The Europe Fungal Protein market is set to grow from an estimated USD 1,321.9 million in 2025 to USD 2,229.8 million by 2035, with a compound annual growth rate (CAGR) of 5.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025) | USD 1,321.9 million |

| Projected Europe Value (2035) | USD 2,229.8 million |

| Value-based CAGR (2025 to 2035) | 5.4% |

Europe's Fungal Protein Market Growth is fuelled by Growing Demand for Sustainable Sources of Protein, Investment in Alternative Proteins, and Improving Fermentation Technology The popularity of highly functional, environmentally friendly, and nutritious alternative protein to animal-based and plant-based proteins from fungal protein is largely coming from yeast and Fusarium venenatum.

Adoption of fungal protein in food and beverages, animal nutrition, and pharmaceuticals is growing on account of the high protein content, digestibility, and ability to be cultivated with minimal exploitation of environmental resources. The emphasis of the European societies on food security, reduction of carbon footprint, and circular economy practices further accentuate investments in fermentation-derived proteins, bioengineered protein synthesis, and precision fermentation.

Fungal protein isolates, hydrolysates, and concentrates of industrial grade with greater performance for upgrading food texture and nutritional profiles along with pharmaceutical formulations are developed by major industry players. Given its increasing relevance for alternative meats, functional foods, dietary supplements, and gut health solutions, there is immense promise for significant technology advancement, strategic collaborations, and regulatory support during the coming years.

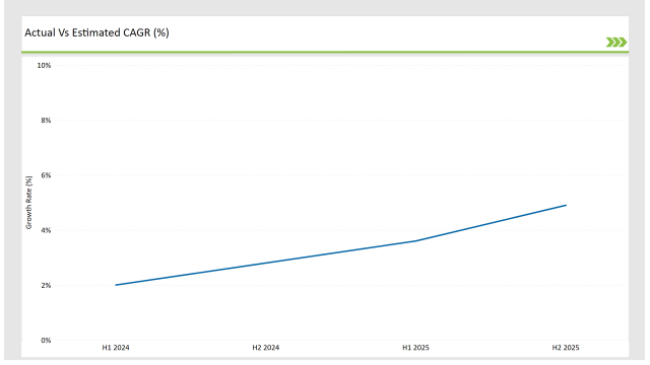

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Fungal Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.0% |

| H2 (2024 to 2034) | 2.8% |

| H1 (2025 to 2035) | 3.6% |

| H2 (2025 to 2035) | 4.9% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Fungal Protein market, the sector is predicted to grow at a CAGR of 2.0% during the first half of 2024, with an increase to 2.8% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.6% in H1 but is expected to rise to 4.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Innovation-Quorn Foods launched a next-generation Fusarium -based mycoprotein with improved amino acid profile for plant-based meats. |

| March-24 | Strategic Partnerships-Lallemand partnered with European biotechnology firms to develop fermentation-enhanced yeast protein for functional foods. |

| February-24 | Expansion of Manufacturing Capacity-Mycorena expanded its Fusarium venenatum protein production facilities to cater to growing demand in alternative protein markets. |

| January-24 | Sustainability Initiatives-Enifer Bio introduced a low-carbon yeast protein formulation, aligning with EU food sustainability goals. |

Fungal Protein Leading Sustainable and High-Performance Alternative

Fungal protein can significantly surpass animal protein inefficiency in the sector of food in Europe. One of the most developed fungi proteins is the one that has been created for it. In contrast to the most common plant-based or animal-derived proteins, the fungal protein is the only one that contains full amino acid profiles, has high digestibility, and offers remarkable texture-enhancing properties that are sought after in functional food formulations, plant-based meats, and sports nutrition.

For example, leading companies like Quorn Foods, Mycorena, and Lallemand are currently involved in the deployment of fungal protein-based functional food ingredients for improving the texture of food, enrichment in protein, and microbial stability. The techniques of precision fermentation and controlled bioprocessing will open the way for manufacturers to enhance the bioavailability and sensory attributes of fungal proteins, thereby ensuring their increased consumer acceptance and broader industrial applications.

Fungal Protein Expanding to Pharmaceuticals and Biotechnology

Besides food and animal nutrition, bacterial protein also has potential in the field of application and is growing rapidly in the case of pharmaceutical and biotechnology. The fungi that result in high bioactivity, immunomodulatory, and functional peptides found in fungal-derived proteins make them valuable for the manufacture of drugs, nutraceuticals, and biopharmaceuticals.

Companies that are at the forefront, such as Enifer Bio and Lallemand, are investigating yeast proteins in the gut microbiome probiotics, and the immune system. Furthermore, mycoproteins are being researched for their effect on lowering cholesterol, antioxidant properties, and inflammation, thus launching new ideas in medicine and nutrition.

The biopharmaceutical market too is utilizing fermentation-derived proteins for drug delivery systems, the engineering of enzymes, and bioprocessing applications, which further expands fungal proteins in a bigger scope.

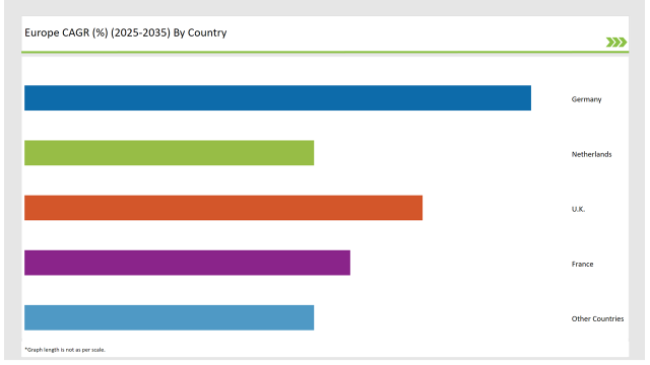

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| Netherlands | 16% |

| UK | 22% |

| France | 18% |

| Other Countries | 16% |

Germany is a primary place for fungal protein to be accepted with large amounts of money invested in food innovation, biotechnology, and alternative protein sources that are sustainable. The startup alternative protein scene of the country along with its research centers is at the forefront of the precision fermentation and microbial protein applications.

Mycorena and Enifer Bio have entered Germany's alternative protein market by introducing the next-generation mycoprotein formulations for use in meat alternatives, functional foods, and medical nutrition. In addition, the adoption of yeast protein isolates for food production has increased due to a strong emphasis on circular economy practices and reduced carbon footprints.

Apart from that, the use of fungal proteins in gut-health products like probiotics, and immune-boosting ingredients has been a major asset for the flourishing functional nutrition and supplement industry, thus, Germany demonstrates its superiority as a frontrunner in the area of fungi protein developments.

France is witnessing a tremendous increase in the consumption of fungal proteins, mainly as alternative meats and environmentally friendly livestock feed products. The trend of adopting a flexitarian or vegan lifestyle has prompted Quorn Foods and Lallemand to add mycoprotein-based functional ingredients to their portfolios.

Moreover, the French livestock sector blends fungal proteins into their animal feeds which translates to its high digestibility, the protein efficiency ratio (PER) being beyond the required levels, and the lesser need for soy-based feeds instead of traditional ones. In addition to that, start-ups whose primary goal is fermentation-derived feed solutions are working with French agricultural cooperatives to produce nutritionally optimized, environmentally-friendly fungal protein feeds.

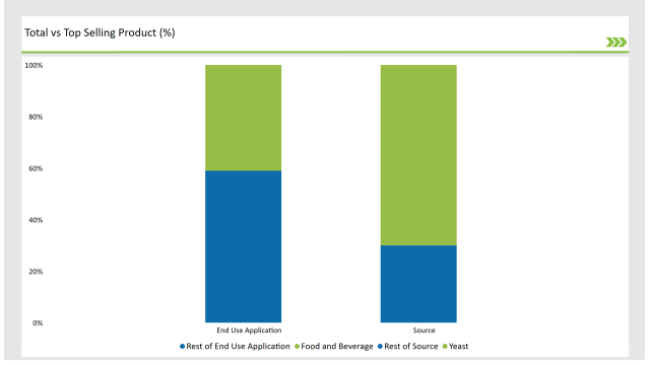

% share of Individual Categories Source and End-Use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Source (Yeast) | 70% |

| Remaining segments | 30% |

The yeast-based fungal protein market is a large segment holding it due to its multifunctionality, fermentation effectiveness, and reliable food, biotechnology, and pharmaceutical applications. Yeast proteins are widely utilized in functional foods, probiotic formulations, fermented beverages, and nutritional supplements thus being the major drivers for fungal protein expansion.

Apart from yeast fermentation technology Lallemand and Enifer Bio are the top companies in the manufacturing of yeast protein hydrolysates and isolates, which are added to plant-based, protein-rich dairy products, baked goods, and animal feed supplements. On top of all, yeast fermentation technology advancements have improved bioavailability and digestibility, thus yeast protein has become a popular choice for sports nutrition and dietary supplements.

Quorn Foods and Mycorena are also developing the Fusarium-based protein to achieve more realistic meat substitutes and products that have more fibrous texture and better amino acid profiles. As the fermentation technologies advance, it is expected that Fusarium-based fungal proteins will find even wider use in the production of pasta and fillets as well as in whole growths for premium functional food.

| Main Segment | Market Share (%) |

|---|---|

| End Use Application (Food and Beverage) | 41% |

| Remaining segments | 59% |

The food and beverage industry has the largest share of the fungal protein market due to the high consumption of the product in plant-based meat, dairy alternatives, and nutritional food products.

The leading food pioneers such as Quorn Foods, Mycorena, and Lallemand are diversifying the strains that the protein fungi are integrated into fermented specialty products, sustainable alternative proteins, and protein-rich functional foods. Fungal protein's capacity to not only improve food product elasticity and functionality but also fortify them against adverse conditions gives it a competitive advantage in food innovation.

The animal nutrition segment is growing very rapidly, where the commercialization of fungal protein is being stimulated by the urgent need to have a more sustainable and digestible alternative to soy and other conventional feed proteins.

Companies such as Enifer Bio and Mycorena are working on specialized fungal protein formulations for the aqua feed and livestock sector, to boost the nutritional outcomes and decrease environmental impacts. Pharmaceutical and biotechnology sections which is primarily due to the employment of fungal proteins in drug delivery systems, enzyme production, and the synthesis of bioactive peptides.

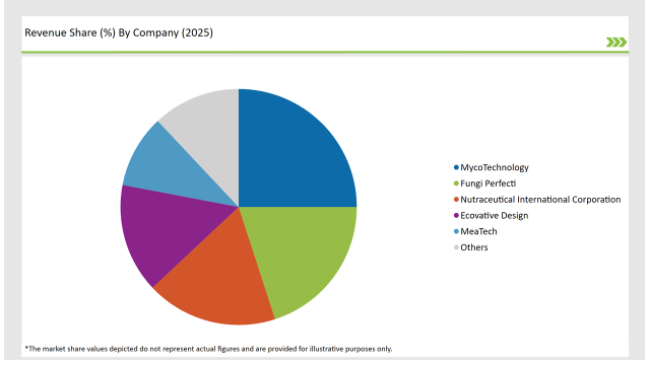

2025 Market share of Europe Fungal Protein manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Myco Technology | 25% |

| Fungi Perfecti | 20% |

| Nutraceutical International Corporation | 18% |

| Ecovative Design | 15% |

| MeaTech | 10% |

| Others | 12% |

Note: The above chart is indicative in nature

The fungal protein sector in Europe is under the influence of a few key players such as Quorn Foods, Mycorena, Lallemand, EniferBio, and Unilever who are spearheading the development of fermentation-based protein production, biotechnology applications, and functional food formulations.

Alternative protein research, mycoprotein section growth, and yeast protein optimization have been areas of focus for these companies that have made them the leaders in the industry and they ensure the widespread utilization of their products across several sectors.

With growing customer interest in sustainable and protein-rich foods, companies are expanding their fermentation plants, making the production scale larger, and the microbial protein synthesis process better. Lallemand and Mycorena use enzyme-enhanced protein extraction and bioengineering methods to improve the nutritional value and application versatility of fungal proteins.

On the other hand, the emergence of start-up and mid-tier biotech companies is reshuffling the market as they introduce new fungal protein products, particularly in gut health supplements, pharmaceutical protein carriers, and bioactive peptide formulations. Companies are making the most of the developments in synthetic biology and precision fermentation to create the next generation of fungal proteins, which will have a higher protein purity and will be optimized for various functions across industries.

As per Source, the industry has been categorized into Yeast, and FusariumVenenatum.

As per End Use Application, the industry has been categorized intoFood and Beverage, Animal Nutrition, and Pharmaceutical and Biotechnology.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Fungal Protein market is projected to grow at a CAGR of 5.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,229.8 million.

Key factors driving the European fungal protein market include the rising demand for sustainable and plant-based protein sources as consumers shift towards healthier diets. Additionally, increasing awareness of the environmental benefits of fungal protein production compared to traditional animal protein sources is fuelling market growth.

Germany, France, Netherlands and UK are the key countries with high consumption rates in the European Fungal Protein market.

Leading manufacturers include MycoTechnology, Fungi Perfecti, Nutraceutical International Corporation, Ecovative Design, and MeaTech known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA