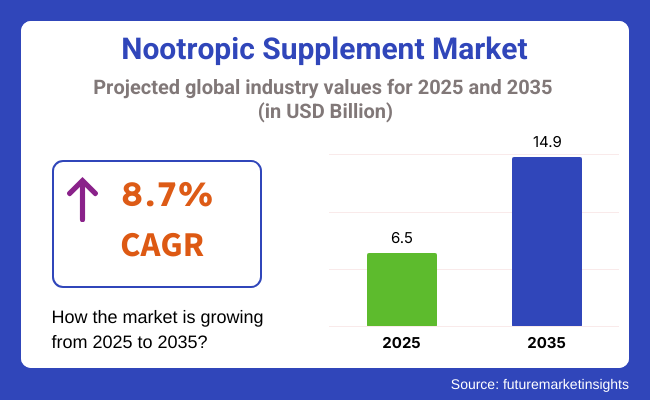

The nootropic supplement market has reached USD 6.5 billion in 2025 and will grow at an 8.7% CAGR from 2025 to 2035. The global industry will reach USD 14.9 billion in 2035.

The major driving force for growth is the increasing worldwide demand for brain-enhancing products due to increased awareness about mental health, learning and job demands, and aging populations desires for long-term brain care. With growing lifestyle needs and neurodegenerative diseases on the rise, consumers are embracing these supplements both therapeutically and proactively.

Product innovation is a top trend, with brands adding adaptogens, amino acids, vitamins, and plant extracts such as Bacopa Monnieri and Lion's Mane to broad-spectrum formulas. New delivery systems, including sublingual sprays, nootropic drinks and time-release capsules, are increasing efficacy and user benefit.

North America presently dominates the industry with high-level consumer awareness and a presence of established health and wellness brands. The growth is anticipated to be the quickest in the Asia-Pacific region on the back of rising disposable incomes, digital trends for wellness, and traditional herbal knowledge incorporation within nations such as India, Japan, and South Korea.

The regulatory inconsistencies, efficacy concerns and disinformation represent significant challenges. Players are moving toward increased scientific substantiation and label clarity to build credibility and sustain consumer loyalty to position the industry for long-term and diversified expansion through 2035.

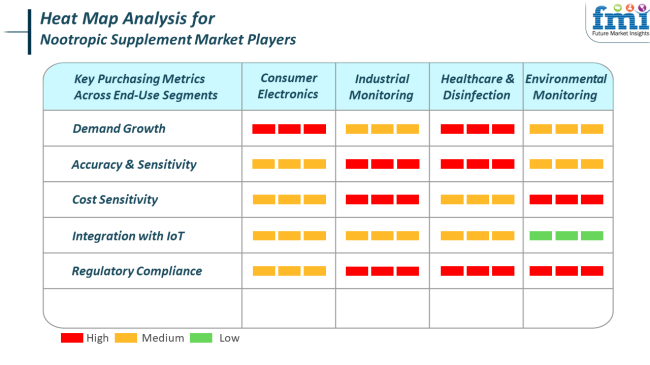

However, in nootropic supplements, the healthcare and disinfection part is the most important, with evidence being considered for efficacy and safety. The strongest purchasing decisions are made based on clinical evidentiary value, neuroprotective effects, and the extent to which a product complies with health authority standards.

Moreover, consumer acceptance is furthered by the rising culture of productivity enhancement and preventive brain health. Purchase patterns within this segment are molded by cost-effective solutions, transparency of ingredients, and brand reputation, with much of this recognition being attributed to wellness brands and trends among the younger generation.

Although the functions of nootropics, when applied to industrial or environmental issues, might soon become limited, newfound intersections in monitoring workplace cognitive performance and tracking mental fatigue might be fruitful avenues for the future. Overall, demand is characterized by a mix of functionality, personalization, and scientific legitimacy.

The industry faces notable risks related to regulatory ambiguity and efficacy verification. Many nootropics fall under dietary supplement classifications, allowing them to bypass rigorous pharmaceutical testing. This regulatory gap can lead to variable product quality and skepticism among consumers and healthcare providers.

Another critical risk stems from misinformation and marketing overstatements. As competition intensifies, some brands may make exaggerated cognitive benefit claims without adequate scientific support, risking reputational damage and potential legal consequences. This undermines overall industry credibility and may prompt regulatory crackdowns.

Lastly, supply chain complexity-especially for plant-derived ingredients-can affect formulation consistency and scalability. Climate variability, geopolitical tensions, and rising demand for clean-label ingredients may challenge raw material sourcing. To ensure industry stability, key players must prioritize transparency, invest in clinical research, and establish resilient sourcing strategies.

Between 2020 and 2024, the industry for nootropic supplements experienced huge growth due to rising consumer demand for brain enhancement and mental health. With the shift to remote work and online learning, there was an explosion in demand for products that enhance focus, memory, and overall brain health.

Furthermore, growth in neuroscience and greater adoption of personal well-being solutions also added to the industry growth. People were demanding natural and herbal nootropics increasingly, and the outcome was a preference for plant-based ingredients for their cognitive benefits.

In the years to come, between 2025 and 2035, the industry for nootropic supplements will witness a growth that is on the rise. Advances in neuroscience and brain science technology will drive more targeted and more powerful formulas.

Individualized nootropic supplements, based on cognitive profiles, will be more popular. Also, adding nootropic substances to functional foods and beverages will spread the industry beyond traditional forms of supplements. Mental health and cognitive function concerns will drive more growth in the industry.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Mental well-being, focus, improvement in memory | Personalized cognitive well-being, brain aging, functional foods |

| Capsules, tablets, herbal nootropics | Personalized supplements, functional beverages, innovative formulations |

| Simple formulations based on conventional herbs and constituents | AI-based personalization, innovative bioavailability strategies |

| Growth in North America and Europe | International growth, including Asia-Pacific and emerging economies |

| Increased demand for natural and herbal supplements | Stringent regulation, emphasis on clinical evidence and efficacy |

| Professionals, students, health-conscious individuals | Broader population, including seniors seeking cognitive longevity |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.1% |

| UK | 7.4% |

| France | 6.6% |

| Germany | 6.9% |

| Italy | 6.2% |

| South Korea | 7.9% |

| Japan | 7.2% |

| China | 8.6% |

| Australia-NZ | 6.8% |

The USA industry shall grow at 8.1% CAGR during the research period. The USA ranks among the highly mature and fastest-growing markets for nootropic supplements due to enhanced consumer demand for brain improvement, mental wellbeing and work productivity.

Specialists, students, and aging consumers are some of the most interested groups of clients with high demand within a very large base. Demand for ingredients such as L-theanine, bacopa monnieri, lion's mane mushrooms, and racetams is driving innovation in supplement formats, including capsules, beverages, powders and gummies. Advances in technology and expansion in digital wellness culture have equally driven the intake of cognitive-enhancing products.

Customers are increasingly incorporating nootropics into daily health regimens targeting concentration, memory, mood stability, and stress resistance. Strategic marketing from supplement companies, celebrity endorsements, and widespread distribution on e-commerce platforms are also propelling robust industry momentum.

Clarity of regulation and consumer confidence in thoroughly researched formulations give the USA an industry edge, and ongoing R&D investment will remain to keep the USA at the vanguard of global nootropic innovation.

The UK industry will grow at 7.4% CAGR during the study period. Cognitive wellness is becoming a mainstream concern across the UK, spurred by increasing awareness of mental health and a more competitive work culture. As customers seek natural and holistic solutions to enhance focus, energy and mood stability, nootropic supplements are gaining traction. The interest spans students, business professionals, and those struggling with stress-related cognitive decline.

Retail growth in health food stores, pharmacy chains and direct-to-consumer online platforms is expanding product visibility. Adaptogens and herbal nootropics such as rhodiola, ginkgo biloba, and ashwagandha are well-established, particularly in combination products. Mental clarity, memory support, and sleep-related cognitive support are among the most significant consumer issues.

The UK industry benefits from increasing research publications and consumer education through wellness media. Regulatory changes remain positive for clean-label, plant-based supplements, paving the way for future growth.

The French industry is expected to grow at 6.6% CAGR during the study period. France is gradually embracing nootropic supplements, where consumers are placing greater importance on cognitive equilibrium, stress relief and productivity enhancement.

French consumers, being conservative about supplements, are increasingly relying on scientifically proven, plant-based formulas. The French industry is particularly driven by professionals and middle-aged consumers seeking to control cognitive function without pharmacy-based intervention.

Retail sales of cognitive supplements are increasing across health food stores and pharmacies, with online sales winning over younger consumers. French consumers prefer blends with natural ingredients like green tea extract, ginseng, and curcumin.

Memory, concentration, and reduction of fatigue are top use cases, with a growing demand for mood stabilizers as part of everyday nootropic blends. Clean-label trends and the need for traceable sourcing are prompting formulators to emphasize product transparency. As knowledge rises and distribution expands, the France industry is poised for moderate and stable growth.

The German industry is projected to grow at 6.9% CAGR during the study period. Germany's health-conscious populace, along with extremely high confidence in evidence-based supplements, provides a solid platform for nootropic industry growth. More consumers are turning to natural remedies for improving concentration, stress management, and cognitive longevity, especially among working professionals and the elderly.

The industry is adequately covered by health food stores, pharmacies, and bio-product stores offering herbal and nutraceutical-based brain enhancers. German consumers tend to favor clinically tested ingredients and products with few artificial additives.

Nootropics with adaptogens, B vitamins, omega-3s, and mushroom extracts are becoming popular. Increased personalized supplementation, intelligent packaging, and subscription-based services are further driving customer engagement. With the right combination of science, sustainability, and innovation, Germany has the potential for a steadily growing industry.

The Italian industry will grow at a 6.2% CAGR during the study period. Italy is witnessing increasing demand for nootropic supplements among students, office professionalsand those looking for natural brain support.

Cognitive impairments, mental fatigue due to age, and mounting levels of work stress are compelling greater adoption and awareness of cognitive enhancers. Italian consumers prefer herbal remedies and are drawn to increasing numbers of Mediterranean-concordant ingredients such as olive leaf extract, grape seed extract, and natural sources of caffeine.

Store shelves are stretching product lines with health-focused pharmacies and online stores. The attraction to the products is further augmented by the growing demand for beauty-from-within and wellness routines that put a high value on mental acuity and emotional stability. As product innovation continues to advance and consumer education improves, Italy's nootropic supplements industry will continue to improve at a steady pace through the forecast period.

The South Korean industry is projected to grow at 7.9% CAGR through the period of the study. South Korea has been experiencing rapid growth in the nootropic segment, driven by a tech-driven and health-conscious consumer base

. Academic stress, long working hours, and societal emphasis on maximum mental performance have created tremendous demand for products that boost focus, memory, and mood. Korean consumers are receptive to functional foods, beauty supplements, and herbal wellbeing blends. Products containing ginseng, lion's mane, and L-tyrosine ingredients are being embraced at breakneck speeds.

Innovation in delivery form-i.e., shots, soft chews, and stick packs-is making the products more convenient and user-friendly. Nootropics are being integrated into daily lives along with skin care and physical wellness products as a badge of whole-health values. With robust local brands and a conducive industry infrastructure, South Korea is well-positioned to be a leader in the Asia-Pacific industry.

Japan's industry is likely to grow at 7.2% CAGR over the study period. Japan's aging population and heavy emphasis on mental sharpness are key drivers for the industry. Preventive wellness and longevity-oriented healthcare practices have driven demand for supplements that provide cognitive function, stress resilience as well as sleep improvement. Consumers want subtle, daily-use supplements with green tea extracts, matcha, DHA, and fermented botanicals.

The regulatory environment in Japan is favorable to high-quality products with proven functional claims. Distribution channels are pharmacies, health stores, and growing online platforms with a wide variety of domestic and imported products. Japan's cultural tradition for functional foods and high demand for cognitive performance improvement ensure long-term growth in the industry in the coming decade.

The Chinese industry will expand at 8.6% CAGR during the study period. China is the world's most rapidly growing industry, fueled by rising awareness regarding mental health, academic competition, and rapid urbanization. Students, young adults, and professionals are the biggest consumers, often motivated by a need for mental sharpness, emotional stability, and improved productivity. Online platforms and wellness influencers have been the driving forces for promoting nootropics, with livestreaming and social commerce playing pivotal roles.

Online products with ingredients such as ginseng, phosphatidylserine, and amino acids are in vogue. Cross-border channels for online shopping are bringing about high-end overseas brands, and local players are capitalizing on traditional Chinese medicine infusions. With the stress relief and mental wellness needs increasing day by day, China is turning into the most dynamic and scalable industry.

Australia-New Zealand is expected to experience growth at the rate of 6.8% CAGR during the research period. Industry demand for nootropic supplements continuously increases in Australia and New Zealand due to improving mental awareness, stress disorders, and customer receptivity toward herbal health products. Students, working professionals, and geriatric customers are readily accepting brain improvement supplements as part of their wellbeing routines.

Established nootropic forms include plant-based adaptogens, omega-3 fatty acids, magnesium, and brain-support blends. Clean-label, TGA-accredited products receive the regulatory endorsement of high consumer confidence.

Health food shops, clinics of practitioners, and online well-being platforms offer extensive product ranges for various cognitive goals. Mental acuity, efficiency, and work-life balance attention are fuelling adoption. Increasing accessibility and familiarity will fuel industry growth in Australia-New Zealand over the forecasting period.

The industry is dominated by the over the counter (OTC) segment, with an estimated 70-75% of the total industry share. OTC nootropics are generally formulated with natural or synthetic cognitive enhancers like L-theanine, caffeine, and bacopa monnieri, as well as lion's mane. They are readily available through e-commerce, health stores and pharmacies.

Brands such as Onnit (Alpha Brain), Mind Lab Pro and Qualia Mind dominate this category by using biohacker communities and lifestyle marketing to push concentration, memory, and mood improvement. This category will grow at a CAGR of 9.1% from 2025 to 2035, as driven by increased mental wellness awareness, stress at work and expanding student base users. The prescribed nootropic segment, though smaller with an estimated 25-30% industry share, is important, particularly for therapeutic cognitive use.

Used to cure ADHD, Alzheimer's and narcolepsy, these consist of drugs such as modafinil, methylphenidate and racetams. The industry is highly regulated and geographically specific, with high penetration in markets such as Germany, France, and the UK. Growth is consistent (CAGR 4.5%) but is limited by prescription practices, legal restrictions, and abuse potential. However, growing interest in cognitive longevity and neurological research may slowly increase the scope of medical nootropics over the next decade.

Capsules and tablets are the leading form in the industry, holding approximately 55-60% of the industry share. The format is popular with consumers due to its convenience, accurate dosage, and ease of portability. Most OTC products, such as Mind Lab Pro, Nootrogen and Performance Lab, utilize capsules to administer multi-ingredient stacks that aim at different cognitive functions.

Developments in time-release capsules and plant-based gelatin alternatives are also boosting attractiveness. Between 2025 and 2035, this form is expected to continue in its leading position, with a CAGR of 8.4%, because consumers will be increasingly looking for standardized, convenient-to-swallow forms.

Powder nootropics constitute the secondary sub-segment, valued at 20-25% industry share. Favored by athletes, gamers and biohackers, powders provide dosing flexibility and quicker absorption. Genius Consciousness and Bulk Supplements are among the brands that appeal to this group with single-ingredient and stackable products.

The format also supports greater concentration and economical bulk buying, which is appealing to heavy users. Disadvantages, however, include taste, preparation time and portability issues. Growth is anticipated to be robust (CAGR 7.9%), particularly with the emergence of DIY nootropic mixing and niche groups centered on customized supplementation.

The industry in Europe is undergoing notable stratification, with innovation-led startups challenging established nutraceutical and pharmaceutical brands. Leading the sector are Onnit Labs' branding strength, diversified supplement stack as well as strategic influencer partnerships.

It has also expanded its Alpha BRAIN® with clinically tested formulations and functional RTD drinks within the fitness and cognitive wellness demographics. Premium biohacking products NooCube and Mind Lab Pro are taking the alternative route by selling caffeine-free, multiple-ingredient formulas supported by mental health studies to differentiate themselves.

In parallel, TruBrain and Nootrobox Inc. are going direct to consumers and are targeting these knowledge workers through their neuroperformance positioning. Prescription-based smart drug niches are the ones that Teva Pharmaceutical Industries Ltd and Cephalon Inc. have targeted, dominating the industry as well as modulating modafinil-like compounds specifically for regulated cognitive support.

Formerly, AlternaScript LLC or Peak Nootropics catered to niche markets by focusing on topical enhancements regarding heightened focus and memory-supporting stacks with customizable blends. These companies have marketed their products in conventional retail to allow consumption of nootropics on the go and wider access in retail, such as Kimera Koffee and Neu Drink.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Onnit Labs | 18-22% |

| NooCube | 12-16% |

| Mind Lab Pro | 10-14% |

| TruBrain | 8-12% |

| Teva Pharmaceutical Industries Ltd | 6-10% |

| Other Players | 30-38% |

| Company Name | Offerings & Activities |

|---|---|

| Onnit Labs | Expanded Alpha BRAIN® product line; partnerships with athletes and celebrities. |

| NooCube | Offers stimulant-free nootropic stacks targeting productivity and memory. |

| Mind Lab Pro | Multi-ingredient formulations clinically tested for cognitive enhancement. |

| TruBrain | Subscription-based nootropic drinks and capsules formulated by neuroscientists. |

| Teva Pharmaceutical Industries Ltd | Offers prescription-based cognitive enhancers under regulated frameworks. |

Key Company Insights

Onnit Labs holds a leading industry share of around 18-22%, dependent on its flagship product, the Alpha BRAIN® product suite, and celebrity endorsement marketing campaigns. The company moves into on-the-go formats such as RTD beverages while developing loyalty through podcast partnerships and holistic wellness business models.

Following NooCube are the strongholds of 12-16% in the high-end lifestyle supplement industry by virtue of a clean-label formulation approach and the growing reputation among professionals and students alike.

Mind Lab Pro holds a 10-14% industry share through scientific transparency and nootropic stack optimization, thus making the brand ideal for biohackers and professionals who want stimulant-free options. With this 8-12% share of the industry, TruBrain is setting itself apart from the rest of the pack by offering neuroscience-led R&D combined with smart packaging and a subscription-based e-commerce model.

The industry remains under the continuous dominance of Teva Pharmaceutical Industries Ltd, covering a broad 6-10% of the total industry share composition on pharmaceutical backing in the commercialized nootropic area through regulated offering courses derived from modafinil analogs for clinical-grade cognitive support.

By ingredient type, the industry is segmented into natural ingredients, such as Panax Ginseng, Ginkgo Biloba, Asiatic Pennywort, Ashwagandha, Bacopa Monnieri, Guarana, Eleuthero, Rhodiola Rosea, Schisandra Chinensis, and others like Maca. The synthetic ingredients include Racetams, Modafinil, Sunifiram, Phosphatidylserine, Choline, DMAE, Unifiram, Hydrafinil, Citicoline, and others like Adranfinil.

By product category, the industry is divided into prescribed and over-the-counter products.

By form, the industry is segmented by form, including capsules/tablets, powder, drinks, and gummies.

By distribution channel, the industry is divided by distribution channel into health food stores, pharmacies and drugstores, professional healthcare practitioners, nutrition stores, healthcare professionals, and online retailers.

By region, the industry is segmented by region, including North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The industry is expected to reach USD 6.5 billion in 2025.

The industry is projected to grow to USD 14.9 billion by 2035.

The industry is expected to grow at 8.7% CAGR during the forecast period.

China, with a projected CAGR of 8.6%, is expected to see significant growth in this industry.

Over-the- counter (OTC) products are the most widely available and consumed segment in the industry.

Key players include Onnit Labs, NooCube, Mind Lab Pro, TruBrain, Teva Pharmaceutical Industries Ltd, AlternaScript LLC, Peak Nootropics, Kimera Koffee, Neu Drink, Cephalon Inc., Zhou Nutrition, Mental Mojo LLC, Accelerated Intelligence Inc., SupNootropic Bio Co. Ltd., and Nootrobox Inc.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 35: Europe Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 37: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Form, 2018 to 2033

Table 39: Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 44: East Asia Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 45: East Asia Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 46: East Asia Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 47: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 48: East Asia Market Volume (Units) Forecast by Form, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 54: South Asia Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 55: South Asia Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 56: South Asia Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 57: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 58: South Asia Market Volume (Units) Forecast by Form, 2018 to 2033

Table 59: South Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 61: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 64: Oceania Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 65: Oceania Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 66: Oceania Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 67: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 68: Oceania Market Volume (Units) Forecast by Form, 2018 to 2033

Table 69: Oceania Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 70: Oceania Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ million) Forecast by Ingredient Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Ingredient Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ million) Forecast by Product Category, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Category, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Form, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Product Category, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 22: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Category, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 32: North America Market Value (US$ million) by Product Category, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 44: North America Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 48: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Category, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Product Category, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Category, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 92: Europe Market Value (US$ million) by Product Category, 2023 to 2033

Figure 93: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 94: Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 104: Europe Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 108: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Product Category, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ million) by Product Category, 2023 to 2033

Figure 123: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 124: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 125: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 131: East Asia Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 134: East Asia Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 135: East Asia Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 138: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 139: East Asia Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Product Category, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 152: South Asia Market Value (US$ million) by Product Category, 2023 to 2033

Figure 153: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 154: South Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 161: South Asia Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 164: South Asia Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 165: South Asia Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 168: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 169: South Asia Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 172: South Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Product Category, 2023 to 2033

Figure 178: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 182: Oceania Market Value (US$ million) by Product Category, 2023 to 2033

Figure 183: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 184: Oceania Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 185: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 191: Oceania Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 194: Oceania Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 195: Oceania Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 198: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 199: Oceania Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: Oceania Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: Oceania Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Product Category, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ million) by Ingredient Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ million) by Product Category, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ million) Analysis by Ingredient Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Ingredient Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Ingredient Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ingredient Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ million) Analysis by Product Category, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product Category, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Category, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Category, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Ingredient Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Category, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nootropic Energy Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Analysis and Growth Projections for Green Supplement Business

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biotin Supplement Market Analysis – Size, Share & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA