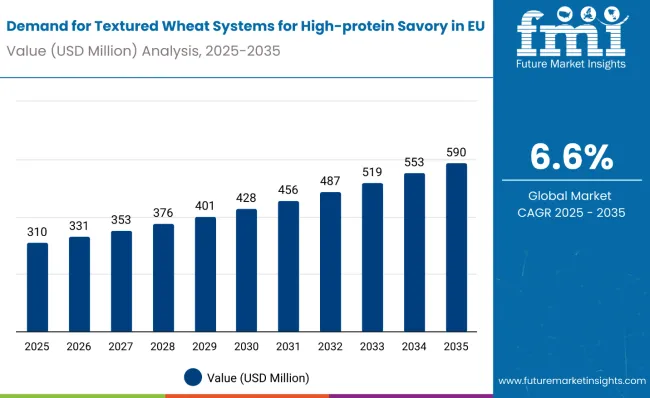

Demand for textured wheat protein systems in high-protein savory applications across the European Union is estimated at USD 310 million in 2025, with projections indicating a rise to USD 590 million by 2035, reflecting a CAGR of approximately 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 310 million |

| Industry Value (2035F) | USD 590 million |

| CAGR (2025 to 2035) | 6.6% |

This growth reflects both expanding wheat protein utilization and increased adoption of seitan-based food products. The rise in demand is linked to growing artisanal food movements, evolving traditional protein alternatives, and cost-effective plant protein sourcing. By 2025, per capita consumption in leading EU countries such as Germany, Austria, and Netherlands averages between 0.3 to 0.5 kilograms, with projections reaching 0.7 kilograms by 2035. Munich leads among metropolitan areas, expected to generate USD 46 million in textured wheat protein demand by 2035, followed by Vienna (USD 38 million), Berlin (USD 34 million), Amsterdam (USD 28 million), and Prague (USD 24 million).

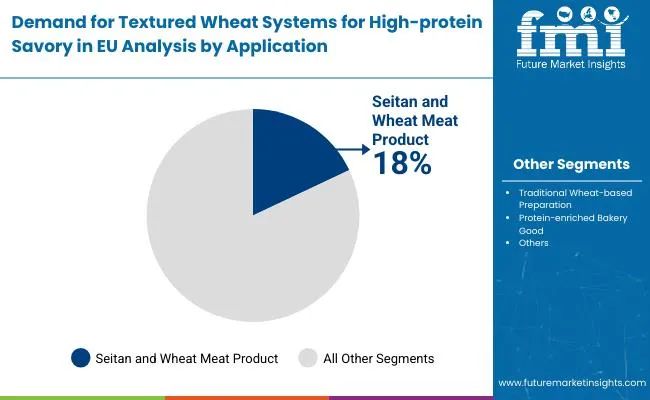

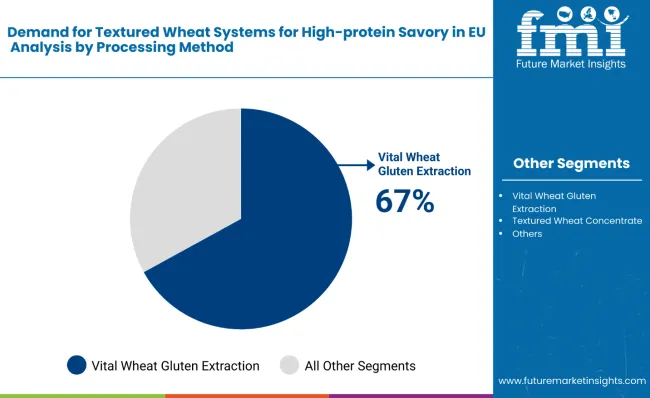

The largest contribution to demand continues to come from seitan and wheat meat products, which are expected to account for 58% of total consumption in 2025, owing to strong artisanal food presence, traditional Asian cuisine adoption, and manufacturer familiarity with wheat protein processing. By processing method classification, vital wheat gluten extraction represents the dominant technology, responsible for 67% of all demand, while hydrated wheat protein and textured wheat concentrates are expanding rapidly.

Consumer adoption is particularly concentrated among traditional food manufacturers and specialty protein processors, with processing expertise and supply chain integration emerging as significant drivers of demand. While gluten sensitivity concerns remain a limitation, the average cost advantage versus other plant proteins has increased from 12% in 2020 to 18% in 2025.

Continued improvements in wheat protein functionality and increasing application diversification are expected to accelerate adoption across European food manufacturing. Regional disparities persist, but demand in Southern European countries is narrowing the gap with traditionally strong Central European processing centers.

The textured wheat protein systems segment across the EU is classified across several categories. By application, the key categories include seitan and wheat meat products, protein-enriched bakery goods, ready meals and convenience foods, and traditional wheat-based preparations. By processing method, the segment spans vital wheat gluten extraction, hydrated wheat protein processing, textured wheat concentrates, and fermented wheat protein systems. By protein functionality, formulations include high-elasticity textures, firm bite characteristics, soft gel textures, and customized binding properties.

By end-user profile, the segment covers artisanal food producers, traditional bakeries, industrial food manufacturers, ethnic cuisine specialists, and health food processors. By region, countries such as Germany, Austria, France, Italy, and Czech Republic are included, along with coverage across all 27 EU member states. By wheat source, key varieties analyzed include hard wheat gluten, soft wheat proteins, organic wheat systems, and heritage wheat varieties.

Seitan and wheat meat products are projected to dominate demand in 2025, supported by growing Asian cuisine popularity, artisanal food movements, and consumer familiarity with wheat-based textures. Other applications such as protein-enriched bakery, ready meals, and traditional preparations are growing steadily, each serving distinct culinary requirements.

Textured wheat systems in EU high-protein savory applications utilize various processing technologies, selected for functionality, cost efficiency, and texture characteristics. Vital wheat gluten extraction remains the most utilized method, though alternative processing approaches are gaining application-specific adoption.

The textured wheat protein category serves a diverse range of food production segments across processing scales, culinary traditions, and distribution approaches. While requirements vary from texture authenticity to cost optimization to cultural authenticity, demand is concentrated among five key producer categories. Each group brings distinct purchasing behaviors, specification preferences, and volume requirements.

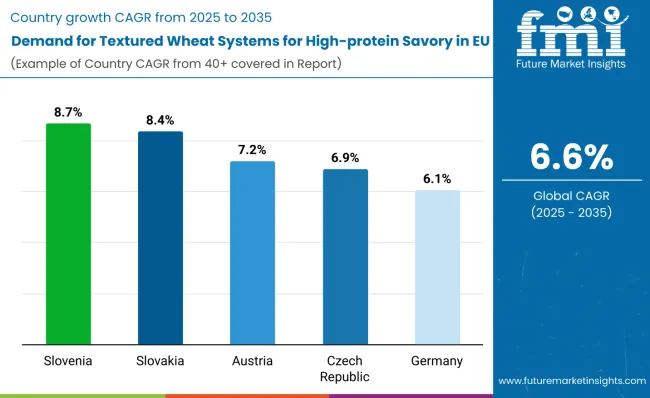

| Countries | CAGR (2025 to 2035) |

|---|---|

| Slovenia | 8.7% |

| Slovakia | 8.4% |

| Austria | 7.2% |

| Czech Republic | 6.9% |

| Germany | 6.1% |

Textured wheat protein demand will not grow uniformly across every EU country. Rising artisanal food production and faster specialty cuisine adoption in Central Europe give Slovenia and Slovakia a measurable edge, while mature Western European countries expand more steadily from a higher base. The table below shows the compound annual growth rate (CAGR) each of the five largest countries is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for textured wheat systems is projected to expand across all major EU countries, but the pace of growth will vary based on artisanal food infrastructure development, ethnic cuisine adoption rates, and traditional food processing investment. Among the top five countries analyzed, Slovenia and Slovakia are expected to register the fastest compound annual growth rates of 8.7% and 8.4% respectively, outpacing more established Western European processing centers.

This acceleration is underpinned by increasing artisanal food movements, growing cultural food diversity, and expanding specialty cuisine processing capabilities. In both countries, per capita consumption is projected to rise from 0.2 kg in 2025 to 0.5 kg by 2035, closing the gap with higher-consumption countries such as Germany and Austria.

Austria and Czech Republic are each forecast to grow at CAGRs of 7.2% and 6.9% over the same period. Both countries already maintain established wheat processing traditions, with widespread adoption of wheat proteins in traditional cuisines and export-oriented specialty food manufacturing. Growth is supported by strong culinary heritage preservation, increasing vegetarian cuisine adoption, and expanding artisanal food service applications.

Germany, while maintaining the highest overall demand in absolute terms, is expected to grow at a CAGR of 6.1%, reflecting its mature but stable processing infrastructure. The country already exhibits higher-than-average per capita consumption (0.4 kg in 2025), extensive ingredient supply networks, and well-developed traditional food technology capabilities.

The competitive environment is characterized by a mix of established wheat processing companies and specialized protein ingredient suppliers. Processing expertise and supply chain control remain decisive success factors: the five largest suppliers collectively serve more than 1,800 food manufacturers across the EU and account for a majority of vital wheat gluten and textured wheat protein supply capacity.

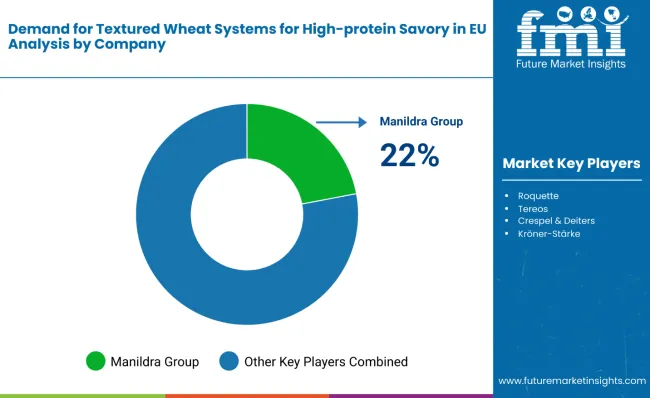

Manildra Group holds the leading position with a 22% demand share, leveraging its Australian wheat processing expertise and European distribution partnerships. The company operates through strategic alliances with European wheat processors, providing high-quality vital wheat gluten and technical application support for seitan manufacturers and artisanal food producers.

Roquette maintains strong positioning through its French wheat processing facilities and comprehensive ingredient portfolio, focusing on application-specific textured wheat proteins for bakery and convenience food segments. The company benefits from established European agricultural relationships and integrated starch-protein processing capabilities.

Tereos leverages its French agricultural cooperative structure and wheat processing heritage to supply cost-effective textured wheat proteins to Central European food manufacturers, emphasizing sustainable sourcing and local supply chain advantages for regional specialty food processors.

Crespel & Deiters, the German wheat specialist, focuses on premium vital wheat gluten and specialized texture systems, targeting artisanal producers and high-end food manufacturers. Its traditional processing methods and quality positioning support higher-margin applications in specialty cuisine segments.

Kröner-Stärke utilizes its German wheat starch processing capabilities and protein extraction expertise to supply textured wheat systems, particularly serving traditional bakery and ethnic food manufacturers requiring authentic wheat protein functionality.

The next tier includes regional wheat processors and ingredient specialists focusing on specific applications or geographic coverage. Cooperative processing arrangements and traditional supplier relationships are expanding textured wheat system availability for smaller artisanal producers, supporting category growth and application diversification.

| Attribute | Details |

|---|---|

| Study Coverage | EU demand and consumption of textured wheat systems for high-protein savory from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025-2035 |

| Units of Measurement | USD (demand value), Metric Tonnes (volume), Kilograms per capita (consumption) |

| Geography Covered | All 27 EU member states; country-level and city-level granularity |

| Top Countries Analyzed | Germany, Austria, France, Italy, Czech Republic, 25+ |

| Top Cities Analyzed | Munich, Vienna, Berlin, Amsterdam, Prague and 50+ |

| By Application | Seitan/wheat meat products, Protein-enriched bakery, Ready meals, Traditional preparations |

| By Processing Method | Vital wheat gluten extraction, Hydrated wheat protein, Textured concentrates, Fermented systems |

| By Protein Functionality | High-elasticity textures, Firm bite characteristics, Soft gel textures, Binding properties |

| By End-User Profile | Artisanal producers, Traditional bakeries, Industrial manufacturers, Ethnic specialists, Health processors |

| Metrics Provided | Demand value (USD), Volume (MT), Per capita consumption (kg), CAGR (2025-2035), Share by segment |

| Price Analysis | Average unit prices by processing method and application |

| Competitive Landscape | Company profiles, demand share analysis, processing capabilities |

| Forecast Drivers | Artisanal food growth, ethnic cuisine adoption, cost competitiveness, traditional food preservation |

By 2035, total EU demand for textured wheat systems in high-protein savory applications is projected to reach USD 590 million, up from USD 310 million in 2025, reflecting a CAGR of approximately 6.6%.

Seitan and wheat meat products hold the leading share, accounting for approximately 58% of total demand in 2025, followed by protein-enriched bakery goods and ready meals applications.

Slovenia and Slovakia lead in projected growth, registering CAGRs of 8.7% and 8.4% respectively between 2025 and 2035, due to expanding artisanal food infrastructure and growing specialty cuisine adoption.

Vital wheat gluten extraction is the dominant processing method (67% share in 2025), driven by established infrastructure and manufacturer familiarity with gluten-based texturization.

Manildra Group leads with 22% demand share, followed by major players including Roquette, Tereos, Crespel & Deiters, and Kröner-Stärke, with growing competition from regional wheat processors and ingredient specialists.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA