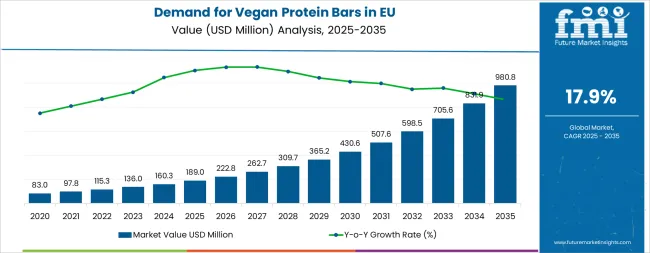

The European vegan protein bars industry is positioned for substantial expansion, projected to grow from USD 189.0 million in 2025 to USD 980.8 million by 2035, advancing at a compound annual growth rate (CAGR) of 17.9% during the forecast period. This remarkable growth trajectory reflects the accelerating consumer shift toward plant-based nutrition, increasing fitness consciousness, and growing demand for convenient, clean-label snacking solutions across European operations.

European Union vegan protein bars sales are projected to grow from USD 189.0 million in 2025 to approximately USD 980.8 million by 2035, recording an absolute increase of USD 788.4 million over the forecast period. This translates into total growth of 417.1%, with demand forecast to expand at a compound annual growth rate (CAGR) of 17.9% between 2025 and 2035. The overall industry size is expected to grow by nearly 5.2X during the same period, supported by the accelerating shift toward plant-based diets, increasing fitness and sports nutrition adoption, and developing applications across convenience snacking, weight management, and general wellness segments throughout European operations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 189 million |

| Market Forecast Value (2035) | USD 980.8 million |

| Forecast CAGR (2025-2035) | 17.9% |

Between 2025 and 2030, EU vegan protein bars demand is projected to expand from USD 189 million to USD 422.4 million, resulting in a value increase of USD 233.4 million, which represents 29.6% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer adoption of plant-based protein alternatives, increasing availability of diverse product formulations, and growing mainstream acceptance of vegan protein bars across retail and e-commerce channels. Manufacturers are expanding their product portfolios to address the evolving preferences for organic, clean-label, and functionally enhanced formulations targeting fitness enthusiasts and health-conscious consumers.

From 2030 to 2035, sales are forecast to grow from USD 422.4 million to USD 980.8 million, adding another USD 555 million, which constitutes 70.4% of the overall ten-year expansion. This period is expected to be characterized by further expansion of online retail channels, integration of advanced ingredient technologies for improved taste and texture, and development of specialized formulations for professional athletes and specific dietary requirements. The growing emphasis on environmental sustainability and increasing consumer willingness to pay premium prices for certified organic and ethically sourced plant-based protein bars will drive demand for innovative vegan protein products.

Between 2020 and 2025, EU vegan protein bars sales experienced steady expansion at a CAGR of 8.0%, growing from USD 107.3 million to USD 189 million. This period was driven by increasing environmental consciousness among European consumers, rising awareness of plant-based nutrition benefits, and growing recognition of vegan diets' health advantages. The industry developed as major sports nutrition companies and specialized vegan brands recognized the commercial potential of plant-based protein alternatives. Product innovations, improved taste profiles, and nutritional fortification began establishing consumer confidence and mainstream acceptance of vegan protein bars.

Industry expansion is being supported by the rapid increase in flexitarian, vegetarian, and vegan consumers across European countries and the corresponding demand for sustainable, ethical, and health-conscious protein sources with proven nutritional benefits. Modern consumers rely on vegan protein bars as convenient, portable nutrition solutions for post-workout recovery, meal replacement, and on-the-go snacking occasions, driving demand for products that match or exceed conventional protein bars' functional properties, nutritional profiles, and taste characteristics. Even minor dietary concerns, such as lactose intolerance, dairy allergies, or environmental consciousness, can drive comprehensive adoption of vegan protein bars to maintain optimal wellness and support sustainable consumption patterns.

The growing awareness of animal welfare issues and increasing recognition of animal agriculture's environmental impact are driving demand for plant-based protein alternatives from certified organic producers with appropriate sustainability credentials and ethical sourcing practices. Regulatory authorities are increasingly establishing clear guidelines for vegan product labeling, nutritional fortification standards, and quality requirements to maintain consumer safety and ensure product consistency. Scientific research studies and dietary analyses are providing evidence supporting plant-based protein's health benefits and environmental advantages, requiring specialized processing methods and standardized formulation protocols for complete amino acid profiles, optimal protein digestibility, and enhanced bioavailability.

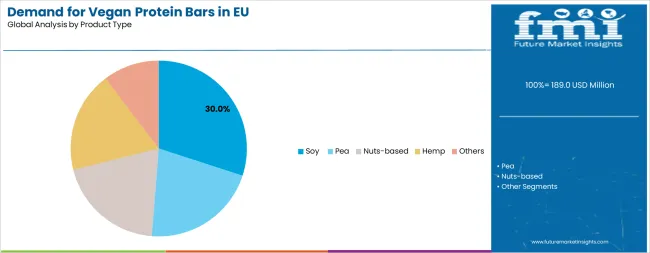

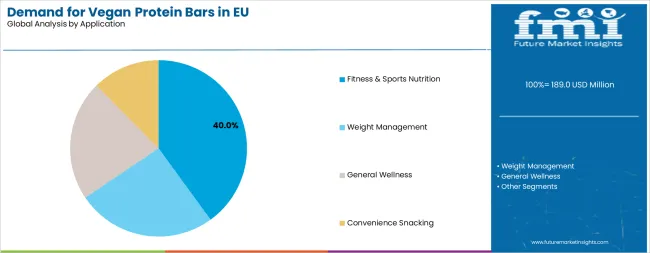

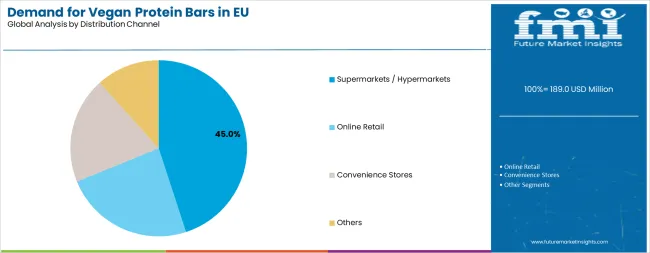

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into soy-based, pea protein, nut-based, hemp, and others. Based on application, sales are categorized into fitness & sports nutrition, weight management, general wellness, and convenience snacking. In terms of distribution channel, demand is segmented into supermarkets/hypermarkets, convenience stores, online retail, and others. By nature, sales are classified into organic and conventional. Regionally, demand covers Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The soy-based segment is projected to account for 30% of EU vegan protein bars sales in 2025, establishing itself as the dominant product variant across European operations. This commanding position is fundamentally supported by soy protein's long-established presence in European operations, comprehensive nutritional profile featuring high protein content with complete amino acid composition, and widespread consumer familiarity developed over decades of availability. The soy-based format delivers exceptional nutritional value, providing manufacturers and consumers with a complete protein source containing all essential amino acids, making it the preferred choice for fitness enthusiasts, athletes, and individuals seeking plant-based protein alternatives with equivalent nutritional benefits to animal-based proteins.

This segment benefits from mature supply chains, well-established production infrastructure, and extensive availability from multiple certified European and international suppliers who maintain rigorous quality standards and organic certifications. Additionally, soy protein offers versatility across various formulations, including bars with different textures, flavors, and functional properties, supported by neutral flavor profiles in modern processing techniques that address historical concerns about beany or off-flavors.

The soy-based segment is expected to maintain its 30.0% share through 2035, demonstrating stable positioning as newer protein sources complement rather than displace soy's established presence.

Fitness and sports nutrition applications are positioned to represent 40% of total vegan protein bars demand across European operations in 2025, maintaining this substantial share through 2035, reflecting the segment's absolute dominance as the primary usage occasion within the overall industry ecosystem. This considerable share directly demonstrates that the largest proportion of vegan protein bar purchases is for pre-workout fuel, post-workout recovery, and protein supplementation among fitness enthusiasts, athletes, and active individuals seeking convenient, portable protein delivery systems.

Modern consumers increasingly view vegan protein bars as performance nutrition products rather than mere snacks, driving demand for products optimized for athletic performance with appropriate protein content (typically 15-20 grams per bar), enhanced amino acid profiles, and functional ingredients supporting exercise recovery and muscle maintenance. The segment benefits from continuous product innovation focused on protein optimization, with manufacturers investing heavily in formulation development to maximize protein content, improve digestibility, and incorporate performance-enhancing ingredients such as BCAAs (branched-chain amino acids), electrolytes, and adaptogens.

The segment's stable share reflects proportional growth across all application categories, with fitness and sports nutrition maintaining its leading position as the core driver of vegan protein bars consumption throughout the forecast period.

Supermarkets and hypermarkets are strategically estimated to control 45% of total European vegan protein bars sales in 2025, maintaining this position through 2035, reflecting the critical importance of mainstream retail accessibility for driving category growth and consumer trial. European consumers consistently demonstrate strong preferences for purchasing vegan protein bars through traditional grocery channels that provide extensive product selection, competitive pricing, and convenient inclusion in regular shopping routines.

The segment provides essential mainstream visibility and accessibility that drives trial among curious consumers and supports regular repurchase among committed users. Major European supermarket chains, including Tesco, Carrefour, Edeka, Albert Heijn, and Mercadona, have systematically expanded vegan protein bars shelf space, often dedicating sections within sports nutrition or healthy snacking categories and positioning them prominently to facilitate discovery and trial behavior.

The segment's stable share reflects balanced growth across all distribution channels, with supermarkets maintaining their dominant position while online retail and convenience stores grow proportionally alongside the overall expansion.

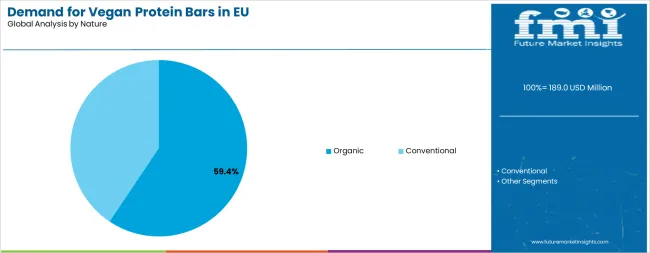

Organic vegan protein bars are strategically positioned to contribute 59.4% of total European sales in 2025, maintaining this substantial share through 2035, representing products produced through certified organic agricultural methods with strict certification requirements. These organic products successfully deliver premium positioning and enhanced consumer trust while ensuring ethical sourcing and environmental sustainability credentials that resonate strongly with health-conscious European consumers.

Organic production serves environmentally aware consumers, health-focused demographics, and quality-conscious buyers who prioritize clean-label ingredients, non-GMO certification, and sustainable sourcing practices over price considerations. The segment derives significant competitive advantages from premium brand positioning, enhanced nutritional credibility, and strong alignment with consumer values regarding environmental sustainability and ethical consumption.

The segment's stable share through 2035 reflects the already-established preference for organic certification within the vegan protein bars category, with organic products commanding the majority position and continuing to grow proportionally with overall expansion.

EU vegan protein bars sales are advancing rapidly due to accelerating plant-based diet adoption, growing fitness and sports nutrition participation, and increasing environmental consciousness regarding animal agriculture impacts. However, the industry faces challenges, including taste and texture gaps compared to conventional protein bars for some consumers, higher price points that limit mass penetration, and nutritional concerns regarding protein quality and amino acid completeness in some formulations. Clean-label ingredient transparency and continued product innovation remain central to industry development.

The rapidly accelerating development of clean-label formulations featuring minimal, recognizable ingredients is fundamentally transforming vegan protein bars' positioning from processed snacks to whole-food-based nutrition solutions embraced by health-conscious consumers. Advanced product formulations featuring short ingredient lists, natural sweeteners, organic certification, and functional ingredient additions such as adaptogens, probiotics, superfoods, and performance-enhancing compounds enable vegan protein bars to deliver comprehensive wellness benefits beyond basic protein supplementation. These innovations prove particularly transformative among mainstream consumers who scrutinize ingredient labels and seek products that align with clean eating principles and nutritional transparency.

Major vegan protein bar brands invest heavily in reformulation projects, ingredient sourcing partnerships, and product development targeting clean-label requirements, recognizing that ingredient quality and transparency directly influence consumer trust and purchase decisions. Manufacturers systematically eliminate artificial sweeteners, preservatives, and synthetic additives while incorporating organic nuts, seeds, dates, and naturally derived protein concentrates that deliver both nutritional value and consumer confidence.

Modern vegan protein bar producers systematically incorporate sustainable packaging solutions featuring compostable wrappers, recycled materials, and minimal packaging designs that address environmental consciousness among target consumers who view packaging choices as extensions of their values. Strategic integration of biodegradable films, paper-based wrappers, and reusable containers enables manufacturers to position vegan protein bars as completely sustainable nutrition solutions where both product and packaging align with environmental principles. These packaging innovations prove essential for brand differentiation and consumer loyalty, as ecological impact concerns represent significant purchase motivators, particularly among younger demographics and urban consumers.

Companies implement comprehensive sustainability communication strategies that document environmental advantages through carbon footprint labeling, transparent sourcing disclosure, and quantifiable impact metrics, enabling consumers to understand their positive contribution through product selection. Manufacturers leverage sustainability messaging in marketing campaigns, social media content, and packaging design, positioning vegan protein bars as simple, impactful actions consumers can take to reduce their environmental footprint without sacrificing nutrition or convenience.

European consumers increasingly seek vegan protein bars tailored to specific dietary requirements, fitness goals, and lifestyle preferences, with manufacturers responding through specialized product lines targeting keto diets, low-sugar formulations, high-fiber variants, allergen-free options, and performance-optimized compositions for different athletic activities. This personalization trend enables brands to segment effectively, commanding premium pricing for specialized formulations while building loyal consumer communities around specific product benefits and nutritional philosophies.

The development of targeted formulations for women's health, digestive wellness, cognitive performance, and immune support expands vegan protein bars beyond basic protein supplementation into comprehensive functional nutrition platforms that address multiple consumer needs simultaneously. Brands collaborate with nutritionists, sports scientists, and wellness experts to develop evidence-based formulations that deliver measurable benefits, supporting marketing claims with clinical research and transparent nutritional disclosure that builds consumer confidence and justifies premium positioning.

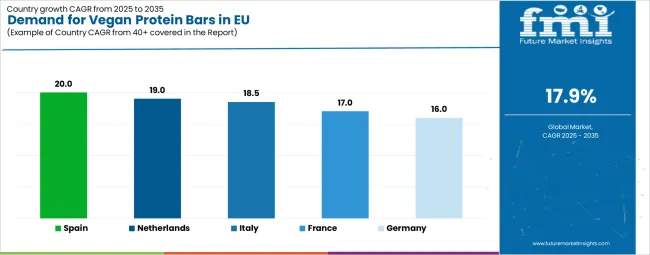

| Country | CAGR % |

|---|---|

| Spain | 20.0% |

| Netherlands | 19.0% |

| Italy | 18.5% |

| France | 17.0% |

| Germany | 16.0% |

EU vegan protein bars sales demonstrate accelerated growth across major European economies, with Spain and the Netherlands leading expansion rates above 19% CAGR through 2035, driven by rapidly evolving fitness culture, environmental consciousness, and premium product positioning. Germany maintains leadership through established vegan infrastructure and mature sports nutrition channels. France benefits from growing fitness participation within urban centers. Italy leverages health consciousness and specialty retail expansion. Spain shows exceptional growth supported by the tourism industry's influence and retail modernization. The Netherlands emphasizes sustainability credentials and organic product dominance. Overall, sales show strong regional development reflecting EU-wide cultural shifts toward plant-based nutrition and active lifestyles.

Revenue from vegan protein bars in Germany is projected to exhibit robust growth with a CAGR of 16.0% through 2035, driven by exceptionally well-developed vegan food culture, comprehensive retail infrastructure for plant-based products, and strong consumer commitment to fitness and environmental sustainability throughout the country. Germany's sophisticated understanding of plant-based nutrition and internationally recognized leadership in vegan product innovation are creating substantial demand for diverse vegan protein bar varieties across fitness enthusiasts, athletes, and health-conscious mainstream consumers.

Major retailers, including Edeka, Rewe, Aldi, and specialized organic chains such as Alnatura, denn's Biomarkt, and Bio Company, systematically expand vegan protein bar selections, often dedicating sports nutrition sections to plant-based options and positioning them prominently alongside conventional protein bars to encourage trial. German demand benefits from high gym membership penetration, substantial disposable income supporting premium organic products, and cultural openness to functional foods that naturally support vegan protein bars adoption across mainstream consumers beyond core vegan demographics.

Revenue from vegan protein bars in France is expanding at a CAGR of 17.0%, substantially supported by evolving consumer attitudes toward plant-based nutrition and rapidly growing fitness participation rates among urban populations. France's increasing environmental consciousness among younger demographics and rising health awareness are systematically driving demand for high-quality vegan protein bar alternatives across diverse consumer segments, including fitness enthusiasts, weight-conscious individuals, and environmentally aware shoppers.

Major retailers, including Carrefour, Auchan, Leclerc, and specialized organic chains, including Naturalia and Biocoop, progressively establish comprehensive vegan protein bar ranges serving the continuously growing demand. French sales particularly benefit from sophisticated consumer expectations regarding taste and quality standards, driving product innovation and premiumization within the vegan protein bars category. Growing CrossFit, functional training, and boutique fitness studio participation is significantly enhancing penetration rates despite historical preference for conventional nutrition products.

Revenue from vegan protein bars in Italy is growing at a robust CAGR of 18.5%, fundamentally driven by increasing health consciousness, growing sports participation rates, and the gradual modernization of Italian dietary patterns to incorporate functional nutrition products. Italy's traditionally Mediterranean diet is evolving to accommodate sports nutrition supplements as fitness culture expands and younger generations embrace active lifestyles requiring convenient protein supplementation.

Major retailers, including Coop Italia, Esselunga, Conad, and Carrefour Italia, strategically invest in sports nutrition category expansion and vegan protein bars offerings to address growing interest in plant-based fitness products. Italian sales particularly benefit from rising gym memberships, increasing running and cycling participation, and developing wellness tourism that exposes consumers to international nutrition trends. Urban centers, including Milan, Rome, Turin, and Bologna, lead adoption with concentration of fitness facilities, health food stores, and environmentally conscious consumer segments.

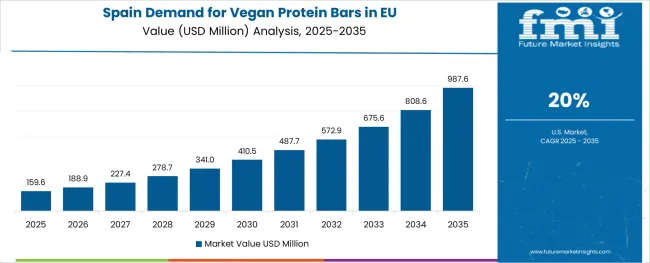

Demand for vegan protein bars in Spain is projected to grow at an exceptional CAGR of 20.0%, the highest among major European operations, substantially supported by tourism industry exposure to international dietary preferences, rapidly expanding fitness culture among younger Spanish consumers, and aggressive retail expansion through major supermarket chains and specialty sports nutrition stores. Spanish food culture is experiencing substantial modernization with younger generations embracing fitness, wellness, and plant-based nutrition as lifestyle priorities rather than niche interests.

Major retailers, including Mercadona, Carrefour España, Alcampo, and Lidl España, systematically expand sports nutrition and vegan protein bars offerings, with aggressive promotional strategies and competitive pricing driving mainstream adoption. Spain's substantial tourism industry exposes domestic consumers to plant-based protein products through fitness facilities, health food cafés, and international visitors' consumption patterns, normalizing vegan protein bars and encouraging trial among curious consumers.

Demand for vegan protein bars in the Netherlands is expanding at a robust CAGR of 19.0%, fundamentally driven by exceptionally strong environmental consciousness, leadership in sustainable food innovation, and comprehensive consumer preference for organic and ethically sourced products across mainstream and specialized channels. Dutch consumers demonstrate particularly high receptivity to plant-based protein alternatives, viewing them as environmental necessities rather than optional lifestyle choices.

Netherlands sales significantly benefit from a well-developed organic retail infrastructure, including Albert Heijn's extensive sports nutrition sections, Ekoplaza's specialized organic stores emphasizing clean-label products, and Marqt's premium positioning, combined with innovative food startups testing cutting-edge formulations in a receptive Dutch environment. The country's cycling culture and active outdoor lifestyle create substantial demand for convenient, portable protein nutrition supporting active lifestyles, while the Dutch dairy industry paradoxically coexists with growing plant-based adoption as consumers increasingly recognize environmental impacts and seek alternatives.

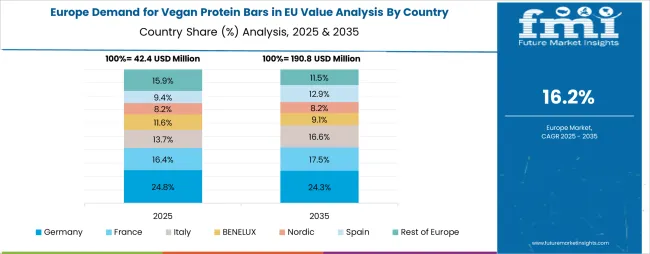

EU vegan protein bars sales are projected to grow from USD 189.0 million in 2025 to USD 980.8 million by 2035, registering a CAGR of 17.9% over the forecast period. Spain is expected to demonstrate the strongest growth trajectory with a 20.0% CAGR, supported by rapidly expanding fitness culture, growing tourism industry influence, and increasing mainstream retail adoption. The Netherlands follows with 19.0% CAGR, attributed to exceptional environmental consciousness and premium organic product preferences. Italy contributes with 18.5% CAGR, driven by health-conscious urban populations and specialty sports nutrition channel growth.

Germany, while maintaining the largest share at 22.0% in 2025, is expected to grow at a more moderate 16.0% CAGR, reflecting maturity and established vegan product infrastructure. France follows with 17.0% CAGR, supported by evolving dietary preferences and the expanding fitness industry. The Rest of Europe region holds 27.0% share, encompassing Nordic countries, Eastern Europe, and other EU member states with emerging adoption of vegan protein bars.

EU vegan protein bars sales are defined by competition among specialized plant-based nutrition brands, sports nutrition companies, and emerging clean-label startups. Companies are investing in taste and texture improvement technologies, clean-label ingredient sourcing, functional nutrition formulations, and sustainability communication to deliver high-quality, appealing, and environmentally responsible vegan protein bar solutions. Strategic partnerships with fitness influencers, retail expansion initiatives, and marketing campaigns emphasizing sustainability credentials and performance benefits are central to strengthening position.

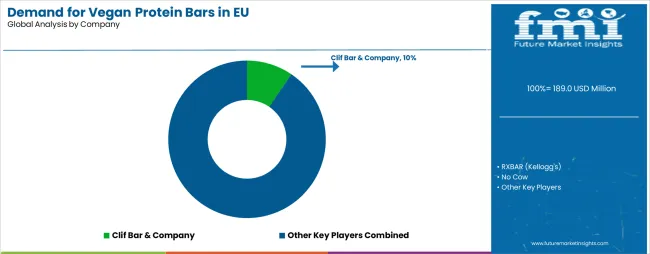

Major participants include Clif Bar & Company with an estimated 14.0% share, leveraging its established brand recognition, comprehensive distribution network across European retail and specialty sports nutrition channels, and reputation for clean-label, organic ingredients. Clif Bar benefits from early entry, manufacturing scale, and the ability to support mainstream retail with consistent supply and promotional investment across multiple product lines targeting different consumer segments.

RXBAR (Kellogg's) holds approximately 12.0% share, emphasizing distinctive clean-label positioning with transparent ingredient communication directly on packaging, minimal ingredient formulations, and protein-forward nutritional profiles appealing to health-conscious consumers. RXBAR's success in positioning as a whole food protein bar rather than processed sports nutrition creates strong brand differentiation and premium pricing opportunities, supported by Kellogg's distribution capabilities and marketing resources.

No Cow accounts for roughly 10.0% share through its specialized positioning within fitness and sports nutrition segments, dairy-free formulations, and a digital-first marketing strategy leveraging social media influencers and direct-to-consumer e-commerce. The company benefits from strong brand community engagement, targeted product development for specific dietary requirements (keto, low-sugar, high-protein), and authentic vegan brand positioning resonating with committed plant-based consumers.

Orgain represents approximately 8.0% share, supporting growth through clinical nutritionist positioning, organic certification emphasis, and functional nutrition formulations targeting specific health outcomes beyond basic protein supplementation. Orgain leverages medical professional endorsements, clean ingredient transparency, and positioning as nutritional therapy rather than mere snacks to command premium pricing and build consumer trust.

Other companies and regional brands collectively hold 56.0% share, reflecting the highly fragmented nature of European sales, where numerous national brands, private label offerings from major retailers, specialized organic producers, and emerging startups serve local operations, niche segments, and specific consumer preferences. This fragmentation provides opportunities for differentiation through innovative protein sources (cricket, spirulina, hemp), unique flavor profiles, specialized functional benefits (gut health, cognitive performance), and regional sourcing narratives that resonate with local consumer values.

| Item | Value |

|---|---|

| Quantitative Units | USD 980.8 million |

| Product Type | Soy-based, Pea Protein, Nuts-based, Hemp, Others |

| Application | Fitness & Sports Nutrition, Weight Management, General Wellness, Convenience Snacking |

| Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others |

| Nature | Organic, Conventional |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Clif Bar & Company, RXBAR (Kellogg's), No Cow, Orgain, Regional brands |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European operations; competitive landscape analysis with established players and emerging plant-based specialists; consumer preferences for organic versus conventional products; integration with sustainable packaging practices and environmental certification programs; innovations in taste and texture optimization technologies; adoption of functional ingredient formulations in sports nutrition segment; regulatory framework analysis for vegan labeling and nutritional claims; supply chain optimization strategies; and penetration analysis for mainstream and fitness-focused European consumers. |

The global demand for vegan protein bars in EU is estimated to be valued at USD 189.0 million in 2025.

The market size for the demand for vegan protein bars in EU is projected to reach USD 980.8 million by 2035.

The demand for vegan protein bars in EU is expected to grow at a 17.9% CAGR between 2025 and 2035.

The key product types in demand for vegan protein bars in EU are soy , pea, nuts-based, hemp and others.

In terms of application, fitness & sports nutrition segment to command 40.0% share in the demand for vegan protein bars in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Protein Market Analysis - Size, Share & Forecast 2025 to 2035

Vegan Protein Foods Market analysis and forecast by Form, Ingredient Type, Animal Type, and Region through 2035

Vegan Protein Concentrate Market

Europe Fish Protein Market Analysis – Growth, Demand & Forecast 2025–2035

Europe Fungal Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Chickpea Protein Market Outlook – Size, Share & Forecast 2025–2035

Europe Duckweed Protein Market Trends – Size, Demand & Forecast 2025–2035

Western Europe Pea Protein Market Analysis - Size, Share & Trends 2025 to 2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Western Europe Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Country Through 2035

Western Europe Texturized Vegetable Protein Market Analysis - Size, Share & Trends 2025 to 2035

Demand for Soy Protein Isolates in EU Size and Share Forecast Outlook 2025 to 2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Demand for Taste-maskers for Plant Protein Bars and Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Pea for High Protein Savory in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA