The Nootropic Energy Bars Market in India is forecasted to expand at a CAGR of 6.21% from 2025 to 2035, reflecting one of the fastest regional trajectories. Growth will be supported by a young population base, rapid urbanization, and increasing reliance on functional foods to enhance productivity and academic performance.

The Nootropic Energy Bars Market in China is projected to record a CAGR of 6.50% between 2025 and 2035, making it a key driver of Asia’s functional food expansion. Growth is being reinforced by consumer acceptance of herbal nootropics and government-backed wellness campaigns.

| Countries | 2025 |

|---|---|

| UK | 18.16% |

| Germany | 20.23% |

| Italy | 9.10% |

| France | 14.83% |

| Spain | 9.36% |

| BENELUX | 6.07% |

| Nordic | 5.94% |

| Rest of Europe | 16% |

| Countries | 2035 |

|---|---|

| UK | 18.44% |

| Germany | 20.92% |

| Italy | 10.42% |

| France | 14.70% |

| Spain | 11.42% |

| BENELUX | 5.25% |

| Nordic | 5.03% |

| Rest of Europe | 14% |

The Nootropic Energy Bars Market in Germany is expected to grow at a CAGR of 6.33% during 2025-2035, reflecting robust demand in Europe’s largest functional food market. The trajectory is supported by consumer emphasis on performance nutrition and preventive health.

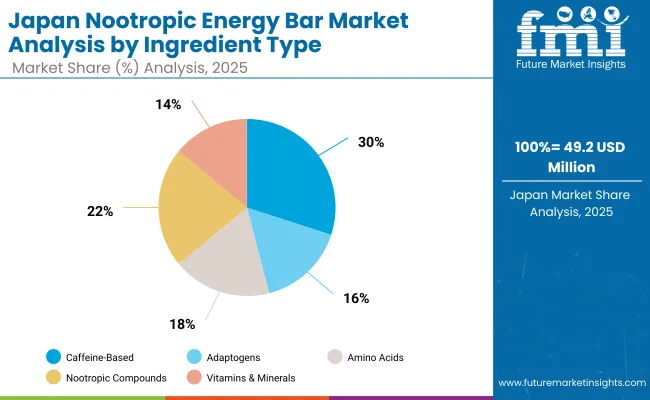

| Japan Ingredient Type | 2025 Share |

|---|---|

| Caffeine-Based | 30% |

| Adaptogens | 16% |

| Amino Acids | 18% |

| Nootropic Compounds | 22% |

| Vitamins & Minerals | 14% |

The Nootropic Energy Bars Market in Japan is projected at USD 49.2 million in 2025, accounting for nearly 6% of the global market. Caffeine-based products contribute the largest share at 30%, while nootropic compounds hold 22%, reflecting a balanced mix between traditional stimulants and advanced cognitive enhancers. This dual dominance stems from consumer trust in familiar caffeine sources and a parallel interest in scientifically validated nootropic ingredients that promise longer-term cognitive benefits. Unlike caffeine, which provides immediate performance effects, adaptogens and amino acids are being positioned for stress resilience and sustained mental health, broadening the category’s relevance to an aging population.

Growth is further reinforced by Japan’s cultural alignment with functional foods and preventive health, where evidence-backed claims and regulatory compliance are essential for consumer adoption. As innovation in adaptogen blends and amino acid formulations deepens, the competitive landscape is expected to shift toward multi-functional bars that integrate focus, clarity, and stress reduction. By 2035, rising demand for premium, science-driven products is forecast to elevate nootropic compounds and adaptogens as stronger challengers to caffeine-led dominance.

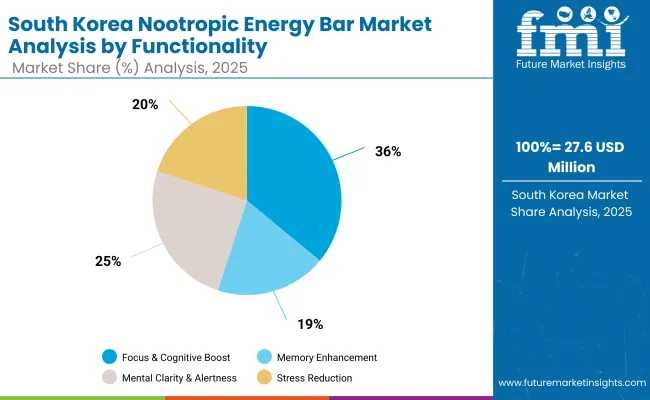

| South Korea Functionality | 2025 Share |

|---|---|

| Focus & Cognitive Boost | 36% |

| Memory Enhancement | 19% |

| Mental Clarity & Alertness | 25% |

| Stress Reduction | 20% |

The Nootropic Energy Bars Market in South Korea is projected to hold a significant position within the Asia-Pacific region by 2025, supported by a strong culture of functional food consumption and rapid adoption of performance-driven nutrition. Focus and cognitive boost bars are expected to dominate with a 36% share, reflecting demand from students, professionals, and the highly competitive gaming community. Mental clarity and alertness products, accounting for 25%, also show strong traction, supported by consumer emphasis on productivity and balanced energy release. Stress reduction, with a 20% share, is being fueled by adaptogen-rich formulations, resonating with younger demographics facing lifestyle pressures.

Growth is anticipated to be reinforced by South Korea’s advanced retail and e-commerce ecosystem, which accelerates consumer education and trial of functional products. Regulatory frameworks requiring scientific substantiation are expected to favor brands delivering evidence-backed claims, particularly in focus and stress resilience categories. Over the coming decade, the market is projected to diversify further, with multi-functional bars that combine focus, clarity, and stress management emerging as key drivers of sustained adoption.

The Nootropic Energy Bars Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse consumer groups and regional markets. Global leaders such as IQBAR, HVMN, and Bulletproof 360 hold significant visibility, supported by early entry advantages, established brand credibility, and strong direct-to-consumer distribution models. Their strategies are increasingly emphasizing premium formulations with amino acids, adaptogens, and nootropic compounds, while subscription-based delivery is being scaled to secure recurring revenue.

Established mid-sized innovators such as NooWave and Mindright are catering to demand for lifestyle-driven products with differentiated positioning around mental clarity, calm energy, and stress management. These brands are accelerating adoption through format innovation, including snack-sized bars and hybrid blends, while leveraging digital platforms for consumer education and engagement.

Specialized regional players are focusing on culturally resonant formulations, such as plant-based adaptogen blends in Asia and protein-fortified formats in Europe, aiming for consumer trust through local ingredient sourcing and transparent labeling. Their strength lies in agility, customization, and alignment with emerging diet trends rather than global scale.

Competitive differentiation is shifting away from simple stimulant-led propositions toward integrated wellness ecosystems, where efficacy validation, clean-label transparency, and digital engagement platforms are expected to define long-term leadership in the category.

Key Developments in Nootropic Energy Bars Market

| Item | Value |

|---|---|

| Quantitative Units | USD 820.0 Million |

| Ingredient Type | Caffeine-Based, Adaptogens, Amino Acids, Nootropic Compounds, Vitamins & Minerals |

| Functionality | Focus & Cognitive Boost, Memory Enhancement, Mental Clarity & Alertness, Stress Reduction |

| Format | Snack Bars, Mini-Bites, Powder-to-Bar (DIY Kits) |

| Base Composition | Plant-Based, Protein-Fortified, Keto -Friendly, High-Fiber |

| Consumer Groups | Students & Professionals, Gamers & Streamers, Athletes & Fitness Enthusiasts, Senior Adults |

| Sales Channels | Online Retail (DTC, Marketplaces), Health Stores & Pharmacies, Convenience Stores, Specialty Nutrition Chains |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | IQBAR, HVMN, NooWave, Bulletproof 360, Mindright |

| Additional Attributes | Dollar sales by ingredient and functionality, adoption trends in gaming and professional productivity, demand for clean-label and plant-based formats, growth in adaptogen and amino acid formulations, rise of DIY personalization kits, regional trends in Asia and Europe, subscription-based D2C models, and emphasis on regulatory-compliant claims supported by scientific evidence. |

The global Nootropic Energy Bars Market is estimated to be valued at USD 820.0 million in 2025.

The market size for the Nootropic Energy Bars Market is projected to reach USD 1,475.8 million by 2035.

The Nootropic Energy Bars Market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in the Nootropic Energy Bars Market are Snack Bars, Mini-Bites, and Powder-to-Bar DIY Kits.

In terms of functionality, the Focus & Cognitive Boost segment is projected to command a 35% share in the Nootropic Energy Bars Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nootropic Supplement Market Growth, Trends and Forecast from 2025 to 2035

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

Leading Providers & Market Share in Energy Gel Industry

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Energy & Power Quality Meters Market Growth - Trends & Forecast through 2034

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Energy Management System Market Analysis – Growth & Forecast 2017-2025

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

New Energy Vehicle Electric Drive Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA