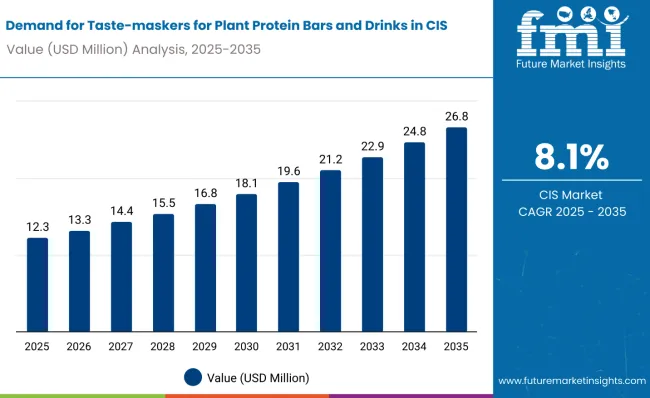

Demand for taste-maskers for plant protein bars and drinks in the Common wealth of Independent States is estimated at USD 12.3 million in 2025, with projections indicating a rise to USD 26.8 million by 2035, reflecting a CAGR of approximately 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.3 million |

| Industry Value (2035F) | USD 26.8 million |

| CAGR (2025 to 2035) | 8.1% |

This growth reflects both expanding production of plant-based protein products and increased consumer acceptance of these formulations across the region. The rise in demand is linked to improving manufacturing capabilities, growing health consciousness, and evolving taste preferences among urban consumers.

By 2025, per capita consumption of plant protein products requiring taste-masking solutions in leading CIS countries such as Russia, Kazakhstan, and Ukraine averages between 0.8 to 1.2 kilograms, with projections reaching 1.7 kilograms by 2035. Moscow leads among metropolitan areas, expected to generate USD 8.2 million in taste-masker sales by 2035, followed by St. Petersburg (USD 3.1 million), Almaty (USD 2.4 million), Kiev (USD 1.9 million), and Minsk (USD 1.1 million).

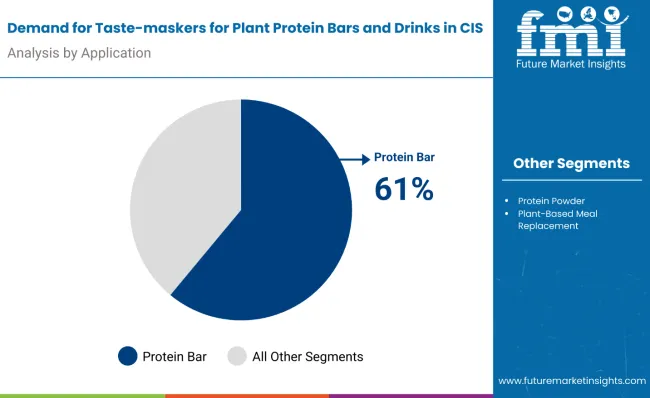

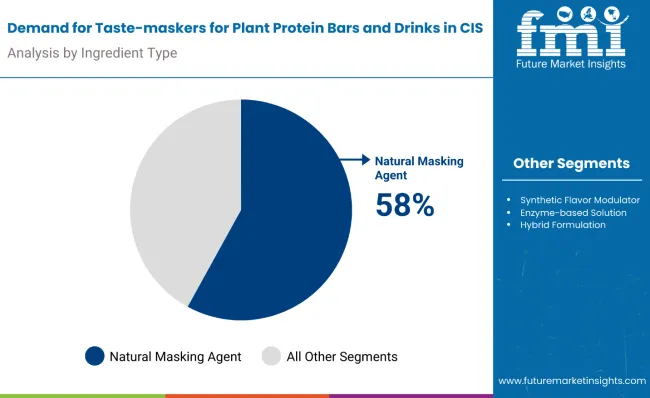

The largest contribution to demand continues to come from protein bar applications, which are expected to account for 61% of total sales in 2025, owing to rapid growth in the functional snack segment and retailer support for health-focused products. By ingredient type, natural masking agents represent the dominant category, responsible for 58% of all sales, while synthetic alternatives maintain steady demand for cost-sensitive applications.

Consumer adoption is particularly concentrated among health-conscious urban professionals and fitness enthusiasts, with income levels and urban density emerging as significant drivers of demand. While regulatory compliance remains a limiting factor, the average efficacy of natural taste-maskers has improved substantially, with off-note reduction improving from 65% in 2020 to 78% in 2025. Continued improvements in extraction technologies and flavor modulation are expected to accelerate product development across mid-tier manufacturers. Regional disparities persist, but per capita demand in rapidly developing cities is narrowing the gap with traditionally strong Russian urban centers.

The taste-maskers segment for plant protein bars and drinks in the CIS is classified across several categories. By application, the key segments include protein bars, ready-to-drink protein beverages, protein powders, and plant-based meal replacements. By ingredient type, the segment spans natural masking agents, synthetic flavor modulators, enzyme-based solutions, and hybrid formulations. By protein source, formulations target pea protein, soy protein, hemp protein, and emerging plant proteins.

By consumer profile, the segment covers fitness enthusiasts, health-conscious professionals, weight management seekers, and lifestyle-focused millennials. By country, major regions include Russia, Kazakhstan, Ukraine, Belarus, and Uzbekistan. By city, key metro areas analyzed include Moscow, St. Petersburg, Almaty, Kiev, and Minsk.

Protein bar applications are projected to dominate sales in 2025, supported by growing snack segment penetration, shelf stability requirements, and consumer preference for convenient nutrition. Other formats such as beverages and powders are growing steadily, each serving distinct consumption patterns.

Taste-maskers for plant protein products in the CIS utilize various ingredient approaches, selected for efficacy, regulatory compliance, cost structure, and consumer acceptance. Natural masking agents remain the most widely specified input, though synthetic alternatives maintain significant presence in cost-sensitive applications.

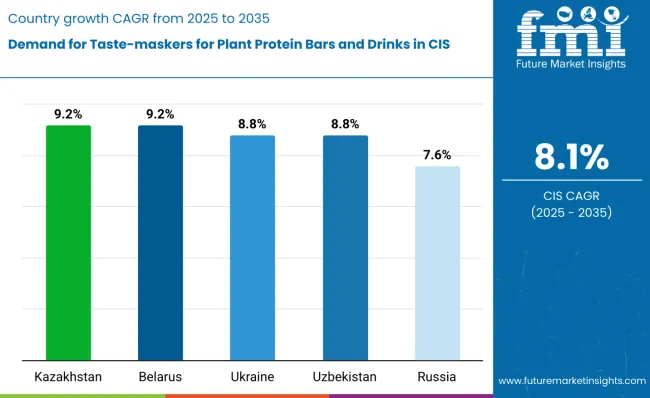

| Countries | CAGR (2025 to 2035) |

|---|---|

| Kazakhstan | 9.2% |

| Belarus | 9.2% |

| Ukraine | 8.8% |

| Uzbekistan | 8.8% |

| Russia | 7.6% |

Taste-masker demand will not grow uniformly across every CIS nation. Rising manufacturing investments and faster adoption of plant protein products in emerging economies give Kazakhstan and Belarus a measurable advantage, while mature Russian operations expand more steadily from a higher base. The table below shows the compound annual growth rate (CAGR) each of the five largest countries is expected to record between 2025 and 2035.

Between 2025 and 2035, demand for taste-maskers in plant protein applications is projected to expand across all major CIS countries, but growth rates will vary based on manufacturing capacity development, regulatory harmonization, and baseline consumption levels. Among the top five countries analyzed, Kazakhstan and Belarus are expected to register the fastest compound annual growth rate of 9.2%, outpacing the more established Russian operations.

This acceleration is underpinned by government support for food processing, growing investment in plant protein manufacturing, and increasing availability of advanced masking technologies. In both countries, per capita spending on taste-masking solutions is projected to rise from USD 0.18 in 2025 to USD 0.42 by 2035, reflecting rapid industry development and improving product sophistication.

Ukraine and Uzbekistan are each forecast to grow at a CAGR of 8.8% over the same period. Both countries benefit from agricultural advantages in plant protein raw materials and expanding food processing capabilities. Ukraine's growth is supported by post-conflict reconstruction investments in modern food technology, while Uzbekistan reflects increasing foreign investment in consumer goods manufacturing and growing middle-class demand for functional foods.

Russia, while maintaining the highest overall demand in absolute terms, is expected to grow at a CAGR of 7.6%, reflecting market maturity and established supplier relationships. The country already exhibits higher-than-average per capita utilization and extensive distribution networks. Growth will likely come from product innovation, premium segment expansion, and export-oriented manufacturing rather than basic market development.

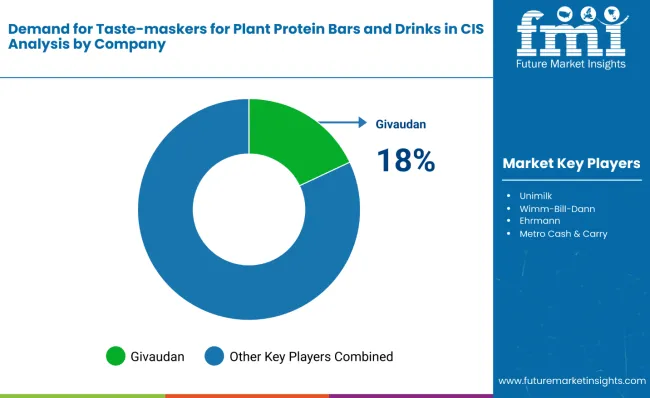

The competitive environment is characterized by a mix of multinational flavor companies and regional ingredient suppliers. Technical expertise and regulatory compliance rather than product breadth remain the decisive success factors, with leading suppliers maintaining dedicated application laboratories and direct relationships with major plant protein manufacturers.

Givaudan maintains the strongest regional presence through its Moscow technical center and established relationships with major food manufacturers. The company's natural masking solutions portfolio covers both protein bars and beverage applications, with particular strength in citrus and vanilla-based modulation systems that address pea protein off-notes.

Firmenich leverages its global expertise in bitter masking to serve the growing CIS plant protein segment, offering both traditional flavor solutions and innovative encapsulation technologies that provide sustained masking performance in shelf-stable applications.

IFF (International Flavors & Fragrances) provides comprehensive masking solutions through regional distribution partnerships, focusing on cost-effective synthetic alternatives that meet local price sensitivity while maintaining efficacy standards for mass-market protein products.

Symrise operates through regional partners to deliver specialized enzyme-based masking systems, particularly targeting premium beverage applications where clean taste profiles justify higher ingredient costs and technical complexity.

Kerry Group serves the region through its European operations, providing integrated solutions that combine masking agents with texture enhancement and nutritional fortification, appealing to manufacturers seeking simplified ingredient sourcing.

Regional suppliers including local flavor houses and ingredient distributors maintain significant presence in cost-sensitive segments, offering competitive pricing and flexible minimum order quantities that serve smaller manufacturers and emerging brands.

| Attribute | Details |

|---|---|

| Study Coverage | CIS sales and consumption of taste-maskers for plant protein bars and drinks from 2020 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 |

| Forecast Period | 2025-2035 |

| Units of Measurement | USD (sales), Metric Tonnes (volume), USD per capita (spending) |

| Geography Covered | All CIS countries; country-level and city-level granularity |

| Top Countries Analyzed | Russia, Kazakhstan, Ukraine, Belarus, Uzbekistan |

| Top Cities Analyzed | Moscow, St. Petersburg, Almaty, Kiev, Minsk |

| By Application | Protein bars, RTD beverages, Protein powders, Meal replacements |

| By Ingredient Type | Natural masking agents, Synthetic modulators, Enzyme-based, Hybrid formulations |

| By Protein Source | Pea, Soy, Hemp, Emerging plant proteins |

| By Consumer Profile | Fitness enthusiasts, Health professionals, Weight management, Lifestyle millennials |

| Metrics Provided | Sales (USD), Volume (MT), Per capita spending (USD), CAGR (2025-2035), Share by segment |

| Price Analysis | Average unit prices by ingredient type and application |

| Competitive Landscape | Company profiles, regional strategies, technical capabilities |

| Forecast Drivers | Manufacturing growth, regulatory changes, consumer acceptance, technology advancement |

By 2035, total CIS sales of taste-maskers are projected to reach USD 26.8 million, up from USD 12.3 million in 2025, reflecting a CAGR of approximately 8.1%.

Protein bars hold the leading share, accounting for approximately 61% of total sales in 2025, followed by ready-to-drink beverages and protein powders.

Kazakhstan and Belarus lead in projected growth, each registering a CAGR of 9.2% between 2025 and 2035, due to manufacturing investments and expanding plant protein production.

Natural masking agents are the dominant category (58% share in 2025), but synthetic modulators maintain significant presence in cost-sensitive mass-market applications.

Major players include Givaudan, Firmenich, IFF, Symrise, and Kerry Group, with growing participation from regional suppliers and specialized ingredient distributors serving local manufacturers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-based Bars Market Analysis by Type, Distribution Channel, and Region Through 2035

Plant-Based Protein Beverages Market Trends – Growth & Forecast 2025 to 2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

High-Protein Plant-Based Cheese Alternatives in the EU Analysis Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Demand for Plant-Based Protein Flavor Maskers and Enhancers in Latin America Size and Share Forecast Outlook 2025 to 2035

Pea Protein in Plant-Based Meat Analysis - Size Share and Forecast outlook 2025 to 2035

Demand for Vegan Protein Bars in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA