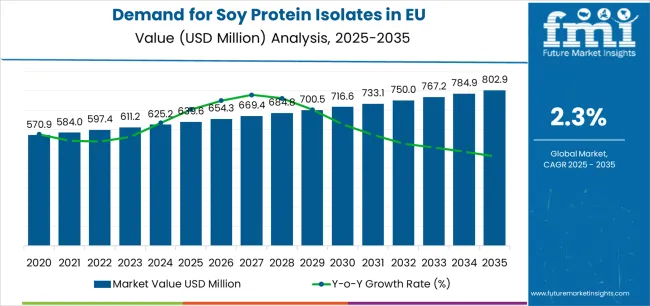

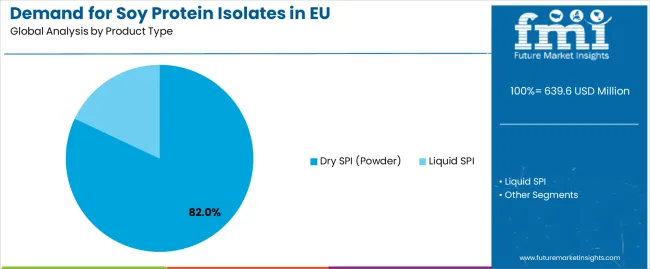

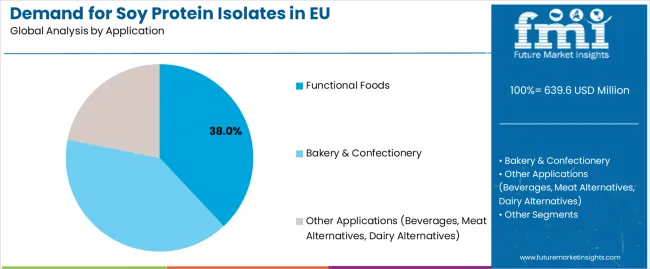

The EU soy protein isolate market is projected to grow from USD 639.6 million in 2025 to USD 802.9 million by 2035, advancing at a moderate CAGR of 2.3%. The dry SPI segment is expected to maintain dominance with an 82.0% share through 2025, while functional foods will remain the top application, accounting for 38.0% of market value in 2025. The industry size is expected to grow steadily during this timeframe, supported by the rising adoption of plant-based proteins in functional foods, beverages, and meat alternatives, growing consumer preference for sustainable and clean-label ingredients, and technological advances in isolation and purification processes that improve taste, solubility, and functional properties.

Between 2025 and 2030, the EU soy protein isolate market is projected to expand from USD 639.6 million to USD 727.2 million, adding USD 87.6 million in value and contributing 54.3% of the total decade-long growth. This first phase of acceleration will be driven by rising consumer interest in plant-based proteins and meat alternatives, which benefit from strong sustainability positioning in the European market. Increasing availability of high-purity soy protein isolates across mainstream food and beverage portfolios will support premiumization and help brands meet evolving consumer expectations for clean-label offerings. During this stage, manufacturers are expected to scale advanced isolation technologies, ensuring improved flavor neutrality, enhanced solubility, and superior functional properties that expand adoption across beverages, dairy alternatives, and nutritional supplements.

From 2030 to 2035, the EU soy protein isolate industry is forecast to grow further from USD 727.2 million to USD 802.9 million, generating an additional USD 73.6 million in revenue, or 45.7% of the ten-year expansion. Growth in this phase will be shaped by mainstream normalization of soy protein isolates across sports nutrition, dietary supplements, and pharmaceutical categories, with manufacturers leveraging the ingredient's complete amino acid profile and bioactive properties. Premium isolates with enhanced functionality will see broader uptake due to their ability to meet high-performance, clean-label requirements across functional and lifestyle-driven applications. This period will also coincide with rising demand for plant-based wellness products that emphasize muscle health, weight management, and preventive nutrition, creating opportunities for scientifically formulated isolates that combine convenience with superior nutritional performance.

Between 2020 and 2025, EU soy protein isolate sales increased from USD 576.5 million to USD 639.6 million, reflecting a 2.1% CAGR. This early development phase was shaped by the pandemic's influence on consumer health consciousness, where demand surged for plant-based proteins with immune-supporting and sustainable benefits. European suppliers responded with investments in isolation capacity and purification technology, improving scalability and consistency of supply across regional markets. Product innovations focused on enhancing taste masking, solubility, and emulsification properties helped shift consumer perceptions, positioning soy protein isolates as viable alternatives to animal-based proteins. The period also saw a steady increase in distribution channels, with ingredient suppliers and food manufacturers improving accessibility, paving the way for accelerated adoption in functional foods, beverages, and alternative proteins.

Industry expansion is being supported by the rising health awareness among European consumers and the demand for sustainable, plant-based proteins that deliver both functional and nutritional benefits. Soy protein isolates enable convenient incorporation of complete proteins with all essential amino acids into everyday diets without the environmental impact associated with animal proteins. The category benefits from dual drivers: necessity-driven adoption by manufacturers seeking clean-label alternatives to animal proteins, and choice-driven consumer demand for plant-based nutrition in sports, wellness, and mainstream food applications. This convergence of functionality, sustainability, and perceived health value is creating sustained opportunities across food, beverage, and nutritional supplement applications.

The growing body of scientific evidence linking plant-based proteins with cardiovascular health, muscle maintenance, and metabolic benefits is driving uptake of soy protein isolates across multiple end-use categories. European regulations encouraging sustainable food systems and reduced environmental impact further reinforce demand, as soy protein isolates provide both nutritional completeness and functional versatility. Producers with advanced isolation technologies gain competitive advantages by offering isolates with superior solubility, neutral taste, and enhanced functionality. At the same time, non-GMO and organic-certified isolates provide reassurance of quality and sustainability, aligning with evolving consumer preferences across the EU.

Expanding sports nutrition, clinical nutrition, and elderly care applications further elevate the role of soy protein isolates in the EU market. Clinical and consumer studies highlight benefits of soy-derived proteins in muscle protein synthesis, satiety management, and healthy aging, creating pathways for innovative formulations. Regulatory emphasis on sustainable ingredients and protein diversification supports broader category legitimacy, giving dedicated suppliers an edge in premium product positioning. Beyond core food and beverage applications, soy protein isolates are increasingly seen as multi-functional ingredients that deliver nutrition, texture, emulsification, and formulation stability simultaneously. This growing normalization across diverse industries ensures soy protein isolates will remain a central component in the EU's plant-based protein economy.

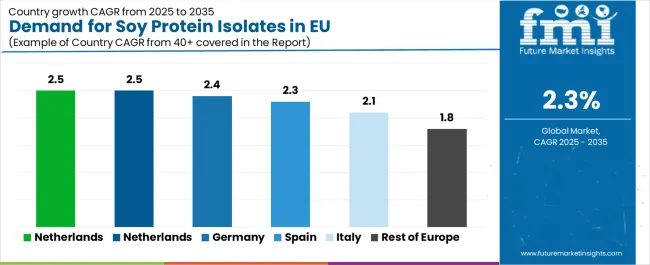

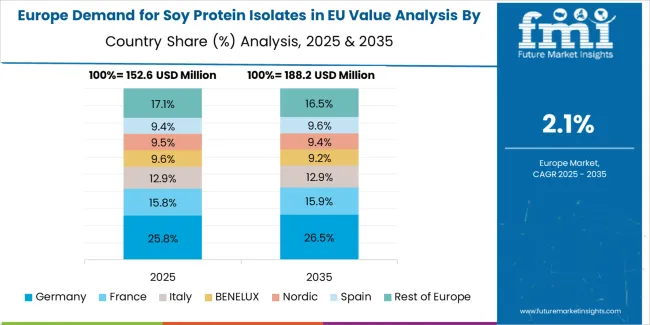

Sales of soy protein isolates are segmented by product type, application, distribution channel, and region. By product type, demand is split between dry SPI (powder) and liquid SPI, with dry powder dominating at 82.0% due to its stability and versatility in manufacturing. By application, the market spans functional foods, bakery & confectionery, and other applications including beverages and meat alternatives; functional foods lead at 38.0%, reflecting fortification trends. Distribution channels include B2B processing, foodservice, and retail/online; B2B processing commands 92.0% share as most isolates are sold as ingredients to manufacturers. Regionally, sales cover Germany, France, Italy, Spain, Netherlands, and Rest of Europe, with Germany maintaining the largest share.

The dry SPI (powder) segment is projected to account for 82.0% of EU soy protein isolate sales in 2025, maintaining dominance through 2035 at 80.4%, firmly establishing itself as the preferred format for industrial food manufacturing and nutritional applications. Growth is fundamentally supported by the powder format's superior stability, extended shelf life, and ease of incorporation into dry blending processes, combined with lower transportation costs and simplified storage requirements compared to liquid alternatives. Dry SPI delivers comprehensive value propositions by meeting both functional processing needs and formulation flexibility, including protein fortification, texture modification, and emulsification properties.

This segment benefits from established infrastructure, widespread manufacturing adoption, and technical familiarity among food technologists, creating efficiency in production and application development. Dry powder format enhances product differentiation through specialized grades targeting specific functionalities - from high-gel strength variants for meat alternatives to dispersible grades for beverages. As a result, dry SPI powders are increasingly incorporated into protein bars, nutritional supplements, bakery products, and dairy alternatives.

The segment's continued dominance through 2035 reflects its fundamental advantages in industrial food processing, though slight share erosion to liquid formats indicates growing demand for ready-to-use solutions in certain applications.

Key advantages:

Functional foods are positioned to represent 38.0% of total EU soy protein isolate demand in 2025, increasing slightly to 39.8% by 2035, reflecting their strong position in protein fortification and nutritional enhancement strategies. This leading share demonstrates the growing adoption of soy protein isolates in protein bars, fortified beverages, meal replacements, and sports nutrition products, where high protein content and complete amino acid profiles drive demand.

European manufacturers are innovating with soy protein isolates in energy bars, protein shakes, breakfast cereals, and snack foods, leveraging their neutral taste, excellent solubility, and functional properties. The segment benefits from the perception of soy protein as a sustainable, complete protein source, supported by clinical research and marketing narratives around plant-based nutrition and environmental responsibility.

The segment's share growth through 2035 reflects its role as a primary driver for protein fortification strategies, enabling mainstream adoption of plant-based proteins while reinforcing functional and sustainable positioning across both traditional and innovative food categories.

Key drivers:

EU soy protein isolate sales are advancing steadily due to increasing demand for plant-based proteins, rising adoption in functional foods and sports nutrition, and the shift toward sustainable, environmental-friendly protein sources that align with European climate goals. The industry faces challenges, including competition from alternative plant proteins like pea and hemp, concerns about soy allergenicity and GMO associations, and taste and texture limitations compared to animal proteins. Continued innovation in isolation technology and formulation improvements remains central to delivering consistent quality and unlocking new applications across food, beverages, nutraceuticals, and clinical nutrition.

The continuous improvement of isolation and purification technologies across the EU is fundamentally transforming soy protein isolates into premium, highly functional ingredients with superior sensory properties. Advanced membrane filtration, enzymatic treatment, and pH-shifting techniques preserve protein integrity while removing undesirable flavors and anti-nutritional factors, allowing manufacturers to deliver isolates that closely match the functionality of animal proteins. This technology proves especially transformative for beverages, clinical nutrition, and sports supplements, where solubility and taste neutrality are critical.

Major European ingredient companies are investing in next-generation isolation infrastructure, process optimization, and sustainability initiatives that reduce water usage and energy consumption while maintaining product quality. Collaborations with research institutes and technology providers are helping optimize protein yield, functional properties, and nutritional profiles. As a result, premium soy protein isolates are increasingly positioned as high-performance ingredients in clean-label nutrition and are expected to gain share in specialized applications.

Modern soy protein isolate producers systematically incorporate sustainability messaging, highlighting benefits such as reduced carbon footprint, lower water usage, and decreased land requirements compared to animal proteins. The association of soy protein with environmental responsibility and climate action allows companies to strategically market isolates as sustainable protein solutions beyond basic nutrition. This integration of sustainability claims into product narratives is fueling adoption in institutional foodservice, public procurement, and environmentally-conscious consumer segments.

Leading suppliers implement lifecycle assessments, carbon footprint calculations, and sustainability certifications to validate environmental claims and expand market penetration. By aligning soy protein isolates with broader European trends in climate action, circular economy, and sustainable food systems, manufacturers position their products as future-proof protein solutions, ensuring long-term regulatory alignment and consumer acceptance.

European consumers increasingly prioritize non-GMO and regionally sourced soy protein isolates, reinforcing the premium segment's projected growth within the market. This trend is supported by strong EU regulatory frameworks around GMO labeling, traceability requirements, and consumer preference for transparency, which provide competitive advantages for certified non-GMO suppliers. Companies adopting European soy sourcing, identity preservation systems, and full supply chain traceability are well positioned to capture premium market share.

The emphasis on provenance also aligns with brand strategies that promote local sourcing, reduced transportation emissions, and support for European agriculture. Partnerships with European soy growers and investments in regional processing capacity improve supply security and resilience while building consumer trust. Non-GMO soy protein isolates increasingly appeal to health-conscious consumers, premium product lines, and clean-label applications, strengthening their role as a differentiator in the EU protein ingredient market.

| Country | CAGR % (2025–2035) |

|---|---|

| Netherlands | 2.5% |

| France | 2.5% |

| Germany | 2.4% |

| Spain | 2.3% |

| Italy | 2.1% |

| Rest of Europe | 1.8% |

Germany is projected to remain the largest EU soy protein isolate market, expanding from USD 172.7 million in 2025 to USD 221.8 million by 2035, at a steady 2.4% CAGR. Growth is anchored by Germany's robust food ingredient infrastructure, widespread adoption of plant-based alternatives, and well-developed distribution channels for functional ingredients. Major food manufacturers such as PHW Group, Rügenwalder Mühle, and ingredient suppliers have integrated soy protein isolates into meat alternatives, dairy substitutes, and nutritional products. German demand benefits from strong consumer acceptance of plant proteins and the country's established role in food technology innovation. While growth is moderate, Germany's market maturity ensures steady expansion through product innovation, application development, and value-added positioning rather than rapid volume growth.

Growth drivers:

France is forecast to grow from USD 127.9 million in 2025 to USD 167.8 million in 2035, recording a 2.5% CAGR. Growth is supported by France's expanding functional food market, rising sports nutrition adoption, and increasing integration of soy protein isolates in dietary supplements and clinical nutrition. French food culture's evolution toward health-conscious consumption patterns drives demand for protein fortification in traditional products. Retailers such as Carrefour and Leclerc showcase plant-based ranges, while supplement manufacturers increasingly leverage soy protein's complete amino acid profile in performance nutrition products. The French market reflects an emphasis on quality, functionality, and scientific validation, positioning soy protein isolates as trusted ingredients for both mainstream and specialized nutritional applications.

Success factors:

Italy's soy protein isolate sales are projected to expand from USD 96.0 million in 2025 to USD 117.3 million in 2035, reflecting a 2.1% CAGR, the slowest among the core EU markets. Growth is shaped by Italy's strong culinary traditions that favor traditional proteins, though steady expansion is occurring in bakery, pasta fortification, and specialized nutrition where soy protein isolates provide functional benefits. Retailers such as Coop and Esselunga promote plant-based alternatives, while local manufacturers explore applications in gluten-free and protein-enriched pasta products. Italy's slower adoption reflects cultural dietary preferences, but opportunities lie in functional applications, sports nutrition, and elderly nutrition targeting specific consumer segments.

Development factors:

Spain's soy protein isolate demand is set to grow from USD 76.8 million in 2025 to USD 97.6 million by 2035, at a 2.3% CAGR, matching the EU average. Expansion is supported by increasing health awareness, growing plant-based product availability, and rising adoption in food manufacturing applications. Spanish retailers, including Mercadona and El Corte Inglés, are expanding plant-protein assortments, while food manufacturers integrate soy isolates into meat alternatives and functional foods. Spain benefits from its growing health and wellness sector, where consumers increasingly seek protein fortification options. This steady adoption reflects Spain's balanced approach to plant protein integration, driving consistent expansion and positioning the country as a stable mid-tier EU market.

Growth enablers:

The Netherlands is forecast to expand from USD 51.2 million in 2025 to USD 68.1 million by 2035, advancing at a 2.5% CAGR, tied for the strongest growth in Western Europe. Growth is driven by the Netherlands' world-class food technology ecosystem, progressive consumer attitudes toward plant proteins, and an innovation culture favoring early adoption of functional ingredients. Dutch firms are innovation leaders, developing next-generation applications for soy protein isolates in alternative proteins, while retailers actively promote plant-based categories. The Netherlands benefits from strong R&D infrastructure, efficient logistics, and consumer openness to novel protein sources. These factors make it a leading hub for soy protein innovation, ensuring the country not only grows domestically but also influences broader European adoption trends.

Innovation drivers:

The Rest of Europe segment, including Belgium, Austria, Poland, Scandinavia, and Eastern Europe, is projected to grow from USD 114.9 million in 2025 to USD 145.4 million by 2035, at the slowest 1.8% CAGR. Growth reflects diverse market dynamics: Nordic countries show moderate adoption despite health-conscious populations due to preference for other plant proteins, while Eastern European markets face slower adoption due to traditional dietary patterns and price sensitivity. Limited processing infrastructure and lower awareness of plant protein benefits constrain growth. The gradual westernization of diets, rising health consciousness, and expanding retail channels provide long-term opportunities. The Rest of Europe segment represents untapped potential that may accelerate as plant-based trends gradually penetrate these markets.

Potential constraints:

EU soy protein isolate sales are projected to grow from USD 639.6 million in 2025 to USD 802.9 million by 2035, registering a modest CAGR of 2.3% over the forecast period. The Netherlands demonstrates the strongest growth trajectory with a 2.5% CAGR, supported by its innovation ecosystem, strong food technology sector, and early adoption of plant-based proteins. France follows with a 2.5% CAGR, attributed to its expanding functional food market and rising consumer acceptance of plant proteins.

Germany records a 2.4% CAGR while maintaining its position as the largest individual market, accounting for 27.0% of EU soy protein isolate sales in 2025, driven by its robust food ingredient infrastructure and established plant-based sector. Spain shows a 2.3% CAGR, matching the EU average and reflecting steady adoption in food manufacturing. Italy demonstrates a 2.1% CAGR, the slowest among major markets, reflecting more traditional dietary preferences. Rest of Europe shows a 1.8% CAGR, indicating slower adoption in emerging markets despite growing interest.

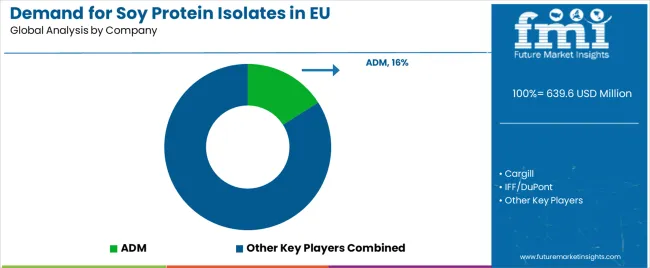

The EU soy protein isolate market is characterized by competition between global ingredient giants, specialized protein manufacturers, and regional processors addressing demand for functional, sustainable, and clean-label protein solutions. Companies are increasingly investing in isolation technology, application development, and sustainability initiatives to secure competitive advantage. Strategic collaborations with food manufacturers, sports nutrition brands, and pharmaceutical companies remain central to market expansion, while emphasis on non-GMO sourcing, traceability, and quality differentiation underpins brand credibility across Europe.

ADM leads the market with an estimated 16.0% share, leveraging its integrated supply chain, global sourcing capabilities, and extensive application expertise across food, beverage, and nutrition sectors. The company's scale and technical support for product development enable it to serve both large multinationals and specialized manufacturers, strengthening its dominant role in the EU soy protein isolate landscape.

Cargill follows with around 11.0% share, positioned as a major supplier through its protein solutions division. Its isolates are recognized for consistent quality, functional performance, and supply reliability, particularly in meat alternatives and dairy substitutes. The company benefits from strong production capacity and its ability to meet EU regulatory and sustainability requirements.

IFF/DuPont, with approximately 9.0% share, excels in specialty isolates and customized solutions for specific applications. Its technical expertise and innovation capabilities give it strategic advantages in high-value segments like clinical nutrition and sports supplements.

Kerry Group holds about 6.0% share, specializing in taste and nutrition solutions that incorporate soy protein isolates. Its formulation expertise ensures steady demand from customers seeking complete nutritional solutions.

Fuji Oil commands roughly 5.0% share, focusing on texturizing applications and bakery solutions where its technical expertise in protein functionality provides differentiation.

The remainder of the market is fragmented, with regional processors, distributors, and emerging players holding 53.0% share. These players differentiate through non-GMO certification, organic offerings, specialized grades, and local market knowledge, reflecting a diverse competitive environment positioned for consolidation as demand matures through 2035.

ADM

Cargill

IFF/DuPont

Kerry Group

Fuji Oil

Roquette Frères

Glanbia Nutritionals

Sonic Biochem

CHS Inc.

| Item | Value |

|---|---|

| Market Value | USD 639.6 million by 2025 |

| Quantitative Units | USD Million |

| Product Type | Dry SPI (Powder), Liquid SPI |

| Application | Functional Foods, Bakery & Confectionery, Other Applications |

| Distribution Channel | B2B Processing, Foodservice, Retail/Online |

| Nature (Form) | Powder (Dry), Liquid (Ready-to-use) |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | ADM, Cargill, IFF/DuPont, Kerry Group, Fuji Oil, plus regional and emerging players |

The global demand for soy protein isolates in EU is estimated to be valued at USD 639.6 million in 2025.

The market size for the demand for soy protein isolates in EU is projected to reach USD 802.9 million by 2035.

The demand for soy protein isolates in EU is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in demand for soy protein isolates in EU are dry spi (powder) and liquid spi.

In terms of application, functional foods segment to command 38.0% share in the demand for soy protein isolates in EU in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA